Home>Finance>When Interest Rates Rise, What Happens To Stocks

Finance

When Interest Rates Rise, What Happens To Stocks

Published: January 19, 2024

Discover the impact of rising interest rates on the stock market. Gain valuable insights into how finance and stock prices are affected in this informative article.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of finance, one of the critical factors that can greatly influence the performance of stocks is interest rates. Interest rates play a crucial role in the overall health of the economy and have a direct impact on businesses, consumers, and investors. As interest rates rise, it is important for investors to understand the potential effects on stock prices and make informed decisions.

The relationship between interest rates and stocks is complex and multifaceted. While rising interest rates can have both positive and negative impacts on the stock market, it is crucial to examine the specific factors and sectors that are most vulnerable to these changes. Understanding how stocks react during periods of rising interest rates can help investors navigate the market and adjust their strategies accordingly.

In this article, we will delve into the relationship between interest rates and stocks, explore the potential implications of rising interest rates on stock prices, analyze the effects on different sectors, discuss the moderating factors that can mitigate these effects, and provide strategies for investors to navigate the market during periods of rising interest rates.

It is important to note that while this article aims to provide insights into the effects of rising interest rates on stocks, investing in the stock market involves risks, and individuals should seek professional advice and do their own research before making any investment decisions.

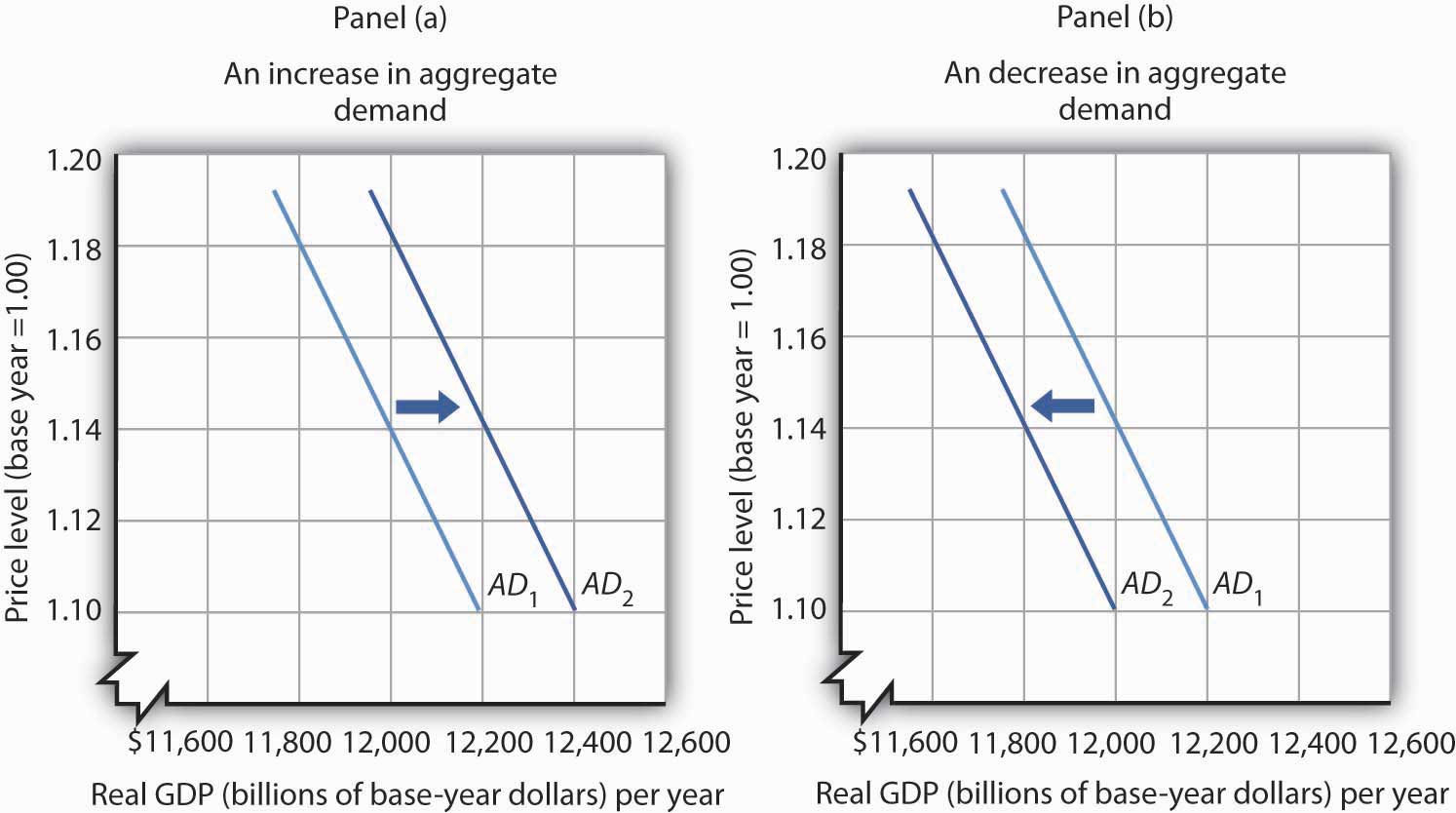

The Relationship between Interest Rates and Stocks

The relationship between interest rates and stocks is an intricate one. Generally, when interest rates are low, borrowing becomes cheaper, and this stimulates economic growth. As a result, companies are more likely to thrive, leading to increased earnings and higher stock prices. Conversely, when interest rates rise, borrowing becomes more expensive, which can potentially slow down economic growth and have a negative impact on stocks.

One key aspect to consider is the borrowing costs for companies. When interest rates are low, companies can access cheap capital, allowing them to invest in expansion, research and development, and other growth opportunities. This leads to increased profitability, which in turn boosts stock prices. Additionally, low interest rates can incentivize consumers to borrow and spend, which can have a positive impact on businesses and ultimately support stock prices.

On the other hand, when interest rates rise, borrowing becomes more expensive for companies. This can lead to decreased profitability, as borrowing costs eat into their earnings. As a result, investors may become less inclined to invest in stocks, causing stock prices to decline. Furthermore, higher interest rates can discourage consumer spending, as loans for big-ticket purchases, such as houses and cars, become more expensive. This slowdown in consumer spending can negatively affect the revenue and earnings of businesses, putting downward pressure on stock prices.

It is worth noting that the relationship between interest rates and stocks is not always straightforward. There are various factors that can influence the impact of rising interest rates on stocks. For instance, the pace at which interest rates rise is essential. If interest rates increase gradually and are in line with market expectations, stocks may have time to adjust, minimizing the impact on prices. Conversely, if interest rates spike unexpectedly or rise rapidly, it can trigger panic in the market and result in significant stock market declines.

Additionally, market sentiment, investor expectations, and macroeconomic indicators also play a role in shaping the relationship between interest rates and stocks. If investors perceive rising interest rates as a sign of a strong and growing economy, they may view it as a positive signal for stocks, leading to continued investment. On the other hand, if rising interest rates are perceived as a threat to economic stability, investors may pull out of the stock market, causing prices to decline.

In summary, the relationship between interest rates and stocks is complex and influenced by a multitude of factors. While rising interest rates generally pose challenges to stocks, the impact can vary depending on the pace of rate hikes, market sentiment, and macroeconomic conditions. Understanding these dynamics is crucial for investors to make well-informed decisions and navigate the stock market effectively during periods of rising interest rates.

Impact of Rising Interest Rates on Stocks

Rising interest rates can have a significant impact on stock prices and the overall performance of the stock market. Understanding the potential effects can help investors adjust their strategies and make informed decisions.

One of the primary impacts of rising interest rates on stocks is the increased cost of borrowing for companies. As interest rates rise, borrowing becomes more expensive, which can squeeze profit margins and hinder business expansion. Companies may need to allocate a larger portion of their earnings towards debt servicing, leaving less capital for investment and growth. This can result in reduced earnings and profitability, leading to a decline in stock prices.

Rising interest rates can also affect investor sentiment and risk appetite. As borrowing costs increase, fixed-income investments, such as bonds, become more attractive relative to stocks. This shift in investor preference can lead to a decrease in demand for stocks, putting downward pressure on prices. Additionally, higher interest rates can increase the discount rate used to value future cash flows, making stocks appear relatively less attractive in terms of their present value.

Another impact of rising interest rates on stocks is the potential slowdown in consumer spending. As borrowing costs rise, individuals may be less inclined to take on loans for major purchases, such as homes, cars, and consumer goods. This can have a direct impact on businesses that rely on consumer spending, leading to lower revenue and earnings. As a result, stock prices of companies in sectors such as retail, automotive, and housing may see declines.

However, it is important to note that not all stocks are equally affected by rising interest rates. Some sectors may be more vulnerable to interest rate changes than others. For example, highly leveraged industries such as real estate investment trusts (REITs) may be particularly sensitive to rising interest rates, as higher borrowing costs can significantly impact their profitability. Conversely, sectors such as utilities and consumer staples, which are known for their stability and reliable cash flows, may be less affected by interest rate hikes.

Furthermore, rising interest rates can have different effects on growth stocks and value stocks. Growth stocks, which typically rely on future earnings growth potential, may see their valuations impacted by higher discount rates. On the other hand, value stocks, which tend to have lower valuations relative to their earnings or book value, may be less affected by rising interest rates.

In summary, rising interest rates can negatively impact stocks through increased borrowing costs, reduced investor demand, and a potential slowdown in consumer spending. However, the extent of the impact may vary depending on the sector, type of stock, and overall market conditions. Investors should carefully analyze their portfolios, sector diversification, and risk tolerance to make informed decisions during periods of rising interest rates.

Effect on Different Sectors

The impact of rising interest rates on different sectors of the stock market can vary. While rising interest rates generally pose challenges to stocks, some sectors are more sensitive to interest rate changes than others. Understanding the potential effects on different sectors can help investors navigate the market more effectively.

1. Financial Sector: The financial sector is one of the most directly affected by changes in interest rates. Banks and other financial institutions benefit from higher interest rates as they can charge more for lending and earn higher interest income. This can lead to improved profitability and an increase in stock prices. On the other hand, rising interest rates can also result in higher borrowing costs for these institutions, which may limit their ability to lend and impact their profitability.

2. Real Estate Sector: Rising interest rates can have a significant impact on the real estate sector. Higher borrowing costs can dampen demand for mortgages, leading to a slowdown in home sales and construction. This can weigh on the earnings of real estate developers, homebuilders, and property management companies, potentially impacting their stock prices. Additionally, rising interest rates may reduce the attractiveness of real estate as an investment relative to other asset classes.

3. Consumer Discretionary Sector: The consumer discretionary sector, which includes industries such as retail, hospitality, and entertainment, can be sensitive to rising interest rates. As borrowing costs increase, consumer spending may decline, affecting the revenue and profitability of companies in this sector. However, the impact may vary depending on the strength of the economy and consumer confidence. Essential goods and services, such as healthcare and utilities, which fall under the consumer staples sector, may be less affected by rising interest rates due to the non-cyclical nature of these industries.

4. Technology Sector: The technology sector is generally known for its growth potential and innovation. While rising interest rates can increase borrowing costs for technology companies, leading to higher expenses, the impact may be relatively moderate compared to other sectors. Investors often focus on the long-term growth prospects and earnings potential of technology companies, which can help mitigate the short-term effects of rising interest rates.

5. Utilities Sector: The utilities sector, which includes companies that provide essential services such as electricity, gas, and water, is often considered a defensive sector. These companies have stable cash flows and are less reliant on borrowing costs. Therefore, rising interest rates may have a relatively smaller impact on their profitability and stock prices compared to other sectors.

It is important to note that these are generalizations, and the impact of rising interest rates can vary within each sector. It is crucial for investors to conduct thorough research and analyze individual companies within these sectors to assess their specific vulnerabilities and opportunities. Diversification across sectors and careful stock selection can help mitigate risks and capture potential gains during periods of rising interest rates.

Factors that Moderate the Effects of Rising Interest Rates

While rising interest rates can have significant implications for the stock market, there are several factors that can help moderate the effects and provide some cushioning for investors. Understanding these factors can provide valuable insights for navigating the market during periods of rising interest rates.

1. Economic Growth: The state of the overall economy plays a crucial role in moderating the effects of rising interest rates. When interest rates rise in an environment of robust economic growth, companies may be better positioned to absorb the impact. Strong economic conditions can lead to increased consumer spending, higher corporate earnings, and favorable business conditions, which can help support stock prices even in the face of rising interest rates.

2. Inflationary Expectations: Rising interest rates are often a response to inflationary pressures. If interest rates rise in order to curb inflation, it can signal that the economy is heating up. In such cases, companies may be able to pass on the increased costs to consumers through higher prices, maintaining or even improving their profit margins. This can help mitigate the negative effects of rising interest rates on stock prices.

3. Sector-specific Factors: Different sectors have varying sensitivities to interest rate changes. Some sectors, such as financials and utilities, may have built-in mechanisms to mitigate the effects of rising interest rates. For example, banks can benefit from higher interest rates through improved lending margins, while utilities can pass on increased costs to consumers. Assessing sector-specific factors and selecting stocks within resilient sectors can contribute to moderating the impact of rising interest rates on investment portfolios.

4. Central Bank Policy: The actions and communication of central banks can have a significant impact on the market’s response to rising interest rates. Central banks will typically provide guidance on their monetary policy decisions, allowing market participants to anticipate and adjust to changes in interest rates. When central banks gradually and clearly communicate their plans to raise rates, it can help minimize market volatility and give investors time to adjust their investment strategies accordingly.

5. Investor Sentiment and Market Psychology: Investor sentiment and market psychology can also play a role in moderating the effects of rising interest rates. If investors perceive rising interest rates as a sign of a strong economy or improved financial stability, it can contribute to positive market sentiment. Moreover, if investors have already factored in the possibility of rising interest rates, it may lead to a more measured response and less abrupt market reactions.

6. Portfolio Diversification: Diversifying across various asset classes, sectors, and geographic regions can help mitigate the effects of rising interest rates. By spreading investments across different types of assets, such as stocks, bonds, and alternative investments, investors can potentially reduce the overall impact of rising interest rates on their portfolios. Similarly, diversifying across sectors and countries can provide exposure to industries and markets that may be less susceptible to rising interest rates.

While these factors can help moderate the effects of rising interest rates on stocks, it is essential to remember that investing in the stock market still carries risks. It is crucial for individuals to conduct thorough research, assess their risk tolerance, and seek professional advice before making any investment decisions.

Strategies for Investors during Rising Interest Rates

As an investor, it is important to have a well-thought-out strategy to navigate the stock market during periods of rising interest rates. Here are some strategies to consider:

1. Evaluate Your Portfolio: Take a closer look at your investment portfolio and assess its vulnerability to rising interest rates. Identify sectors or individual stocks that may be more sensitive to interest rate changes and consider reallocating your investments accordingly. Diversify your portfolio across different asset classes to help mitigate the impact of rising rates.

2. Focus on Quality: During periods of rising interest rates, it can be beneficial to focus on high-quality stocks with strong fundamentals. Consider companies with stable earnings, solid balance sheets, and a history of consistent dividend payments. These companies may be better equipped to weather the effects of rising rates and provide a more stable return on investment.

3. Embrace Defensive Stocks: Defensive sectors, such as utilities, healthcare, and consumer staples, tend to be less sensitive to interest rate changes. These sectors provide essential goods and services that consumers rely on regardless of economic conditions. Adding some defensive stocks to your portfolio can help provide stability and potentially buffer against potential downturns caused by rising rates.

4. Consider Dividend Stocks: Dividend-paying stocks can be particularly attractive during periods of rising interest rates. Dividends can provide a steady stream of income, which can help offset the potential impact of rising rates on stock prices. Look for companies with a history of consistently increasing dividends and sustainable payout ratios.

5. Watch for Opportunities in Undervalued Sectors: Rising interest rates can create investment opportunities in sectors that may have been overlooked or undervalued. Keep an eye on sectors that may benefit from an improving economy or sectors that have the potential to perform well despite rising rates. Conduct thorough research and analysis to identify such opportunities.

6. Stay Informed and Monitor Economic Indicators: Keep abreast of economic indicators and central bank policies that can influence interest rates. Pay attention to inflation data, employment reports, GDP growth, and other macroeconomic factors. Monitoring these indicators can help you anticipate changes and adjust your investment strategy accordingly.

7. Consider Fixed Income and Bond Investments: As interest rates rise, fixed income and bond investments may become more attractive. Consider diversifying your portfolio with bonds or bond funds that can provide steady income and potentially serve as a hedge against volatility in the stock market.

8. Don’t Panic, Stick to Your Long-term Plan: Finally, it is crucial to remain calm and stick to your long-term investment plan. Short-term fluctuations in the market, including rising interest rates, are a natural part of investing. Avoid knee-jerk reactions and focus on your long-term investment goals. If necessary, consult with a financial advisor who can provide guidance and help you make informed decisions.

Remember, everyone’s financial situation and risk tolerance are different. It is important to assess your own circumstances and consult with a professional advisor before making any investment decisions during periods of rising interest rates.

Conclusion

Rising interest rates can have a significant impact on the stock market, but understanding the relationship between interest rates and stocks is crucial for investors. While rising interest rates generally pose challenges, there are factors that can moderate the effects and strategies that investors can adopt to navigate the market more effectively.

The relationship between interest rates and stocks is complex, influenced by factors such as economic growth, inflation expectations, and sector-specific dynamics. While the overall impact of rising rates on stocks can be negative, not all sectors and stocks are equally affected. Some sectors, such as financials and utilities, may be better positioned to withstand rising rates, while others, like real estate and consumer discretionary, may be more vulnerable.

Investors can employ various strategies to navigate the stock market during periods of rising interest rates. This can include evaluating their portfolio, focusing on high-quality and defensive stocks, considering dividend-paying stocks, monitoring undervalued sectors, and staying informed about economic indicators and central bank policies. Additionally, incorporating fixed income and bond investments can provide stability and diversification.

It is important for investors to remember that navigating the stock market during periods of rising interest rates requires a long-term perspective and a well-diversified portfolio. Markets can be volatile in the short term, and it is crucial to stay focused on long-term goals and adapt investment strategies accordingly.

Lastly, investors should remember that financial markets are influenced by various factors, and there are risks involved in investing. Conducting thorough research, seeking professional advice, and regularly reviewing and adjusting investment strategies are essential for successful investing.

By understanding the relationship between interest rates and stocks, being mindful of sector dynamics, and adopting appropriate strategies, investors can make informed decisions and navigate the stock market successfully during periods of rising interest rates.