Finance

What Is Accounting Ratios

Modified: February 21, 2024

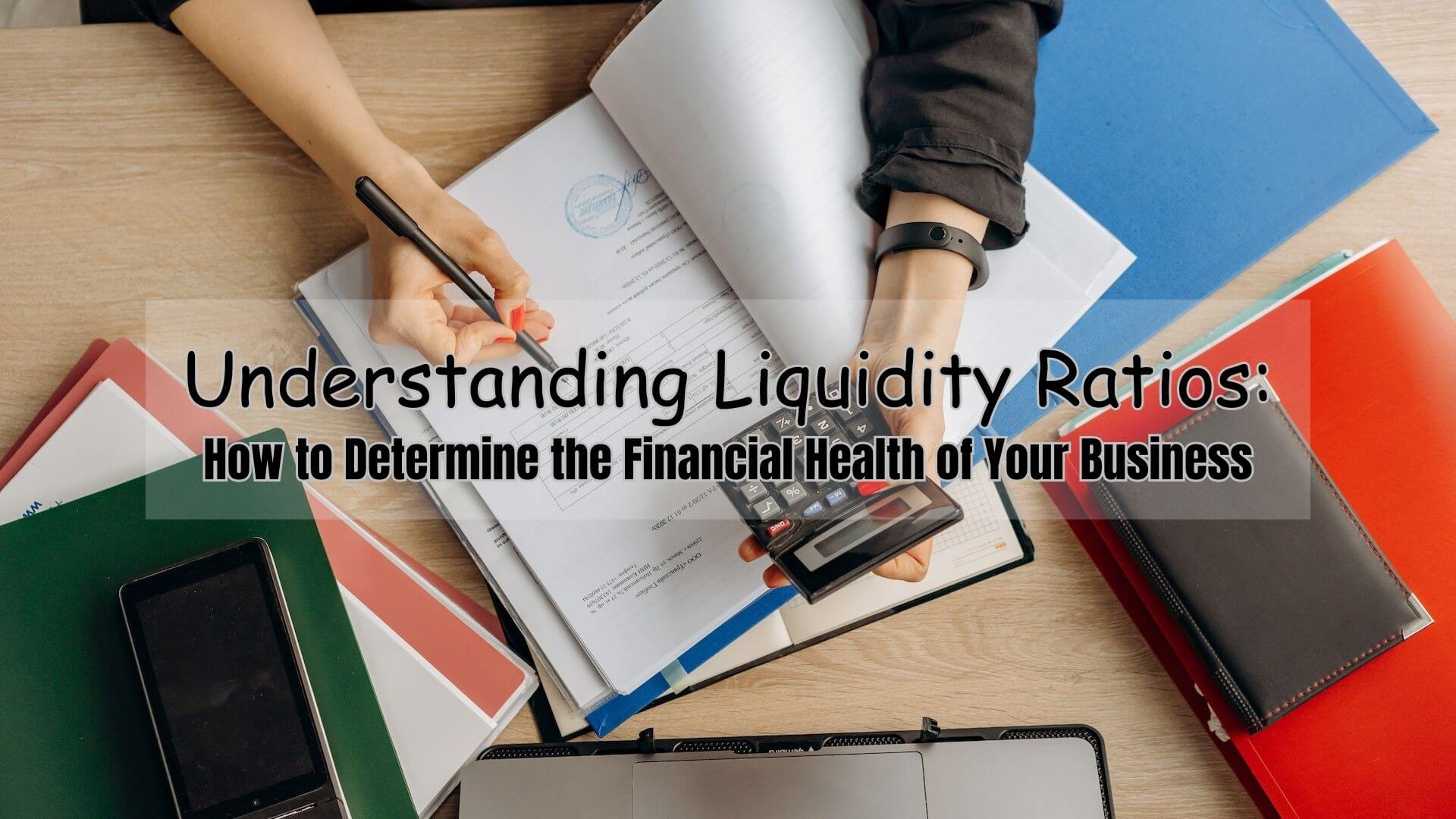

Learn about accounting ratios in finance and how they can help analyze a company's financial performance. Discover the importance of understanding and using these ratios for effective financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Accounting ratios are financial metrics used to analyze the performance and financial health of a company. They provide valuable insights into a company’s profitability, liquidity, efficiency, and solvency. By calculating and analyzing accounting ratios, businesses can make informed decisions about their operations, strategies, and financial positions.

Accounting ratios are derived from the financial statements of a company, such as the balance sheet, income statement, and cash flow statement. These ratios are calculated by comparing different financial figures and determining their relationship to each other.

The use of accounting ratios is essential for both businesses and investors. For businesses, accounting ratios help assess their financial stability, identify areas of improvement, and measure their performance against industry benchmarks. For investors, accounting ratios provide insights into the profitability and financial health of a company, helping them make informed investment decisions.

Throughout this article, we will explore the different types of accounting ratios, their importance, and their limitations. Understanding these ratios will empower businesses and investors to analyze financial statements effectively and make informed decisions.

Definition of Accounting Ratios

Accounting ratios, also known as financial ratios, are quantitative measures used to assess the financial performance, efficiency, and stability of a company. These ratios provide a way to analyze and interpret financial statements, helping businesses and investors gauge the financial health and performance of an organization.

Accounting ratios are calculated by comparing various financial figures from a company’s financial statements. These figures are typically obtained from the balance sheet, income statement, and cash flow statement. By comparing these figures, accounting ratios provide insights into the relationships between different financial elements and help evaluate a company’s financial position.

These ratios are useful for both internal and external stakeholders. Internally, they are used by management to monitor performance, identify areas of improvement, and make informed business decisions. Externally, accounting ratios are utilized by investors, creditors, and other stakeholders to assess the financial viability and stability of a company before entering into business transactions or making investment decisions.

Accounting ratios can be categorized into various types, including liquidity ratios, activity ratios, profitability ratios, and solvency ratios. Each ratio type provides a different perspective on a company’s financial performance and can be used to assess different aspects of its operations.

It’s important to note that accounting ratios should not be viewed in isolation. Instead, they should be analyzed in conjunction with other financial information and industry benchmarks to gain a comprehensive understanding of a company’s financial health.

In the following sections, we will delve into each type of accounting ratio and explore their significance in evaluating a company’s financial position and performance.

Importance of Accounting Ratios

Accounting ratios play a crucial role in financial analysis and decision-making for businesses and investors. Here are some key reasons why accounting ratios are important:

- Performance Evaluation: Accounting ratios enable businesses to assess their financial performance over time. By comparing ratios from different accounting periods, companies can identify trends, strengths, and areas for improvement. This evaluation helps management make informed decisions to enhance profitability and efficiency.

- Benchmarking: Accounting ratios provide a benchmark to compare a company’s performance against industry standards and competitors. By comparing ratios with industry averages, businesses can identify areas where they excel or lag behind their peers. This benchmarking aids in setting realistic goals and targets to drive financial growth.

- Identifying Financial Weaknesses: Accounting ratios help pinpoint financial weaknesses within a company’s operations. For example, liquidity ratios can reveal if a company has enough cash resources to meet short-term obligations. By identifying weaknesses, businesses can implement strategies to address these issues and improve their financial stability.

- Evaluating Profitability: Profitability ratios determine the ability of a company to generate profits from its operations. These ratios indicate the company’s efficiency in utilizing its resources and generating returns. By monitoring these ratios, businesses can assess their profitability and make appropriate pricing, cost, and revenue decisions.

- Assessing Risk: Accounting ratios provide insights into a company’s financial risk and stability. Solvency ratios, for instance, measure a company’s long-term debt-paying capacity. By analyzing these ratios, stakeholders can assess the risk associated with investing in a particular company or extending credit to it.

- Effective Decision-Making: Accounting ratios serve as reliable indicators for making informed business decisions. By examining various ratios, businesses can evaluate the impact of potential decisions on their financial performance. Whether it’s expanding operations, acquiring assets, or managing cash flow, accounting ratios guide decision-making processes.

- Investment Decision-Making: Investors rely on accounting ratios to assess the financial health and performance of a company before making investment decisions. These ratios provide a snapshot of a company’s profitability, liquidity, and efficiency, helping investors evaluate potential risks and returns.

Overall, accounting ratios are vital tools for financial analysis and decision-making. They provide valuable insights into a company’s financial performance, stability, and potential risks. By using these ratios, businesses and investors can make informed decisions that support growth, profitability, and long-term success.

Types of Accounting Ratios

Accounting ratios can be grouped into different categories based on the aspect of a company’s financial performance they measure. Here are the main types of accounting ratios:

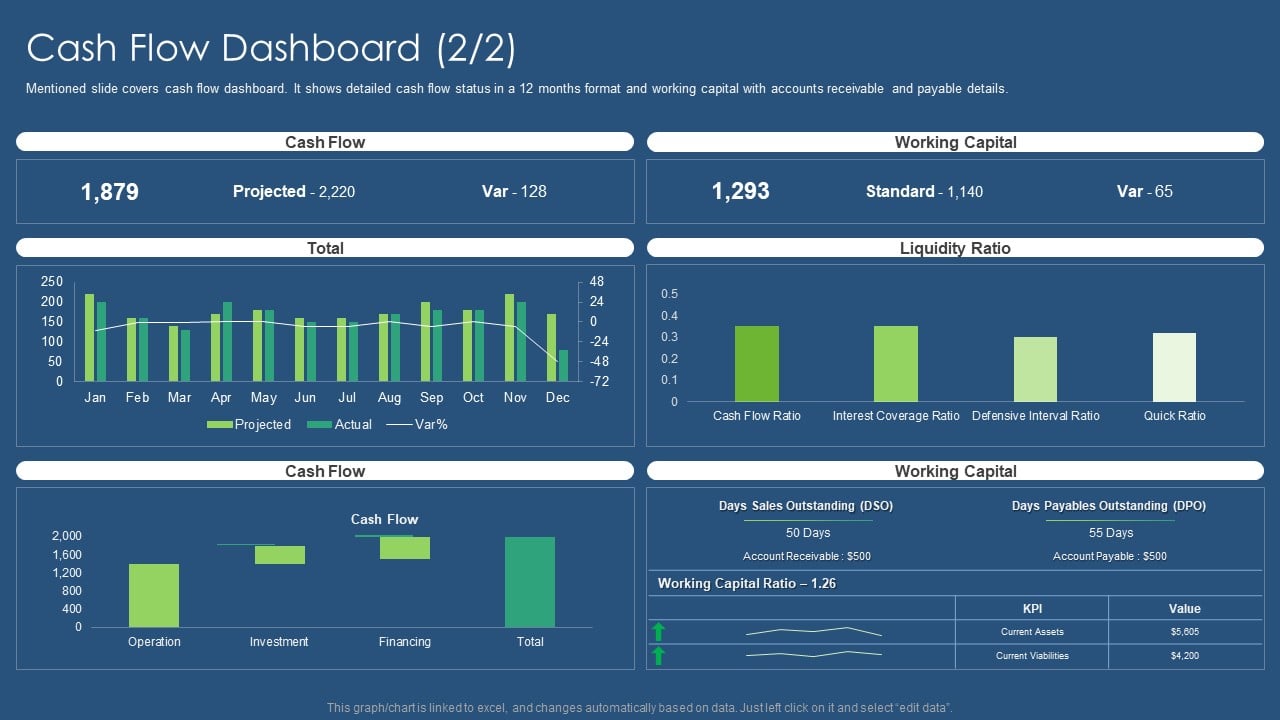

- Liquidity Ratios: Liquidity ratios assess a company’s ability to meet its short-term obligations. These ratios indicate the availability of liquid assets to cover immediate financial needs. The two commonly used liquidity ratios are the current ratio (current assets divided by current liabilities) and the quick ratio (quick assets divided by current liabilities). These ratios help stakeholders gauge a company’s short-term financial health and its ability to pay off debts.

- Activity Ratios: Activity ratios, also known as efficiency ratios, measure how effectively a company utilizes its assets to generate sales and revenue. These ratios assess the efficiency of inventory management, accounts receivable collection, and asset utilization. Common activity ratios include inventory turnover ratio, accounts receivable turnover ratio, and asset turnover ratio. Activity ratios help businesses identify areas of improvement in managing their assets and improve overall operational efficiency.

- Profitability Ratios: Profitability ratios indicate a company’s ability to generate earnings and profits relative to its sales, assets, and equity. These ratios are crucial for assessing the financial performance and sustainability of a business. Key profitability ratios include gross profit margin, net profit margin, return on assets (ROA), and return on equity (ROE). By analyzing these ratios, businesses can evaluate their profitability and compare it to industry benchmarks.

- Solvency Ratios: Solvency ratios measure a company’s long-term financial stability and its ability to meet its long-term obligations. These ratios assess the proportion of debt to equity and the company’s ability to generate cash flow to cover debt payments. Common solvency ratios include debt-to-equity ratio, interest coverage ratio, and debt ratio. These ratios help stakeholders determine the financial risk associated with investing in a company and its long-term ability to meet financial obligations.

Each type of accounting ratio provides unique insights into a different aspect of a company’s financial performance. It’s important for businesses and investors to analyze multiple ratios across these categories to obtain a well-rounded view of a company’s financial health and overall performance.

Liquidity Ratios

Liquidity ratios measure the ability of a company to meet its short-term obligations and are essential for assessing its financial stability. These ratios evaluate the availability of liquid assets that can be readily converted to cash to cover immediate financial needs. By analyzing liquidity ratios, businesses can determine if they have sufficient assets to meet their current obligations.

The two commonly used liquidity ratios are:

- Current Ratio: The current ratio is calculated by dividing a company’s current assets by its current liabilities. It indicates the proportion of current assets available to cover each dollar of current liabilities. A current ratio of 1 or higher is generally considered favorable, as it indicates that the company has sufficient assets to cover its short-term obligations. However, a very high current ratio may indicate inefficient use of assets.

- Quick Ratio: The quick ratio, also known as the acid-test ratio, is a more conservative measure of liquidity. It excludes inventory from the current assets since inventory may not be easily converted to cash in the short term. The quick ratio is calculated by dividing a company’s quick assets (current assets minus inventory) by its current liabilities. A quick ratio of 1 or higher is considered favorable, indicating the company’s ability to meet short-term obligations without relying heavily on inventory.

Liquidity ratios provide valuable insights into a company’s short-term financial health and its ability to manage cash flow and short-term obligations. These ratios are vital for creditors and suppliers when assessing a company’s creditworthiness, and for businesses themselves in managing their working capital effectively.

It’s important to note that while a high liquidity ratio indicates a good short-term financial position, excessively high ratios may suggest that the company is not efficiently utilizing its assets. On the other hand, low liquidity ratios may indicate potential liquidity issues and the need for additional financing or improved cash flow management.

By monitoring liquidity ratios regularly and comparing them to industry benchmarks, businesses can ensure they have enough resources to meet their short-term obligations and navigate financial challenges effectively.

Activity Ratios

Activity ratios, also known as efficiency ratios, provide insights into how effectively a company utilizes its assets to generate sales and revenue. These ratios evaluate the efficiency and effectiveness of various operational processes, such as inventory management, accounts receivable collection, and asset utilization. By analyzing activity ratios, businesses can identify areas where they can improve their operational efficiency and optimize resource utilization.

Some commonly used activity ratios include:

- Inventory Turnover Ratio: This ratio measures how efficiently a company manages its inventory. It is calculated by dividing the cost of goods sold (COGS) by the average inventory. A high inventory turnover ratio indicates that the company is selling its inventory quickly, which can suggest effective inventory management and reduced carrying costs. However, a very high turnover ratio may also imply stockouts and missed sales opportunities.

- Accounts Receivable Turnover Ratio: This ratio measures how efficiently a company collects payments from its customers. It is calculated by dividing net credit sales by the average accounts receivable. A higher turnover ratio indicates that the company is collecting payments from customers quickly, which suggests effective credit and collection policies. A lower turnover ratio may signal potential liquidity issues or ineffective credit management.

- Asset Turnover Ratio: This ratio evaluates how efficiently a company utilizes its assets to generate sales. It is calculated by dividing net sales by average total assets. A higher asset turnover ratio indicates that the company generates more sales per dollar of assets. This ratio is particularly useful for comparing companies within the same industry to assess their operational efficiency.

Activity ratios vary across industries, so it is important to compare them with industry benchmarks and analyze trends over time. By identifying areas of improvement revealed by these ratios, businesses can take steps to optimize their operational processes, reduce costs, and enhance overall efficiency.

It is worth noting that activity ratios should be analyzed in conjunction with other financial metrics and factors specific to the company’s industry. For example, a high inventory turnover ratio may be desirable in a retail industry but not necessarily in a manufacturing setting where a higher level of inventory is needed to support production.

By regularly monitoring activity ratios and evaluating them in the context of the company’s operations and industry, businesses can make more informed decisions to drive operational efficiency, improve resource utilization, and ultimately enhance their profitability.

Profitability Ratios

Profitability ratios measure a company’s ability to generate earnings and profits relative to its sales, assets, and equity. These ratios provide insights into the company’s profitability, efficiency in managing its resources, and its potential for long-term sustainability. By analyzing profitability ratios, businesses can assess their financial performance and compare it to industry benchmarks and competitors.

Here are some commonly used profitability ratios:

- Gross Profit Margin: This ratio measures the percentage of revenue that remains after deducting the cost of goods sold (COGS). It is calculated by dividing gross profit by revenue. A higher gross profit margin indicates that a company is efficiently managing its direct production costs and generating more profit per dollar of revenue.

- Net Profit Margin: The net profit margin measures the percentage of revenue that remains after deducting all expenses, including COGS, operating expenses, interest, and taxes. It is calculated by dividing net profit by revenue. A higher net profit margin indicates that a company is effectively controlling its costs and generating more profit relative to its revenue.

- Return on Assets (ROA): ROA evaluates the profitability of a company in relation to its total assets. It is calculated by dividing net income by average total assets. ROA indicates how efficiently a company utilizes its assets to generate profit. A higher ROA suggests better asset utilization and profitability.

- Return on Equity (ROE): ROE measures the profitability of a company from the perspective of its shareholders. It is calculated by dividing net income by average total equity. ROE indicates the return earned by shareholders on their investment. A higher ROE suggests better profitability and indicates that the company is generating more profit per dollar invested by shareholders.

Profitability ratios are crucial for businesses as they help evaluate the financial health and sustainability of the company. By monitoring these ratios, businesses can identify areas where they can improve profitability, control costs, and enhance overall performance.

It is important to note that profitability ratios should not be analyzed in isolation; they should be evaluated in conjunction with other financial indicators and industry benchmarks. Additionally, profitability ratios can vary significantly across industries, so comparisons should be made within the same industry to gain meaningful insights.

By regularly assessing and benchmarking profitability ratios, businesses can make informed decisions to optimize their operations, improve profitability, and create value for their shareholders.

Solvency Ratios

Solvency ratios are financial metrics that assess a company’s long-term financial stability and its ability to meet its long-term obligations. These ratios provide insights into the proportion of debt a company carries and its capacity to generate cash flow to cover debt payments. By analyzing solvency ratios, businesses and investors can evaluate the financial risk associated with a company and its ability to repay its debts on time.

Here are some commonly used solvency ratios:

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholders’ equity. It is calculated by dividing total debt by total equity. A higher debt-to-equity ratio indicates a higher level of financial risk, as it suggests that the company relies more on debt financing. Lower ratios indicate a more conservative capital structure and less risk.

- Interest Coverage Ratio: The interest coverage ratio measures a company’s ability to cover interest expenses with its earnings before interest and taxes (EBIT). It is calculated by dividing EBIT by interest expenses. A higher interest coverage ratio indicates that the company has sufficient earnings to cover its interest obligations, which reflects a lower risk of defaulting on debt payments.

- Debt Ratio: The debt ratio compares a company’s total debt to its total assets. It is calculated by dividing total debt by total assets. The debt ratio provides insights into the proportion of a company’s assets financed by debt. A higher debt ratio indicates a higher level of financial leverage and potential risk.

Solvency ratios are essential for both companies and investors. For companies, solvency ratios help assess their long-term financial stability and plan for future debt repayments. For investors, solvency ratios provide insights into the risk associated with investing in a particular company and its ability to meet its financial obligations.

It’s important to note that solvency ratios should be analyzed in conjunction with other financial indicators and benchmarked against industry peers. Additionally, solvency ratios can vary across industries, so comparisons should be made within the same industry for a meaningful assessment.

By regularly monitoring solvency ratios, businesses can take proactive measures to manage their debt levels, improve their financial stability, and ensure the long-term sustainability of their operations.

Limitations of Accounting Ratios

While accounting ratios provide valuable insights into a company’s financial performance, it’s important to recognize their limitations and consider them in conjunction with other factors. Here are some limitations to keep in mind when analyzing accounting ratios:

- Historical Perspective: Accounting ratios are based on historical financial data, which may not reflect the current or future performance of a company. Economic and market conditions can change rapidly, impacting a company’s financial position. Therefore, it’s crucial to consider other factors such as industry trends, market conditions, and future projections when interpreting accounting ratios.

- Industry Variations: Accounting ratios can vary widely across industries due to differences in business models, capital requirements, and operating cycles. Comparing ratios between companies in different industries may not provide meaningful insights. It’s important to evaluate ratios within the same industry or against industry benchmarks to get reliable comparisons.

- Financial Data Quality: The accuracy and quality of financial data can impact the validity of accounting ratios. Inaccurate or incomplete data can lead to misleading ratio analysis. It’s important to ensure the integrity of financial statements and verify the accuracy of the data used for calculating ratios.

- Limitations of Financial Statements: Accounting ratios are derived from financial statements, which have their limitations. Financial statements are prepared based on accounting principles and may not capture the full financial picture of a company. Companies may use different accounting methods or estimates, which can affect the ratios calculated using these statements.

- External Factors: Accounting ratios do not consider external factors such as changes in government regulations, technological advancements, or shifts in consumer behavior. These factors can significantly impact a company’s financial performance and may not be fully captured by accounting ratios alone.

- Potential Manipulation: In some cases, companies may manipulate their financial statements to present a more favorable picture of their financial performance. This can distort the ratios and mislead stakeholders. It’s important to conduct a thorough analysis of financial statements and consider multiple ratios to detect any anomalies or inconsistencies.

Despite these limitations, accounting ratios remain a valuable tool for financial analysis. When used appropriately and in conjunction with other financial indicators and industry benchmarks, accounting ratios provide valuable insights into a company’s financial performance, stability, and potential areas of improvement.

Conclusion

Accounting ratios serve as powerful tools for evaluating a company’s financial performance, stability, and potential risks. By analyzing liquidity ratios, businesses can assess their short-term financial health and their ability to meet immediate obligations. Activity ratios provide insights into operational efficiency and resource utilization, helping companies optimize their processes. Profitability ratios gauge a company’s ability to generate earnings and assess its overall financial viability. Solvency ratios are crucial for evaluating a company’s long-term financial stability and its capacity to repay debt.

However, it’s important to recognize the limitations of accounting ratios. They provide a historical perspective, may vary across industries, and are contingent on the accuracy and quality of financial data. External factors and the potential for manipulation by companies can also impact the validity of ratio analysis. Therefore, it’s crucial to consider other factors such as industry trends, external conditions, and future projections when interpreting accounting ratios.

Accounting ratios should be used as part of a comprehensive financial analysis, in conjunction with other financial indicators and industry benchmarks. Regular monitoring of these ratios allows businesses to identify areas for improvement, make informed decisions, and ensure long-term financial stability.

Ultimately, accounting ratios provide valuable insights into a company’s financial health, performance, and potential risks. When used appropriately and with a holistic perspective, they empower businesses and investors to make informed decisions that drive growth, profitability, and long-term success.