Finance

What Insurance Do I Need To Drive For Uber?

Published: November 20, 2023

Discover the essential insurance coverage you need when driving for Uber. Understand the financial aspects and protect yourself on the road.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Personal Auto Insurance

- Uber Insurance Coverage

- Periods of Ridesharing

- Period 0: App Off

- Period 1: App On, No Passenger

- Period 2: En Route to Pick Up the Passenger

- Period 3: Passenger in the Vehicle

- Insurance Options for Uber Drivers

- Rideshare Insurance Policies

- Commercial Auto Insurance

- Determining the Right Insurance Coverage

- Conclusion

Introduction

With the rise of ridesharing services like Uber, many individuals are looking to supplement their income or even make a full-time living by driving for these platforms. However, one question that often arises is: what insurance do I need to drive for Uber?

When you drive for Uber, your personal auto insurance policy may not provide adequate coverage for the unique risks and liabilities associated with ridesharing. This is because most personal auto insurance policies exclude coverage for commercial activities, such as transporting passengers for hire. In the event of an accident, you may find yourself responsible for medical expenses, property damage, and other costs if your insurance company denies your claim due to ridesharing activities.

Thankfully, Uber provides insurance coverage for its drivers, but it is important to understand the different periods of ridesharing and the level of coverage provided during each period. Additionally, there are other insurance options available to Uber drivers that can provide additional protection and peace of mind.

In this article, we will explore the various insurance considerations for Uber drivers, including the coverage provided by Uber, the periods of ridesharing, and the insurance options available to drivers. By understanding the insurance requirements and options, you can make an informed decision to ensure you have the necessary coverage while driving for Uber.

Personal Auto Insurance

Before diving into the specifics of Uber insurance, it’s important to understand how personal auto insurance factors into the equation. Most individuals who drive for Uber also use their personal vehicles for everyday activities, such as commuting to work or running errands. As a result, they typically have a personal auto insurance policy in place.

Personal auto insurance provides coverage for typical driving situations, such as accidents and damage to your own vehicle. However, it’s important to check your policy to see if it covers ridesharing activities. Many personal auto insurance policies have exclusions for driving for hire or using a vehicle for commercial purposes.

Some insurance companies offer rideshare endorsements or add-ons that can be added to a personal auto insurance policy to provide coverage during ridesharing activities. These add-ons can help bridge the coverage gap, but they may come with limitations and higher premiums.

When evaluating your personal auto insurance policy, it’s crucial to review the terms and conditions to understand if and how ridesharing activities are covered. If your policy doesn’t provide adequate coverage or has exclusions for ridesharing, you may need to explore additional insurance options to ensure you’re fully protected while driving for Uber.

Uber Insurance Coverage

Uber provides insurance coverage to its drivers, but the level of coverage varies depending on the period of ridesharing. It’s important to understand the different periods and the corresponding insurance coverage provided by Uber.

There are three distinct periods of ridesharing:

- Period 0: App Off

- Period 1: App On, No Passenger

- Period 2: En Route to Pick Up the Passenger

- Period 3: Passenger in the Vehicle

Period 0: App Off

During Period 0, when the Uber app is off and you are not available to accept rides, Uber’s insurance coverage does not apply. Your personal auto insurance policy would be the primary coverage during this time. However, it’s important to note that if you’re using your personal vehicle for both personal and ridesharing purposes, there may be limitations or exclusions in your policy.

Period 1: App On, No Passenger

Once the Uber app is turned on and you are waiting for a ride request, Uber provides contingent liability coverage. This coverage is intended to bridge the gap between your personal auto insurance and the additional risks inherent in ridesharing. Uber’s contingent liability coverage typically includes:

- Third-party liability coverage: This covers bodily injury and property damage to third parties if you are at fault in an accident while waiting for a ride request.

- Contingent comprehensive and collision coverage: This covers physical damage to your vehicle, subject to a deductible, in the event of an accident while waiting for a ride request.

It’s important to note that Uber’s contingent liability coverage may have coverage limits and deductibles, so it’s crucial to review the details of the policy to understand the extent of coverage provided during Period 1.

Periods of Ridesharing

When driving for Uber, it’s important to understand the different periods of ridesharing as they determine the level of insurance coverage provided by Uber. Let’s explore each period in more detail:

Period 0: App Off

During Period 0, your Uber app is turned off, meaning you are not available to accept ride requests. At this time, you are considered to be driving for personal use, and your personal auto insurance policy will be the primary coverage. It’s essential to review your policy to ensure it covers personal use and to understand any limitations or exclusions related to ridesharing.

Period 1: App On, No Passenger

Once you turn on the Uber app and are waiting for a ride request, you enter Period 1. During this period, Uber provides contingent liability coverage. This coverage acts as a backup to your personal auto insurance and typically includes third-party liability coverage and contingent comprehensive and collision coverage. However, keep in mind that this coverage is only activated if your personal auto insurance does not apply or does not provide adequate coverage.

Period 2: En Route to Pick Up the Passenger

Period 2 begins when you accept a ride request and are en route to pick up the passenger. During this period, Uber’s commercial insurance policy comes into play. Uber’s commercial policy provides primary liability coverage, which protects you against bodily injury and property damage to third parties caused by an accident. This coverage continues until the passenger is picked up.

Period 3: Passenger in the Vehicle

Period 3 starts when the passenger enters your vehicle and continues until the ride is completed and the passenger exits. Uber’s commercial insurance policy provides the highest level of coverage during this period. It includes liability coverage for bodily injury and property damage to third parties, as well as coverage for any injuries you may sustain as a driver.

It’s important to note that during Periods 2 and 3, Uber’s insurance coverage generally exceeds the coverage provided during Period 1. However, it’s still advisable to review the details of the policy to understand the specific coverage limits and any deductibles that may apply.

Understanding these periods is crucial for Uber drivers to ensure they have the right insurance coverage and protection throughout their ridesharing activities.

Period 0: App Off

During Period 0, the Uber app is turned off, and you are not available to accept ride requests. This means that you are not actively engaged in ridesharing activities and are considered to be driving for personal use. During this period, your personal auto insurance policy will be the primary coverage.

It’s important to review your personal auto insurance policy to ensure it covers personal use and to understand any limitations or exclusions related to ridesharing. Many personal auto insurance policies have exclusions for commercial activities, such as transporting passengers for hire. If your policy excludes ridesharing or does not provide adequate coverage, you may need to explore other insurance options to ensure you’re protected.

Keep in mind that if you use your personal vehicle for both personal and ridesharing purposes, there may be limitations or exclusions in your policy. Some insurance companies offer rideshare endorsements or add-ons that can be added to your personal auto insurance policy to provide coverage during ridesharing activities. These add-ons can help bridge the coverage gap and provide peace of mind while you’re driving for Uber.

It’s crucial to understand that during Period 0, Uber’s insurance coverage does not apply. Therefore, it’s essential to have appropriate personal auto insurance coverage to protect yourself and others while driving for personal use.

Remember, even though you may not be actively driving for Uber during Period 0, it’s still important to maintain the necessary insurance coverage. Accidents can happen at any time, and having adequate personal auto insurance coverage can help protect you financially in the event of an incident.

Before you begin driving for Uber, take the time to review your personal auto insurance policy and consider any necessary add-ons or endorsements to ensure you have the right coverage during all periods of ridesharing.

Period 1: App On, No Passenger

Period 1 is the time when you have turned on the Uber app and are waiting for ride requests, but you don’t have a passenger in your vehicle yet. During this period, Uber provides contingent liability coverage to its drivers. Contingent liability coverage acts as a backup to your personal auto insurance policy and is designed to bridge the gap between personal use and the risks associated with ridesharing.

The contingent liability coverage provided by Uber during Period 1 typically includes:

- Third-party liability coverage: This coverage protects you against bodily injury and property damage claims made by third parties if you are found at fault in an accident. It provides financial protection in case you cause an accident while waiting for a ride request.

- Contingent comprehensive and collision coverage: This coverage applies to physical damage to your vehicle, subject to a deductible, if you are involved in an accident while waiting for a ride request.

It’s important to note that Uber’s contingent liability coverage during Period 1 only comes into effect if your personal auto insurance policy doesn’t cover ridesharing activities or provides inadequate coverage.

However, it’s crucial to review the details of Uber’s contingent liability coverage, including any limitations or exclusions that may apply. The coverage may have certain conditions, such as a requirement to maintain personal auto insurance, and it may have coverage limits and deductibles that could affect your out-of-pocket expenses in case of a claim.

Additionally, it’s essential to keep in mind that contingent liability coverage from Uber may not cover certain scenarios, such as non-accident-related damages or injuries. It’s always a good idea to consult with your insurance agent or provider to understand the specifics of your personal auto insurance policy and any additional coverage needed during Period 1.

By understanding the insurance coverage provided by Uber during Period 1 and reviewing your personal auto insurance policy, you can ensure that you have the necessary protection while waiting for ride requests.

Period 2: En Route to Pick Up the Passenger

Period 2 begins when you have accepted a ride request and are en route to pick up the passenger. During this period, Uber’s commercial insurance policy comes into effect to provide coverage for you as a driver and protect you against potential liability while driving to the pick-up location.

Uber’s commercial insurance policy during Period 2 typically includes the following coverage:

- Primary liability coverage: This coverage protects you against liability for bodily injury and property damage to third parties if you are at fault in an accident while en route to pick up the passenger. It provides financial protection for legal and medical expenses for third parties involved in an accident caused by you.

It’s important to note that during Period 2, the liability coverage provided by Uber becomes the primary coverage, meaning it takes precedence over your personal auto insurance policy. This is an important distinction from Period 1, where Uber’s coverage is contingent upon your personal auto insurance.

Uber’s commercial insurance policy during Period 2 typically carries generous liability coverage limits to provide substantial protection for both drivers and third parties involved in a potential accident. However, it’s important to review the terms and conditions of the policy to ensure you have a clear understanding of the coverage and any applicable deductibles.

It’s also worth noting that during Period 2, your personal auto insurance policy may not provide coverage. Many personal auto insurance policies exclude coverage for commercial activities, such as driving for hire or transporting passengers for pay. In such cases, relying solely on your personal auto insurance may leave you exposed to potential gaps in coverage.

Having the commercial insurance coverage provided by Uber during Period 2 ensures that you have the necessary protection while en route to pick up passengers. This coverage not only protects you but also provides peace of mind for the passengers you are about to transport.

It’s always a good practice to review your personal auto insurance policy and consult with your insurance agent to understand how your personal coverage interacts with Uber’s commercial insurance during Period 2. By understanding the insurance coverage provided during this period, you can ensure you have appropriate protection and minimize potential gaps in coverage.

Period 3: Passenger in the Vehicle

Period 3 of ridesharing begins when you have picked up the passenger and continues until the ride is completed and the passenger exits the vehicle. It is the time when the highest level of insurance coverage provided by Uber comes into effect, ensuring both you as the driver and the passenger are adequately protected.

During Period 3, Uber’s commercial insurance policy provides comprehensive coverage, including:

- Primary liability coverage: This coverage protects you against liability for bodily injury and property damage to third parties if you are at fault in an accident while the passenger is in the vehicle. It provides financial protection for medical expenses, property damage, and legal expenses.

- Uninsured/underinsured motorist coverage: This coverage protects you and your passengers if you are involved in an accident with an uninsured or underinsured driver who is at fault. It provides coverage for medical expenses and property damage beyond what the at-fault driver’s insurance may cover.

- Contingent comprehensive and collision coverage: This coverage applies to physical damage to your vehicle, subject to a deductible, in the event of an accident while the passenger is in the vehicle.

It’s important to note that during Period 3, Uber’s commercial insurance coverage is primary, meaning it takes priority over your personal auto insurance policy. This provides drivers with the peace of mind that they are protected from potential liability and damages during the duration of the ride.

Having the comprehensive insurance coverage provided by Uber during Period 3 not only protects you but also ensures the safety and well-being of your passengers. It provides reassurance to both you and your passengers that in the event of an accident or unforeseen circumstances, there is insurance coverage in place to handle any potential financial obligations.

While Uber’s commercial insurance during Period 3 offers robust coverage, it is still advisable to review the details of the policy, including any coverage limits and deductibles, to fully understand the extent of coverage provided. Understanding the insurance coverage during Period 3 is crucial for Uber drivers to ensure they have the right protection while transporting passengers.

By being aware of the insurance coverage provided during Period 3 and understanding how it interacts with your personal auto insurance policy, you can ensure that you have the necessary coverage and peace of mind as you transport passengers safely to their destinations.

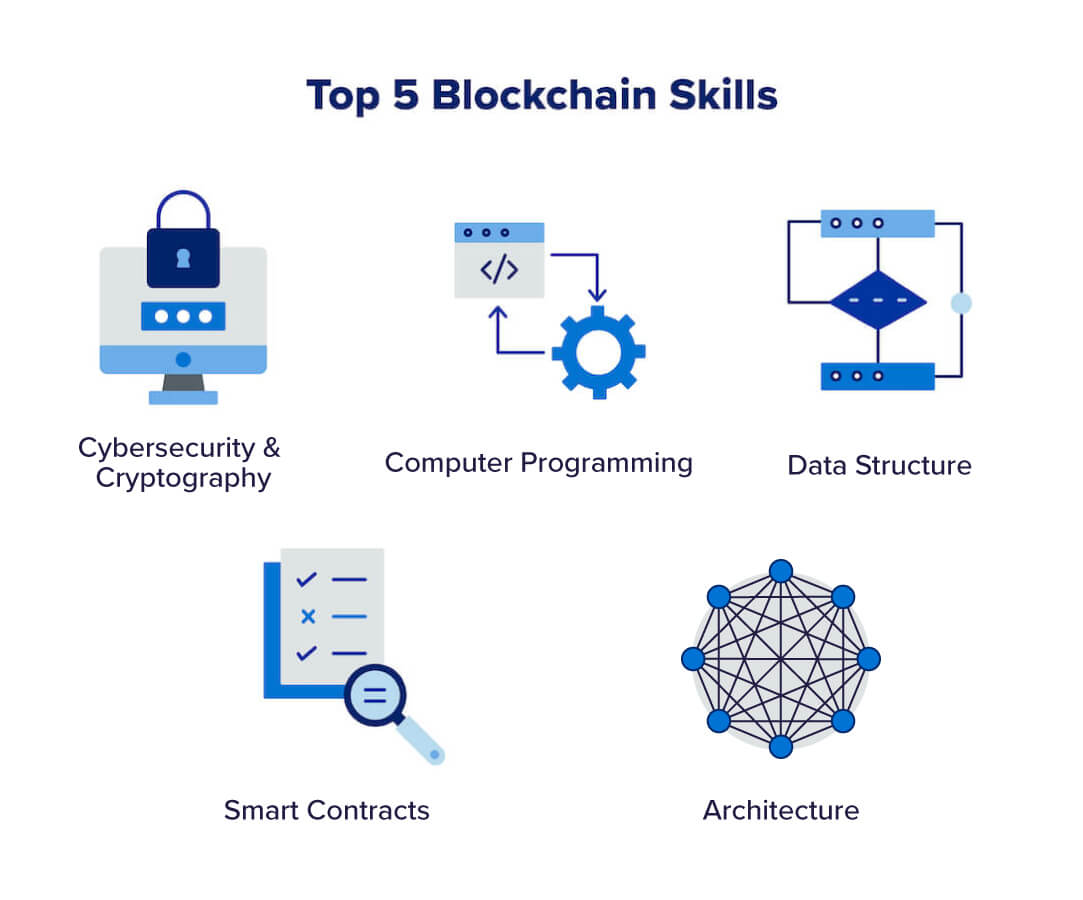

Insurance Options for Uber Drivers

While Uber provides insurance coverage for its drivers during specific periods of ridesharing, some drivers may desire additional protection or supplemental coverage. Here are some insurance options that Uber drivers can consider:

Rideshare Insurance Policies

Many insurance companies now offer specific rideshare insurance policies designed to fill the coverage gaps associated with driving for platforms like Uber. These policies are tailored for rideshare drivers and provide coverage during all periods of ridesharing, including when the app is off or you are on your personal time. Rideshare insurance policies can provide peace of mind by eliminating potential gaps in coverage and ensuring comprehensive protection while driving for Uber.

Commercial Auto Insurance

Since personal auto insurance policies often exclude coverage for commercial activities, such as ridesharing, some Uber drivers opt for commercial auto insurance. Commercial auto insurance is designed to provide coverage for businesses and commercial vehicles. While it offers comprehensive protection, it tends to be more expensive than personal auto insurance. However, it may be a viable option for drivers who use their vehicles primarily for ridesharing and want to ensure they have adequate coverage at all times.

Determining the Right Insurance Coverage

When considering insurance options as an Uber driver, it’s crucial to evaluate your individual needs and assess the level of coverage that makes you feel adequately protected. Factors to consider may include the nature of your driving, the amount of time you spend ridesharing, and your personal financial situation.

It’s important to consult with insurance professionals who specialize in ridesharing insurance or commercial auto insurance to understand the nuances of each policy and assess which coverage options are most appropriate for your specific circumstances. They can help you navigate through the intricacies of insurance policies, evaluate the costs and benefits, and ensure you have the right level of protection as an Uber driver.

Ultimately, having the right insurance coverage as an Uber driver is essential to protect yourself, your passengers, and your financial well-being. By considering rideshare insurance policies or commercial auto insurance, you can enhance your coverage and have peace of mind while you enjoy the flexibility and potential income of driving for Uber.

Rideshare Insurance Policies

As an Uber driver, one popular insurance option to consider is a rideshare insurance policy. Specific to the needs of rideshare drivers, these policies are designed to bridge the coverage gaps that may exist between personal auto insurance and the insurance provided by Uber.

Rideshare insurance policies offer comprehensive coverage during all periods of ridesharing, including when the app is off and during the waiting period when the app is on but there is no passenger in the vehicle. These policies provide coverage for both liability and physical damage to your vehicle, ensuring you have protection in case of an accident or other unforeseen events.

With a rideshare insurance policy, you can have peace of mind knowing that you are covered even during the times when your personal auto insurance policy may not provide adequate protection. This type of policy eliminates any potential gaps in coverage and offers seamless and continuous protection throughout your ridesharing activities.

When considering a rideshare insurance policy, it is recommended to review the coverage details carefully. Look for policies that provide coverage for all periods of ridesharing, offer high liability limits, and have reasonable deductibles for physical damage to your vehicle.

Some insurance companies may offer rideshare endorsements or add-ons that can be added to your existing personal auto insurance policy. This can be a convenient option if you prefer to stick with your current insurer. However, not all insurers may offer this option, and the terms and coverage provided may vary, so it’s important to verify with your insurance provider.

When choosing a rideshare insurance policy, it’s advisable to consult with insurance professionals who specialize in ridesharing insurance. They can help you navigate through the available options, evaluate the costs and benefits, and recommend the most suitable policy based on your specific needs.

Investing in a rideshare insurance policy as an Uber driver is a proactive step towards protecting yourself and your passengers. It ensures you have the necessary coverage to handle any potential risks and helps you drive with confidence knowing that you are prepared for unexpected circumstances.

Commercial Auto Insurance

Another insurance option to consider as an Uber driver is commercial auto insurance. While personal auto insurance policies typically exclude coverage for commercial activities, commercial auto insurance is specifically designed to provide coverage for businesses and commercial vehicles, including ridesharing.

Commercial auto insurance offers comprehensive coverage for your vehicle, liability, and medical expenses in case of an accident or other covered events. It covers a variety of risks and may include protection against bodily injury, property damage, collision, comprehensive coverage, and uninsured/underinsured motorist coverage.

One of the key advantages of commercial auto insurance is that it provides coverage regardless of the nature of your driving activities, whether personal use or ridesharing. This means you have continuous protection without worrying about potential gaps in coverage during different periods of driving.

While commercial auto insurance offers broad coverage, it’s important to note that it tends to be more expensive than personal auto insurance. The higher premiums are typically due to the increased risks associated with commercial driving and the potential liability involved in transporting passengers for hire.

When considering commercial auto insurance, it’s essential to evaluate your driving habits, the amount of time you spend ridesharing, and your specific needs. If you primarily use your vehicle for ridesharing and have a high volume of passengers, commercial auto insurance may be a suitable option to ensure you have adequate coverage at all times.

To obtain commercial auto insurance, you can reach out to insurance providers that specialize in commercial vehicle coverage. They will assess your driving history, vehicle usage, and other relevant factors to determine appropriate coverage options and premiums based on your specific situation.

While commercial auto insurance may come at a higher cost, it offers the advantage of comprehensive protection and peace of mind for Uber drivers who want to ensure they have continuous coverage while operating their vehicles for hire.

Before making a decision, it’s advisable to consult with insurance professionals who specialize in commercial auto insurance. They can guide you through the details, terms, and costs associated with commercial policies, helping you make an informed choice that best meets your needs as an Uber driver.

Determining the Right Insurance Coverage

As an Uber driver, it’s essential to have the right insurance coverage to protect yourself, your passengers, and your financial well-being. Here are some factors to consider when determining the appropriate insurance coverage for your ridesharing activities:

Driving Habits and Frequency

Consider how frequently you drive for Uber and the nature of your ridesharing activities. If you only drive occasionally or on a part-time basis, your personal auto insurance policy with additional rideshare endorsements may be sufficient. However, if ridesharing is your primary source of income and you drive extensively, you may need to explore commercial auto insurance or specialized rideshare insurance policies.

Personal Auto Insurance Policy

Review your personal auto insurance policy to understand its coverage limitations and exclusions related to ridesharing. Determine if your policy covers you during all periods of ridesharing or if you need additional coverage to fill the gaps. Consider speaking with your insurance provider to clarify any uncertainties.

Risk Tolerance

Assess your risk tolerance and financial situation. Think about the potential costs you could be responsible for in the event of an accident or other covered incidents. Having higher liability limits and comprehensive coverage can provide greater financial protection but may come at a higher cost in terms of premiums.

Rideshare Insurance Policies and Commercial Auto Insurance

Evaluate the availability and affordability of rideshare insurance policies and commercial auto insurance. Compare the coverage, premiums, and benefits of these options to determine the best fit for your needs. Consult with insurance professionals who specialize in these types of policies to understand the specifics and ensure you are adequately protected.

By considering all these factors and consulting with insurance experts, you can determine the right insurance coverage for your ridesharing activities. Remember that each driver’s situation is unique, and there is no one-size-fits-all approach. Prioritize having sufficient coverage to protect yourself, your passengers, and your financial interests while driving for Uber.

Regularly review your insurance coverage to ensure it aligns with any changes in your driving habits or policy requirements. As an Uber driver, staying updated and maintaining the right insurance coverage will provide peace of mind and ensure you drive with confidence.

Conclusion

Driving for Uber can be a lucrative and flexible way to earn income, but it’s crucial to understand the insurance requirements and options available to ensure you have the necessary coverage. While Uber provides insurance coverage for its drivers during specific periods of ridesharing, additional insurance options may be worth considering to supplement or enhance your protection.

Personal auto insurance is typically the starting point for many Uber drivers, but it may not provide adequate coverage for ridesharing activities. Review your policy carefully to understand any limitations or exclusions related to ridesharing, and consider adding rideshare endorsements or exploring specialized coverage options.

Rideshare insurance policies are specifically designed to address the unique needs of rideshare drivers. They offer comprehensive coverage during all periods of ridesharing, filling the gaps that personal auto insurance may leave. Rideshare policies can provide peace of mind and protect you from potential financial risks and liabilities.

Commercial auto insurance is another option to consider, particularly if you primarily use your vehicle for ridesharing or have a high volume of passengers. Commercial policies offer broad coverage but tend to be more expensive than personal auto insurance due to the increased risks associated with commercial driving.

When determining the right insurance coverage, factors such as your driving habits, risk tolerance, and financial situation should be taken into account. Consulting with insurance professionals who specialize in rideshare or commercial auto insurance can provide valuable guidance in navigating the available options.

Ultimately, having the right insurance coverage as an Uber driver is essential to protect yourself, your passengers, and your financial well-being. By understanding the various insurance options and selecting the coverage that best suits your needs and circumstances, you can drive with confidence and peace of mind.

Regularly review your insurance coverage to ensure it remains up to date and aligned with any changes in your driving habits or policy requirements. As an Uber driver, being properly insured is not only a legal requirement but a responsible choice that safeguards your livelihood and the safety of those you transport.