Finance

What Paperwork Do I Need To Get Car Insurance?

Published: November 5, 2023

Discover the essential paperwork to have on hand when obtaining car insurance. From driver's license to vehicle registration, we've got you covered. Finance your peace of mind today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

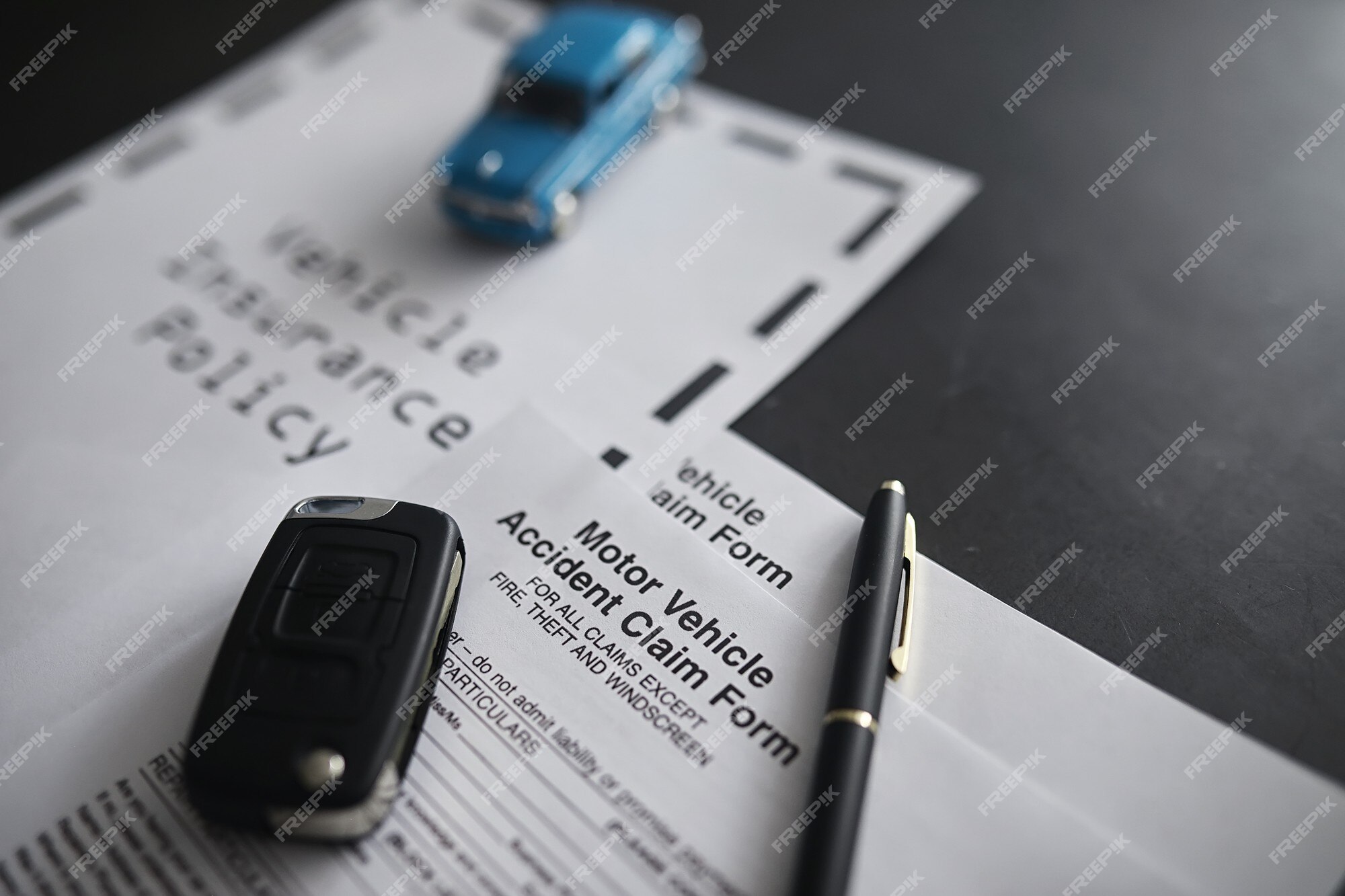

Getting car insurance is an essential step for any vehicle owner. It provides financial protection in case of accidents, theft, or any other unfortunate events. However, before you can secure the coverage you need, there is some necessary paperwork that you must gather and submit to the insurance company. This article will guide you through the various documents required to obtain car insurance, ensuring a smooth and hassle-free process.

When it comes to car insurance, the specific paperwork you need may vary depending on your location and the insurance provider you choose. However, there are some common documents that almost all insurers will require. These documents serve to establish your identity, proof of ownership, and other relevant information about you and your vehicle.

By having all the necessary paperwork ready in advance, you can streamline the insurance application process and avoid any delays or complications. So let’s take a closer look at the essential documents you’ll need to provide when getting car insurance.

Proof of Ownership

One of the primary documents you’ll need when applying for car insurance is proof of ownership of the vehicle. This proof typically comes in the form of a vehicle title or a bill of sale. It serves to establish that you are the rightful owner of the vehicle and have the legal authority to insure it.

If you are purchasing a new vehicle, the dealership or seller will provide you with the necessary documentation, such as a title or a temporary registration. It is crucial to keep these documents safe, as you will need them for insurance purposes.

If you already own the vehicle and are renewing or switching insurance companies, you can provide a copy of the vehicle title or registration as proof of ownership. Ensure that the document is up to date and in your name.

In some cases, if there is a lien on the vehicle, meaning you have a loan or financing for it, you may need to provide additional paperwork. This can include a letter from the lienholder authorizing you to insure the vehicle or a copy of the loan agreement. Consult with your insurance provider to determine the specific requirements in such situations.

Having the appropriate proof of ownership is crucial for obtaining car insurance as it safeguards against fraudulent claims and ensures that you have the legal rights to insure and drive the vehicle. Therefore, make sure you gather all the necessary documents in advance to simplify the insurance application process and get the coverage you need.

Proof of Identity

When applying for car insurance, you will need to provide proof of your identity. This is to verify that you are who you claim to be and to ensure that the insurance policy is issued to the correct person. The required documents may vary depending on your location and insurance provider, but common forms of identification include:

- Driver’s License: Your driver’s license is a crucial document that establishes your identity and verifies that you are legally eligible to drive. Insurance companies will typically require a valid driver’s license as proof of identity.

- Passport: If you do not have a driver’s license or if you reside in a country where a passport is an accepted identification document, you may be required to provide a valid passport.

- Government-Issued ID: In some cases, a government-issued ID, such as a national identity card or a state-issued identification card, may be accepted as proof of identity.

It is important to ensure that the identification documents you provide are current, valid, and not expired. In addition, the information on your identification should match the details you provide on your insurance application.

Keep in mind that insurance companies have strict policies regarding identity verification to prevent fraud. Providing accurate and legitimate proof of identity is crucial for obtaining car insurance and ensuring that the policy is issued to the correct individual.

Before submitting your application, double-check the requirements of your insurance provider and ensure that you have the necessary documents on hand. By providing the appropriate proof of identity, you can confidently move forward with the car insurance application process.

Driver’s License

When applying for car insurance, one of the essential documents you will need to provide is your driver’s license. Your driver’s license serves as proof that you are legally allowed to operate a motor vehicle. Insurance companies require a valid and current driver’s license to verify your identity and driving history.

Insurance providers will typically ask for a copy of your driver’s license as part of the application process. They may request either a physical copy or a scanned copy of your license. Some insurance companies also offer the convenience of uploading a photo of your license through their online portals or mobile apps.

It is important to ensure that your driver’s license is not expired and that it matches the information you provide on your insurance application. Any discrepancies may result in delays or complications with your insurance coverage.

In addition to verifying your identity, your driver’s license may also impact your car insurance premium. Insurance companies consider factors such as your driving record, traffic violations, and accidents when determining your insurance rates. Thus, the information on your driver’s license will play a role in assessing your risk profile.

In some cases, if you have an international driver’s license or hold a license from a foreign country, you may need to provide additional documentation. This can include a translation of the license or other supporting documents as required by your insurance provider.

While the specific requirements for driver’s license documentation may vary depending on your location and insurance company, having a valid and current license is essential for obtaining car insurance. So ensure that you have a copy of your driver’s license ready when applying for insurance to streamline the process and secure the coverage you need.

Vehicle Registration

When applying for car insurance, it is important to provide proof of vehicle registration. Vehicle registration is a legal document issued by the government that confirms your ownership of the vehicle and provides important details about it. This documentation is crucial for insurance companies to verify the specific vehicle you want to insure.

Typically, your vehicle registration will include information such as the vehicle identification number (VIN), make, model, year of manufacture, and other relevant details. It serves as an official record of your vehicle’s registration with the local Department of Motor Vehicles (DMV) or equivalent agency.

Insurance companies will require a copy of your vehicle registration as proof of ownership and to gather accurate information about your car. This allows them to determine the appropriate coverage and premiums based on the vehicle’s specifications.

It is essential to keep your vehicle registration updated and ensure that it matches the information you provide during the insurance application process. Any discrepancies may result in delays or complications with your insurance coverage.

In some cases, if you have recently purchased a new vehicle, you may not have the permanent registration documents yet. In such instances, temporary registration or a bill of sale may be accepted by insurance companies. Check with your insurance provider to determine their specific requirements.

Remember, the vehicle registration document is crucial for obtaining car insurance as it confirms legal ownership and provides vital information about the vehicle. Make sure you have a copy of your vehicle registration readily available when applying for insurance to simplify the process and ensure accurate coverage.

Proof of Address

When applying for car insurance, one of the documents you will need to provide is proof of your address. Insurance companies require this information to verify your residency and determine the appropriate rating factors for your policy. It helps them assess the risk associated with the area in which you live.

The specific documents accepted as proof of address may vary between insurance providers, but some common forms include:

- Utility Bills: A recent utility bill such as electricity, water, or gas bill can serve as proof of address. Ensure that the bill is in your name and includes your current residential address.

- Bank Statement: A bank statement that shows your name, address, and is dated within the past few months can be accepted as proof of address.

- Government-Issued Documents: Certain government-issued documents like a tax assessment, voter registration card, or residency permit may be considered valid proof of address.

- Lease Agreement: If you are renting a property, providing a copy of your lease agreement may be accepted as proof of address.

It is important to note that insurance companies may have specific requirements regarding the age of the documents and the format in which they are provided. Check with your insurance provider to ensure compliance with their guidelines.

Having the correct and up-to-date proof of address is crucial for completing your car insurance application. It helps establish your residency and ensures that the insurance company has accurate information for underwriting and rating purposes.

Before applying for car insurance, gather the necessary documents to prove your address. Keeping copies readily available will streamline the application process and help you secure the coverage you need.

Insurance Application

The insurance application is a crucial step in obtaining car insurance. It is a form that you must fill out and submit to the insurance company to initiate the coverage process. The application collects pertinent information about you, your vehicle, and your driving history.

The specific details required in an insurance application may vary between insurance providers, but some common information typically includes:

- Personal Information: This includes your full name, date of birth, occupation, and contact details. You may also be asked for your social security number or national identification number.

- Vehicle Information: You will need to provide details about the vehicle you want to insure, such as its make, model, year, VIN (Vehicle Identification Number), and mileage.

- Driving History: Insurance companies typically want to know about your driving history. This includes information about any accidents, tickets or citations, license suspensions or revocations, and any claims you have made in the past.

- Usage: You may be asked to provide information about how the vehicle will be used, whether for personal or business purposes, and the estimated annual mileage.

- Coverage and Deductible Selection: You will need to decide on the desired level of coverage, such as liability, collision, comprehensive, or additional options. Additionally, you will select the deductible amount, which is the out-of-pocket expense you agree to pay in the event of a claim.

The insurance application is a critical document as it serves as the basis for your policy and the determination of premiums. It is important to provide accurate and complete information to avoid any issues with your coverage in the future.

Insurance companies may offer different methods for submitting the application, such as online forms, over the phone, or through an agent. Ensure that you understand the specific requirements and process of your chosen insurance provider.

By carefully completing the insurance application, you can ensure that the insurance company has all the necessary information to underwrite your policy effectively. This helps you secure the appropriate coverage and receive accurate premium quotes for your car insurance.

Vehicle Information

Providing accurate and detailed information about your vehicle is a crucial part of the car insurance application process. Insurance companies require specific details about your vehicle to assess its risk profile and determine the coverage options and premiums.

When completing the application, you will typically need to provide the following vehicle information:

- Make and Model: The make and model of your vehicle refer to the manufacturer and the specific model name.

- Year: You should provide the year of manufacture of your vehicle. This helps insurance companies assess factors like depreciation and safety features.

- VIN (Vehicle Identification Number): The VIN is a unique 17-digit code assigned to each vehicle. It provides vital information about the vehicle’s specifications, history, and ownership.

- Mileage: You will be asked to provide the estimated annual mileage. This helps insurers gauge the vehicle’s usage and potential risk.

- Modifications: If you have made any modifications or additions to your vehicle, such as aftermarket upgrades or customizations, you should disclose them on the application. These modifications may impact the coverage and premiums.

It is crucial to provide accurate and truthful information about your vehicle. Any discrepancies or omissions could lead to issues with your coverage or potential claim denials in the future. Additionally, an accurate representation of your vehicle’s details ensures that you receive the proper coverage based on its specifications.

It is also important to note that insurance companies may have specific guidelines regarding the type of vehicles they cover. Some may have restrictions or limitations on certain vehicle types, such as high-performance sports cars or vehicles with salvage titles. Check with your insurance provider to ensure compliance with their requirements.

By providing comprehensive and accurate vehicle information, you can streamline the insurance application process and ensure that you receive the appropriate coverage for your specific vehicle.

Vehicle Inspection

In some cases, insurance companies may require a vehicle inspection as part of the car insurance application process. The purpose of the inspection is to assess the condition of the vehicle, verify its existence, and identify any pre-existing damage or issues that may affect the coverage.

The need for a vehicle inspection can vary depending on factors such as the age of the vehicle, its value, or if it has a salvage or rebuilt title. Insurance companies may also conduct inspections for new policyholders, as well as in cases where there are concerns about the vehicle’s condition or discrepancies in the provided information.

The inspection process typically involves a qualified inspector examining the vehicle both externally and internally. They will assess the vehicle’s overall condition, functionality of key components, and any signs of previous damage or repairs. They may also check the mileage, VIN, and other important details to ensure consistency with the application.

In some cases, the inspection may be conducted at a designated inspection center chosen by the insurance company. Alternatively, it may be possible for an inspector to visit your location, making the process more convenient for you.

It is important to note that the cost of the inspection may be borne by either the insurance company or the policyholder. Check with your insurance provider to understand their specific requirements and any associated costs.

By conducting a vehicle inspection, insurance companies can accurately assess the vehicle’s condition and potential risks, ultimately ensuring that the coverage provided aligns with the actual state of the vehicle. It helps prevent any fraudulent claims or disputes related to the vehicle’s condition.

If your insurance company requires a vehicle inspection, they will provide you with the necessary information and instructions on how to schedule it. Ensure that you comply with the requirements to avoid any delays or complications with your car insurance coverage.

Previous Insurance Information

When applying for car insurance, it is important to provide information about your previous insurance coverage, if applicable. Insurance companies often require details about your prior insurance history to assess your risk profile, determine your eligibility for certain coverage options, and understand any potential claim history.

The specific information that you may be asked to provide about your previous insurance includes:

- Insurance Company: You will need to provide the name of your previous insurance company.

- Policies and Coverage: Details about your previous insurance policies, such as the duration of coverage, types of coverage (liability, collision, comprehensive, etc.), and coverage limits.

- Claims History: Insurance companies will inquire about any previous claims you have made, including the nature of the claims, dates of occurrence, and the amount paid out. This information helps them assess your risk profile and potential for future claims.

- Insurance lapse: If there was any gap in your previous insurance coverage, you may be asked to provide an explanation for the lapse. Insurance companies consider continuous coverage as a positive factor when determining rates.

It is important to provide accurate and truthful information about your previous insurance history. Insurance companies may cross-reference the information provided with industry databases to verify your claims history.

Even if you had no prior insurance, it is essential to disclose this information. Not having previous insurance coverage may affect your eligibility for certain discounts or programs offered by insurance providers.

The information about your previous insurance is used by insurance companies to assess your risk profile and determine the appropriate premiums and coverage options for your policy. By providing complete and accurate information, you ensure that your new insurance policy aligns with your needs and that you receive accurate premium quotes.

If you are unsure about the exact details of your previous insurance, you can usually find the necessary information on your previous insurance policy documentation or by contacting your previous insurance company directly.

Payment Information

When applying for car insurance, one crucial aspect to consider is providing the necessary payment information. Insurance companies require this information to set up your premium payments and ensure that the policy remains active and in effect.

Here are some key aspects of payment information you may need to provide:

- Payment Method: You will typically need to specify the preferred payment method, such as credit card, debit card, electronic funds transfer (EFT), or check. Some insurance companies also offer automatic payment options for added convenience.

- Bank Account or Credit Card Details: Depending on the chosen payment method, you will need to provide the relevant financial account information, such as bank account details or credit card information. This enables the insurance company to process future premium payments.

- Premium Frequency: You will choose the frequency at which you want to make premium payments, such as monthly, quarterly, semi-annually, or annually. Keep in mind that some insurance companies may offer discounts for choosing certain payment frequencies.

- Authorization: By providing your payment information, you are authorizing the insurance company to deduct the agreed-upon premiums from your designated account or credit card. This ensures that the payments are made on time and that your coverage remains in force.

It is essential to provide accurate payment information to avoid any disruption in your coverage. Ensure that the account or card details you provide are valid and up to date.

Keep in mind that failure to make premium payments on time may result in a lapse in coverage or cancellation of the policy. It is important to understand the payment terms and due dates specified by your insurance provider to avoid any issues.

Insurance companies prioritize the security of your payment information. They employ various measures to safeguard the data you provide, maintaining the confidentiality and integrity of the transaction.

By providing the necessary payment information accurately and promptly, you can ensure that your car insurance coverage remains active and that your premiums are paid on time. This ensures the continued protection and financial security provided by your insurance policy.

Conclusion

Obtaining car insurance requires gathering and submitting several crucial documents to the insurance company. These documents serve to establish proof of ownership, identity, address, and other necessary information about you and your vehicle. By ensuring that you have all the required paperwork ready in advance, you can streamline the application process and avoid delays or complications.

The proof of ownership, such as a vehicle title or bill of sale, confirms that you are the rightful owner of the vehicle and have the legal authority to insure it. Proof of your identity, typically through a driver’s license or passport, ensures that the insurance policy is issued to the correct person.

Vehicle registration documents provide essential information about the vehicle, including the VIN, make, model, and year. This helps insurance companies assess risk and determine appropriate coverage options.

Proof of address, such as utility bills or government-issued documents, serves to verify your residency and is a crucial component of the insurance application process.

Providing accurate details about your previous insurance coverage, including the insurance company name, policy details, and claims history, helps insurers assess your risk profile and determine appropriate premiums.

Finally, payment information is necessary to set up premium payments and ensure the policy remains active. Providing the preferred payment method, financial account or credit card details, and choosing the payment frequency helps ensure smooth premium transactions.

By understanding and gathering the required paperwork, you can simplify the car insurance application process and secure the coverage you need. Remember to provide accurate and truthful information to avoid any complications with your insurance policy in the future.

Consult with your chosen insurance provider for specific requirements and guidelines regarding the necessary paperwork, and be prepared to provide any additional documentation they may request. With the right documents in hand, you’ll be on your way to obtaining the car insurance coverage that meets your needs and offers peace of mind on the road.