Finance

What Is A 760 Credit Score

Published: October 22, 2023

Learn what a 760 credit score means and how it can impact your financial future. Discover the importance of managing your finances to achieve this favorable credit score.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

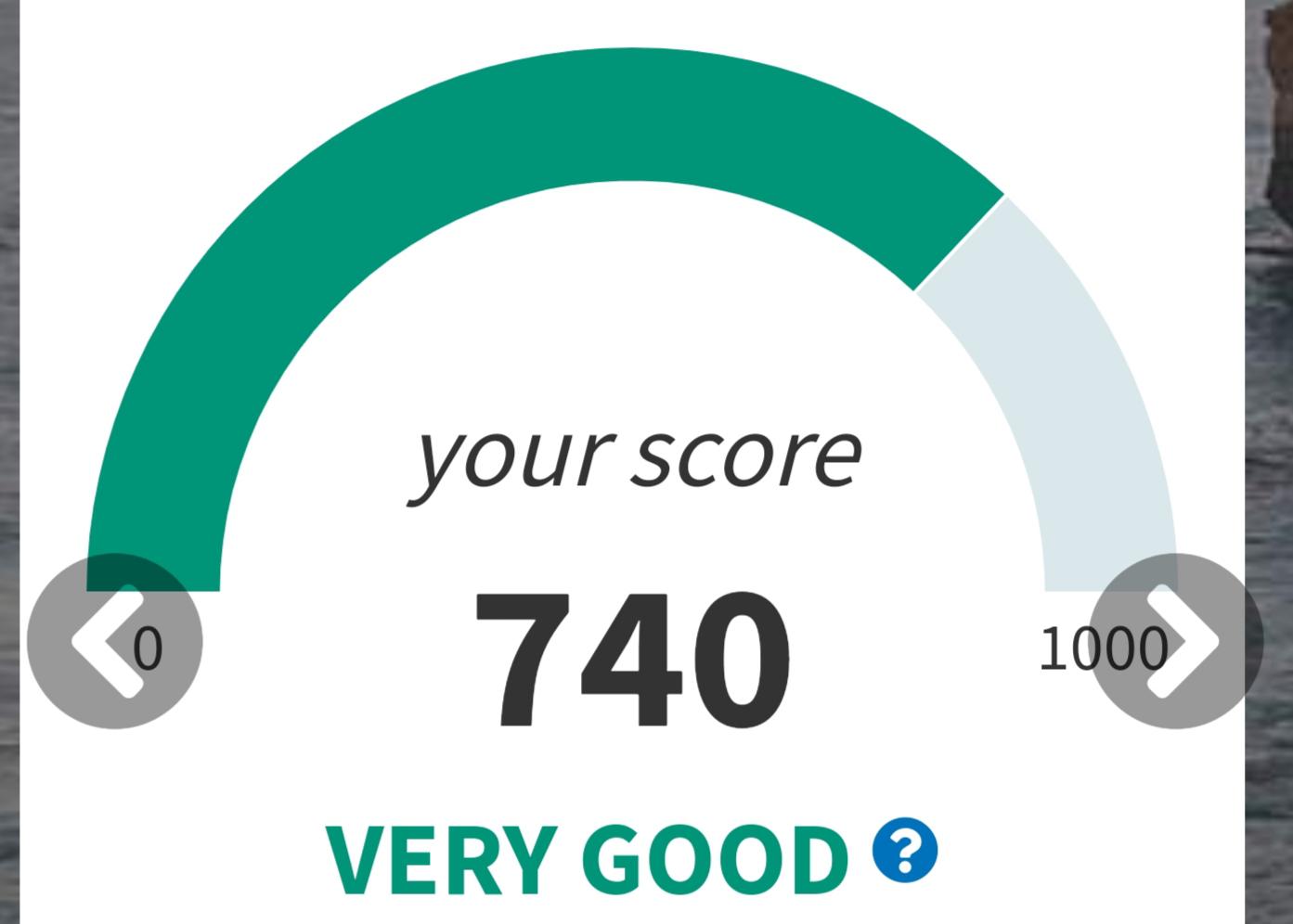

Having a good credit score is essential for accessing financial opportunities and achieving financial stability. Among the various credit score ranges, a 760 credit score is considered excellent and can open doors to favorable interest rates, loan approvals, and other financial benefits.

In this article, we will explore what a 760 credit score signifies, the factors that contribute to it, the benefits it offers, and how you can achieve and maintain this coveted credit score. We will also address common misconceptions surrounding 760 credit scores.

Understanding and managing your credit score is crucial, as it can impact your ability to secure loans, obtain favorable interest rates, rent an apartment, purchase a car, or even secure a job. A 760 credit score demonstrates responsible financial behavior and a solid track record of managing credit, leading to increased trust and confidence from lenders and financial institutions.

Whether you aim to achieve a 760 credit score or simply want to improve your overall creditworthiness, this article will provide valuable insights and practical tips to help you on your financial journey.

What is a 760 Credit Score?

A 760 credit score falls within the range of “excellent” on the FICO credit scoring scale, which ranges from 300 to 850. It is an indicator of a strong credit history and responsible financial management. Lenders and creditors generally consider individuals with a 760 credit score to be low-risk borrowers.

To understand the significance of a 760 credit score, it’s important to know how credit scores are calculated. The FICO scoring model takes into account several factors, including payment history, credit utilization, length of credit history, credit mix, and recent credit inquiries.

A 760 credit score is achieved through consistent, on-time payment of bills and debts, keeping credit utilization low, maintaining a diverse mix of credit accounts, and avoiding excessive new credit applications.

With a 760 credit score, you are likely to enjoy various financial benefits. Lenders and financial institutions will view you as a financially responsible individual, increasing the chances of obtaining loans and credit cards with favorable interest rates and terms. It can also help you to negotiate better deals when applying for a mortgage, auto loan, or personal loan.

Besides facilitating borrowing, a high credit score can also impact other aspects of your financial life. Landlords may prefer tenants with a good credit score, making it easier to secure a rental property. Utility companies might waive security deposits for individuals with excellent credit scores. Even employers in certain industries may consider credit scores in the hiring process, as responsible financial behavior can demonstrate reliability and trustworthiness.

Understanding the importance of a 760 credit score and how it is achieved lays the foundation for building a strong financial future. In the following sections, we will explore the factors that contribute to a 760 credit score and the steps you can take to achieve and maintain this desirable credit score.

Factors that Contribute to a 760 Credit Score

Achieving a 760 credit score requires careful management of several key factors that impact your creditworthiness. Understanding these factors can help you make informed decisions and maintain a strong credit profile. Here are the main factors that contribute to a 760 credit score:

- Payment History: The most significant factor influencing your credit score is your payment history. Making all your payments on time, including credit card bills, loan installments, and utility bills, demonstrates responsible financial behavior and contributes positively to your credit score.

- Credit Utilization: Credit utilization is the percentage of your available credit that you are currently using. To maintain a 760 credit score, it is recommended to keep your credit utilization below 30%. This shows lenders that you are using credit responsibly and not relying heavily on borrowed funds.

- Length of Credit History: The length of your credit history also plays a role in determining your credit score. Having a longer credit history indicates a more established financial track record and can boost your score.

- Credit Mix: A diverse mix of credit accounts, such as credit cards, loans, and mortgages, can be beneficial in achieving a high credit score. Having different types of credit and managing them responsibly showcases your ability to handle various financial obligations.

- Recent Credit Inquiries: Every time you apply for new credit, it results in a hard inquiry on your credit report. Multiple hard inquiries within a short period can negatively impact your credit score. It is important to limit credit applications and only apply for credit when necessary.

By focusing on these factors and adopting healthy financial habits, you can work towards achieving and maintaining a 760 credit score. It takes time and consistency to build a solid credit profile, so it’s essential to remain patient and committed to sound financial practices.

Benefits of Having a 760 Credit Score

Having a 760 credit score offers numerous benefits that can significantly impact your financial well-being. Lenders and creditors consider individuals with high credit scores to be low-risk borrowers, making them eligible for better financial opportunities. Let’s explore some of the key benefits of having a 760 credit score:

- Favorable Interest Rates: With a 760 credit score, you are likely to qualify for loans and credit cards with lower interest rates. This can save you a substantial amount of money over time, whether you’re applying for a mortgage, auto loan, or personal loan.

- Higher Credit Limits: Lenders are more inclined to provide higher credit limits to individuals with a 760 credit score. This can give you better purchasing power and more flexibility when managing your finances.

- Easier Loan Approvals: A 760 credit score increases your chances of getting approved for loans and credit applications. Lenders have more confidence in your ability to repay the borrowed funds, making the application process smoother and quicker.

- Premium Credit Cards: Many premium credit cards with exclusive benefits and rewards are typically available to individuals with excellent credit scores. These cards often offer perks like cashback, travel rewards, and access to airport lounges, granting you the opportunity to enjoy enhanced benefits and privileges.

- Rental Approval: Landlords often consider an applicant’s credit score when deciding whether to approve a rental application. With a 760 credit score, you are more likely to be approved for your desired rental property, as landlords tend to view you as a reliable tenant.

- Lower Insurance Premiums: Some insurance providers consider credit scores when determining insurance premiums. By having a 760 credit score, you may qualify for lower insurance rates, including auto insurance and homeowner’s insurance.

- Employment Opportunities: While not universally applicable, certain employers in finance, banking, or positions that involve handling money may consider credit scores during the hiring process. A high credit score can demonstrate responsibility and reliability, enhancing your overall employability.

These benefits highlight the importance of maintaining a strong credit score. With a 760 credit score, you can enjoy better financial terms, increased confidence from lenders, and access to a wider range of financial opportunities. It is crucial to continue practicing responsible financial habits to not only reap these benefits but also strengthen your financial well-being in the long run.

How to Achieve and Maintain a 760 Credit Score

While a 760 credit score is considered excellent, it is achievable with a disciplined approach to managing your finances. Here are some key steps to help you achieve and maintain a 760 credit score:

- Pay Every Bill on Time: Consistently making on-time payments is crucial to maintaining a good credit score. Set up payment reminders or automate your payments to ensure you never miss a due date.

- Keep Credit Utilization Low: Aim to utilize no more than 30% of your total available credit. This means keeping your credit card balances low compared to your credit limits. Low credit utilization demonstrates responsible credit management.

- Monitor Your Credit Report: Regularly review your credit report for any errors or discrepancies. Reporting inaccuracies to the credit bureaus can help improve your credit score. You can access your credit report for free once a year from each of the major credit bureaus.

- Diversify Your Credit Mix: Having a mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. However, only open new credit accounts when necessary and ensure you can manage them responsibly.

- Avoid Excessive Credit Applications: Each time you apply for new credit, it results in a hard inquiry on your credit report which can temporarily lower your score. Limit credit applications and only apply for credit when needed.

- Establish a Long Credit History: The length of your credit history is an important factor in your credit score. Be patient and maintain a positive credit history over time to improve your score.

- Manage Debt Responsibly: Avoid excessive debt and make sure to make timely payments on loans and credit cards. Minimize carrying high balances on your credit cards to demonstrate responsible debt management.

- Keep Old Credit Accounts Open: Closing old credit accounts can potentially hurt your credit score. Keep older accounts open, especially if they have a positive payment history, as they contribute to the length of your credit history.

By following these practices consistently over time, you can improve your credit score and aim for a 760 credit score. It’s important to note that building and maintaining a good credit score requires patience and discipline. Regularly monitor your credit score to track your progress and adjust your financial habits as needed.

Common Misconceptions about 760 Credit Scores

While a 760 credit score is an impressive achievement, there are several misconceptions that surround it. Understanding these misconceptions can help you have a more accurate perspective on what a 760 credit score entails. Let’s debunk some of the common misconceptions:

- Perfect Credit: One common misconception is that a 760 credit score represents perfect credit. While a 760 credit score is considered excellent, credit scores can go up to 850. Remember that credit scores are not an absolute measure of perfection, but rather a reflection of responsible credit management.

- Instant Approval: Another misconception is that a 760 credit score guarantees instant approval for all credit applications. While a high credit score puts you in a favorable position, lenders also consider other factors such as income, debt-to-income ratio, and employment stability when making lending decisions.

- Set-and-Forget: Some might believe that achieving a 760 credit score means they can stop actively managing their credit. However, credit scores require ongoing attention and responsible financial behavior to maintain. Continuously monitoring and managing your credit is crucial for long-term financial health.

- Only Credit Cards Matter: Some individuals may focus solely on credit cards when building credit. While credit cards can play a significant role, a well-rounded credit profile includes other forms of credit, such as loans and mortgages. Maintaining a mix of credit accounts demonstrates your ability to manage various financial obligations.

- Closing Credit Accounts Improves Scores: Closing old credit accounts in an attempt to improve credit scores is another misconception. In reality, closing accounts can potentially lower your credit score, especially if they have a long and positive payment history. It is generally better to keep old accounts open, even if you’re not actively using them.

- Income Affects Credit Score: Your income does not directly impact your credit score. Credit scores are determined based on factors such as payment history, credit utilization, and length of credit history. However, lenders may consider your income when evaluating your ability to handle new credit or loan obligations.

Understanding these misconceptions can help you have a more realistic view of credit scores and credit management. It’s important to educate yourself about credit and continually seek accurate information to make informed financial decisions.

Conclusion

Achieving and maintaining a 760 credit score is a goal worth striving for. It represents excellent creditworthiness and opens up a world of financial opportunities. By focusing on key factors such as on-time payments, low credit utilization, and a diverse credit mix, you can work towards improving your credit score over time.

Having a 760 credit score comes with a range of benefits, including access to better interest rates, higher credit limits, and increased approval chances for loans and credit cards. It can also positively impact other areas of your life, such as rental applications and insurance premiums.

However, it’s important to dispel common misconceptions surrounding credit scores. Understand that a 760 credit score does not equate to perfection or guarantee instant approval for all credit applications. Continuous attention to your credit management is necessary to maintain a strong credit profile.

By implementing responsible financial habits, such as paying bills on time, keeping credit utilization low, and diversifying your credit accounts, you can improve your chances of achieving and maintaining a 760 credit score. Remember to regularly monitor your credit report, address any inaccuracies, and make adjustments as needed along the way.

Building and maintaining a strong credit score is a long-term process that requires patience, discipline, and financial responsibility. With determination and consistent effort, you can reach your goal of a 760 credit score and enjoy the many benefits it brings to your financial life.