Home>Finance>What Is A Google Temporary Hold On My Credit Card

Finance

What Is A Google Temporary Hold On My Credit Card

Modified: February 21, 2024

Discover what a Google temporary hold on your credit card means in finance and how it can impact your transactions. Get insights and tips to resolve the issue efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Card Holds

- What is a Google Temporary Hold?

- Reasons for Google Temporary Holds

- How Does a Google Temporary Hold Work?

- Duration of Google Temporary Holds

- How to Check for Google Temporary Holds on Your Credit Card

- Managing Google Temporary Holds

- How to Remove a Google Temporary Hold

- Tips for Dealing with Google Temporary Holds

- Conclusion

Introduction

Let’s face it – managing your credit card can sometimes be a confusing process. From interest rates to rewards programs, there are many aspects to navigate. One such aspect that often raises questions is the concept of temporary holds placed on your credit card. In this article, we will focus specifically on Google temporary holds and shed light on what they are and how they work.

When using Google services or making purchases through Google platforms, you may have come across the term “temporary hold” associated with your credit card. It’s natural to wonder what exactly this means and how it impacts your financial standing. Understanding the ins and outs of these holds can help you avoid any unnecessary confusion or concern.

In simple terms, a temporary hold is an authorization placed on your credit card by a merchant or service provider to ensure that funds are available before completing a transaction. This hold acts as a guarantee that you have the necessary funds to cover the final purchase amount.

Google temporary holds, as the name suggests, are holds specifically associated with transactions made through Google services such as the Google Play Store, Google Ads, or Google Cloud. These holds are implemented to protect both the buyer and the seller, ensuring that the transaction can proceed smoothly and securely.

It’s important to note that temporary holds are not unique to Google. Many other online platforms and retailers utilize this practice to validate credit card information and minimize the risk of fraudulent activities. Understanding how these holds work can help alleviate any concerns you may have about the security and stability of your credit card transactions.

Understanding Credit Card Holds

Before diving into the specifics of Google temporary holds, it’s essential to have a solid understanding of credit card holds in general. A credit card hold, also known as an authorization hold or a pre-authorization, is a temporary freeze placed on your available credit card balance by a merchant or service provider.

The purpose of a credit card hold is to ensure that the customer has sufficient funds to cover the cost of a transaction. It acts as a safety net for merchants, protecting them from potential losses due to insufficient funds or declined payments.

Here’s how a credit card hold typically works:

- When you make a purchase, the merchant requests an authorization from your credit card issuer.

- The credit card issuer places a hold on the specified amount in your available credit, reducing your available balance accordingly.

- If the transaction is successfully completed, the hold is converted into a charge, and the funds are transferred from your account to the merchant.

- If the transaction is not completed or canceled, the hold is released, and the funds become available again in your account.

This process ensures that the merchant can securely process transactions without the risk of insufficient funds. While credit card holds can be an inconvenience for cardholders, they are a standard practice in the world of finance.

It’s crucial to understand that credit card holds are different from actual charges. When a hold is placed, the funds are still in your account but are set aside for the specific transaction. The actual payment occurs when the hold is turned into a charge.

Now that we have a solid understanding of credit card holds, let’s delve deeper into Google temporary holds and how they function in relation to your credit card transactions.

What is a Google Temporary Hold?

A Google temporary hold, as mentioned earlier, is a specific type of credit card hold associated with transactions made through Google services. When you make a purchase or engage in activities such as app downloads, in-app purchases, or advertising campaigns through Google platforms, a temporary hold may be placed on your credit card.

The purpose of a Google temporary hold is to ensure that you have sufficient funds to cover the cost of the transaction or service you are accessing. It acts as a security measure to protect both the buyer and Google from potential financial risks.

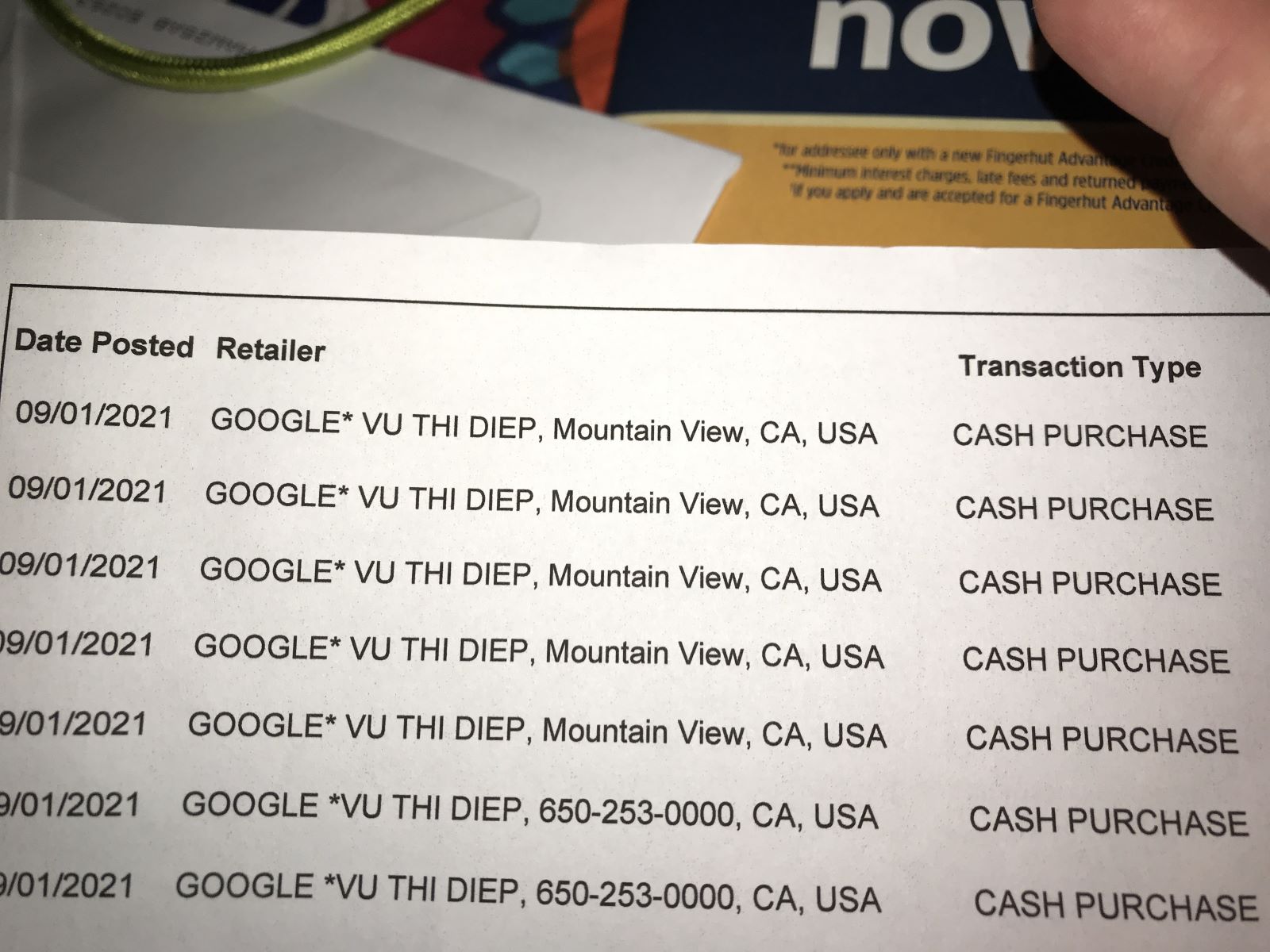

Google temporary holds are typically placed when the merchant or service provider needs to verify your credit card and confirm that it is valid. This authentication process helps prevent unauthorized or fraudulent transactions from taking place.

For example, imagine you want to purchase a paid app from the Google Play Store. When you click the “Buy” button, Google contacts your credit card issuer and asks for authorization to charge the specified amount. While awaiting approval, Google places a temporary hold on your credit card for that particular transaction amount.

If the authorization is successful, the hold is converted into a charge, and the funds are transferred to the merchant. However, if the authorization is declined, the hold is released, and the funds become available in your account again.

It’s essential to note that Google temporary holds are not charges themselves. They are simply a temporary freeze on your available credit card balance to ensure the transaction can be completed successfully. The hold will be reflected in your credit card statement as a pending transaction, but it will not affect your current balance until it is converted into an actual charge.

Understanding the purpose and mechanics of Google temporary holds is crucial to alleviate any confusion or concerns you may have about your credit card transactions on Google platforms.

Reasons for Google Temporary Holds

Google temporary holds are implemented for several reasons, all aimed at ensuring smooth and secure transactions for both buyers and sellers. Understanding these reasons can help shed light on the purpose of these holds and why they are necessary in the digital payment landscape.

1. Verification of Funds: One primary reason for Google temporary holds is to verify that the customer has sufficient funds to cover the transaction. This helps prevent instances of insufficient funds or declined payments, ensuring that buyers can complete their purchases without any issues.

2. Fraud Prevention: Temporary holds act as a security measure to safeguard against fraudulent transactions. By placing a hold on the funds, Google can verify the validity of the credit card and ensure that the transaction is authorized by the cardholder. This helps protect both the buyer and Google from potential financial losses due to fraudulent activities.

3. Order Integrity: Google temporary holds also help maintain order integrity by reducing the risk of duplicate or excessive orders. Placing a hold on the funds ensures that customers cannot make multiple purchases with the same credit card, potentially causing confusion or additional expenses.

4. Subscription Services: In the case of subscription-based services offered through Google platforms, temporary holds may be used to validate the credit card and ensure that future recurring payments can be successfully processed. This helps ensure a seamless and uninterrupted subscription experience for the user.

5. Advertising and Promotions: When running advertising campaigns or promotional activities through Google Ads, temporary holds may be placed to confirm that advertisers have sufficient funds to cover the costs. This ensures that advertisers are financially responsible for the ad campaigns they run on Google’s advertising network.

By implementing these temporary holds, Google aims to create a secure and reliable payment environment for both buyers and sellers. While these holds may cause some temporary inconvenience for users, they serve as an essential part of maintaining the integrity and security of transactions conducted through Google services.

How Does a Google Temporary Hold Work?

Now that we understand the reasons behind Google temporary holds, let’s delve into how they actually work. The process of a Google temporary hold involves a series of steps that ensure a smooth and secure transaction for both buyers and sellers.

1. Initiation: When you make a purchase or engage in a transaction through a Google platform, such as the Google Play Store or Google Ads, Google sends a request to your credit card issuer to authorize the transaction amount.

2. Authorization Request: Google contacts your credit card issuer and provides the necessary information, including the transaction amount, merchant details, and your credit card information. This request prompts the credit card issuer to place a temporary hold on the specified amount in your available credit.

3. Verification Process: The credit card issuer then verifies the transaction by checking factors such as available credit, account status, and validity of the credit card. If the credit card issuer approves the transaction, the temporary hold is converted into an actual charge.

4. Conversion to Charge: Once the credit card issuer approves the transaction, the temporary hold is converted into an actual charge. The funds are transferred from your account to the merchant or service provider, completing the transaction process.

5. Hold Release: If the credit card issuer declines the transaction or if there are any issues during the verification process, the temporary hold is released. The funds become available again in your account, and the transaction does not proceed.

Throughout this entire process, it’s important to note that the temporary hold is not an actual charge. It is simply a hold on the funds in your account, which is released if the transaction is not completed. The temporary hold will be reflected in your credit card statement as a pending transaction until it is either converted into a charge or released.

By following these steps, Google ensures that buyers have a seamless and secure experience when making transactions through their platforms. The temporary hold system helps protect users from potential unauthorized or fraudulent transactions, while also allowing merchants and service providers to verify the validity of credit cards and guarantee sufficient funds for the transaction.

Duration of Google Temporary Holds

The duration of Google temporary holds can vary depending on various factors, including the type of transaction and the policies of your credit card issuer. Generally, temporary holds placed by Google are relatively short-lived and typically last for a few days.

For example, when purchasing a digital product or service through the Google Play Store, the temporary hold is usually released within 1-3 business days. However, it’s important to keep in mind that the specific duration may vary depending on your credit card issuer and their individual policies.

It’s worth noting that while the temporary hold itself may be short-lived, the actual charge or payment may take some time to appear on your credit card statement. This delay is typically due to the processing time required by your credit card issuer to reconcile the transaction and update your account balance.

If you notice that a temporary hold from Google is still reflecting on your credit card statement beyond the expected duration, it’s advisable to reach out to your credit card issuer directly to inquire about the hold and seek clarification on when it will be released.

Overall, the duration of Google temporary holds is relatively short, ensuring that the held funds are released promptly once the transaction is either authorized or declined. However, it’s important to keep track of your credit card statements and reach out to your credit card issuer if there are any discrepancies or concerns regarding the length of the hold.

Remember, temporary holds are a standard practice in the payment industry, and while they may cause a temporary reduction in your available credit, they are designed to protect both buyers and sellers by ensuring the availability of funds and minimizing the risk of fraudulent transactions.

How to Check for Google Temporary Holds on Your Credit Card

It’s essential to stay informed about any temporary holds placed on your credit card by Google to ensure that your transactions and finances are accurately reflected. Here are some steps you can follow to check for Google temporary holds on your credit card:

- Review your credit card statement: One of the simplest ways to check for Google temporary holds is by reviewing your credit card statement. Make sure to carefully go through the transaction details and look for any pending or authorized charges associated with your Google transactions.

- Check your online banking system: If your credit card issuer provides an online banking system or mobile app, log in and navigate to your credit card account. Look for a section that displays pending transactions or temporary authorizations. This will show you any pending Google temporary holds on your card.

- Contact your credit card issuer: If you are unable to find information about Google temporary holds through your credit card statement or online banking system, contacting your credit card issuer directly is a recommended option. They can provide you with the most up-to-date information regarding any temporary holds on your credit card and offer assistance in understanding the specifics.

By regularly checking your credit card statements and accessing your online banking system, you can stay informed about any Google temporary holds that may be affecting your credit card balance. Being proactive in monitoring your transactions helps you stay on top of your financial activity and ensures that you can address any potential issues promptly.

Remember, temporary holds are a part of the transaction process and are typically short-lived. However, if you notice any discrepancies or unauthorized holds on your credit card, it is crucial to contact your credit card issuer immediately to report the issue and take appropriate action to protect your account.

Managing Google Temporary Holds

Managing Google temporary holds on your credit card involves being aware of the holds, understanding their impact on your available credit, and taking necessary steps to ensure a smooth transaction process. Here are some tips to help you effectively manage Google temporary holds:

- Monitor your credit card activity: Regularly review your credit card statements and online banking system to stay informed about any temporary holds placed by Google. This allows you to track your transactions, verify the accuracy of the holds, and identify any unauthorized charges or discrepancies.

- Keep track of your available credit: Temporary holds can temporarily reduce your available credit, so it’s important to keep track of the impact they have on your credit card balance. By staying aware of your available credit, you can avoid reaching your credit limit or facing declined payments due to insufficient funds.

- Plan your purchases accordingly: If you know you have pending Google temporary holds on your credit card, it’s important to consider their impact when making new purchases. Take into account the held funds and ensure that you have sufficient available credit to cover both the existing holds and any new charges you plan to make.

- Communicate with your credit card issuer: If you have any concerns or questions about the temporary holds placed by Google, don’t hesitate to reach out to your credit card issuer. They can provide you with guidance, clarify any hold-related policies, and address any specific issues you may be facing.

- Be vigilant against unauthorized charges: While temporary holds are a standard part of the transaction process, it’s crucial to remain vigilant for any unauthorized charges on your credit card. Regularly review your statements and contact your credit card issuer if you notice any suspicious or unrecognized transactions.

By following these strategies, you can effectively manage Google temporary holds and ensure a smooth experience when using Google services. The key is to stay informed, be proactive in monitoring your credit card activity, and communicate with your credit card issuer if you have any questions or concerns.

Remember, temporary holds are a protective measure to ensure the security and validity of your transactions. They play a crucial role in minimizing risks associated with fraudulent activities and unauthorized charges. By managing these holds effectively, you can navigate your credit card transactions with confidence and peace of mind.

How to Remove a Google Temporary Hold

If you have a Google temporary hold on your credit card and the transaction has been completed or canceled, the hold should be automatically released within a few days. However, if you believe that a hold has been incorrectly placed or if you need it to be removed urgently, here are some steps you can take:

- Contact the merchant: If the hold was placed by a specific merchant, such as a purchase from the Google Play Store, consider reaching out to their customer support. They may be able to provide insight into the hold and assist you in resolving the issue.

- Reach out to Google support: If the hold was placed directly by Google or you’re unsure about its origin, contacting Google support is a recommended step. They can investigate the reason for the hold, verify if it is still active, and guide you on the appropriate course of action.

- Contact your credit card issuer: If you believe the hold is incorrect or should have been released, contacting your credit card issuer directly is another option. Explain the situation, provide any necessary details, and ask for their assistance in removing the hold from your credit card.

- Dispute the hold: In rare cases where the hold remains on your credit card despite efforts to resolve the issue, you may need to consider disputing the hold with your credit card issuer. They will guide you through the dispute process and investigate the situation to ensure a fair resolution.

It’s important to note that while these steps can be helpful, the removal of a Google temporary hold ultimately depends on various factors, including the policies of the merchant, Google, and your credit card issuer. The timeline for the removal of the hold may vary as well.

As a general rule, most temporary holds placed by Google should be automatically released within a few days if there are no issues with the transaction. However, if you believe there is an error or if the hold persists beyond a reasonable duration, taking the appropriate action with the merchant, Google, or your credit card issuer is crucial to resolve the situation and have the hold removed.

Remember to keep track of your credit card statements, document any communication related to the temporary hold, and be persistent in seeking assistance until the hold is successfully removed from your credit card.

Tips for Dealing with Google Temporary Holds

Dealing with Google temporary holds on your credit card can seem challenging at times, but with the right approach, you can navigate the process smoothly. Here are some helpful tips to keep in mind when dealing with Google temporary holds:

- Stay informed: Regularly review your credit card statements and online banking system to stay updated on any temporary holds placed by Google. Being aware of these holds allows you to monitor your finances effectively and address any concerns promptly.

- Keep track of your available credit: Temporary holds can temporarily reduce your available credit, so it’s essential to keep track of the impact they have on your credit card balance. Understanding your available credit helps you make informed decisions when making additional purchases.

- Plan your transactions: If you have pending Google temporary holds, plan your future transactions accordingly. Consider the held funds and ensure that you have enough available credit to cover both the existing holds and any new charges you plan to make.

- Communicate with your credit card issuer: If you have questions or concerns about the temporary holds placed by Google, reach out to your credit card issuer for assistance. They can provide guidance, clarification on policies, and support to help resolve any issues you may encounter.

- Be alert for unauthorized charges: While temporary holds are a part of the transaction process, it’s important to stay vigilant for any unauthorized charges on your credit card. Regularly review your statements and immediately report any suspicious transactions to your credit card issuer.

- Document all communication: Keep records of any correspondence related to the temporary holds, including emails or phone calls with Google, the merchant, or your credit card issuer. Having documentation can be helpful if there are any disputes or discrepancies that need to be resolved.

- Be patient: Temporary holds are a standard practice, and it’s common for them to be released within a few days. While it may be frustrating to see the funds temporarily tied up, exercising patience and allowing the process to unfold can help avoid unnecessary stress.

By following these tips, you can effectively navigate the process of dealing with Google temporary holds. Remember to stay informed, plan your transactions wisely, communicate with relevant parties when needed, and document all important information. This approach will help ensure a smooth and hassle-free experience when using Google services.

Keep in mind that temporary holds are designed to protect both buyers and sellers, reducing the risk of fraudulent transactions and enhancing transaction security. While they may cause temporary inconveniences, they play a crucial role in maintaining the integrity and safety of your credit card transactions.

Conclusion

Google temporary holds can be a source of confusion and concern for credit card users, but with a clear understanding of how they work and effective management strategies, you can navigate these holds with confidence.

In this article, we have explored what Google temporary holds are and their importance in ensuring secure and reliable transactions through Google services. We’ve discussed the reasons behind these holds, their duration, and how they impact your available credit.

We have also provided practical tips for managing Google temporary holds, such as monitoring your credit card activity, staying informed, planning your transactions, and maintaining open communication with your credit card issuer and Google support. By following these tips, you can effectively handle temporary holds and minimize any disruptions to your financial experience.

Remember, Google temporary holds are a standard part of the transaction process designed to protect both buyers and sellers. They play a vital role in preventing fraudulent transactions, verifying the availability of funds, and maintaining the integrity of your credit card transactions.

As a credit card user, it’s important to stay informed, exercise patience, and be proactive in managing your credit card activity. Regularly monitor your statements, verify your available credit, and address any concerns or discrepancies promptly to ensure a smooth and secure financial experience.

By empowering yourself with knowledge about Google temporary holds and implementing effective management techniques, you can confidently engage in transactions via Google platforms, knowing that your finances are protected and your transactions are secure.

Remember, temporary holds are a temporary inconvenience that serves a greater purpose – safeguarding your financial well-being in the digital age.