Finance

What Is A Liquidity Crisis?

Published: February 23, 2024

Learn about liquidity crises in finance and how they can impact markets and businesses. Understand the causes, effects, and potential solutions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Significance of Liquidity Crises in Finance

When discussing financial stability, the term “liquidity crisis” often emerges as a critical concern. In the realm of finance, liquidity serves as the lifeblood of economic functionality. It represents the ease with which an asset can be converted into cash without causing a significant impact on its price. In simpler terms, liquidity is the ability to access cash quickly without incurring substantial losses.

Understanding the dynamics of liquidity crises is paramount for individuals, businesses, and policymakers. These crises can have far-reaching implications, ranging from economic downturns to the collapse of financial institutions. Therefore, gaining insight into the nature, causes, and implications of liquidity crises is essential for comprehending the intricate web of financial systems.

This article aims to delve into the multifaceted concept of liquidity crises, shedding light on their underlying causes, signs, and the profound impact they can have on the financial landscape. By exploring these aspects, readers can gain a deeper understanding of the significance of liquidity in the realm of finance and the measures that can be taken to mitigate the potential fallout from liquidity crises.

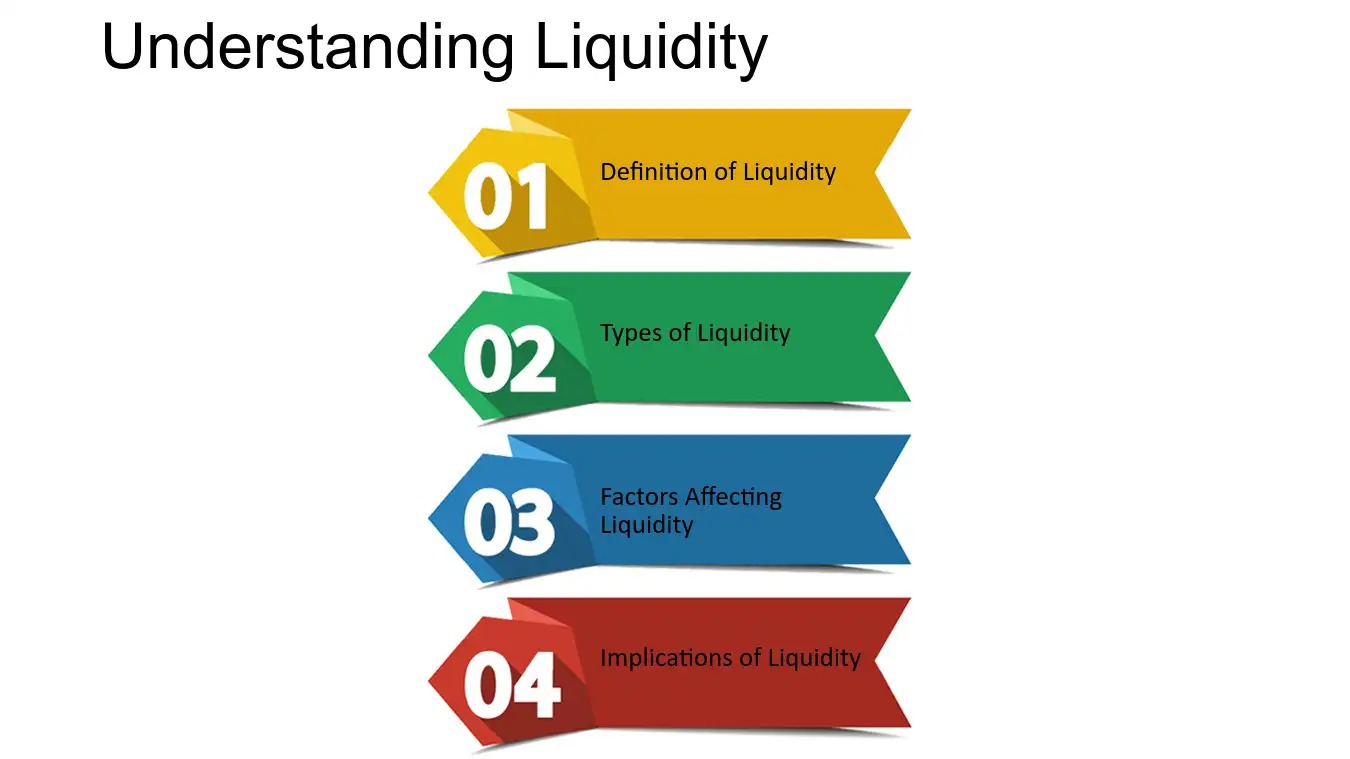

Understanding Liquidity

Liquidity, in the context of finance, denotes the degree to which an asset or security can be quickly bought or sold in the market without causing a significant change in its price. It reflects the ease with which an asset can be converted into cash. This concept is integral to the efficient functioning of financial markets and is a crucial determinant of an entity’s financial health.

Assets are often categorized based on their liquidity. Cash is the most liquid asset, as it can be readily used for transactions. Marketable securities and government bonds are also considered highly liquid due to their ability to be sold quickly with minimal impact on their value. In contrast, real estate and certain types of investments may be less liquid, as they can take longer to sell and may incur a greater price impact.

Liquidity plays a pivotal role in maintaining financial stability. It enables businesses to meet their short-term obligations, facilitates smooth transactions in the market, and provides individuals with the flexibility to access funds when needed. Moreover, it underpins the functioning of financial institutions, allowing them to manage deposit withdrawals and meet unexpected funding requirements.

Understanding the various dimensions of liquidity is crucial for making informed financial decisions. Whether it pertains to personal investments, corporate finance, or macroeconomic policymaking, the concept of liquidity holds immense significance. By comprehending the nuances of liquidity, individuals and entities can navigate financial landscapes with greater prudence and adaptability.

Causes of Liquidity Crisis

A liquidity crisis can stem from a confluence of factors within the financial ecosystem. Understanding the underlying causes is instrumental in preempting and addressing potential liquidity challenges. Several key factors can contribute to the emergence of a liquidity crisis:

- Asset Illiquidity: A mismatch between the maturity of assets and liabilities can trigger a liquidity crisis. If an entity holds illiquid assets that cannot be readily sold or used as collateral to raise funds to meet short-term obligations, it can lead to a liquidity crunch.

- Credit Crunch: Tightening credit conditions within the financial system can constrain the availability of funds, exacerbating liquidity pressures. Lenders may become more risk-averse, leading to reduced lending activity and heightened liquidity strains for borrowers.

- Market Panics: Sudden market downturns or panics can erode investor confidence, prompting mass withdrawals from investment funds and financial institutions. This surge in redemption requests can strain the liquidity reserves of these entities, potentially culminating in a crisis.

- Regulatory Changes: Shifts in regulatory requirements or capital adequacy standards can impact the liquidity positions of financial institutions. Compliance with stringent regulations may tie up capital and limit the availability of liquid funds, contributing to liquidity challenges.

- Counterparty Risks: Concerns regarding the creditworthiness of counterparties in financial transactions can trigger a liquidity crisis. If market participants become wary of engaging with certain counterparties, it can impede the smooth functioning of financial markets and exacerbate liquidity constraints.

These causes are not mutually exclusive and can interact in complex ways, amplifying the likelihood of liquidity crises. By recognizing these underlying factors, stakeholders can proactively implement measures to mitigate liquidity risks and fortify the resilience of financial systems.

Signs of a Liquidity Crisis

Identifying the warning signs of a liquidity crisis is pivotal for averting potential financial turmoil. Several indicators may signal the onset of a liquidity crunch, prompting stakeholders to take preemptive measures. These signs encompass various facets of the financial landscape and can serve as crucial barometers for assessing liquidity stress:

- Increasing Borrowing Costs: A surge in borrowing costs, particularly for short-term funding, can signify tightening liquidity conditions. Elevated interest rates on interbank loans and corporate debt may herald liquidity strains.

- Declining Asset Prices: Deteriorating asset values, especially in markets with high trading volumes, can signal liquidity issues. Rapid declines in asset prices may impede the ability to convert holdings into cash at favorable terms.

- Reduced Market Depth: Shrinkage in market depth, reflected in wider bid-ask spreads and diminished trading volumes, can indicate diminishing liquidity. This can hinder the seamless execution of transactions and raise concerns about market liquidity.

- Withdrawal Pressures: Heightened withdrawal requests from depositors or investors can strain the liquidity reserves of financial institutions. Large-scale fund outflows may precipitate a liquidity crisis if not managed effectively.

- Credit Rating Downgrades: Downgrades in the credit ratings of entities, particularly financial institutions, can signal heightened liquidity risks. Credit rating agencies may factor in liquidity metrics when assessing an entity’s financial health.

These signs collectively underscore the nuanced interplay of factors that can culminate in a liquidity crisis. Monitoring these indicators with vigilance can empower stakeholders to proactively address emerging liquidity challenges and fortify the resilience of financial systems.

Impact of Liquidity Crisis

A liquidity crisis can exert profound ramifications across the financial landscape, permeating various sectors and stakeholders. The repercussions of such crises extend beyond immediate liquidity constraints and can reverberate through the broader economy, engendering a ripple effect of consequences:

- Financial Institution Vulnerability: Financial institutions, particularly banks, can face heightened vulnerability during a liquidity crisis. Strains on funding sources and liquidity reserves may impede their ability to extend credit and meet the demands of depositors, potentially eroding confidence in the financial system.

- Market Volatility: Liquidity crises can fuel heightened market volatility, leading to erratic price movements and diminished investor confidence. This volatility can cascade across asset classes, exacerbating systemic risk and impairing market stability.

- Credit Crunch: Reduced liquidity can precipitate a credit crunch, constraining the availability of financing for businesses and individuals. This can impede investment, dampen economic activity, and exacerbate the challenges faced by entities reliant on access to credit.

- Asset Price Depreciation: Liquidity crises can trigger distress selling and asset price depreciation, particularly in illiquid markets. This can erode wealth, amplify market dislocations, and engender adverse wealth effects, impacting consumer spending and investment behavior.

- Macroeconomic Implications: The reverberations of a liquidity crisis can permeate the broader economy, influencing employment, consumption patterns, and investment dynamics. Prolonged liquidity strains can exacerbate economic downturns and impede the efficacy of monetary and fiscal policy measures.

These impacts underscore the far-reaching ramifications of liquidity crises, underscoring the imperative of preemptive measures and coordinated responses to mitigate their adverse effects. By comprehending the multifaceted impact of liquidity crises, stakeholders can fortify the resilience of financial systems and endeavor to avert systemic disruptions.

Managing Liquidity Crisis

Effectively navigating a liquidity crisis necessitates astute management and proactive measures to mitigate its repercussions. Stakeholders across the financial spectrum can adopt various strategies to address and manage liquidity challenges, fostering resilience and stability in the face of potential crises:

- Stress Testing and Scenario Analysis: Conducting rigorous stress testing and scenario analysis can fortify the preparedness of financial institutions and market participants. Assessing the impact of adverse liquidity conditions can inform proactive measures and contingency plans.

- Liquidity Risk Management: Implementing robust liquidity risk management frameworks is pivotal for preempting crises. This entails maintaining adequate liquidity buffers, diversifying funding sources, and adhering to prudent liquidity risk metrics.

- Central Bank Interventions: Central banks can play a pivotal role in managing liquidity crises by providing liquidity support to financial institutions and markets. Open market operations, discount window facilities, and emergency lending programs can alleviate acute liquidity strains.

- Enhanced Regulatory Oversight: Regulators can bolster oversight and prudential regulations to enhance the resilience of financial institutions. This can encompass liquidity stress testing requirements, enhanced reporting standards, and stringent liquidity risk management guidelines.

- Communication and Transparency: Maintaining open communication and transparency during periods of heightened liquidity stress is imperative. Clear and timely communication can assuage market concerns, bolstering confidence and mitigating the risk of contagion.

By proactively embracing these measures, stakeholders can fortify the resilience of financial systems and mitigate the potential fallout from liquidity crises. Effective liquidity management is integral to fostering stability and confidence within the financial ecosystem, underscoring the imperative of preemptive and coordinated efforts to address liquidity challenges.

Conclusion

Understanding the intricacies of liquidity crises is paramount for navigating the complexities of the financial landscape. Liquidity, as the lifeblood of economic functionality, underscores the importance of swift access to cash without incurring substantial losses. The causes of a liquidity crisis are multifaceted, encompassing factors such as asset illiquidity, credit crunch, market panics, regulatory changes, and counterparty risks. Recognizing the signs of an impending liquidity crisis, including escalating borrowing costs, declining asset prices, reduced market depth, and withdrawal pressures, empowers stakeholders to take preemptive action.

The impact of a liquidity crisis extends far beyond immediate liquidity constraints, permeating financial institutions, market volatility, credit availability, asset prices, and macroeconomic dynamics. Managing a liquidity crisis necessitates astute strategies, including stress testing, liquidity risk management, central bank interventions, enhanced regulatory oversight, and transparent communication. By proactively embracing these measures, stakeholders can fortify the resilience of financial systems and mitigate the potential fallout from liquidity crises.

In conclusion, the significance of liquidity in the realm of finance cannot be overstated. A nuanced understanding of liquidity crises, coupled with proactive and coordinated measures, is imperative for fostering stability and confidence within the financial ecosystem. By fortifying liquidity management frameworks and preempting potential crises, stakeholders can navigate the intricacies of the financial landscape with prudence and adaptability, mitigating the adverse effects of liquidity strains and bolstering the resilience of financial systems.