Home>Finance>What Is A M3? Definition, Liquidity, Disuse, And M Classifications

Finance

What Is A M3? Definition, Liquidity, Disuse, And M Classifications

Published: December 21, 2023

Learn about M3 in finance: its definition, liquidity, disuse, and classifications. Gain insights into this important financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is a M3? Definition, Liquidity, Disuse, and M Classifications

Finance can be a complex and challenging field to navigate, especially when it comes to understanding the different monetary aggregates. One such aggregate is known as M3, which plays a significant role in the global economy. In this blog post, we will explore the definition of M3, its liquidity implications, reasons for its disuse, and the different classifications within the M3 framework.

Key Takeaways:

- M3 is a monetary aggregate that measures the total amount of money in circulation within an economy, including physical currency, checking accounts, savings accounts, and other forms of liquid assets.

- M3 is an important indicator of an economy’s liquidity, reflecting the availability of funds for transactions and investment.

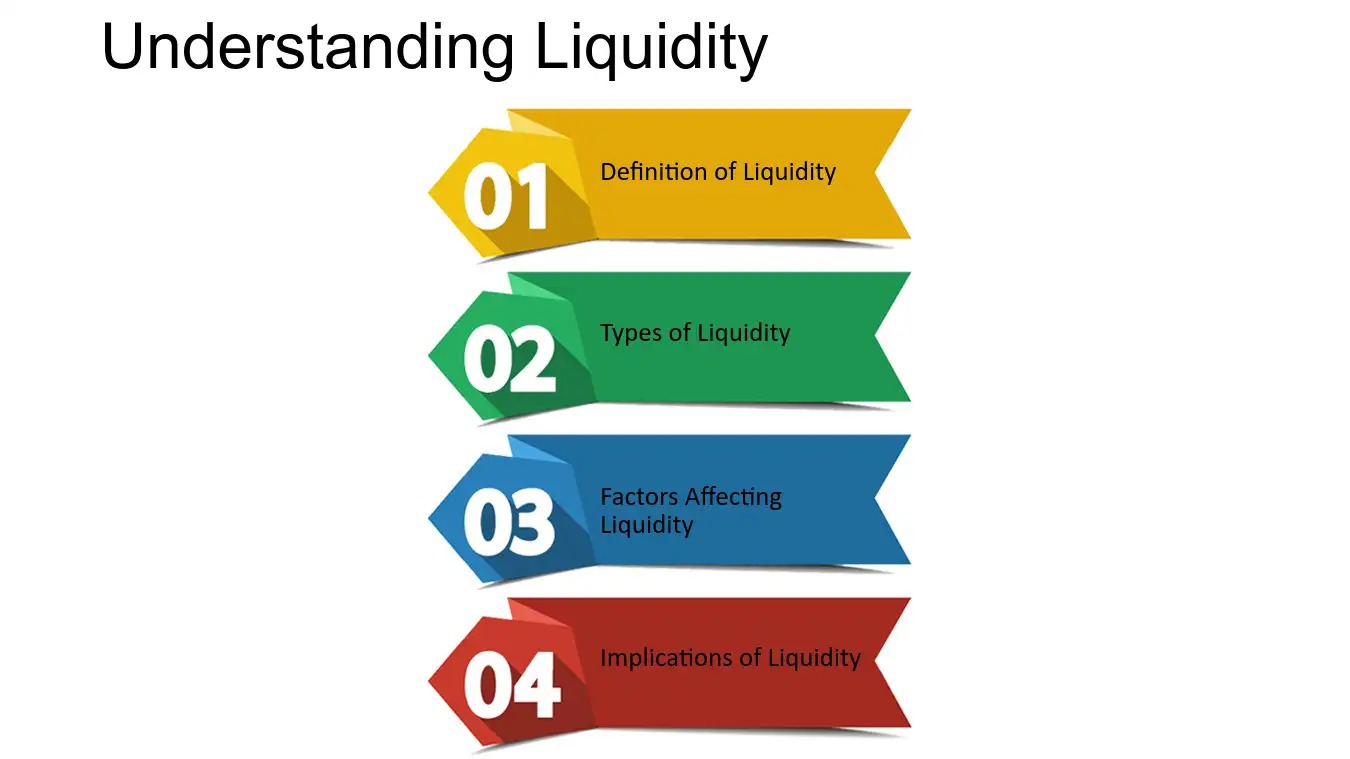

Understanding M3: Definition and Liquidity

M3, often referred to as the broad money supply, encompasses all forms of money that are readily accessible for spending or investment purposes. It includes not only physical currency but also various types of deposits and liquid assets held by individuals, businesses, and financial institutions. These can range from checking accounts and savings accounts to money market funds and short-term securities.

The liquidity of M3 is vital for the smooth functioning of an economy. When the M3 supply is abundant, it indicates that there are sufficient funds available for individuals and businesses to engage in transactions, invest in assets, and support economic growth. Conversely, a contraction in M3 may lead to a liquidity crunch, making it more challenging for economic participants to obtain financing, slowing down economic activity.

Disuse of M3 and Evolving Monetary Policies

While M3 was once a widely tracked and referenced measure of a nation’s money supply, its usage has declined in recent years. Central banks and financial institutions now rely on other monetary aggregates or a combination of indicators to monitor economic trends and make informed monetary policy decisions.

One reason for the disuse of M3 is the evolving nature of financial markets and the changing dynamics of money creation. With the rise of non-bank financial intermediaries and complex financial instruments, the traditional focus on M3 as a measure of money supply has become less relevant in capturing the overall liquidity conditions of an economy.

M3 Classifications: Narrow, Broad, and Extended

Within the M3 framework, there are different classifications that allow for a more nuanced analysis of the money supply:

- Narrow Money (M1): M1 refers to the most liquid subset of money, including physical currency, checking accounts, and other demand deposits. It represents the portion of the money supply that is readily available for spending.

- Broad Money (M2): M2 includes the elements of M1, as well as savings accounts, time deposits, and money market mutual funds. It provides a broader view of the money supply, capturing assets that may not be as immediately available for spending but can still be converted into cash relatively easily.

- Extended Money (M3): M3 encompasses the elements of both M1 and M2, along with additional long-term deposits, institutional money market funds, and other financial instruments. This classification takes into account assets with a longer maturity period, providing a more comprehensive measure of the overall money supply.

Overall, while M3 may not be the primary focus of monetary policy discussions today, it still holds value in understanding the dynamics of money supply and the overall liquidity conditions within an economy. By considering the various classifications within the M3 framework, analysts can gain a more holistic view of the money circulating in a given nation, aiding informed decision-making processes.

For more insights into the world of finance and economics, be sure to explore our other informative blog posts in the FINANCE category.