Home>Finance>How To Estimate Partial Derivatives From Contour Maps

Finance

How To Estimate Partial Derivatives From Contour Maps

Published: October 6, 2023

Learn how to estimate partial derivatives in finance using contour maps. Improve your analytical skills and make better financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of partial derivatives and contour maps! If you’re diving into the realm of finance, understanding how to estimate partial derivatives from contour maps is an essential skill to acquire. Whether you’re a financial analyst, an economist, or simply someone interested in exploring the intricate workings of the financial world, this article will guide you through the process.

But before we delve into the methodology of estimating partial derivatives from contour maps, let’s first establish a solid understanding of what partial derivatives are and how they relate to the finance industry.

Partial derivatives, a concept rooted in mathematics, are differential operators that measure the sensitivity of a function to changes in its inputs, while holding other variables constant. For instance, in finance, partial derivatives can be used to assess the impact of changes in interest rates, exchange rates, or the overall market on various financial instruments.

Contour maps, on the other hand, are graphical representations that illustrate the relationship between two independent variables and a dependent variable by displaying curves of constant value. In finance, contour maps are often used to visualize the risk and reward profiles of various investment strategies or to analyze the relationship between two financial variables.

Now that we have a basic understanding of partial derivatives and contour maps, it’s time to explore the methods used to estimate partial derivatives from contour maps. In the following sections, we will discuss two different approaches that can be employed to obtain these estimates.

So, whether you’re a seasoned financial professional looking to refresh your knowledge or a newcomer seeking to gain a deeper understanding of this topic, let’s embark on this journey together and unlock the secrets of estimating partial derivatives from contour maps in the realm of finance.

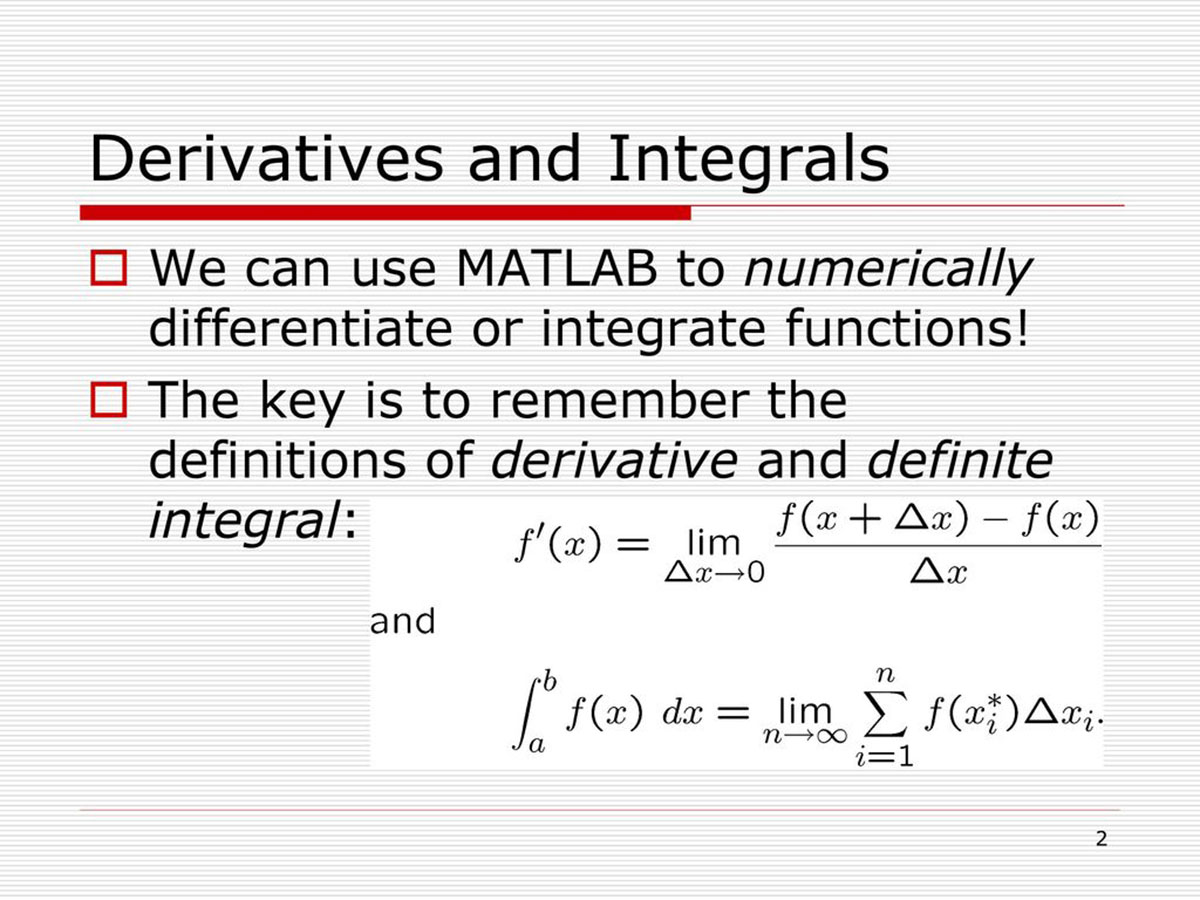

Definition of Partial Derivatives

Before we dive into estimating partial derivatives from contour maps, let’s first establish a clear understanding of what partial derivatives are and how they are calculated.

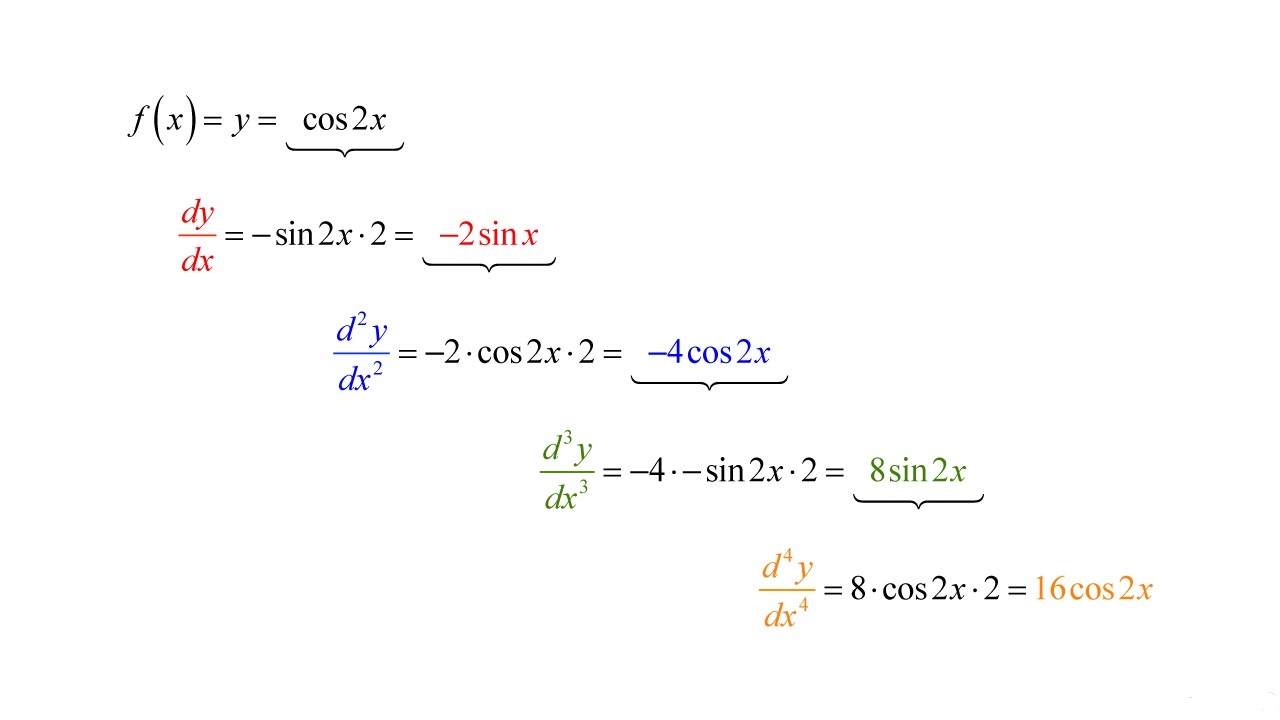

In mathematics, a partial derivative is a derivative with respect to only one variable in a function that depends on multiple variables. It measures the rate at which the function changes with respect to that specific variable while holding all other variables constant.

Let’s consider a simple example to illustrate this concept. Suppose we have a function f(x, y) that represents the value of a financial instrument as a function of two variables, x and y. The partial derivative of f with respect to x would provide us with the rate of change of f with respect to x, while keeping y fixed.

The partial derivative of f(x, y) with respect to x is denoted as ∂f/∂x or df/dx, and it is calculated by treating y as a constant and taking the standard derivative of f with respect to x.

Similarly, the partial derivative of f with respect to y, denoted as ∂f/∂y or df/dy, measures the rate of change of f with respect to y while holding x constant.

Partial derivatives are crucial in finance as they allow us to understand how a financial variable changes in response to changes in other variables. For example, we can use partial derivatives to determine how the price of a stock changes with respect to changes in interest rates or how the value of a bond changes with respect to changes in market volatility.

To calculate partial derivatives, we can use various mathematical techniques such as the chain rule or implicit differentiation. However, in this article, we will focus on estimating partial derivatives from contour maps.

Now that we have a solid definition and understanding of partial derivatives, let’s move on to exploring the use of contour maps and how they enable us to estimate these derivatives in the context of finance.

Understanding Contour Maps

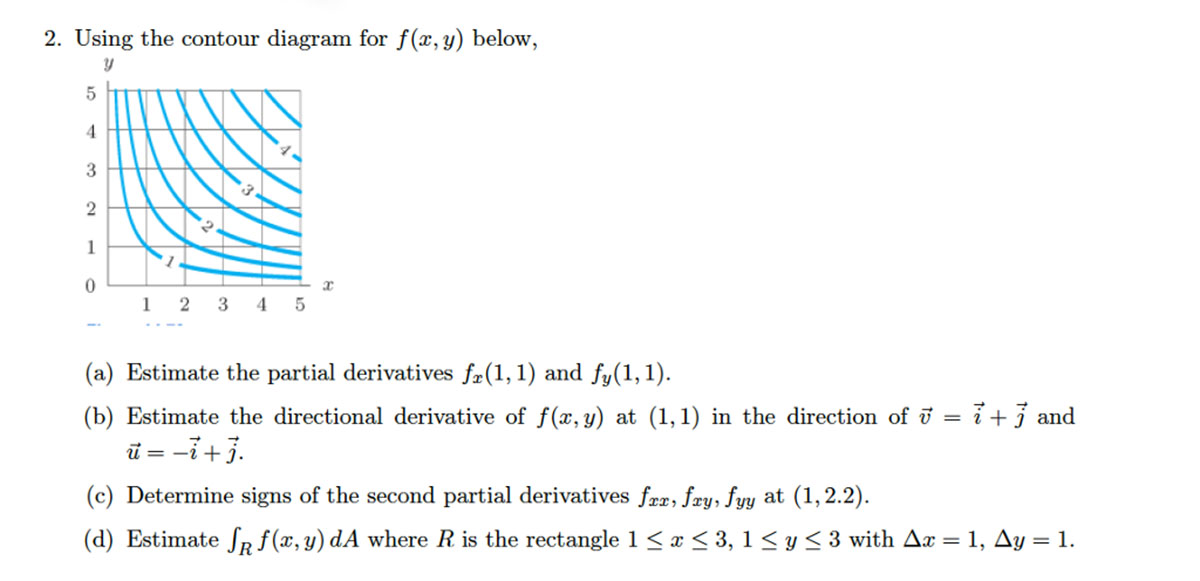

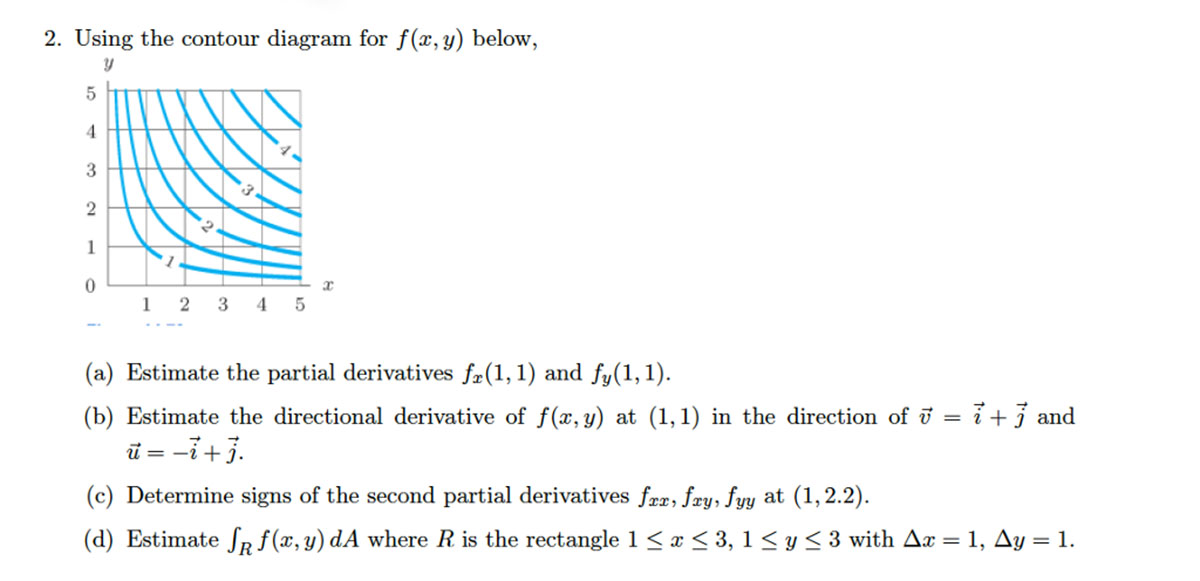

In the realm of finance, contour maps are powerful tools that provide valuable insights into the relationships between two independent variables and a dependent variable. These graphical representations help visualize patterns and trends, making it easier to analyze and interpret complex financial data.

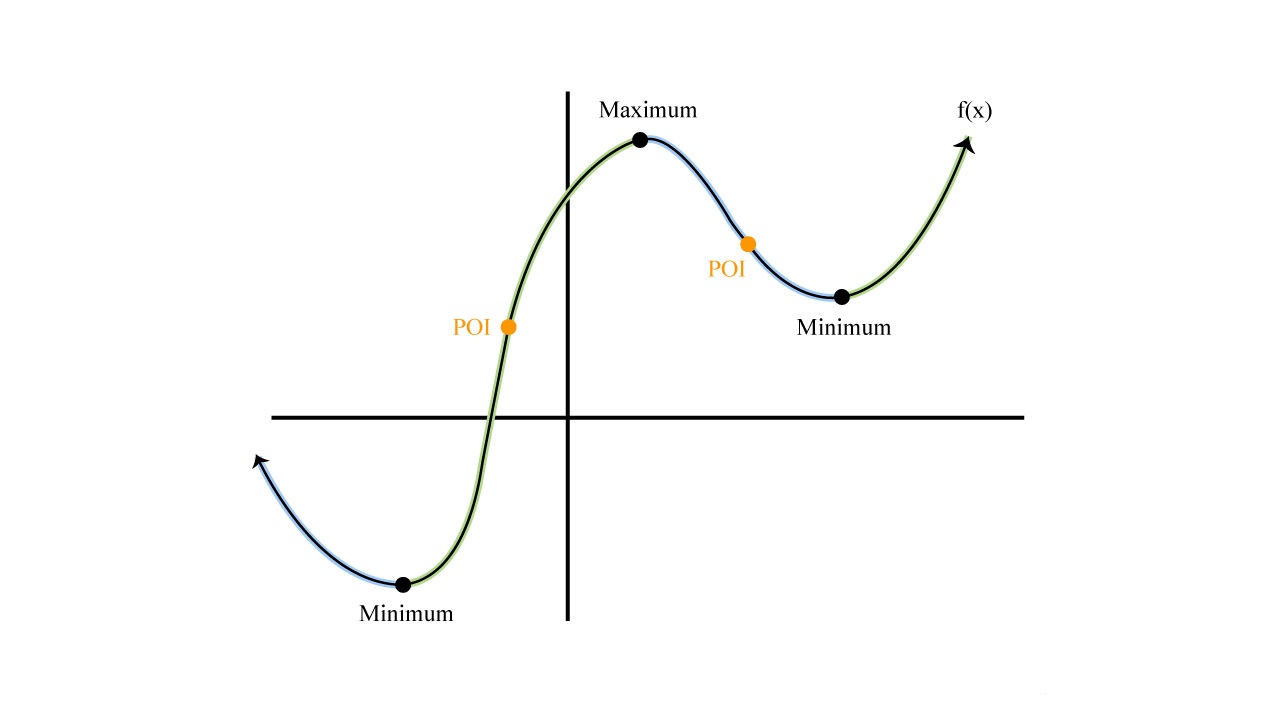

A contour map consists of contour lines that represent curves of constant value for the dependent variable. These lines connect points on a graph that share the same value of the dependent variable, creating a map with a series of distinct contour lines.

Let’s consider an example to illustrate how contour maps are used. Suppose we have a contour map that represents the relationship between interest rates and bond prices. The horizontal axis represents the different values of interest rates, while the vertical axis represents the corresponding bond prices. The contour lines on the map connect the points where the bond prices are equal, forming curves that indicate areas of constant bond price.

By examining the contour map, we can identify areas of higher or lower bond prices and understand how these prices change as interest rates vary. Contour maps provide a visual representation of the relationship between these two variables, allowing analysts and investors to make informed decisions based on the observed patterns.

Contour maps are not limited to just two variables; they can also represent the relationship between multiple variables. In finance, these maps can be used to analyze multivariate relationships, such as the dependencies between asset prices, economic indicators, and market indices.

Understanding contour maps is crucial for estimating partial derivatives in the context of finance. By analyzing the contour lines and their behavior on the map, we can estimate the partial derivatives of the dependent variable with respect to the independent variables.

Now that we have a solid understanding of contour maps, let’s explore the methods used to estimate partial derivatives from these graphical representations in the next section.

Method 1: Estimating Partial Derivatives from Contour Maps

Estimating partial derivatives from contour maps is a useful technique that allows us to approximate the rate at which a dependent variable changes in response to changes in the independent variables. Let’s explore one method that can be used to estimate these partial derivatives: the method of finite differences.

The method of finite differences is based on the idea that the slope of a contour line represents the rate of change of the dependent variable. By measuring the slope of the contour lines at different points, we can estimate the partial derivatives.

Here’s how the method works:

- Select two points on a given contour line that are close to each other. These points should have known values of the independent variables and the dependent variable.

- Calculate the difference in the values of the dependent variable between the two points.

- Calculate the difference in the values of the independent variable between the two points.

- Divide the difference in the dependent variable by the difference in the independent variable to obtain an approximation of the slope of the contour line.

- This approximation can be considered as an estimate of the partial derivative of the dependent variable with respect to the independent variable.

Repeat this process for multiple points on the contour line to obtain an average estimate of the partial derivative. The more points you include, the more accurate your estimate will be.

It’s important to note that the accuracy of the estimates depends on the spacing between the points and the smoothness of the contour lines. If the contour lines are irregular or if the points are too far apart, the estimates may not be accurate.

The method of finite differences is a practical and straightforward approach to estimate partial derivatives from contour maps. It provides a good starting point for understanding the relationships between variables in finance and can be a valuable tool for decision-making and risk analysis.

Next, let’s explore another method, which utilizes gradient vectors, to estimate partial derivatives from contour maps.

Method 2: Using Gradient Vectors to Estimate Partial Derivatives

In addition to the method of finite differences, another approach to estimate partial derivatives from contour maps is by utilizing gradient vectors. The gradient vector represents the direction and magnitude of the steepest ascent of a function at a given point.

To estimate the partial derivatives using gradient vectors, follow these steps:

- Locate a point on the contour map where you want to estimate the partial derivatives.

- Determine the coordinates of the point, which represent the values of the independent variables.

- Calculate the gradient vector at that point by taking the partial derivatives of the function with respect to each independent variable.

- The components of the gradient vector represent the partial derivatives of the function with respect to each independent variable.

- Interpret the gradient vector by considering the direction and magnitude of its components. The direction indicates how the function is changing relative to the independent variables, while the magnitude represents the rate of change.

The advantage of using gradient vectors is that they provide a more precise estimation of the partial derivatives compared to the method of finite differences. By considering the entire vector, rather than just two nearby points, we can capture more information about the behavior of the function in the vicinity of the chosen point.

It’s worth noting that the use of gradient vectors requires a deeper understanding of vector calculus and the techniques involved in calculating partial derivatives. However, once mastered, this method can offer more accurate estimates and a more nuanced understanding of the relationships between variables.

While the method of using gradient vectors may require more computational effort, it provides a robust framework for estimating partial derivatives from contour maps in finance.

Now that we’ve explored two different methods for estimating partial derivatives from contour maps, let’s discuss the accuracy and limitations of these approaches in the next section.

Discussion on Accuracy and Limitations

As with any estimation method, it is important to consider the accuracy and limitations of estimating partial derivatives from contour maps. While these methods provide valuable insights into the relationships between variables, they also have certain constraints to be aware of.

Accuracy may vary depending on the complexity of the function and the smoothness of the contour lines. If the function is highly nonlinear or if the contour lines are irregular and discontinuous, the accuracy of the estimates may be compromised.

The method of finite differences relies on choosing appropriate points on the contour lines and calculating differences in values. However, the spacing between points and the choice of those points can affect the accuracy of the estimates. If the points are too far apart or if they do not capture the behavior of the function adequately, the estimates may not be reliable.

Similarly, the method of using gradient vectors provides more precise estimates by considering the entire vector. However, this method requires a deeper understanding of vector calculus and appropriate techniques for calculating partial derivatives. It may be more computationally intensive and time-consuming compared to the method of finite differences.

Another limitation to consider is the assumption of linearity. Estimating partial derivatives from contour maps assumes that the relationship between the variables is linear. In reality, financial relationships can be nonlinear, and contour maps may not capture the full complexity of these relationships. It is crucial to interpret the estimates with caution and consider the broader context and potential nonlinearity of the variables.

Additionally, the accuracy of the estimates may depend on the resolution and quality of the contour maps used. An insufficient number of contour lines or low-quality maps may result in less accurate estimates.

It is also important to note that estimating partial derivatives from contour maps provides approximations rather than exact values. These estimates should be used as tools for analysis and decision-making, but they may not capture all the nuances and intricacies of the true derivatives.

Despite these limitations, estimating partial derivatives from contour maps remains a valuable technique in finance. It enables us to gain insights into the relationships between variables and make informed decisions based on these estimates. By being aware of the potential limitations and considering the broader context, we can leverage this method effectively in financial analysis.

Now that we have discussed accuracy and limitations, let’s conclude our exploration of estimating partial derivatives from contour maps in the next section.

Conclusion

Estimating partial derivatives from contour maps is a powerful method that allows us to analyze the relationships between variables in the realm of finance. By leveraging these techniques, we can estimate the rate at which a dependent variable changes in response to changes in the independent variables.

In this article, we explored two methods for estimating partial derivatives from contour maps: the method of finite differences and the use of gradient vectors. The method of finite differences provides a straightforward approach by measuring the slope of contour lines, while the use of gradient vectors offers a more precise estimation by considering the entire vector.

However, it is essential to acknowledge the accuracy and limitations of these estimation methods. The accuracy of the estimates can vary based on the complexity and smoothness of the function, the spacing between points, and the resolution of the contour maps. The assumption of linearity and the approximation nature of the estimates should also be considered.

Despite these limitations, estimating partial derivatives from contour maps remains a valuable tool for financial analysts, economists, and decision-makers in the finance industry. By understanding the relationships between variables, we can gain insights into market trends, risk assessment, and investment strategies.

It is crucial to interpret the estimates within the broader context, considering potential nonlinearity, data quality, and relying on additional analytical methods to validate the findings.

As you embark on further exploration in the world of finance, we encourage you to continue using these techniques and refining your understanding of estimating partial derivatives from contour maps. This knowledge can help you make more informed decisions and navigate the complexities of the financial landscape.

So, put your skills to the test, analyze those contour maps, and uncover the hidden insights that partial derivatives have to offer in the fascinating world of finance.