Finance

What Is The Credit Card Fee For Quickbooks

Modified: February 21, 2024

Looking for Quickbooks credit card fee information? Discover the finance details and implications of using credit cards with Quickbooks, helping you manage your finances efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Card Fees

- Exploring QuickBooks Credit Card Processing

- Types of Credit Card Fees in QuickBooks

- Explanation of QuickBooks Credit Card Transaction Fees

- Overview of QuickBooks Merchant Service Fees

- Assessing QuickBooks Payment Gateway Fees

- Additional QuickBooks Credit Card Processing Charges

- Factors That Influence Credit Card Fees in QuickBooks

- How to Calculate Credit Card Fees in QuickBooks

- Tips to Minimize Credit Card Fees in QuickBooks

- Conclusion

Introduction

When it comes to managing finances, businesses often rely on various tools and software solutions to streamline their processes. One popular choice for small businesses is QuickBooks, a comprehensive accounting software that offers a range of features to help manage finances efficiently. QuickBooks also provides credit card processing services, allowing businesses to accept payments from customers using credit cards.

However, like any payment processing service, there are fees and charges associated with using credit cards in QuickBooks. It’s important for businesses to understand these fees to effectively manage their financial transactions and minimize costs. In this article, we will delve into the topic of credit card fees in QuickBooks, exploring the different types of fees, how they are calculated, and provide tips on minimizing these fees.

By gaining a solid understanding of credit card fees in QuickBooks, businesses can make informed decisions when it comes to selecting the right payment processing options, optimizing their financial processes, and ultimately, improving their bottom line.

Understanding Credit Card Fees

Before diving into the specific credit card fees in QuickBooks, it’s essential to have a clear understanding of how credit card fees work in general. When a business accepts credit card payments, they enter into an agreement with a payment processor or merchant services provider. These providers act as intermediaries between the business, the customer, and the credit card issuers.

Credit card fees are charges imposed by these intermediaries for processing credit card transactions. They typically consist of two main components:

- Interchange Fees: These are fees set by the credit card associations (such as Visa, Mastercard, or American Express) and paid to the card-issuing banks. The interchange fees vary based on factors like the type of card used, the transaction volume, and the risk associated with the transaction.

- Processor Markup: The payment processors or merchant services providers add their markup on top of the interchange fees. This markup covers their operational costs, profit margins, and additional services provided to the businesses.

It’s important to note that credit card fees are usually charged as a percentage of the transaction value, known as the “discount rate,” along with a per-transaction fee. The discount rate and per-transaction fee will vary depending on the payment processor and the specific terms agreed upon.

Understanding these basic components of credit card fees lays the foundation for comprehending the credit card fees associated with QuickBooks credit card processing. In the next sections, we will explore the different types of fees that businesses encounter when using credit cards in QuickBooks and provide insights into how these fees are calculated.

Exploring QuickBooks Credit Card Processing

QuickBooks offers a seamless and convenient credit card processing solution for businesses of all sizes. With QuickBooks, businesses can easily accept credit card payments from customers, whether it’s in-person, online, or via mobile devices.

One of the main advantages of using QuickBooks for credit card processing is the integration it provides with your accounting software. When a credit card transaction is processed, QuickBooks automatically records the payment and updates the corresponding accounts, saving businesses time and ensuring accurate financial records.

QuickBooks supports various payment methods, including traditional swipe or dip, chip, and contactless payments. This versatility allows businesses to cater to the preferences of their customers, providing a seamless payment experience.

Additionally, QuickBooks also provides businesses with the ability to set up recurring payments, which can be particularly helpful for subscription-based or membership businesses. This feature simplifies the management of recurring transactions, ensuring timely and efficient collections.

Moreover, QuickBooks provides businesses with the ability to generate customizable invoices and email them directly to customers. Customers can then conveniently pay their invoices online using credit cards, reducing the need for manual payment collection and simplifying the entire billing process.

By leveraging QuickBooks credit card processing, businesses can enhance their cash flow, improve payment collection efficiency, and streamline their overall financial operations.

Types of Credit Card Fees in QuickBooks

When using credit card processing services in QuickBooks, businesses may encounter various types of fees. Here are some of the common credit card fees that businesses should be aware of:

- Transaction Fees: These are fees charged for each credit card transaction processed through QuickBooks. It is typically a flat fee per transaction, regardless of the transaction amount.

- Discount Rate: The discount rate is a percentage of the transaction amount that is charged by the payment processor for processing the transaction. This fee is typically based on the interchange fees set by the credit card associations.

- Authorization Fees: These fees are charged for processing and verifying the authorization of a credit card transaction. Authorization fees are usually applicable for card-not-present transactions, where the cardholder’s information is manually entered.

- Monthly Fees: In some cases, there may be monthly fees associated with using QuickBooks credit card processing services. These fees can include charges for account maintenance, access to certain features, or additional services provided by the payment processor.

- Chargeback Fees: Chargeback fees are incurred when a customer disputes a transaction and initiates a chargeback. These fees are charged to the business to cover administrative costs and potential losses related to the disputed transaction.

It’s important to note that the specific fees and their amounts may vary depending on the payment processor and the terms agreed upon. Businesses should carefully review the fee structure and terms provided by the payment processor when setting up credit card processing in QuickBooks.

By understanding the different types of credit card fees in QuickBooks, businesses can accurately assess the costs associated with credit card processing and make informed decisions to manage their financial transactions effectively.

Explanation of QuickBooks Credit Card Transaction Fees

QuickBooks credit card transaction fees are the charges incurred for processing credit card transactions through the QuickBooks platform. Understanding these fees is essential for businesses to accurately calculate their costs and assess the profitability of accepting credit card payments. Here’s an explanation of the different transaction fees commonly associated with QuickBooks credit card processing:

- Transaction Fee: This fee is charged for each individual credit card transaction processed through QuickBooks. It is usually a fixed amount, typically ranging from $0.25 to $0.50 per transaction. This fee covers the cost of processing and verifying the transaction details.

- Discount Rate: The discount rate is a percentage of the transaction amount that the payment processor charges for processing the credit card transaction. It is typically a combination of interchange fees set by the credit card associations and the markup added by the payment processor. Discount rates can vary depending on factors such as the type of card used (debit, credit, rewards card), industry risk, and transaction volume.

- Authorization Fee: For card-not-present transactions, where the credit card information is manually entered, an authorization fee may be charged. This fee covers the cost of verifying the transaction and ensuring that the cardholder’s information is valid. Authorization fees are typically a fixed amount per transaction.

- Chargeback Fee: If a customer disputes a transaction and initiates a chargeback, QuickBooks may charge a fee to the business. Chargeback fees cover the administrative costs associated with handling and resolving the chargeback, as well as any potential losses incurred by the payment processor and the business.

The specific transaction fees can vary depending on the payment processor or merchant services provider used in conjunction with QuickBooks. It is important for businesses to review and understand the fee structure provided by the payment processor to accurately calculate their overall transaction costs.

By comprehending the various transaction fees in QuickBooks, businesses can make informed decisions about their payment processing methods and effectively manage their financial transactions.

Overview of QuickBooks Merchant Service Fees

QuickBooks Merchant Services is a payment processing solution offered by Intuit, the company behind QuickBooks. By using QuickBooks Merchant Services, businesses can seamlessly integrate their payment processing capabilities with their QuickBooks software. While the specific fees associated with QuickBooks Merchant Services can vary based on factors such as the type of business and the agreement with the payment processor, here is an overview of the common fees to expect:

- Transaction Fee: Each transaction processed through QuickBooks Merchant Services typically incurs a per-transaction fee. This fee covers the cost of processing the payment and can range from a flat fee per transaction (e.g., $0.25) to a percentage of the transaction amount.

- Discount Rate: The discount rate is a percentage of the transaction amount that the payment processor charges for each transaction. This fee encompasses not only the interchange fees set by the credit card associations but also the payment processor’s markup. The discount rate can vary based on factors such as the type of card used, the risk associated with the transaction, and the industry in which the business operates.

- Monthly Service Fee: Some QuickBooks Merchant Services plans may have a monthly service fee associated with them. This fee covers the cost of maintaining the merchant account and providing access to the payment processing features. The amount of the monthly service fee can vary depending on the specific plan chosen by the business.

- Chargeback Fee: In the event of a customer dispute resulting in a chargeback, QuickBooks Merchant Services may charge a fee to handle the administrative tasks associated with resolving the dispute. This fee helps compensate for the time and effort involved in addressing chargebacks and potential losses for the payment processor and the business.

- Additional Fees: There may be additional fees associated with QuickBooks Merchant Services, such as PCI compliance fees, statement fees, and setup fees. These fees may vary based on the payment processor and the specific terms and conditions agreed upon.

It’s crucial for businesses to carefully review and understand the fee structure offered by QuickBooks Merchant Services before selecting a plan. By doing so, businesses can accurately assess the costs associated with the payment processing service and choose the plan that aligns with their needs and budget.

Understanding the overview of QuickBooks Merchant Service fees allows businesses to make informed decisions about their payment processing options while effectively managing their financial transactions.

Assessing QuickBooks Payment Gateway Fees

A payment gateway is a service that securely processes credit card transactions between businesses, customers, and banks. QuickBooks offers its own payment gateway solution, known as QuickBooks Payments, which seamlessly integrates with the QuickBooks software. Here is an assessment of the fees associated with QuickBooks Payment Gateway:

- Transaction Fee: QuickBooks Payments charges a per-transaction fee for each credit card transaction processed through its payment gateway. The fee can be a flat amount (e.g., $0.25) or a percentage of the transaction value, depending on the specific terms agreed upon.

- Discount Rate: The discount rate is a percentage of the transaction amount that represents the cost of processing the credit card transaction. This fee includes the interchange fees set by the credit card associations and the payment processor’s markup. The discount rate may vary based on factors such as the type of card used (debit, credit, rewards), the industry, and the transaction volume.

- Monthly Service Fee: QuickBooks Payments may have a monthly service fee associated with its payment gateway services. This fee covers the cost of maintaining the payment gateway infrastructure and providing access to its features. The amount of the monthly service fee can vary based on the plan chosen by the business.

- Chargeback Fee: If a customer initiates a chargeback for a transaction processed through QuickBooks Payments, a chargeback fee may be imposed. This fee covers the administrative costs involved in handling and resolving the chargeback, as well as any potential losses incurred by the payment gateway.

- Additional Fees: QuickBooks Payment Gateway may have additional fees such as setup fees, PCI compliance fees, and statement fees. These fees are specific to the payment gateway service and can vary based on the terms and conditions provided by QuickBooks Payments.

Businesses should carefully review the fee structure and terms of QuickBooks Payment Gateway to accurately assess the costs associated with using the service. By understanding the fees, businesses can evaluate the value provided by the payment gateway and make informed decisions when selecting a payment processing solution for their QuickBooks software.

Assessing the QuickBooks Payment Gateway fees enables businesses to optimize their financial transactions by understanding the costs involved and selecting the most suitable payment processing option.

Additional QuickBooks Credit Card Processing Charges

In addition to the transaction fees and discount rates associated with credit card processing in QuickBooks, businesses may encounter additional charges that could impact their overall costs. Understanding these additional charges is crucial for accurately evaluating the expenses involved in using credit card processing services. Here are some of the common additional charges that businesses should be aware of:

- Statement Fees: Some payment processors or merchant services providers may charge statement fees for providing monthly statements and reports detailing the credit card transactions processed through QuickBooks. These fees typically cover the printing and mailing costs of the statements and can be avoided by opting for electronic statements.

- PCI Compliance Fees: Payment Card Industry (PCI) compliance is a set of security standards that businesses must adhere to when processing credit card transactions. Some payment processors may charge PCI compliance fees to cover the costs of ensuring that their systems and processes meet these standards. It’s important for businesses to understand their PCI compliance obligations and any associated fees.

- Chargeback Fees: In the event of a customer dispute leading to a chargeback, businesses may be subject to chargeback fees imposed by the payment processor. These fees aim to cover the administrative costs involved in managing the chargeback process and any potential losses incurred by the payment processor and the business.

- Early Termination Fees: Some payment processing agreements may include early termination fees if a business decides to cancel its contract before the agreed-upon term. These fees can be substantial, so it’s essential to review the terms of the agreement carefully and consider the potential long-term commitment before entering into a contract.

- Additional Service Charges: Depending on the payment processor or merchant services provider, there may be additional service charges for specific features, such as recurring billing, advanced reporting, or customer support. These charges can vary, so businesses should assess their needs and the value provided by these additional services before opting for them.

It’s important for businesses to thoroughly review the terms and conditions provided by the payment processor or merchant services provider chosen for credit card processing in QuickBooks. By understanding and accounting for these additional charges, businesses can accurately assess the overall costs involved and make informed decisions regarding their credit card processing services.

Awareness of the additional charges associated with QuickBooks credit card processing allows businesses to effectively manage their financial transactions and ensure transparency in their payment processing costs.

Factors That Influence Credit Card Fees in QuickBooks

Several factors can influence the credit card fees associated with processing transactions through QuickBooks. Understanding these factors is crucial for businesses to effectively manage their payment processing costs. Here are some key factors that can impact credit card fees in QuickBooks:

- Type of Card Used: The type of credit card used for a transaction can affect the fees. Generally, debit cards tend to have lower interchange fees compared to credit cards, while rewards or premium cards may have higher interchange fees. Understanding the mix of cards used by customers can help businesses gauge their overall fee structure.

- Transaction Volume: The volume of credit card transactions a business processes through QuickBooks can impact the fees. Payment processors often offer discounted rates for businesses with higher transaction volumes. Therefore, businesses that process a large number of credit card transactions may be eligible for lower fees, helping reduce their overall expenses.

- Industry Risk: The industry in which a business operates can influence credit card fees. Some industries, such as travel or online retail, are considered higher risk due to factors like chargeback potential or fraud susceptibility. Payment processors may pass on higher interchange fees for these industries, which can result in higher overall credit card processing costs.

- Payment Processor: Different payment processors or merchant services providers offer varying fee structures for credit card processing. It’s important for businesses to evaluate and compare the rates, discount rates, and additional fees offered by different providers to determine the best fit for their needs and budget.

- Payment Processing Method: The method used to process credit card payments can affect the fees. For example, in-person transactions with card present (swiped or dipped) often have lower fees compared to card-not-present transactions, where the card’s information is manually entered. Understanding the cost implications of different payment processing methods can help businesses choose the most cost-effective approach.

By considering these factors, businesses can have a better understanding of the credit card fees in QuickBooks and make informed decisions regarding their payment processing strategy. Analyzing transaction volume, the industry’s risk, payment processor options, and payment processing methods can help businesses optimize their fees and effectively manage their payment processing costs in QuickBooks.

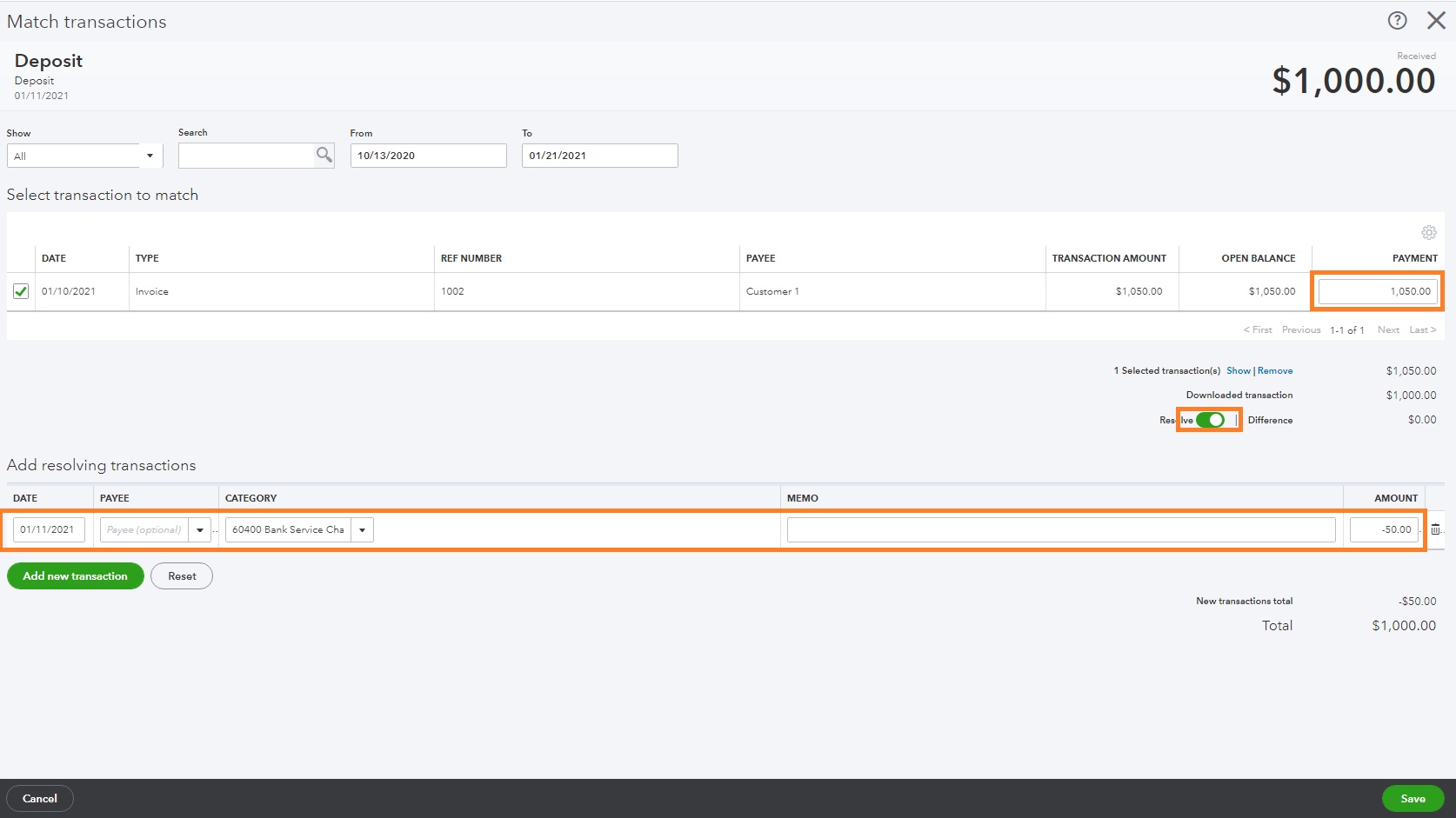

How to Calculate Credit Card Fees in QuickBooks

Calculating credit card fees in QuickBooks involves understanding the fee structure provided by the payment processor and performing some basic calculations. Here is a step-by-step guide on how to calculate credit card fees in QuickBooks:

- Review the Fee Structure: Start by reviewing the fee structure provided by your payment processor or merchant services provider. This includes the transaction fees, discount rates, and any additional charges or fees applicable to your account.

- Determine the Transaction Volume: Analyze the number of credit card transactions your business processes on a monthly basis. This data will be crucial in calculating the overall credit card fees.

- Calculate the Total Transaction Fees: Multiply the per-transaction fee by the total number of credit card transactions processed in a month. This will give you the total transaction fees incurred.

- Calculate the Discount Fees: Multiply the total transaction amount by the discount rate to determine the amount deducted as discount fees for credit card processing. This represents the percentage of the transaction volume that goes towards paying the payment processor’s fees.

- Calculate Other Applicable Fees: Consider any additional fees such as monthly service fees, authorization fees, chargeback fees, or other charges outlined in your fee structure. Add these fees to the overall credit card fees calculation.

- Calculate the Total Credit Card Fees: Sum up the total transaction fees, discount fees, and any applicable additional fees to arrive at the total credit card fees for the month.

- Review and Analyze: Regularly review and analyze the credit card fees calculated in QuickBooks to assess the impact on your bottom line. This will help you evaluate the profitability of accepting credit card payments and make informed decisions on optimizing your payment processing strategies.

It’s important to note that the calculations may vary based on the fee structure and terms provided by your payment processor or merchant services provider. Therefore, it’s crucial to consult your specific agreement and understand the variables that might impact your credit card fees in QuickBooks.

By following these steps and regularly reviewing your credit card fees in QuickBooks, you can gain clarity on the costs associated with credit card processing and make informed decisions to manage your payment processing expenses effectively.

Tips to Minimize Credit Card Fees in QuickBooks

Managing credit card fees is essential for businesses using QuickBooks to process payments. Here are some tips to help minimize credit card fees in QuickBooks:

- Compare Payment Processors: Take the time to research and compare different payment processors or merchant services providers. Look for those that offer competitive fee structures, including lower transaction fees and discount rates. Choose a provider that aligns with your business needs and offers cost-effective solutions.

- Negotiate Fees: Don’t be afraid to negotiate with payment processors. Depending on your transaction volume and business profile, you may have some leverage to negotiate lower fees. Discuss your needs and explore the possibility of discounted rates or waived fees, especially if you have a solid processing history.

- Optimize Payment Processing Methods: Explore different payment processing methods to find the most cost-effective option. Swiped or dipped transactions typically have lower fees compared to card-not-present transactions, so encourage in-person payments when feasible. Additionally, consider implementing payment solutions such as ACH transfers or digital wallets, which may have lower processing costs.

- Encourage Debit Card Usage: Debit card transactions often have lower interchange fees compared to credit card transactions. Encourage customers to use their debit cards for payments whenever possible. Offering incentives or discounts for debit card usage can be an effective strategy to promote this type of payment and reduce fees.

- Monitor Fraud and Chargebacks: Take proactive measures to minimize fraud and chargeback rates. Implement robust security measures, such as encryption and tokenization, to protect customer data. Verify transactions and customer information diligently to reduce the likelihood of disputed transactions. By minimizing chargebacks, you can avoid related fees and potential financial losses.

- Review Statements and Fee Structures: Regularly review your monthly statements and fee structures to ensure accuracy and identify any unexpected or unnecessary charges. Stay informed about any changes in your payment processor’s fee schedule and be proactive in addressing any discrepancies or concerns.

- Streamline Operations: Increase operational efficiency to reduce the number of transactions and associated fees. Implement systems that allow for batch processing of transactions rather than individual processing. This reduces the number of per-transaction fees incurred and improves overall processing efficiency.

By implementing these tips, businesses can minimize credit card fees in QuickBooks and optimize their payment processing expenses. It’s important to regularly review fee structures, stay informed about industry trends, and explore available options to ensure that you are using the most cost-effective credit card processing solution for your business.

Conclusion

Understanding credit card fees in QuickBooks is crucial for businesses looking to streamline their financial transactions while managing costs effectively. By comprehending the types of fees, calculating fees accurately, and implementing strategies to minimize them, businesses can optimize their payment processing and improve their bottom line.

In this article, we explored the different types of credit card fees businesses may encounter when using credit card processing in QuickBooks. We discussed transaction fees, discount rates, authorization fees, and chargeback fees, among others, shedding light on their purpose and impact on businesses.

We also provided an overview of QuickBooks Merchant Service fees and QuickBooks Payment Gateway fees, highlighting the additional charges businesses may encounter when using these services. Understanding these fees ensures transparency in the overall credit card processing costs within the QuickBooks ecosystem.

Furthermore, we discussed factors that influence credit card fees in QuickBooks, such as the type of card used, transaction volume, industry risk, and choice of payment processor. We emphasized the importance of conducting thorough research, negotiating fees, and optimizing payment processing methods to minimize costs.

To calculate credit card fees accurately, businesses need to review the fee structure, consider transaction volume and discount rates, and factor in additional fees. Regularly assessing and analyzing credit card fees allows businesses to stay informed about their financials and make informed decisions to manage payment processing expenses effectively.

Finally, we provided essential tips for minimizing credit card fees in QuickBooks, including comparing payment processors, optimizing payment processing methods, promoting debit card usage, and monitoring fraud and chargebacks. By implementing these strategies, businesses can reduce fees and achieve cost savings.

In conclusion, maintaining a thorough understanding of credit card fees in QuickBooks, along with proactive management and strategic decision-making, empowers businesses to optimize their payment processing operations and effectively manage their financial transactions.