Finance

What Is A Participating Insurance Policy?

Published: November 16, 2023

Learn about participating insurance policies in the world of finance and how they can benefit you. Explore the advantages of these policies and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A participating insurance policy is a type of life insurance policy that offers policyholders the opportunity to share in the profits of the insurance company. Unlike non-participating policies, participating policies provide the policyholders with additional financial benefits such as dividends and bonuses.

This article will provide a comprehensive understanding of what a participating insurance policy is and how it works. We will explore the benefits of these policies and discuss important factors to consider when purchasing one. Finally, we will provide examples of participating insurance policies to illustrate their application in real-life scenarios.

Insurance is an essential component of financial planning, and life insurance plays a crucial role in protecting the financial well-being of loved ones in the event of the policyholder’s death. While there are different types of life insurance policies available, participating policies offer unique advantages that can significantly enhance the policyholder’s returns.

Participating policies are typically offered by mutual insurance companies, which are owned by policyholders rather than external shareholders. This ownership structure allows policyholders to share in the company’s profits through dividends and bonuses.

Throughout this article, we will explore participating insurance policies in depth, shedding light on their key features, benefits, and considerations. Whether you are a seasoned investor or a first-time insurance buyer, understanding participating insurance policies is crucial for making informed financial decisions.

Definition of a Participating Insurance Policy

A participating insurance policy, also known as a par policy or a dividend-paying policy, is a type of life insurance policy that allows policyholders to receive dividends and bonuses based on the financial performance of the insurance company. Unlike non-participating policies, where the policyholder pays a fixed premium and does not share in the company’s profits, participating policies offer the potential for additional returns.

When policyholders buy a participating insurance policy, they become members of a mutual insurance company, effectively becoming shareholders in the company. As owners of the company, policyholders are entitled to receive a portion of the profits generated by the company’s operations.

The dividends received from a participating policy can take various forms. They can be paid out in cash, used to offset future premium payments, or reinvested into the policy to increase its cash value and death benefit. The specific method of dividend payment varies depending on the insurance company and the policy’s terms and conditions.

Participating policies are a popular choice among individuals who are seeking long-term financial security and are willing to assume some investment risk. These policies provide an opportunity to benefit from the success of the insurance company in addition to the protection provided by life insurance coverage.

It is important to note that the payment of dividends is not guaranteed and depends on various factors such as the insurance company’s financial performance, investment returns, and mortality experience. While participating policies have a history of providing dividends, it is important for policyholders to thoroughly review the policy terms and conditions and consider the financial stability and track record of the insurance company before purchasing a policy.

In summary, a participating insurance policy is a type of life insurance policy that allows the policyholder to share in the profits of the insurance company. By purchasing a participating policy, policyholders become members of a mutual insurance company and have the potential to receive dividends and bonuses based on the company’s financial performance. This type of policy offers the potential for additional returns and can be an attractive option for individuals looking for long-term financial security.

How Participating Insurance Policies Work

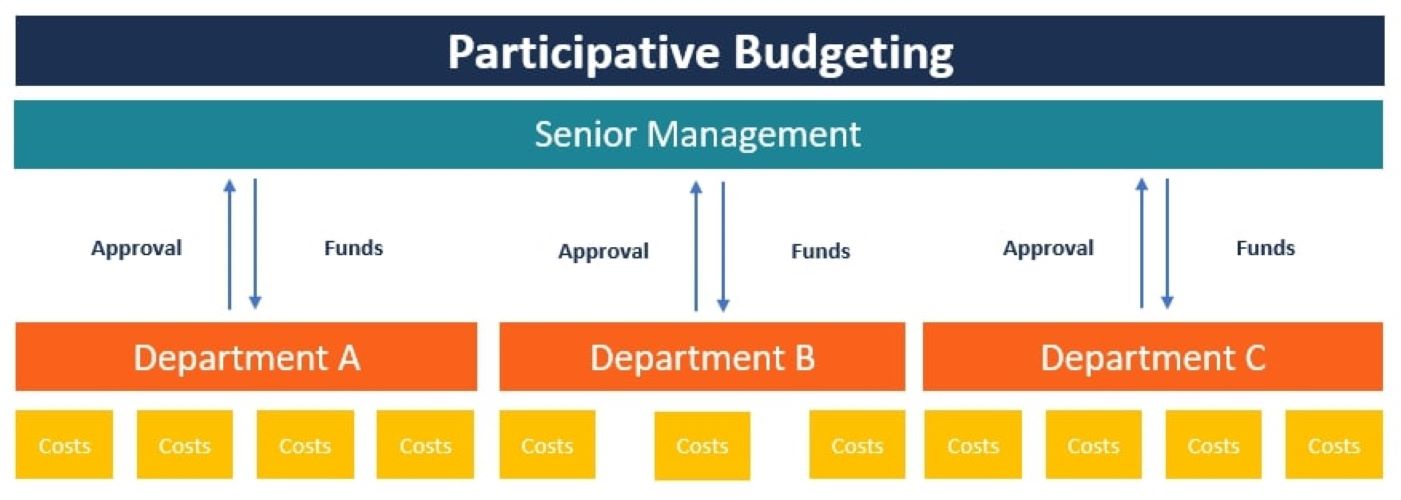

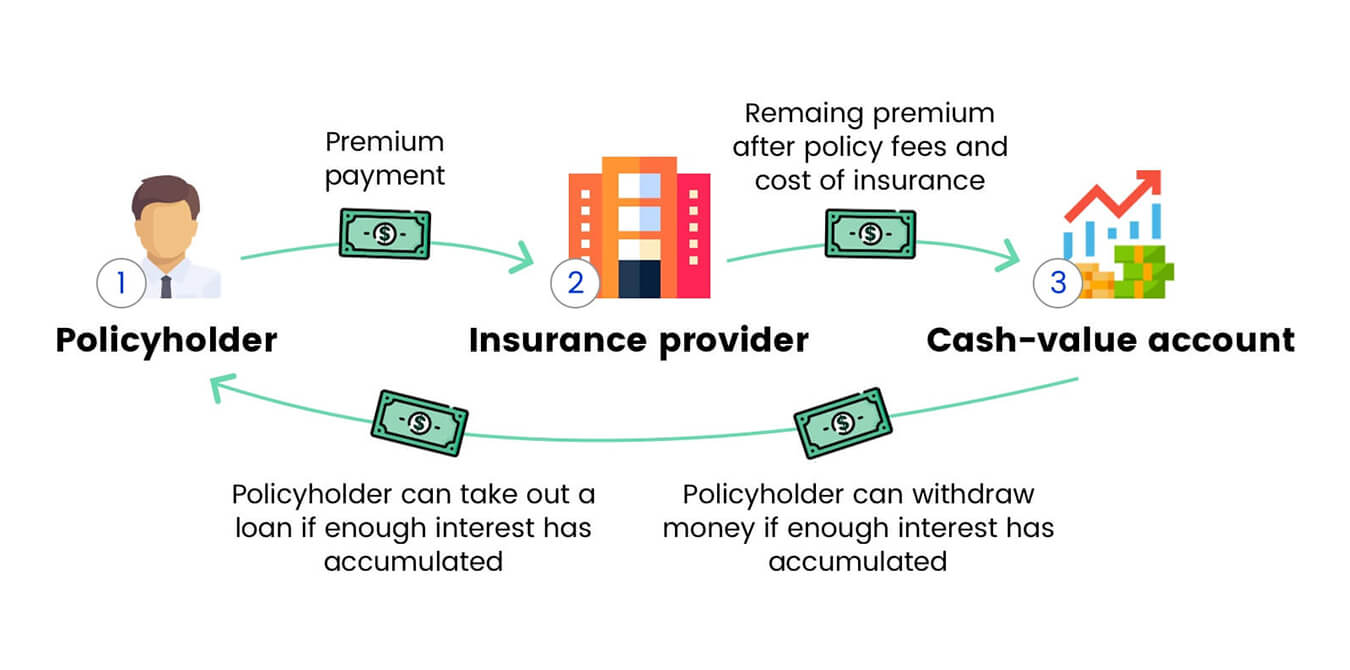

Participating insurance policies work on the principle of sharing profits between the insurance company and the policyholders. Here’s a step-by-step breakdown of how these policies operate:

- Premium Payments: Policyholders pay regular premiums to the insurance company. These premiums cover the cost of the insurance coverage and any administrative expenses.

- Investing the Premiums: The insurance company invests the premiums in various assets such as stocks, bonds, and real estate to generate returns.

- Company Profits: The insurance company earns profits from its investments and its underwriting activities (collecting more in premiums than it pays out in claims).

- Calculating Dividends: At the end of each fiscal period, the insurance company calculates its profits and determines the amount of dividends it can distribute to the participating policyholders.

- Dividend Distribution: The insurance company distributes the dividends to the participating policyholders based on the terms and conditions of the policy. Dividends can be received in the form of cash, used to pay future premiums, or reinvested into the policy to increase its cash value and death benefit.

The calculation of dividends for participating policies is complex and depends on various factors such as the company’s profits, investment returns, and mortality experience. Insurance companies use actuarial calculations to determine how much of the profits should be allocated to participating policyholders.

It is important to note that dividends are not guaranteed. The amount and frequency of dividend payments can vary from year to year based on the financial performance of the insurance company. Policyholders should carefully review the policy terms and conditions to understand how dividends are calculated and how they can be utilized.

Participating policies also offer the opportunity to accumulate cash value over time. As the policyholder pays premiums and earns dividends, the policy’s cash value grows. This cash value can be accessed by the policyholder through policy loans or withdrawals, providing a source of liquidity if needed.

An important aspect of participating policies is their long-term nature. These policies are designed to provide coverage for the policyholder’s entire life, rather than for a specific term. Policyholders should consider their long-term financial goals and the premiums required for the duration of the policy when deciding to purchase a participating policy.

In summary, participating insurance policies operate by allowing policyholders to share in the profits of the insurance company. Policyholders pay premiums, and the insurance company invests those premiums to generate returns. Profits are calculated, and dividends are distributed to the participating policyholders. The policy’s cash value also grows over time, providing additional benefits. Understanding how participating policies work is crucial for policyholders to make informed decisions regarding their insurance and investment needs.

Benefits of Participating Insurance Policies

Participating insurance policies offer several benefits that make them an attractive option for individuals seeking life insurance coverage. Here are some of the key benefits:

- Potential for Dividends: Participating policyholders have the opportunity to receive dividends based on the profits and performance of the insurance company. These dividends can provide an additional source of income or be used to enhance the policy’s cash value or death benefit.

- Long-Term Financial Security: Participating policies are designed to provide coverage for the policyholder’s entire life. This long-term coverage ensures that loved ones are protected financially in the event of the policyholder’s death, offering peace of mind and financial security.

- Accumulation of Cash Value: Participating policies have a cash value component that grows over time. As premiums are paid and dividends are earned, the policy’s cash value increases. This cash value can be accessed by the policyholder through policy loans or withdrawals, providing a source of liquidity if needed.

- Policy Flexibility: Participating policies often allow policyholders to customize their coverage to suit their individual needs. You may have the flexibility to adjust the death benefit, premium payment frequency, or even apply for additional coverage without undergoing medical underwriting.

- Protection Against Inflation: Some participating policies offer the option to add inflation protection through riders or policy enhancements. This ensures that the policy’s death benefit keeps pace with the rising cost of living, providing adequate financial protection for beneficiaries in the future.

- Potential for Tax Advantages: The dividends received from a participating policy are typically considered a return of premium and may be tax-free. Additionally, the cash value of the policy grows on a tax-deferred basis, meaning you won’t have to pay taxes on the gains until you withdraw them.

- Participation in the Insurance Company’s Success: By purchasing a participating policy, you become a member of a mutual insurance company and share in its profits. This sense of ownership allows you to benefit from the success and financial stability of the company.

- Flexible Dividend Options: Participating policies offer various options for dividend utilization. You can choose to receive dividends in cash, use them to offset premium payments, or reinvest them into the policy to increase its cash value and death benefit.

It is important to note that the benefits of participating policies can vary depending on the insurance company and the specific terms and conditions of the policy. Before purchasing a participating policy, it is essential to thoroughly review the policy details and consider your individual financial goals and needs.

In summary, participating insurance policies offer a range of benefits, including the potential for dividends, long-term financial security, accumulation of cash value, policy flexibility, protection against inflation, potential tax advantages, participation in the insurance company’s success, and flexible dividend options. These benefits make participating policies an appealing choice for individuals seeking life insurance coverage with the potential for additional returns and financial benefits.

Considerations for Purchasing a Participating Insurance Policy

While participating insurance policies offer attractive benefits, it is essential to carefully consider certain factors before purchasing a policy. Here are some key considerations to keep in mind:

- Financial Stability of the Insurance Company: Before choosing a participating policy, it is crucial to research and evaluate the financial stability and track record of the insurance company. Look for companies with strong financial ratings and a history of consistent dividend payments.

- Review Policy Details: Thoroughly review the terms and conditions of the participating policy. Understand how dividends are calculated, the options for dividend utilization, and any guarantees or limitations associated with the policy.

- Evaluate Premium Affordability: Participating policies usually have higher premiums compared to non-participating policies. Ensure that the premiums are affordable and fit within your long-term budget to avoid the risk of policy lapse.

- Understand Policy Flexibility: Participating policies often offer flexibility in terms of adjusting the death benefit, changing premium payment frequency, or adding additional coverage. Evaluate whether the policy can be customized to meet your evolving needs and financial goals.

- Compare with Non-Participating Policies: Consider the benefits and drawbacks of participating policies compared to non-participating policies. Non-participating policies may have lower premiums but do not offer the potential for dividends or participation in the company’s profits.

- Long-Term Commitment: Participating policies are designed to be long-term commitments, often covering the policyholder’s entire life. Ensure that you are prepared to pay premiums for the duration of the policy and that it aligns with your long-term financial goals.

- Tax Implications: While participating policies may offer potential tax advantages, it is essential to consult with a tax professional to understand the specific tax implications in your jurisdiction and how they may affect your overall financial situation.

- Seek Professional Guidance: Consider consulting with a financial advisor or insurance professional who specializes in participating insurance policies. They can provide personalized guidance and help you evaluate your options based on your individual circumstances and goals.

By carefully considering these factors and seeking professional advice, you can make an informed decision when purchasing a participating insurance policy that aligns with your financial needs and objectives.

In summary, purchasing a participating insurance policy requires careful consideration of the insurance company’s financial stability, reviewing policy details, evaluating premium affordability, understanding policy flexibility, comparing with non-participating policies, assessing the long-term commitment, understanding tax implications, and seeking professional guidance. Taking these considerations into account will help you choose a participating policy that suits your financial goals and provides you with the desired benefits and financial security.

Examples of Participating Insurance Policies

There are various insurance companies that offer participating insurance policies with different features and benefits. Here are a few examples of participating insurance policies to provide a better understanding:

- New York Life Insurance Company: New York Life is a well-established mutual insurance company that offers participating policies. Their participating whole life policies provide a guaranteed death benefit, potential for dividends, and the ability to accumulate cash value over time. Policyholders have the flexibility to choose how dividends are utilized – as cash withdrawals, premium reductions, or to increase the policy’s cash value.

- MassMutual: MassMutual is another leading mutual insurance company known for its participating policies. Their participating policies typically offer lifelong coverage, the potential for dividends, and the ability to build cash value. MassMutual policyholders can choose to receive dividends in various ways, such as receiving cash payments or using them to offset future premiums.

- Northwestern Mutual: Northwestern Mutual is a prominent mutual insurance company that offers participating policies with a range of features. Their participating whole life policies provide guaranteed death benefits, potential for dividends, and cash value accumulation. Policyholders can use their dividends to increase the policy’s cash value, purchase additional coverage, or receive them as cash payments.

- Guardian Life Insurance Company: Guardian is known for its participating whole life policies that offer policyholders protection and the opportunity for dividend participation. Guardian’s participating policies have flexible premium payment options and the ability to customize coverage to suit individual needs. Dividends can be used to increase cash value, pay premiums, or receive in cash.

- Massachusetts Mutual Life Insurance Company: Massachusetts Mutual, commonly known as MassMutual, also offers participating policies. Their participating whole life policies provide lifelong protection, the potential for dividends, and cash value accumulation. MassMutual policyholders have the option to receive dividends as cash, use them to pay premiums, or reinvest them to enhance policy performance.

These are just a few examples of insurance companies that offer participating insurance policies. It’s important to note that each company may have different policy features, dividend payment methods, and policyholder benefits. When considering a participating policy, it is crucial to thoroughly review the policy details, financial stability of the company, and consult with an insurance professional to ensure it aligns with your specific needs and goals.

In summary, participating insurance policies are available from various reputable insurance companies such as New York Life, MassMutual, Northwestern Mutual, Guardian Life, and Massachusetts Mutual. These policies offer benefits such as guaranteed death benefits, potential dividends, and the ability to accumulate cash value. Understanding the specific features and benefits of each policy is essential when selecting a participating insurance policy that suits your financial objectives.

Conclusion

Participating insurance policies provide policyholders with a unique opportunity to share in the profits of the insurance company. These policies offer several benefits, including the potential for dividends, long-term financial security, accumulation of cash value, policy flexibility, and participation in the company’s success. By understanding how participating policies work and carefully considering factors such as the financial stability of the insurance company and the policy details, individuals can make informed decisions regarding their life insurance and investment needs.

While participating policies offer attractive benefits, it is important to remember that dividends are not guaranteed and can vary depending on the insurance company’s financial performance. Policyholders should thoroughly review the policy terms and conditions and consider their long-term financial goals and premium affordability before purchasing a participating policy.

Remember to evaluate participating policies in comparison to non-participating policies to determine which option best suits your needs. Additionally, consulting with a financial advisor or insurance professional can provide valuable guidance and help navigate the complexities of these policies.

Ultimately, participating insurance policies can play a vital role in providing financial protection and potential returns for individuals and their families. By carefully considering the benefits and considerations, individuals can choose a participating policy that aligns with their long-term financial goals and provides the desired level of financial security.

In conclusion, participating insurance policies offer a unique opportunity to participate in the success of an insurance company while providing essential life insurance coverage. When approached with careful consideration and professional guidance, these policies can serve as valuable assets in building a strong financial foundation for the future.