Finance

What Is A Promotional APR?

Published: March 3, 2024

Learn how a promotional APR can help you save money and manage your finances effectively. Understand the benefits and potential drawbacks of promotional APR offers in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Introduction

When it comes to managing your finances, understanding the intricacies of annual percentage rates (APR) is crucial. One type of APR that can significantly impact your financial decisions is the promotional APR. This special offer is often used by credit card companies and lenders to entice consumers with an attractive interest rate for a limited period. It’s important to grasp the nuances of promotional APR, including its benefits and potential drawbacks, to make informed financial choices.

In this article, we’ll delve into the concept of promotional APR, exploring its definition, how it differs from regular APR, and the advantages it offers. Additionally, we’ll discuss essential considerations to keep in mind before utilizing promotional APR to ensure that you can leverage this financial tool effectively while avoiding potential pitfalls.

Whether you’re considering a promotional APR credit card offer or contemplating a promotional APR loan, having a comprehensive understanding of this financial feature is essential for making sound financial decisions. Let’s embark on a journey to unravel the intricacies of promotional APR and empower you to navigate the world of finance with confidence.

Understanding Promotional APR

Before delving into the specifics of promotional APR, it’s essential to comprehend the concept of APR itself. APR represents the annual percentage rate, which reflects the annual cost of borrowing and is expressed as a percentage. When a financial institution offers a promotional APR, it means that they are providing a temporary, reduced interest rate on a credit card balance or loan.

Unlike regular APR, which applies for an extended period and is based on the ongoing interest rate, promotional APR is a limited-time offer. It is commonly used as a marketing tool to attract new customers or encourage existing ones to engage in specific financial activities, such as making purchases with a credit card or taking out a loan.

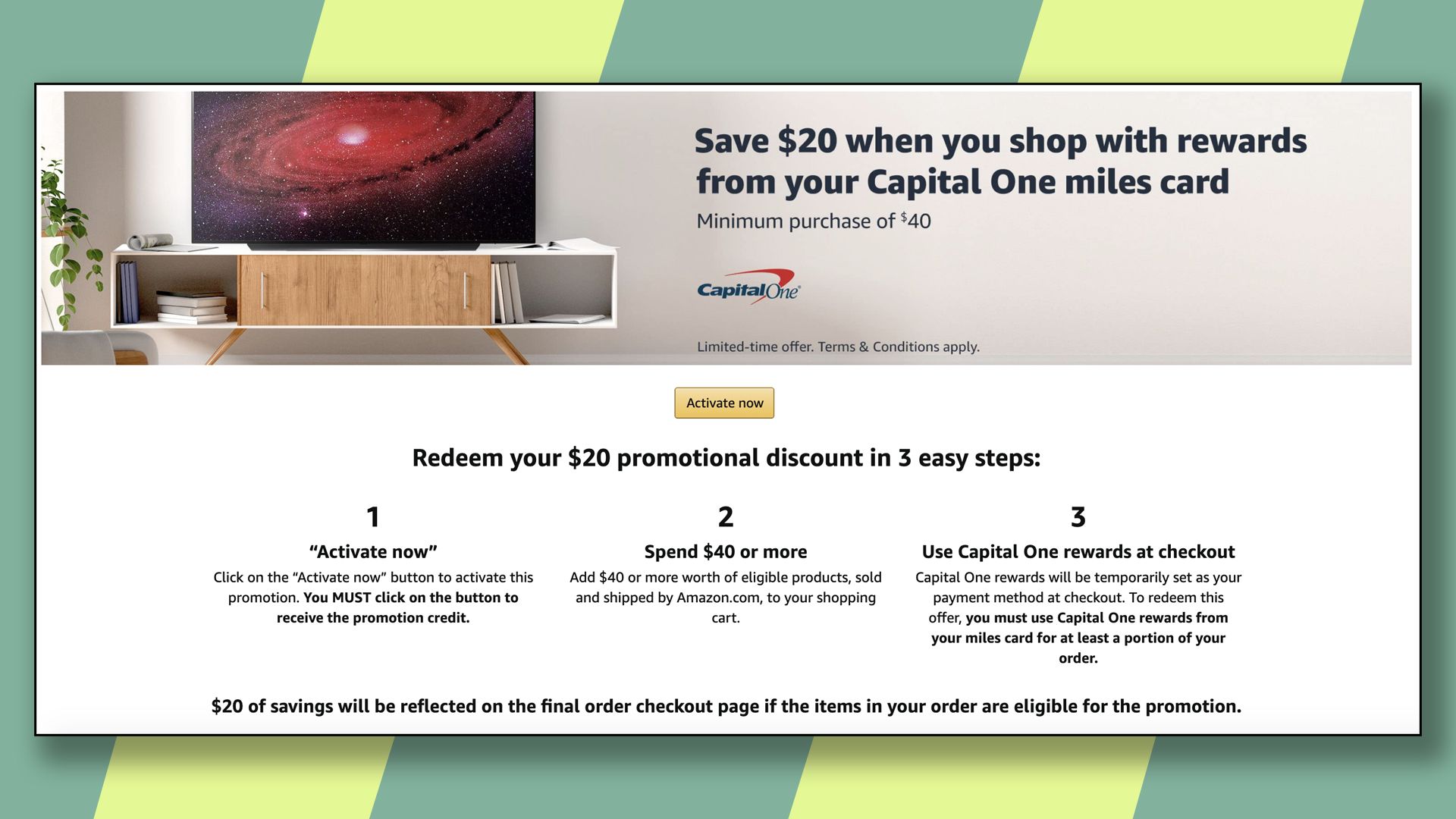

Promotional APRs can come in various forms, such as 0% APR for a certain period or a significantly reduced interest rate compared to the standard APR. These offers may apply to balance transfers, new purchases, or both, depending on the terms and conditions set by the financial institution.

It’s important to note that promotional APRs are not exclusive to credit cards; they can also be associated with loans, including personal loans, auto loans, and mortgages. Understanding the duration and scope of the promotional APR offer is crucial for evaluating its potential impact on your financial situation.

By gaining a clear understanding of promotional APR, you can make informed decisions about utilizing these offers to your advantage. In the following sections, we’ll explore the benefits of promotional APR and essential considerations to bear in mind when navigating this aspect of personal finance.

Benefits of Promotional APR

Utilizing a promotional APR can offer several advantages for consumers seeking to manage their finances strategically. One of the primary benefits is the potential to save money on interest payments. For example, a 0% promotional APR on balance transfers can provide a window of time during which no interest accrues, enabling individuals to consolidate and pay down existing high-interest debt more efficiently.

Additionally, promotional APR offers can be advantageous for individuals planning significant purchases. By taking advantage of a low or 0% promotional APR on new purchases, consumers can spread out payments over the promotional period without incurring substantial interest charges. This can be particularly beneficial for budgeting and managing cash flow.

Furthermore, promotional APRs can serve as an opportunity to access funds for specific purposes, such as home improvements or unexpected expenses, without immediately incurring high interest costs. This can provide a financial cushion and flexibility, especially when compared to traditional loans or credit options with higher ongoing interest rates.

Moreover, promotional APR offers can be beneficial for individuals seeking to build or improve their credit. By responsibly managing a promotional APR credit card or loan, individuals can demonstrate their creditworthiness and establish a positive payment history, which can contribute to enhancing their overall credit profile.

It’s important to note that while promotional APR offers present these potential advantages, it’s crucial to approach them with careful consideration and a clear repayment strategy. In the next section, we’ll explore essential considerations to keep in mind before leveraging promotional APR to ensure that you can make the most of these offers while avoiding potential pitfalls.

Considerations Before Using Promotional APR

Before taking advantage of a promotional APR offer, it’s essential to consider several key factors to ensure that you can leverage this financial tool effectively and responsibly.

Repayment Capacity: Assess your ability to repay the borrowed funds within the promotional period. Whether it’s a credit card balance or a loan, understanding your repayment capacity is crucial to avoid accumulating high-interest charges once the promotional APR period ends.

Terms and Conditions: Thoroughly review the terms and conditions associated with the promotional APR offer. Pay close attention to important details, such as the duration of the promotional period, any associated fees, and the standard APR that will apply after the promotional period expires.

Impact on Credit Score: Understand how utilizing a promotional APR offer may impact your credit score. While responsible use can have positive effects, it’s essential to be aware of any potential implications for your credit profile.

Financial Goals: Align the use of promotional APR with your financial objectives. Whether it’s debt consolidation, making a significant purchase, or addressing unexpected expenses, ensure that leveraging the promotional APR supports your broader financial goals and plans.

Repayment Strategy: Develop a clear repayment strategy to address the borrowed funds before the promotional period concludes. Having a structured plan in place can help you avoid being caught off guard by high-interest charges once the promotional APR expires.

Comparison with Alternatives: Compare the promotional APR offer with alternative financing options. Evaluate the total cost of borrowing, including any fees, and consider whether the promotional APR offer aligns with your overall financial needs and preferences.

By carefully considering these factors and approaching promotional APR offers with a well-defined strategy, you can maximize the benefits while mitigating potential risks. Now that we’ve explored the considerations associated with using promotional APR, let’s conclude our comprehensive understanding of this financial feature.

Conclusion

Understanding promotional APR and its implications is essential for making informed financial decisions. This special offer, often utilized by credit card companies and lenders, can provide consumers with opportunities to save on interest, manage cash flow, and achieve specific financial goals. However, leveraging promotional APR requires careful consideration and a clear repayment strategy to ensure that it aligns with your overall financial objectives.

By comprehensively understanding the terms and conditions, assessing your repayment capacity, and aligning the use of promotional APR with your financial goals, you can make the most of these offers while minimizing potential drawbacks. It’s crucial to approach promotional APR as a temporary financial tool and not rely solely on the temporary benefits it offers.

Additionally, responsible use of promotional APR can contribute to building or improving your credit profile, enhancing your financial stability in the long run. Whether it’s taking advantage of a 0% promotional APR on balance transfers or leveraging a reduced interest rate for new purchases, strategic utilization of these offers can be a valuable component of your financial toolkit.

As with any financial decision, it’s important to weigh the benefits and considerations associated with promotional APR and ensure that it aligns with your overall financial strategy. By staying informed, exercising prudence, and approaching promotional APR with a clear understanding of its impact, you can harness its potential to support your financial well-being and achieve your long-term objectives.

With a comprehensive understanding of promotional APR, you are better equipped to navigate the dynamic landscape of personal finance, making informed choices that lay the groundwork for a secure and prosperous financial future.