Home>Finance>What Happens When A Life Insurance Policy Exceeds Certain IRS Limits?

Finance

What Happens When A Life Insurance Policy Exceeds Certain IRS Limits?

Published: October 15, 2023

Are you aware of the consequences when a life insurance policy surpasses IRS limits? Understand the financial implications of exceeding these thresholds and plan accordingly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of life insurance policies and financial planning. If you’re considering purchasing a life insurance policy or already have one in place, it’s important to understand the intricacies of policy limits and the potential consequences of exceeding those limits. In this article, we’ll delve into the topic of what happens when a life insurance policy exceeds certain IRS limits and the tax implications that come with it.

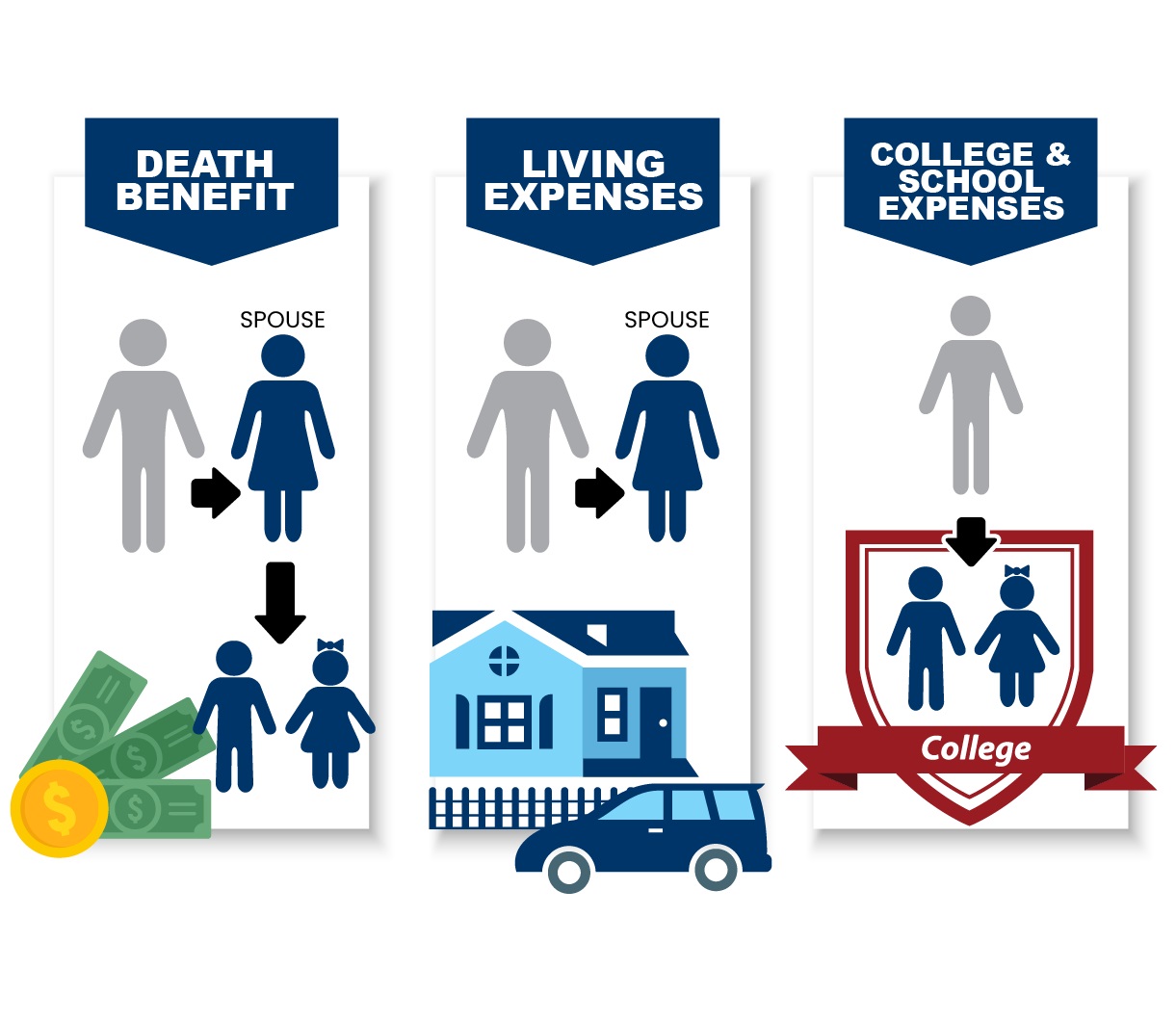

A life insurance policy is a crucial part of one’s financial strategy as it provides financial security to loved ones in the event of the policyholder’s death. However, there are strict guidelines set by the Internal Revenue Service (IRS) to ensure that life insurance policies do not become vehicles for tax avoidance.

Understanding the limits set by the IRS is essential to ensure that your life insurance policy remains compliant and avoids unnecessary tax consequences. This article aims to shed light on the potential implications that arise when a life insurance policy exceeds these limits and provide guidance on how to navigate through these situations.

It’s important to note that we are not tax or financial advisors, and this article should not be considered as professional advice. The purpose is to offer general information and raise awareness of the topic. You should consult with a qualified professional to discuss your specific circumstances and obtain personalized advice.

Now, let’s dive deeper into the concept of life insurance policy limits and the potential consequences that may arise when these limits are exceeded.

Understanding Life Insurance Policy Limits

Life insurance policy limits refer to the maximum amount of coverage that a policyholder can have on their life insurance policy. These limits are set by the insurance company and may vary based on factors such as the policyholder’s age, health, and income. It’s essential to understand these limits to ensure that your policy remains within the permissible range.

Insurance companies typically determine policy limits based on the policyholder’s income and financial needs. The purpose of these limits is to prevent individuals from purchasing excessive coverage solely for tax avoidance purposes. The IRS has specific guidelines in place to regulate the amount of coverage that can be obtained without triggering adverse tax consequences.

The limits set by the IRS primarily revolve around the concept of the policy’s cash value and its relationship to the total death benefit. Cash value represents the accumulated investment portion of a life insurance policy, while the death benefit is the amount paid out to beneficiaries upon the death of the insured.

The IRS limits the amount of cash value that can accrue in a policy without incurring adverse tax consequences. If the policy exceeds these limits, it may be classified as a modified endowment contract (MEC), which has different tax treatment than a traditional life insurance policy.

The specific limits set by the IRS can vary depending on several factors, including the age of the insured and the premium payment duration. It’s crucial to review your policy documents and consult with your insurance provider or financial advisor to determine the exact limits that apply to your specific policy.

Exceeding life insurance policy limits can have significant tax implications, which we will explore in the next section.

Consequences of Exceeding IRS Limits

Exceeding the life insurance policy limits set by the IRS can have several consequences, both from a tax perspective and in terms of the policy’s classification. Let’s explore these consequences in more detail.

1. Taxation: When a life insurance policy exceeds the IRS limits and is classified as a modified endowment contract (MEC), the tax treatment changes. Generally, withdrawals and policy loans from a traditional life insurance policy are considered tax-free. However, with an MEC, any distributions above the policy’s basis are subject to taxation. These distributions are not only taxable but also subject to an additional 10% penalty if taken before the age of 59 1/2.

2. Loss of Tax Advantages: Traditional life insurance policies offer a variety of tax advantages, such as tax-deferred growth of cash value and tax-free death benefit payouts to beneficiaries. However, once a policy crosses the IRS limits and becomes an MEC, these tax advantages may be lost. The policyholder may end up with reduced tax benefits and potentially increased tax obligations.

3. Changes in Policy Structure: Exceeding the IRS limits may require changes to the policy structure. To bring the policy back within the permissible limits, options such as reducing the death benefit, increasing premium payments, or surrendering portions of the policy may need to be considered. These changes can impact the policyholder’s financial planning goals and may require additional financial resources.

4. Impact on Beneficiaries: When a policy becomes an MEC due to exceeding the IRS limits, the tax implications extend to the beneficiaries as well. They may face tax obligations on any distributions received from the policy. This can reduce the intended financial benefits of the policy and create unexpected tax burdens for the beneficiaries.

It’s crucial to be aware of these consequences and the potential impact they can have on your financial situation. Staying within the IRS limits ensures that your life insurance policy remains in line with the desired tax treatment and preserves the intended benefits for both policyholders and beneficiaries.

Next, let’s explore the tax implications in more detail.

Tax Implications of Excess Life Insurance Policy

Exceeding the IRS limits on a life insurance policy can result in significant tax implications. It’s important to understand these implications to make informed decisions regarding your policy. Here’s an overview of the key tax considerations when a life insurance policy exceeds the permissible limits:

1. Income Tax: If a life insurance policy becomes classified as a modified endowment contract (MEC) due to exceeding the IRS limits, any distributions above the policy’s basis are subject to income tax. These distributions include withdrawals and policy loans. Unlike traditional life insurance policies, where distributions are generally tax-free, MEC distributions are taxable as ordinary income in the year they are received.

2. Penalty Tax: In addition to regular income tax, any taxable distributions from an MEC policy taken before the age of 59 1/2 are also subject to a 10% penalty tax. This penalty is designed to discourage policyholders from using life insurance policies as a tax-advantaged investment vehicle. It’s important to consider this penalty when evaluating the tax implications of excessive policy amounts.

3. Loss of Tax-Advantaged Growth: One of the benefits of a traditional life insurance policy is tax-deferred growth of the cash value. The policyholder can invest the cash value without incurring taxes on the gains until distributions are made. However, with an MEC, the tax advantages are lost, and the policyholder must pay income tax on any investment gains within the policy.

4. Estate Tax: Excessive life insurance policy amounts can also have implications for estate taxes. The death benefit of a life insurance policy is generally not subject to income tax for the beneficiaries. However, if the policyholder’s estate is subject to estate taxes, the death benefit amount may be included in the calculation of the taxable estate. This can potentially increase the overall estate tax liability.

It’s crucial to consult with a qualified tax advisor or financial professional to fully understand the tax implications of your specific life insurance policy and devise appropriate strategies to mitigate any potential tax burdens. There may be options available to restructure the policy or adjust the funding to bring it back within the IRS limits and preserve the desired tax advantages.

Now that we’ve explored the tax implications, let’s move on to discuss the options available for dealing with excess policy amounts.

Options for Dealing with Excess Policy Amounts

When a life insurance policy exceeds the IRS limits, there are several options available to address the excess policy amounts and mitigate potential tax consequences. Let’s explore some of these options:

1. Policy Surrender: Policyholders may choose to surrender the excess policy amount to bring it back within the IRS limits. By surrendering a portion of the policy, the cash value and death benefit are reduced, ensuring compliance with the allowable limits. However, it’s important to carefully consider the financial impact of surrendering a policy, as it may result in loss of coverage and potential surrender charges.

2. Premium Adjustments: Another option is to adjust the premium payments to reduce the excess policy amount. By increasing the premiums or reducing the coverage, the policy can be structured to fall within the permissible limits. However, this option may require additional financial resources and should be evaluated carefully to ensure it aligns with your financial goals.

3. Policy Restructuring: Depending on the specifics of your policy, it may be possible to restructure the excess policy amount into a separate policy that complies with the IRS limits. This can help maintain the desired coverage while addressing the tax implications. Policyholders should consult with their insurance provider or financial advisor to explore this option further.

4. Tax-Deferred Investments: If the tax advantages of the life insurance policy are no longer desirable due to excess policy amounts, an alternative option is to invest in tax-deferred retirement accounts, such as an IRA or 401(k). These accounts offer similar tax advantages, allowing for potential growth without immediate tax implications, while also contributing to retirement savings.

5. Estate Planning Strategies: If the excess policy amounts are primarily driven by concerns regarding estate taxes, engaging in estate planning strategies can help mitigate the potential tax burden. Strategies such as establishing a trust or utilizing gifting techniques can help reduce the taxable estate and ensure efficient wealth transfer to beneficiaries.

Remember, each individual’s circumstances and goals are unique, and the best course of action for dealing with excess policy amounts may vary. It’s important to consult with qualified professionals, such as insurance agents, financial advisors, and tax experts, to evaluate your options and determine the most appropriate solution based on your specific needs.

Now that we’ve explored the options available, let’s summarize the key points discussed in this article.

Conclusion

Understanding the limits and tax implications associated with a life insurance policy is essential for anyone seeking financial security and planning for the future. Exceeding the IRS limits on a life insurance policy can result in significant tax consequences and necessitate careful consideration of available solutions.

In this article, we discussed the potential consequences of exceeding IRS limits, which include changes in tax treatment, loss of tax advantages, and potential impacts on beneficiaries. We also explored the tax implications, such as income tax and penalties, that arise when a life insurance policy becomes classified as a modified endowment contract (MEC).

To address excess policy amounts, several options can be considered, including policy surrender, adjustments to premiums, policy restructuring, investing in tax-deferred accounts, and implementing estate planning strategies.

It’s crucial to work with qualified professionals, such as insurance agents, financial advisors, and tax experts, to evaluate your specific situation and determine the most appropriate approach for dealing with excess policy amounts. They can guide you through the decision-making process, help you understand the tax implications, and devise suitable strategies to align your life insurance policy with your financial goals and objectives.

Remember, this article serves as general information and should not be considered professional advice. Always consult with a qualified professional to address your unique circumstances and receive personalized recommendations.

By staying informed and taking proactive steps, you can ensure that your life insurance policy remains within the IRS limits, providing the intended financial security for your loved ones while minimizing potential tax burdens.

Thank you for reading this article, and we hope you found it helpful in navigating the complexities of life insurance policy limits and their tax implications.