Finance

What Is A Returned Payment On A Credit Card

Published: October 26, 2023

Learn what a returned payment on a credit card is and its implications in the world of finance. Understand how it can affect your credit score and financial standing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing credit cards can be a convenient way to make purchases and build credit. However, there are situations that can occur where a payment made on a credit card may be returned. This can be an inconvenience for cardholders and can have negative consequences on their financial well-being. In this article, we will explore what a returned payment is, the causes behind it, the potential consequences that cardholders may face, and how to avoid such situations.

When it comes to credit card payments, a returned payment refers to a transaction that was unsuccessful in processing and ultimately gets sent back to the cardholder’s account. It is essentially like a bounced check, where the payment does not go through due to various reasons. This can usually happen when there are insufficient funds in the cardholder’s bank account, incorrect card information provided, or even technical issues in the payment processing system.

Returned payments can be frustrating for credit cardholders as it not only disrupts their financial plans but can also lead to penalties, fees, and potential damage to their credit score. Understanding the causes behind a returned payment is crucial for avoiding such situations in the future and maintaining good financial standing.

Next, we will delve into the various causes of returned payments on credit cards, shedding light on common issues that cardholders may encounter. By understanding these causes, individuals can take proactive steps to prevent a returned payment from occurring and protect their financial stability.

Definition of a Returned Payment

A returned payment on a credit card occurs when a payment made by the cardholder is unable to be processed successfully and is returned to the cardholder’s account. It is essentially a failed transaction that can happen for various reasons, such as insufficient funds in the cardholder’s bank account, incorrect card information provided during the payment process, or technical issues with the payment processing system.

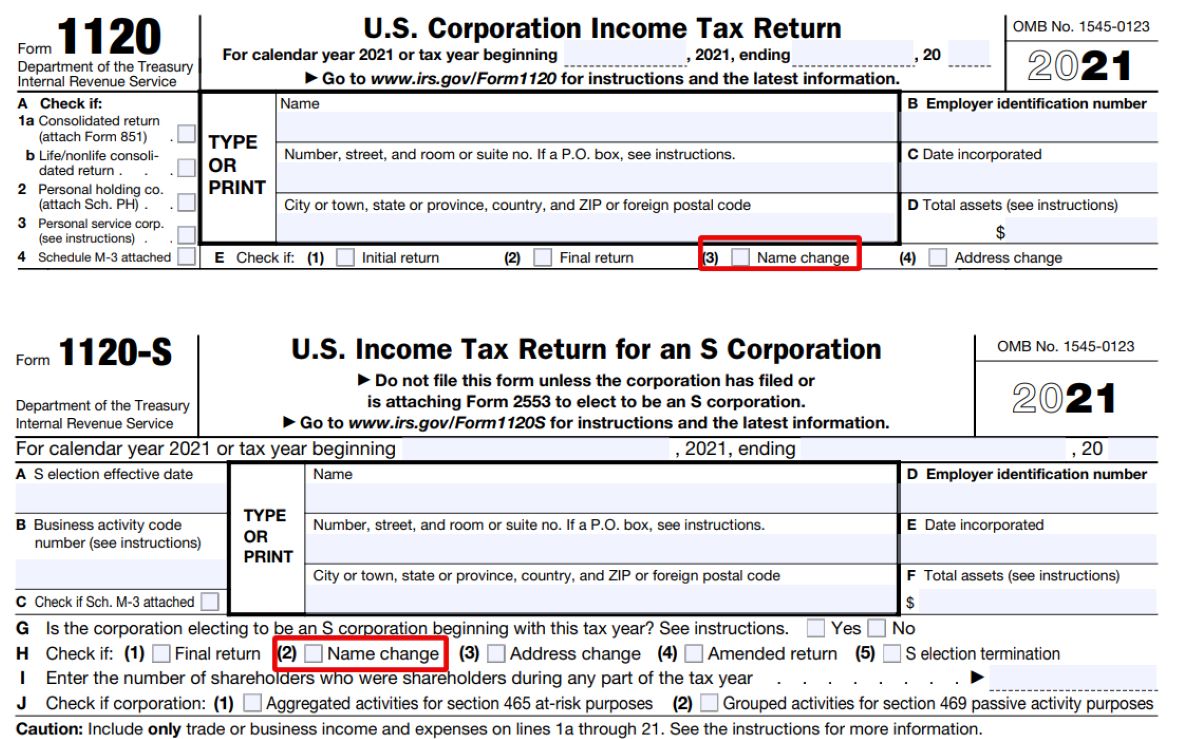

When a payment is returned, it can have immediate consequences for the cardholder. The credit card company may charge a returned payment fee, which can range from a few dollars to a significant percentage of the payment amount. Additionally, the returned payment can negatively impact the cardholder’s credit score. Credit bureaus may be notified of the returned payment, and this information can remain on the cardholder’s credit report for up to seven years.

It’s important to note that a returned payment is different from a late payment. A late payment occurs when a cardholder fails to make a payment by the due date. While a late payment can also result in penalties and damage to the credit score, a returned payment specifically refers to a payment that was unable to be processed successfully.

The consequences of a returned payment can extend beyond financial penalties. It can also result in a strained relationship between the cardholder and the credit card company. If a cardholder has a history of returned payments, it may negatively impact their ability to obtain credit in the future. Lenders and financial institutions may view returned payments as a sign of financial instability and be hesitant to extend credit to such individuals.

Understanding the definition of a returned payment is crucial for cardholders to navigate their credit card payments successfully. By being aware of the potential pitfalls and consequences, individuals can take proactive steps to prevent and address returned payments, ultimately safeguarding their financial standing.

Causes of a Returned Payment

There are several common causes that can lead to a returned payment on a credit card. Understanding these causes is essential for cardholders to avoid such situations and ensure smooth payment transactions. Here are some of the primary reasons behind returned payments:

- Insufficient Funds: One of the most common causes of returned payments is insufficient funds in the cardholder’s bank account. When a payment is made, the credit card company attempts to withdraw the funds from the linked account. If there are not enough funds available, the payment will be returned.

- Inaccurate Card Information: Providing incorrect card information during the payment process can also result in a returned payment. This can include entering incorrect card numbers, expiration dates, or security codes. It’s crucial to double-check all the provided information before submitting a payment to avoid any potential errors.

- Banking or Technical Issues: Sometimes, returned payments can occur due to banking or technical issues. These can include server outages, system glitches, or problems with the payment processing network. While these issues may be out of the cardholder’s control, they can still result in returned payments.

- Expired or Frozen Card: If a credit card has expired or has been frozen or closed by the issuing bank, any payment attempts made with that card will likely be returned. It’s important to ensure that the card being used for payments is active and valid.

- Payment Posting Delays: In some cases, a returned payment can happen due to delays in payment posting. If a payment is made close to the due date or there are delays in the processing and posting of the payment, it may result in a returned payment. It’s advisable to make payments well in advance to account for any potential delays.

By understanding the common causes of returned payments, cardholders can take the necessary precautions to avoid them. This includes maintaining sufficient funds in the linked bank account, double-checking card information before making payments, and staying informed about any banking or technical issues that may impact payment processing. Taking these steps can help prevent the inconvenience and potential financial consequences of returned payments.

Consequences of a Returned Payment

A returned payment on a credit card can have several negative consequences for the cardholder. It’s crucial to be aware of these potential outcomes to understand the importance of avoiding such situations. Here are some of the main consequences that individuals may face due to a returned payment:

- Returned Payment Fees: One of the immediate consequences of a returned payment is the imposition of a returned payment fee by the credit card company. This fee can range from a few dollars to a significant percentage of the payment amount, depending on the card’s terms and conditions. These fees can add up over time and further impact the cardholder’s financial situation.

- Negative Impact on Credit Score: A returned payment can also have a detrimental effect on the cardholder’s credit score. Credit bureaus may be notified of the returned payment, especially if it remains unpaid for an extended period. This negative information can stay on the cardholder’s credit report for up to seven years, potentially lowering their credit score and making it more challenging to secure future credit.

- Limited Access to Credit: Consistent returned payments can lead to a strained relationship between the cardholder and the credit card company. Lenders and financial institutions may perceive returned payments as a sign of financial instability and may become hesitant to extend credit to individuals with a history of returned payments. This can limit the cardholder’s access to credit options in the future, making it more challenging to obtain loans or new credit cards.

- Penalties and Collection Efforts: In addition to the returned payment fee, the credit card company may impose further penalties for non-payment or returned payments. These penalties can include increased interest rates, late payment fees, or even the initiation of collection efforts to recover the outstanding balance. These consequences can escalate the financial burden on the cardholder and further damage their creditworthiness.

- Damaged Relationship with Creditors: Consistent returned payments can strain the relationship between the cardholder and their creditors. It can create a negative perception of the individual’s ability to manage their finances, which may lead to a loss of trust from creditors. This can have long-term implications when it comes to obtaining credit or negotiating favorable terms and conditions.

It’s essential to emphasize the significance of avoiding returned payments to maintain good financial standing. By making timely and accurate payments, cardholders can avoid the negative consequences mentioned above and ensure a healthy credit profile.

How to Avoid Returned Payments

Avoiding returned payments on a credit card requires careful attention to payment details and proactive financial management. By following these best practices, cardholders can minimize the chances of experiencing a returned payment:

- Maintain Sufficient Funds: Ensure that there are enough funds in your bank account to cover the credit card payment. Regularly monitor your account balance and plan your payments accordingly. If necessary, set up alerts or reminders to avoid any surprises.

- Double-Check Payment Information: Before submitting a payment, verify that the card information, including the card number, expiration date, and security code, is entered correctly. Even a small error can result in a returned payment.

- Make Payments in Advance: Avoid waiting until the last minute to make credit card payments. Aim to make payments well ahead of the due date to allow sufficient processing time and avoid any potential delays or issues.

- Keep Card Information Up to Date: Regularly update your credit card information with the issuing bank or financial institution. This includes ensuring that the card is not expired, frozen, or closed. If needed, request a new card before the current one expires to avoid disruption in payment processing.

- Communicate with Your Bank: If you anticipate any issues with making a payment, such as temporary financial challenges or technical difficulties, communicate with your bank or credit card company as soon as possible. They may be able to provide options or temporary solutions to prevent a returned payment.

- Set up Automatic Payments or Reminders: Consider setting up automatic payments through your bank or credit card company. This ensures that payments are made on time and reduces the chances of forgetting or missing a due date. Alternatively, if you prefer manual payments, set up reminders or alarms to prompt you to make timely payments.

- Monitor Your Accounts: Regularly review your bank and credit card statements to ensure that payments are being processed correctly and there are no returned payments or unauthorized charges. Promptly address any discrepancies or issues with your financial institution.

By implementing these strategies, cardholders can significantly reduce the risk of returned payments on their credit cards. Maintaining a proactive approach to managing payments and staying vigilant with financial information can help ensure smooth transactions and protect their financial well-being.

Dealing with a Returned Payment

Experiencing a returned payment on a credit card can be frustrating, but there are steps you can take to address and rectify the situation. Here’s how to deal with a returned payment:

- Contact Your Bank or Credit Card Company: As soon as you become aware of the returned payment, get in touch with your bank or credit card company. They can provide specific details about the reason for the return and offer guidance on resolving the issue.

- Address the Payment Issue: Address the cause of the returned payment promptly. If it was due to insufficient funds, deposit the required amount into your bank account. If the issue was incorrect card information, provide the correct details to ensure accurate payment processing.

- Pay Any Applicable Fees: Make sure to pay any fees associated with the returned payment. These fees can vary depending on the credit card company’s policies. Settle the fees promptly to avoid additional penalties or negative impact on your credit score.

- Follow up on Credit Reporting: If the returned payment has affected your credit report, monitor it closely. If the information is incorrect or outdated, dispute it with the credit bureaus. Taking proactive steps to rectify any negative impact on your credit score is crucial for maintaining good financial health.

- Review Your Payment Strategy: Evaluate your payment strategy to prevent future returned payments. Ensure there are sufficient funds in your bank account, double-check payment details before submitting, and consider setting up automatic payments or reminders to stay on top of your payment schedule.

- Learn from the Experience: Use the returned payment as an opportunity to learn and improve your financial management skills. Reflect on what caused the issue and take steps to prevent similar situations from happening in the future. Building good financial habits can help you avoid returned payments and maintain a healthy credit profile.

Remember, addressing a returned payment promptly and taking proactive measures to prevent future occurrences is crucial for protecting your financial wellness. If you continue to experience difficulties or have questions, don’t hesitate to reach out to your bank or credit card company for assistance and guidance.

Conclusion

Managing credit card payments effectively is essential for maintaining good financial health. Understanding and avoiding returned payments is a crucial aspect of this process. A returned payment occurs when a payment made on a credit card is unable to be processed successfully and is sent back to the cardholder’s account. This can happen due to various reasons, including insufficient funds, inaccurate card information, technical issues, and expired or frozen cards.

The consequences of a returned payment can be significant. They can include returned payment fees, damage to the cardholder’s credit score, limited access to credit, penalties, and strained relationships with creditors. To avoid these consequences, individuals should maintain sufficient funds, double-check payment information, make payments in advance, keep card information up to date, communicate with their bank, and monitor their accounts regularly.

If a returned payment does occur, cardholders should reach out to their bank or credit card company to address the issue and resolve it promptly. Paying any applicable fees, following up on credit reporting, and reviewing their payment strategy are important steps to take. Learning from the experience and implementing better financial management habits can help individuals prevent future returned payments.

By proactively managing credit card payments and avoiding returned payments, individuals can maintain a healthy credit profile, prevent unnecessary fees and penalties, and ensure a smooth financial journey. Taking the time to understand the causes and consequences of returned payments will enable cardholders to navigate their credit card payments successfully and protect their financial well-being.