Finance

What Is Virtual Credit Card Payment

Published: November 7, 2023

Discover the benefits of virtual credit card payments in the world of finance. Safely make online purchases and protect your sensitive information with this convenient payment method.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Virtual Credit Card Payment

- Advantages of Virtual Credit Card Payment

- How Virtual Credit Card Payment Works

- Security Measures of Virtual Credit Card Payment

- Popular Providers of Virtual Credit Card Payment

- Comparison of Virtual Credit Card Payment with Traditional Credit Card Payment

- Potential Drawbacks of Virtual Credit Card Payment

- Conclusion

Introduction

In today’s digital age, the way we make payments and conduct financial transactions has evolved significantly. One such innovation that has gained popularity is virtual credit card payment. Virtual credit card payment offers a convenient and secure way to make purchases online without the need for physical credit cards. It has revolutionized the e-commerce landscape, providing individuals and businesses with a seamless and efficient payment solution.

Virtual credit card payment, also known as virtual card payment or virtual payment solutions, allows users to generate a unique virtual card number for each online transaction. This virtual card functions similar to a traditional credit card, but with added security and privacy features. It acts as a temporary proxy for the actual credit card, ensuring that sensitive financial information is not exposed during online purchases.

The rise of virtual credit card payment can be attributed to the increasing concerns over online security and identity theft. With the proliferation of online shopping and the ever-growing number of data breaches, consumers are becoming more cautious about sharing their credit card details online. Virtual credit card payment offers a layer of protection, giving users peace of mind while making online transactions.

Moreover, virtual credit card payment offers convenience and flexibility. With just a few clicks, users can generate a virtual card number that can be used for a single transaction or for a specific period. This feature is particularly useful for recurring payments or subscriptions, as users can easily set predetermined spending limits and expiration dates for each virtual card.

As the popularity of virtual credit card payment continues to grow, it is important to understand how it works, the security measures in place, and the potential drawbacks. In this article, we will explore the definition of virtual credit card payment, its advantages, the security measures taken, popular providers, and how it compares to traditional credit card payment. So let’s dive in and discover the world of virtual credit card payment.

Definition of Virtual Credit Card Payment

Virtual credit card payment refers to a digital payment method that allows users to make transactions online without sharing their actual credit card details. It serves as a secure and convenient alternative to traditional credit or debit card payments, offering an additional layer of protection against fraud and unauthorized transactions.

With virtual credit card payment, users can generate a unique virtual card number for each online transaction. This virtual card number is linked to their existing credit card or bank account, but it does not reveal any sensitive information like the cardholder’s name, card expiration date, or security code. Instead, it acts as a proxy, ensuring that the user’s personal and financial data remains confidential.

Virtual credit card payment can be used for both one-time purchases and recurring payments. For one-time purchases, users generate a virtual card number specifically for that transaction. Once the payment has been made, the virtual card number becomes invalid, preventing any unauthorized charges in the future. For recurring payments, users can set spending limits and expiration dates for each virtual card, providing greater control over their finances.

Virtual credit card payment can be operated through various platforms, including financial institutions, online payment providers, and mobile wallet apps. These platforms generate a virtual card number that can be used on any website or app that accepts credit card payments. It offers convenience, allowing users to make purchases without physically presenting their credit card information or carrying multiple physical cards.

Overall, virtual credit card payment provides a secure and efficient way to make online payments. By utilizing virtual card numbers, users can protect their financial information and minimize the risk of identity theft or fraudulent transactions. It is an ideal solution for individuals and businesses alike, offering peace of mind while conducting online transactions in an increasingly interconnected world.

Advantages of Virtual Credit Card Payment

Virtual credit card payment offers numerous advantages to both consumers and businesses. Here are some of the key benefits:

- Enhanced Security: One of the primary advantages of virtual credit card payment is the increased security it provides. Since the virtual card numbers are unique to each transaction and are not linked to the user’s actual credit card details, the risk of identity theft and fraudulent transactions is significantly reduced. Moreover, virtual cards often come with additional security features like spending limits and transaction alerts to further protect users against unauthorized usage.

- Privacy Protection: With virtual credit card payment, users can keep their personal and financial information private. Since the virtual card numbers do not reveal any sensitive details, users can confidently make purchases online without worrying about their information being compromised. This is particularly important in an era where data breaches and online fraud are on the rise.

- Convenience and Flexibility: Virtual credit card payment offers unmatched convenience and flexibility. Users can easily generate virtual card numbers whenever they need to make a purchase and customize the spending limits and expiration dates to suit their specific needs. It eliminates the need to carry physical credit cards or remember multiple card details, making online shopping a seamless and hassle-free experience.

- Control over Spending: Virtual credit card payment empowers users with greater control over their spending. By setting spending limits for each virtual card, users can avoid overspending and stick to their budget. This is especially beneficial for recurring payments or subscriptions, as users can set the card to expire after the payment cycle is completed or for a specific time period.

- Easier Account Management: Keeping track of online transactions becomes simpler with virtual credit card payment. Instead of sifting through multiple credit card statements, users can easily monitor their virtual card transactions through the online payment platform or mobile app. This allows for better record-keeping and easier reconciliation of expenses.

These advantages make virtual credit card payment an appealing option for consumers and businesses alike. It offers a secure, private, and convenient way to make online payments, providing peace of mind and streamlining financial transactions in the digital realm.

How Virtual Credit Card Payment Works

Virtual credit card payment works by generating a unique virtual card number that is used for online transactions. Here’s a step-by-step breakdown of how it works:

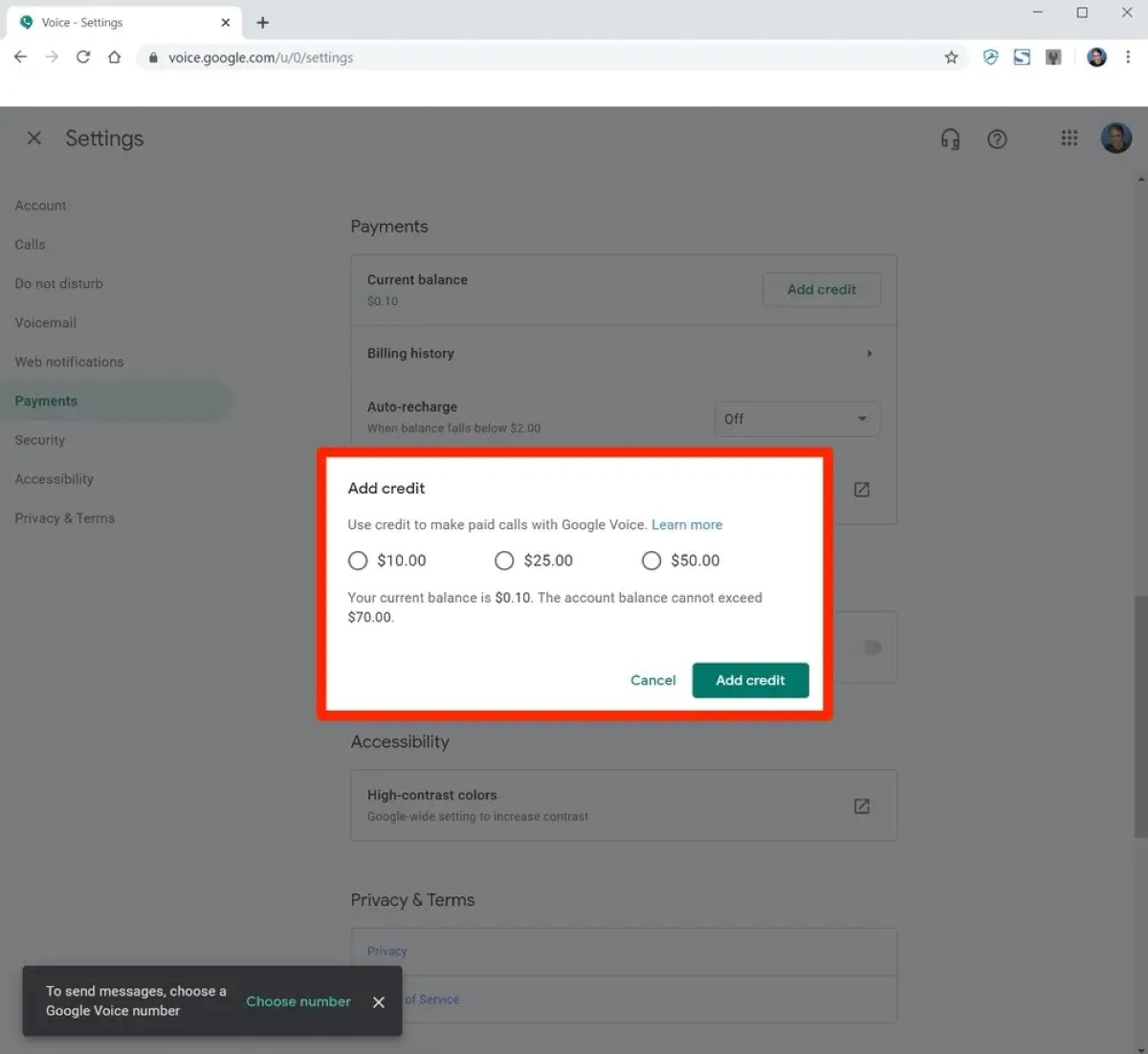

- 1. Creation of Virtual Card: To initiate a virtual credit card payment, users first need to create a virtual card. This can be done through their credit card issuer, a financial institution, online payment provider, or mobile wallet app. The user typically provides their credit card or bank account information to associate the virtual card with their existing payment account.

- 2. Generation of Virtual Card Number: Once the virtual card is created, a unique virtual card number is generated for each transaction. This number is different from the user’s actual credit card number and is typically valid for a limited time or specific transaction.

- 3. Transaction Authorization: When making an online purchase, the user provides the virtual card number, along with any other necessary payment details like the billing address and CVV code. The transaction is then sent for authorization.

- 4. Authorization and Payment: The payment gateway or online merchant verifies the virtual card number, checks for available funds, and proceeds with the transaction. The virtual card acts as a middle layer between the user’s actual credit card and the merchant, ensuring that the user’s sensitive information is not exposed during the transaction.

- 5. Transaction Completion: Once the transaction is authorized and payment is successful, the virtual card number becomes invalid. It can no longer be used for any future transactions, providing an added layer of security against fraudulent charges.

It’s worth noting that virtual credit card payment works seamlessly with most online merchants and payment gateways. The virtual card number can be used for various types of transactions, including online purchases, bill payments, subscriptions, and more.

Additionally, some virtual credit card payment providers offer additional features like spending limits, transaction alerts, and the ability to manage multiple virtual cards through a single platform. This allows users to have better control over their spending and enhance their overall online payment experience.

Overall, virtual credit card payment simplifies the process of making secure online transactions by keeping the user’s actual credit card details private and offering added layers of security and convenience. It is a reliable and efficient payment method that enables individuals and businesses to navigate the digital landscape safely.

Security Measures of Virtual Credit Card Payment

Virtual credit card payment takes several security measures to ensure the safety and protection of user information. Here are some of the key security features and measures implemented in virtual credit card payment systems:

- Encryption: Virtual credit card payment platforms utilize strong encryption protocols to secure the transmission of data during online transactions. This encryption scrambles the information, making it unreadable to unauthorized parties.

- Tokenization: Tokenization is a crucial security measure in virtual credit card payment. Instead of transmitting the user’s actual credit card details, a token is generated and sent for transaction processing. This token is a unique identifier that stands in place of the sensitive information, adding an extra layer of protection.

- Fraud Monitoring: Virtual credit card payment providers have sophisticated fraud detection systems in place. They monitor transactions in real-time, using algorithms and machine learning to identify suspicious patterns or potential fraud. If any suspicious activity is detected, these systems can trigger alerts and block transactions to protect the user’s funds.

- Multi-Factor Authentication: To enhance security, virtual credit card payment may require users to go through multi-factor authentication. This could involve verification through a password, PIN, biometric authentication, or one-time passwords (OTPs) sent through SMS or email.

- Transaction Limits: Virtual credit card payment platforms often allow users to set transaction limits for each virtual card. By setting spending caps, users can prevent unauthorized transactions and minimize the risk of financial loss in case of account compromise.

- Expiration Dates: Each virtual card is typically assigned an expiration date. After this date, the virtual card becomes invalid and cannot be used for any further transactions. This ensures that even if the virtual card details are compromised, it cannot be misused beyond the specified timeframe.

- Zero Liability Policy: Many virtual credit card payment providers offer a zero liability policy, which protects users against unauthorized transactions. If a user becomes a victim of fraud or unauthorized charges, they are typically not held responsible for any resulting financial loss.

By implementing these security measures, virtual credit card payment adds an extra layer of protection to online transactions. Users can have peace of mind knowing that their personal and financial information is safeguarded, reducing the risk of identity theft, fraud, and unauthorized access to their funds.

It’s important for users to choose reputable virtual credit card payment providers that prioritize security and adhere to industry-standard practices. Additionally, users should also take personal precautions such as regularly monitoring their transactions, using strong and unique passwords, and keeping their devices and software up to date to further enhance security.

Popular Providers of Virtual Credit Card Payment

As virtual credit card payment continues to gain popularity, several providers offer this convenient and secure payment solution. Here are some of the popular providers in the virtual credit card payment space:

- Privacy.com: Privacy.com is a well-known virtual credit card payment provider that allows users to generate virtual card numbers for online transactions. It offers features such as spending limits, transaction controls, and the ability to link multiple bank accounts or credit cards to the platform.

- PayPal: PayPal is a widely recognized online payment platform that offers virtual credit card payment services. Users can create virtual cards, known as PayPal Key, to make purchases online. PayPal Key enables users to pay on any website that accepts Mastercard by using the funds from their PayPal account.

- Shopify: Shopify, an e-commerce platform, provides its users with virtual credit card payment solutions. Shopify’s platform enables businesses to generate virtual card numbers, set spending limits, and manage payments seamlessly, making it a popular choice for online retailers.

- Citi Virtual Account Numbers: Citi Virtual Account Numbers is a service offered by Citibank that allows cardholders to create virtual card numbers for online transactions. This service helps protect the user’s actual credit card details while providing greater control over online purchases.

- Capital One Eno: Capital One’s Eno is a virtual credit card assistant that offers virtual card numbers to customers. Eno can help users generate virtual card numbers, monitor transactions, and provide additional security features such as virtual account lock and merchant-specific virtual card numbers.

These are just a few examples of popular virtual credit card payment providers. It’s important to research and choose a provider that best suits your needs, taking into consideration factors such as security features, ease of use, and compatibility with online merchants and payment gateways.

It’s worth noting that some banks and financial institutions also offer virtual credit card payment services to their customers. Checking with your bank or card issuer can provide insights into any virtual card offerings they may have.

As the demand for virtual credit card payment continues to grow, it is likely that more providers will enter the market, offering innovative features and enhanced security measures. Users should stay informed about the latest offerings and choose a provider that can meet their specific requirements for online payment convenience and security.

Comparison of Virtual Credit Card Payment with Traditional Credit Card Payment

Virtual credit card payment and traditional credit card payment are two distinct methods of making transactions, each with its own advantages and limitations. Let’s compare them in terms of security, convenience, and usage:

- Security: Virtual credit card payment offers enhanced security compared to traditional credit card payment. With virtual cards, users can generate unique card numbers for each transaction, minimizing the risk of fraud and unauthorized access to their actual credit card details. Traditional credit cards, on the other hand, carry the risk of physical theft or unauthorized use if the card falls into the wrong hands.

- Privacy: Virtual credit card payment provides more privacy compared to traditional credit card payment. Since virtual card numbers do not reveal personal information, users can make purchases online without exposing their actual credit card details. Traditional credit cards require users to share their card number, CVV code, and other personal information when making purchases.

- Convenience: Both virtual credit card payment and traditional credit card payment offer convenience, but virtual credit cards may have an edge in certain scenarios. Virtual credit cards can be easily generated for individual transactions or specific time periods, offering flexibility and controlled spending. Traditional credit cards, although convenient, carry the risk of overspending and require physical possession for use.

- Merchant Acceptance: Traditional credit cards have widespread acceptance among merchants globally. They are typically accepted in brick-and-mortar stores, online retailers, and various businesses worldwide. While virtual credit card payment is also widely accepted, some smaller or less tech-savvy merchants may not have the infrastructure to process virtual card transactions.

- Rewards and Benefits: Traditional credit cards often provide rewards programs, cashback opportunities, and travel perks. Users can accumulate reward points or enjoy discounts on specific purchases. Virtual credit cards may have limited or no rewards programs, as they are typically associated with an existing credit card or bank account.

- Offline Usage: Traditional credit cards can be used for offline transactions, such as in-store purchases or at ATMs. Virtual credit cards, being digital in nature, are primarily designed for online transactions and may not be suitable for offline use.

In summary, virtual credit card payment offers greater security and privacy, as well as added convenience and control over spending. However, traditional credit cards have broader acceptance, extensive rewards programs, and the ability to be used offline. Users should evaluate their specific needs and preferences to determine which method of payment aligns best with their lifestyle and financial goals.

It’s worth noting that both virtual and traditional credit card payment methods have their place in the modern financial landscape. Some individuals may choose to utilize both methods depending on the situation, leveraging the benefits of each to optimize their financial transactions.

Potential Drawbacks of Virtual Credit Card Payment

While virtual credit card payment offers numerous advantages, it is important to be aware of potential drawbacks that users may encounter. Here are some of the potential drawbacks of virtual credit card payment to consider:

- Merchant Acceptance: Although virtual credit cards have gained widespread acceptance, there may still be some online merchants or service providers that do not support virtual card transactions. This limitation could restrict users’ ability to make purchases from certain platforms.

- Offline Usage: Virtual credit cards are primarily designed for online transactions and may not be suitable for offline use. Users may need to rely on their traditional credit cards or other payment methods when making in-store purchases or using ATMs.

- Limited Rewards Programs: Virtual credit cards may not offer the same level of rewards programs or cashback opportunities as traditional credit cards. Since most virtual cards are linked to an existing credit card or bank account, users may miss out on the additional perks and benefits associated with their primary credit card.

- Dependency on Technology: Virtual credit card payment relies heavily on technology and internet connectivity. If there are connectivity issues or technical glitches, users may experience difficulties in generating virtual card numbers or completing transactions. This dependence on technology can be a potential drawback in certain situations.

- Account Management: Managing multiple virtual cards and tracking transactions across different platforms may require additional effort and organization. Users must keep track of virtual card details, spending limits, and expiration dates to ensure smooth transactions and prevent any inconveniences.

- Learning Curve: Some users may find it initially challenging to navigate the virtual credit card payment system and understand the processes involved. It may take time to become familiar with generating virtual card numbers and managing the associated settings.

- Integration Challenges: Integrating virtual credit card payment systems with certain software or platforms can present challenges for businesses. Compatibility issues or technical hurdles may arise when incorporating virtual credit card payment options into existing payment infrastructure.

Despite these potential drawbacks, virtual credit card payment remains a valuable and secure payment option for many users. By evaluating these drawbacks alongside the benefits, individuals and businesses can make informed decisions about incorporating virtual credit card payment into their financial routines.

It’s important to keep in mind that the drawbacks mentioned may vary depending on the specific virtual credit card payment provider and the individual’s requirements. Conducting thorough research and selecting a reputable provider can help mitigate some of these potential issues.

Conclusion

Virtual credit card payment has emerged as a secure and convenient method of making online transactions. It offers enhanced security, privacy protection, and control over spending, making it an attractive option for consumers and businesses alike. By generating unique virtual card numbers for each transaction, users can minimize the risk of fraud and unauthorized access to their actual credit card details.

The advantages of virtual credit card payment are evident, including the added layers of security, ease of use, and flexibility it provides. Users can enjoy the convenience of making online purchases without sharing sensitive information, while also maintaining better control over their spending habits. Additionally, virtual credit card payment gives users peace of mind in an era of increasing online threats and data breaches.

While there are potential drawbacks, such as limited merchant acceptance and offline usage, these can be overcome with proper planning and consideration. Users must weigh the benefits against the limitations and decide if virtual credit card payment aligns with their specific needs and preferences.

As virtual credit card payment continues to evolve, it is crucial to stay informed about the latest security measures, providers, and features available in the market. Conducting proper research, choosing reputable providers, and adopting best practices for online payment security can further enhance the overall experience and ensure a smooth and secure transition to virtual credit card payment.

In conclusion, virtual credit card payment is reshaping the way we make online transactions. It offers a safe and efficient alternative to traditional credit card payment, empowering users to protect their financial information while enjoying the convenience of online shopping. With its increasing popularity and advancements in technology, virtual credit card payment is set to play a significant role in the future of digital payments.