Finance

What Is Am Acord Certificate Of Insurance?

Modified: February 21, 2024

Learn about the important Am Acord Certificate of Insurance in the field of finance. Understand its significance and how it protects businesses and financial institutions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Am Acord Certificate of Insurance

- Purpose of Am Acord Certificate of Insurance

- Components of Am Acord Certificate of Insurance

- How to Obtain an Am Acord Certificate of Insurance

- Importance of Am Acord Certificate of Insurance

- Key Information provided in an Am Acord Certificate of Insurance

- Limitations of an Am Acord Certificate of Insurance

- Frequently Asked Questions about Am Acord Certificate of Insurance

- Conclusion

Introduction

Welcome to the world of insurance, where peace of mind meets financial security. In today’s uncertain times, having the right insurance coverage is essential to protect yourself, your assets, and your business. One crucial document in the insurance world is the Acord Certificate of Insurance, which provides detailed information about the coverage you have in place. But what exactly is an Acord Certificate of Insurance? Specifically, this article will focus on the Am Acord Certificate of Insurance, a widely recognized and accepted form in the insurance industry.

Whether you are a business owner, a contractor, or a freelancer, understanding the ins and outs of the Am Acord Certificate of Insurance can be invaluable. It can help you navigate the complex insurance landscape, negotiate contracts, and provide proof of coverage to clients or business partners. In this article, we will dive into the definition, purpose, components, importance, and limitations of the Am Acord Certificate of Insurance. We will also provide insights on how to obtain this certificate and highlight the key information it provides.

So, if you’re ready to demystify the world of insurance and gain a deeper understanding of the Am Acord Certificate of Insurance, let’s begin exploring this essential document together.

Definition of Am Acord Certificate of Insurance

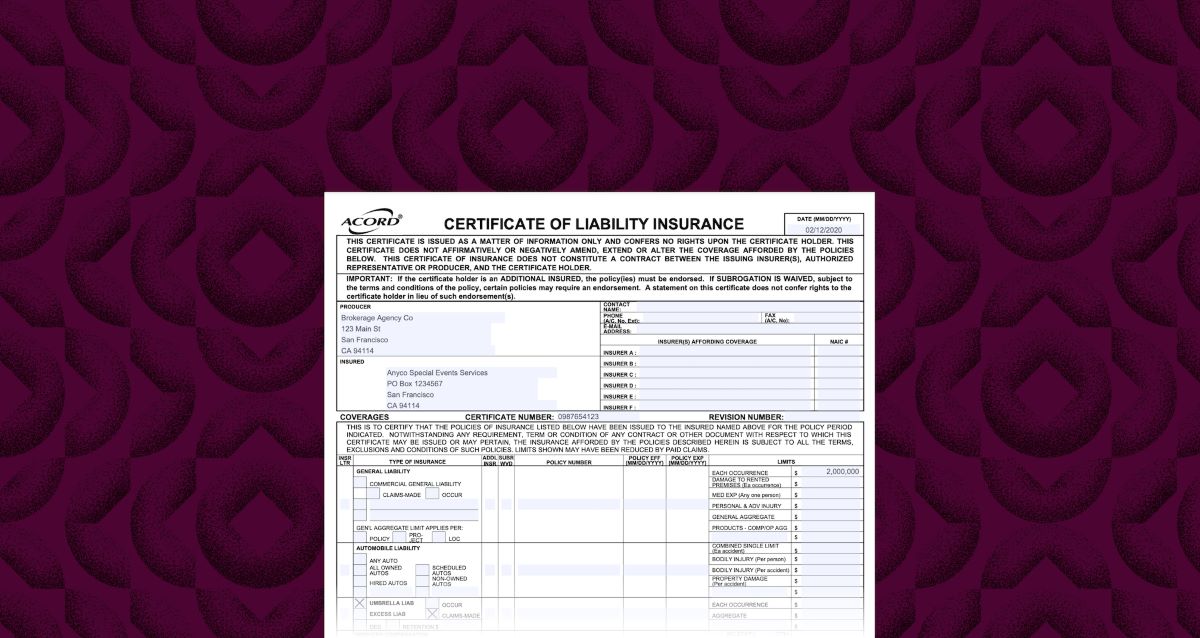

The Am Acord Certificate of Insurance is a standardized document that provides evidence of insurance coverage. It is issued by an insurance company or insurance agent to their policyholder as proof of their existing insurance policy. The certificate includes important details about the policy, such as the coverage type, policy limits, effective dates, and the name of the insured party.

Am Acord stands for the Association for Cooperative Operations Research and Development, which is a nonprofit organization that develops standardized forms and data exchange standards for the insurance industry. The Am Acord Certificate of Insurance is widely recognized and accepted by insurers, contract handlers, and other parties involved in insurance transactions.

This certificate is not an insurance policy itself but rather a summary of the insurance policy’s key information. It serves as a snapshot of the policyholder’s coverage at a specific moment in time. The Am Acord Certificate of Insurance is typically requested by third parties, such as clients, lenders, vendors, or government agencies, as proof of insurance coverage.

Having an Am Acord Certificate of Insurance is essential for various reasons. For businesses, it helps establish credibility, as it shows that the company has appropriate insurance coverage in place. It also ensures that clients or business partners are protected in case of any liability or risk associated with the insured party’s operations. By providing this certificate, policyholders can demonstrate their commitment to risk management and comply with contractual obligations.

Overall, the Am Acord Certificate of Insurance is a vital document that ensures transparency and facilitates smooth business transactions in the insurance industry. It allows for easy verification of insurance coverage and provides peace of mind to all parties involved.

Purpose of Am Acord Certificate of Insurance

The purpose of the Am Acord Certificate of Insurance is to provide a concise summary of the insurance coverage in place for a policyholder. It serves as a proof of insurance document that can be presented to third parties to demonstrate the policyholder’s current and valid insurance coverage. The primary goal of this certificate is to ensure transparency, establish credibility, and meet the insurance requirements of clients, vendors, lenders, and other stakeholders.

For policyholders, the Am Acord Certificate of Insurance serves as a crucial tool for various purposes:

- Evidence of Insurance: The certificate provides tangible proof that the policyholder has a valid insurance policy in place. It includes essential details, such as the name of the insured, the type of coverage, policy limits, and effective dates, which can be easily verified by the requesting party.

- Contractual Compliance: Many contracts and agreements require proof of insurance coverage. By providing an Am Acord Certificate of Insurance, policyholders can demonstrate their compliance with contractual obligations and protect all parties involved in the agreement.

- Risk Management: The certificate helps policyholders manage their risks effectively. By having the appropriate insurance coverage and providing the certificate to clients or business partners, policyholders can mitigate potential liabilities and protect their interests in case of accidents, damages, or claims.

- Business Development: The certificate can be a valuable asset when attracting clients or bidding on projects. It showcases the policyholder’s commitment to risk management, which can enhance their credibility and competitiveness in the marketplace.

For third parties, such as clients, vendors, or lenders, the Am Acord Certificate of Insurance serves as a means to:

- Verify Insurance: Third parties can easily verify an insured party’s insurance coverage by examining the certificate. It provides the necessary information to ensure that the policyholder has adequate coverage to meet the requirements of the particular transaction or engagement.

- Minimize Risk: By requesting the certificate, third parties can protect themselves from potential risks or liabilities associated with the insured party. It provides them with confidence knowing that they are dealing with an entity that has appropriate insurance coverage in place.

- Ensure Compliance: Many industry regulations and government agencies require proof of insurance to ensure compliance with legal and safety requirements. By requesting the Am Acord Certificate of Insurance, these entities can ensure that the policyholder meets the necessary insurance standards.

Overall, the purpose of the Am Acord Certificate of Insurance is to facilitate transparent and compliant business transactions, protect all parties involved, and provide reassurance that proper insurance coverage exists.

Components of Am Acord Certificate of Insurance

The Am Acord Certificate of Insurance consists of several important components that provide a comprehensive overview of the policyholder’s insurance coverage. These components include:

- Insured Party: This section identifies the name of the policyholder or insured party. It typically includes their legal business name and address.

- Certificate Holder: This section specifies the name and address of the entity or individual requesting the certificate. It is often a client, a vendor, or a government agency.

- Insurance Company: The insurance company’s name and contact information are provided in this section. It allows the certificate holder to get in touch with the insurer for verification or additional information.

- Policy Information: This section outlines the key details of the insurance policy, including the policy number, type of coverage, policy limits, and effective dates. It specifies the specific line(s) of business covered, such as general liability, professional liability, property, or workers’ compensation.

- Additional Insureds: If other entities or individuals are covered by the policy, this section lists their names and details. Additional insureds are typically parties who have an interest in the insured’s operations or have a contractual relationship with the insured party.

- Cancellation Provision: This section indicates the requirements and conditions for cancellation or non-renewal of the policy. It may include a notice period, cancellation reasons, or provisions for automatic renewal.

- Coverage Description: This section offers a brief summary of the coverage provided by the policy. It may include specific endorsements, limits, and exclusions, giving the certificate holder an overview of the policy’s scope.

- Certificate Holder’s Interest: This section highlights the interests the certificate holder has in the policy, such as “Additional Insured,” “Loss Payee,” or “Mortgagee.” It specifies the type of relationship the certificate holder has with the policyholder.

- Waiver of Subrogation: If the policy contains a waiver of subrogation provision, it will be explicitly stated in this section. A waiver of subrogation prevents the insurance company from recovering damages from a third party after paying a claim.

These components collectively provide a clear snapshot of the policyholder’s insurance coverage, allowing the certificate holder to verify the policy’s details and ensure compliance with contractual requirements.

How to Obtain an Am Acord Certificate of Insurance

Obtaining an Am Acord Certificate of Insurance is a relatively straightforward process. Here are the steps to follow:

- Contact your insurance provider: Reach out to your insurance company or insurance agent and inform them of your need for an Am Acord Certificate of Insurance. Provide them with the necessary details, such as the name and address of the certificate holder, any additional insured parties, and the type of coverage required.

- Provide relevant information: Your insurance provider will require specific details to complete the certificate. This includes your policy number, effective dates, policy limits, and any endorsements or additional coverage required by the certificate holder.

- Review and customization: Your insurance provider will generate the Am Acord Certificate of Insurance based on the information provided. Review the certificate to ensure that all the details are accurate and meet the requirements of the certificate holder. If necessary, request any customizations or amendments to the certificate.

- Distribute the certificate: Once you have reviewed and approved the certificate, your insurance provider will provide you with the final version. Distribute the certificate to the certificate holder and any additional insured parties as required.

- Keep a copy: It is essential to keep a copy of the Am Acord Certificate of Insurance for your records. This allows you to reference the certificate in interactions with clients, vendors, or other parties who may request proof of insurance coverage.

It’s important to note that the process of obtaining an Am Acord Certificate of Insurance may vary slightly depending on your insurance provider and specific policy. Some insurance companies offer online platforms or portals where you can request and access certificates conveniently. Others may require you to contact your insurance agent directly.

Regardless of the process, open communication with your insurance provider is key. They can guide you through the necessary steps and ensure that you obtain a valid and accurate Am Acord Certificate of Insurance that meets your needs and the requirements of the certificate holder.

Importance of Am Acord Certificate of Insurance

The Am Acord Certificate of Insurance holds significant importance for both policyholders and certificate holders. Here are some key reasons why this certificate is essential:

- Proof of Insurance: The Am Acord Certificate of Insurance serves as tangible proof that a policyholder has valid insurance coverage. It provides assurance to certificate holders that the policyholder has met their insurance obligations and can fulfill any potential liabilities arising from their operations.

- Risk Management: For policyholders, this certificate is an essential risk management tool. By carrying adequate insurance coverage and presenting the certificate when necessary, policyholders can mitigate potential risks, protect their assets, and safeguard their financial well-being.

- Compliance with Contracts: Many contracts and agreements require proof of insurance. The Am Acord Certificate of Insurance helps policyholders meet these contractual obligations, ensuring that they are in compliance and promoting trust and confidence among all parties involved.

- Business Credibility: Having an Am Acord Certificate of Insurance enhances a policyholder’s credibility and professionalism. It signifies that the policyholder takes risk management seriously, providing assurance to clients, vendors, and partners that they are working with a responsible and reliable entity.

- Protection for Certificate Holders: For certificate holders, this document is crucial in minimizing risk and protecting their interests. It verifies that the policyholder has insurance coverage, reducing the likelihood of financial loss in case of accidents, damages, or claims.

- Contractor Compliance: In the construction industry, the Am Acord Certificate of Insurance is particularly important. General contractors often require subcontractors to provide this certificate as proof of liability insurance coverage. It ensures that all parties involved in a construction project are adequately protected.

- Industry Standards: The Am Acord Certificate of Insurance is widely recognized and accepted in the insurance industry. Its standardized format and information make it easy for certificate holders to review and verify insurance coverage, streamlining business transactions and reducing administrative burden.

In summary, the Am Acord Certificate of Insurance is of utmost importance as it provides proof of insurance coverage, helps manage risks, ensures compliance with contractual requirements, enhances business credibility, and protects the interests of all parties involved in the insurance transaction.

Key Information provided in an Am Acord Certificate of Insurance

The Am Acord Certificate of Insurance contains crucial information about the policyholder’s insurance coverage. This information helps certificate holders, such as clients, vendors, or government agencies, assess the adequacy of the policyholder’s coverage and protect their interests. Here are the key details typically included in an Am Acord Certificate of Insurance:

- Insured Party: The certificate identifies the name and address of the policyholder or insured party. This information ensures that the certificate pertains to the correct entity and helps avoid any confusion or misidentification.

- Certificate Holder: The certificate specifies the name and address of the entity or individual requesting the certificate. This ensures that the certificate is provided to the intended recipient and helps establish a clear line of communication.

- Insurance Company: The certificate includes the name and contact information of the insurance company providing coverage. This enables the certificate holder to verify the authenticity of the insurance policy and reach out to the insurer if needed.

- Policy Information: This section outlines key details of the insurance policy, such as the policy number, type of coverage, policy limits, and effective dates. It provides a summary of the coverage that the policyholder has in place.

- Additional Insureds: If other entities or individuals are also covered under the policy, their names and information are listed in this section. This allows the certificate holder to determine if they are included within the coverage and ensures that their interests are protected.

- Cancellation Provision: The certificate highlights any specific provisions or conditions for cancellation or non-renewal of the policy. This information provides transparency to the certificate holder about the potential termination of the policy and the associated requirements or restrictions.

- Coverage Description: This section provides a brief overview of the policy’s coverage, including any endorsements, exclusions, or special provisions. It helps the certificate holder understand the scope and limitations of the insurance policy.

- Certificate Holder’s Interest: The certificate specifies the type of interest the certificate holder has in the policy, such as “Additional Insured,” “Loss Payee,” or “Mortgagee.” This information clarifies the relationship between the certificate holder and the policyholder and establishes their respective rights and responsibilities.

- Waiver of Subrogation: If the policy includes a waiver of subrogation provision, it will be explicitly stated in this section. This clause prevents the insurance company from pursuing recovery from a third party after paying a claim.

It’s important to note that the layout and specific information provided in an Am Acord Certificate of Insurance can vary slightly depending on the insurer and policy terms. However, these key elements are typically included to provide a comprehensive snapshot of the policyholder’s insurance coverage.

Limitations of an Am Acord Certificate of Insurance

While the Am Acord Certificate of Insurance is a valuable document for providing proof of insurance coverage, it is important to understand its limitations. Here are some key limitations to consider:

- Validity Period: The Am Acord Certificate of Insurance represents a snapshot of the policyholder’s coverage at a specific moment in time. It is only valid for the effective dates stated on the certificate. If the certificate is expired or if the policy is canceled, the coverage may no longer be in force.

- Policy Exclusions and Conditions: The certificate provides a general overview of the policy coverage, but it may not detail all specific exclusions, limitations, or conditions in the policy. It is crucial for the certificate holder to review the actual policy document to fully understand the extent of coverage and any restrictions or requirements that may apply.

- No Modification Rights: The certificate holder cannot modify or alter the terms of the insurance policy based on the information provided in the certificate. Any changes or adjustments to the coverage must be made directly with the insurance company or through endorsements to the policy itself.

- Limited Verification: While the Am Acord Certificate of Insurance provides verification of insurance coverage, it does not guarantee the accuracy or validity of the information provided. Certificate holders should verify the certificate’s authenticity and contact the insurance company directly for confirmation if necessary.

- Single Purpose: The certificate is typically issued for a specific purpose or request, such as a particular project or client engagement. It may not be used for other purposes or by other parties without the consent of the policyholder.

- Operational Changes: It is essential for policyholders to communicate any significant changes in their operations, coverage, or insurance policies to the certificate holder, even if the policy has not yet expired. Failure to do so may result in coverage gaps or inconsistencies between the certificate and the actual policy.

- Non-Negotiable Document: The certificate is a standardized form that cannot be modified or negotiated by the certificate holder. If specific insurance requirements are needed, a separate contract or endorsement may be necessary to address those requirements.

It is crucial for both policyholders and certificate holders to understand these limitations and to rely on the actual insurance policy for detailed and specific information. While the Am Acord Certificate of Insurance provides a convenient summary of insurance coverage, it is not a substitute for careful review and understanding of the policy terms and conditions.

Frequently Asked Questions about Am Acord Certificate of Insurance

Here are some commonly asked questions about the Am Acord Certificate of Insurance:

- What is an Am Acord Certificate of Insurance?

- Who issues an Am Acord Certificate of Insurance?

- Who requests an Am Acord Certificate of Insurance?

- What information is included in an Am Acord Certificate of Insurance?

- Can an Am Acord Certificate of Insurance be customized?

- Is the Am Acord Certificate of Insurance a legally binding document?

- How long is an Am Acord Certificate of Insurance valid?

- Can an Am Acord Certificate of Insurance be used for multiple purposes or by multiple parties?

- What should I do if I need an Am Acord Certificate of Insurance?

An Am Acord Certificate of Insurance is a standardized document that provides evidence of insurance coverage. It summarizes important policy details, such as the insured party, policy limits, effective dates, and the name of the insurance company.

An Am Acord Certificate of Insurance is issued by an insurance company or insurance agent to their policyholder as proof of their existing insurance coverage.

An Am Acord Certificate of Insurance is typically requested by third parties, such as clients, vendors, lenders, or government agencies. They request this certificate to verify the policyholder’s insurance coverage.

An Am Acord Certificate of Insurance includes details such as the insured party’s name and address, certificate holder’s name and address, insurance company information, policy number, coverage type, policy limits, effective dates, additional insureds, and other relevant information related to the policy.

While the general format of the Am Acord Certificate of Insurance is standardized, certain sections can be customized to meet specific requirements. For example, additional insureds can be added, or specific endorsements may be included.

No, the Am Acord Certificate of Insurance is not a legally binding document. It is a summary of the insurance policy’s key information and does not alter or modify the terms of the actual policy.

An Am Acord Certificate of Insurance is valid for the specified effective dates mentioned on the certificate. It represents the coverage in place at a specific moment in time.

No, typically an Am Acord Certificate of Insurance is issued for a specific purpose or request. It may not be used for other purposes or by other parties without the consent of the policyholder.

If you need an Am Acord Certificate of Insurance, contact your insurance provider or insurance agent and provide them with the necessary details. They will assist you in obtaining the certificate.

These answers provide a general understanding of the Am Acord Certificate of Insurance. However, it is always recommended to consult with your insurance provider or agent for specific details pertaining to your policy and any certificate requirements.

Conclusion

The Am Acord Certificate of Insurance is a vital document in the insurance industry that provides proof of insurance coverage. It is widely recognized and accepted, serving as a key tool for policyholders and certificate holders alike. This standardized certificate offers transparency, establishes credibility, and ensures compliance with contractual obligations.

By obtaining an Am Acord Certificate of Insurance, policyholders can demonstrate their commitment to risk management, protect their assets, and enhance their business credibility. It allows for easy verification of insurance coverage and provides peace of mind to clients, vendors, lenders, and government agencies.

For certificate holders, the certificate serves as a means to verify insurance coverage, protect their interests, and ensure compliance with legal and safety requirements. It enables them to make informed decisions and minimize potential risks associated with working with the insured party.

While the Am Acord Certificate of Insurance is an important document, it does have limitations. It represents coverage at a specific moment in time, and the actual policy terms and conditions should be reviewed for complete understanding. Customization is limited, and the certificate itself is not a legally binding document.

In conclusion, understanding the Am Acord Certificate of Insurance is essential for policyholders and certificate holders in navigating the insurance landscape. It helps foster transparent and compliant business transactions while providing reassurance and protection to all parties involved. By effectively utilizing this certificate, stakeholders can confidently move forward, knowing that proper insurance coverage exists to safeguard their interests.