Finance

How To Read A Certificate Of Insurance

Modified: February 21, 2024

Learn how to read a certificate of insurance in the finance field with our comprehensive guide. Gain valuable insights and protect your financial interests.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Basics of a Certificate of Insurance

- Key Information in a Certificate of Insurance

- Types of Insurance Coverage Listed in a Certificate

- Additional Insureds and Their Importance

- Policy Limits and Deductibles

- Exclusions and Endorsements

- Verifying the Authenticity of a Certificate of Insurance

- How to Interpret Policy Numbers and Coverage Dates

- Common Mistakes to Avoid When Reading a Certificate of Insurance

- Conclusion

Introduction

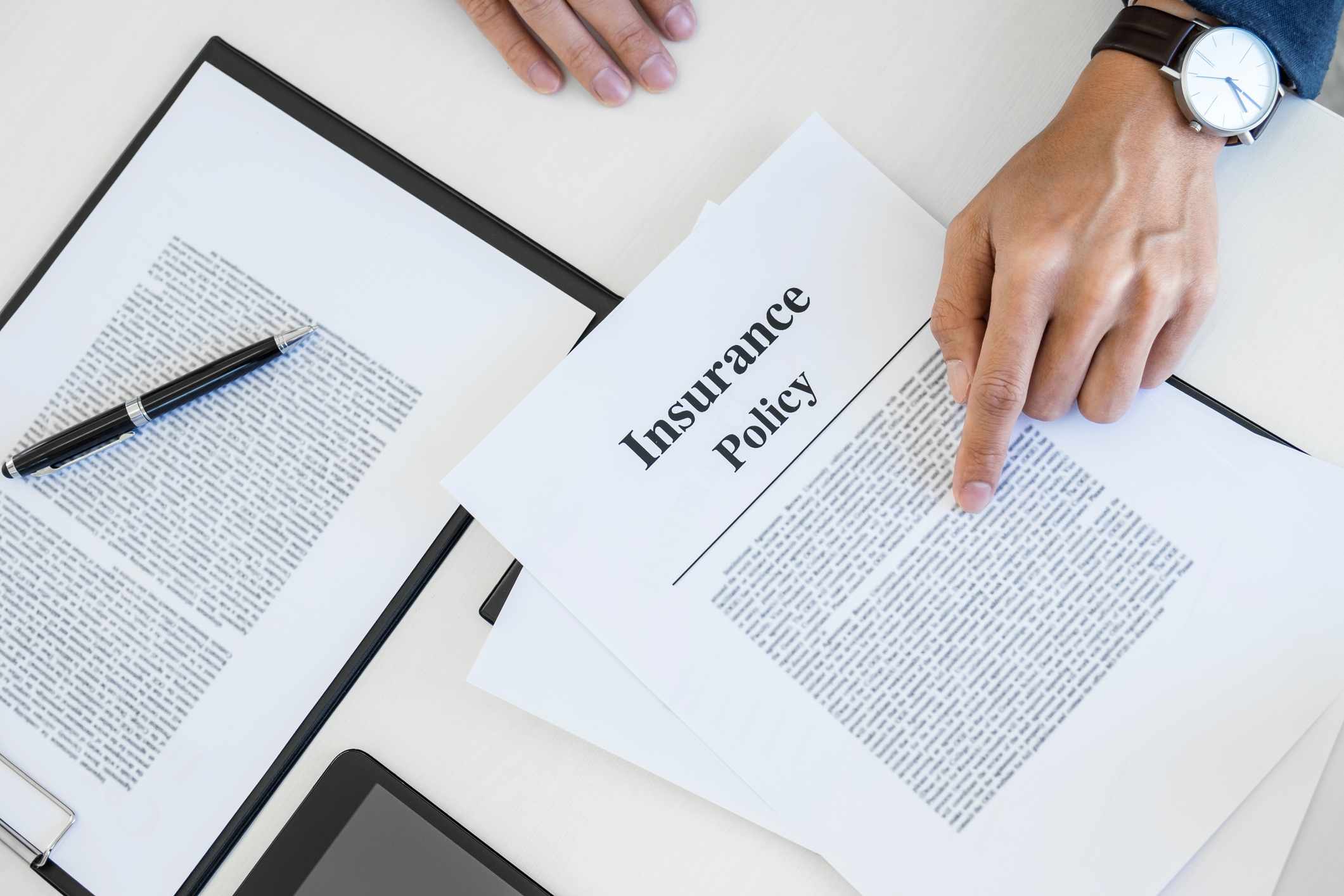

When it comes to managing risk and protecting your business, insurance is a vital tool. It provides financial security and peace of mind in the face of unexpected events. However, understanding the intricacies of insurance policies can be overwhelming, especially when presented with complex documents like a Certificate of Insurance (COI).

A Certificate of Insurance is a document that summarizes the essential details of an insurance policy. It serves as proof that an individual or organization has insurance coverage and provides key information about the policy, including coverage dates, policy limits, and the types of coverage provided.

Reading and understanding a Certificate of Insurance is crucial for any business owner or professional. It allows you to assess the extent of coverage, verify the authenticity of the document, and ensure that your insurance needs are adequately met. In this article, we will delve into the essential components of a Certificate of Insurance and provide you with the knowledge to make informed decisions regarding your insurance coverage.

Understanding the Basics of a Certificate of Insurance

A Certificate of Insurance is a standardized document provided by an insurance company, typically issued to a policyholder or a third-party as proof of insurance coverage. It does not serve as a legally binding contract, but rather as a summary of the policy details. Understanding the basics of a Certificate of Insurance is essential to ensure that you have the necessary coverage for your business.

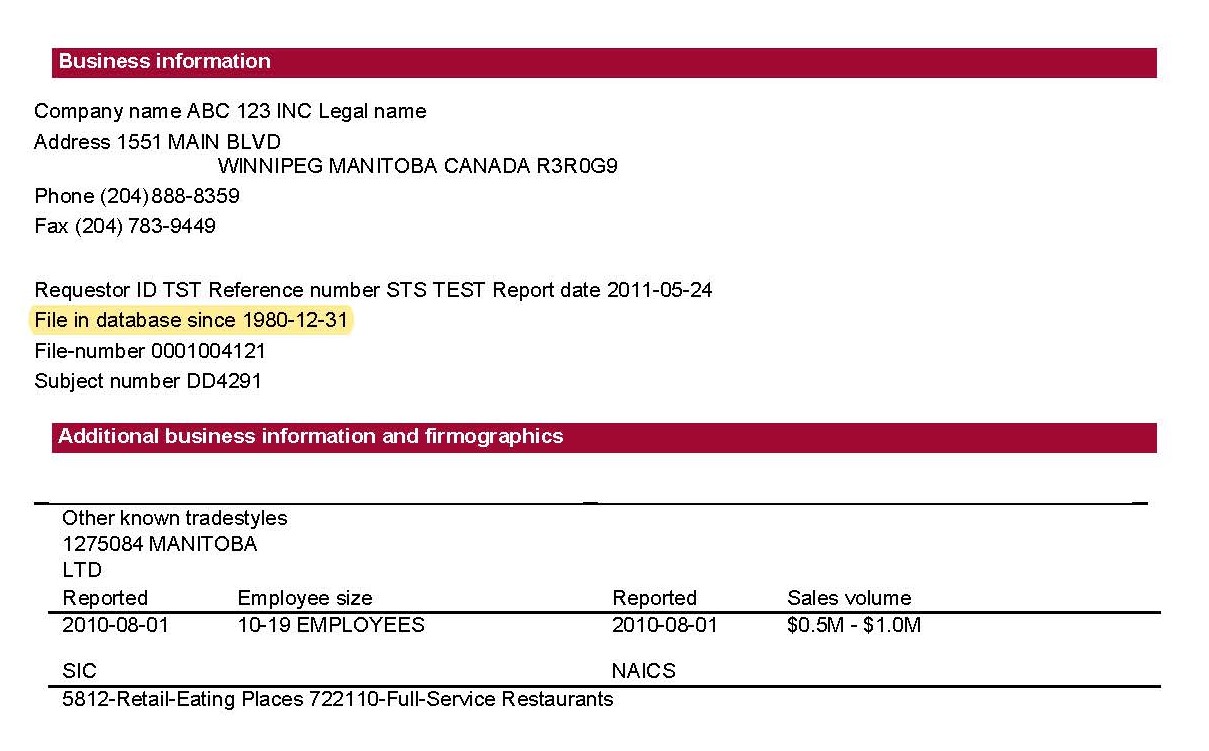

At first glance, a Certificate of Insurance might seem confusing due to its format and the information presented. However, once you grasp the key components, it becomes easier to interpret. The document typically contains the following information:

- Policyholder Information: This includes the name and contact details of the individual or organization that holds the insurance policy.

- Insurance Company Information: The Certificate will also provide details about the insurance company, such as their name, address, and contact information.

- Coverage Dates: One of the crucial aspects of a Certificate of Insurance is the coverage period. It specifies the dates during which the policy is in effect.

- Policy Types: The document will outline the types of insurance coverage provided, such as General Liability, Property, Professional Liability, Workers’ Compensation, etc.

- Policy Limits: Policy limits refer to the maximum amount the insurance company will pay in the event of a claim. These limits can vary depending on the type of coverage.

By understanding the basics of a Certificate of Insurance, you can confidently assess the coverage provided and ensure that it aligns with your specific needs. It is important to note that the Certificate does not provide exhaustive details about the entire policy; rather, it serves as a snapshot of the essential information. For a comprehensive understanding of your insurance policy, it is recommended to review the full policy document.

Key Information in a Certificate of Insurance

A Certificate of Insurance contains crucial information that enables you to understand your insurance coverage and ensure that it meets your specific requirements. By familiarizing yourself with the key information in a Certificate of Insurance, you can make informed decisions regarding your risk management strategies. Here are the essential details to look out for:

- Policyholder Information: This section provides the name and contact details of the policyholder, who is the individual or organization that holds the insurance policy. It is important to verify that the information accurately reflects your business.

- Insurance Company Information: This section includes the name, address, and contact details of the insurance company providing the coverage. It is essential to ensure that the insurance company is reputable and has a proven track record in the industry.

- Coverage Dates: The coverage dates specify the period during which the policy is in effect. Be sure to check that the start and end dates align with your insurance needs, and be aware of any potential gaps in coverage.

- Policy Types: The Certificate will outline the types of insurance coverage provided. These may include General Liability, Property, Professional Liability, Workers’ Compensation, and more. Understanding the specific types of coverage can help you assess whether your business is adequately protected.

- Policy Limits: Policy limits refer to the maximum amount the insurance company will pay in the event of a claim. It is crucial to review these limits to ensure that they align with your business’s potential risks and liabilities. Consider factors such as the nature of your operations, the value of your assets, and the potential severity of claims.

By paying attention to these key pieces of information, you can gain a comprehensive understanding of your insurance coverage and determine whether it meets your specific needs. However, it is important to remember that a Certificate of Insurance is not a substitute for reviewing the full policy document. For a detailed analysis of your coverage, it is recommended to consult with your insurance agent or broker.

Types of Insurance Coverage Listed in a Certificate

A Certificate of Insurance provides a concise summary of the various types of insurance coverage that a policyholder holds. Understanding the different types of coverage listed in the Certificate is crucial for assessing the extent of protection provided for your business. Here are some common types of insurance coverage you may find:

- General Liability Insurance: This coverage protects against bodily injury, property damage, and advertising or personal injury claims arising from your business operations. It is a fundamental coverage that most businesses carry.

- Property Insurance: Property insurance covers the physical assets of your business, such as buildings, equipment, inventory, and furniture, against losses from perils like fire, theft, or natural disasters.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) Insurance, this coverage protects professionals against claims of negligence, errors, or omissions in the services they provide. It is particularly important for professionals in fields such as law, medicine, and consulting.

- Workers’ Compensation Insurance: Workers’ compensation insurance provides coverage for employees who suffer work-related injuries or illnesses. It helps pay for medical expenses, disability benefits, and lost wages.

- Commercial Auto Insurance: If your business uses vehicles for operations, commercial auto insurance provides coverage for vehicles used for business purposes, including liability for accidents and physical damage to the vehicles.

- Cyber Liability Insurance: With the increasing prevalence of cyber threats, cyber liability insurance protects businesses against losses resulting from a data breach or cyber-attacks, including expenses related to data recovery, legal costs, and customer notification.

- Umbrella Insurance: Umbrella insurance provides additional liability coverage that goes beyond the limits of your primary liability policies, giving you extra protection in the event of a major claim.

These are just a few examples of the types of coverage that can be included in a Certificate of Insurance. The specific coverages listed will depend on the individual needs of the policyholder and the nature of their business or profession. It is crucial to review the coverage types to ensure that they align with your specific risks and potential liabilities. If you have additional coverage needs, you may need to discuss them with your insurance agent or broker to ensure that you are adequately protected.

Additional Insureds and Their Importance

When reviewing a Certificate of Insurance, you may come across the term “Additional Insured.” This refers to parties other than the policyholder who are granted limited coverage under the insurance policy. Understanding the concept of additional insureds and their importance is crucial for managing your business’s contractual obligations and potential liabilities.

The inclusion of additional insureds in an insurance policy is common in various business relationships, such as contracts, leases, or partnerships. By adding a party as an additional insured, the policyholder extends a certain level of protection to that party for claims arising from the policyholder’s actions or operations. This arrangement can provide benefits for both parties involved:

- Protection for the Additional Insured: By being named as an additional insured, the party receives coverage under the policyholder’s insurance policy. This means that if a claim arises due to the policyholder’s actions or negligence, the additional insured may have coverage for the damages or liabilities caused. It can provide peace of mind and financial protection for the additional insured.

- Compliance with Contractual Requirements: Many contracts or agreements stipulate the requirement for one party to name the other as an additional insured. This is often done to ensure that both parties share the risk and potential liabilities associated with the specific project or business relationship. By including the additional insured in the insurance policy, the policyholder fulfills their contractual obligation.

- Risk Management: Adding additional insureds can also be a strategic risk management tool. By extending coverage to other parties involved in a project, such as subcontractors or vendors, the policyholder helps ensure that there is adequate insurance coverage for all the potential risks and liabilities associated with the project.

It is essential to carefully review the Certificate of Insurance to identify any additional insureds and ensure that the proper parties are listed. The detailed information of the additional insured, including their legal name and relationship to the policyholder, should be clearly stated. If you are named as an additional insured on a Certificate of Insurance, it is advisable to obtain a copy of the endorsement or contract that outlines the specific terms and conditions of your coverage.

It is important to note that being named as an additional insured does not provide the same level of coverage as being the policyholder. Additional insureds typically have limited coverage and are subject to the terms and conditions of the policy. Therefore, it is crucial to review the insurance policy to understand the extent of the coverage provided as an additional insured.

In summary, the inclusion of additional insureds in an insurance policy is a common practice in business relationships. It provides protection for the additional insured, helps fulfill contractual obligations, and enhances risk management. By understanding the concept of additional insureds, you can navigate contractual agreements and ensure that your business’s potential liabilities are adequately addressed.

Policy Limits and Deductibles

Policy limits and deductibles are two essential terms that you will often encounter in a Certificate of Insurance. Understanding these terms is crucial for assessing the level of coverage provided by your insurance policy and managing potential out-of-pocket expenses in the event of a claim.

Policy Limits: Policy limits refer to the maximum amount that an insurance company will pay for a covered claim. These limits can vary depending on the type of coverage and the specific terms of the policy. For example, in a General Liability Insurance policy, there may be separate limits for bodily injury and property damage claims.

The policy limits are typically stated as a per-occurrence limit and an aggregate limit. The per-occurrence limit is the maximum amount the insurer will pay for a single claim, while the aggregate limit is the maximum amount the insurer will pay for multiple claims during the policy period. It is crucial to review these limits to ensure that they align with your business’s potential risks and liabilities.

When assessing policy limits, consider factors such as the nature of your business, the potential severity of claims, and the value of your assets. Ensuring that your policy limits are adequate can help protect your business from financial hardships in the event of a significant claim.

Deductibles: A deductible is the amount of money that the policyholder must pay out of pocket before the insurance coverage kicks in. Deductibles are common in Property Insurance and Commercial Auto Insurance policies. For example, if you have a $1,000 deductible and experience a covered loss of $5,000, you would be responsible for paying the first $1,000, and the insurance company would cover the remaining $4,000.

Choosing a deductible involves a trade-off between higher premiums and higher out-of-pocket expenses. A higher deductible typically results in lower insurance premiums, while a lower deductible leads to higher premiums. It is important to select a deductible amount that balances your budget and risk tolerance.

When reviewing a Certificate of Insurance, pay close attention to the policy limits and deductibles specified. Ensure that the limits are in line with your business’s needs and that the deductibles are manageable for potential claims. If you have any concerns or questions about the policy limits or deductibles, reach out to your insurance agent or broker for clarification.

Ultimately, understanding policy limits and deductibles is crucial for assessing the scope of coverage and managing the financial implications of a claim. By aligning these terms with your business’s risks and needs, you can ensure that your insurance policy provides adequate protection while also being financially feasible.

Exclusions and Endorsements

Exclusions and endorsements are important components of an insurance policy that can significantly impact the coverage provided. It is essential to understand these terms when reviewing a Certificate of Insurance to ensure that you have a comprehensive understanding of the policy’s limitations and any additional coverage enhancements.

Exclusions: Exclusions are specific risks or circumstances that are not covered by an insurance policy. They outline situations where the insurance company will not provide compensation or liability coverage. Exclusions can vary depending on the type of coverage and the specific terms of the policy. Some common examples of exclusions include intentional acts, acts of war, pollution, and pre-existing conditions.

It is crucial to carefully review the exclusions in your insurance policy to understand the limitations of your coverage. By being aware of these exclusions, you can take necessary measures to mitigate potential risks or consider supplemental coverage options to fill any gaps.

Endorsements: Endorsements, also known as riders, are additional provisions or modifications to an insurance policy. They can be used to add, remove, or modify coverage to tailor the policy to your specific needs. Endorsements may be included in the Certificate of Insurance or listed separately as additional documentation.

Endorsements can provide valuable enhancements to your coverage by expanding or customizing the policy to meet your unique requirements. Some common endorsements include adding coverage for specific perils, increasing policy limits, or extending coverage to additional insureds.

When reviewing a Certificate of Insurance, thoroughly read any endorsements listed to ensure you have a complete understanding of the coverage enhancements or modifications. If you have any questions or concerns about the endorsements, consult with your insurance agent or broker for clarification.

Understanding the exclusions and endorsements in your insurance policy is crucial for managing your business’s risks and ensuring that you have the necessary coverage. By reviewing these sections in the Certificate of Insurance, you can identify any potential gaps in coverage and explore options to adjust your policy as needed.

Remember, every insurance policy is different, and the exclusions and endorsements can vary based on the insurer and the type of coverage. Take the time to carefully review and understand these sections to make informed decisions about your insurance needs.

Verifying the Authenticity of a Certificate of Insurance

Ensuring the authenticity of a Certificate of Insurance is crucial to protect your business from fraudulent or invalid coverage. Here are some steps you can take to verify the authenticity of a Certificate of Insurance:

- Contact the Insurance Company: Reach out to the insurance company listed on the Certificate of Insurance to confirm the policy’s validity. You can ask for confirmation of coverage, policy details, and any additional insureds listed on the certificate.

- Verify the Insurance Company: Do some research to validate the insurance company’s legitimacy. Check if they are licensed and in good standing with the relevant insurance regulatory authorities. You can also look for customer reviews or seek recommendations from trusted sources.

- Review the Certificate for Errors: Carefully review the details on the Certificate of Insurance for any discrepancies or errors. Pay attention to the policyholder’s name, insurance company information, policy numbers, coverage dates, and types of coverage listed. Inconsistencies may raise red flags about the authenticity of the certificate.

- Request a Copy of the Full Policy: If you have any doubts about the Certificate of Insurance, ask the policyholder to provide a copy of the full insurance policy. Reviewing the complete policy document will provide you with a more comprehensive understanding of the coverage and further validate its authenticity.

- Consult with Professionals: If you are unsure about the authenticity of a Certificate of Insurance, consider consulting with insurance professionals, such as insurance agents or brokers. They can help review the certificate and provide guidance on verifying its validity.

By taking these steps to verify the authenticity of a Certificate of Insurance, you can ensure that you are dealing with a legitimate insurance policy that offers reliable coverage. Protecting your business from potential fraud or inadequate insurance protection is crucial for mitigating risks and safeguarding your financial well-being.

Remember, it is essential to be proactive in verifying the authenticity of a Certificate of Insurance and not solely rely on the document itself. This will help you make informed decisions regarding your business’s risk management strategies and ensure that you are adequately protected.

How to Interpret Policy Numbers and Coverage Dates

Policy numbers and coverage dates are important elements found in a Certificate of Insurance. Understanding how to interpret these details is crucial for managing your insurance coverage effectively. Here’s what you need to know:

Policy Numbers: Policy numbers are unique identifiers assigned by the insurance company to each individual insurance policy. These numbers help identify and track your specific policy amidst the insurer’s records. Policy numbers can vary in format and length, depending on the insurance company.

When reviewing a Certificate of Insurance, ensure that the policy number listed matches the policy number provided by your insurance company. This verification step helps confirm that the Certificate accurately represents your specific insurance policy.

Coverage Dates: The coverage dates indicated in a Certificate of Insurance specify the period during which the policy is in effect. It is essential to understand the two types of coverage dates:

- Effective Date: This is the start date when the insurance coverage becomes active. It marks the beginning of the policy period and indicates when the coverage starts to protect your business.

- Expiration Date: This is the end date when the insurance coverage ceases. After the expiration date, the policy will no longer provide coverage unless it is renewed or replaced with a new policy.

It is crucial to review the coverage dates to ensure that your business has continuous coverage without any gaps. If you have an ongoing relationship with the insurance company, ensure that your policy is renewed before the expiration date to avoid any interruptions in coverage.

When interpreting policy numbers and coverage dates, it is vital to keep in mind that the Certificate of Insurance provides a summary of the insurance policy. For a comprehensive understanding of your coverage, refer to the full policy document and consult with your insurance agent or broker.

By accurately interpreting policy numbers and coverage dates in a Certificate of Insurance, you can ensure that you are referencing the correct policy and that your coverage is valid and up-to-date. The policy number serves as a unique identifier, and the coverage dates provide clarity on the effective and expiration dates of your insurance policy.

Common Mistakes to Avoid When Reading a Certificate of Insurance

When reading a Certificate of Insurance, it is important to approach it with a critical eye and avoid making common mistakes that could lead to misunderstandings or missed opportunities for your business. By being aware of these mistakes, you can better navigate the document and make informed decisions regarding your insurance coverage. Here are some common mistakes to avoid:

- Not Reading the Entire Document: One of the biggest mistakes is assuming that the Certificate of Insurance contains all the necessary information about your coverage. While it provides a summary, it is essential to review the full insurance policy document to understand the complete terms and conditions of your coverage.

- Overlooking Important Details: When reviewing the Certificate, carefully read and understand all the details, including policyholder information, insurance company information, coverage dates, policy types, and policy limits. Missing or misinterpreting these details may lead to misunderstandings about your coverage.

- Not Verifying the Authenticity: Don’t assume that a Certificate of Insurance is automatically valid. Take the necessary steps to verify its authenticity by contacting the insurance company and confirming the details provided on the certificate.

- Failure to Identify Exclusions: Neglecting to review the exclusions listed in the Certificate can lead to misunderstandings about what risks or circumstances are not covered by your policy. Pay close attention to these exclusions and assess how they may impact your coverage.

- Not Understanding Additional Insureds: If there are additional insureds listed on the Certificate, be sure to understand the extent of their coverage and the specific terms. Don’t assume that they have the same level of coverage as the primary policyholder.

- Ignoring Policy Numbers and Coverage Dates: Policy numbers and coverage dates provide critical information about your specific policy. Ensure that the policy number matches the one provided by your insurance company and that the coverage dates align with your coverage needs.

- Skipping Endorsements: Endorsements can have a significant impact on your coverage. Overlooking or not fully understanding the endorsements listed in the Certificate may result in missed opportunities for additional coverage or modifications tailored to your specific needs.

- Not Seeking Professional Advice: If you have any doubts or questions about the Certificate of Insurance, don’t hesitate to seek advice from insurance professionals, such as agents or brokers. They can provide clarification and ensure that you have a comprehensive understanding of your coverage.

By avoiding these common mistakes, you can navigate the Certificate of Insurance more effectively and make informed decisions regarding your insurance coverage. It is essential to approach the document with attention to detail, verify its authenticity, and seek professional advice when needed. This proactive approach will help ensure that your business has the necessary protection and manages potential risks effectively.

Conclusion

Understanding how to read and interpret a Certificate of Insurance is crucial for any business owner or professional. It allows you to assess the extent of coverage, verify the authenticity of the document, and ensure that your insurance needs are adequately met.

In this article, we have explored the basics of a Certificate of Insurance, including key information such as policyholder details, insurance company information, coverage dates, policy types, and policy limits. We have also highlighted the importance of additional insureds and the role they play in extending coverage to third parties. Furthermore, we discussed policy limits and deductibles, which impact the level of protection and potential out-of-pocket expenses.

To effectively navigate a Certificate of Insurance, it is important to be aware of exclusions and endorsements, which outline what is not covered and any additional provisions or modifications to the policy. Verifying the authenticity of the certificate through communication with the insurance company and careful examination of details is also crucial.

We emphasized the significance of understanding policy numbers and coverage dates to ensure that you are referencing the correct policy and that your coverage is valid and up-to-date. Lastly, we highlighted common mistakes to avoid when reading a Certificate of Insurance, such as not reading the entire document, failing to verify the authenticity, and overlooking important details.

By being knowledgeable about these aspects and taking a diligent approach when reviewing a Certificate of Insurance, you can make informed decisions about your insurance coverage and effectively manage the risks associated with your business.

Remember, if you have any questions or concerns, do not hesitate to consult with insurance professionals who can provide comprehensive guidance and ensure that you have the necessary coverage to protect your business and its interests.