Home>Finance>What Is Business Risk? Definition, Factors, And Examples

Finance

What Is Business Risk? Definition, Factors, And Examples

Published: October 20, 2023

Learn about business risk in finance, including its definition, factors, and examples. Gain insights into the potential risks that organizations face and how they can affect financial outcomes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Business Risk: Definition, Factors, and Examples

Running a successful business involves taking calculated risks. These risks can include anything that may impact the financial health and stability of a company, and are referred to as business risks. But what exactly is business risk, and what factors contribute to it? In this article, we will explore the definition of business risk, discuss its various factors, and provide some examples to help you better understand this crucial concept.

Key Takeaways:

- Business risk refers to the potential for loss or failure that a company may face due to internal or external factors.

- Understanding and managing business risks is essential for long-term success and sustainability.

Defining Business Risk

Business risk is the possibility of experiencing financial loss or negative consequences as a result of various factors that can influence a company’s operations, profitability, or overall success. These risks can originate from both internal and external sources and can occur in different areas of a business, such as operations, finance, marketing, or legal compliance.

It is important to note that while risk-taking is an inherent part of doing business, too much risk can lead to negative consequences. Therefore, effective risk management is crucial for identifying potential risks, evaluating their potential impact, and developing strategies to minimize or mitigate them.

Factors Contributing to Business Risk

Several factors can contribute to business risk. Here are some of the most common ones:

- Market Volatility: Fluctuations in market conditions, such as changing customer preferences, economic downturns, or new competitors entering the market, can pose significant risks to businesses.

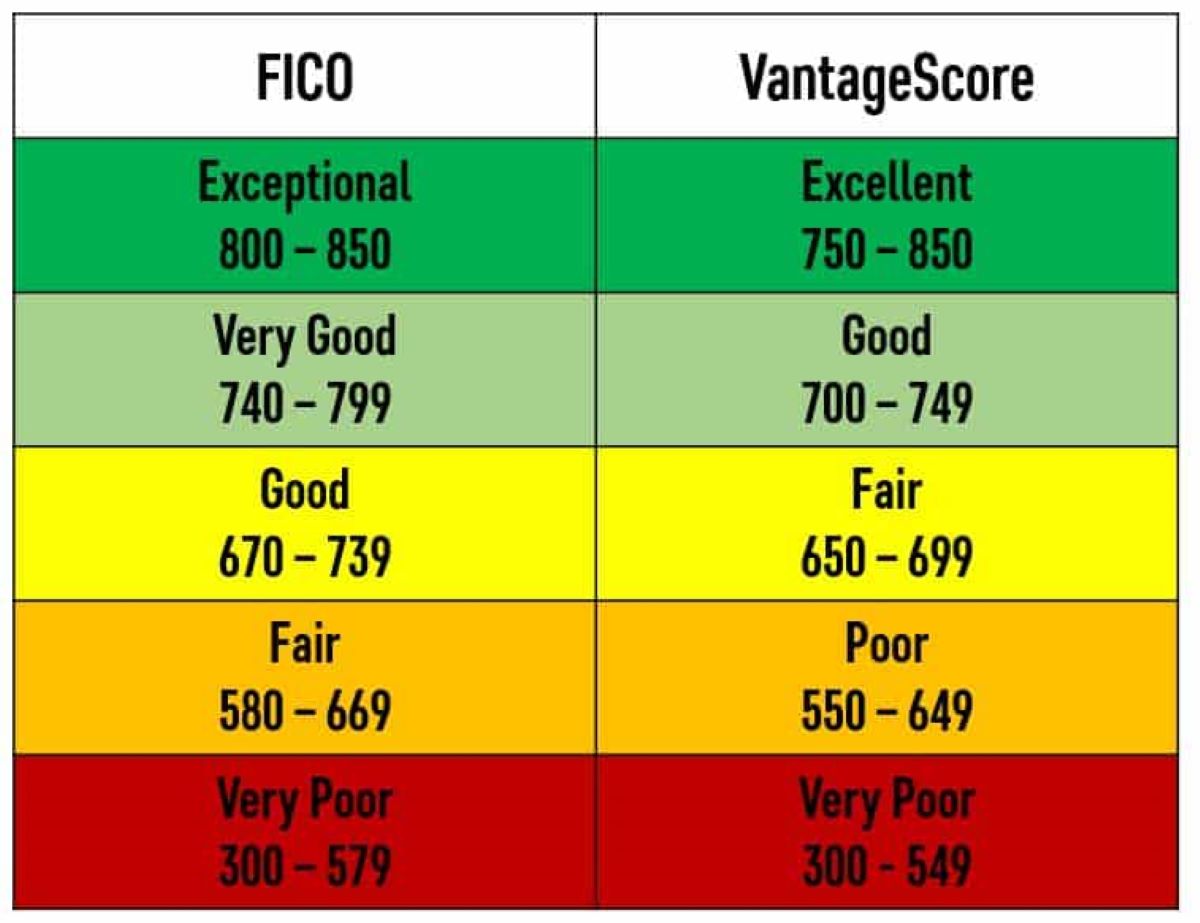

- Financial Risks: These include risks related to capital structure, debt management, liquidity, and cash flow. Poor financial management can lead to bankruptcy or insolvency.

- Operational Risks: Issues related to the day-to-day operations of a business, such as equipment failure, supply chain disruptions, or breakdowns in processes, can significantly impact productivity and profitability.

- Regulatory and Compliance Risks: Not complying with industry regulations, legal requirements, or government policies can result in penalties, lawsuits, reputational damage, and even business closure.

- Technological Risks: Rapid advancements in technology can create both opportunities and risks for businesses. Failing to adapt to new technologies or falling behind competitors in terms of innovation can result in loss of market share.

- Reputational Risks: Negative publicity, customer dissatisfaction, or unethical business practices can damage a company’s reputation, leading to a loss of trust from customers, partners, and stakeholders.

Examples of Business Risks

To illustrate the concept of business risk, here are a few examples:

- Market Risk: A company operating in the retail industry might face a decline in sales due to changing consumer preferences or the emergence of a new dominant competitor in the market.

- Financial Risk: Taking on excessive debt without sufficient cash flow to meet the repayment obligations can lead to financial distress, making it challenging for a business to operate and ultimately resulting in bankruptcy.

- Operational Risk: A manufacturing company may experience a disruption in its supply chain due to a natural disaster, delaying the delivery of raw materials and hampering production.

- Regulatory Risk: A pharmaceutical company failing to comply with strict regulations regarding drug manufacturing and safety may face significant fines and legal repercussions, damaging its reputation and profitability.

- Technological Risk: A bookstore relying solely on physical retail outlets and failing to adapt to online sales platforms may lose customers to competitors that offer convenient digital shopping experiences.

- Reputational Risk: A restaurant chain facing a food safety scandal can suffer a severe blow to its reputation, leading to a decline in customer trust and a decrease in sales.

In Conclusion

Understanding and managing business risk is vital for the long-term success and sustainability of any organization. By identifying the potential risks, actively evaluating their potential impact, and implementing risk management strategies, businesses can better navigate uncertain environments and reduce the likelihood of encountering significant financial loss or failure. Remember, taking risks is part of running a business, but informed decision-making and risk mitigation strategies can help businesses thrive amidst challenges and uncertainties.