Home>Finance>Morningstar Risk Rating: Definition, Factors Assessed, And Example

Finance

Morningstar Risk Rating: Definition, Factors Assessed, And Example

Published: December 26, 2023

Learn about Morningstar Risk Rating in finance, including the definition, factors assessed, and an example. Understand the importance of assessing risk in your investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Morningstar Risk Rating: Definition, Factors Assessed, and Example

Welcome to an informative dive into the world of Morningstar Risk Rating. If you’ve ever wondered how investments are assessed for risk, then keep reading! In this article, we will explore the definition of Morningstar Risk Rating, the factors that are assessed, and provide an example to help solidify your understanding.

Key Takeaways:

- Morningstar Risk Rating is a measure that assesses the level of risk associated with an investment.

- The factors assessed include historical price volatility, financial health of the company, and potential for losses.

So, let’s dive right in and explore what Morningstar Risk Rating is all about.

What is Morningstar Risk Rating?

Morningstar Risk Rating is a system used to evaluate the level of risk associated with an investment. The goal of this rating is to provide investors with a better understanding of the potential ups and downs that may be associated with a particular investment.

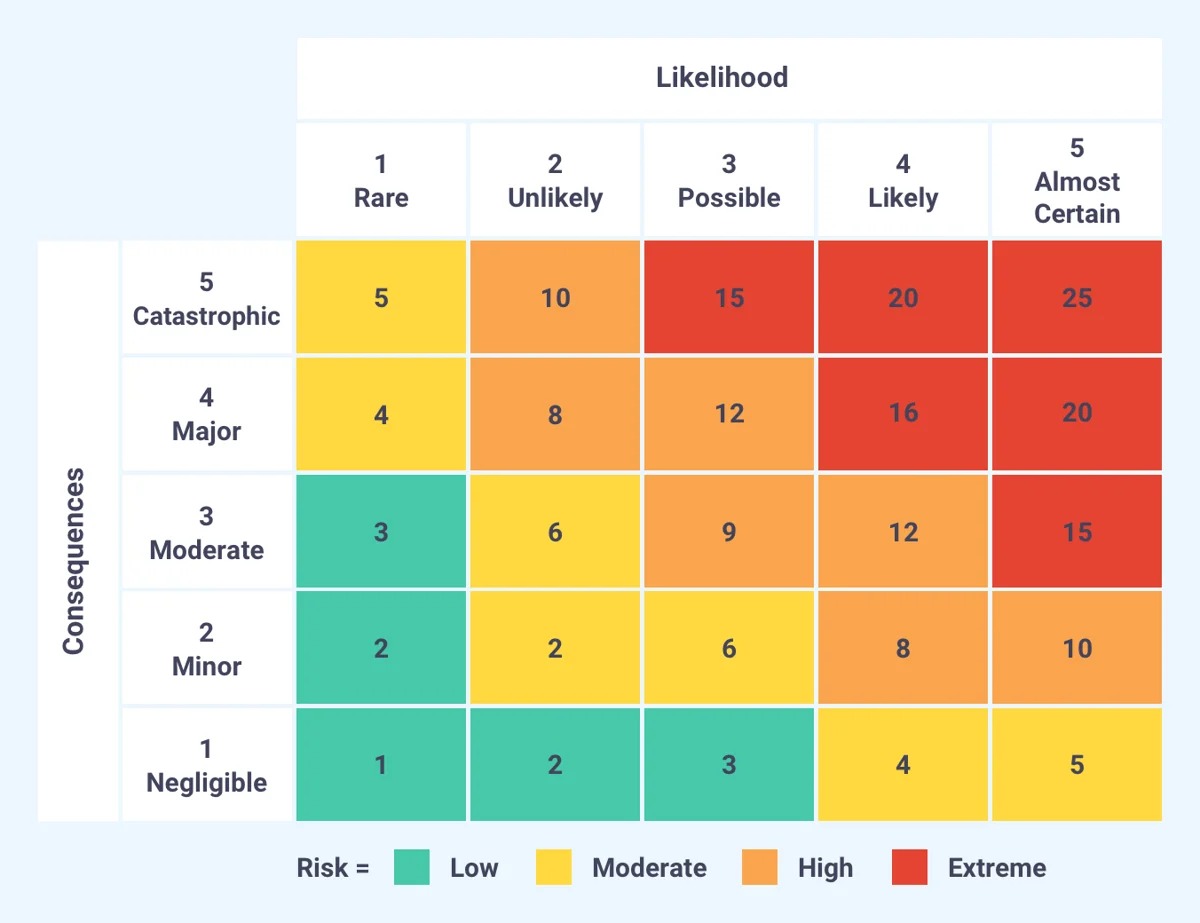

The Morningstar Risk Rating is based on a scale ranging from 1 to 5, with 1 being the lowest risk and 5 being the highest. This scale allows investors to quickly gauge the risk level of an investment without delving into complex financial analysis.

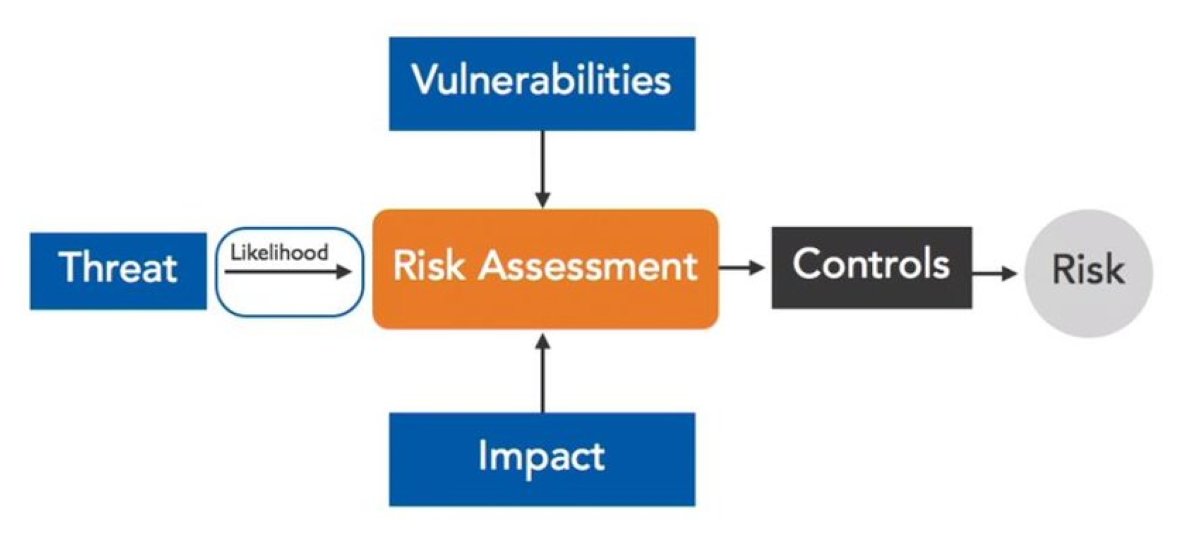

Factors Assessed

The Morningstar Risk Rating takes into consideration several factors to determine the level of risk associated with an investment. These factors include:

- Historical Price Volatility: This factor examines the fluctuations in an investment’s price over a specific period of time. Higher price volatility is generally associated with a higher risk rating.

- Financial Health of the Company: This factor evaluates the financial stability and health of the company behind the investment. A company with unstable financials may have a higher risk rating.

- Potential for Losses: This factor assesses the potential for significant losses in the investment. Investments with higher potential for losses will receive a higher risk rating.

By analyzing these factors, Morningstar Risk Rating offers investors a standardized measurement of risk, enabling them to make informed decisions about their investments.

An Example

Let’s consider an example to illustrate how Morningstar Risk Rating works:

Investment A has shown significant price volatility over the past year, indicating a higher level of risk. Additionally, the financial health of the company behind the investment is stable and does not raise any concerns. However, there is a higher potential for losses due to market conditions. Based on these factors, Investment A receives a Morningstar Risk Rating of 4.

On the other hand, Investment B has displayed minimal price volatility and exhibits a strong financial position. The potential for losses is also low. Considering these factors, Investment B receives a Morningstar Risk Rating of 2.

These ratings provide investors with a quick and easy way to evaluate the risk associated with each investment, helping them make well-informed decisions.

Conclusion

Morningstar Risk Rating plays a crucial role in assisting investors in understanding the level of risk associated with an investment. By considering historical price volatility, financial health, and potential for losses, investors can make more informed decisions about their investment portfolios.

Remember, when utilizing Morningstar Risk Ratings, it is essential to consider your own risk tolerance and investment goals to ensure alignment with your personal financial strategy.