Finance

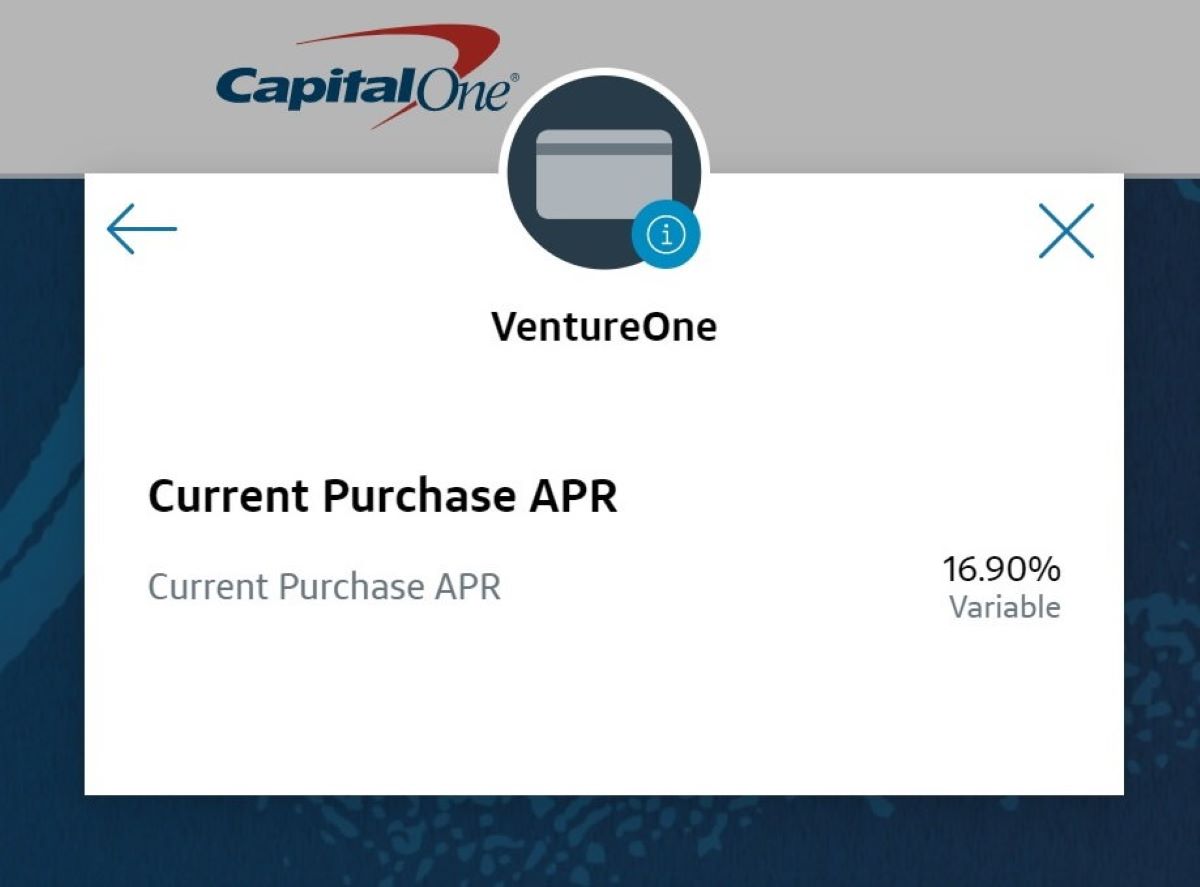

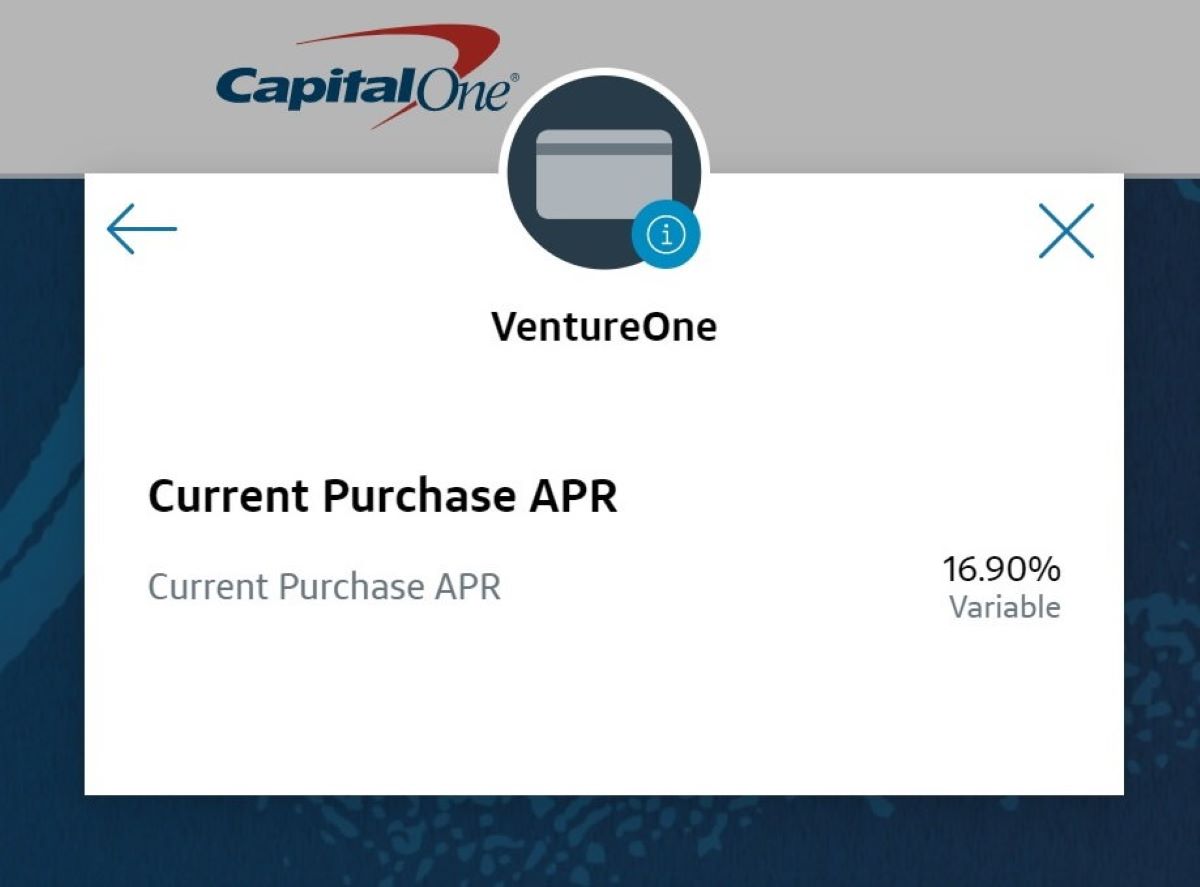

What Is Capital One APR?

Published: March 3, 2024

Learn all about Capital One APR and how it impacts your finances. Understand the ins and outs of Capital One's APR rates and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where understanding the nuances of Annual Percentage Rate (APR) is crucial for making informed decisions. As we delve into the realm of Capital One APR, we’ll unravel the intricacies of this essential financial concept and explore its impact on your financial well-being. Whether you’re a seasoned financial guru or a curious novice, this guide will equip you with the knowledge to navigate the realm of APR with confidence.

Capital One, a prominent player in the financial industry, offers a diverse range of financial products, each accompanied by its unique APR structure. Understanding Capital One’s approach to APR is pivotal for anyone utilizing their services or considering doing so. By the end of this journey, you’ll have a comprehensive grasp of what Capital One APR entails, how it’s calculated, and the factors influencing it. Moreover, you’ll discover practical strategies for managing and optimizing your Capital One APR, empowering you to make informed financial decisions.

Join us as we demystify Capital One APR, empowering you to navigate the world of finance with confidence and insight. Let’s embark on this enlightening exploration of Capital One APR, where financial literacy meets practical wisdom.

Understanding APR

Annual Percentage Rate (APR) serves as a cornerstone of the financial landscape, encompassing the cost of borrowing on an annual basis. It goes beyond the nominal interest rate by incorporating additional fees and charges, providing a comprehensive view of the true cost of financial products. When it comes to Capital One, understanding the nuances of APR is essential for evaluating the cost of credit cards, loans, and other financial offerings.

At its core, APR represents the annualized cost of borrowing, expressed as a percentage of the principal amount. This figure enables consumers to compare the true cost of different financial products, facilitating informed decision-making. Whether you’re considering a Capital One credit card or loan, the APR offers valuable insights into the total cost of utilizing these financial instruments.

It’s important to note that APR encompasses not only the interest rate but also additional costs such as origination fees, annual fees, and other charges associated with the financial product. By factoring in these expenses, APR provides a holistic perspective on the actual cost of borrowing from Capital One, empowering consumers to make sound financial choices.

As we navigate the realm of Capital One APR, understanding the significance of this metric is pivotal. It serves as a powerful tool for comparing financial products, evaluating their cost, and ultimately making informed decisions that align with your financial goals. Now that we’ve laid the foundation for comprehending APR, let’s delve into the specific types of Capital One APR and their implications for consumers.

Types of Capital One APR

Capital One offers a range of financial products, each accompanied by distinct types of APR tailored to specific consumer needs. Understanding these variations is essential for choosing the most suitable financial instrument. Here are the primary types of Capital One APR:

- Purchase APR: This type of APR applies to purchases made using a Capital One credit card. It represents the interest charged on outstanding balances resulting from purchases. The Purchase APR is a key consideration for consumers who frequently utilize their credit cards for everyday expenses or significant purchases.

- Balance Transfer APR: For individuals seeking to transfer balances from other credit cards to a Capital One card, the Balance Transfer APR comes into play. This rate applies to the transferred balances and influences the overall cost of consolidating debts onto a Capital One credit card.

- Introductory APR: Capital One often provides promotional introductory APRs to attract new customers. These temporary, lower-than-usual rates are offered for a specified period, allowing cardholders to enjoy reduced interest expenses during the introductory period.

- Cash Advance APR: When cardholders obtain cash advances using their Capital One credit cards, the Cash Advance APR dictates the interest charged on these transactions. It’s important to note that cash advances often incur higher APRs and additional fees compared to regular purchases.

By recognizing the distinct types of Capital One APR, consumers can align their financial needs with the most relevant APR structure. Whether it’s managing everyday expenses, consolidating debts, or taking advantage of promotional offers, understanding these APR variations is crucial for making informed financial decisions.

How Capital One Calculates APR

Capital One employs a standardized method for calculating APR across its various financial products, ensuring transparency and consistency in its approach. The calculation of APR involves several key components:

- Interest Rate: The fundamental element of APR calculation is the interest rate applied to the outstanding balance. Capital One determines this rate based on factors such as the cardholder’s creditworthiness, prevailing market rates, and the specific type of financial product.

- Additional Fees: In addition to the interest rate, Capital One incorporates any applicable fees into the APR calculation. These may include annual fees, balance transfer fees, cash advance fees, and other charges associated with the financial product.

- Amortization Period: The amortization period, or the time over which the interest is calculated, plays a crucial role in determining the APR. For credit cards, the amortization period is typically the billing cycle, while for loans, it corresponds to the loan term.

- Compounding Frequency: Capital One considers the frequency of interest compounding when calculating APR. Whether the interest accrues daily, monthly, or annually impacts the overall APR and the cost of borrowing.

By factoring in these components, Capital One arrives at the comprehensive APR for each financial product, providing consumers with a clear understanding of the total cost of borrowing. This transparent approach empowers individuals to make informed decisions aligned with their financial circumstances and goals.

Understanding how Capital One calculates APR is instrumental in evaluating the cost of credit cards, loans, and other financial offerings. By grasping the intricacies of this calculation process, consumers can effectively compare different products, assess their affordability, and make prudent financial choices.

Factors Affecting Capital One APR

Several key factors influence the determination of APR for Capital One’s financial products, shaping the cost of borrowing and the overall financial landscape for consumers. Understanding these influential elements is essential for comprehending the variability of APR and its impact on individual financial circumstances. Here are the primary factors affecting Capital One APR:

- Creditworthiness: One of the most significant factors influencing APR is the applicant’s creditworthiness. Individuals with higher credit scores typically qualify for lower APRs, reflecting their perceived lower risk as borrowers. Conversely, those with lower credit scores may face higher APRs, compensating for the elevated lending risk.

- Market Conditions: The prevailing economic environment and market interest rates play a pivotal role in determining Capital One’s APR. Fluctuations in market conditions can influence the APR for new financial products and impact existing APRs for variable-rate products.

- Product Type: The type of financial product, such as credit cards, personal loans, or auto loans, can significantly impact the APR. Each product category may have distinct risk profiles and associated APR ranges, reflecting the specific considerations and market dynamics related to that product type.

- Introductory Offers: Capital One frequently introduces promotional APR offers to attract new customers. These introductory rates, often lower than standard APRs, provide temporary cost savings for cardholders during the promotional period.

- Regulatory Environment: Changes in financial regulations and legislative developments can influence the APR landscape. Compliance with regulatory requirements and industry standards may prompt adjustments to APR structures for Capital One’s financial products.

By recognizing the multifaceted nature of these factors, consumers can gain insights into the dynamics shaping Capital One’s APR offerings. This understanding empowers individuals to proactively manage their financial profiles, improve their creditworthiness, and leverage favorable market conditions to secure more advantageous APRs.

As we navigate the realm of Capital One APR, it becomes evident that these factors collectively contribute to the nuanced landscape of borrowing costs. By comprehending the interplay of creditworthiness, market dynamics, product types, promotional offers, and regulatory influences, consumers can make informed decisions that align with their financial goals and aspirations.

Managing Capital One APR

Effectively managing Capital One APR involves proactive steps aimed at optimizing borrowing costs and enhancing overall financial well-being. By implementing strategic measures and leveraging available resources, individuals can navigate the realm of APR with confidence and precision. Here are practical strategies for managing Capital One APR:

- Improving Creditworthiness: Enhancing one’s credit profile through responsible financial behaviors, such as timely bill payments and prudent credit utilization, can lead to improved credit scores. A higher credit score often translates to more favorable APR offers from Capital One and other financial institutions.

- Exploring Balance Transfer Options: For individuals carrying balances with higher APRs, exploring Capital One’s balance transfer offers can be a viable strategy. Transferring balances to a card with a lower APR or taking advantage of promotional balance transfer rates can help reduce interest expenses and facilitate debt repayment.

- Negotiating with Capital One: Engaging in open communication with Capital One to discuss APR adjustments or explore available promotional offers can yield favorable outcomes. In some cases, cardholders may successfully negotiate lower APRs or secure temporary promotional rates, especially if they have a positive payment history.

- Understanding and Leveraging Promotional Offers: Staying informed about Capital One’s promotional APR offers and utilizing them strategically can provide cost-saving opportunities. Whether it’s taking advantage of introductory APRs on new credit cards or leveraging promotional rates for balance transfers, being aware of these offers can lead to substantial interest savings.

- Regularly Reviewing Terms and Conditions: Keeping abreast of changes in the terms and conditions of Capital One’s financial products is essential. By staying informed about any adjustments to APRs, fees, or promotional offers, consumers can make informed decisions regarding their financial strategies.

By implementing these proactive measures, individuals can take control of their borrowing costs and optimize their financial outcomes. Managing Capital One APR effectively entails a combination of financial prudence, strategic utilization of available resources, and proactive engagement with the financial institution.

As we navigate the realm of Capital One APR management, it becomes evident that informed decision-making and proactive financial management are instrumental in optimizing borrowing costs and enhancing overall financial well-being. By leveraging these strategies, individuals can navigate the intricacies of Capital One APR with confidence and strategic acumen.

Conclusion

Embarking on the journey to comprehend Capital One APR has provided valuable insights into the multifaceted world of borrowing costs and financial management. By unraveling the intricacies of Annual Percentage Rate and its specific implications within the realm of Capital One’s financial offerings, we’ve empowered individuals to make informed decisions and navigate the financial landscape with confidence.

Understanding the significance of APR as a comprehensive measure of borrowing costs is pivotal for evaluating the true expense of utilizing credit cards, loans, and other financial products. Capital One’s diverse APR structures, including Purchase APR, Balance Transfer APR, and promotional Introductory APRs, offer tailored solutions to meet varying consumer needs. By recognizing the nuanced factors influencing Capital One APR, such as creditworthiness, market conditions, and product types, individuals can strategically manage their borrowing costs and optimize their financial outcomes.

Moreover, the proactive strategies for managing Capital One APR, including improving creditworthiness, exploring balance transfer options, and leveraging promotional offers, equip consumers with the tools to navigate the complexities of APR with precision and foresight. By engaging in open communication with Capital One and staying informed about available resources, individuals can take control of their borrowing costs and enhance their financial well-being.

As we conclude this enlightening exploration of Capital One APR, it’s evident that financial literacy, proactive financial management, and informed decision-making are paramount in optimizing borrowing costs and achieving financial goals. By leveraging the insights gained from this journey, individuals can navigate the realm of Capital One APR with confidence, ensuring that their financial decisions align with their aspirations and contribute to long-term financial stability.

Armed with a deeper understanding of Capital One APR and the strategies for managing it effectively, individuals are poised to embark on a journey of financial empowerment, making informed choices and optimizing their financial outcomes. The knowledge gained from this exploration serves as a beacon of financial wisdom, illuminating the path to prudent financial management and well-informed decision-making within the realm of Capital One APR.