Home>Finance>How To Cash Out Cryptocurrency Without Paying Taxes

Finance

How To Cash Out Cryptocurrency Without Paying Taxes

Published: October 5, 2023

Learn how to cash out your cryptocurrency without incurring any tax obligations. Get expert finance tips and strategies to maximize your profits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Tax Implications of Cryptocurrency Cashouts

- Key Factors to Consider Before Cashing Out Cryptocurrency

- Strategies for Minimizing Tax Liability when Cashing Out Cryptocurrency

- Method 1: Holding Cryptocurrency for Over a Year to Qualify for Long-term Capital Gains Tax Rates

- Method 2: Using Tax-Loss Harvesting to Offset Gains with Losses

- Method 3: Donating Cryptocurrency to Charitable Organizations

- Method 4: Structuring Cryptocurrency Cashouts as Loans

- Method 5: Establishing Offshore Entities for Tax Planning Purposes

- Reporting Your Cryptocurrency Cashouts to the Tax Authorities

- Keeping Accurate Records and Seeking Professional Advice

- Conclusion

Introduction

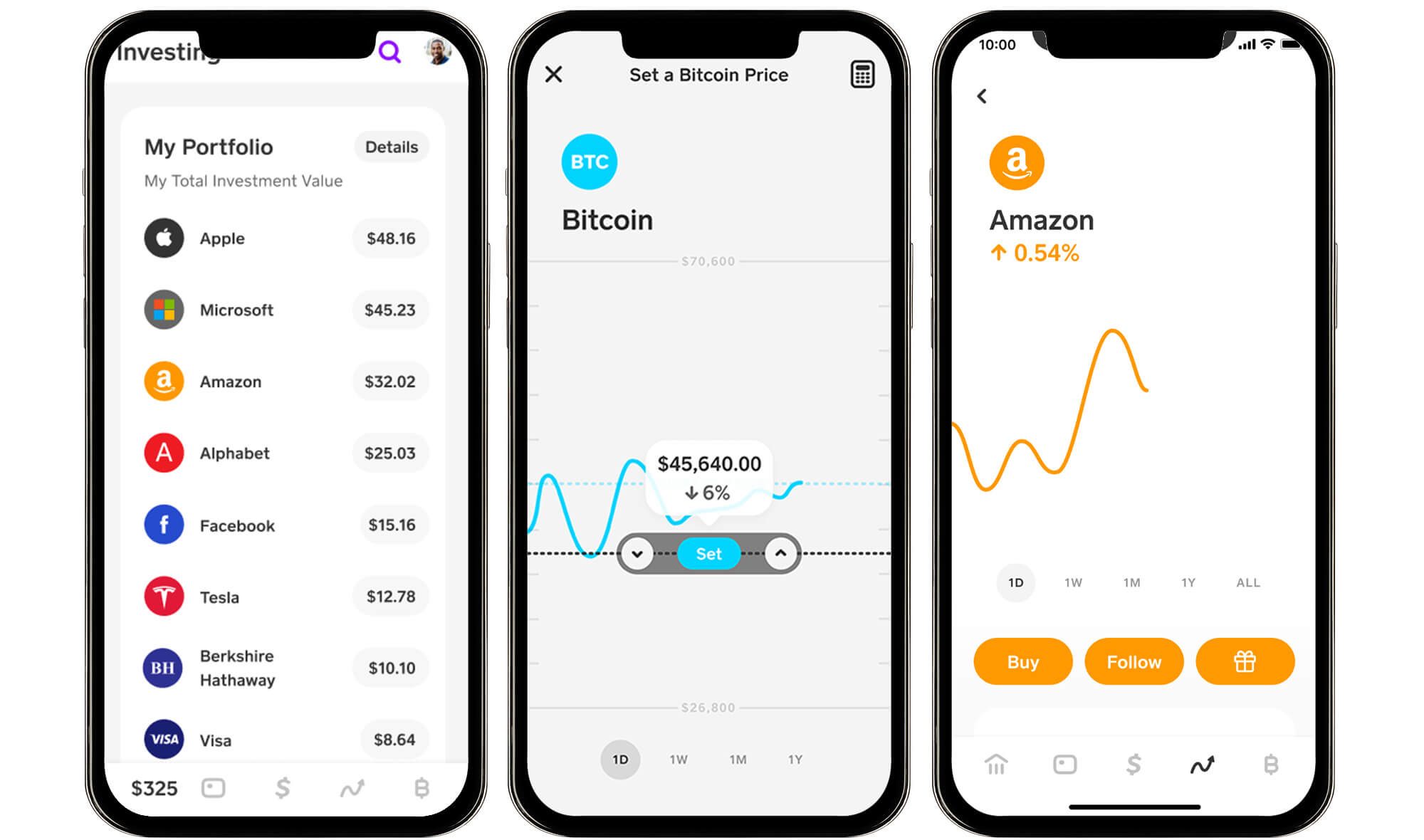

As the popularity of cryptocurrencies continues to soar, many investors are looking to cash out their holdings and realize their profits. However, it’s important to understand that cashing out cryptocurrency can have significant tax implications.

Cryptocurrency, such as Bitcoin or Ethereum, is considered property by tax authorities. This means that when you sell or exchange your cryptocurrency for traditional currency, you may be subject to capital gains taxes. It’s crucial to be aware of the tax rules and regulations that govern cryptocurrency cashouts in order to minimize your tax liability and ensure compliance with the law.

In this article, we will explore the various tax implications of cashing out cryptocurrency and discuss key factors that you need to consider before making any transactions. We will also outline strategies that can help you minimize your tax liability and legally reduce the amount of taxes you owe. Additionally, we will highlight the importance of reporting your cryptocurrency cashouts to the tax authorities and keeping accurate records to support your tax filings.

It’s important to note that tax laws surrounding cryptocurrencies are constantly evolving and can vary from country to country. Therefore, it is essential to do your research, consult with a tax professional, and stay updated on the latest regulations in your jurisdiction. By doing so, you can navigate the tax landscape and make informed decisions when cashing out your cryptocurrency.

Now, let’s delve into the details and understand the tax implications of cashing out cryptocurrency.

Understanding the Tax Implications of Cryptocurrency Cashouts

Cashing out cryptocurrency triggers taxable events that can result in capital gains or losses. When you sell or exchange your cryptocurrency for traditional currency, the difference between the purchase price and the selling price is considered a capital gain or loss. This gain or loss is subject to taxation in most jurisdictions.

The tax rate imposed on cryptocurrency cashouts depends on the holding period. If you held the cryptocurrency for less than a year before cashing out, it is classified as a short-term capital gain or loss and is typically taxed at your ordinary income tax rate. On the other hand, if you held the cryptocurrency for more than a year, it is classified as a long-term capital gain or loss, which often qualifies for lower tax rates.

In addition to capital gains taxes, cashing out cryptocurrency may also incur other tax obligations, such as state and local taxes or taxes on cryptocurrency mining. It’s important to research and understand the specific tax laws in your jurisdiction to ensure compliance.

Furthermore, tax authorities are becoming increasingly vigilant in tracking cryptocurrency transactions. The use of blockchain technology makes it easier for authorities to identify individuals who have failed to report or underreport their cryptocurrency activities. Failing to comply with tax obligations can lead to penalties, fines, and even criminal charges.

It’s important to note that tax regulations surrounding cryptocurrencies can be complex and are still evolving. The specific rules and requirements may vary depending on your country of residence. Therefore, it’s crucial to consult with a tax professional who has expertise in cryptocurrency taxation to ensure that you are in full compliance with the law.

Now that we have a basic understanding of the tax implications of cryptocurrency cashouts, let’s move on to the key factors that you need to consider before cashing out your cryptocurrency.

Key Factors to Consider Before Cashing Out Cryptocurrency

Before cashing out your cryptocurrency, there are several important factors that you should carefully consider. These factors can have a significant impact on your tax liability and overall financial situation. Let’s explore them in more detail:

- Holding Period: The length of time you have held your cryptocurrency can impact the tax rate you will be subject to. As mentioned earlier, if you held the cryptocurrency for more than a year, you may qualify for long-term capital gains tax rates, which are often lower than ordinary income tax rates. On the other hand, if you held the cryptocurrency for a short period of time, you may face higher tax rates.

- Tax Bracket: Your current income level and tax bracket are important factors to consider. If you are already in a high-tax bracket, cashing out a significant amount of cryptocurrency may push you into an even higher bracket, resulting in higher tax rates. Understanding your tax bracket can help you plan the timing and amount of your cashouts strategically to minimize your tax liability.

- Amount of Gain: The amount of gain you have realized from your cryptocurrency investments will directly impact your tax liability. Higher gains will lead to higher tax obligations. It’s essential to assess your gains and losses accurately to determine the potential tax implications.

- Tax Deductions: Explore potential deductions that may be applicable to your cryptocurrency cashouts. For example, if you used specific cryptocurrency exchanges or platforms, you may be eligible for deductions or credits. Additionally, if you incurred expenses related to your cryptocurrency investments, such as transaction fees or equipment costs, you may be able to deduct them from your overall tax liability. Consulting with a tax professional can help you identify and maximize available deductions.

- Future Cryptocurrency Price Movements: Consider the potential future value of your cryptocurrency investments. If the price is expected to increase significantly in the future, it may be advantageous to delay cashing out. By holding onto your cryptocurrency for longer, you can potentially benefit from lower tax rates or defer taxation altogether.

- Personal Financial Goals: Reflect on your personal financial goals and how cashing out your cryptocurrency aligns with those goals. Are you cashing out to cover immediate financial needs? Or are you looking to reinvest the funds elsewhere? Understanding your long-term financial objectives will help you make informed decisions about the timing and amount of your cryptocurrency cashouts.

Considering these key factors before cashing out your cryptocurrency will help you make well-informed decisions and minimize your tax liability. However, it’s crucial to remember that each individual’s financial situation is unique, and it’s advisable to consult with a tax professional who specializes in cryptocurrency taxation to ensure that you are making the best choices for your specific circumstances.

Strategies for Minimizing Tax Liability when Cashing Out Cryptocurrency

When cashing out cryptocurrency, there are several strategies you can employ to minimize your tax liability. These strategies can help you legally reduce the amount of taxes you owe and optimize your overall financial situation. Let’s explore some of these strategies:

- Method 1: Holding Cryptocurrency for Over a Year

- Method 2: Using Tax-Loss Harvesting

- Method 3: Donating Cryptocurrency to Charitable Organizations

- Method 4: Structuring Cryptocurrency Cashouts as Loans

- Method 5: Establishing Offshore Entities for Tax Planning Purposes

If you have held your cryptocurrency for more than a year, consider waiting to cash out until you qualify for long-term capital gains tax rates. Long-term capital gains tax rates are typically lower than ordinary income tax rates and can significantly reduce your tax liability. Patience can pay off when it comes to minimizing your tax obligations.

Tax-loss harvesting involves selling investments that have experienced losses to offset the gains from your cryptocurrency cashouts. By strategically selling assets that have depreciated in value, you can offset the capital gains and potentially lower your overall tax liability. However, it’s important to be aware of tax-loss harvesting rules and consult with a tax professional to ensure compliance.

If you are passionate about supporting charitable causes, consider donating your cryptocurrency directly to qualified charitable organizations. The donation can provide tax benefits, as you may be eligible for a charitable deduction based on the fair market value of the donated cryptocurrency. This strategy allows you to avoid capital gains taxes while supporting causes close to your heart.

Another strategy to consider is structuring your cryptocurrency cashouts as loans. Instead of selling your cryptocurrency, you can borrow against it and use the loan proceeds for your financial needs. By doing so, you can potentially defer the recognition of capital gains and reduce your immediate tax liability. However, it’s crucial to consult with a tax professional and weigh the potential benefits against the risks and costs associated with this strategy.

For individuals with significant cryptocurrency holdings, establishing offshore entities can provide tax planning opportunities. Offshore entities can offer favorable tax jurisdictions or structures that can legally reduce your tax obligations. However, setting up and maintaining offshore entities can be complex, and it’s crucial to work with experienced professionals to ensure compliance with international tax laws and regulations.

Each of these strategies has its own potential benefits and considerations. It’s important to conduct thorough research, seek professional advice, and carefully evaluate your specific circumstances before implementing any tax minimization strategy. By doing so, you can intelligently optimize your tax position when cashing out your cryptocurrency.

Method 1: Holding Cryptocurrency for Over a Year to Qualify for Long-term Capital Gains Tax Rates

One effective strategy for minimizing your tax liability when cashing out cryptocurrency is to hold your investments for over a year. By doing so, you may qualify for long-term capital gains tax rates, which are often more favorable compared to ordinary income tax rates.

Long-term capital gains tax rates are typically lower because they are designed to incentivize long-term investment and economic growth. These rates vary depending on your income level and tax bracket, but they are generally lower than short-term capital gains tax rates.

When holding cryptocurrency for over a year, it’s important to keep accurate records of your acquisition date and the fair market value of the cryptocurrency at the time of acquisition. This information is crucial for calculating your capital gains or losses accurately.

Timing is key when employing this strategy. If you are considering cashing out your cryptocurrency and have held it for less than a year, you may want to wait until the year mark to qualify for long-term capital gains tax rates. However, keep in mind that cryptocurrency markets are volatile, and waiting too long could expose you to potential price fluctuations that may impact your overall profits.

It’s worth noting that not all countries treat cryptocurrency in the same way for taxation purposes. Therefore, it’s crucial to consult with a tax professional who specializes in cryptocurrency taxation in your jurisdiction. They can guide you on the specific requirements and regulations regarding long-term capital gains tax rates and ensure you are in compliance with the law.

This strategy not only helps in minimizing your tax liability but can also have other benefits. By holding onto your cryptocurrency for a longer period, you have the potential to take advantage of potential future price appreciation, further enhancing your investment returns. However, it’s important to carefully assess your financial goals, market conditions, and tax implications before deciding on the optimal timing for your cryptocurrency cashout.

Remember, cryptocurrency tax laws are constantly evolving, and it’s crucial to stay updated on any regulatory changes that may impact the taxation of long-term capital gains. By staying informed and working with a knowledgeable tax advisor, you can effectively utilize this strategy to minimize your tax liability when cashing out cryptocurrency.

Method 2: Using Tax-Loss Harvesting to Offset Gains with Losses

An effective strategy for minimizing your tax liability when cashing out cryptocurrency is to utilize a technique called tax-loss harvesting. Tax-loss harvesting involves selling investments that have experienced losses to offset the gains from your cryptocurrency cashouts. By strategically selling assets that have depreciated in value, you can offset the capital gains and potentially lower your overall tax liability.

The concept behind tax-loss harvesting is to “harvest” or realize losses on certain investments to offset the taxable gains from other investments. This can be particularly useful when cashing out cryptocurrency, as it can help reduce the capital gains tax owed on the profits made from selling your cryptocurrency.

Here’s how tax-loss harvesting works:

- Identify which assets in your investment portfolio have declined in value. These assets would be considered as having realized losses.

- Sell the assets with realized losses to lock in the losses for tax purposes.

- Offset the capital gains from cashing out your cryptocurrency with the losses from the sold assets.

- If the total losses offset the gains entirely, you may eliminate the need to pay taxes on the gains from your cryptocurrency cashout.

It’s important to note that tax-loss harvesting is subject to certain rules and limitations. In many jurisdictions, you cannot use losses to offset gains if you repurchase the same or substantially identical investment within a short period of time (usually 30 days) before or after the sale. This is known as the “wash-sale” rule. Understanding the rules and regulations in your jurisdiction is crucial to ensure compliance.

Additionally, it’s important to consider the overall financial impact of tax-loss harvesting. While it can help reduce your tax liability, selling assets at a loss means realizing an actual loss on your investments. Therefore, it’s essential to carefully evaluate the potential long-term impact on your portfolio and investment strategy before undertaking tax-loss harvesting.

Utilizing tax-loss harvesting requires diligent monitoring and analysis of your investment portfolio. It’s advisable to consult with a tax professional who can help you identify investments with losses, evaluate the potential tax benefits, and ensure compliance with tax laws and regulations.

Overall, tax-loss harvesting is a valuable strategy that can help offset gains from cashing out cryptocurrency and potentially reduce your tax liability. However, it’s essential to approach it with careful consideration and expert guidance to fully leverage its benefits.

Method 3: Donating Cryptocurrency to Charitable Organizations

Another effective strategy for minimizing your tax liability when cashing out cryptocurrency is to consider donating it directly to qualified charitable organizations. Donating cryptocurrency can provide tax benefits, as you may be eligible for a charitable deduction based on the fair market value of the donated cryptocurrency.

When you donate cryptocurrency to a qualified charitable organization, it is treated similarly to donating cash or other property. The fair market value of the cryptocurrency at the time of the donation determines the deduction you can claim on your tax return.

Here are some key aspects to consider when donating cryptocurrency:

- Tax Benefits: Donating cryptocurrency allows you to offload your investment while potentially minimizing your tax liability. By donating the cryptocurrency directly, you can avoid capital gains taxes that would have been owed if you had sold the cryptocurrency and then donated the proceeds. Additionally, you may be eligible for a tax deduction based on the fair market value of the donated cryptocurrency at the time of the donation.

- Charitable Deduction: The amount of charitable deduction you can claim depends on several factors, including the fair market value of the donated cryptocurrency, your income level, and the specific tax laws in your jurisdiction. Consult with a tax professional to understand the specific rules and limitations of charitable deductions for cryptocurrency donations.

- Qualified Charitable Organizations: Ensure that the charitable organization you plan to donate to is qualified to receive tax-exempt donations. In most jurisdictions, these organizations are registered nonprofits that have a 501(c)(3) status in the United States. Verify the tax-exempt status and consider reaching out to the organization to confirm their ability to accept cryptocurrency donations.

- Record-Keeping: Maintain detailed records of your cryptocurrency donation, including documentation of the transaction, the fair market value of the cryptocurrency at the time of the donation, and any acknowledgment provided by the charitable organization. These records will be crucial for substantiating your tax deduction claims.

- Tax Reporting: Depending on the jurisdiction, you may need to report your cryptocurrency donation separately on your tax return. Familiarize yourself with the reporting requirements and consult with a tax professional to ensure compliance.

Donating cryptocurrency to charitable organizations not only allows you to support causes you believe in, but it also offers potential tax benefits. By working with a tax professional and understanding the rules and regulations, you can optimize your tax savings while making a positive impact through your cryptocurrency cashout.

It’s important to note that tax laws surrounding cryptocurrency donations can vary by jurisdiction and may change over time. Stay informed about the specific regulations in your country and consult with a tax advisor who specializes in cryptocurrency taxation to ensure compliance and maximize your tax benefits.

Method 4: Structuring Cryptocurrency Cashouts as Loans

Structuring your cryptocurrency cashouts as loans can be a strategic method to minimize your immediate tax liability when cashing out. Instead of selling your cryptocurrency, you can borrow against it and use the loan proceeds for your financial needs. This allows you to potentially defer the recognition of capital gains and reduce your immediate tax obligations.

Here’s how this strategy works:

- Collateralize Your Cryptocurrency: Use your cryptocurrency as collateral to secure a loan from a financial institution or lending platform. The loan amount is typically determined based on the value of your cryptocurrency.

- Receive Loan Proceeds: Once approved, you receive the loan proceeds in traditional currency or other forms of liquidity, depending on the lending arrangement.

- Deferring Capital Gains: By taking out a loan instead of selling your cryptocurrency, you postpone triggering a taxable event. Since the transaction is considered a loan, you don’t realize capital gains, and therefore, you can potentially defer the associated tax liability.

- Repaying the Loan: Over time, you can gradually repay the loan with interest as per the agreed terms. The collateralized cryptocurrency serves as security against the loan.

- Tax Implications: It’s important to consult with a tax professional to understand the specific tax implications of this strategy in your jurisdiction. While you may be deferring immediate taxes on the capital gains, interest payments and potential tax deductions associated with the loan may apply.

It’s crucial to note that structuring cryptocurrency cashouts as loans may involve risks and costs. Before opting for this strategy, consider the interest rates, terms, and potential risks associated with borrowing against your cryptocurrency. Losing access to your cryptocurrency collateral and potential fluctuations in its value are factors to consider.

This method is often utilized by individuals who believe in the long-term value of their cryptocurrency and wish to avoid immediate tax consequences. However, it’s important to thoroughly evaluate your financial goals, market conditions, and the specific terms and requirements of the loan arrangement before implementing this strategy.

Given that this method involves financial services and borrowing arrangements, it’s advisable to seek guidance from experienced professionals in the cryptocurrency and lending industries. Working with tax experts and advisors who understand the complexities of cryptocurrency taxation can help you navigate this strategy effectively and minimize your tax liability while managing associated risks.

Remember that tax laws are subject to change, and regulations surrounding cryptocurrency and loan transactions vary across jurisdictions. Stay informed about the legal and tax implications in your country, and consult with experts to ensure compliance with local regulations.

Method 5: Establishing Offshore Entities for Tax Planning Purposes

For individuals with significant cryptocurrency holdings, establishing offshore entities can be an effective tax planning strategy. Offshore entities can offer favorable tax jurisdictions or structures that can legally reduce your tax obligations when cashing out cryptocurrency.

Here are some key aspects to consider when using offshore entities for tax planning:

- Understanding Offshore Jurisdictions: Offshore jurisdictions are countries or territories that offer tax advantages, such as low or zero capital gains tax, no income tax, or reduced reporting requirements. Examples include Switzerland, the Cayman Islands, and Malta, among others. It’s crucial to familiarize yourself with the specific tax laws, regulations, and reporting obligations in these jurisdictions.

- Choosing the Right Entity Structure: Depending on your goals and circumstances, you may consider establishing an offshore company, trust, or foundation. Each entity structure has its own advantages and considerations in terms of tax planning, asset protection, and compliance requirements. Work with legal and tax professionals to determine the most suitable structure for your specific needs.

- Ensuring Compliance: While offshore entities can offer tax benefits, it’s essential to comply with all applicable laws and regulations. Failure to do so can result in severe penalties and legal consequences. Be diligent in fulfilling reporting requirements, disclosing income, and maintaining proper records to demonstrate legitimate business activities.

- Tax Treaties and Exchange of Information: Many countries have entered into tax treaties and agreements for the exchange of financial information to combat tax evasion. Ensure that your offshore entity structure adheres to these regulations and that you remain compliant with your tax obligations in your home country.

- Seeking Professional Guidance: Establishing and maintaining offshore entities for tax planning purposes can be complex and requires expert guidance. Work with experienced professionals who specialize in international tax laws, offshore structuring, and compliance to ensure that you navigate this strategy legally and effectively.

It’s important to note that offshore tax planning should be approached with caution and transparency. While offshore entities can offer legitimate tax advantages, they are subject to intense scrutiny by tax authorities worldwide. Implementing this strategy solely for the purpose of evading taxes is illegal and can lead to severe consequences.

Before pursuing offshore tax planning, consider the potential costs, administrative burdens, and reputational risks associated with this strategy. Understand the trade-offs and carefully evaluate the financial and legal implications in light of your specific circumstances.

Given the evolving nature of international tax regulations, it’s crucial to stay informed about changes in the laws and regulations of both your home country and the chosen offshore jurisdiction. Regularly consult with tax professionals who possess expertise in cross-border tax planning to ensure ongoing compliance and to take advantage of any new opportunities that may arise.

Reporting Your Cryptocurrency Cashouts to the Tax Authorities

When cashing out cryptocurrency, it is essential to fulfill your tax reporting obligations by accurately reporting your transactions to the tax authorities. Failing to do so can result in penalties, fines, or even legal consequences. Here are some key considerations when reporting your cryptocurrency cashouts:

- Understand the Reporting Requirements: Familiarize yourself with the specific tax laws and reporting requirements in your jurisdiction. Each country may have its own rules and regulations for reporting cryptocurrency transactions. It’s important to stay updated on any changes or updates to ensure compliance.

- Keep Accurate Records: Maintain detailed and accurate records of your cryptocurrency transactions, including the purchase and sale dates, transaction amounts, the fair market value of the cryptocurrency at the time of the transactions, and any associated fees. These records will serve as evidence for your tax reporting and can help support the accuracy of your reported gains or losses.

- Differentiate Between Fiat and Cryptocurrency Transactions: Clearly distinguish between transactions involving traditional fiat currency and those involving cryptocurrency. Keep separate records for cryptocurrency transactions to ensure accurate reporting and avoid confusion.

- Use Tax Reporting Tools and Software: Consider using tax reporting tools or software specifically designed for cryptocurrency transactions. These tools can automate the process of calculating gains or losses, generate accurate reports, and simplify your tax reporting obligations.

- Consult with a Tax Professional: Given the complexities of cryptocurrency taxation, it is advisable to consult with a tax professional who has expertise in this area. They can provide guidance on your reporting obligations, assist in the accurate calculation of gains or losses, and help ensure compliance with tax laws.

- File Tax Returns on Time: Be diligent in submitting your tax returns on or before the deadline specified by the tax authorities. Late or incorrect filings may result in penalties or interest charges. If you are uncertain about any aspect of your tax reporting, seek professional advice to ensure accuracy and timeliness.

It’s important to note that some tax authorities have started implementing stricter guidelines and regulations specifically targeting cryptocurrency transactions. They may be actively monitoring and enforcing compliance in this area, given the increased adoption and usage of cryptocurrencies.

By fulfilling your tax reporting obligations and accurately reporting your cryptocurrency cashouts, you can ensure compliance with the law and maintain a transparent financial record. Doing so not only helps you avoid any potential legal ramifications but also establishes your credibility as a responsible taxpayer.

As always, tax laws and regulations are subject to change, and it’s crucial to stay informed about any updates relevant to cryptocurrency reporting in your jurisdiction. Regularly consult with tax professionals to ensure ongoing compliance and to take advantage of any available tax planning opportunities.

Keeping Accurate Records and Seeking Professional Advice

When it comes to cashing out cryptocurrency and managing your tax obligations, it is crucial to keep accurate records and seek professional advice. These practices are essential for maintaining compliance with tax laws and optimizing your financial situation. Here’s why:

- Record-Keeping: Keep detailed and organized records of all your cryptocurrency transactions, including purchases, sales, exchanges, and any fees involved. Record the transaction dates, the amounts involved, and the fair market value of the cryptocurrency at the time of each transaction. Accurate records are vital for calculating gains or losses, determining tax liability, and supporting the accuracy of your tax filings.

- Tax Reporting: Ensure that your records align with the specific tax reporting requirements of your jurisdiction. Different countries may have different rules and regulations for reporting cryptocurrency transactions. By maintaining accurate records, you can easily report your cashouts and fulfill your tax reporting obligations with confidence.

- Professional Guidance: Seek advice from tax professionals who specialize in cryptocurrency taxation. They can provide valuable assistance in understanding the tax implications of your cashouts, optimizing your tax planning strategies, and ensuring compliance with the ever-evolving tax laws.

- Tax Planning: Work with tax professionals to develop tax planning strategies tailored to your specific financial goals. They can help you identify opportunities to minimize your tax liability through proper timing of cashouts, utilization of tax deductions and credits, and exploring legal structures and jurisdictions that offer tax advantages.

- Stay Updated: Cryptocurrency taxation is a rapidly evolving field, with new regulations and guidelines being introduced regularly. Stay informed about any changes and updates to the tax laws in your jurisdiction. Professional advisors can provide the latest insights and help you stay compliant with the most recent requirements.

- Compliance and Risk Mitigation: By keeping accurate records and seeking professional advice, you can ensure compliance with tax laws and reduce the risk of errors, omissions, or potential penalties. A proactive approach to tax compliance and risk mitigation can protect your financial interests and provide peace of mind.

Remember that cryptocurrency tax issues can be complex, and the consequences of non-compliance can be significant. By maintaining accurate records and seeking professional advice, you demonstrate your commitment to fulfilling your tax obligations and effectively managing your financial affairs.

Additionally, consulting with professionals who specialize in cryptocurrency taxation allows you to tap into their expertise and experience. They can provide tailored advice based on your specific situation, helping you navigate the complexity of the tax landscape and make informed decisions regarding your cryptocurrency cashouts.

Ultimately, by keeping accurate records and seeking professional advice, you can ensure compliance, optimize your tax position, and confidently navigate the tax implications of cashing out cryptocurrency.

Conclusion

Cashing out cryptocurrency can be a significant financial event with tax implications that need to be carefully considered. By understanding the tax laws and regulations surrounding cryptocurrency cashouts, you can minimize your tax liability while ensuring compliance with the law.

In this article, we have explored key strategies for minimizing tax liability when cashing out cryptocurrency. These strategies include holding cryptocurrency for over a year to qualify for long-term capital gains tax rates, using tax-loss harvesting to offset gains with losses, donating cryptocurrency to charitable organizations, structuring cashouts as loans, and establishing offshore entities for tax planning purposes.

Additionally, we have emphasized the importance of reporting your cryptocurrency cashouts to the tax authorities, keeping accurate records, and seeking professional advice. These practices are crucial for maintaining compliance, optimizing your tax position, and mitigating the risk of penalties or legal consequences.

It’s important to note that tax laws surrounding cryptocurrencies are evolving and can vary by jurisdiction. Therefore, it is advisable to consult with experienced tax professionals who specialize in cryptocurrency taxation to ensure that you are making informed decisions and staying compliant with the latest regulations.

Remember, while the goal is to minimize your tax liability, it’s essential to be cautious and prioritize compliance. Engaging in illegal tax practices or evading tax obligations can have severe consequences.

By carefully considering the strategies outlined in this article, keeping accurate records, seeking professional advice, and staying informed about the latest developments in cryptocurrency taxation, you can navigate the tax implications of cashing out cryptocurrency effectively and optimize your financial outcomes.