Finance

What Is Cash Surrender Value Life Insurance?

Modified: December 29, 2023

Discover the ins and outs of cash surrender value life insurance! Learn how this financial tool can provide valuable benefits and help secure your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Surrender Value

- How Cash Surrender Value is Calculated

- Benefits of Cash Surrender Value Life Insurance

- Drawbacks of Cash Surrender Value Life Insurance

- Factors Affecting the Cash Surrender Value

- Tax Implications of Cash Surrender Value

- How to Access Cash Surrender Value

- Alternatives to Cash Surrender Value Life Insurance

- Conclusion

Introduction

Life insurance is a crucial component of financial planning, providing protection and financial security for your loved ones in the event of your passing. While there are various types of life insurance policies available, one option to consider is cash surrender value life insurance.

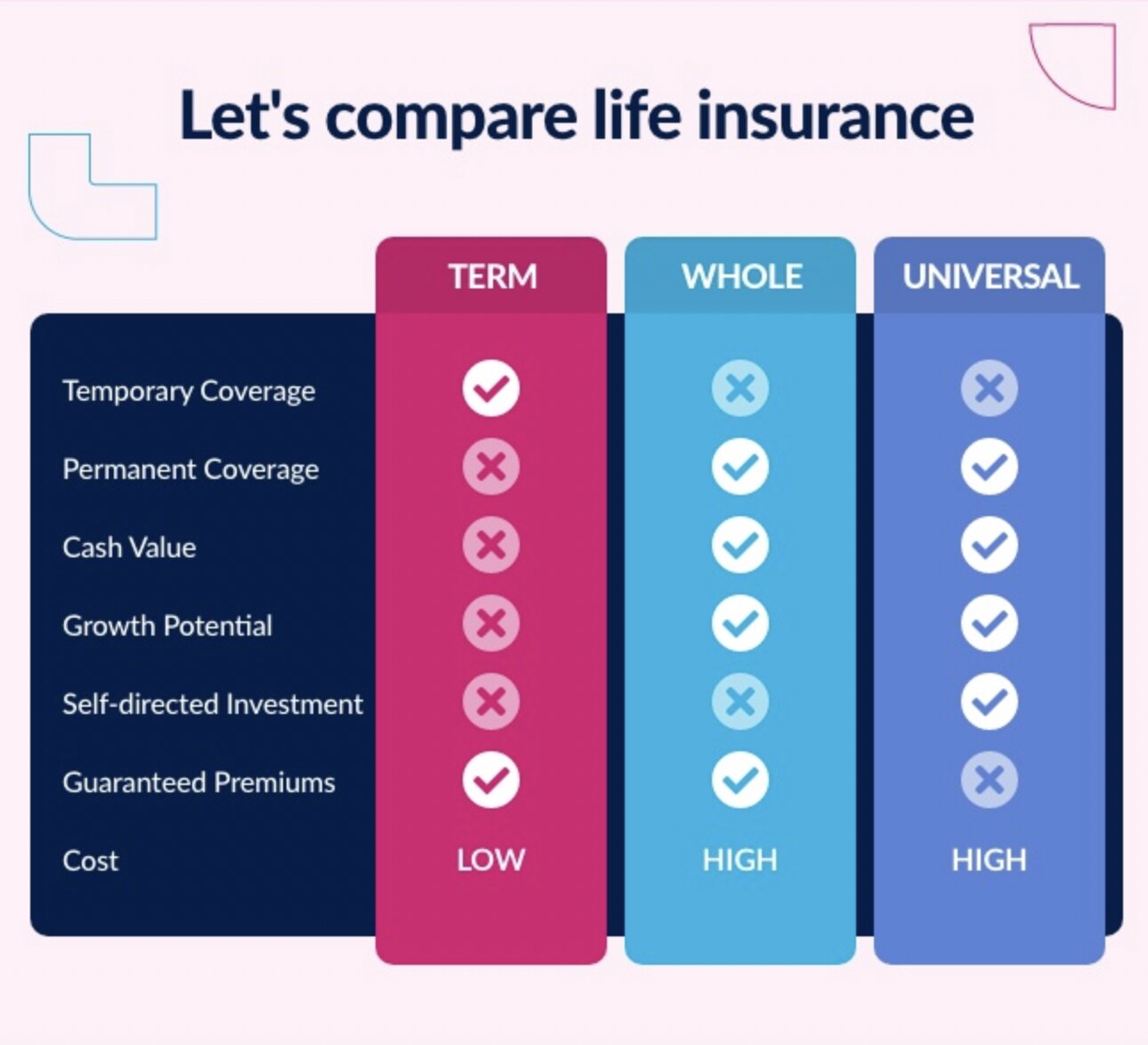

Cash surrender value refers to the amount of money you can receive if you surrender or cancel your life insurance policy before its maturity date. This feature is typically offered in permanent life insurance policies, such as whole life or universal life insurance, which provide coverage for your entire lifetime as long as the policy remains active.

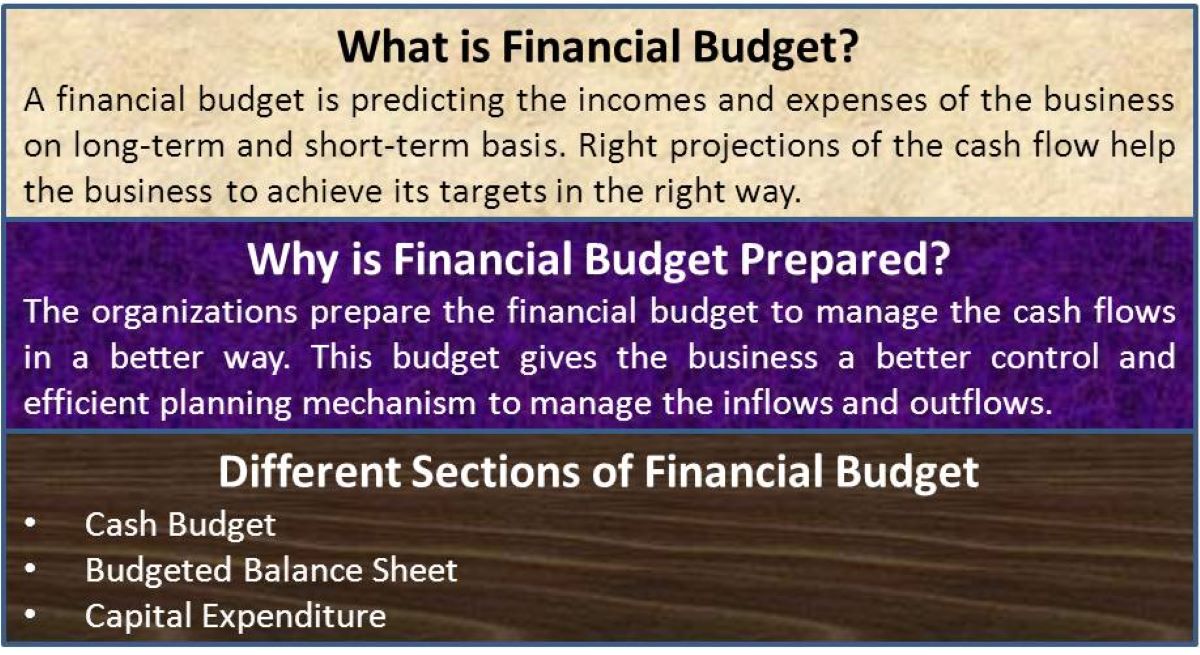

Understanding cash surrender value is important as it allows you to make informed decisions about your policy and maximize its benefits. In this article, we will explore the definition of cash surrender value, how it is calculated, the benefits and drawbacks of cash surrender value life insurance, factors affecting the cash surrender value, tax implications, how to access the cash surrender value, alternative options, and more.

Whether you are considering purchasing a new life insurance policy or have an existing policy, having a clear understanding of cash surrender value will empower you to make informed decisions that align with your financial goals and circumstances.

Definition of Cash Surrender Value

Cash surrender value, also known as surrender cash value or simply surrender value, is the amount of money that you would receive if you decide to cancel or surrender your permanent life insurance policy before its maturity date. This value represents the accumulated cash value of the policy, which is the amount that has built up over time through premium payments and potential investment growth.

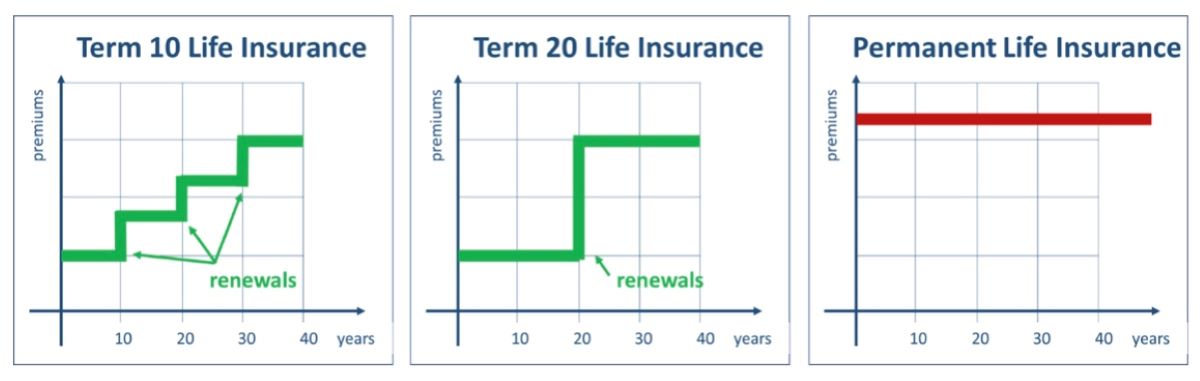

Unlike term life insurance, which provides coverage for a specific period of time, permanent life insurance policies have a cash value component that grows over time. A portion of each premium payment goes towards the cost of insurance coverage, while the rest is invested by the insurance company. This investment component is responsible for the accumulation of cash value within the policy.

The cash surrender value is not the same as the death benefit or the total amount your beneficiaries would receive upon your passing. It is the amount of money that you can access if you decide to terminate your policy prematurely.

It’s important to note that the cash surrender value may not be equivalent to the total amount of premiums paid into the policy. Some of the premium money goes towards administrative fees, mortality charges, and other associated costs. Therefore, the cash surrender value may be lower than the cumulative premiums paid.

The surrender value of a policy is determined based on various factors, such as the duration of the policy, the amount of premiums paid, the investment performance of the policy’s underlying assets, and any applicable surrender charges or penalties.

By understanding the definition and mechanics of cash surrender value, policyholders can make informed decisions about their life insurance policies, weighing the benefits and drawbacks associated with accessing the accumulated cash value.

How Cash Surrender Value is Calculated

The calculation of cash surrender value in a life insurance policy can be complex and varies depending on the specific policy terms, insurance company, and other factors. However, there are a few key components that generally contribute to the calculation:

- Premium Payments: The amount of premiums you have paid into the policy is a significant factor in determining the cash surrender value. The more premiums you have paid, the higher the surrender value is likely to be.

- Investment Performance: If your policy has an investment component, such as with universal life insurance, the performance of the underlying investment accounts can impact the cash surrender value. If the investments have experienced growth, it can contribute to an increased surrender value. Conversely, if the investments have underperformed, the surrender value may be lower.

- Surrender Charges or Penalties: Some life insurance policies impose surrender charges or penalties if you decide to access the cash surrender value within a certain period after policy issuance. These charges are intended to discourage policy surrender and may reduce the overall value you receive.

- Policy Expenses: Insurance companies deduct various expenses from the premiums you pay, such as administrative fees and mortality charges. These expenses are typically subtracted from the cash surrender value, potentially reducing the final amount you receive.

- Policy Duration: The length of time that the policy has remained active also plays a role in calculating the cash surrender value. Generally, the longer a policy has been in effect, the higher the surrender value tends to be.

It’s important to review your life insurance policy documents or consult with your insurance provider to understand the specific formula for calculating the cash surrender value. Additionally, keep in mind that the calculations may be subject to certain caveats and limitations outlined in the policy terms and conditions.

By understanding how the cash surrender value is calculated, policyholders can gain insight into the factors that influence the final amount they may receive if they decide to surrender their policy. This knowledge can help inform their decisions about accessing the accumulated cash value of their insurance policy.

Benefits of Cash Surrender Value Life Insurance

Cash surrender value life insurance offers several benefits to policyholders. Understanding these advantages can help individuals make informed decisions when selecting a life insurance policy.

- Access to Cash: One of the primary benefits of cash surrender value life insurance is the ability to access the accumulated cash value within the policy. Life is unpredictable, and there may be times when policyholders face financial difficulties or unexpected expenses. The cash surrender value can provide a source of funds that can be used for various purposes, such as covering medical expenses, paying off debts, or financing education.

- Flexible Premium Payments: Cash surrender value life insurance policies typically offer the flexibility to adjust premium payments over time. Policyholders may have the option to increase or decrease their premium amounts, skip payments, or even use the accumulated cash value to cover future premiums. This flexibility can be beneficial in managing financial obligations as circumstances change.

- Tax-Advantaged Growth: The cash value component of permanent life insurance policies grows on a tax-deferred basis. This means that policyholders do not have to pay taxes on the investment gains within the policy as long as the funds remain within the policy. This tax advantage can help the cash value grow more rapidly compared to taxable investment accounts.

- Collateral for Loans: The cash surrender value can often be used as collateral to secure low-interest loans from the insurance company or other financial institutions. This provides policyholders with an additional source of credit that can be utilized for various purposes, such as funding a business venture or home renovation.

- Protection for Beneficiaries: While the primary purpose of a life insurance policy is to provide financial protection for loved ones upon the policyholder’s passing, cash surrender value life insurance offers an additional layer of flexibility. In the event of a financial crisis or change in circumstances, policyholders have the option to utilize the accumulated cash value instead of surrendering the policy entirely, potentially leaving a reduced death benefit to their beneficiaries.

These benefits highlight the value of cash surrender value life insurance as a tool for financial planning and providing flexibility during different stages of life. It is essential to carefully consider these advantages in relation to your specific financial goals and needs before making a decision.

Drawbacks of Cash Surrender Value Life Insurance

While cash surrender value life insurance offers several benefits, it is important to consider the drawbacks associated with this type of policy. Understanding these disadvantages can help individuals make informed decisions about whether cash surrender value life insurance is the right choice for their financial needs.

- Surrender Charges: Many cash surrender value life insurance policies impose surrender charges or penalties if you decide to access the cash value or terminate the policy within a certain period, typically the first few years. These charges can significantly reduce the amount of money you receive and may diminish the perceived benefits of the policy.

- Reduced Death Benefit: When you access the cash value or surrender your policy, it often results in a reduction or elimination of the death benefit. This means that your beneficiaries may receive a reduced payout upon your passing. If the primary goal of your life insurance policy is to provide financial protection for loved ones, surrendering the policy might not be in their best interest.

- Insurance Costs: Cash surrender value policies tend to have higher premiums compared to term life insurance. The additional costs associated with building up cash value and investment components can make these policies more expensive on an ongoing basis. It is important to assess whether the benefits of the cash value justify the increased costs over time.

- Opportunity Cost: The cash value component of a life insurance policy is often invested by the insurance company. While this provides the potential for growth, it also means that you are relying on the insurer to make sound investment decisions. If the investment performance does not meet your expectations, it may impact the overall growth of the cash value.

- Limited Flexibility: Accessing the cash surrender value of your policy typically requires surrendering or canceling the entire policy. This lack of flexibility means that you lose the coverage and protection provided by the policy. If you still have a need for life insurance coverage, surrendering the policy may not be the most optimal choice.

It’s important to carefully weigh these drawbacks against the benefits and your specific financial situation. Working with a financial advisor can help you assess whether cash surrender value life insurance is the right fit for your long-term financial goals and needs.

Factors Affecting the Cash Surrender Value

The amount of cash surrender value in a life insurance policy is influenced by various factors. Understanding these factors can help policyholders gain insight into how their premiums and policy provisions contribute to the accumulation of cash value. Here are some key factors that can affect the cash surrender value:

- Premium Payments: The amount and frequency of premium payments impact the cash surrender value. Policies with higher premium amounts or regular payments tend to accumulate more significant cash values over time.

- Policy Duration: The length of time that the policy remains active plays a critical role in the growth of the cash surrender value. Generally, the longer a policy has been in effect, the higher the surrender value is likely to be.

- Investment Performance: If the life insurance policy has an investment component, such as with universal life insurance, the performance of the underlying investments can affect the cash surrender value. Positive investment returns can contribute to a higher cash value, while poor investment performance may result in a lower surrender value.

- Mortality and Expense Charges: Life insurance policies have various fees, including mortality charges and administrative expenses. These charges are deducted from the premium payments and can reduce the amount that goes towards building the cash value.

- Surrender Charges: Some insurance policies have surrender charges or penalties if you decide to access the cash value or surrender the policy within a specific period. These charges are usually higher in the early years of the policy and decrease over time.

- Policy Loans and Withdrawals: Policy loans or withdrawals can impact the cash surrender value. If you borrow against the policy or make partial withdrawals, the remaining cash value may be reduced accordingly.

- Interest Rate: The interest rate credited on the cash value by the insurance company affects its growth. Higher interest rates can lead to faster accumulation of cash value, while lower rates may slow down the growth.

- Cost of Insurance: The cost of insurance coverage provided by the policy affects the cash surrender value. As the policyholder ages, the cost of insurance generally increases, which can impact the cash value growth if premiums remain constant.

It’s important to review your policy documents and consult with your insurance provider to fully understand how these factors specifically apply to your life insurance policy. By considering these factors, policyholders can gain a better understanding of how their policy accumulates cash value over time.

Tax Implications of Cash Surrender Value

The cash surrender value of a life insurance policy can have several tax implications that policyholders should be aware of. While life insurance policies generally offer tax advantages, it’s essential to understand how accessing the cash surrender value may impact your tax situation. Here are some key tax considerations to keep in mind:

- Tax-Deferred Growth: The cash value component of a life insurance policy grows on a tax-deferred basis. This means that the investment gains within the policy are not subject to immediate taxation. As long as the funds remain within the policy, they can continue to grow tax-free.

- Surrender Value Taxation: If you decide to surrender your life insurance policy and access the cash surrender value, any amount received above the total amount of premiums paid may be subject to taxation. The portion considered as taxable income is typically the accumulated growth or investment gains within the policy.

- Ordinary Income Tax: If the cash surrender value is considered taxable income, it is typically taxed as ordinary income. The amount received may be added to your taxable income for the year, potentially impacting your overall tax bracket.

- Capital Gains Tax: If the cash surrender value includes substantial investment gains, it may be subject to capital gains tax rather than ordinary income tax. The tax rate will depend on your income level and the duration of time the investment gains have been accumulating.

- LIFO Taxation: Some life insurance policies utilize the LIFO (Last-In, First-Out) accounting method when calculating cash surrender value. Under LIFO taxation, any withdrawals or surrenders are treated as if they came from the earnings first, which can lead to higher taxable income.

- Potential Penalty Tax: In certain situations, if you surrender your policy before a certain age or before the policy has been in effect for a specific period, there may be additional penalty taxes you need to consider. These penalties are in place to discourage early policy terminations.

- Tax-Free Loans: In some cases, policyholders can access the cash surrender value through policy loans, which do not trigger immediate taxation. Loans against the cash value are considered debt and not treated as taxable income. However, it’s important to note that any unpaid loan balance plus interest may eventually reduce the death benefit paid to beneficiaries.

It’s crucial to consult with a tax professional or financial advisor for guidance on the specific tax implications of accessing the cash surrender value in your life insurance policy. They can provide personalized advice based on your unique circumstances to help you navigate the tax landscape effectively.

How to Access Cash Surrender Value

If you have a cash surrender value life insurance policy and wish to access the accumulated cash value, there are typically several options available to you. The specific methods for accessing the cash surrender value may vary depending on your insurance company and policy terms. Here are some common ways to access the cash surrender value:

- Surrender the Policy: The most straightforward way to access the cash surrender value is to surrender or cancel your life insurance policy. By doing so, you forfeit the death benefit, but you will receive the cash value that has accumulated over time.

- Partial Surrender: Some policies allow for partial surrenders, which means you can withdraw a portion of the cash surrender value while keeping the policy in force. Keep in mind that any partial surrender may result in a reduction in the overall death benefit and cash value.

- Policy Loan: Depending on your policy’s terms, you may have the option to take out a loan against the cash surrender value. Policy loans allow you to access the cash value while keeping the policy in force. These loans typically accrue interest, which will need to be repaid. Failure to repay the loan may result in a reduction of the death benefit.

- Withdrawals: Some policies allow for partial withdrawals from the cash surrender value. Similar to partial surrenders, withdrawals may reduce the policy’s death benefit and cash value. It’s important to check your policy’s terms for any restrictions or fees associated with withdrawals.

- Collateral for Loans: In some cases, you may be able to use the cash surrender value as collateral to secure a loan from a financial institution. This allows you to access funds while leveraging the value of your life insurance policy.

Keep in mind that accessing the cash surrender value will impact the overall value and benefits of your life insurance policy. Consider the long-term implications, such as the reduction of the death benefit, potential tax consequences, and the impact on future premium payments before making a decision.

Before taking any action, it’s essential to review your policy documents, understand the terms and conditions, and consult with your insurance provider or a financial advisor. They can provide guidance specific to your policy and help you make an informed decision that aligns with your financial goals and circumstances.

Alternatives to Cash Surrender Value Life Insurance

While cash surrender value life insurance can provide access to accumulated cash value, it may not be the most suitable option for everyone. Depending on your financial goals and circumstances, there are alternatives to consider. Here are some alternatives to cash surrender value life insurance:

- Term Life Insurance: If your primary goal is to provide financial protection for a specific period, such as the duration of a mortgage or until your children are financially independent, term life insurance may be a cost-effective alternative. Term policies offer coverage for a fixed term without building cash value, resulting in lower premiums.

- Permanent Life Insurance without Cash Value: Permanent life insurance policies, such as guaranteed universal life insurance, exist without the cash value component. These policies provide lifelong coverage but do not accumulate cash value. They may be more affordable than cash value policies and can still offer peace of mind and financial protection.

- Investment and Savings Accounts: For individuals looking to grow their savings and investments, utilizing traditional investment and savings accounts may be a viable alternative. By investing in stocks, bonds, mutual funds, or other financial products, you have the potential to earn higher returns and maintain more control over your funds compared to relying solely on a life insurance policy.

- Retirement Accounts: Contributing to retirement accounts, such as IRAs or 401(k)s, offers long-term growth potential and tax advantages. These accounts are specifically designed to help you save for retirement and may provide more flexibility and control over your funds compared to a cash surrender value policy.

- Long-Term Care Insurance: If you are concerned about covering potential long-term care costs in the future, consider purchasing a dedicated long-term care insurance policy. These policies provide coverage specifically for long-term care needs and can help protect your assets and financial well-being in the event of significant health-related expenses.

Each alternative has its own set of advantages and considerations. It’s crucial to assess your financial goals, risk tolerance, and future needs before deciding on the most appropriate option. Consulting with a financial advisor can provide valuable guidance in selecting the most suitable alternatives to cash surrender value life insurance based on your individual circumstances.

Remember that any decision regarding life insurance and financial planning should be made after careful consideration and a thorough understanding of the associated benefits, drawbacks, and potential consequences.

Conclusion

Cash surrender value life insurance can be a valuable tool in financial planning, providing policyholders with access to the accumulated cash value within their life insurance policies. Understanding the definition, calculation, benefits, drawbacks, and factors affecting cash surrender value is essential in making informed decisions about your life insurance policy.

The cash surrender value offers the flexibility to access funds, whether for unexpected expenses, financial hardships, or other financial goals. It provides a source of liquidity that can be used to address immediate financial needs.

However, accessing the cash surrender value may have drawbacks, such as surrender charges, reduced death benefit, and potential tax implications. It is important to carefully weigh the pros and cons, considering your long-term financial objectives, risk tolerance, and overall financial situation.

Exploring alternative options, such as term life insurance, permanent insurance without cash value, investment accounts, retirement accounts, or dedicated long-term care insurance, can provide additional avenues for achieving financial goals outside of cash surrender value life insurance.

Ultimately, the decision to access the cash surrender value or choose an alternative option should be based on a thorough assessment of your needs, preferences, and financial circumstances. Consulting with a financial advisor can provide valuable insights and guidance to help you navigate the complexities of life insurance and make the best decision for your financial future.

Remember, life insurance is a crucial component of financial planning, and understanding cash surrender value empowers you to make informed choices that align with your goals and priorities.