Home>Finance>What Is The Cash Surrender Value Of Life Insurance?

Finance

What Is The Cash Surrender Value Of Life Insurance?

Published: October 15, 2023

Discover the cash surrender value of life insurance and its impact on your finances. Learn how it can provide a valuable financial resource when needed.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is a valuable financial tool that provides protection and peace of mind for individuals and their loved ones. It ensures that in the event of an untimely death, beneficiaries will receive a payout, known as the death benefit. However, life insurance policies also offer an additional benefit known as the cash surrender value.

The cash surrender value is the amount of money that policyholders can receive if they decide to terminate or surrender their life insurance policy before the end of its term. This value is the accumulated cash value of the policy, which is the portion of the premiums paid that is not used to cover the cost of insurance. Instead, it is invested by the insurance company to generate returns.

The concept of cash surrender value may seem simple, but understanding all its aspects is crucial for policyholders looking to make informed financial decisions. In this article, we will deep dive into the intricacies of cash surrender value, including how it is calculated, factors that affect it, and its tax implications. Furthermore, we will explore alternatives to surrendering a policy and how policyholders can utilize their cash surrender value effectively.

Whether you are considering surrendering your life insurance policy or simply want to explore all your options, this article will provide you with a comprehensive understanding of the cash surrender value and its significance in the world of life insurance.

Understanding Cash Surrender Value

The cash surrender value of a life insurance policy represents the amount of money that policyholders are entitled to receive if they decide to terminate their policy prematurely. It is essentially the savings component of a life insurance policy and can be an attractive feature for individuals looking for financial flexibility.

When you purchase a life insurance policy, a portion of your premium payments goes towards covering the cost of insurance, while the remaining portion goes towards building the cash value of the policy. The cash value grows over time, accruing interest and dividends, depending on the policy type and performance of the underlying investments.

It’s important to note that the cash value of a life insurance policy takes time to accumulate. In the early years of the policy, a significant portion of the premiums goes towards the cost of insurance, and the cash value may only start building up after a few years. As the policy matures, a larger proportion of the premium is allocated to the cash value component.

The cash surrender value represents the available amount that policyholders can receive if they surrender or terminate their life insurance policy before its maturity or before the death of the insured. This cash value can be a valuable asset, providing policyholders with a financial safety net or the opportunity to explore other investment opportunities.

It’s important to note that the cash surrender value is not equal to the full face value or death benefit of the policy. The death benefit is the amount that will be paid out to the beneficiaries upon the death of the insured. The cash surrender value is typically lower than the death benefit because it takes into account the expenses and fees associated with terminating the policy prematurely.

Understanding the cash surrender value of your life insurance policy is crucial, as it can help you assess the financial implications of surrendering the policy and make an informed decision based on your unique circumstances and financial goals.

Calculation of Cash Surrender Value

The calculation of cash surrender value varies depending on the type of life insurance policy you have. Here are some common methods used by insurance companies to determine the cash surrender value:

- Ordinary Life Policies: For whole life or ordinary life policies, the cash surrender value is based on a predetermined schedule or formula provided by the insurance company. This formula takes into account factors such as the policy’s duration, premium payments, and interest credited to the cash value.

- Universal Life Policies: Universal life insurance policies generally have more flexibility when it comes to determining the cash surrender value. The policy’s cash value is determined by the accumulated premiums, expenses, and the performance of the underlying investments. The insurance company calculates the cash surrender value based on the policy’s net surrender value, which deducts any surrender charges or fees.

- Variable Life Policies: With variable life insurance policies, the cash surrender value is tied to the performance of the policy’s investment options. The cash surrender value fluctuates based on the returns of the underlying investments. Insurance companies provide periodic statements that reflect the current cash surrender value based on the performance of the investments.

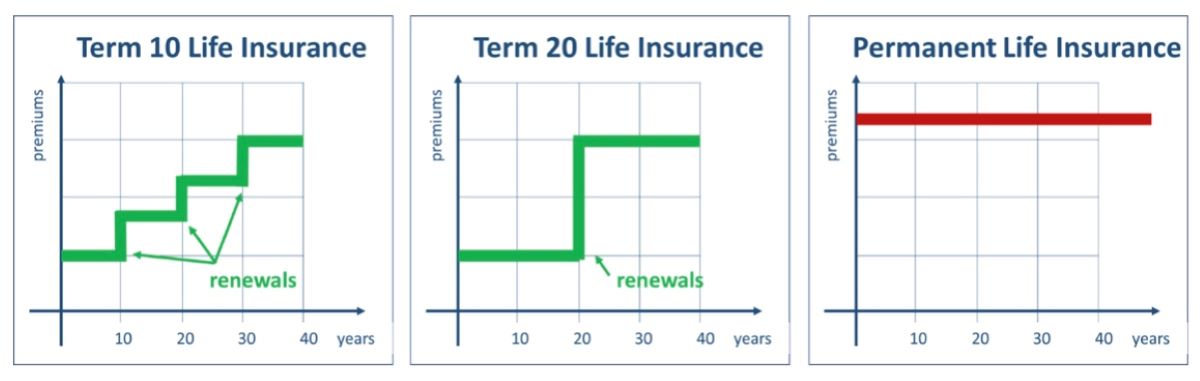

- Term Life Policies: Term life insurance policies generally do not have a cash surrender value. They are designed to provide coverage for a specific period, and once the term ends, the policy expires with no cash value. If a policyholder decides to surrender a term life policy before its expiration, there is typically no cash surrender value.

When calculating the cash surrender value, insurance companies often deduct any outstanding loans or unpaid premiums from the accumulated cash value. Additionally, surrender charges or fees may also be deducted, especially for policies surrendered within the first few years. These charges are meant to recoup administrative costs and may vary depending on the insurance company and policy terms.

Keep in mind that the cash surrender value is not a guaranteed amount and may fluctuate depending on market conditions, policy performance, and the terms and conditions outlined in the insurance contract. It is always advised to review the policy details and consult with your insurance company or financial advisor to understand the specific calculation method used for your policy.

Factors Affecting Cash Surrender Value

Several factors can influence the cash surrender value of a life insurance policy. Understanding these factors is essential for policyholders to have a clearer picture of how their decisions and external conditions can impact the value of their policy. Here are some key factors that can affect the cash surrender value:

- Premium Payments: The amount and consistency of premium payments directly impact the cash value of a life insurance policy. Higher premium payments and consistent payments over the policy’s duration can result in a higher cash surrender value.

- Policy Type: The type of life insurance policy you have plays a significant role in determining the cash surrender value. Whole life or permanent policies generally have a higher cash surrender value compared to term life policies, which may not have any cash value.

- Policy Duration: The longer a life insurance policy has been active, the more time it has had to accumulate cash value. Policies that have been in force for a longer period generally have a higher cash surrender value.

- Interest Rates: The interest rates credited to the cash value component of a policy can affect the growth of the cash surrender value. Higher interest rates can lead to faster accumulation of cash value and a higher cash surrender value.

- Policy Expenses and Charges: The expenses and charges associated with a life insurance policy, such as administrative fees, cost of insurance charges, and surrender charges, can impact the cash surrender value. These expenses are deducted from the cash value, reducing the overall value of the policy.

- Market Performance (For Variable Policies): For variable life insurance policies, the performance of the underlying investments can directly affect the cash surrender value. If the investments perform well, the cash value can increase. Conversely, poor market performance can result in a lower cash surrender value.

- Surrender Timing: The timing of surrendering a life insurance policy can impact the cash surrender value. Surrendering a policy early on may result in lower cash value due to surrender charges or fees. On the other hand, surrendering a policy after a certain period when the policy has accumulated more cash value may result in a higher cash surrender value.

It’s important to note that these factors can interact with one another, and their impact on the cash surrender value may vary depending on the specific terms and conditions of your life insurance policy. Consulting with your insurance company or a financial advisor can provide personalized insights into how these factors may affect your policy specifically.

Surrendering a Life Insurance Policy

Surrendering a life insurance policy means voluntarily terminating the policy before its maturity or before the death of the insured. This decision should be carefully considered as it can have financial implications and impact your long-term goals. Here are some important points to understand about surrendering a life insurance policy:

1. Reason for Surrender: Before surrendering your policy, it’s important to understand why you are considering this option. Evaluate your current financial situation, future goals, and whether you still need the coverage provided by the policy. Explore alternative options and consider seeking advice from a financial professional to ensure surrendering the policy aligns with your overall financial strategy.

2. Surrender Charges: Many life insurance policies, especially those with cash value components, may have surrender charges or fees associated with early termination. These charges are meant to recover the costs incurred by the insurance company when issuing the policy. Review your policy documents or contact your insurance company to understand the surrender charges applicable to your policy.

3. Cash Surrender Value: When you surrender your life insurance policy, you are entitled to receive the cash surrender value. This is the accumulated cash value of the policy, after deducting any outstanding loans, unpaid premiums, and surrender charges, if applicable.

4. Tax Considerations: Surrendering a life insurance policy may have tax implications. The cash surrender value received may be subject to income tax if it exceeds the premiums paid into the policy. Consult with a tax advisor to understand the tax implications specific to your situation, as rules can vary depending on your jurisdiction and policy type.

5. Alternatives to Surrender: If you are considering surrendering your policy due to financial difficulties or changing needs, explore alternative options before making a final decision. You may be able to reduce the death benefit, adjust the premium payments, or utilize features such as policy loans or partial withdrawals to meet your current objectives without surrendering the policy completely.

6. Impact on Coverage: Surrendering a life insurance policy means you will no longer have the coverage provided by the policy. If you are surrendering a policy without securing an alternative coverage option, ensure that you are comfortable with the potential financial impact on your loved ones in the event of your passing.

Surrendering a life insurance policy is a significant decision that should be made after careful consideration and evaluation of your unique circumstances. It is advisable to review your policy documents, consult with your insurance company, and seek guidance from a financial professional to fully understand the implications and explore all available options.

Utilizing Cash Surrender Value

The cash surrender value of a life insurance policy can be a valuable asset that provides policyholders with financial flexibility and opportunities. Here are some ways you can effectively utilize the cash surrender value:

1. Emergency Fund: One option is to use the cash surrender value to establish or boost your emergency fund. An emergency fund is crucial for unexpected expenses or periods of financial instability. Having a cash reserve can provide peace of mind and prevent the need to rely on high-interest debt or liquidate other investments.

2. Debt Repayment: If you have outstanding debts, such as credit card debt, personal loans, or a mortgage, using the cash surrender value to pay off or reduce these debts can be beneficial. By eliminating high-interest debt, you can improve your financial position and potentially save on interest payments.

3. Retirement Planning: The cash surrender value can be redirected towards retirement savings. You may choose to contribute the funds to a retirement account, such as an Individual Retirement Account (IRA) or a 401(k). This can help boost your retirement savings and provide a tax-deferred or tax-free growth opportunity, depending on the account type.

4. Alternative Investments: The cash surrender value can be invested in other vehicles, such as stocks, bonds, mutual funds, or real estate. Diversifying your investments can potentially generate higher returns and provide opportunities for long-term growth. Consider consulting with a financial advisor to ensure you make informed investment decisions that align with your risk tolerance and financial goals.

5. Purchase a new life insurance policy: If you still require life insurance coverage but wish to change your policy type or provider, you can utilize the cash surrender value to help fund the premium payments of a new policy. This can help you secure the coverage you need while making use of the accumulated cash value from the surrendered policy.

It is important to evaluate and prioritize your financial needs and goals before deciding how to use the cash surrender value. Consider discussing your options with a financial advisor who can help guide you based on your specific circumstances and objectives.

Keep in mind that utilizing the cash surrender value effectively requires careful planning and consideration. Be aware of any tax implications or potential penalties associated with the chosen course of action, and compare the potential benefits to the long-term value of maintaining the existing life insurance policy.

Tax Implications of Cash Surrender Value

When it comes to the cash surrender value of a life insurance policy, there are tax implications to consider. The tax treatment of the cash surrender value depends on several factors, including the premiums paid, the policy type, and the amount received upon surrender. Here are some key points to understand about the tax implications:

1. Tax-Free Nature: Generally, the growth within a life insurance policy is tax-deferred, meaning that policyholders do not pay taxes on the accumulation of cash value while the policy is in force. As long as the policy remains active, the cash value can grow without being subject to income taxes.

2. Surrender Value vs. Premiums Paid: When surrendering a life insurance policy, the cash surrender value received may include not only the premiums paid but also the accumulated earnings. The portion of the cash surrender value that exceeds the total premiums paid is considered taxable income.

3. Taxable Income Calculation: The taxable portion of the cash surrender value is determined by subtracting the total premiums paid from the total cash surrender value. The difference is treated as ordinary income and may be subject to income tax in the year of surrender. It’s important to consult with a tax advisor to accurately calculate the taxable portion and to understand the tax implications specific to your situation.

4. Surrender Charges Deductible: Surrender charges or fees associated with terminating the life insurance policy may be tax-deductible. These charges can be deducted from the cash surrender value, reducing the taxable income generated from the surrender.

5. Estate Tax Considerations: If the policyholder passes away and their beneficiaries receive the death benefit, it is generally not subject to income tax. However, the death benefit may be included in the policyholder’s estate for estate tax purposes. It’s important to consult with an estate planning professional to understand how the cash surrender value and death benefit may impact your overall estate planning strategy.

6. Modified Endowment Contract (MEC): In some cases, a life insurance policy may become classified as a MEC if certain premium payment thresholds are exceeded. MECs have different tax rules, and withdrawals or surrenders may be subject to income tax and potentially incur additional penalties. It’s crucial to monitor your policy and consult with a financial advisor to avoid unintentionally triggering the MEC status.

It’s important to note that tax laws can vary by jurisdiction, and policies may have different tax implications depending on their specific terms and conditions. Therefore, it is highly recommended to consult with a tax advisor or financial professional to fully understand the tax implications of surrendering a life insurance policy and to ensure compliance with tax regulations.

Alternatives to Surrendering a Policy

Surrendering a life insurance policy is not the only option if you find yourself in a situation where the current policy no longer aligns with your needs. Here are some alternatives to consider before making the decision to surrender your policy:

1. Paid-Up Insurance: If you have accumulated sufficient cash value within your policy, you may have the option to convert it to a paid-up policy. This means that you no longer need to pay future premiums, and the policy remains in force with a reduced death benefit. This option allows you to maintain some level of coverage while eliminating the need for ongoing premium payments.

2. Policy Loans: Some life insurance policies offer the ability to take out a loan against the cash value. This can be a valuable option if you need access to funds but still want to maintain the policy. Keep in mind that policy loans accrue interest, which can affect the cash value and death benefit if not repaid. However, if managed properly, policy loans can be a useful alternative to surrendering the policy entirely.

3. Reduced Coverage: If you no longer require the full coverage provided by your current policy, you may have the option to reduce the death benefit. This can result in lower premium payments while still maintaining some level of coverage. Review your policy terms and consult with your insurance company to explore this option and understand how it may impact the cash value.

4. Exchange or Conversion: Depending on the type of life insurance policy you have, you may be able to exchange or convert it into a different policy type that better suits your current needs. For example, a term life policy can often be converted into a permanent policy without undergoing medical underwriting. This allows you to maintain coverage while potentially taking advantage of the cash value component.

5. Policy Surrender for Partial Cash Value: If you are in need of funds but do not want to surrender the entire policy, some insurance companies offer the option to surrender a portion of the cash value while keeping the rest of the policy intact. This allows you to access some funds while still retaining a reduced death benefit and potential for future growth.

When considering alternatives to surrendering a life insurance policy, it’s important to carefully review the policy terms, potential fees, and the impact on the cash value and death benefit. Consult with your insurance provider and a financial advisor to fully understand the options available and make an informed decision that aligns with your current financial goals and needs.

Conclusion

The cash surrender value of a life insurance policy provides policyholders with options and flexibility when it comes to their financial planning. Understanding the concept of cash surrender value, its calculation, and the factors that affect it is vital for making informed decisions about your life insurance policy.

When contemplating surrendering your policy, consider all alternatives, such as paid-up insurance, policy loans, reducing coverage, or policy conversion. Each option has its own advantages and considerations, so it’s crucial to assess your specific circumstances and financial goals before making a decision.

Additionally, be mindful of the tax implications associated with surrendering a life insurance policy. The tax treatment of the cash surrender value depends on various factors, including the policy type, premiums paid, and the amount received upon surrender. Consulting with a tax advisor can help you navigate the complexities and understand the potential tax consequences.

Ultimately, your financial journey is unique to you, and the decision to surrender a life insurance policy should be made after careful evaluation of your individual needs, objectives, and the potential impact on your overall financial plan.

Remember to review your policy documents, consult with your insurance provider, and seek guidance from qualified professionals who can offer personalized advice tailored to your situation. By understanding the intricacies of the cash surrender value and exploring all viable options, you can make informed decisions that align with your financial goals and provide a solid foundation for your future.