Finance

What Is Credco Credit Inquiry?

Published: March 5, 2024

Learn about Credco credit inquiries and their impact on your finance. Understand how they affect your credit score and loan applications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit inquiries, where financial decisions and credit scores intersect. In this article, we will delve into the realm of Credco credit inquiries, shedding light on what they are, why they matter, and how they can impact your financial standing. Understanding Credco credit inquiries is crucial for anyone navigating the complex landscape of credit and seeking to maintain a healthy credit profile.

Credit inquiries play a pivotal role in the financial realm, influencing lending decisions and shaping individuals' creditworthiness. Credco, a leading provider of credit reporting and consumer information, is a key player in this domain. By examining Credco credit inquiries, we can gain valuable insights into their significance and the implications they hold for consumers.

Throughout this article, we will explore the intricacies of Credco credit inquiries, unraveling their impact on credit scores and financial well-being. Whether you are a seasoned financial aficionado or someone taking the first steps toward understanding credit, this exploration of Credco credit inquiries will equip you with essential knowledge to navigate the credit landscape with confidence.

So, join us on this enlightening journey as we demystify Credco credit inquiries and discover their significance in the realm of personal finance.

Understanding Credco Credit Inquiry

Before delving into the specifics of Credco credit inquiries, it’s essential to grasp the fundamental concept of credit inquiries. A credit inquiry, also known as a credit pull or credit check, occurs when a third party requests to view an individual’s credit report. This request is typically made by lenders, creditors, or service providers to assess an individual’s creditworthiness when they apply for a loan, credit card, or other financial products.

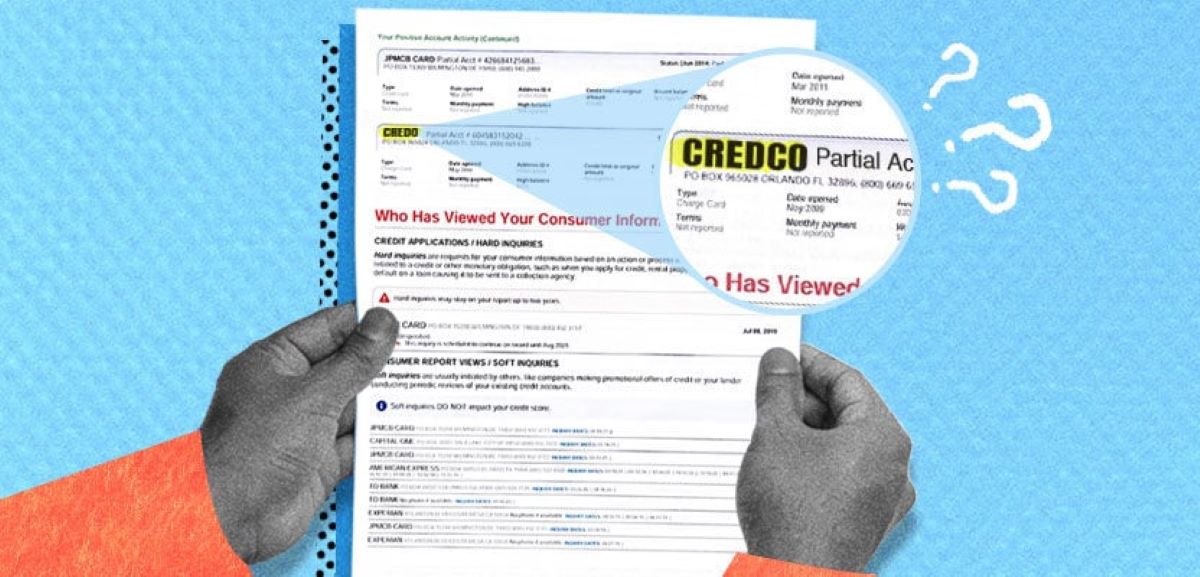

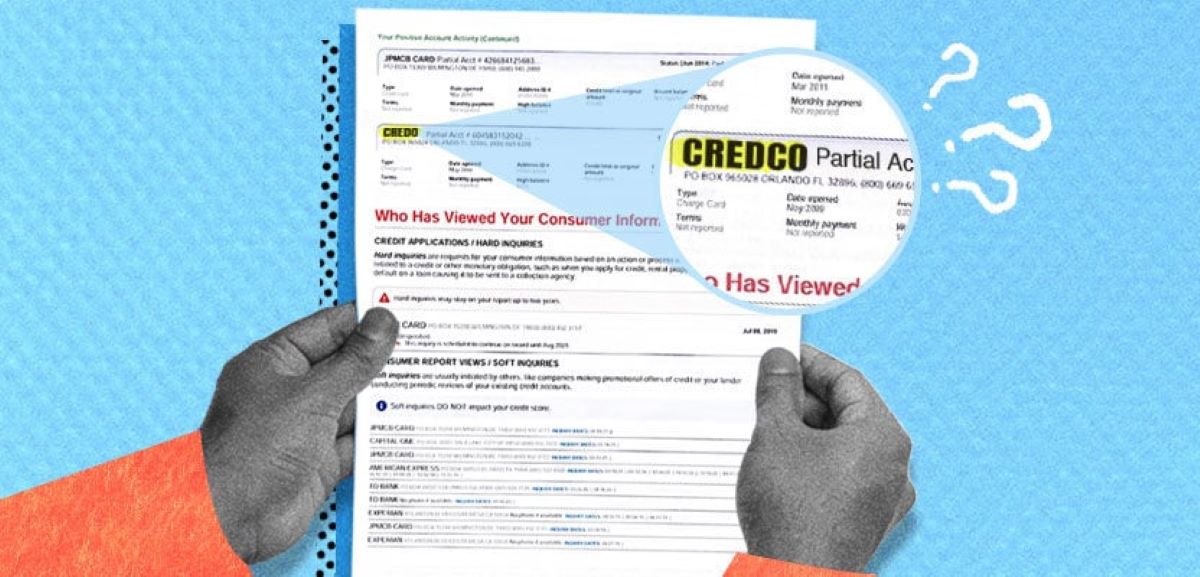

Credco, short for CoreLogic Credco, is a prominent consumer information and credit reporting agency that provides insights and data to support informed lending decisions. When a lender or financial institution partners with Credco, they may utilize Credco credit inquiries to evaluate an individual’s credit history and assess the associated risks before extending credit.

It’s important to note that there are two types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries occur when a potential lender reviews an individual’s credit report as part of a credit application process. These inquiries are typically initiated when someone applies for a mortgage, auto loan, or credit card. On the other hand, soft inquiries, often associated with background checks or pre-approved offers, do not impact an individual’s credit score.

When it comes to Credco credit inquiries, they are primarily associated with hard inquiries, as they are typically conducted in the context of credit applications. By leveraging Credco’s comprehensive consumer information, lenders can gain a detailed understanding of an individual’s credit history and make well-informed lending decisions.

Understanding Credco credit inquiries involves recognizing their role in facilitating fair and responsible lending practices. By providing lenders with valuable credit insights, Credco contributes to the foundation of trust and transparency in the credit ecosystem, benefiting both consumers and lenders alike.

Now that we’ve established the groundwork for comprehending Credco credit inquiries, let’s delve deeper into why these inquiries matter and how they can impact your financial journey.

Why Credco Credit Inquiry Matters

Credco credit inquiries hold significant relevance in the realm of personal finance and credit management. These inquiries matter for several compelling reasons, each of which underscores their impact on individuals’ financial well-being.

- Lending Decisions: When individuals apply for credit, whether it’s a mortgage, auto loan, or credit card, lenders conduct credit inquiries to assess the associated risks. Credco credit inquiries, known for their comprehensive consumer information, play a crucial role in enabling lenders to make informed and responsible lending decisions. By leveraging Credco’s insights, lenders can gain a holistic view of an individual’s credit history, empowering them to extend credit with confidence.

- Creditworthiness Evaluation: Credco credit inquiries directly contribute to the evaluation of an individual’s creditworthiness. As these inquiries provide lenders with detailed credit information, they influence the terms and conditions offered to consumers. A positive credit history revealed through Credco inquiries can result in favorable interest rates and credit terms, while a less favorable history may lead to less favorable terms.

- Impact on Financial Opportunities: The outcomes of Credco credit inquiries can significantly impact individuals’ access to financial opportunities. A strong credit profile, as depicted in Credco inquiries, can open doors to competitive loan offers, higher credit limits, and enhanced financial products. Conversely, a less favorable credit history may limit the availability of credit options and lead to less advantageous terms.

By understanding why Credco credit inquiries matter, individuals can appreciate the pivotal role these inquiries play in shaping their financial journey. Whether it’s securing a mortgage for a dream home, obtaining an auto loan for a new vehicle, or accessing credit cards with favorable terms, the impact of Credco credit inquiries reverberates across various facets of personal finance.

Next, we’ll explore how Credco credit inquiries can affect individuals’ credit scores, shedding light on the interconnected nature of credit inquiries and creditworthiness.

How Credco Credit Inquiry Affects Your Credit Score

Understanding the impact of Credco credit inquiries on your credit score is essential for managing your credit profile effectively. When you apply for credit, whether it’s a loan or a credit card, the resulting credit inquiry can influence your credit score. It’s important to differentiate between the effects of hard inquiries, such as those associated with Credco credit inquiries, and soft inquiries on your credit score.

Hard inquiries, including Credco credit inquiries, can have a temporary impact on your credit score. Each hard inquiry typically results in a small decrease in your score, as it indicates that you are actively seeking new credit. However, the effect of a single hard inquiry is minimal and often offset by other positive credit behavior. It’s important to note that credit scoring models are designed to recognize rate shopping for certain types of loans, such as mortgages or auto loans, and treat multiple inquiries within a specific timeframe as a single inquiry.

On the other hand, soft inquiries, which are not associated with credit applications, do not affect your credit score. These inquiries may occur when you check your own credit report, when a potential employer conducts a background check, or when you receive pre-approved credit offers. Credco inquiries primarily involve hard inquiries, reflecting the credit application process and its potential impact on your credit score.

While the impact of Credco credit inquiries on your credit score is temporary, it’s crucial to be mindful of the cumulative effects of multiple inquiries within a short timeframe. A flurry of credit applications can raise concerns among lenders and may lead to more significant credit score impacts. Therefore, it’s advisable to apply for credit strategically and conscientiously to minimize potential effects on your credit score.

By understanding how Credco credit inquiries affect your credit score, you can navigate the credit application process with awareness and make informed decisions to maintain a healthy credit profile. Next, we’ll explore how you can monitor Credco credit inquiries and stay informed about your credit activity.

How to Monitor Credco Credit Inquiry

Monitoring Credco credit inquiries and staying informed about your credit activity is a proactive approach to managing your credit profile. By keeping a close eye on Credco inquiries, you can gain valuable insights into the instances where your credit report is accessed by potential lenders. Here are effective strategies to monitor Credco credit inquiries:

- Regularly Check Your Credit Report: Access your credit report from major credit bureaus, such as Equifax, Experian, and TransUnion, to review any Credco credit inquiries. Under the Fair Credit Reporting Act (FCRA), you are entitled to a free credit report from each bureau annually. Examining your credit report allows you to identify any unauthorized or unfamiliar Credco inquiries, enabling you to address potential issues promptly.

- Utilize Credit Monitoring Services: Consider enrolling in credit monitoring services that provide real-time alerts about changes to your credit report, including new inquiries. These services offer added convenience by delivering notifications directly to your email or mobile device, keeping you informed about Credco credit inquiries and other credit-related activities.

- Stay Vigilant Against Identity Theft: Monitoring Credco credit inquiries serves as a protective measure against identity theft and unauthorized credit access. By promptly identifying unfamiliar inquiries, you can take necessary steps to safeguard your personal information and mitigate potential fraudulent activities.

By actively monitoring Credco credit inquiries, you can maintain a proactive stance in safeguarding your credit profile and addressing any irregularities effectively. This proactive approach aligns with the principles of responsible credit management and empowers you to take control of your financial well-being.

As we conclude this exploration of monitoring Credco credit inquiries, it’s evident that staying informed about your credit activity is a cornerstone of sound credit management. By leveraging the strategies outlined above, you can navigate the credit landscape with confidence and ensure that Credco inquiries accurately reflect your credit application activities.

Conclusion

In conclusion, Credco credit inquiries play a pivotal role in shaping individuals’ credit experiences and influencing lending decisions. By understanding the significance of Credco inquiries and their impact on credit scores, individuals can navigate the credit landscape with awareness and make informed financial decisions.

Throughout this exploration, we’ve unveiled the essence of Credco credit inquiries, shedding light on their role in evaluating creditworthiness and facilitating responsible lending practices. From the lens of credit applications to the nuances of credit score impacts, Credco inquiries serve as a compass guiding individuals through the intricacies of the credit ecosystem.

It’s crucial to recognize the temporary nature of credit score impacts resulting from Credco inquiries, particularly hard inquiries associated with credit applications. By adopting a strategic approach to credit applications and vigilantly monitoring credit activity, individuals can mitigate potential credit score fluctuations and maintain a healthy credit profile.

Monitoring Credco credit inquiries emerges as a proactive strategy, enabling individuals to stay informed about their credit report access and promptly address any irregularities. This proactive stance aligns with the principles of responsible credit management, empowering individuals to safeguard their credit profiles and mitigate the risks of unauthorized credit access.

As we navigate the dynamic landscape of personal finance and credit management, understanding Credco credit inquiries equips individuals with the knowledge to make informed decisions, protect their credit standing, and pursue their financial goals with confidence. By embracing the insights gleaned from this exploration, individuals can embark on their credit journeys with clarity and resilience, leveraging the significance of Credco inquiries to shape their financial well-being.

In essence, Credco credit inquiries serve as a testament to the interconnected nature of credit, lending, and consumer empowerment, underscoring their enduring impact on individuals’ financial trajectories. By embracing a proactive and informed approach to managing Credco inquiries, individuals can navigate the credit landscape with resilience, safeguard their credit profiles, and pursue their aspirations with unwavering confidence.