Finance

What Is JPMCD Credit Inquiry

Published: March 5, 2024

Learn about JPMCD credit inquiries and their impact on your finances. Understand how these inquiries affect your credit score and financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

When it comes to managing your financial well-being, understanding the intricacies of credit inquiries is crucial. One such inquiry that often raises questions is the JPMCD credit inquiry. In this article, we will delve into the specifics of JPMCD credit inquiries, exploring their significance, impact, and how to handle them effectively. By gaining insight into this aspect of credit management, you can make informed decisions and take proactive steps to maintain a healthy credit profile.

Whether you’re applying for a loan, credit card, or mortgage, your credit history plays a pivotal role in the approval process. Financial institutions, including JPMorgan Chase, conduct credit inquiries to assess an individual’s creditworthiness and determine the risk associated with extending credit. Understanding why these inquiries are conducted and their implications on your credit score is essential for navigating the complex landscape of personal finance.

Throughout this article, we will unravel the intricacies of JPMCD credit inquiries, shedding light on their significance and providing actionable insights for managing and addressing these inquiries. By the end of this exploration, you will have a comprehensive understanding of JPMCD credit inquiries and be better equipped to navigate the realm of credit management with confidence.

**

Understanding JPMCD Credit Inquiry

**

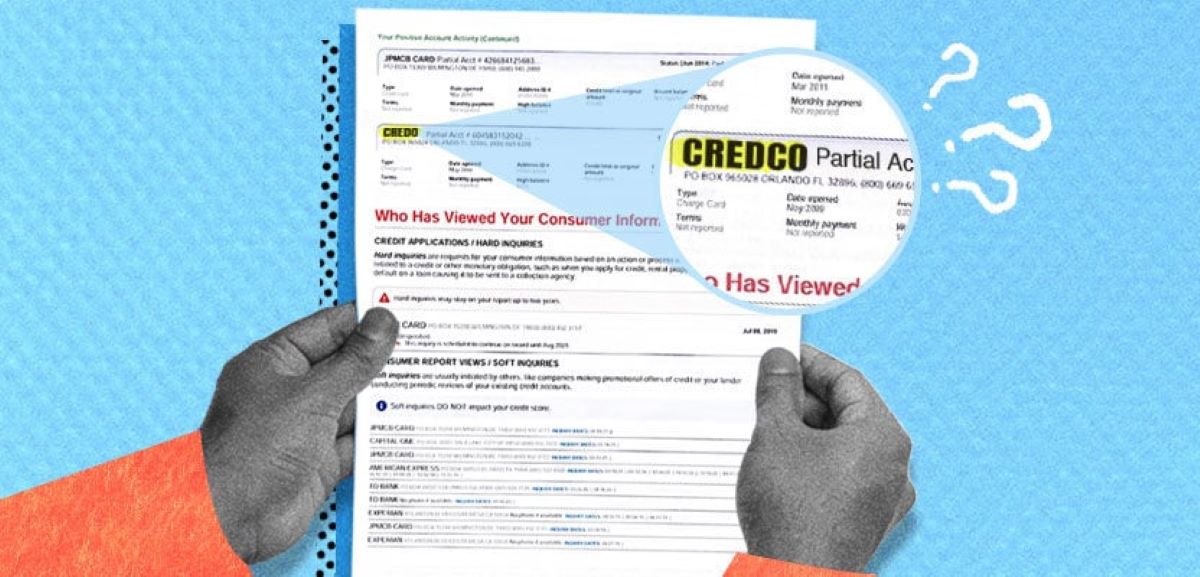

Before delving into the specifics of JPMCD credit inquiries, it’s important to grasp the fundamental concept of a credit inquiry. A credit inquiry, also known as a credit check, occurs when a lender or financial institution requests to view your credit report from one of the major credit bureaus. This inquiry provides the requester with insight into your credit history, including your payment history, outstanding debts, and the length of your credit history.

In the case of JPMCD credit inquiries, these are initiated by JPMorgan Chase, one of the leading financial institutions globally. When you apply for a financial product or service offered by JPMorgan Chase, such as a credit card or loan, the company may conduct a credit inquiry to evaluate your creditworthiness. This inquiry helps JPMorgan Chase assess the level of risk associated with extending credit to you, ultimately influencing their decision regarding your application.

It’s important to note that there are two types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries occur when you apply for credit, such as a mortgage or auto loan, and typically have a temporary impact on your credit score. On the other hand, soft inquiries, which are not related to credit applications, may occur when a company checks your credit as part of a background check or when you check your own credit report.

When it comes to JPMCD credit inquiries, they are generally classified as hard inquiries, as they are directly linked to credit applications. Understanding the nature of these inquiries and their distinction from soft inquiries is essential for comprehending their impact on your credit profile.

By gaining a clear understanding of JPMCD credit inquiries and their classification within the realm of credit checks, you can navigate the credit application process with greater awareness and preparedness.

**

Why JPMCD Conducts Credit Inquiries

**

JPMorgan Chase, like many other financial institutions, conducts credit inquiries for several reasons, all of which are aimed at assessing the creditworthiness and risk associated with extending credit to an individual. By understanding the motivations behind these inquiries, you can gain insight into the factors that influence JPMorgan Chase’s decision-making process when considering credit applications.

One primary reason for JPMCD credit inquiries is to evaluate an individual’s financial responsibility and track record of managing credit. By reviewing an applicant’s credit history, JPMorgan Chase can assess their likelihood of repaying debts and managing credit obligations in a timely manner. This assessment is crucial for the company to make informed decisions regarding credit approvals and to mitigate the risk of default.

Furthermore, JPMorgan Chase conducts credit inquiries to comply with regulatory requirements and internal risk management protocols. As a leading financial institution, JPMorgan Chase is subject to regulatory standards that mandate thorough credit assessments for all credit applicants. By conducting these inquiries, the company ensures compliance with industry regulations and internal risk management best practices.

Additionally, credit inquiries enable JPMorgan Chase to determine the most suitable credit terms for approved applicants. By evaluating an individual’s credit history and financial standing, the company can tailor credit offers, including interest rates and credit limits, to align with the applicant’s risk profile. This personalized approach to credit offers enhances the overall customer experience and contributes to responsible lending practices.

By comprehending the underlying reasons for JPMCD credit inquiries, applicants can appreciate the importance of these assessments in the context of responsible lending, regulatory compliance, and personalized credit offerings. This understanding empowers individuals to engage with the credit application process proactively and with a heightened awareness of the factors that influence credit decisions made by JPMorgan Chase.

**

Impact of JPMCD Credit Inquiry on Credit Score

**

Understanding the impact of JPMCD credit inquiries on your credit score is essential for managing your credit profile effectively. When JPMorgan Chase conducts a credit inquiry as part of your credit application, it results in a temporary impact on your credit score. This impact is a crucial consideration for individuals seeking to maintain or improve their creditworthiness.

Hard inquiries, such as those initiated by JPMorgan Chase, typically have a minor and short-term effect on your credit score. The exact impact may vary depending on your overall credit history and the frequency of recent credit inquiries. Generally, a single hard inquiry may result in a small decrease in your credit score, typically around 5-10 points. However, the impact is temporary, and your score is likely to recover within a few months, especially as you demonstrate responsible credit management.

It’s important to note that credit scoring models take into account the presence of multiple credit inquiries within a specific timeframe. If you apply for several credit accounts within a short period, it may raise concerns about your financial stability and could potentially have a more pronounced impact on your credit score.

Despite the temporary nature of the impact, being mindful of the frequency of credit inquiries and managing them judiciously is crucial for maintaining a healthy credit profile. When considering credit applications, including those with JPMorgan Chase, it’s advisable to space out your applications and avoid unnecessary or excessive inquiries. This approach can help mitigate the short-term impact on your credit score and demonstrate responsible credit-seeking behavior to potential lenders.

By understanding the transient nature of the impact and adopting a strategic approach to credit applications, individuals can navigate the credit-seeking process while minimizing the effects on their credit score. This proactive approach contributes to the maintenance of a positive credit profile and supports long-term financial stability.

**

How to Address JPMCD Credit Inquiries

**

Effectively addressing JPMCD credit inquiries involves proactive steps aimed at managing the impact of these inquiries on your credit profile and maintaining a healthy financial standing. When you become aware of a JPMCD credit inquiry on your credit report, consider the following strategies to address and navigate the implications of the inquiry:

- Monitor Your Credit Report: Regularly monitoring your credit report allows you to stay informed about any credit inquiries, including those initiated by JPMorgan Chase. By reviewing your report, you can verify the accuracy of the inquiries and identify any unauthorized or suspicious activity.

- Understand the Timing: Recognize that the impact of JPMCD credit inquiries on your credit score is temporary. If you plan to apply for additional credit in the near future, consider spacing out your applications to minimize the cumulative impact of multiple inquiries.

- Communicate with JPMorgan Chase: If you have concerns or questions regarding a specific credit inquiry conducted by JPMorgan Chase, consider reaching out to the company’s customer service or credit department. Seeking clarification and understanding the purpose of the inquiry can provide valuable insights.

- Practice Responsible Credit Management: Focus on maintaining healthy credit habits, such as making timely payments, keeping credit card balances low, and avoiding unnecessary credit applications. By demonstrating responsible credit management, you can mitigate the impact of credit inquiries and bolster your creditworthiness over time.

- Seek Professional Guidance: If you encounter challenges related to credit inquiries or credit management, consider seeking guidance from a certified credit counselor or financial advisor. These professionals can offer personalized insights and strategies to address credit-related concerns effectively.

By implementing these proactive measures, individuals can navigate JPMCD credit inquiries with confidence and address their impact on their credit profile strategically. Maintaining open communication with JPMorgan Chase, practicing responsible credit management, and seeking professional guidance when needed are integral components of effectively managing credit inquiries and fostering long-term financial well-being.

**

Conclusion

**

As we conclude our exploration of JPMCD credit inquiries, it’s evident that these inquiries play a significant role in the credit application process and have implications for individuals seeking to manage their credit profiles effectively. By understanding the nature of these inquiries, their impact on credit scores, and proactive strategies for addressing them, individuals can navigate the credit-seeking journey with confidence and informed decision-making.

JPMorgan Chase’s commitment to conducting credit inquiries aligns with responsible lending practices, regulatory compliance, and the personalized assessment of credit applicants. The insights gained from this article shed light on the motivations behind these inquiries and equip individuals with the knowledge to engage with the credit application process proactively.

Furthermore, the transient impact of JPMCD credit inquiries on credit scores underscores the importance of strategic credit management. By monitoring credit reports, practicing responsible credit habits, and seeking guidance when needed, individuals can mitigate the short-term effects of credit inquiries and maintain a positive credit profile.

Ultimately, the journey of credit management is a dynamic and multifaceted endeavor, and understanding the intricacies of credit inquiries, including those initiated by JPMorgan Chase, empowers individuals to make informed financial decisions and pursue their goals with confidence.

By embracing a proactive and informed approach to credit inquiries, individuals can cultivate long-term financial stability and position themselves for success in their credit endeavors. As you navigate your financial journey, may the insights shared in this article serve as a valuable resource, guiding you toward a future of informed financial decisions and empowered credit management.