Finance

What Is A Consumer Credit Inquiry

Published: March 5, 2024

Learn about consumer credit inquiries and their impact on your finances. Understand how credit inquiries can affect your credit score and borrowing ability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of consumer credit inquiries, a crucial aspect of the financial landscape that can significantly impact your creditworthiness. When you apply for credit, whether it’s a credit card, auto loan, mortgage, or personal loan, the potential lender will likely request information about your credit history from one or more credit bureaus. This request is known as a consumer credit inquiry, and it plays a pivotal role in the lender’s decision-making process.

Understanding consumer credit inquiries is essential for anyone seeking to manage and improve their credit profile. By delving into the intricacies of this fundamental component of the credit system, you can gain valuable insights into how inquiries affect your credit score and overall financial well-being. Moreover, learning about the different types of inquiries and their impact will empower you to make informed decisions when it comes to applying for credit.

Join us on a journey to explore the nuances of consumer credit inquiries, from their various forms to their implications for your financial health. By the end of this comprehensive guide, you’ll have a deeper understanding of how inquiries influence your credit standing and how to navigate them wisely.

Understanding Consumer Credit Inquiries

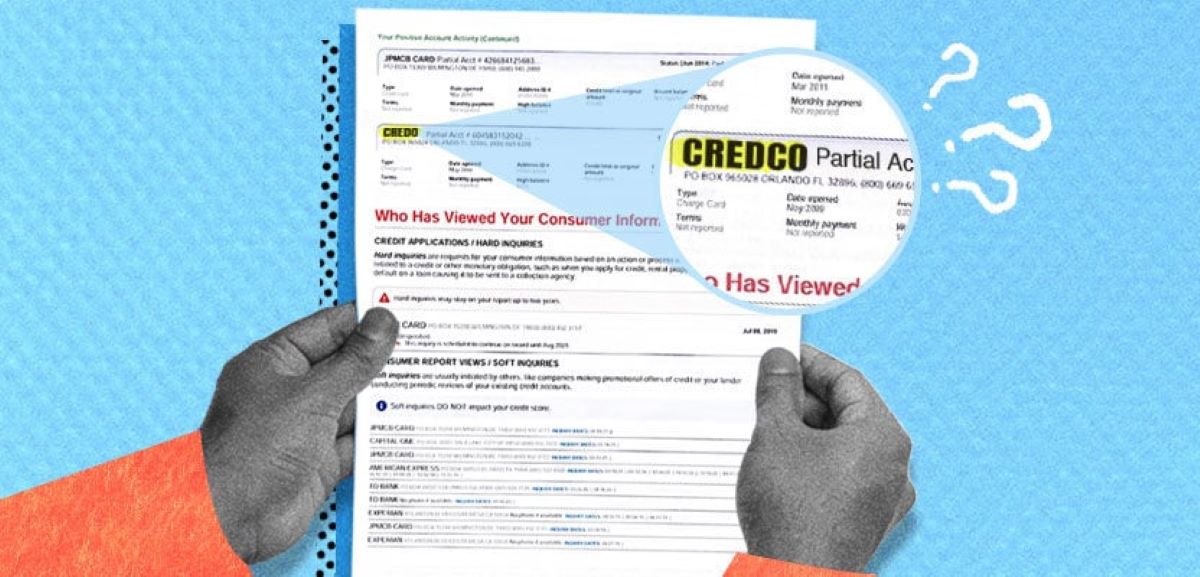

Consumer credit inquiries, also known as credit pulls or credit checks, occur when a lender or creditor requests to view your credit report from one or more of the major credit bureaus. These inquiries serve as a means for the lender to assess your creditworthiness and determine the level of risk associated with extending credit to you. It’s important to note that there are two types of consumer credit inquiries: hard inquiries and soft inquiries.

Hard inquiries are typically initiated when you apply for a new line of credit, such as a credit card, loan, or mortgage. These inquiries are recorded on your credit report and may impact your credit score, albeit to a minor extent. On the other hand, soft inquiries occur when your credit report is accessed for reasons other than a credit application, such as pre-approved credit offers or background checks. Unlike hard inquiries, soft inquiries do not affect your credit score.

Understanding the distinction between hard and soft inquiries is crucial, as it allows you to discern the potential impact on your credit profile. Being aware of when and why these inquiries occur empowers you to make informed decisions about your credit applications and financial behavior.

Moreover, it’s essential to recognize that consumer credit inquiries reflect your recent credit-seeking activities. Lenders may interpret multiple recent inquiries as a sign of financial distress or overextension, potentially raising concerns about your ability to manage additional credit responsibly. This underscores the significance of managing credit inquiries judiciously and being mindful of their implications.

Types of Consumer Credit Inquiries

Consumer credit inquiries encompass two primary types: hard inquiries and soft inquiries, each serving distinct purposes and carrying varying implications for your credit profile.

- Hard Inquiries: These inquiries occur when you apply for new credit, such as a credit card, loan, or mortgage. Lenders initiate hard inquiries to assess your creditworthiness and determine the associated risk. When a hard inquiry is made, it is recorded on your credit report and may have a minor impact on your credit score. While a single hard inquiry is unlikely to cause significant credit score fluctuations, multiple inquiries within a short timeframe can signal heightened credit risk to potential lenders.

- Soft Inquiries: Unlike hard inquiries, soft inquiries do not result from credit applications. Instead, they occur when your credit report is accessed for non-credit-related purposes, such as background checks, pre-approved offers, or when you check your own credit report. Importantly, soft inquiries do not affect your credit score, enabling you to review your credit report or explore pre-qualified credit offers without worrying about potential score reductions.

Understanding the nature of these inquiries is essential for managing your credit effectively. By recognizing the circumstances under which hard and soft inquiries arise, you can make informed decisions about pursuing new credit opportunities while mitigating potential impacts on your credit score.

Impact of Consumer Credit Inquiries

Consumer credit inquiries exert varying degrees of influence on your credit score and overall creditworthiness. Understanding their impact is crucial for navigating the credit landscape effectively and making informed financial decisions.

Hard Inquiries: When a hard inquiry is generated as a result of a credit application, it may cause a temporary dip in your credit score. This is due to the fact that multiple hard inquiries within a short period can indicate a heightened risk of overextending credit, potentially signaling financial distress. While a single hard inquiry is unlikely to have a substantial impact, it’s advisable to space out credit applications to minimize the cumulative effect on your credit score.

Soft Inquiries: Unlike hard inquiries, soft inquiries do not affect your credit score. Whether they stem from background checks, pre-approved offers, or personal credit report reviews, soft inquiries enable you to explore credit opportunities and monitor your credit standing without incurring any negative impact on your score.

It’s important to note that the impact of inquiries on your credit score is relatively minor compared to other factors such as payment history and credit utilization. However, being mindful of the frequency and timing of credit applications can help you maintain a healthy credit profile and minimize potential score fluctuations.

Furthermore, lenders reviewing your credit report may take into account the presence of recent inquiries when evaluating your creditworthiness. While inquiries alone are not determinative of your credit risk, they provide insight into your recent credit-seeking behavior and may influence a lender’s decision when extending new credit.

By understanding the impact of consumer credit inquiries, you can adopt strategies to manage them effectively and mitigate any potential adverse effects on your credit score and financial standing.

How to Minimize the Impact of Consumer Credit Inquiries

Effectively managing consumer credit inquiries can help minimize their impact on your credit score and overall creditworthiness. By adopting strategic approaches, you can navigate the credit landscape while mitigating potential negative repercussions.

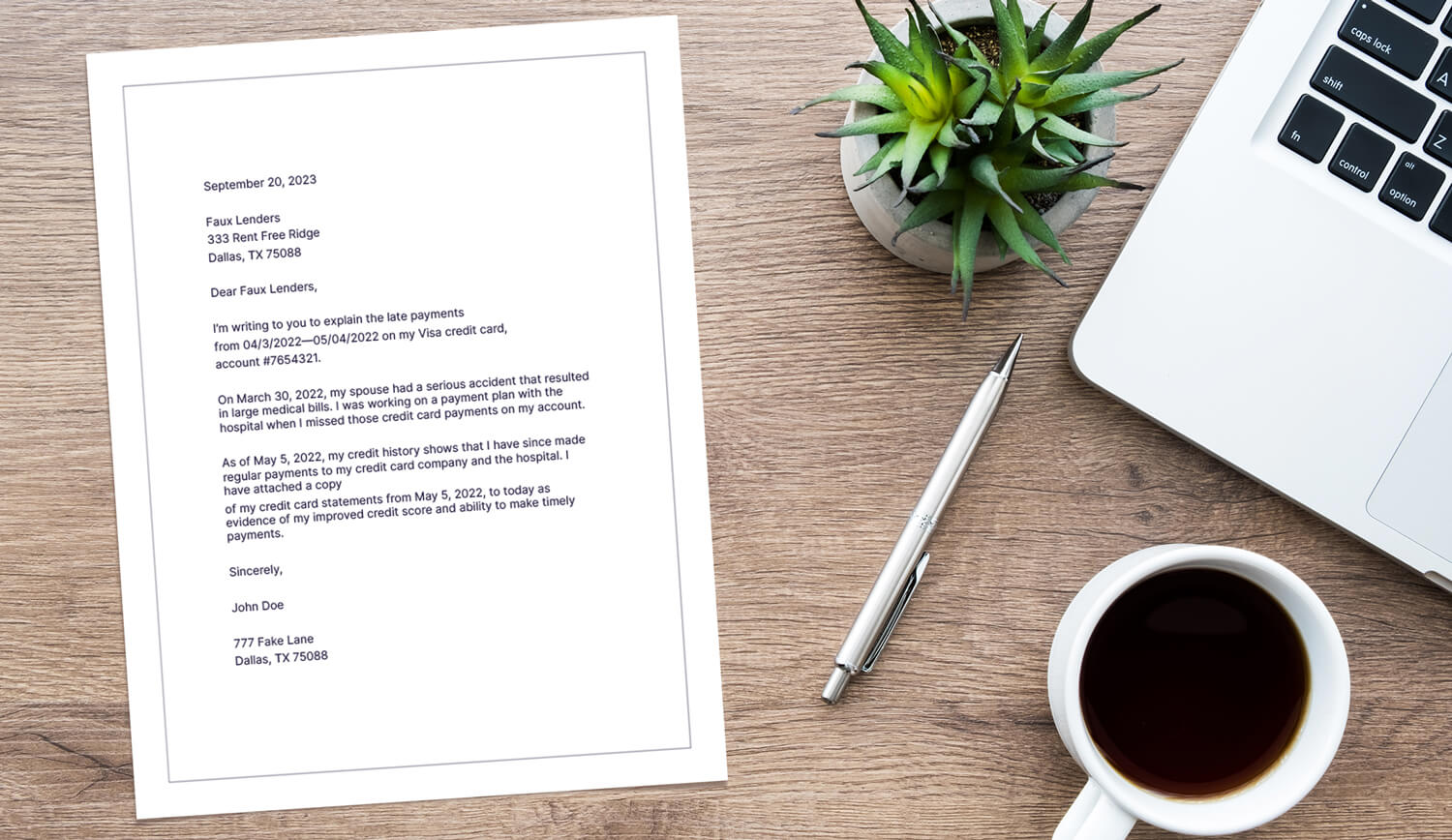

1. Plan Your Credit Applications: When seeking new credit, consider spacing out your applications to avoid multiple hard inquiries within a short timeframe. By planning your credit applications strategically, you can reduce the likelihood of signaling heightened credit risk to potential lenders.

2. Explore Pre-Approved Offers: Take advantage of pre-approved credit offers, which typically involve soft inquiries. This allows you to assess potential credit opportunities without triggering hard inquiries that could impact your credit score.

3. Monitor Your Credit Report: Regularly reviewing your credit report enables you to stay informed about any inquiries and detect any unauthorized or erroneous entries. By promptly addressing inaccuracies, you can ensure that your credit report accurately reflects your credit-seeking activities.

4. Understand the Purpose of Inquiries: Before consenting to a credit check, ensure that you understand the context and purpose of the inquiry. By being aware of whether an inquiry is hard or soft, you can make informed decisions about authorizing credit checks and minimize unnecessary impacts on your credit score.

5. Utilize Rate Shopping Protections: When applying for certain types of credit, such as auto loans or mortgages, credit scoring models typically recognize rate shopping and treat multiple inquiries within a specific timeframe as a single inquiry. This allows you to explore loan options without incurring multiple separate inquiries and potential credit score reductions.

By implementing these proactive measures, you can effectively manage consumer credit inquiries and reduce their impact on your credit score. This strategic approach empowers you to pursue credit opportunities while safeguarding your creditworthiness and financial well-being.

Conclusion

Consumer credit inquiries play a pivotal role in the credit evaluation process, shaping lenders’ perceptions of your creditworthiness and influencing your overall financial standing. By gaining a comprehensive understanding of the types and impact of these inquiries, you can navigate the credit landscape with greater confidence and prudence.

Recognizing the distinction between hard and soft inquiries empowers you to make informed decisions when pursuing new credit opportunities. Understanding the potential impact of inquiries on your credit score underscores the importance of managing them judiciously and strategically planning credit applications.

While consumer credit inquiries contribute to the intricate dynamics of credit assessment, they are just one facet of your credit profile. By maintaining responsible credit behavior, such as making timely payments and managing credit balances prudently, you can mitigate the impact of inquiries and uphold a positive credit standing.

Ultimately, by leveraging the insights garnered from this guide, you are equipped to approach consumer credit inquiries with a heightened awareness of their implications. This knowledge empowers you to make informed credit decisions, safeguard your credit score, and pursue your financial goals with confidence.

As you continue your journey in the realm of personal finance, remember that knowledge and prudence are your allies. By leveraging these assets, you can navigate the complexities of consumer credit inquiries and optimize your credit management strategies for long-term financial well-being.