Home>Finance>What Is Credit Balance Refund Debit Bank Of America

Finance

What Is Credit Balance Refund Debit Bank Of America

Modified: January 15, 2024

Learn how to get a credit balance refund from Bank of America. Understand the process for debiting your account and managing your finances efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to an informative article about Credit Balance Refund Debit Bank of America. In the world of finance, it is crucial to understand and manage the various aspects of your banking accounts, including credit balance refunds. Whether you have received a credit balance on your Bank of America account and you are wondering how to utilize it, or you are simply curious about how the process works, this article will provide you with all the necessary information.

Bank of America, one of the largest financial institutions in the United States, offers a wide range of banking services to its customers, including checking accounts, savings accounts, and credit cards. In certain situations, such as overpayment or a return of merchandise, you may find yourself with a credit balance on your Bank of America account. It’s essential to understand how credit balance refunds work and how they are debited from your Bank of America account.

In this article, we will delve into the concept of a credit balance refund and explore the specifics of how it is processed by Bank of America. We will also outline the steps you can take to request a credit balance refund from Bank of America and highlight some important considerations and potential fees associated with this process. So, let’s dive in and unravel the intricacies of credit balance refund debit Bank of America.

What is a Credit Balance Refund?

A credit balance refund occurs when there is an excess amount of funds in your Bank of America account. This can happen for a variety of reasons, such as overpaying your credit card bill, receiving a refund for a returned purchase, or having a payment credited to your account that exceeds your outstanding balance. Instead of keeping this excess amount in your account, you have the option to request a refund from Bank of America.

When you have a credit balance on your Bank of America account, it means that the bank owes you money. The credit balance refund allows you to retrieve that money and manage it according to your financial needs. It’s important to note that a credit balance refund is different from a regular withdrawal or transfer from your account. Instead of deducting funds from your account balance, a credit balance refund aims to reimburse you for the excess amount that you have already paid.

It’s essential to keep track of your account balances and be aware of any credits that you may have. If you notice a credit balance on your Bank of America account, it’s a good idea to understand the options available to you, including requesting a credit balance refund. By doing so, you can reclaim the excess funds and put them to better use, whether it’s paying off other bills, adding to your savings, or investing in your future financial goals.

Now that we have a basic understanding of credit balance refunds, let’s explore how Bank of America handles this process specifically and how you can navigate it to your advantage.

Understanding Debit Bank of America

Before we delve into the specifics of how a credit balance refund is debited from your Bank of America account, let’s first gain a clear understanding of what debit means in the banking context. In simple terms, a debit refers to the deduction of funds from your account balance. When you make a purchase using your Bank of America debit card, for example, the corresponding amount is debited from your checking account.

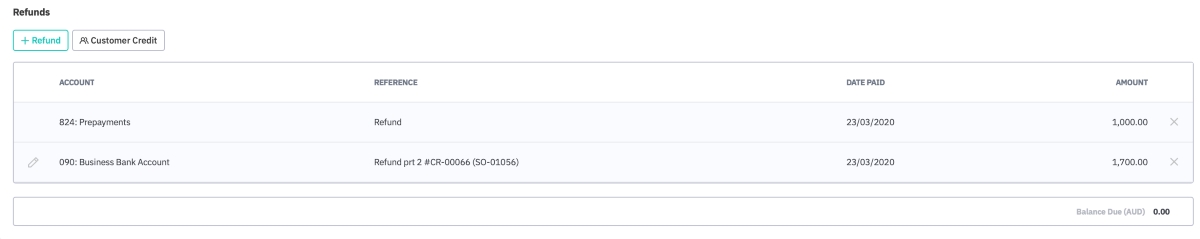

When it comes to credit balance refunds, Bank of America follows a similar debit process. Once you initiate a credit balance refund request, the bank will process it and deduct the refunded amount from your account, effectively debiting it. The refund will be reflected as a debit transaction on your account statement.

It’s important to note that Bank of America has different types of accounts, including checking, savings, and credit card accounts. The specific account where the credit balance is held will determine how the refund is debited. For instance, if you have a credit balance on your Bank of America checking account, the refund will be debited from that account. If the credit balance is on a Bank of America credit card, the refund will be debited from that card’s balance.

Additionally, it’s worth mentioning that Bank of America offers various ways to access your funds, including online banking, mobile banking, ATMs, and branch visits. Debit transactions and credit balance refunds can be made through any of these channels, depending on your preference and convenience.

Understanding the concept of debit Bank of America is crucial when it comes to credit balance refunds, as it gives you insight into how the refund process works and how the refunded amount will be debited from your specific account. With this understanding in mind, let’s now explore the step-by-step process of how to request a credit balance refund from Bank of America.

How Does a Credit Balance Refund Debit Bank of America Work?

When it comes to a credit balance refund debit Bank of America, the process involves several steps to ensure a smooth and efficient transaction. Here is a breakdown of how it works:

- Identifying the credit balance: The first step is to identify that you have a credit balance on your Bank of America account. This can be done by reviewing your account statements or monitoring your account balance online or through the mobile banking app.

- Initiating the refund request: Once you have confirmed the credit balance, you can initiate the credit balance refund request. You have the option to request the refund online, through the Bank of America mobile app, or by contacting the Bank of America customer service helpline.

- Providing necessary information: During the refund request process, you will be required to provide essential information, such as your account details, the amount to be refunded, and the reason for the refund. Be sure to have this information readily available to expedite the process.

- Processing the refund: After submitting the refund request, Bank of America will review and process it. This may involve verifying the credit balance, ensuring that the amount requested is accurate, and confirming any other necessary details.

- Debiting the refund: Once the credit balance refund is approved, Bank of America will initiate the debit transaction. The refunded amount will be deducted from your account, resulting in a reduced balance. This debit transaction will be reflected in your account statement.

- Confirmation and notification: Bank of America will provide confirmation of the refund through various channels. You may receive a confirmation email, notification through the mobile app, or a message in your online banking portal. It’s important to review these notifications to ensure the accuracy of the refund.

The debit process for a credit balance refund with Bank of America is designed to be convenient and secure. By following these steps and providing the necessary information, you can rest assured that your credit balance will be appropriately debited and the refund will be processed efficiently.

Now that we understand the process of how a credit balance refund is debited from your Bank of America account, let’s move on to the next section, where we will outline the steps you can take to request a credit balance refund.

Steps to Request a Credit Balance Refund Debit Bank of America

Requesting a credit balance refund from Bank of America is a straightforward process that can be completed in a few simple steps. Follow these guidelines to initiate a refund request:

- Review your account balance: Before proceeding with the refund request, review your Bank of America account balance to confirm the presence of a credit balance. This can be done through online banking, the mobile app, or by checking your account statement.

- Choose your preferred contact method: Bank of America provides multiple channels for refund requests, including online banking, the mobile app, and customer service helpline. Choose the method that is most convenient for you.

- Access your account: Log in to your Bank of America online banking account or open the mobile app. If using the mobile app, navigate to the appropriate section for refund requests.

- Initiate the refund request: Locate the option to request a credit balance refund. This can typically be found under the “Customer Service” or “Contact Us” section. Click on the relevant link or button to begin the process.

- Provide necessary information: As part of the refund request, you will be asked to provide specific details such as your account number, the amount to be refunded, and the reason for the refund. Fill out the required fields accurately and completely.

- Double-check the information: Before submitting the refund request, review all the information you have entered to ensure its accuracy. Any mistakes or discrepancies may delay the refund process.

- Submit the request: Once you have verified the information, click on the “Submit” or “Request Refund” button to send your refund request to Bank of America.

- Monitor the refund status: Bank of America will process your refund request and provide you with updates on its status. This may include confirmation emails, notifications through the mobile app, or updates in your online banking portal. Keep an eye out for these notifications to stay informed.

By following these steps, you can successfully request a credit balance refund debit Bank of America. Remember to provide accurate and complete information to expedite the refund process. If you encounter any issues or have questions, don’t hesitate to contact Bank of America’s customer service for assistance.

In the next section, we will discuss important considerations and potential fees to keep in mind when requesting a credit balance refund.

Important Considerations and Potential Fees

When requesting a credit balance refund debit Bank of America, there are a few important considerations and potential fees to keep in mind. These factors can affect the refund process and your overall banking experience. Here are a few key points to consider:

- Refund processing time: Bank of America aims to process credit balance refunds in a timely manner. However, the actual processing time may vary depending on various factors, including the complexity of the refund request and any additional verification required. It’s important to be aware that the refund may not be processed immediately, and you may need to allow some time for it to reflect in your account.

- Confirmation and documentation: Bank of America will provide confirmation of the credit balance refund through various communication channels. It’s important to review these notifications and keep them for your records. In case of any disputes or discrepancies, having proper documentation will be helpful.

- Account balances and statements: Even after a credit balance refund, it’s essential to monitor your account balances and statements regularly. This ensures that all transactions are accurately reflected and that there are no further issues or discrepancies with your account.

- Potential fees: Depending on the type of Bank of America account you have and the specific circumstances surrounding your credit balance refund, there may be potential fees associated with the refund process. These fees could include service charges, processing fees, or other applicable charges. It’s important to review Bank of America’s fee schedule or contact customer service to understand any potential fees upfront.

- Communication and customer service: Should you have any questions or concerns regarding the credit balance refund process, don’t hesitate to reach out to Bank of America’s customer service. Their representatives can provide you with clarification, address any issues, and guide you through the refund process more effectively.

By keeping these considerations in mind, you can navigate the credit balance refund process with Bank of America more effectively and minimize any potential fees or issues that may arise. Remember to stay vigilant, review all communications and documentation, and consult with customer service whenever necessary.

With these important considerations covered, let’s move on to the next section, where we will address some frequently asked questions (FAQs) related to credit balance refund debit Bank of America.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions (FAQs) about credit balance refund debit Bank of America:

-

How long does it take for a credit balance refund to be processed?

The processing time for a credit balance refund can vary depending on factors such as the complexity of the refund request and any additional verification required. While Bank of America strives to process refunds in a timely manner, it’s important to allow some time for the refund to be processed and reflected in your account. It’s recommended to monitor your account and keep an eye out for any communications from the bank regarding the status of your refund.

-

Can I request a credit balance refund through the mobile app?

Yes, Bank of America provides the option to initiate a credit balance refund request through its mobile app. You can conveniently submit your request and provide the necessary information directly through the app. This offers flexibility and convenience, especially for customers who prefer managing their finances on their mobile devices.

-

Do I have to pay any fees for a credit balance refund?

There may be potential fees associated with the credit balance refund process depending on your specific circumstances and the type of Bank of America account you hold. These fees could include service charges, processing fees, or other applicable charges. It’s important to review Bank of America’s fee schedule or contact customer service to understand any potential fees upfront and ensure that you are aware of any charges related to the refund process.

-

What should I do if I have not received my credit balance refund?

If you have not received your credit balance refund within a reasonable timeframe, it’s advisable to contact Bank of America’s customer service. They can assist you in addressing any concerns or issues regarding the refund status. It’s also a good practice to have the necessary documentation, such as confirmation emails or account statements, readily available to provide additional details as required.

-

Can I use a credit balance refund to pay off my Bank of America credit card?

Yes, if you have a credit balance on your Bank of America credit card, you can use the credit balance refund to offset any outstanding balance on the card. This can help reduce or eliminate any payment due and effectively utilize the refunded amount towards your credit card balance.

These FAQs address some common inquiries related to credit balance refund debit Bank of America. If you have any other specific questions or concerns, it’s recommended to reach out to Bank of America’s customer service for personalized assistance and guidance.

Now, let’s conclude our article.

Conclusion

Understanding how a credit balance refund debit Bank of America works is essential for effectively managing your finances and making the most of your banking experience. By following the steps outlined in this article, you can confidently initiate a credit balance refund request and ensure that the refunded amount is properly debited from your Bank of America account.

Remember to review your account balances regularly, monitor for credit balances, and promptly request refunds when necessary. Keeping in mind important considerations such as processing time, potential fees, and documentation will help streamline the refund process and minimize any potential issues.

Bank of America offers multiple channels for refund requests, including online banking, the mobile app, and customer service helpline. Choose the method that is most convenient for you and provide accurate and complete information to ensure a smooth refund process.

If you have any questions or concerns regarding credit balance refund debit Bank of America, don’t hesitate to reach out to the bank’s customer service. They are there to assist you and provide guidance throughout the refund process.

By being proactive and knowledgeable about credit balance refunds, you can effectively manage your finances, reclaim any excess funds, and use them to meet your financial goals.

We hope this article has provided you with valuable insights into the world of credit balance refund debit Bank of America. Remember to stay informed, review your account statements, and take advantage of the resources available to you through Bank of America to optimize your banking experience.

Thank you for reading, and we wish you success in managing your credit balance refunds with Bank of America!