Finance

What Is Energy Hedging

Published: January 15, 2024

Learn about the importance of energy hedging in finance and how it helps manage risk and stabilize prices.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Energy hedging is a financial strategy that provides protection against market volatility and price fluctuations in the energy sector. It allows companies and individuals to manage their exposure to the risks associated with energy prices. Energy prices can be highly volatile due to various factors such as geopolitical events, supply and demand dynamics, and weather conditions. As a result, hedging becomes essential for participants in the energy market to mitigate potential losses and ensure stability in their operations.

Energy hedging involves entering into derivative contracts, such as futures, options, and swaps, that allow parties to lock in prices for future delivery of energy commodities, such as oil, natural gas, or electricity. By doing so, market participants can safeguard themselves against adverse price movements and secure a more predictable cost structure.

The practice of energy hedging is prevalent among energy producers, consumers, and traders. Producers, such as oil and gas companies, can hedge their production by locking in prices for future sales, protecting themselves from a decline in prices. On the other hand, energy consumers, such as manufacturers or airlines, can hedge their energy purchases by fixing prices in advance, guarding against a spike in energy costs. Traders, who are involved in buying and selling energy commodities, also engage in hedging to manage their trading risks.

Energy hedging plays a crucial role in stabilizing energy markets and ensuring a reliable supply of energy. It provides a means for market participants to manage their exposure to price fluctuations, reduce their financial risk, and make informed business decisions. In addition to risk management benefits, energy hedging can also offer opportunities for profit or cost savings, depending on the market conditions and the effectiveness of the hedging strategy implemented.

In this article, we will delve into the details of energy hedging, exploring various strategies, advantages, and disadvantages. We will also discuss the risks associated with energy hedging and factors to consider when implementing a hedging program. Furthermore, we will provide examples of energy hedging in practice, showcasing how different entities utilize this financial tool to manage their energy price risks.

Definition of Energy Hedging

Energy hedging refers to the practice of using financial instruments to manage and mitigate the risks associated with energy price fluctuations. It involves entering into derivative contracts, such as futures, options, and swaps, to lock in prices for future delivery of energy commodities.

By hedging their energy exposure, market participants can protect themselves against adverse movements in energy prices. This can include both upward price spikes and downward price declines. The goal of energy hedging is to provide stability and predictability in energy costs, ensuring that businesses can effectively plan and manage their budgets.

Energy hedging allows companies and individuals to manage their exposure to various energy commodities, including oil, natural gas, and electricity. Hedging in the energy market is particularly important due to the inherent volatility and uncertainty associated with energy prices. Factors such as geopolitical tensions, changes in supply and demand dynamics, and weather conditions can cause significant fluctuations in energy prices, which can have a profound impact on the profitability and financial stability of energy market participants.

Derivative contracts, which are the primary tools used for energy hedging, allow market participants to fix prices for future energy deliveries. Futures contracts, for example, enable participants to lock in prices for standardized contracts to be executed at a specified future date. Options contracts provide the right, but not the obligation, to buy or sell energy commodities at a predetermined price within a specified time frame. Swaps contracts involve an agreement to exchange cash flows based on the difference between predetermined prices and market prices.

It’s important to note that while energy hedging can mitigate risk, it does not eliminate it entirely. Hedging can protect against price fluctuations to a certain extent, but it cannot guarantee profits or prevent losses in all scenarios. The effectiveness of an energy hedging strategy depends on various factors, including market conditions, the accuracy of price forecasts, and the skill and experience of the hedging participants.

Overall, energy hedging provides a means for market participants to manage their exposure to price volatility and reduce the financial risk associated with energy commodities. It allows businesses to plan and operate with more certainty, ensuring stability in their energy costs and protecting against adverse market conditions.

Purpose of Energy Hedging

The primary purpose of energy hedging is to manage and mitigate the risks associated with energy price fluctuations. By implementing effective hedging strategies, market participants aim to achieve the following objectives:

1. Risk Management:

Energy prices can be highly volatile, driven by various factors such as geopolitical events, supply and demand dynamics, and weather conditions. Energy hedging allows companies to protect themselves against unfavorable price movements and manage their exposure to market risks. By hedging their energy purchases or sales, participants can reduce financial uncertainty and ensure more predictable cost structures.

2. Financial Planning:

Energy costs can have a significant impact on the financial performance of businesses, particularly those that are heavily reliant on energy commodities. Hedging provides a tool for companies to forecast and manage their energy expenses, enabling better financial planning and budgeting. By locking in prices for future energy deliveries, market participants can have greater visibility into future costs, aiding in decision-making and resource allocation.

3. Price Stability:

Energy hedging helps maintain stability in energy prices by reducing market volatility. By hedging their risk, participants contribute to a more balanced supply and demand equilibrium in the energy market. This stability benefits both producers and consumers, as it allows them to operate with more predictable costs and revenues, reducing the potential for sudden shocks or disruptions.

4. Competitiveness:

Hedging can enhance the competitiveness of companies operating in energy-intensive sectors. By managing their energy price risks, market participants can avoid sudden cost increases or fluctuations, which could affect their pricing strategies and profit margins. This enables them to remain competitive in the market and make informed business decisions, even in uncertain or volatile energy market conditions.

5. Profit Opportunities:

While risk management is the primary driver of energy hedging, there are also potential profit opportunities associated with effective hedging strategies. Skilled hedgers can take advantage of market inefficiencies or price differentials to generate additional revenue or cost savings. This requires a deep understanding of market dynamics and the ability to accurately forecast energy price movements.

Overall, the purpose of energy hedging is to protect against adverse price fluctuations, manage financial risk, ensure stability in energy costs, and improve strategic decision-making. It provides a valuable tool for market participants to navigate the complexities of the energy market and achieve their financial and operational objectives.

Types of Energy Hedging Strategies

There are several common strategies that market participants employ when engaging in energy hedging. These strategies vary in complexity and effectiveness depending on the specific goals and risk tolerances of the participants. Here are some of the most commonly used energy hedging strategies:

1. Futures Contracts:

Futures contracts are one of the most straightforward and widely used energy hedging instruments. Participants enter into an agreement to buy or sell a standardized quantity of the underlying energy commodity at a predetermined price and future date. Futures contracts allow market participants to lock in prices and protect against potential price fluctuations. They are particularly popular among energy producers and consumers who want to secure a fixed price for their future deliveries or purchases.

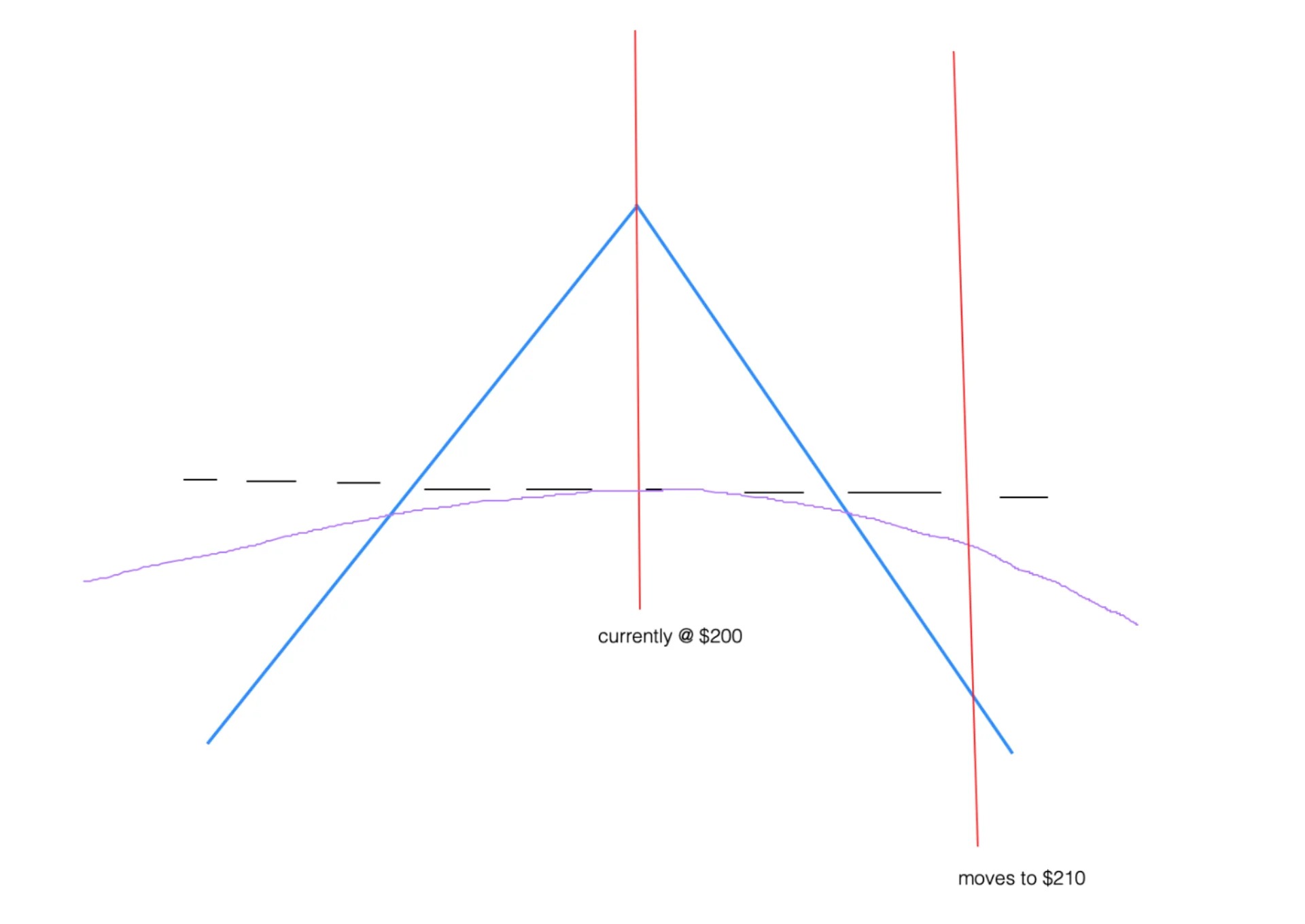

2. Options Contracts:

Options contracts provide the right, but not the obligation, to buy or sell a specific quantity of an energy commodity at a predetermined price (strike price) within a specified time period. Call options give the holder the right to buy, while put options give the holder the right to sell. Options provide flexibility to market participants, as they can choose whether or not to exercise the contract based on market conditions. They are often used as insurance against adverse price movements, allowing participants to limit their downside risk while retaining the potential for upside gain.

3. Swaps Contracts:

Swaps involve the exchange of cash flows based on the difference between predetermined prices and market prices. In an energy swap, two parties agree to exchange future energy cash flows, typically based on fixed and floating prices. Swaps can be customized to suit the specific needs of participants, allowing them to manage various types of risks, including price risk, volume risk, and basis risk. This flexibility makes swaps a popular choice for hedging in the energy market.

4. Collars:

A collar is a strategy that combines the purchase of a put option (to limit downside risk) with the sale of a call option (to offset the cost of the put option). This strategy establishes a price range within which the market participant can buy or sell the energy commodity. Collars provide a cost-effective way to hedge against price fluctuations while still allowing for potential price appreciation within a certain range.

5. Spread Trading:

Spread trading involves simultaneously buying and selling related energy commodities or contracts to profit from the price difference between them. For example, a market participant may buy futures contracts for one month and sell futures contracts for another month, aiming to profit from the price differential between those months. Spread trading can be used to hedge against price volatility or to take advantage of market inefficiencies.

6. Options Spreads:

Options spreads involve combining multiple options contracts to create a more complex hedging strategy. This strategy can include the use of various combinations of call and put options, such as vertical spreads, horizontal spreads, and diagonal spreads. Options spreads are designed to mitigate risk and potentially reduce the cost of engaging in options hedging.

It’s important for market participants to carefully evaluate their risk tolerance, market outlook, and financial objectives when selecting an energy hedging strategy. Each strategy has its own advantages and limitations, and the suitability of a particular strategy will depend on the specific circumstances and goals of the participant.

Advantages of Energy Hedging

Energy hedging offers several key advantages to market participants in the energy sector. By effectively managing their exposure to energy price fluctuations, participants can benefit in the following ways:

1. Risk Mitigation:

The primary advantage of energy hedging is the ability to mitigate and manage price risk. By locking in prices for future energy deliveries or purchases, market participants can protect themselves against adverse price movements. This provides stability in energy costs and reduces financial uncertainty, allowing businesses to plan and budget more effectively.

2. Price Stability:

Hedging can help maintain price stability in the energy market. Participants who hedge their energy purchases or sales contribute to a more balanced supply and demand equilibrium, reducing extreme price fluctuations. Price stability benefits both producers and consumers by providing a predictable cost structure, supporting long-term planning, and fostering a more stable business environment.

3. Financial Planning:

Energy hedging enables better financial planning and budgeting. By fixing prices for future energy deliveries, market participants have greater visibility into their future costs, allowing for more accurate forecasting and financial projections. This helps manage cash flow, plan capital expenditures, and make strategic decisions with greater confidence.

4. Competitive Advantage:

Hedging can provide a competitive edge for companies operating in energy-intensive industries. By managing their energy price risks, participants can avoid sudden cost increases that could eat into profit margins. This allows companies to remain competitive by offering more stable pricing to customers, ensuring their products or services remain attractive in the market.

5. Opportunities for Cost Savings:

Effective energy hedging strategies can provide opportunities for cost savings. By actively managing and monitoring energy prices, market participants can take advantage of favorable market conditions, timing their purchases or sales to achieve better pricing. Skilled hedgers can optimize their hedging positions to capture potential market inefficiencies, generating additional revenue or cost savings.

6. Strategic Decision-Making:

Hedging enhances strategic decision-making by reducing uncertainty. When energy costs are effectively managed and predictable, companies can make informed decisions about expanding operations, investing in new technologies, or entering into long-term contracts. Energy hedging allows participants to focus on core business activities, confident in their ability to navigate potential price shocks or disruptions.

Overall, energy hedging provides a range of advantages, including risk mitigation, price stability, improved financial planning, competitive advantage, cost savings, and strategic decision-making. By effectively managing their energy price exposure, market participants can position themselves for long-term success in the dynamic and unpredictable energy market.

Disadvantages of Energy Hedging

While energy hedging offers significant benefits, it is not without its drawbacks. Market participants should carefully consider the following disadvantages before engaging in energy hedging:

1. Cost:

Engaging in energy hedging can be costly. Participants may incur expenses related to transaction fees, margin requirements, and the cost of the hedging instruments themselves. These costs can erode potential profits or increase overall expenses, especially if the hedging strategy is not carefully planned and executed.

2. Complexity:

Energy hedging involves navigating complex financial instruments and understanding market dynamics. It requires a deep understanding of derivatives and the energy market, including factors that impact energy prices. Implementing a successful hedging strategy requires expertise and resources to analyze market trends, forecast price movements, and make informed decisions.

3. Opportunity Cost:

Hedging can result in missed opportunities if energy prices move counter to the hedged position. If prices rise and a market participant has locked in a lower price through hedging, they may miss out on potential profits. Similarly, if prices decline and a participant has hedged at a higher price, they may not be able to take advantage of lower market prices.

4. Inaccurate Price Forecasting:

An effective energy hedging strategy relies on accurate price forecasting. If market participants incorrectly predict price movements, it can lead to ineffective hedging positions or missed opportunities. Inaccurate forecasts can be influenced by unpredictable factors such as geopolitical events, technological advances, or sudden shifts in supply and demand dynamics.

5. Counterparty Risk:

Engaging in energy hedging involves entering into agreements with counterparties, such as financial institutions or other market participants. There is a risk that the counterparty may default on its obligations, leading to financial losses. Proper due diligence and risk assessment of counterparty creditworthiness are essential to minimize this risk.

6. Overhedging:

Overhedging occurs when market participants hedge their energy exposure beyond what is necessary or appropriate. This can lead to wasted resources, higher costs, and the potential for missed opportunities. Proper risk assessment and careful consideration of hedging positions are crucial to avoid overhedging.

Despite these disadvantages, energy hedging remains a valuable tool for managing and mitigating risks in the energy market. By understanding the potential drawbacks and implementing sound hedging strategies, participants can effectively navigate the complexities of energy price volatility while balancing risk and opportunity.

Risks Associated with Energy Hedging

While energy hedging offers the potential for risk mitigation, it also comes with its own set of risks that market participants should be aware of. Understanding these risks is crucial for effective hedging strategies. Here are some of the key risks associated with energy hedging:

1. Market Volatility:

Energy markets can be highly volatile, driven by factors such as geopolitical events, supply and demand dynamics, and weather conditions. Hedging positions may not fully protect against extreme or unexpected price movements, leading to potential losses. Market participants need to closely monitor market conditions and adjust their hedging strategies accordingly to navigate this volatility.

2. Basis Risk:

Basis risk refers to the potential mismatch between the underlying energy commodity being hedged and the derivative contract used for hedging. The basis, or difference, between the reference price in the derivative contract and the actual market price can fluctuate, resulting in imperfect hedging. This can occur due to differences in delivery locations, quality of the commodity, or other factors that affect the basis. Market participants should consider basis risk when evaluating the effectiveness of their hedging strategies.

3. Liquidity Risk:

Liquidity risk arises when there is insufficient trading volume or market participants to allow for smooth execution of hedging transactions. Illiquid markets can make it challenging to enter or exit hedging positions at desired prices, potentially leading to higher costs or limited flexibility. Market participants should consider the liquidity of the underlying commodity and the hedging instrument before initiating hedging strategies.

4. Credit Risk:

Credit risk refers to the potential for a counterparty in the hedging transaction to default on its obligations. This risk is particularly relevant for over-the-counter (OTC) derivative contracts, where participants enter bilateral agreements with other market participants or financial institutions. Proper due diligence and credit assessment of counterparties are crucial to mitigate credit risk and ensure that hedging positions are protected.

5. Regulatory Risk:

Regulatory changes can impact energy markets and the effectiveness of hedging strategies. New regulations or policy shifts related to energy production, consumption, or trading can introduce uncertainty and affect the market dynamics. Participants should stay abreast of regulatory developments and adjust their hedging strategies accordingly to manage regulatory risk effectively.

6. Inadequate Risk Assessment:

Failure to conduct thorough risk assessment and scenario analysis before implementing hedging strategies can expose market participants to unexpected risks. Inadequate understanding of market dynamics, improper forecasting, and inadequate risk management frameworks can lead to ineffective hedging positions or missed opportunities. Market participants should ensure they have a robust risk management system in place and regularly evaluate and adjust their hedging strategies based on market conditions.

It is important for market participants to be aware of these risks and develop a comprehensive risk management strategy that considers both the potential benefits and drawbacks of energy hedging. By carefully navigating these risks, participants can mitigate potential losses and optimize their energy price risk management efforts.

Factors to Consider when Hedging Energy

Hedging energy requires careful consideration of various factors to ensure an effective and successful hedging strategy. Market participants should assess the following factors to make informed decisions when hedging energy:

1. Risk Tolerance:

Market participants should evaluate their risk tolerance and appetite for potential losses. Understanding how much risk they are willing to take on will help determine the appropriate hedging strategy. Conservative participants may opt for strategies that provide more certainty and protection, while those with a higher risk tolerance may pursue strategies that offer greater potential for profit.

2. Market Outlook:

Evaluating the market outlook is crucial when deciding on an energy hedging strategy. Participants should analyze supply and demand fundamentals, geopolitical factors, regulatory changes, and other market dynamics. Understanding these factors can help anticipate potential price movements and identify opportunities or risks for hedging positions.

3. Financial Objectives:

Market participants should clearly define their financial objectives when hedging energy. Whether it is to protect against price fluctuations, stabilize energy costs, generate additional revenue, or manage budgetary constraints, aligning hedging strategies with financial objectives is essential for success. Clear goals can guide the selection of appropriate hedging instruments and positions.

4. Hedging Instruments:

Different hedging instruments serve unique purposes and carry distinct risks. Market participants should evaluate the suitability of various instruments such as futures contracts, options contracts, or swaps, based on their risk profile, desired level of protection, and market conditions. Understanding the features and mechanics of each instrument is crucial before committing to a specific hedging strategy.

5. Timing and Frequency:

Timing and frequency of hedging activities are important considerations. Participants should determine when to enter and exit hedging positions based on price forecasts and market conditions. Hedging too early or too late can impact the effectiveness of the strategy. Additionally, the frequency of adjusting or rolling over hedging positions should be evaluated to adapt to changing market dynamics.

6. Cost and Flexibility:

Participants should assess the costs associated with hedging activities, including transaction fees, margin requirements, and potential financing costs. Balancing costs with the desired level of protection and flexibility is crucial. Some hedging instruments may offer more flexibility to adjust positions, while others may have higher upfront costs but offer stronger protection against adverse price movements.

7. Monitoring and Review:

Regular monitoring and review of hedging positions and market conditions are essential. Participants should establish a robust monitoring system to track price movements, evaluate the effectiveness of hedging strategies, and make necessary adjustments as market conditions evolve. Regular review allows for optimization of hedging positions and can help identify potential risks or opportunities.

By considering these factors, market participants can develop a well-informed energy hedging strategy that aligns with their risk tolerance, financial objectives, and market outlook. Strategic decision-making, continuous monitoring, and adjusting hedging positions when necessary will increase the chances of achieving successful risk management and financial outcomes.

Examples of Energy Hedging

Energy hedging is widely practiced by companies and individuals in the energy sector to manage price risks and stabilize energy costs. Here are a few examples of energy hedging in practice:

1. Oil Producers:

Oil producers often engage in energy hedging to mitigate the risks of price volatility. For example, an oil company may enter into futures contracts to lock in prices for future oil deliveries. By doing so, they can protect themselves against potential price declines and ensure a minimum revenue level, even if oil prices fall. This hedging strategy provides stability in cash flow and allows oil producers to plan their operations and investments more effectively.

2. Airlines:

Airlines are highly exposed to jet fuel price fluctuations, which can have a significant impact on operating costs. To manage this risk, airlines may hedge their fuel expenses by entering into futures contracts or options contracts. By locking in prices for future fuel purchases, airlines can mitigate the risk of sudden price spikes and stabilize their fuel costs. Effective fuel hedging can provide airlines with cost certainty, allowing them to manage ticket prices and financial projections more accurately.

3. Electricity Retailers:

Electricity retailers often engage in hedging to manage the price risk associated with wholesale electricity prices. They may enter into electricity futures contracts to lock in prices for the purchase or sale of electricity over a specified period. This allows retailers to manage their exposure to volatile electricity market prices, providing stability in their pricing to consumers. By hedging their electricity purchases or sales, retailers can offer more competitive rates to customers and avoid sudden cost fluctuations.

4. Natural Gas Consumers:

Industrial and commercial consumers of natural gas, such as manufacturing plants or hospitals, often rely on hedging to manage their energy costs. They may enter into natural gas futures contracts to secure fixed prices for future gas purchases. This protects them from potential price increases during high-demand periods or supply disruptions. Natural gas consumers can effectively budget their energy expenses, ensuring predictable costs and protecting their profit margins.

5. Renewable Energy Developers:

Renewable energy developers face risks related to the future market price of electricity generated from their projects. To manage this risk, developers may hedge their electricity sales by entering into power purchase agreements (PPAs) with fixed pricing or by using financial derivatives. This hedges against potential declines in electricity prices, ensuring a stable revenue stream from renewable energy projects, which are typically long-term investments.

These are just a few examples of how energy hedging is utilized in practice. Market participants across various sectors in the energy industry employ hedging strategies to manage price risks, stabilize their costs, and support effective financial planning. The specific hedging instruments and strategies employed may vary depending on the nature of the business and the exposure to energy price fluctuations.

Conclusion

Energy hedging is a vital financial strategy that allows market participants to manage and mitigate the risks associated with energy price fluctuations. By utilizing various hedging instruments such as futures contracts, options contracts, or swaps, participants can protect themselves from adverse price movements, stabilize energy costs, and improve financial planning.

Energy hedging offers several advantages, including risk mitigation, price stability, improved financial planning, competitive advantage, cost savings, and enhanced strategic decision-making. It allows companies and individuals operating in the energy sector to navigate the uncertainties and volatility of energy markets, ensuring stability in their operations and protecting their financial performance.

However, energy hedging also comes with certain risks and considerations. Market participants must be aware of factors such as market volatility, basis risk, liquidity risk, credit risk, regulatory risk, and the importance of accurate risk assessment. Inadequate risk management or ineffective hedging strategies can result in significant financial losses.

To develop a successful energy hedging strategy, market participants must carefully evaluate their risk tolerance, market outlook, financial objectives, and hedging instruments. Timing, cost, flexibility, and ongoing monitoring also play critical roles in optimizing hedging positions and managing potential risks.

Examples of energy hedging can be seen across various sectors, such as oil producers, airlines, electricity retailers, natural gas consumers, and renewable energy developers. Each sector utilizes specific hedging strategies to address their unique risks and exposure to energy price fluctuations.

In conclusion, energy hedging is a valuable tool for managing risks, achieving price stability, and enhancing financial performance in the energy sector. It allows market participants to navigate the complexities of the energy market, make informed decisions, and protect against adverse price movements. By carefully assessing risks, implementing effective strategies, and monitoring market conditions, participants can maximize the benefits of energy hedging and position themselves for success in a rapidly changing energy landscape.