Finance

What Are Hedging Costs

Published: January 15, 2024

Discover the impact of hedging costs in finance and how they can affect your investments. Learn strategies to minimize these expenses and maximize your returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where managing risks and maximizing returns are constant challenges. One of the key tools used by financial institutions and investors to mitigate risks is hedging. Hedging is a strategic practice of taking offsetting positions to protect against adverse price movements in assets or liabilities. It allows individuals and organizations to minimize potential losses and secure their financial positions.

In this article, we will dive into the concept of hedging and explore the various types of hedging strategies. Specifically, we will focus on understanding hedging costs, which play a crucial role in determining the effectiveness and profitability of hedging activities.

Before delving into the specifics, it’s important to note that hedging costs can vary across different financial markets, instruments, and time periods. However, by gaining a clear understanding of the factors influencing hedging costs and implementing effective strategies, investors can minimize these costs and optimize their hedging strategies.

Let’s explore the fascinating world of hedging costs and learn how to navigate the complexity of financial markets.

Definition of Hedging

Hedging, in the context of finance, refers to a risk management strategy that involves taking offsetting positions to reduce the potential impact of adverse price movements. It is commonly used by investors, financial institutions, and businesses to protect themselves against market volatility and uncertainties. By hedging, individuals and organizations aim to minimize potential losses and stabilize their financial positions.

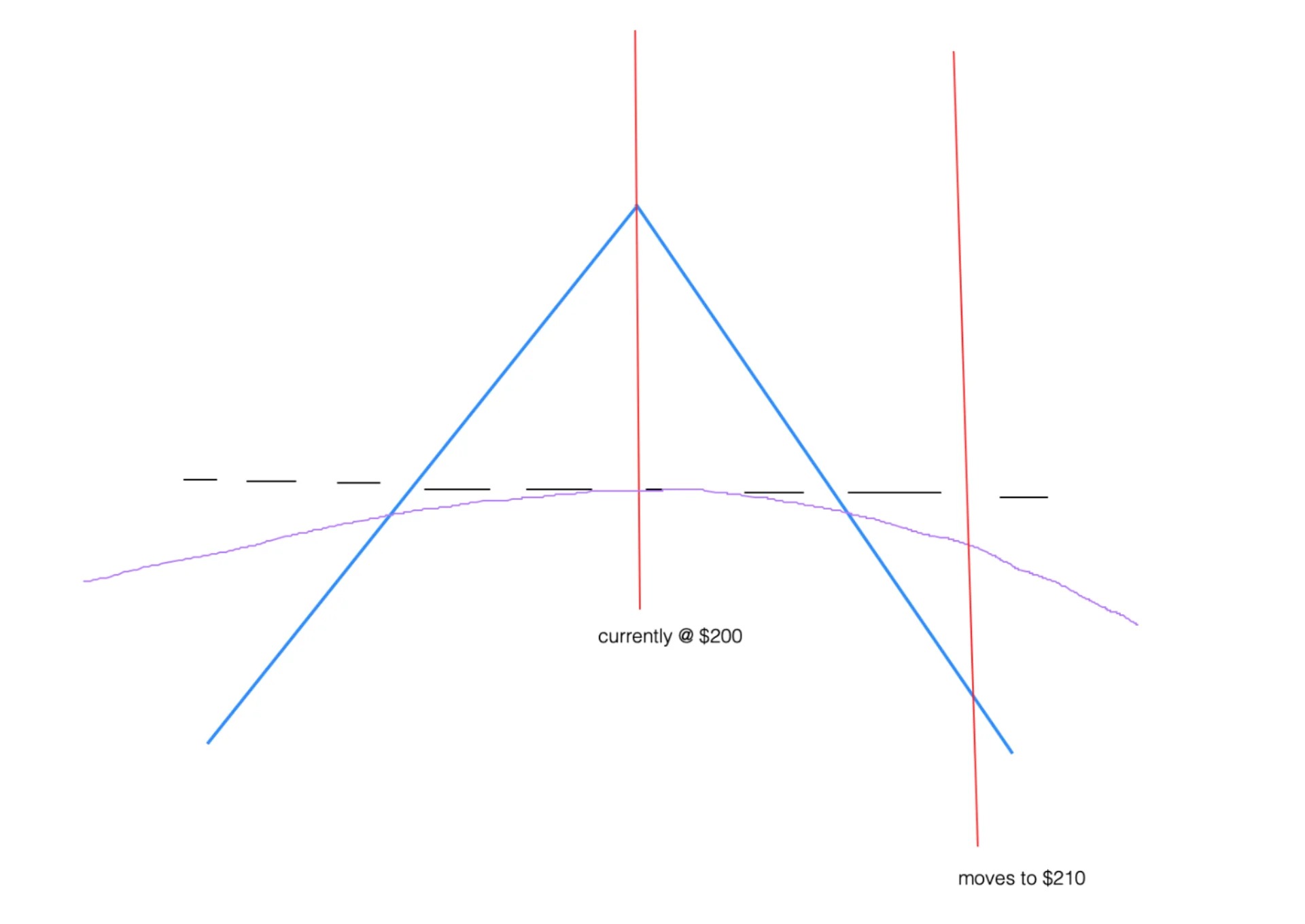

At its core, hedging involves entering into a trade or investment that is negatively correlated with an existing position. This means that if the value of one position decreases, the other position will likely increase in value, thereby offsetting the losses. By balancing the risks and rewards of different positions, hedging allows investors to limit their exposure to market fluctuations.

There are various types of hedging strategies that investors can employ, depending on their specific needs and objectives. Some of the commonly used hedging techniques include:

- Forward Contracts: These are agreements between two parties to buy or sell an asset at a predetermined price and date in the future. Forward contracts help mitigate the risk of price changes by fixing the purchase or sale price in advance.

- Options: Options give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a specific timeframe. They provide flexibility and protection against unfavorable price movements.

- Futures Contracts: Similar to forward contracts, futures contracts allow participants to buy or sell an asset at a predetermined price and date. However, futures contracts are standardized and traded on organized exchanges.

- Swaps: Swaps involve the exchange of cash flows or assets between two parties over a predetermined period. They help manage interest rate risks, foreign exchange risks, and other financial uncertainties.

By utilizing these hedging strategies, investors can reduce their exposure to market risks and protect their portfolios from potential losses. However, it’s important to understand that hedging does not eliminate all risks; rather, it aims to mitigate them to a certain extent.

Now that we have established a clear definition of hedging let’s delve deeper into the concept of hedging costs and their significance in hedging strategies.

Types of Hedging

When it comes to hedging, there are various strategies and techniques that can be employed to manage different types of risks. Here are some of the commonly used types of hedging:

- Price Risk Hedging: This type of hedging focuses on managing the risk of price fluctuations in assets or commodities. It is commonly used by producers, consumers, and traders to protect against adverse movements in the prices of raw materials, commodities, or financial instruments. For example, a farmer may hedge against falling crop prices by entering into a futures contract to sell their produce at a predetermined price.

- Foreign Exchange (FX) Hedging: FX hedging is employed by businesses and investors to manage the risks associated with currency fluctuations. It involves taking positions in foreign exchange markets to protect against adverse movements in exchange rates. This type of hedging is especially relevant for companies engaged in international trade or individuals with exposure to foreign currencies.

- Interest Rate Hedging: Interest rate hedging is used to mitigate the risk of fluctuations in interest rates. It is commonly utilized by individuals and businesses with variable-rate loans, floating-rate bonds, or investments in interest-rate-sensitive instruments. Interest rate swaps and interest rate futures are common tools employed for interest rate hedging purposes.

- Portfolio Hedging: Portfolio hedging involves taking positions to offset the risk of adverse movements in the overall value of an investment portfolio. It aims to protect against market downturns and volatility. Investors may use options, futures, or other derivative instruments to hedge their portfolios against fluctuations in broad market indices.

- Systematic Risk Hedging: Systematic risk, also known as market risk, refers to the risk associated with overall market conditions and cannot be eliminated through diversification. Hedging against systematic risk involves taking positions that move in the opposite direction to the broader market. This type of hedging aims to protect against general market downturns that can impact a wide range of assets.

It’s worth noting that the choice of hedging strategy depends on the specific risk exposures and objectives of the individual or organization. Each type of hedging strategy has its own set of tools and instruments that can be used to mitigate risks effectively.

Now that we have a clear understanding of the different types of hedging, let’s explore the concept of hedging costs and their significance in the hedging process.

Understanding Hedging Costs

When engaging in hedging activities, it’s important to consider the costs involved. Hedging costs refer to the expenses associated with implementing and maintaining hedging positions. These costs can include direct expenses, such as transaction fees and premiums, as well as indirect costs, such as opportunity costs and market impact.

Direct Hedging Costs:

Direct hedging costs are the explicit expenses incurred while establishing and maintaining a hedge position. These costs can vary depending on the type of hedging instrument used. For example, when using options, the cost includes the premium paid to acquire the option contract. Likewise, when trading futures contracts, there are transaction costs involved, such as brokerage fees and exchange fees.

Indirect Hedging Costs:

Indirect hedging costs are the hidden or implicit costs associated with hedging strategies. These costs are not immediately visible but can impact the overall effectiveness of the hedge. One of the main indirect costs is opportunity cost, which refers to the potential profits forgone when implementing a hedge position. By hedging, investors may miss out on potential gains if the market moves in their favor. However, the purpose of hedging is to protect against potential losses, so this opportunity cost is acceptable in reducing downside risk.

Another factor to consider is market impact. Hedging large positions or making frequent adjustments to hedge positions can impact the market and result in unfavorable execution prices. This market impact cost is particularly relevant for institutional investors and large market participants.

Overall, understanding and factoring in hedging costs is essential for making informed decisions. It’s important to strike a balance between the benefits of hedging and the associated costs. Effective hedging strategies aim to minimize costs while providing adequate protection against potential risks.

In the next section, we will explore the factors that can influence hedging costs, giving you a comprehensive understanding of the various elements to consider when implementing hedging strategies.

Factors Affecting Hedging Costs

Several factors can affect the costs associated with hedging strategies. Understanding these factors is essential for investors and financial institutions to effectively manage their hedging activities. Here are some key factors that can influence hedging costs:

- Volatility: The level of price volatility in the market can significantly impact hedging costs. Higher volatility generally leads to increased option premiums and wider bid-ask spreads for futures contracts. This can result in higher direct hedging costs.

- Liquidity: The liquidity of the hedging instrument or market is an important factor to consider. Illiquid markets or instruments with low trading volumes can lead to wider spreads, higher transaction costs, and increased indirect hedging costs.

- Time Horizon: The length of the hedging period can affect costs. Longer-term hedges may require rolling over or adjusting positions, which can result in higher transaction costs and potentially increased market impact costs.

- Instrument Selection: The choice of hedging instrument can impact costs. Options tend to have premiums, while futures typically involve transaction fees. The specific characteristics of each instrument, such as expiration dates or strike prices, can also influence costs.

- Counterparty Risk: Hedging through derivative contracts involves counterparties, which introduces the element of counterparty risk. The creditworthiness and stability of the counterparty can influence costs, including the cost of any collateral requirements or credit risk premiums.

- Regulatory Considerations: Regulatory requirements and restrictions may impact hedging costs. For example, certain derivatives may require higher capital reserves, resulting in increased costs for financial institutions.

- Market Conditions: The current state of the market, such as supply and demand dynamics, economic indicators, and geopolitical events, can impact hedging costs. Unpredictable market conditions can lead to increased volatility and wider spreads, affecting both direct and indirect hedging costs.

It’s important to analyze these factors and assess their potential impact on the overall cost of a hedging strategy. By carefully considering these factors, investors can make informed decisions and implement cost-effective hedging strategies that align with their risk tolerance and financial objectives.

Now that we understand the factors that can affect hedging costs, let’s explore the specific components that make up direct and indirect hedging costs, allowing us to gain a clearer perspective on how to measure and manage these costs effectively.

Direct Hedging Costs

Direct hedging costs are the explicit expenses incurred when establishing and maintaining hedging positions. These costs can vary depending on the type of hedging instrument used and the specific characteristics of the market. Understanding and managing these costs is crucial for optimizing hedging strategies. Here are the key components of direct hedging costs:

- Transaction Fees: When executing hedging transactions, such as buying or selling options or futures contracts, investors may incur transaction fees. These fees can include brokerage commissions, exchange fees, and regulatory charges. The exact amount of these fees can vary depending on the specific market and the size of the transaction.

- Premiums: If options are utilized for hedging, the cost of the option premium is a significant component of direct hedging costs. The premium represents the price paid by an investor to acquire the right to buy or sell an underlying asset at a specified price within a specific timeframe. Premiums are influenced by factors such as the volatility of the underlying asset, time to expiration, and the strike price relative to the current market price.

- Spread Costs: In the case of futures contracts, spread costs can impact direct hedging costs. The spread refers to the difference between the bid and ask prices quoted in the market. When entering or exiting a futures position, investors may incur costs due to the bid-ask spread. These costs can be influenced by factors such as market liquidity, trading volume, and order size.

- Margin Requirements: Margin requirements are the minimum amount of collateral that participants must maintain when trading certain derivative contracts. Margin requirements can vary depending on the instrument and market conditions. Participants must allocate funds for margin purposes, which can impact their overall cost of hedging.

- Expiry Costs: Certain hedging instruments, such as options, have expiration dates. If a hedging position is held until expiration, additional costs may arise, such as the need to roll over the position or unwind the hedge. These costs will depend on prevailing market conditions, transaction fees, and any adjustments needed.

It’s important for investors to carefully evaluate and consider these direct hedging costs when formulating their hedging strategies. Balancing the effectiveness of the hedge against the associated expenses is crucial to achieve the desired risk management outcomes.

Now that we have explored direct hedging costs, let’s move on to understanding the components of indirect hedging costs, which play an equally important role in the overall cost-efficiency of hedging strategies.

Indirect Hedging Costs

Indirect hedging costs are the hidden or implicit expenses associated with hedging strategies. These costs are not directly measurable in monetary terms but can have a significant impact on the overall effectiveness and profitability of hedging activities. It is crucial to understand and manage these costs to optimize hedging strategies. Here are the key components of indirect hedging costs:

- Opportunity Costs: Hedging involves taking offsetting positions in the market, which means investors may miss out on potential gains if the market moves in their favor. These missed opportunities are known as opportunity costs. By hedging against potential losses, investors accept the trade-off of relinquishing some potential profits. Evaluating and quantifying these opportunity costs can be challenging, as they depend on the specific market conditions and the alternative investment opportunities available.

- Market Impact Costs: Adjusting or rebalancing hedge positions can impact the market, resulting in unfavorable execution prices. When initiating large hedging transactions or frequently adjusting positions, investors may experience market impact costs. These costs occur due to the market’s reaction to a considerable demand or supply imbalance caused by the hedging activities. Market impact costs can be particularly significant for institutional investors or large market participants.

- Tracking Error: Tracking error refers to the divergence between the performance of a hedged position and the performance of the asset being hedged. It measures the effectiveness of the hedge in offsetting price movements. Higher tracking error indicates that the hedge may not perfectly align with the underlying risk exposure, leading to potential deviations and additional costs.

- Administrative Costs: Hedging strategies require ongoing monitoring, analysis, and administrative efforts. These administrative costs include expenses related to risk management systems, data analysis tools, and personnel. While not directly related to the execution of hedge positions, these costs are essential for ensuring the effectiveness and oversight of the hedging process.

Indirect hedging costs are challenging to measure and quantify precisely. However, acknowledging and considering these costs is crucial for achieving a comprehensive evaluation of the overall cost of a hedging strategy. Investors must strike a balance between the cost of hedging and the benefits of risk reduction to optimize their hedging activities.

Now that we have explored direct and indirect hedging costs, let’s move on to understanding how to measure and evaluate the effectiveness of hedging costs in the next section.

Measuring Hedging Costs

Measuring hedging costs is essential for evaluating the effectiveness and profitability of hedging strategies. While some direct costs, such as transaction fees and premiums, are relatively straightforward to quantify, measuring indirect costs can be more challenging. Here are some approaches to measure hedging costs:

- Cost-to-Market: The cost-to-market approach compares the performance of a hedged position to the hypothetical performance of an unhedged position. By analyzing the difference in returns between the two, investors can estimate the cost of the hedge. A higher cost-to-market ratio indicates higher hedging costs.

- Scenario Analysis: Scenario analysis involves simulating different market scenarios to assess the impact of hedging on portfolio performance. By examining the potential outcomes under various market conditions, investors can gain insight into the costs involved in different hedging strategies.

- Historical Backtesting: Historical backtesting involves analyzing the past performance of a hedging strategy and comparing it to the actual market movements during that period. This approach helps evaluate the effectiveness of a hedge by assessing how well it protected against adverse price movements and the associated costs incurred.

- Benchmark Comparison: Benchmark comparison involves comparing the performance of a hedged portfolio to a benchmark index or a similar investment strategy without hedging. This approach allows investors to assess the relative performance and costs of their hedging strategy against a suitable benchmark.

- Monitoring and Analysis: Ongoing monitoring and analysis of the hedge positions, costs incurred, and the overall impact on portfolio performance are crucial for assessing hedging costs. Regular evaluation of transaction fees, premium expenses, tracking error, and other indirect costs can provide insights into the effectiveness of the hedge and help identify areas for improvement.

It’s important to note that measuring hedging costs is not a one-size-fits-all approach. The appropriate method may vary depending on the specific hedge strategy, investment horizon, market conditions, and available data. Investors should tailor their measurement techniques to suit their individual circumstances and objectives.

By employing robust measurement approaches, investors can make informed decisions about their hedging strategies, optimize costs, and effectively manage risks in their financial portfolios.

Now that we understand how to measure hedging costs, let’s explore some strategies to minimize these costs and enhance the efficiency of hedging strategies.

Strategies to Minimize Hedging Costs

Minimizing hedging costs is a crucial aspect of effective risk management and optimizing hedging strategies. By employing the following strategies, investors can reduce expenses and enhance the efficiency of their hedging activities:

- Cost-Benefit Analysis: Conducting a thorough cost-benefit analysis is essential before implementing a hedge. It helps evaluate the potential benefits of hedging against the expected costs. By carefully assessing the risks, rewards, and associated expenses, investors can make informed decisions about whether or not to hedge and the most cost-effective approach to follow.

- Consider Alternative Instruments: Exploring different hedging instruments can help identify the most cost-efficient options. Investors should compare the costs associated with different derivatives, such as options, futures, and swaps, based on their specific risk exposure and time horizon. By considering alternative instruments, investors can select the instrument that offers the desired protection with the lowest direct costs.

- Optimize Timing for Transactions: Timing can significantly impact hedging costs. Investors should aim to execute their hedge transactions during periods of lower volatility and wider bid-ask spreads to reduce transaction costs. Additionally, monitoring market conditions and executing transactions when liquidity is high can help minimize market impact costs.

- Review and Adjust Hedge Ratios: Regularly reviewing and adjusting the hedge ratios can help optimize costs. The hedge ratio represents the proportional relationship between the hedged position and the underlying exposure. By periodically reassessing and fine-tuning the hedge ratio based on changing market conditions, investors can strike a balance between risk reduction and minimizing direct hedging costs.

- Efficient Trade Execution: Selecting the most suitable trading platforms and brokers can contribute to cost savings. Investors should seek brokerage services that offer competitive commission rates, low spreads, and efficient trade execution. Additionally, utilizing technology and algorithms can help minimize trading costs and improve trade execution efficiency.

- Regular Monitoring and Evaluation: Ongoing monitoring and evaluation of hedging strategies are crucial for identifying any inefficiencies or unnecessary costs. By regularly reviewing the performance, costs, and effectiveness of the hedge, adjustments can be made to improve cost efficiency. Continuously analyzing direct and indirect hedging costs, tracking error, and portfolio performance enables investors to optimize their hedging strategies over time.

By implementing these strategies, investors can minimize hedging costs and achieve their risk management objectives while maintaining a cost-effective approach. It is essential to regularly reassess and adjust hedging strategies to ensure they remain aligned with changing market conditions and individual objectives.

Now that we have explored the strategies to minimize hedging costs, let’s summarize the key points covered in this article.

Conclusion

Hedging is a crucial risk management strategy in the world of finance, allowing individuals and organizations to mitigate potential losses and secure their financial positions. However, it is important to understand and manage the costs associated with hedging to make informed decisions and optimize effectiveness.

In this article, we explored the definition of hedging and the various types of hedging strategies utilized in finance. We delved into the concept of hedging costs, which encompass both direct and indirect expenses. Direct hedging costs include transaction fees, premiums, spread costs, margin requirements, and expiry costs. While indirect hedging costs consist of opportunity costs, market impact costs, tracking errors, and administrative expenses.

Factors such as volatility, liquidity, time horizon, instrument selection, counterparty risk, regulatory considerations, and market conditions can influence hedging costs. Measuring and evaluating these costs can be done through approaches such as cost-to-market analysis, scenario analysis, historical backtesting, benchmark comparison, and ongoing monitoring and analysis.

To minimize hedging costs, investors can employ strategies such as conducting cost-benefit analysis, considering alternative instruments, optimizing timing for transactions, reviewing and adjusting hedge ratios, efficient trade execution, and regular monitoring and evaluation.

By implementing these strategies, individuals and organizations can strike a balance between risk reduction and cost efficiency in their hedging strategies. It is crucial to continuously reassess and adjust hedging strategies to align with changing market conditions and objectives.

Overall, understanding and managing hedging costs are vital for successful risk management and optimal financial decision-making. By considering the factors influencing costs, employing cost-effective strategies, and regularly assessing performance, investors can navigate the complex world of hedging with confidence.