Finance

What Is The Cheapest Hedging

Published: January 15, 2024

Discover the most cost-effective hedging strategies in the world of finance. Explore the cheapest ways to protect your investments and minimize risks with expert advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, risk management plays a vital role in safeguarding investments and ensuring stability in uncertain markets. One of the key tools used for risk management is hedging. Hedging involves strategies aimed at offsetting potential losses by taking opposite positions in related assets or markets.

The goal of hedging is to protect against adverse price movements, reduce volatility, and preserve capital. While the concept of hedging is fairly straightforward, the challenge lies in finding the most cost-effective hedging strategies.

In this article, we will explore the concept of hedging and delve into the various factors to consider when implementing a hedging strategy. We will also discuss traditional and alternative hedging options available in the market. Additionally, we will evaluate the cost-effectiveness of different hedging strategies and highlight the cheapest approaches to mitigate risk.

By the end of this article, you will have a clear understanding of the cheapest hedging strategies available and be equipped to make informed decisions when it comes to managing risk in your investment portfolio.

Understanding Hedging

Hedging is a risk management strategy that involves taking opposite positions in different financial instruments or markets. The main objective of hedging is to offset potential losses in one asset or market by profiting from the opposite position in another asset or market. By doing so, hedging aims to reduce exposure to price volatility and mitigate downside risk.

There are various types of hedging strategies that investors can utilize, depending on their risk tolerance, investment objectives, and market conditions. Some common hedging techniques include:

- Long and Short Positions: Hedging can involve taking both long and short positions in the same or different assets. For example, an investor who is long on a specific stock may take a short position in a correlated stock to hedge the risk.

- Derivatives: Derivative instruments, such as options, futures, and forwards, are commonly used for hedging purposes. These instruments allow investors to establish specific rights or obligations related to an underlying asset, enabling them to hedge against price fluctuations.

- Asset Allocation: Hedging can also be achieved through strategic asset allocation. By distributing investments across different asset classes, such as stocks, bonds, and commodities, investors can create a diversified portfolio that helps mitigate overall risk.

It is important to note that hedging does not eliminate risk entirely. Instead, it aims to minimize the impact of adverse price movements on a portfolio. While hedging may reduce potential losses, it can also limit potential gains. Therefore, investors must carefully assess the cost and effectiveness of hedging strategies and strike a balance that aligns with their risk tolerance and investment goals.

To implement an effective hedging strategy, investors must consider several factors, including:

- Market Conditions: Assessing the current market environment and anticipating potential risks and opportunities is crucial for effective hedging. Understanding the underlying factors that can impact asset prices is key to determining appropriate hedging strategies.

- Correlation Analysis: Identifying the correlation between different assets or markets is essential to establish the effectiveness of a hedging strategy. Correlated assets move in tandem, while negatively correlated assets move in opposite directions.

- Cost of Hedging: The cost of implementing a hedge is an important consideration. Investors must evaluate the associated costs, such as transaction fees, margin requirements, and insurance premiums, and weigh them against the potential benefits of the hedge.

- Time Horizon: The time frame over which a hedge is implemented is crucial. Short-term hedging strategies may focus on near-term risks, while long-term hedging strategies aim to protect against potential losses over an extended period.

By understanding these key factors and utilizing appropriate hedging techniques, investors can manage risk, protect their investments, and navigate volatile market conditions more effectively.

Factors to Consider for Hedging

When it comes to implementing a hedging strategy, there are several important factors that investors need to consider. These factors can help determine the most effective approach to hedging and ensure that the strategy aligns with their risk tolerance and investment goals. Let’s explore some key factors to consider when hedging:

1. Risk Tolerance: Each investor has a unique risk tolerance level, which dictates their ability to tolerate potential losses. Some investors are more risk-averse and prefer conservative hedging strategies, while others may be more comfortable taking on higher levels of risk to seek greater returns.

2. Investment Objectives: Clarifying investment objectives is crucial in determining the appropriate hedging strategy. Different investors may have varying goals, such as capital preservation, income generation, or long-term growth. The hedging strategy should align with these objectives and be tailored to meet specific needs.

3. Time Horizon: The time frame over which an investor plans to hold their investments plays a significant role in determining the most suitable hedging strategy. Short-term investors may focus on hedging against near-term risks, while long-term investors may opt for strategies that offer protection over an extended period.

4. Asset Allocation: Analyzing the composition of an investment portfolio is essential for effective hedging. Diversification across different asset classes, such as stocks, bonds, and commodities, can help minimize risk. The allocation of assets can also impact the choice of hedging instruments and strategies.

5. Market Conditions: Assessing the current market conditions is crucial in identifying potential risks and opportunities. A thorough analysis of economic trends, geopolitical events, and industry-specific factors can help determine the appropriate hedging strategy. Different market environments may warrant different hedging approaches.

6. Correlation Analysis: Understanding the correlation between different assets or markets is fundamental. Positive correlation implies that the value of assets moves in tandem, while negative correlation indicates that they move in opposite directions. Investors can utilize this information to select hedging instruments that provide the greatest offset against potential losses.

7. Cost Considerations: Hedging strategies may incur costs such as transaction fees, margin requirements, or insurance premiums. Evaluating the cost-effectiveness of different hedging instruments is essential. Investors should carefully assess the potential benefits of hedging against the associated costs to ensure that the strategy aligns with their financial goals.

By taking these factors into account, investors can make more informed decisions when implementing a hedging strategy. Ultimately, the goal is to protect against downside risk, reduce volatility, and create a more secure investment portfolio.

Traditional Hedging Options

There are several traditional hedging options available to investors that have been widely utilized over the years. These options provide a means to reduce risk and manage exposure to price fluctuations in various financial markets.

1. Futures Contracts: Futures contracts are widely used for hedging purposes, especially in commodities and currencies. These contracts obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price and date in the future. By taking a futures position opposite to their existing investment, investors can mitigate the risk of adverse price movements.

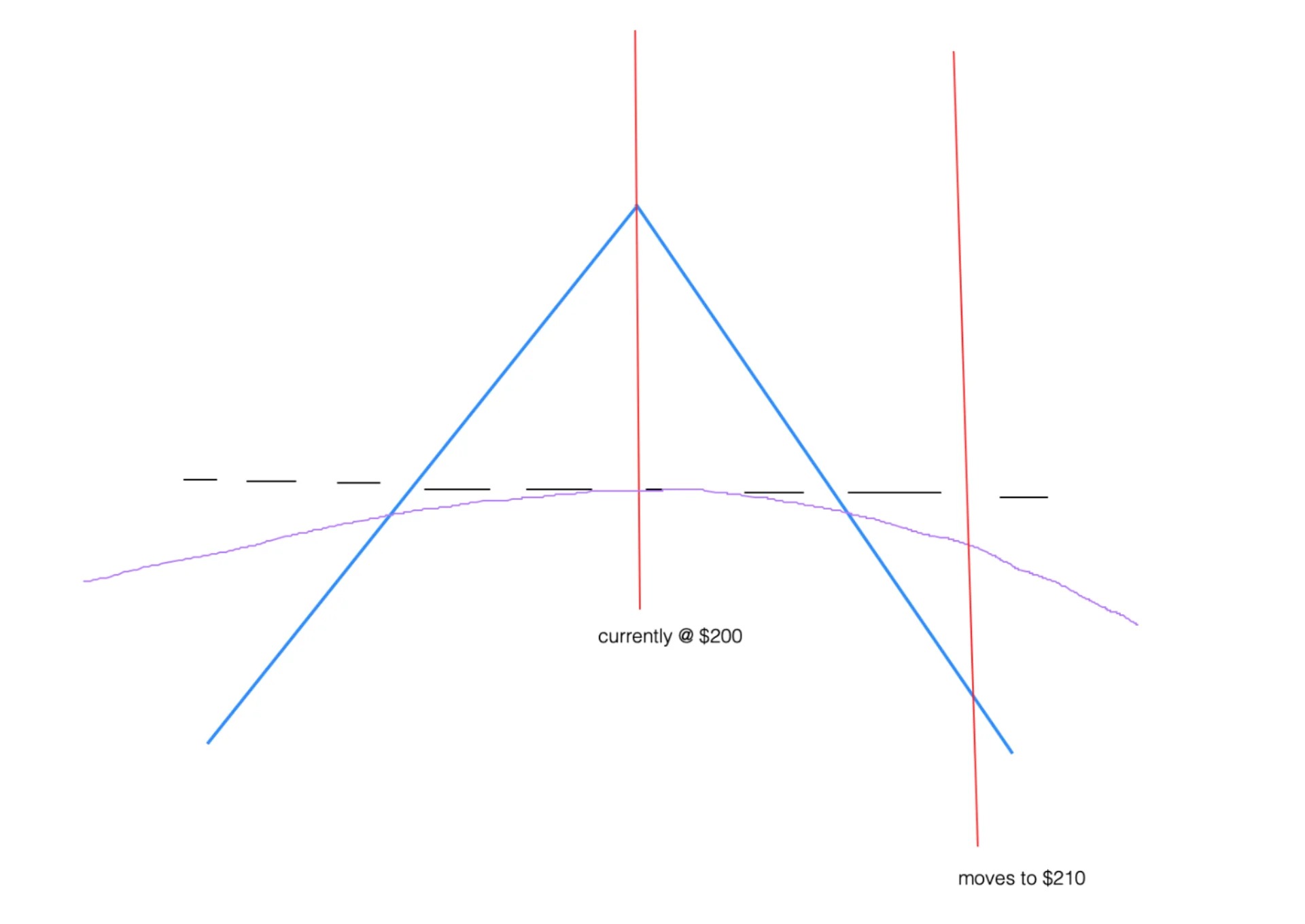

2. Options Contracts: Options contracts provide the holder with the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price within a specified period. Options can be used as a hedging tool to protect against price fluctuations. For example, a put option can provide downside protection by allowing the holder to sell the asset at a predetermined price even if the market price declines.

3. Swaps: Swaps are agreements between two parties to exchange cash flows or other financial instruments. They can be used to hedge against interest rate risk, currency risk, or commodity price risk. For example, a company that has taken a loan with a variable interest rate may enter into an interest rate swap to convert the variable rate to a fixed rate and mitigate the risk of rising interest rates.

4. Forward Contracts: Similar to futures contracts, forward contracts are agreements to buy or sell an asset at a specified price and date in the future. Unlike futures, forward contracts are typically traded over-the-counter (OTC) and have more flexibility in terms of customization. Forward contracts can be utilized to hedge against currency risk, interest rate risk, or commodity price risk.

5. Short Selling: Short selling involves borrowing shares of a security and selling them with the expectation of buying them back at a lower price in the future. This strategy can be utilized to hedge against a decline in the value of a particular stock or to hedge against market downturns. However, short selling carries its own risks and can result in unlimited losses if the price of the borrowed shares increases.

These traditional hedging options provide a range of strategies to manage risk and protect investments. Each option has its own unique characteristics and suitability depending on the specific investment and market conditions. It is essential for investors to thoroughly analyze and understand the features and risks associated with each traditional hedging option before implementing them in their portfolio.

Alternative Hedging Options

While traditional hedging options have been widely utilized for risk management, there are also alternative hedging options available to investors. These alternative strategies provide innovative ways to hedge against market risks and offer more flexibility in tailoring hedging approaches to specific investment needs. Let’s explore some popular alternative hedging options:

1. Exchange-Traded Funds (ETFs): ETFs are investment funds that are traded on stock exchanges, representing a diversified portfolio of underlying assets. Certain ETFs are designed to track inverse or leveraged movements of specific markets or sectors. Investors can use these ETFs to hedge against potential downturns or to take advantage of inverse market movements.

2. Options Collars: A collar strategy involves simultaneously buying a put option to limit downside risk and selling a call option to generate income. This strategy can protect against significant losses while still allowing for some potential upside gain. Collars are commonly used by investors with concentrated stock positions to hedge against declines while limiting the cost of protection.

3. Risk Reversal: A risk reversal strategy involves simultaneously buying a call option and selling a put option with the same expiration date. This strategy allows investors to hedge against downside risk while potentially benefiting from upside movements in the underlying asset. Risk reversals are commonly used by investors who want to protect against market volatility while maintaining the potential for gains.

4. Volatility Index (VIX) Options: The VIX, often referred to as the “fear gauge,” measures market volatility. Investors can utilize VIX options to hedge against potential market downturns or increased volatility. These options can provide protection during periods of market stress or uncertainty, as the VIX tends to rise when markets experience significant fluctuations.

5. Alternative Investments: Alternative investments, such as real estate, private equity, and hedge funds, can offer unique hedging opportunities. These investments often have low correlations with traditional asset classes, providing diversification benefits and potentially serving as a hedge against market downturns. However, alternative investments also come with their own risks and may require a longer-term investment horizon.

6. Risk Parity Strategies: Risk parity strategies aim to balance risk across different asset classes, taking into account the historical volatility and correlation of each asset class. By allocating investments based on risk rather than traditional asset allocation, risk parity strategies seek to provide a more balanced portfolio that reduces the impact of any single asset class and hedges against extreme market events.

These alternative hedging options provide investors with additional tools to manage risk and protect their portfolios. Each strategy has its own unique features, risk profiles, and suitability for different investment objectives. Diversifying hedging approaches through traditional and alternative options can enhance risk management and improve overall portfolio performance.

Evaluating the Cost of Hedging Options

When considering hedging options, it is essential to evaluate the costs associated with implementing these strategies. While hedging can provide protection against potential losses, it comes at a cost that can impact investment returns. Evaluating the cost-effectiveness of hedging strategies is crucial to ensure that the benefits outweigh the expenses. Here are some key factors to consider when assessing the cost of hedging options:

1. Transaction Costs: Every hedging transaction incurs transaction costs, such as brokerage fees, commissions, and bid-ask spreads. These costs can vary depending on the type of hedging instrument and the size of the transaction. Investors should analyze the transaction costs and assess their impact on the overall performance of the investment.

2. Margin Requirements: Some hedging strategies, such as futures and options contracts, may require margin deposits or collateral. Margin requirements tie up capital that could otherwise be deployed in other investments. It is important to consider the opportunity cost of holding margin requirements and understand the impact on returns.

3. Insurance Premiums: Certain hedging strategies, like purchasing insurance or protection against specific risks, involve paying premiums. These premiums act as an ongoing cost to maintain the protection. Investors must compare the cost of the premiums with the potential benefits of the insurance coverage to determine whether it is cost-effective.

4. Counterparty Risk: Hedging instruments often involve entering into contracts or agreements with counterparties. It is important to assess the counterparty risk and evaluate the cost associated with mitigating this risk, such as credit default swaps or collateral requirements. Understanding the potential costs linked to counterparty risk is crucial in selecting the most suitable hedging options.

5. Opportunity Cost: Implementing a hedging strategy may require allocating capital or resources that could be utilized for other investment opportunities. Investors should carefully consider the potential returns from alternative investments and weigh them against the cost of hedging. Evaluating the opportunity cost allows investors to determine whether the potential benefits of hedging outweigh the missed investment opportunities.

6. Tax Implications: Hedging strategies can have tax implications that need to be considered. Different hedging instruments may have varying tax treatments, such as futures contracts qualifying for lower tax rates compared to short-term capital gains on options trading. Factoring in the tax implications allows investors to accurately assess the total cost of implementing hedging strategies.

7. Effectiveness of Hedging: Ultimately, the cost-effectiveness of hedging strategies depends on their effectiveness in reducing risk and protecting investments. It is important to evaluate the historical performance and success rate of the chosen hedging options. The effectiveness of hedging should be measured against the cost incurred to determine the overall value proposition.

By carefully evaluating the costs associated with different hedging options, investors can make informed decisions about the most cost-effective strategies for managing risk in their investment portfolios. Balancing the costs and benefits of hedging can help optimize risk-return trade-offs and enhance overall portfolio performance.

The Cheapest Hedging Strategies

When it comes to implementing hedging strategies, cost is an essential factor that investors must consider. While effective hedging can provide protection against potential losses, it is important to select strategies that are not overly expensive and do not erode investment returns. Here are some of the cheapest hedging strategies that investors can consider:

1. Portfolio Diversification: Diversifying your investment portfolio is one of the most cost-effective ways to hedge against risk. By allocating your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of any single investment on your overall portfolio. This diversification can help mitigate the risk of adverse price movements and offer a level of protection at a relatively low cost.

2. Stop-Loss Orders: A stop-loss order is a simple and cost-effective hedging strategy that helps limit potential losses. With a stop-loss order, you set a predetermined price at which your investment will be automatically sold if it reaches that level. This strategy helps protect against significant declines in asset value and allows you to exit a position before losses become too substantial. Stop-loss orders can be easily placed through most brokers and are usually accompanied by minimal transaction fees.

3. Covered Call Options: Writing covered call options involves selling call options on a stock that you already own. This strategy generates income from the premiums received while providing limited protection against downward price movements. By selling the call options, you are essentially agreeing to sell your shares at a predetermined price, offsetting potential losses. This strategy is relatively low cost and can be implemented using a standard brokerage account.

4. Ratio Spreads: A ratio spread involves buying and selling options contracts in an unequal ratio to hedge against potential price movements. This strategy can be used to protect against downside risk while still allowing for some upside potential. By adjusting the number of options bought and sold, investors can customize the ratio spread to their risk tolerance and investment objectives. Ratio spreads can be a cost-effective means of hedging options positions.

5. Market Index ETFs: Exchange-traded funds (ETFs) that track market indices provide a cost-effective way to hedge against broad market risks. These index ETFs allow investors to gain exposure to a diversified portfolio of stocks that mirrors a specific market index. By investing in an index ETF, investors can offset potential losses in their individual stock holdings with the gains from the ETF’s performance. This strategy provides overall market hedging at a low cost.

6. Risk Sharing through Insurance: Depending on the specific asset or investment, obtaining insurance coverage can be a viable option for hedging against certain risks. Insurance policies, such as property insurance or liability insurance, can provide protection against losses due to unforeseen events. While insurance premiums are an ongoing cost, they can help mitigate potential large losses and provide peace of mind at a relatively low cost.

It is important to note that while these hedging strategies can be cost-effective, they each have their own set of risks and limitations. Investors should carefully assess their investment objectives, risk tolerance, and the specific market conditions before implementing any hedging strategy. Additionally, monitoring and adjusting hedging strategies as market conditions change is essential to ensure continued effectiveness.

Case Studies: Comparison of Cheap Hedging Options

To better understand the cost-effectiveness and effectiveness of various cheap hedging options, let’s examine two case studies and compare their outcomes:

Case Study 1: Diversification vs. Stop-Loss Orders

In this case study, an investor holds a diversified portfolio consisting of stocks, bonds, and commodities. The investor also implements a stop-loss order strategy on a portion of their stock holdings.

During a market downturn, the value of the investor’s stock portfolio declines. However, the diversification across different asset classes partially offsets the losses. Moreover, the stop-loss orders automatically trigger, selling some stocks at predetermined levels, further limiting the losses. The diversification strategy acts as a long-term hedge against various risks, while the stop-loss orders provide a short-term protection mechanism.

In terms of cost, diversification does not incur additional expenses beyond the transaction costs associated with maintaining the portfolio. Stop-loss orders typically involve small transaction fees but provide a quick and straightforward hedging solution.

Case Study 2: Covered Call Options vs. Market Index ETFs

In this case study, an investor owns a stock with the potential for upside but wants to protect against potential downside risk. The investor considers implementing a covered call options strategy or investing in a market index ETF.

The investor decides to write covered call options, generating income from the premiums received while protecting against limited downside risk. If the stock price stays below the predetermined selling price, the investor keeps the premium and any capital appreciation. If the stock price rises significantly, the investor sacrifices some potential gains but still benefits from the income received from writing the options.

In contrast, investing in a market index ETF provides broader market hedging. If the overall market experiences a decline, the ETF’s performance partly offsets the losses in the investor’s individual stock holdings.

Cost-wise, writing covered call options involves transaction fees and potential commission charges when buying and selling options contracts. Market index ETFs have ongoing expense ratios, but the costs are lower compared to active management or other complex hedging strategies.

Each case study demonstrates different cheap hedging options and their suitability for various scenarios. The choice of strategy depends on the investor’s risk tolerance, investment objectives, and the specific market conditions at the time.

It is important for investors to carefully evaluate the potential benefits and drawbacks of each hedging option and determine which strategy aligns best with their financial goals and risk management requirements.

Conclusion

Hedging is a crucial risk management tool that allows investors to protect their investments and mitigate potential losses in volatile markets. While there are various hedging strategies available, it is important to consider the cost-effectiveness and suitability of each option. By selecting the cheapest hedging strategies, investors can effectively manage risk without significantly eroding investment returns.

Portfolio diversification emerges as a cost-effective hedge, as it provides broad exposure to different asset classes and helps offset potential losses through correlation benefits. Additionally, stop-loss orders offer a simple and low-cost way to protect against significant declines in specific investments.

Covered call options and market index ETFs are other cheap hedging options that investors can consider. Covered call options generate income from premiums while providing limited downside protection, allowing investors to participate in potential upside gains. Market index ETFs offer broad market hedging and can offset losses in individual stock holdings.

However, it is essential for investors to assess each hedge in the context of their risk tolerance, investment objectives, and market conditions. Cost-effectiveness should be evaluated against the potential benefits of hedging and the overall impact on investment returns.

While cheap hedging strategies can reduce risk, it is important to note that no hedge can eliminate risk entirely. Investors should always carefully evaluate risks and seek professional advice when implementing hedging strategies.

In conclusion, by understanding the concepts of hedging, evaluating the cost of different strategies, and selecting the most suitable and cost-effective options, investors can effectively manage risk and protect their investments. A well-implemented hedging strategy can provide peace of mind and contribute to long-term investment success.