Finance

What Is Hedging?

Published: January 15, 2024

Discover the concept of hedging in finance and how it can manage risk and protect investments. Explore different hedging strategies and their benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, managing risk is a crucial aspect of ensuring stability and profitability. One powerful tool that financial institutions and investors use to mitigate risk is hedging. Hedging is a strategy that involves taking offsetting positions in the market to protect against adverse price movements.

Hedging serves as a form of insurance, allowing individuals and businesses to minimize potential losses by locking in favorable prices for assets or commodities. By engaging in hedging, market participants can protect themselves from unforeseen events, such as fluctuations in interest rates, currency values, or commodity prices.

While hedging can be complex, it plays an integral role in managing risk in various sectors, including the stock market, foreign exchange market, and commodity markets. This article will dive deeper into the concept of hedging, explore different hedging strategies, and discuss the benefits and limitations of hedging.

Understanding hedging is crucial for both investors and businesses, as it helps them make informed decisions and protect their investments. By utilizing hedging strategies effectively, individuals and organizations can navigate market volatility with greater confidence.

Definition of Hedging

Hedging is a risk management strategy used in finance to minimize or offset potential losses by taking opposing positions in the market. It involves initiating a second position that is inversely correlated to an existing position, with the aim of balancing out any potential losses. The primary objective of hedging is to protect against adverse price movements and reduce the overall risk exposure.

At its core, hedging is a form of insurance. Just as individuals purchase insurance policies to protect themselves against future uncertainties, market participants hedge their investments to safeguard against unfavorable market conditions. By implementing hedging strategies, investors and businesses can limit their downside risk and secure their financial positions.

Hedging can be executed through various financial instruments, such as options, futures contracts, swaps, and forwards. These instruments provide the flexibility to take offsetting positions in different markets, allowing investors to control the volatility of their portfolio.

It’s important to note that hedging serves as a risk management tool rather than a profit generation technique. The goal of hedging is not to generate substantial returns but to minimize the potential impact of adverse market movements on existing investments.

Overall, hedging provides a means for individuals and organizations to protect their assets and investments from unforeseen market events. By effectively managing risk through hedging, market participants can mitigate losses, maintain financial stability, and navigate volatile market conditions with greater confidence.

Purpose of Hedging

The primary purpose of hedging is to mitigate and manage risk. By employing hedging strategies, individuals and organizations can protect themselves against unfavorable market conditions and potential losses. Here are some key purposes of hedging:

- Protecting investments: One of the main purposes of hedging is to safeguard investments from adverse price movements. By taking offsetting positions, investors can minimize the impact of market volatility and protect the value of their holdings. This is especially important for long-term investors who aim to preserve their capital.

- Managing price fluctuations: Hedging is commonly used to manage price fluctuations in various markets. For example, in the commodities market, producers may use hedging strategies to lock in favorable prices for their products, protecting themselves from price volatility. Similarly, importers/exporters may hedge against currency fluctuations to stabilize their profits.

- Reducing downside risk: Hedging allows investors to reduce their exposure to downside risk. By taking opposing positions in the market, any potential losses from one position can be offset by gains from the other. This helps to limit the impact of adverse market movements and preserve capital.

- Ensuring stability in cash flows: Businesses often use hedging to ensure stability in cash flows. For instance, a company with significant foreign currency exposure may use currency hedging to protect against fluctuations in exchange rates, ensuring that they can accurately forecast and plan their revenue and expenses.

- Enhancing portfolio diversification: Hedging can also play a role in portfolio diversification. By incorporating different hedging strategies, investors can reduce the overall risk of their portfolio and potentially achieve more stable returns. This is particularly important for those with a diverse range of investments across different asset classes.

Overall, the purpose of hedging is to protect investments, manage price fluctuations, reduce downside risk, ensure stability in cash flows, and enhance portfolio diversification. By employing effective hedging strategies, individuals and businesses can navigate uncertain market conditions with greater confidence and minimize potential losses.

Types of Hedging

Hedging strategies can vary widely depending on the specific market and type of risk being managed. Here are some common types of hedging:

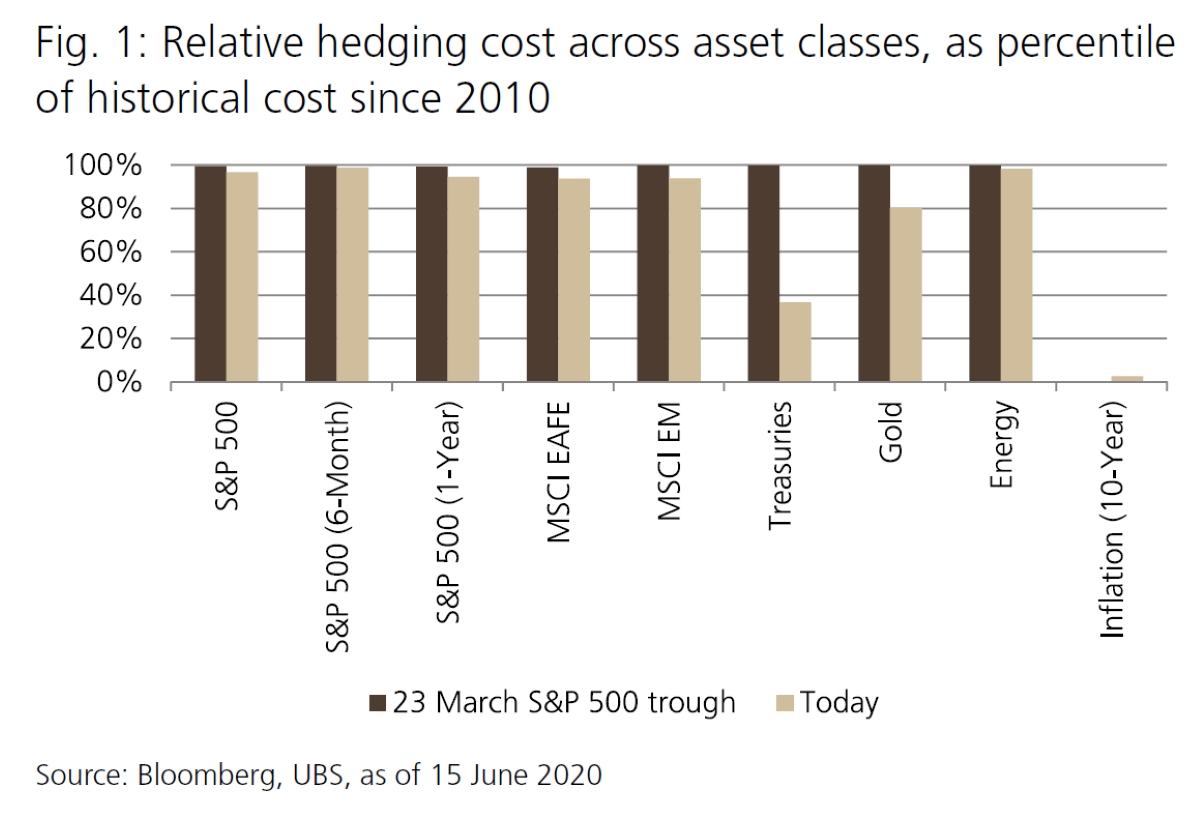

- Stock market hedging: In the stock market, investors can use various hedging techniques to protect their stock positions. For example, they can purchase put options, which give them the right to sell their stocks at a predetermined price, providing a form of insurance against potential price declines.

- Foreign exchange hedging: Businesses involved in international trade often employ foreign exchange hedging strategies to manage currency risk. This can be done through forward contracts, currency swaps, or options to lock in exchange rates and mitigate the impact of currency fluctuations.

- Interest rate hedging: Interest rate hedging is used to protect against fluctuations in interest rates. For instance, a company with variable-rate debt might enter into an interest rate swap, converting the variable interest payments into fixed-rate payments, enabling them to better manage their cash flow and exposure to interest rate movements.

- Commodity hedging: Producers and consumers of commodities often use hedging strategies to protect against price volatility. Futures contracts and options can be utilized to fix the price of commodities, providing stability and certainty in pricing for both buyers and sellers.

- Portfolio hedging: Portfolio hedging involves diversifying investments to reduce overall portfolio risk. This can be achieved through various techniques such as using derivatives, short selling, or investing in uncorrelated assets. The goal is to offset potential losses in one area of the portfolio with gains in another.

It is essential to note that the choice of hedging strategy depends on the specific risk exposure, objectives, and market conditions. Each type of hedging strategy has its own advantages and disadvantages, and it is crucial to carefully assess and select the most appropriate strategy based on individual circumstances.

Ultimately, the goal of implementing these different types of hedging strategies is to protect against risk and minimize potential losses in a dynamic and ever-changing market environment.

Examples of Hedging Strategies

Hedging strategies can take various forms depending on the specific market and risk being managed. Here are some common examples of hedging strategies:

- Long and short positions: One common hedging strategy is to take both a long and a short position in related assets. For instance, an investor who is long on a specific stock may choose to short a correlated stock to balance out potential losses. This strategy allows for potential gains in one position to offset potential losses in the other.

- Options contracts: Options are derivative contracts that provide the right, but not the obligation, to buy or sell an asset at a specific price within a predetermined timeframe. Investors can use options to hedge against potential price fluctuations. For example, purchasing put options can protect against downward movements in the price of a stock or other asset.

- Futures contracts: Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. They can be used to hedge against price fluctuations in various markets, such as commodities, currencies, and interest rates. By taking a futures position opposite to their existing exposure, investors can offset potential losses.

- Forward contracts: Forward contracts are similar to futures contracts but are customized agreements between two parties. They are often used in foreign exchange hedging to lock in an exchange rate for a future transaction. By entering into a forward contract, businesses can protect themselves against currency fluctuations and ensure more predictable cash flows.

- Swaps: Swaps involve exchanging cash flows or liabilities with another party to manage risk. For example, an interest rate swap allows two parties to exchange fixed and variable interest rate payments, helping to mitigate interest rate risk. Swaps can also be used to manage currency risk or commodity price risk.

These are just a few examples of hedging strategies, and the choice of strategy depends on the specific risk exposure and objectives of the investor or business. It is crucial to carefully analyze the market conditions, costs, and potential benefits of each strategy before implementation.

By utilizing these hedging strategies, individuals and organizations can mitigate risk, protect their investments, and navigate uncertain market conditions with greater confidence.

Benefits of Hedging

Hedging offers several benefits to individuals, businesses, and financial institutions. Here are some key advantages of implementing hedging strategies:

- Risk reduction: One of the primary benefits of hedging is risk reduction. By taking offsetting positions, investors can minimize potential losses and protect their investments against adverse market movements. Hedging allows for more controlled exposure to risk and helps to stabilize portfolio performance.

- Preservation of capital: Hedging provides a means to preserve capital by limiting downside risk. By hedging against potential losses, individuals and businesses can safeguard their investments and maintain financial stability, even in volatile market conditions. This is especially important for long-term investors seeking to protect their principal investment.

- Stabilized cash flows: Hedging can help businesses ensure stability in cash flows. By managing risks related to interest rates, foreign exchange rates, or commodity prices, companies can mitigate the impact of market fluctuations on their revenue and expenses. This stability enables better financial planning and budgeting.

- Reduced uncertainty: Hedging strategies provide a sense of certainty in an uncertain market environment. By locking in prices or rates through instruments such as futures contracts or options, individuals and businesses can eliminate or reduce uncertainty related to future market conditions.

- Increased flexibility: Hedging allows for increased flexibility in financial decision-making. By managing risk, individuals and businesses have more choices in pursuing opportunities for growth or navigating challenges. It provides a greater ability to adapt to changing market dynamics.

- Enhanced portfolio diversification: Hedging can contribute to portfolio diversification by incorporating different asset classes and hedging strategies. This diversification helps to spread risk and potentially achieve more stable returns over time. By reducing the correlation between investments, hedging can create a more balanced and resilient portfolio.

In summary, the benefits of hedging include risk reduction, preservation of capital, stabilized cash flows, reduced uncertainty, increased flexibility, and enhanced portfolio diversification. By effectively implementing hedging strategies, individuals and businesses can mitigate risk, protect investments, and navigate the complex and ever-changing financial landscape with greater confidence.

Risks and Limitations of Hedging

While hedging can be an effective risk management tool, it is important to be aware of the potential risks and limitations involved. Here are some of the main risks and limitations of hedging:

- Cost: Hedging strategies often involve additional costs, such as fees and premiums associated with derivative instruments like options or futures contracts. These costs can eat into potential profits and impact overall investment returns. It is essential to carefully consider the cost-effectiveness of hedging strategies.

- Imperfect correlation: Hedging works best when there is a high degree of correlation between the hedging instrument and the asset being hedged. However, perfect correlation is rare, and there may be instances where the hedge does not fully offset the losses incurred in the underlying position. In such cases, there may still be some level of risk exposure.

- Opportunity cost: Hedging involves taking counter positions that limit potential gains. While hedging helps to protect against losses, it may also prevent investors from fully benefiting from positive market movements. There is an opportunity cost associated with hedging, as it restricts the upside potential of the investment.

- Complexity: Hedging strategies can be complex and require a deep understanding of financial instruments and market dynamics. It may be challenging for individual investors or businesses without specialized knowledge to implement and manage hedging strategies effectively. Improper execution can lead to unintended consequences and potential losses.

- Timing: Accurately timing hedging decisions is crucial for effective risk management. Market movements can be unpredictable, and implementing hedges too early or too late can result in suboptimal outcomes. Poor timing may lead to missed opportunities or ineffective protection against market risks.

- Regulatory and legal risks: Hedging activities are subject to regulatory and legal requirements that vary across jurisdictions. Non-compliance with these regulations can result in penalties or legal disputes. It is essential to understand and adhere to the applicable laws and regulations when engaging in hedging activities.

Overall, while hedging can provide valuable protection against market risks, it is not without its risks and limitations. Investors and businesses should carefully assess the costs, correlations, opportunity costs, complexity, timing, and regulatory aspects before implementing hedging strategies.

Factors to Consider when Hedging

When implementing a hedging strategy, several factors should be considered to ensure its effectiveness and suitability for the specific risk exposure. Here are some key factors to consider when hedging:

- Risk assessment: Before hedging, it is essential to thoroughly assess the risks involved. Identify the specific risks the hedging strategy aims to address and evaluate their potential impact on investments or business operations. This assessment will help determine the appropriate hedging instruments and strategies to employ.

- Objective and time horizon: Define the objective and time horizon of the hedging strategy. Are you seeking to protect against short-term price volatility or long-term market trends? Understanding the objectives and time frame will guide the selection of suitable hedging instruments and the duration of the hedge.

- Correlation: Consider the correlation between the hedging instrument and the asset being hedged. The effectiveness of the hedge depends on how closely the two are correlated. Evaluate historical data and market trends to determine the correlation and select the most appropriate hedging instrument accordingly.

- Cost-effectiveness: Evaluate the costs associated with the chosen hedging strategy. Consider transaction fees, margin requirements, premiums, and other expenses related to the hedging instruments. Assess whether the potential benefits of the hedge justify the associated costs and ensure it aligns with your risk tolerance and investment objectives.

- Flexibility: Consider the flexibility of the chosen hedging strategy. Markets can be unpredictable, and circumstances may change. Ensure that the hedging strategy allows for adjustments or exits if needed. Flexibility is crucial to adapt to changing market conditions and optimize the effectiveness of the hedge over time.

- Monitoring and management: Continuous monitoring and management of the hedge is crucial. Regularly review the effectiveness of the hedge and its alignment with the intended objectives. Keep track of market trends, economic indicators, and other relevant factors that may impact the hedge. Adjustments or modifications may be necessary to ensure optimal risk management.

- Expertise and knowledge: Consider the level of expertise and knowledge required to implement and manage the selected hedging strategy effectively. Complex strategies may necessitate professional advice or the involvement of experienced individuals or institutions with relevant expertise. Ensure that you have access to the necessary resources and knowledge to make informed decisions.

By carefully considering these factors, investors and businesses can make informed decisions when hedging, increasing the likelihood of successful risk management and achieving desired financial outcomes.

Critiques of Hedging

While hedging is widely used as a risk management tool, it has also faced criticism from various perspectives. Below are some common critiques of hedging:

- Speculation and market manipulation: Critics argue that some hedging activities can contribute to speculation and market manipulation. They believe that certain market participants may use hedging strategies to create artificial demand or suppress prices, affecting market dynamics and distorting price discovery.

- Reduced market efficiency: Hedging can potentially reduce market efficiency by dampening price movements. When investors engage in hedging, they may limit their exposure to risk and reduce the impact of market fluctuations. While this can provide stability, it can also impede the market’s ability to reflect genuine supply and demand dynamics.

- Complexity and accessibility: Critics argue that hedging strategies can be overly complex and difficult for individual investors or smaller businesses to understand and implement. The use of sophisticated financial instruments and specialized knowledge may create barriers to entry, limiting access to effective risk management for certain market participants.

- Opportunity cost: Hedging can also face criticism for its opportunity cost. By hedging against potential losses, investors may miss out on potential gains if the market moves in their favor. Critics argue that this cautious approach can limit profit potential and prevent investors from fully benefiting from positive market movements.

- Over-reliance on hedging: Some criticize the over-reliance on hedging as a risk management strategy. While hedging can provide protection against specific risks, it is not a panacea, and excessive reliance on hedging may neglect other risk management techniques and diversification strategies that could be more suitable for certain contexts.

- Counterparty risk: Engaging in hedging strategies often involves entering into derivative contracts or agreements with counterparties. Critics highlight the potential counterparty risk, as these counterparties may default or fail to fulfill their obligations, leaving the hedger exposed to losses.

It is important to consider these critiques and recognize that hedging, like any financial strategy, has its limitations and potential drawbacks. However, it is also worth noting that when used prudently and with a clear understanding of its purpose, hedging can be an effective risk management tool that provides stability and protection in volatile market conditions.

Conclusion

Hedging is a powerful risk management strategy that plays a vital role in navigating the intricate world of finance. By taking offsetting positions in the market, individuals and businesses can mitigate potential losses and protect their investments against adverse price movements.

Throughout this article, we have explored the definition of hedging, its purpose, various types of hedging strategies, and the benefits and limitations it brings. Hedging allows for risk reduction, preservation of capital, stabilized cash flows, and increased portfolio diversification. It provides a sense of certainty, flexibility, and control in uncertain market conditions.

However, it is important to consider the potential risks and critiques associated with hedging. Costs, imperfect correlations, opportunity costs, complexity, timing, regulatory risks, and counterparty risks are among the factors that need to be carefully evaluated and managed to ensure the effectiveness of hedging strategies.

Ultimately, the decision to hedge should be based on a thorough understanding of the specific risk exposure, investment objectives, and market conditions. It requires a careful assessment of costs, correlations, and potential impacts on investment returns. Seeking professional advice and developing a sound risk management plan can contribute to successful hedging outcomes.

In conclusion, hedging is a valuable tool that allows investors and businesses to maintain financial stability, reduce risk, and navigate the complexities of the financial markets. When executed thoughtfully and in alignment with individual circumstances, it can be an essential component of a well-rounded risk management strategy.