Finance

What Is ERC On Credit Report

Modified: February 21, 2024

Learn what ERC, or Early Repayment Charge, is on your credit report and how it can impact your finances. Understand the implications of ERC and its significance in credit management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit reports! If you’ve ever applied for a loan, credit card, or any form of credit, chances are you’ve come across the term “ERC” on your credit report. ERC stands for “Early Repayment Charge,” and understanding its significance is crucial to managing your credit effectively.

Credit reports play a vital role in our financial lives, as they provide lenders with valuable insights into our borrowing history. These reports contain a wealth of information, including details about our credit accounts, payment history, and outstanding balances.

While credit reports may seem overwhelming at first, it’s important to take the time to understand their various components. By doing so, you can take control of your financial future and ensure that your credit standing remains in good shape.

One such component is ERC, which refers to the charges imposed by lenders when borrowers repay their loans or credit obligations earlier than originally agreed upon. These charges serve as a way for lenders to recoup potential interest income that they would have received if the borrower had continued making payments.

ERC is applicable to various credit products, including personal loans, mortgages, and credit cards. It’s crucial to be aware of the presence of ERC on your credit report, as it can impact your credit score and overall financial profile.

In this article, we will delve deep into the world of ERC on credit reports, exploring its importance, factors that contribute to it, and how it can affect your credit score. We will also provide you with valuable tips for managing ERC effectively and maintaining a healthy credit standing.

Understanding Credit Reports

Before we dive into the specifics of ERC on credit reports, it’s essential to have a basic understanding of what credit reports are and how they function.

A credit report is a detailed record of an individual’s credit history and financial activities. It is compiled by credit bureaus, which gather information from various sources such as lenders, banks, credit card companies, and other financial institutions.

Credit reports contain several key components, including personal information (such as your name, address, and social security number), credit accounts (such as loans and credit cards), payment history, outstanding balances, and any public records (like bankruptcies or court judgments) that may affect your creditworthiness.

Lenders use credit reports to assess an individual’s creditworthiness and make informed decisions on whether to extend credit or lend money. They provide a detailed snapshot of your financial behavior, which lenders use to evaluate the level of risk associated with lending you money.

It’s worth noting that there are several credit reporting agencies, such as Experian, Equifax, and TransUnion, and each may have slightly different information on your credit report. Therefore, it’s a good practice to review your credit reports from all three agencies periodically to ensure the accuracy of the information being reported.

Now that we have a basic understanding of credit reports, let’s explore the concept of ERC and its significance on these reports.

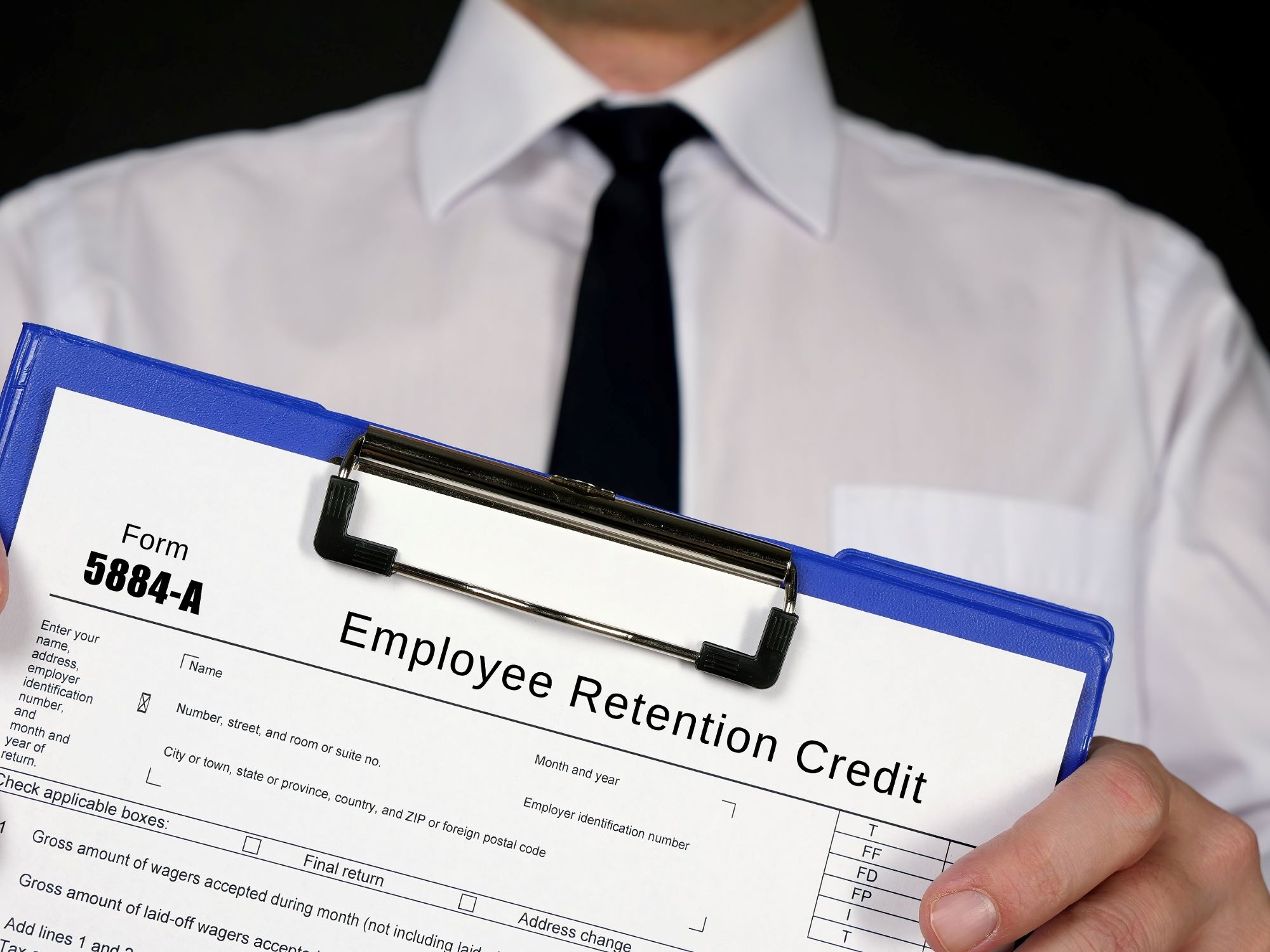

What is ERC?

ERC, also known as Early Repayment Charge or Early Redemption Charge, refers to a fee imposed by lenders when borrowers repay their loans or credit obligations earlier than the agreed-upon terms. Essentially, it is a penalty for paying off your debt ahead of schedule.

The purpose of ERC is to compensate the lender for the potential loss of interest income that they would have received if the borrower had continued making regular payments until the end of the agreed-upon term. It serves as a form of financial protection for lenders, as early repayment can disrupt their projected cash flow and impact their profitability.

ERC can vary depending on the type of credit product. For example, in the case of mortgages, lenders may charge a percentage of the outstanding loan balance as an ERC. Personal loans and credit cards may have fixed flat fees for early repayment.

It’s important to note that not all loans or credit products have ERC. Some lenders may offer more flexible terms that allow borrowers to repay their debt without incurring any additional charges. However, for others, ERC may be a standard practice, particularly for long-term loans or loans with favorable interest rates.

The specific details of ERC, including the amount and duration it is applicable for, will be outlined in the loan agreement or credit card terms and conditions. It’s crucial for borrowers to review these documents carefully and fully understand the implications of early repayment.

ERC serves as a mechanism for lenders to mitigate the potential loss of interest income and maintain their profit margins. While it may seem like an additional burden for borrowers, understanding the presence and impact of ERC on your credit report is vital for managing your credit effectively.

Importance of ERC on Credit Reports

The presence of ERC on your credit report holds significant importance for several reasons. It not only impacts your credit score but also provides valuable insights into your financial behavior and creditworthiness.

1. Impact on Credit Score:

ERC can have a direct impact on your credit score. Credit scoring models take into account various factors, including your payment history, credit utilization, and the presence of any negative marks on your credit report. Early repayment charges can be viewed as a negative mark, as they indicate that you did not fulfill the terms of your credit agreement. This can result in a slight decrease in your credit score.

2. Potential Lender Perception:

ERC on your credit report can also influence how lenders perceive your creditworthiness. Some lenders may view early repayment charges as a sign of financial instability or an inability to meet your financial obligations. This perception can affect your chances of obtaining credit in the future or may result in higher interest rates.

3. Financial Planning and Decision Making:

The presence of ERC on your credit report serves as a reminder of the terms and conditions of your loans or credit agreements. It can help you plan your finances more effectively and make informed decisions about early repayment. Understanding the potential charges involved can help you decide whether it makes financial sense to pay off your debt early or if it’s more beneficial to continue making regular payments.

4. Negotiating Power:

Having awareness of ERC on your credit report can provide you with negotiating power when dealing with lenders. It allows you to have an informed discussion about the possibility of reducing or waiving the early repayment charges. In some cases, lenders may be willing to work with you to find a mutually beneficial solution.

Overall, the importance of ERC on your credit report lies in its impact on your credit score, the perception of your creditworthiness among lenders, and its role in your financial decision-making process. By understanding its implications, you can manage your credit effectively and make informed choices regarding early debt repayment.

Factors that Contribute to ERC

Several factors contribute to the calculation of ERC on your credit accounts. Understanding these factors can help you anticipate and manage potential charges effectively. Here are the key elements that lenders consider when determining the early repayment charges:

1. Loan Type and Terms:

The type of loan you have and its terms play a significant role in the calculation of ERC. Mortgages, personal loans, and credit cards may have different methods of calculating the charges. Long-term loans with fixed interest rates are more likely to have higher ERC, while shorter-term loans with variable interest rates may have lower or no charges for early repayment.

2. Remaining Balance:

The outstanding balance on your loan or credit account at the time of early repayment affects the ERC. Typically, the higher the remaining balance, the higher the charge imposed. Lenders calculate the charges based on a percentage of the outstanding amount or a fixed fee, which is often specified in the loan agreement or credit card terms.

3. Interest Rate Differential:

The difference between the interest rate at which you initially borrowed and the current market interest rate at the time of early repayment can contribute to ERC. If the current interest rates are lower than the rate on your loan, the lender may include this differential in the early repayment charges.

4. Loan Amortization:

The stage of the loan amortization process influences the ERC. In the early stages of the loan, more of your monthly payment goes towards interest rather than principal repayment. As a result, early repayment may significantly impact the lender’s interest income, leading to higher charges being imposed.

5. Lender Policies and Regulations:

Each lender may have its own policies and regulations regarding ERC. It’s essential to review the loan agreement or credit card terms to understand the specific charges associated with early repayment. Additionally, regulatory guidelines in your jurisdiction may also govern the maximum amount or calculation method for ERC.

6. Negotiation Potential:

In some cases, the opportunity for negotiation with the lender may impact the charges. If you have a good relationship with your lender or can demonstrate valid reasons for early repayment, such as financial hardship or a better offer from another lender, they may be willing to reduce or waive the ERC.

Understanding these factors can help you anticipate the potential charges associated with early repayment and make more informed decisions. It’s important to thoroughly review the terms and conditions of your loans or credit agreements and consider the financial implications of early repayment before making a decision.

How ERC Affects Your Credit Score

ERC, or Early Repayment Charge, can have an impact on your credit score, albeit indirectly. While it is not a direct factor that credit scoring models consider, it can influence other components of your credit report that affect your score. Here’s how ERC can potentially influence your credit score:

1. Payment History:

Your payment history is a crucial factor in determining your credit score. It reflects your ability to make timely payments on your credit accounts. If you choose to repay a loan or credit obligation early and incur an ERC, it may affect your payment history. Lenders may view the presence of an ERC as an indication that you did not fulfill the terms of your credit agreement. This can result in a negative mark on your credit report, impacting your credit score.

2. Credit Utilization:

Credit utilization refers to the amount of available credit you are currently using. It is a significant factor in credit scoring models, with lower utilization generally being viewed more favorably. When you repay a loan or credit account early, it reduces your outstanding balance, subsequently lowering your credit utilization ratio. This can positively impact your credit score, as it demonstrates responsible credit management. However, any ERC charges incurred will be reflected in your account balance and may affect your credit utilization.

3. Credit Mix:

Credit mix refers to the variety of credit accounts you have, such as loans and credit cards. Having a diverse mix of credit accounts can positively impact your credit score. If you choose to repay a loan early and incur an ERC, it may reduce the variety in your credit mix, potentially impacting your credit score. However, the impact on this component is relatively minor compared to other factors, such as payment history and credit utilization.

4. Overall Creditworthiness:

While ERC itself may not directly impact your credit score, lenders may view the presence of ERC on your credit report as a factor in assessing your creditworthiness. Some lenders may view early repayment charges as a sign of financial instability or an inability to meet your financial obligations. This perception can influence their decisions on extending credit or the terms they offer you.

It’s important to note that the specific impact of ERC on your credit score will depend on various factors, including the severity of the charges, your overall credit history, and the credit scoring model being used. It’s always recommended to prioritize making timely payments and managing your credit responsibly to maintain a good credit score. While ERC may have some temporary influence, it is not as significant as factors like payment history and credit utilization.

Remember to review your credit report regularly and ensure its accuracy. If you notice any discrepancies or errors related to ERC charges, you can dispute them with the credit bureaus to have them corrected and ensure that your credit report reflects your true creditworthiness.

Tips for Managing ERC on Your Credit Report

Dealing with ERC, or Early Repayment Charge, on your credit report requires careful consideration and effective management strategies. Here are some tips to help you navigate and manage ERC effectively:

1. Review the Loan Agreement or Credit Card Terms:

Before considering early repayment, thoroughly review the loan agreement or credit card terms. Understand the specific conditions and charges associated with early repayment, including the calculation method and any potential fees. This will give you a clear understanding of the potential costs involved before making a decision.

2. Evaluate the Financial Impact:

Assess the financial impact of early repayment and the ERC charged. Calculate the total cost of repaying early, including any applicable charges, and compare it to the benefits of paying off the debt sooner. Consider factors such as potential cost savings on interest payments and the impact on your cash flow. This will help you determine if early repayment is financially beneficial for you.

3. Prioritize Higher-Interest Debt:

If you have multiple debts, prioritize paying off those with higher interest rates. By focusing on debts that accrue more interest, you can potentially save more money in the long run. Consider utilizing any extra funds available to make additional payments towards these high-interest debts, while continuing to meet the minimum payment requirements on other debts.

4. Negotiate with Lenders:

Depending on your financial situation and relationship with the lender, consider negotiating the ERC. Reach out to your lender and discuss the possibility of reducing or waiving the charges. Explain your circumstances and provide valid reasons for early repayment. While not guaranteed, some lenders may be willing to work with you to find a mutually beneficial solution.

5. Monitor Your Credit Report:

Regularly monitor your credit report to ensure accuracy and to identify any errors or discrepancies related to ERC. If you notice any incorrect information or discrepancies, dispute them with the credit bureaus to have them corrected. This will help ensure that your credit report accurately reflects your financial standing and creditworthiness.

6. Seek Professional Advice:

If you are unsure about the implications of early repayment or need guidance on managing ERC, consider seeking advice from a financial advisor or credit counselor. They can help you understand the potential impact on your credit and financial situation and provide personalized recommendations based on your specific circumstances.

Remember, managing ERC effectively requires careful evaluation, financial planning, and clear communication with lenders. By being proactive and informed, you can make decisions that align with your financial goals and maintain a healthy credit profile.

Conclusion

Understanding ERC (Early Repayment Charge) on your credit report is essential for managing your credit effectively. While it may initially seem like an added burden, being aware of ERC and its impact can help you make informed financial decisions.

ERC serves as a financial protection mechanism for lenders, offsetting potential losses due to early repayment. It can affect your credit score indirectly, impacting factors such as payment history and credit utilization. However, the specific impact will depend on various factors and credit scoring models used.

When dealing with ERC, review your loan agreements or credit card terms to understand the charges and any potential negotiation possibilities with the lender. Evaluate the financial implications of early repayment and prioritize higher-interest debt. Monitoring your credit report for accuracy is vital, as it ensures your credit profile reflects the true state of your financial standing.

If you find yourself unsure about managing ERC, seeking advice from a financial advisor or credit counselor can provide valuable guidance tailored to your specific situation.

Remember, managing ERC requires careful consideration and weighing the costs and benefits. By staying informed and proactive, you can effectively navigate ERC and maintain a healthy credit standing.

Ultimately, understanding and managing ERC on your credit report will empower you to make responsible financial decisions and maintain a strong credit profile, setting you on a path towards financial success.