Home>Finance>Capital Budgeting: Definition, Methods, And Examples

Finance

Capital Budgeting: Definition, Methods, And Examples

Published: October 22, 2023

Learn about the definition, methods, and examples of capital budgeting in finance. Enhance your understanding of how businesses allocate financial resources for long-term projects.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Capital Budgeting: Making Smart Financial Investments

When it comes to managing finances, making the right investment decisions is crucial for any business or organization. This is where capital budgeting comes into play. But what does capital budgeting mean, and how can it help you make informed financial choices? In this blog post, we’ll dive into the definition of capital budgeting and explore its methods and examples.

Key Takeaways:

- Capital budgeting is the process of evaluating and selecting long-term investments that align with an organization’s strategic goals.

- There are several methods to evaluate capital budgeting projects, including the payback period, net present value (NPV), and internal rate of return (IRR).

What is Capital Budgeting?

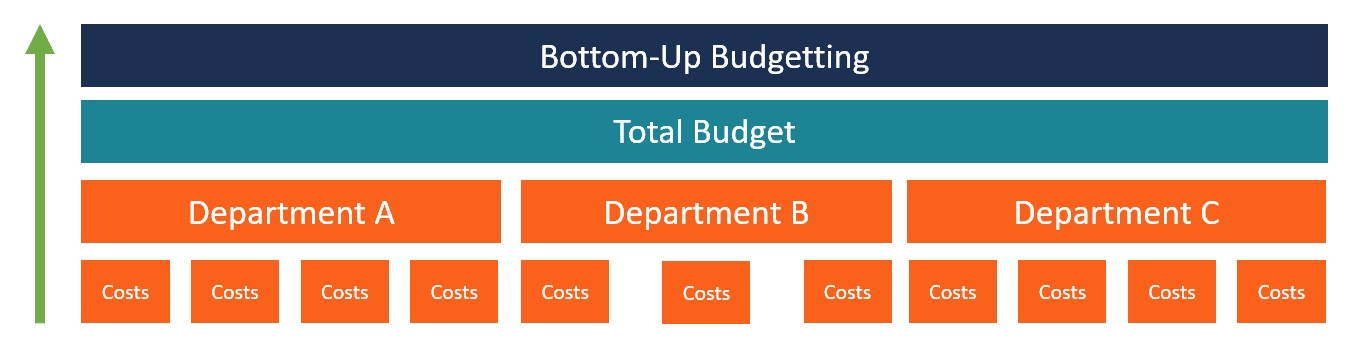

Capital budgeting, also known as investment appraisal, refers to the process businesses use to evaluate and select long-term investments. These investments could include purchasing new equipment, expanding facilities, or launching a new product line. Capital budgeting helps businesses allocate their limited resources to projects that will generate the highest returns and contribute to the overall growth and profitability of the company.

Methods of Capital Budgeting:

There are several methods businesses employ to evaluate potential investment projects. Let’s explore some of the most common ones:

- Payback Period: This method calculates the time required for an investment to generate enough cash flow to recoup its initial cost. It focuses on the liquidity and risk of the investment by considering how quickly the business can recover its investment.

- Net Present Value (NPV): NPV is a widely used method that considers the time value of money. It calculates the present value of anticipated cash flows from an investment and subtracts the initial cost. If the NPV is positive, the investment is considered financially viable.

- Internal Rate of Return (IRR): IRR measures the profitability of an investment by determining the rate of return that makes the net present value of the investment zero. If the IRR exceeds the cost of capital, the investment is deemed favorable.

Real-life Examples:

To better understand how capital budgeting works in practice, let’s consider a couple of examples:

- Example 1 – New Manufacturing Equipment: A manufacturing company is considering investing in new machinery that will help increase productivity and reduce costs. By using capital budgeting techniques like NPV and IRR, the company can assess the financial feasibility of the investment, considering factors such as cash flow projections, equipment lifespan, and the required investment amount.

- Example 2 – Retail Store Expansion: A retail company wants to expand its operations by opening new stores in different locations. By performing a capital budgeting analysis, the company can evaluate the potential profitability of each location, taking into account variables such as rental costs, projected revenues, and expected customer footfall.

These examples illustrate how businesses can utilize capital budgeting methods to make informed investment decisions and optimize their use of financial resources.

Conclusion:

Capital budgeting is a crucial process for businesses looking to make sound investment choices. By carefully evaluating potential projects using methods like payback period, NPV, and IRR, organizations can ensure that their financial resources are allocated wisely. So, whether you’re a business owner, a financial professional, or an investor, understanding the principles of capital budgeting will empower you to make educated decisions and maximize your financial returns.