Finance

What Is Hedging In Investing

Published: January 15, 2024

Learn about hedging in finance and how it can help you mitigate investment risks. Gain insights into different hedging strategies and their benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of investing! As you embark on your journey to grow your wealth and achieve your financial goals, you may come across the term “hedging” and wonder what it means and how it can impact your investment strategy. Whether you’re a seasoned investor or just starting out, understanding hedging is crucial for navigating the complex and often volatile world of finance.

Hedging, in the context of investing, refers to a risk management strategy that aims to offset potential losses by taking an opposing position to an existing investment. It involves making additional investments or entering into derivative contracts to reduce the impact of adverse price movements in the market. The goal of hedging is not to generate profits, but rather to protect existing investments from downside risks.

At its core, hedging is like buying insurance for your investments. Just as you purchase car insurance to protect yourself from potential accidents, hedging helps protect your investment portfolio from unforeseen events or market fluctuations that could erode its value. By implementing hedging strategies, investors can mitigate some of the uncertainty and volatility that comes with investing, providing a degree of stability and peace of mind.

When it comes to hedging, there are various strategies and techniques that investors can utilize. Each strategy serves a different purpose and may be suitable for different investment scenarios. It’s important to have a good understanding of how each strategy works and when to apply them effectively to maximize their benefits.

While hedging can be a valuable tool in managing risk, it’s also essential to consider the potential drawbacks and limitations. Hedging strategies can be complex and require a thorough analysis of market conditions and risk tolerance. It’s crucial to carefully assess the costs, potential impact on returns, and the overall suitability of the strategy before implementing it in your investment portfolio.

In this article, we will delve deeper into the concept of hedging in investing. We will explore various hedging strategies, discuss their benefits and risks, and provide examples to illustrate how hedging works in real-world investment scenarios. Additionally, we will highlight the factors to consider when implementing a hedging strategy to ensure its effectiveness and align it with your investment objectives.

So, let’s dive in and unlock the secrets of hedging in investing to enhance your understanding and equip you with the tools to navigate the ever-changing landscape of the financial markets!

Definition of Hedging

In the world of finance, hedging refers to a risk management strategy employed by investors to mitigate potential losses that may arise from adverse price movements in the market. It involves taking a position that will offset any potential negative impact on existing investments.

Hedging is like an insurance policy for your investments. Just as insurance provides protection against unforeseen events, hedging aims to safeguard your portfolio from market volatility and unexpected fluctuations. By implementing hedging strategies, investors can reduce the risk of significant losses and preserve the value of their investments.

One of the key principles of hedging is that it involves taking an opposing position to an existing investment. This means that if an investor holds a long position in a particular asset, they will take a short position or enter into derivative contracts to hedge against potential downside risks. The idea behind this is that any losses incurred in one position will be offset by gains in the other, resulting in a more balanced and protected portfolio.

There are several ways to implement a hedging strategy. Investors can employ various financial instruments such as options, futures contracts, swaps, or even exchange-traded funds (ETFs) to hedge against potential losses. These instruments allow investors to take speculative positions that will protect their existing investments or enable them to profit from adverse market movements.

It’s important to note that hedging is not the same as speculation. While both involve taking positions in the financial markets, the primary purpose of hedging is to manage risk and protect investments, whereas speculation aims to generate profits from anticipating price movements.

Hedging can be employed across different types of investments, including stocks, bonds, commodities, currencies, and derivatives. The specific hedging strategy employed will depend on the investment vehicle, market conditions, and the investor’s risk tolerance.

In summary, hedging is a risk management strategy that aims to protect investments by taking positions that offset potential losses. It involves implementing various financial instruments to reduce the impact of adverse market movements. By utilizing hedging strategies, investors can enhance the stability and security of their portfolios, providing a degree of protection and peace of mind in uncertain market conditions.

Purpose of Hedging in Investing

The primary purpose of hedging in investing is to manage risk and protect investment portfolios from potential losses caused by adverse market movements. By employing hedging strategies, investors aim to minimize the impact of fluctuations in asset prices, volatility, and unexpected events that can negatively impact the value of their investments.

One of the main reasons investors hedge is to preserve capital. When markets are unpredictable or volatile, hedging allows investors to limit their exposure to potential losses, thereby safeguarding their initial investment. By taking an opposing position to their existing investments, investors can offset any downward movements in the market and reduce the risk of significant capital erosion.

Hedging also provides a way to maintain a desired level of portfolio diversification. By utilizing different hedging instruments and strategies, investors can distribute risk across multiple asset classes, sectors, or geographic regions. This diversification helps mitigate the impact of adverse events that may affect specific sectors or markets, ensuring a more balanced and resilient portfolio.

Another purpose of hedging is to align investment objectives and risk tolerance. Different investors have varying risk appetites and goals. Hedging allows investors to customize their risk exposure based on their individual preferences. Some investors may be more conservative and prioritize capital preservation, while others may be willing to take on higher risks for potential higher returns. Hedging strategies can be adjusted accordingly to strike a balance between risk and reward, aligning with investors’ overall investment objectives.

Hedging also plays a crucial role in managing the potential impact of currency fluctuations. When investing in international markets, changes in foreign exchange rates can add an additional layer of risk. Hedging against currency risk ensures that the value of investments remains relatively stable, regardless of exchange rate movements. This is particularly important for multinational corporations and institutional investors with global operations.

Furthermore, hedging can be used to protect against specific risks associated with certain industries or sectors. For example, commodity producers may use hedging strategies to mitigate the impact of price fluctuations in raw materials such as oil, gas, or agricultural products. This allows them to secure more favorable prices, ensuring their profitability even in volatile markets.

Overall, the purpose of hedging in investing is to manage risk, preserve capital, maintain diversification, align with investment objectives and risk tolerance, mitigate currency risk, and protect against industry-specific risks. By incorporating hedging strategies into their investment approach, investors can build a more robust and resilient portfolio, reducing the potential for substantial losses and achieving long-term financial success.

Different Types of Hedging Strategies

Hedging strategies come in various forms, each designed to address different types of risks and investment objectives. Implementing the right hedging strategy requires a comprehensive understanding of the specific risk being hedged and the available financial instruments. Here are some commonly used hedging strategies:

- Long and Short Hedging: This strategy involves taking opposite positions in the same or related assets. For example, if an investor holds a long position in a stock, they may simultaneously take a short position in a related stock or an index to hedge against potential losses. This strategy aims to offset the impact of adverse market movements on the overall portfolio.

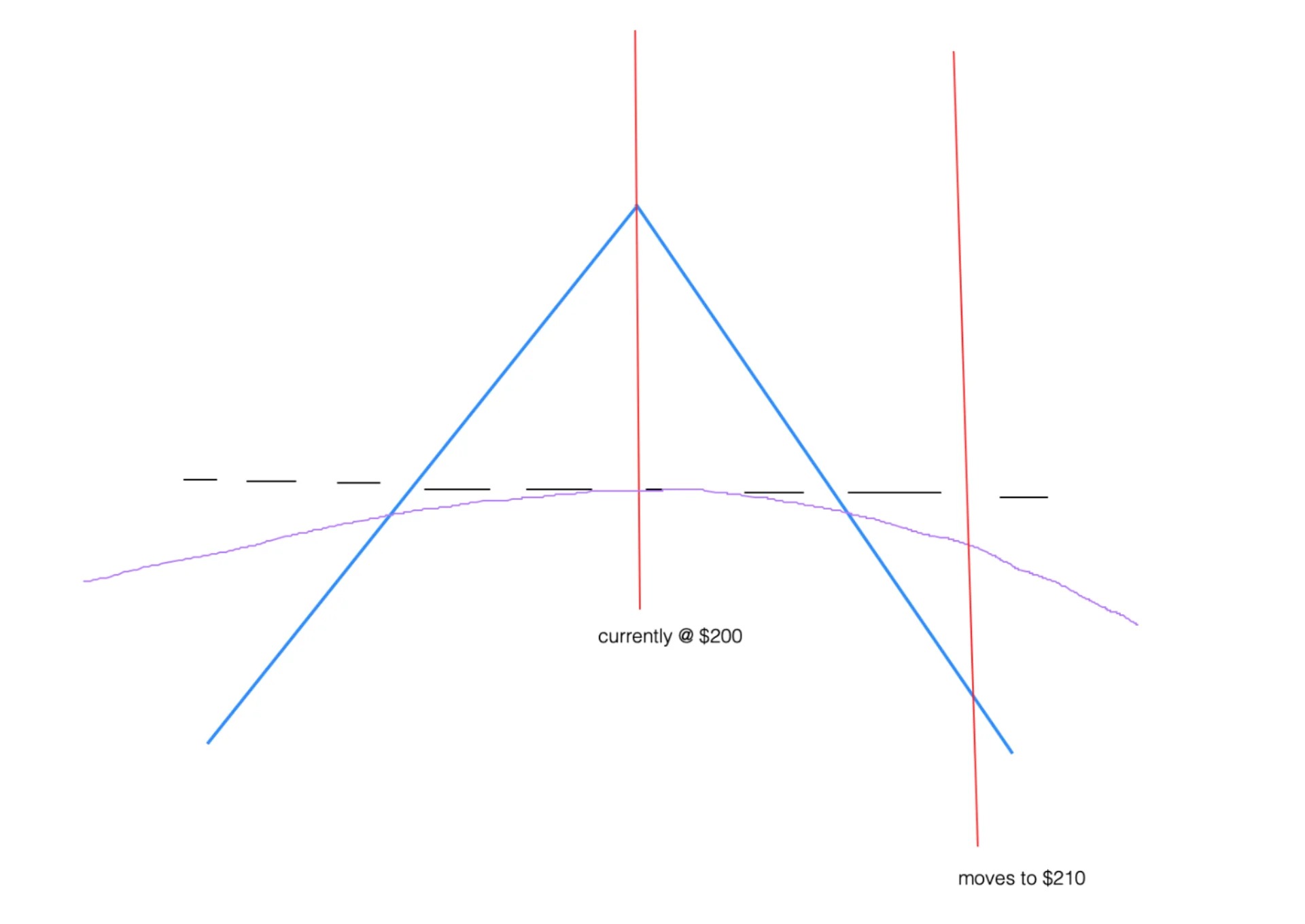

- Options Hedging: Options provide investors with the right, but not the obligation, to buy (call option) or sell (put option) a particular asset at a specified price within a certain timeframe. Options hedging strategies involve using options contracts to protect investments from significant price fluctuations. For example, investors can purchase put options on their existing holdings to hedge against potential downside risk.

- Futures Hedging: Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date. Futures hedging involves taking opposite positions in futures contracts to offset potential losses on existing positions. For instance, if an investor holds a portfolio of stocks, they may take a short position in stock index futures to hedge against market downturns.

- Currency Hedging: Currency fluctuations can impact the value of international investments. Currency hedging involves using financial instruments such as currency forwards, futures, or options to mitigate the risk of unfavorable exchange rate movements. This strategy is commonly employed by multinational corporations and international investors to protect against currency volatility.

- Commodity Hedging: Companies involved in the production or consumption of commodities often use commodity hedging strategies to manage price fluctuations. This may involve entering into futures contracts, options contracts, or using derivatives instruments to hedge against potential losses due to volatile commodity prices.

- Portfolio Hedging: Portfolio hedging aims to provide a more comprehensive approach to risk management by hedging the overall portfolio rather than individual assets. This strategy involves using a combination of different hedging techniques to protect the entire investment portfolio from systematic risks such as market downturns or industry-specific shocks.

It’s important to note that each hedging strategy has its own advantages, limitations, and costs. Investors should carefully assess their specific risk exposure, investment objectives, and market conditions to determine which strategy is most suitable for their needs.

Furthermore, selecting the appropriate financial instruments for hedging is crucial. Options, futures, swaps, and other derivative instruments are commonly used in hedging strategies, but each has its own intricacies and complexities. Investors should have a good understanding of these instruments and the associated risks before incorporating them into their hedging strategies.

Ultimately, the choice of hedging strategy will depend on various factors, including the investor’s risk tolerance, investment objectives, time horizon, and the specific risks they seek to hedge. By selecting the right hedging strategy and implementing it effectively, investors can reduce their exposure to price volatility, protect their investments, and enhance their overall portfolio stability.

Benefits and Risks of Hedging

Hedging in investing offers both benefits and risks. Understanding these advantages and potential drawbacks is essential for investors looking to employ hedging strategies in their portfolios.

Benefits of Hedging:

1. Risk Management: Hedging allows investors to manage and minimize potential losses resulting from adverse market movements. By taking opposite positions or utilizing derivatives, investors can offset the impact of market volatility and protect their portfolios.

2. Capital Preservation: One of the main benefits of hedging is preserving capital. By implementing hedging strategies, investors can mitigate downside risks and safeguard their initial investment. This provides stability and safeguards the value of the portfolio.

3. Diversification: Hedging can help investors achieve portfolio diversification. By employing different hedging techniques across various assets or sectors, investors spread risk and reduce the impact of adverse events that may affect specific investments. This promotes stability and resilience in the portfolio.

4. Customization and Risk Alignment: Hedging strategies can be tailored to individual risk preferences and investment objectives. Investors can adjust their hedging approach based on their risk tolerance and goals, allowing for a more personalized investment strategy.

5. Protection from External Factors: Hedging strategies can mitigate the impact of external factors on investments. For example, currency hedging protects against foreign exchange rate fluctuations, ensuring the stability of international investments.

Risks of Hedging:

1. Cost of Hedging: Implementing hedging strategies often incurs costs, such as brokerage fees, option premiums, or other transaction expenses. These costs can impact overall investment returns and need to be carefully considered.

2. Potential for Reduced Returns: While hedging protects against losses, it may also limit upside potential. By hedging against downside risk, investors may miss out on potential gains if the market moves favorably. It’s essential to strike a balance between risk mitigation and potential returns.

3. Complexity: Hedging strategies can be complex, involving derivative instruments and sophisticated financial instruments. Investors need to have a good understanding of these strategies and the associated risks before implementing them. Professional advice or expertise may be required to navigate the complexities of hedging.

4. Inaccurate Timing: Timing plays a crucial role in hedging. Making incorrect predictions or implementing hedges at the wrong time may result in ineffective protection or even magnify losses. Proper analysis and market understanding are necessary to time hedging strategies effectively.

5. Overcomplication and Overexposure: Overcomplicating hedging strategies or excessively hedging positions can lead to overexposure or unnecessary costs. It’s important to strike a balance between risk management and simplicity in order to avoid unintended consequences.

It is important for investors to weigh these benefits and risks carefully and determine whether hedging aligns with their investment goals, risk tolerance, and overall investment strategy. Consulting with a financial advisor or a seasoned professional can provide valuable insights and guidance in making informed decisions regarding hedging strategies.

Examples of Hedging in Investing

To better understand how hedging works in practice, let’s explore a few examples of how investors can utilize hedging strategies to protect their portfolios:

1. Equity Portfolio Hedging: Suppose an investor holds a significant position in a particular stock or a portfolio of stocks, and they anticipate a potential market downturn. To hedge against this downside risk, the investor can purchase put options on the stock or stock index futures. If the market declines, the value of the put options or futures contracts would increase, offsetting the losses incurred in the equity portfolio. This hedging strategy helps protect the portfolio from significant losses in adverse market conditions.

2. Currency Hedging: Imagine an investor has international investments denominated in a foreign currency. Fluctuations in exchange rates can impact the value of these investments. To mitigate currency risk, the investor can engage in currency hedging using financial instruments such as currency forwards. By entering into a currency forward contract, the investor can lock in a predetermined exchange rate, protecting the value of their investments from adverse currency movements.

3. Commodity Price Hedging: Companies involved in the production or consumption of commodities often face price volatility. To hedge against fluctuations in commodity prices, a producer or consumer can enter into futures contracts. For example, an airline company concerned about rising fuel prices can enter into a futures contract to lock in a specific price for future fuel purchases. If fuel prices increase in the market, the gains from the futures contracts will offset the higher fuel costs, protecting the company’s profitability.

4. Interest Rate Hedging: A company or individual with floating-rate debt may be concerned about potential interest rate increases, which would result in higher borrowing costs. To hedge against this risk, the borrower can enter into an interest rate swap, where they exchange their variable interest rate payments for a fixed-rate payment. If interest rates rise, the fixed-rate payments received through the swap will offset the increased interest payments on the debt, providing interest rate protection.

5. Portfolio Diversification: Hedging can also be achieved through portfolio diversification. By allocating investments across different asset classes, sectors, or geographic regions, investors spread their risk and limit exposure to any single asset or market. This diversification strategy mitigates the impact of specific events or market downturns on the overall portfolio, enhancing stability and reducing vulnerabilities.

These examples illustrate how hedging can be applied to different investment scenarios and risks. It is important to note that the effectiveness of hedging strategies depends on various factors, including market conditions, the accuracy of predictions, and the specific instruments used for hedging. Careful analysis, risk assessment, and consideration of costs are crucial when implementing hedging strategies to ensure the desired outcomes are achieved.

Remember, hedging is not about generating profits, but rather about protecting investments and managing risk. It is a tool that allows investors to navigate uncertain market conditions with greater confidence, safeguarding their capital and improving the long-term stability of their portfolios.

Factors to Consider when Implementing a Hedging Strategy

Implementing a hedging strategy requires careful consideration of various factors to ensure its effectiveness and alignment with investment objectives. Here are some key factors to consider when implementing a hedging strategy:

1. Risk Assessment: Conduct a thorough risk assessment to identify the specific risks you want to hedge against. Consider the potential impact of market fluctuations, currency exchange rates, interest rates, or any other factors relevant to your investments. Understanding the risks allows you to design a targeted hedging strategy that addresses your specific concerns.

2. Investment Objectives: Ensure that the hedging strategy aligns with your investment objectives. Different investors have different goals, whether it’s capital preservation, income generation, or long-term growth. The chosen hedging strategy should support and enhance your overall investment objectives.

3. Risk Tolerance: Assess your risk tolerance and determine the level of risk you are willing to accept. Some investors may have a low appetite for risk and prioritize capital preservation, while others may be more comfortable taking on higher levels of risk for potential returns. Your risk tolerance will help you determine the appropriate hedging strategy that balances risk and reward within your comfort zone.

4. Time Horizon: Consider your investment time horizon when selecting a hedging strategy. Short-term traders may require more frequent adjustments and active management of hedging positions, while long-term investors may take a more passive approach. Aligning your time horizon with your hedging strategy ensures that it remains relevant and effective in achieving your investment goals.

5. Cost and Complexity: Evaluate the costs associated with implementing the hedging strategy. Consider the transaction costs, fees, premiums, or any other expenses incurred. It’s essential to weigh the potential benefits against the costs to determine whether the strategy is economically viable. Additionally, consider the complexity of the strategy and your level of understanding. Choose a strategy that matches your expertise and comfort level to avoid unintended consequences.

6. Monitoring and Adjustments: Regularly monitor the effectiveness of your hedging strategy and be prepared to make adjustments if necessary. Market conditions, economic factors, or changes in your investment portfolio may require periodic reassessment and modification of the hedging strategy. Stay informed and stay proactive in managing your hedging positions.

7. Professional Advice: Seeking professional advice can provide valuable insights and expertise when implementing a hedging strategy. Financial advisors or asset managers with experience in hedging can offer guidance on selecting appropriate strategies, analyzing risks, and optimizing your hedging approach. They can help ensure that your hedging strategy complements your overall investment plan and enhances your risk management efforts.

Remember, there is no one-size-fits-all approach to hedging. Each investor’s situation is unique, and the right hedging strategy will depend on individual circumstances, investment goals, and risk tolerance. By carefully considering these factors and seeking expert advice when needed, you can implement an effective hedging strategy that protects your investments and provides greater stability in an uncertain market environment.

Conclusion

Hedging is a vital risk management strategy in the world of investing. It allows investors to protect their portfolios from adverse market movements, manage risk, and enhance overall stability. By taking opposing positions or utilizing various financial instruments, investors can offset potential losses, preserve capital, and achieve their investment objectives.

Throughout this article, we have explored the definition of hedging, its purpose, different strategies, and the benefits and risks associated with it. We learned that hedging helps manage risk, preserve capital, maintain diversification, align with investment objectives, protect against currency fluctuations, and mitigate sector-specific risks. However, it’s essential to consider the costs, complexity, and potential impact on returns when implementing a hedging strategy.

As an investor, it is crucial to assess your risk exposure, understand your investment goals, and determine your risk tolerance before implementing a hedging strategy. Carefully select the appropriate hedging instruments and strategies that align with your needs and objectives. Regularly monitor the effectiveness of your hedging positions and be prepared to make adjustments as market conditions evolve.

Remember, hedging is not a foolproof solution, and it does not guarantee profits or eliminate all risks. However, it can provide a layer of protection and stability in your investment portfolio, allowing you to navigate uncertain market conditions with greater confidence.

To make informed decisions about hedging, consider consulting with a financial advisor or a professional who specializes in risk management and hedging strategies. Their expertise and guidance can help you tailor a hedging approach that suits your specific needs and supports your long-term investment goals.

In conclusion, hedging is a powerful tool in a well-rounded investment strategy. By effectively managing risk and protecting investments, hedging provides investors with the confidence and stability necessary to navigate the ever-changing landscape of the financial markets successfully.