Finance

What Is Delta Hedging

Published: January 15, 2024

Learn about delta hedging in finance and how it helps mitigate risk in investment portfolios. Explore the benefits and strategies of delta hedging today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Delta Hedging

- The Importance of Delta in Options Trading

- How Delta Hedging Works

- Advantages and Disadvantages of Delta Hedging

- Practical Examples of Delta Hedging

- Determining the Optimal Delta Hedge Ratio

- Common Challenges and Considerations in Delta Hedging

- Delta Hedging Strategies for Different Market Conditions

- Conclusion

Introduction

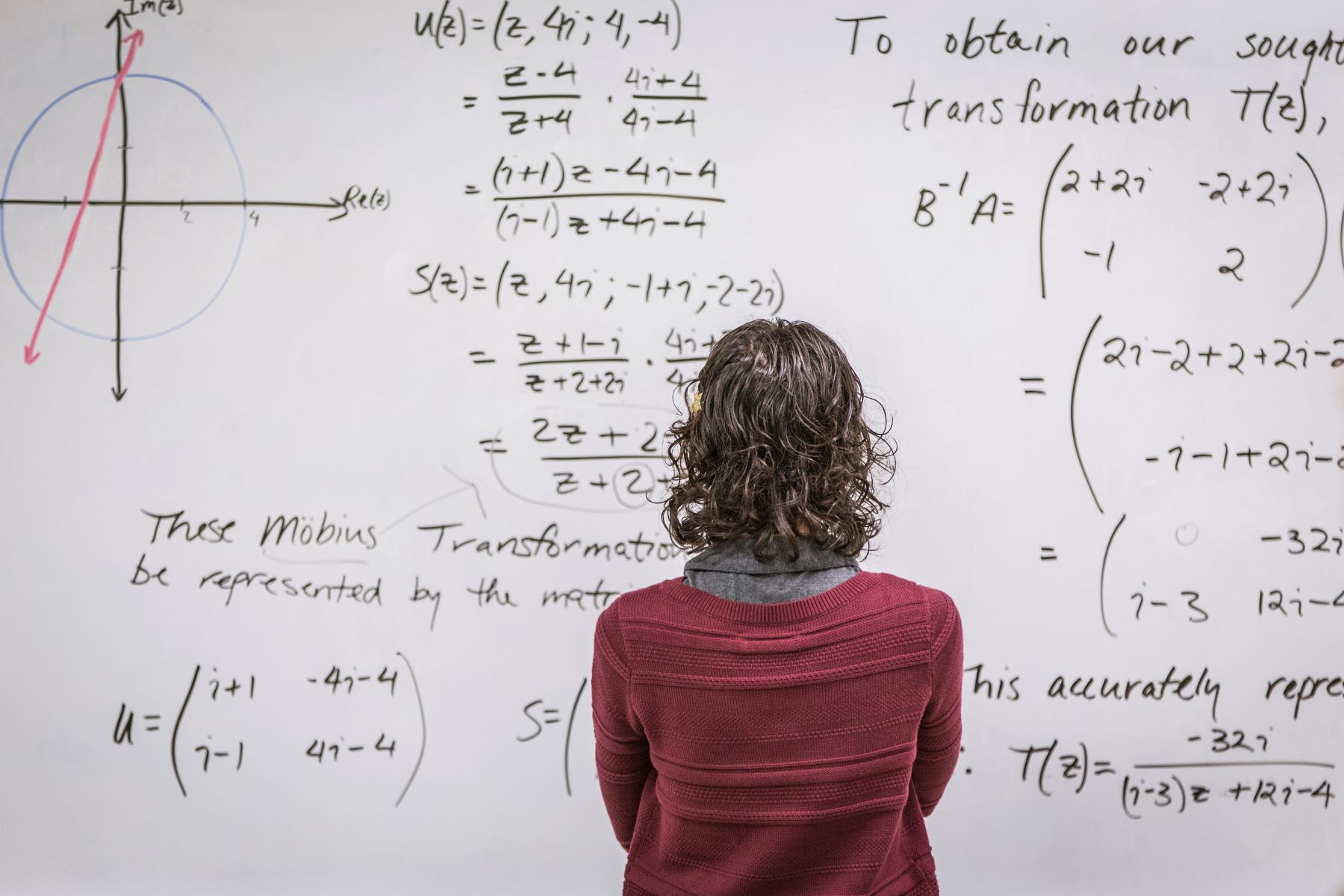

Welcome to the world of delta hedging, a fascinating concept in the realm of finance and options trading. Delta hedging is a technique used by traders and investors to manage the risks associated with options contracts. It involves strategically balancing the exposures of options positions with corresponding positions in the underlying asset.

Options trading can be highly lucrative, but it also carries inherent risks. Prices of options can be influenced by various factors, including changes in the price of the underlying asset, market volatility, and time decay. Delta, one of the key parameters of options, quantifies the rate of change in the price of an option in relation to changes in the price of the underlying asset.

Delta hedging is based on the principle of maintaining a neutral or desired delta position. By adjusting the delta of the options portfolio using underlying asset positions, traders aim to minimize potential losses resulting from adverse price movements.

This article delves into the world of delta hedging, explaining its importance in options trading, how it works, its advantages and disadvantages, and practical examples of its implementation. We will also explore the factors involved in determining the optimal delta hedge ratio and discuss common challenges faced and strategies employed in different market conditions.

Whether you are a seasoned trader looking to refine your options trading strategies or someone new to the world of finance seeking a deeper understanding of derivatives, this article will equip you with valuable insights into the fascinating world of delta hedging.

Understanding Delta Hedging

Delta hedging revolves around the concept of delta, which measures the sensitivity of an option’s price to changes in the underlying asset’s price. Delta ranges from 0 to 1 for call options and from -1 to 0 for put options. A delta of 0.5 indicates that the option price will increase by $0.50 for every $1 increase in the underlying asset’s price.

Delta hedging aims to reduce or eliminate the directional risk associated with options positions. By establishing offsetting positions in the underlying asset, traders can neutralize the delta of their options portfolio. This allows for more precise risk management and can help protect against adverse market movements.

For example, suppose you hold a call option with a delta of 0.6. This means that if the underlying asset’s price increases by $1, the option price will increase by $0.60. To delta hedge this position, you would sell short a fraction of the underlying asset that corresponds to the delta of the option. In this case, you would sell short 0.6 shares of the underlying asset to neutralize the delta of the call option.

The ability to delta hedge becomes particularly crucial when dealing with complex options strategies or portfolios with multiple positions. By managing the delta of the overall portfolio, traders can ensure that they are adequately protected against adverse market moves.

It’s important to note that delta is not a static value and can change due to various factors, such as changes in the underlying asset’s price, time to expiration, and changes in implied volatility. Therefore, delta hedging requires ongoing monitoring and adjustments to maintain the desired delta neutrality.

Delta hedging is most commonly employed in options trading, but it can also be used with other derivatives, such as futures or swaps. By employing delta hedging strategies, traders and investors can reduce their exposure to market volatility and enhance their risk management capabilities.

In the next section, we will explore the importance of delta in options trading and how delta hedging can help mitigate risk and enhance profitability.

The Importance of Delta in Options Trading

In options trading, understanding and managing delta is crucial for a variety of reasons. Delta serves as a key indicator of the sensitivity of an option’s price to changes in the underlying asset’s price.

One of the main reasons delta is important in options trading is that it allows traders to assess the probability of an option expiring in-the-money or out-of-the-money. A high delta value indicates that the option is more likely to be profitable if the price of the underlying asset moves in the desired direction. Conversely, a low delta value suggests that the option’s profitability is more dependent on larger price movements in the underlying asset.

Delta can also help traders determine the amount of exposure they have to price movements in the underlying asset. A higher delta means greater exposure, while a lower delta indicates less sensitivity to price changes. By adjusting the delta through delta hedging, traders can control their level of risk and adjust their positions accordingly.

Another reason delta is of utmost importance in options trading is its role in calculating options pricing models, such as the Black-Scholes model. Delta is one of the key inputs in these models and helps determine the fair value of an option. Understanding delta is crucial for accurately valuing options, as it directly affects their pricing.

Furthermore, delta provides insights into the potential profit or loss of an options position. By multiplying delta by the change in the price of the underlying asset, traders can estimate the approximate change in the value of their options. For example, if an option has a delta of 0.5 and the underlying asset’s price increases by $2, the option’s value would theoretically increase by $1.

Moreover, delta hedging can help traders reduce their exposure to market volatility. By neutralizing the delta of options positions, traders can minimize the impact of price fluctuations in the underlying asset. This allows them to focus on other factors, such as implied volatility and time decay, in order to optimize their options trading strategies.

Overall, delta plays a crucial role in options trading as it helps traders assess the probability of profit, manage risk, determine options pricing, and estimate potential profits or losses. By understanding and effectively utilizing delta, options traders can enhance their decision-making processes and increase their chances of success.

In the next section, we will explore how delta hedging works and how it can be implemented to manage risk in options trading.

How Delta Hedging Works

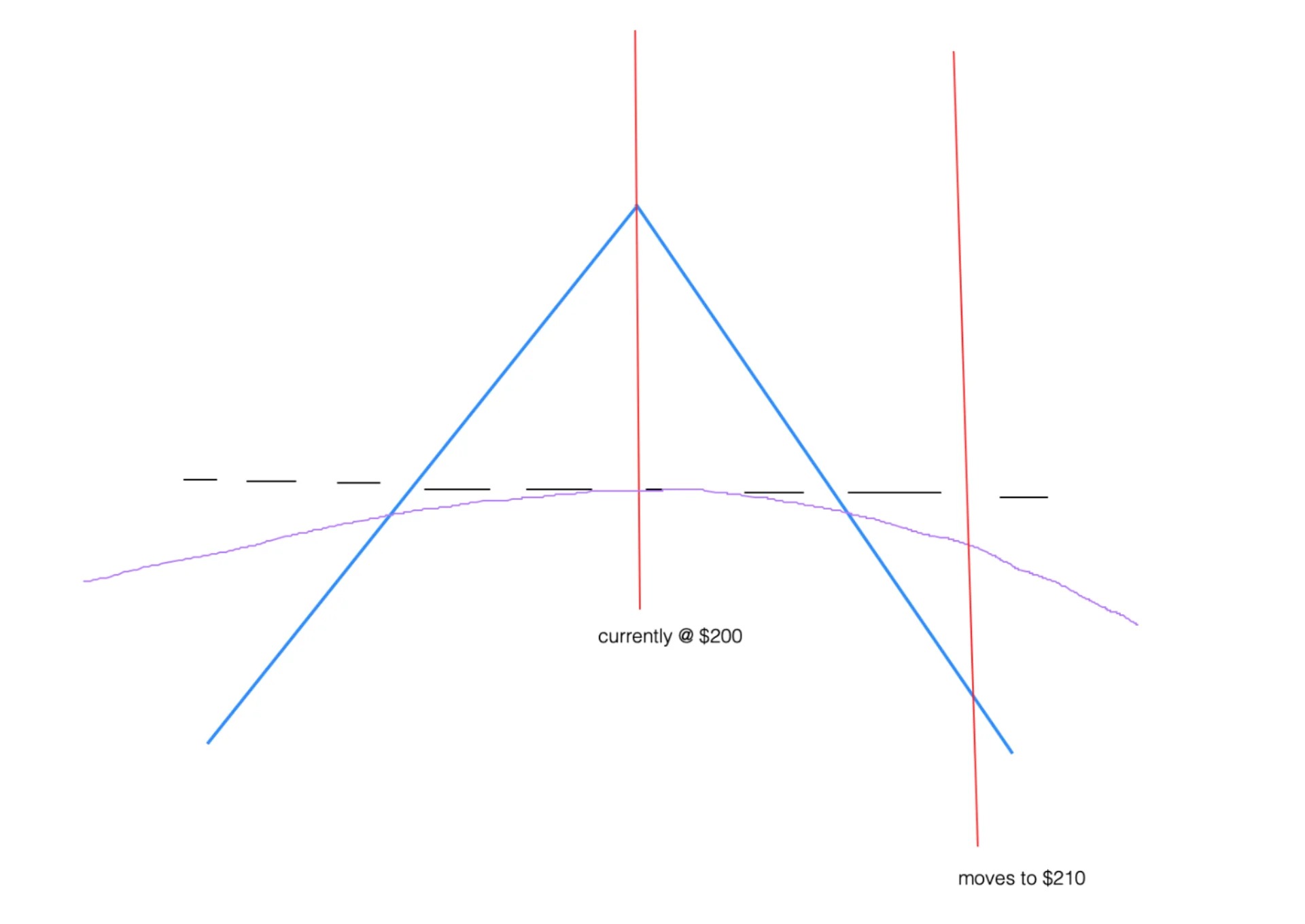

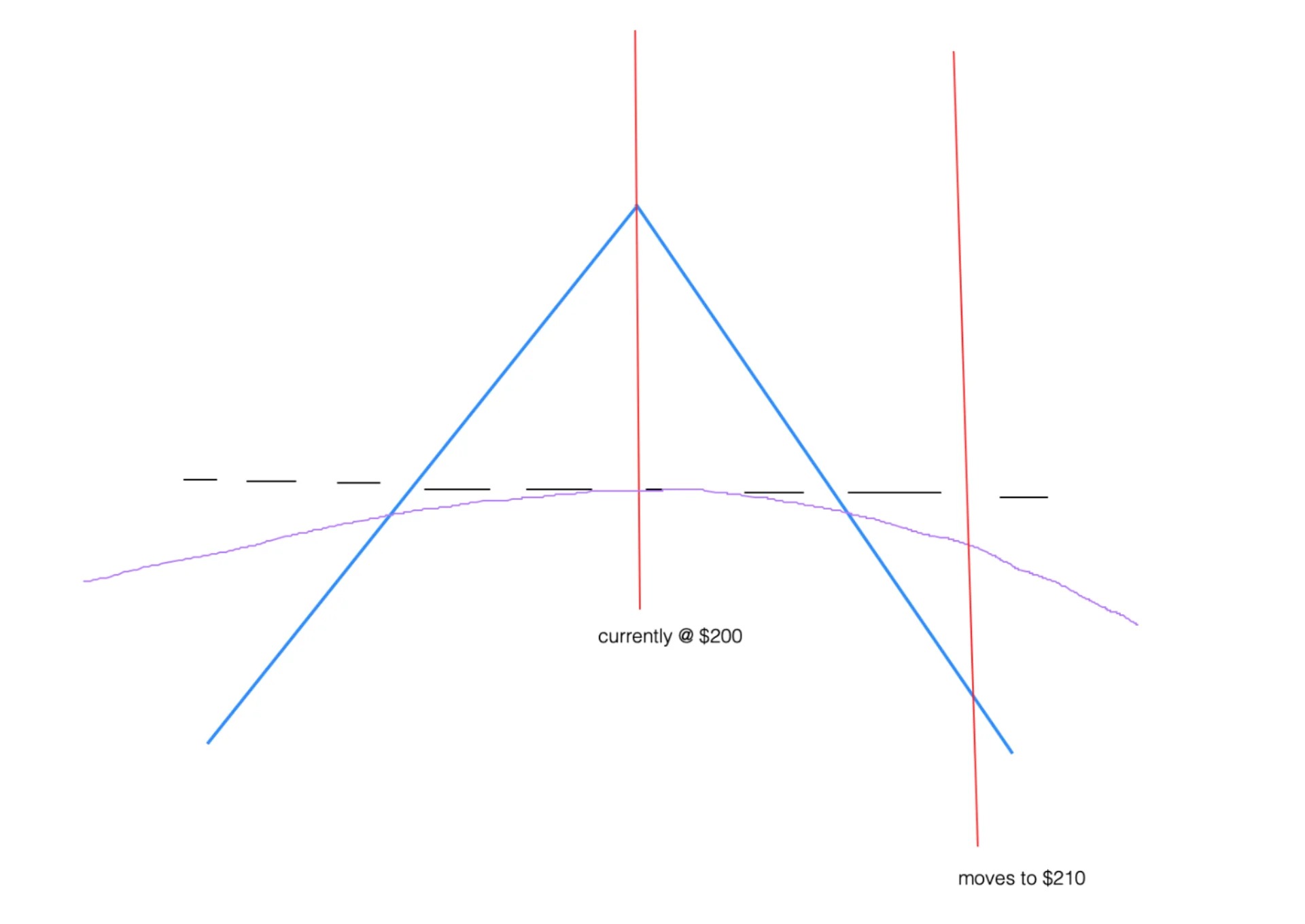

Delta hedging is a dynamic process that involves continuously adjusting the delta of an options position to offset changes in the price of the underlying asset. The goal is to maintain a neutral or desired delta position, effectively reducing the risk associated with directional price movements.

The process of delta hedging is based on the principle of establishing offsetting positions in the underlying asset that counterbalance the delta of the options position. By doing so, traders can achieve a delta-neutral or delta-targeted portfolio.

Let’s consider an example to understand how delta hedging works. Suppose you hold a call option with a delta of 0.7, meaning that if the underlying asset’s price increases by $1, the option price will increase by $0.70. To delta hedge this position, you would sell short an equivalent amount of the underlying asset.

Let’s say the delta of the underlying asset is 1, indicating a one-to-one relationship with its price. Therefore, selling short one share of the underlying asset would neutralize the delta of the call option, resulting in a delta-neutral position.

Now, if the price of the underlying asset increases by $1, the call option’s delta would also increase by 0.7, indicating a larger exposure to price movements. To maintain delta neutrality, you would need to adjust your position by selling short an additional fraction of the underlying asset to offset the increased delta of the call option.

Conversely, if the price of the underlying asset decreases, the delta of the call option would decrease as well. In this case, you would need to adjust your position by buying back an equivalent amount of the underlying asset to maintain delta neutrality.

The frequency of delta adjustments depends on the trader’s risk tolerance and desired level of delta neutrality. Some traders may choose to make small adjustments on a daily basis, while others may opt for less frequent adjustments. The key is to ensure that the delta remains within a desired range to effectively manage risk.

It’s important to note that delta hedging is an ongoing process and requires constant monitoring and adjustments. As the price of the underlying asset, time to expiration, and implied volatility change, the delta of the options positions also fluctuates. Traders must stay vigilant and make necessary adjustments to maintain the desired delta neutrality.

Delta hedging can be implemented using various instruments, including stock, futures contracts, or options on the underlying asset. The choice of instrument depends on factors such as market liquidity, cost considerations, and specific trading strategies.

In the next section, we will explore the advantages and disadvantages of delta hedging, helping you understand its potential benefits and limitations in options trading.

Advantages and Disadvantages of Delta Hedging

Delta hedging offers several advantages to traders and investors in options trading. Let’s explore the benefits it provides:

1. Risk Management: Delta hedging allows traders to effectively manage and reduce the risk associated with options positions. By maintaining a neutral or desired delta position, traders can offset potential losses resulting from adverse price movements in the underlying asset. It provides a level of protection and helps limit downside risk.

2. Increased Precision: Delta hedging enables traders to fine-tune their options positions by adjusting the delta to match their risk tolerance and market outlook. This level of precision allows for more strategic decision-making and better alignment of positions with market conditions.

3. Lower Cost of Hedging: Delta hedging can be a cost-effective way to manage risk. By utilizing offsetting positions in the underlying asset, traders can eliminate or reduce the need for more expensive hedging instruments, such as options or futures contracts.

4. Flexibility: Delta hedging provides flexibility in managing options positions. Traders can adjust their delta exposure based on market conditions, volatility, and their own risk appetite. This adaptability allows for agile decision-making and the ability to capitalize on market opportunities.

While delta hedging offers numerous advantages, it’s important to also consider its potential disadvantages:

1. Complexity: Delta hedging can be a complex strategy, particularly for those new to options trading. It requires a deep understanding of delta, options pricing models, and ongoing monitoring and adjustments. Traders need to dedicate time and effort to study and implement effective delta hedging techniques.

2. Potential Losses: Although delta hedging aims to reduce risk, it does not eliminate the possibility of losses. Adverse price movements, unexpected volatility changes, or incorrect delta adjustments can still result in losses. Traders need to continuously assess and manage their delta positions to minimize potential losses.

3. Execution Challenges: Delta hedging requires timely execution of trades to maintain delta neutrality. This can pose challenges, particularly in fast-moving markets or illiquid assets. Traders need to have access to real-time data, efficient trading platforms, and the ability to execute trades accurately and swiftly.

4. Transaction Costs: Delta hedging involves frequent adjustments to positions, which can result in transaction costs. These costs can eat into profits, particularly for traders with smaller trading capital. It’s important to consider transaction costs and ensure they are factored into the overall trading strategy.

Despite these potential drawbacks, the benefits of delta hedging often outweigh the disadvantages, especially for traders and investors who prioritize risk management and precision in their options trading strategies.

In the next section, we will explore practical examples of delta hedging in different scenarios, helping you understand how this strategy can be employed in real-world trading situations.

Practical Examples of Delta Hedging

Delta hedging is a versatile strategy that can be applied in various trading scenarios. Let’s explore a few practical examples to understand how delta hedging works in real-world situations:

Example 1: Protective Put Strategy

Suppose you own a portfolio of stocks and want to protect against a potential decline in their value. To implement a protective put strategy, you can purchase put options on the stocks. These put options act as insurance, providing downside protection.

However, the put options have a delta that reflects their sensitivity to changes in the stock price. To maintain a neutral delta position, you can sell short a fraction of the underlying stocks. By doing so, the decreasing value of the stocks will be offset by the increasing value of the put options, resulting in a delta-neutral position.

Example 2: Call Option Writing

Consider a scenario where you believe the price of a stock will remain relatively stable or slightly decrease. In this case, you can employ a call option writing strategy to generate income. By writing (selling) call options on the stock, you receive premium income but expose yourself to potential losses if the stock price rises sharply.

To delta hedge the call options you have written, you can establish a short position in the underlying stock. The short stock position will offset the increasing value of the call options if the stock price rises, allowing you to maintain a delta-neutral position and mitigate potential losses.

Example 3: Volatility Trading

Delta hedging can also be utilized in volatility trading strategies. Volatility is a critical factor in options pricing, as it affects the probability of the option expiring in-the-money or out-of-the-money. Traders who anticipate an increase in volatility can employ delta hedging to benefit from such movements.

For example, if you believe that implied volatility will increase, you can purchase options contracts with a positive delta to benefit from the price increase resulting from higher volatility. To maintain a delta-neutral position, you can sell short an equivalent amount of the underlying asset or write call options on the asset.

These are just a few examples of how delta hedging can be implemented in different trading scenarios. The key is to keep a close eye on the delta of your options positions and make timely adjustments to maintain the desired delta neutrality.

In the next section, we will explore one of the key considerations in delta hedging, which is determining the optimal delta hedge ratio.

Determining the Optimal Delta Hedge Ratio

The optimal delta hedge ratio refers to the ratio of the delta of the options position to the delta of the underlying asset position used for delta hedging. This ratio is a crucial consideration in delta hedging, as it determines the level of delta neutrality and risk management for a given options portfolio.

The optimal delta hedge ratio can vary depending on several factors, including the trader’s risk appetite, market conditions, and specific trading strategies. The goal is to strike a balance between reducing risk and maximizing profitability.

Typically, traders aim to achieve a delta-neutral or delta-targeted portfolio to minimize the impact of directional price movements. A delta-neutral position means that the net delta of the options positions is zero, effectively removing exposure to price changes in the underlying asset.

To determine the optimal delta hedge ratio, traders analyze the delta of the options positions and calculate the corresponding delta of the underlying asset required for delta neutrality. This is done by dividing the delta of the options position by the delta of the underlying asset.

For example, if an options portfolio has a total delta of 1.5 and the delta of the underlying asset is 0.75, the optimal delta hedge ratio would be 2. This means that for every 1.5 deltas in the options positions, 2 shares of the underlying asset would need to be held to achieve delta neutrality.

It’s important to note that the optimal delta hedge ratio is not a fixed number and may need to be adjusted based on changing market conditions. Traders need to continuously monitor the delta of the options positions and make necessary adjustments to maintain the desired delta neutrality.

Factors that can influence the determination of the optimal delta hedge ratio include the time to expiration of the options, implied volatility, and the trader’s outlook on the underlying asset’s price movement. Traders may also consider the potential impact of transaction costs, liquidity constraints, and margin requirements when determining the optimal ratio.

Additionally, traders may choose to deviate from a perfectly delta-neutral position by targeting a specific delta based on their market outlook and risk appetite. This allows for more flexibility in capturing potential profits from directional price movements while still managing risk through delta hedging.

It’s worth noting that determining the optimal delta hedge ratio requires experience, analysis, and the ability to adapt to changing market conditions. Traders may experiment with different ratios and adjust them based on the performance and risk profile of their options positions.

In the next section, we will discuss common challenges and considerations in delta hedging, helping you navigate potential obstacles in implementing this strategy.

Common Challenges and Considerations in Delta Hedging

While delta hedging can be an effective risk management strategy in options trading, it is not without its challenges and considerations. Let’s explore some of the common challenges that traders may encounter when implementing delta hedging:

1. Liquidity: Liquidity is a crucial aspect to consider when delta hedging. In fast-moving markets or when dealing with illiquid assets, it may be challenging to execute trades at desirable prices, leading to potential slippage and increased transaction costs. Traders should ensure that there is sufficient liquidity in the underlying asset and options market before engaging in delta hedging.

2. Variations in Delta: Delta is not a static value and can change due to various factors, such as changes in the underlying asset’s price, time decay, and changes in implied volatility. As a result, maintaining delta neutrality requires ongoing monitoring and adjustments. Traders should be prepared to analyze and update their positions regularly to manage the changing delta values.

3. Transaction Costs: Frequent adjustments in delta hedging can lead to increased transaction costs, especially for retail traders with limited capital. It is important to factor in the impact of transaction costs on the profitability of delta hedging strategies. A careful balance must be struck between risk management and the associated expenses.

4. Margin Requirements: Margin requirements can pose challenges for traders implementing delta hedging strategies. Maintaining a delta-neutral position may require holding a significant number of shares of the underlying asset, which could tie up a substantial amount of capital. Traders should be mindful of the margin requirements and ensure they have sufficient capital to support the delta hedge ratios they employ.

5. Model Assumptions: Delta hedging strategies often rely on pricing models, such as the Black-Scholes model, which make certain assumptions about market conditions. These assumptions may not always hold true in real-world situations, potentially impacting the effectiveness of delta hedging strategies. Traders should be aware of the limitations of the models they use and regularly assess their strategies’ performance against actual market conditions.

6. Risk Management vs. Profit Maximization: Achieving perfect delta neutrality may not always be the most profitable option. Traders must strike a balance between risk management and profit maximization. This may involve accepting a non-zero delta position to capitalize on favorable market movements while still employing delta hedging techniques to manage risks effectively.

Considering these challenges and considerations can help traders navigate the complexities of delta hedging. It’s important to continuously reassess and adjust strategies based on market conditions, risk tolerance, and available resources.

In the next section, we will explore different delta hedging strategies that traders can employ based on different market conditions.

Delta Hedging Strategies for Different Market Conditions

Delta hedging strategies can vary based on the prevailing market conditions and the trader’s outlook on the underlying asset. Here are a few delta hedging strategies commonly employed in different market scenarios:

1. Neutral Delta Hedging: This strategy is employed when the trader expects the underlying asset to remain relatively stable or experience small price fluctuations. The goal is to maintain a delta-neutral position by adjusting the delta of the options portfolio with offsetting positions in the underlying asset. This strategy helps protect against unexpected price movements and provides stability to the portfolio.

2. Bullish Delta Hedging: When anticipating an upward trend in the price of the underlying asset, traders may employ a bullish delta hedging strategy. This involves adjusting the delta to be slightly positive, indicating a bullish view. The trader can then adjust the position by buying more of the underlying asset or increasing call options to participate in potential gains while still maintaining some level of risk management through delta hedging techniques.

3. Bearish Delta Hedging: The bearish delta hedging strategy is employed when anticipating a downward trend in the underlying asset. In this case, traders adjust the delta to be slightly negative, indicating a bearish outlook. They can then adjust the position by either selling short or reducing the holdings of the underlying asset to mitigate potential losses if the price declines. Delta hedging allows for risk management while still taking advantage of downside opportunities.

4. Volatility Trading: Delta hedging can be utilized in strategies that aim to profit from changes in implied volatility. When expecting an increase in volatility, traders may adjust their delta by buying options to benefit from the potential price movement resulting from higher volatility. This strategy allows traders to take advantage of the expansion or contraction of volatility while still managing risk through delta hedging.

5. Gamma Scalping: Gamma measures the rate of change in an option’s delta as the price of the underlying asset fluctuates. Gamma scalping is a strategy that involves continuously adjusting the delta of an options position to take advantage of small price movements in the underlying asset. Traders buy or sell the underlying asset to maintain a neutral delta position. This strategy aims to capture profits from the gamma effect and can be employed during periods of high volatility or when there are frequent price fluctuations.

These are just a few examples of delta hedging strategies that traders can employ based on different market conditions and outlooks. The key is to assess the market environment, determine the desired level of risk exposure, and adjust the delta accordingly to align with the trading strategy.

It’s important to note that no single strategy guarantees success, and traders should continuously analyze and adapt their delta hedging strategies to changing market conditions.

In the following section, we will conclude the article and summarize the key points discussed in our exploration of delta hedging.

Conclusion

Delta hedging is a powerful risk management strategy in options trading that allows traders to effectively manage the sensitivity of their options positions to changes in the price of the underlying asset. By adjusting the delta through offsetting positions in the underlying asset, traders can achieve delta neutrality and reduce the impact of directional price movements.

In this article, we have explored the importance of delta in options trading and how delta hedging works. We have discussed the advantages and disadvantages of delta hedging, emphasizing the benefits of risk management and increased precision in trading strategies. We also provided practical examples of delta hedging in different scenarios, highlighting its versatility in protecting against losses or capitalizing on market opportunities.

We discussed the determination of the optimal delta hedge ratio, considering factors such as risk appetite, market conditions, and specific trading strategies. We also addressed common challenges and considerations in delta hedging, such as liquidity, variations in delta, transaction costs, model assumptions, and the balance between risk management and profit maximization.

Furthermore, we explored different delta hedging strategies for different market conditions, emphasizing the importance of adapting strategies based on market outlook and risk tolerance. Strategies such as neutral delta hedging, bullish, bearish, volatility trading, and gamma scalping were discussed as applicable approaches to varying market scenarios.

It is crucial for traders to continuously monitor and adjust their delta positions to maintain the desired level of delta neutrality and risk management. Delta hedging requires ongoing analysis, assessment of market conditions, and flexibility to optimize outcomes.

By implementing delta hedging strategies, traders can effectively manage risk, increase precision in options trading, and navigate the complexities of the financial markets. It is essential to combine delta hedging with a comprehensive understanding of the underlying asset, market dynamics, and other risk management techniques to enhance overall trading success.

As you continue your journey in options trading, remember that delta hedging is just one tool in your arsenal. Explore and experiment with different strategies, adapt to changing market conditions, and always stay informed. With careful analysis and implementation, delta hedging can help you achieve your trading goals while managing risk effectively.