Finance

What Is ‘Risk Hedging’?

Published: January 15, 2024

Learn about risk hedging in finance and how it can help protect your investments and mitigate potential losses. Explore different strategies and tools to manage financial risks effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Risk hedging is a fundamental concept in the world of finance. It involves various strategies and techniques that individuals, businesses, and financial institutions use to mitigate or minimize potential losses from unforeseen events or fluctuations in the market. Whether it’s protecting against volatile market conditions, currency fluctuations, or other risk factors, risk hedging plays a crucial role in managing financial exposures and ensuring stability.

In simple terms, risk hedging is akin to buying insurance. Just as you protect your home or car with insurance to safeguard against potential damage or loss, risk hedging serves as a financial safety net. It involves taking proactive steps to limit or offset any potential negative impact that adverse market movements or unexpected events may have on investments, assets, or liabilities.

By employing risk hedging strategies, individuals and businesses can minimize their financial exposure and protect themselves against unforeseen risks. It allows them to plan, manage, and navigate uncertainties with confidence, putting them in a more secure position to achieve their long-term financial goals.

It is important to note that risk hedging is not about avoiding risks altogether, but rather about managing and mitigating them in a controlled manner. Every investment or business venture inherently carries some level of risk, and risk hedging is a means to safeguard against negative outcomes.

This article will provide a comprehensive overview of risk hedging, exploring its definition, types, benefits, strategies, examples, and limitations. By understanding the concept of risk hedging, individuals and businesses can make informed decisions to protect their financial interests and navigate the ever-changing landscape of the financial markets.

Definition of Risk Hedging

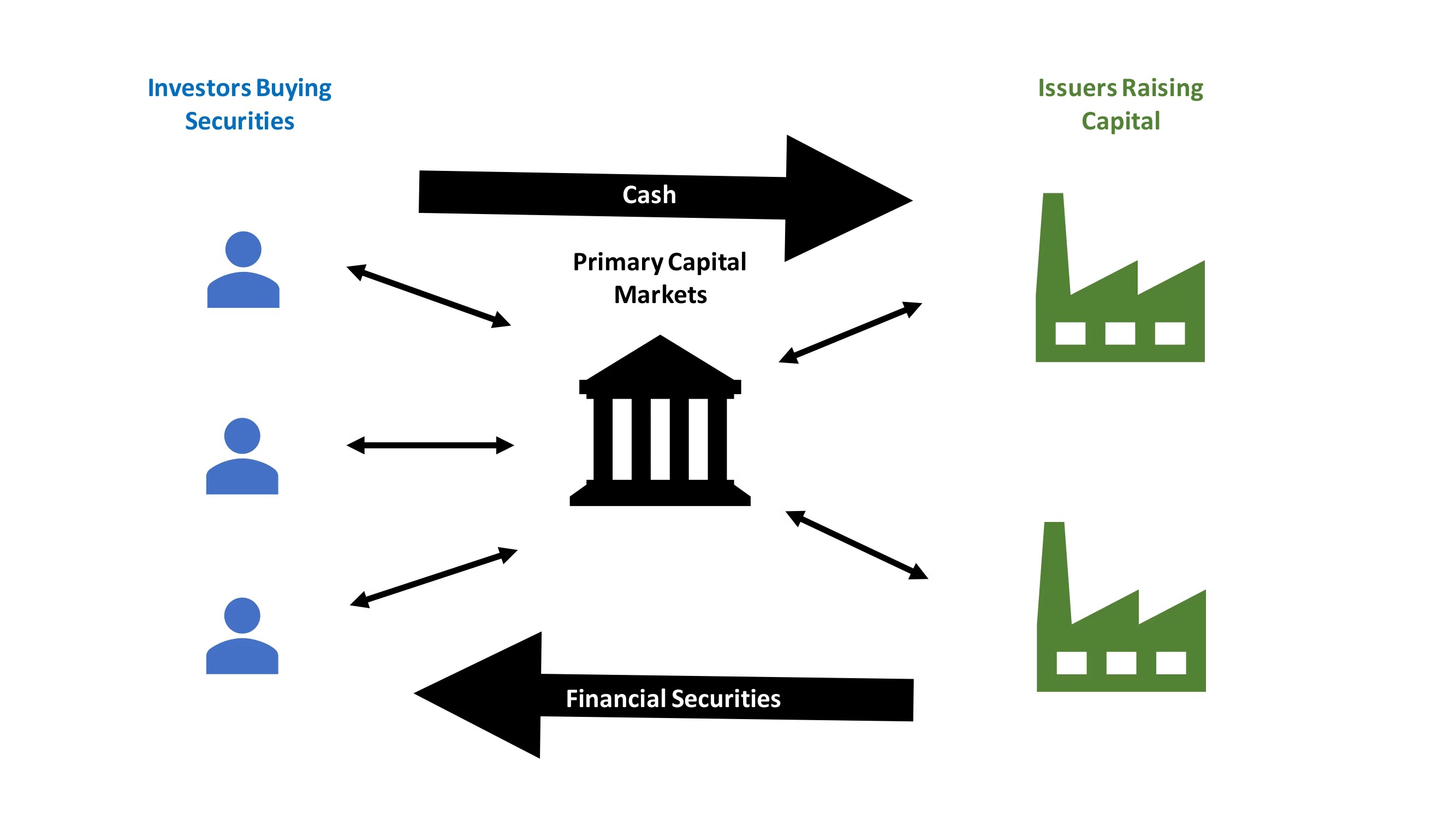

Risk hedging, also known as financial hedging or simply hedging, refers to the practice of employing various strategies and techniques to reduce or offset potential financial losses resulting from adverse market movements or unexpected events. It is a risk management tool used to protect investments, assets, or liabilities against uncertain or unfavorable market conditions.

Hedging involves taking counteractive positions or actions that help mitigate the impact of potential risks. It aims to reduce the volatility or uncertainty associated with financial exposures, allowing individuals, businesses, and financial institutions to better manage their financial risks. By hedging, they seek to limit potential losses while still allowing for potential gains in their investment or business activities.

The primary goal of risk hedging is to create a balance between risk and return. It recognizes that taking on risks is an inherent part of financial activities, but it seeks to control those risks in a way that aligns with the individual or organization’s risk tolerance and financial objectives.

There are various types of risks that can be addressed through hedging, including market risks, currency risks, interest rate risks, credit risks, and operational risks. These risks can arise from factors such as economic conditions, geopolitical events, industry trends, regulatory changes, or company-specific factors.

It’s important to note that risk hedging is not about eliminating all potential risks. Instead, it focuses on managing and mitigating risks in a way that allows individuals and organizations to function and make informed decisions while protecting their financial interests.

Overall, risk hedging provides a mechanism for individuals, businesses, and financial institutions to proactively safeguard their investments and navigate the uncertainties of the financial markets. It enables them to minimize potential losses and maintain stability in the face of adverse events or market fluctuations.

Types of Risk Hedging

Risk hedging encompasses various strategies and techniques that can be employed to manage different types of financial risks. Let’s explore some common types of risk hedging:

- Market Risk Hedging: This type of hedging involves strategies to protect against fluctuations in stock prices, commodity prices, or overall market conditions. It can include diversification, where investments are spread across different asset classes, or the use of derivative instruments such as options or futures contracts.

- Currency Risk Hedging: Currency fluctuations can significantly impact international investments or businesses operating in foreign markets. Currency risk hedging involves taking measures to minimize the impact of these fluctuations, such as using forward contracts, currency swaps, or options to lock in exchange rates.

- Interest Rate Risk Hedging: Interest rate changes can affect the cost of borrowing or the income generated from investments. Hedging against interest rate risk can involve using interest rate swaps, forward rate agreements, or interest rate futures to manage exposure to fluctuating interest rates.

- Credit Risk Hedging: Credit risk refers to the potential for borrowers to default on their repayments. Credit risk hedging strategies include credit default swaps, collateralization, and diversification across a range of borrowers to reduce the overall credit risk exposure.

- Operational Risk Hedging: Operational risks are associated with internal processes, systems, and human error. Hedging against operational risks can involve implementing robust risk management procedures, contingency plans, and insurance coverage.

These are just a few examples of risk hedging strategies, and the specific approach taken will depend on the nature of the risk being hedged and the individual or organization’s risk appetite and financial goals. It’s important to note that risk hedging strategies may involve costs, such as premiums for insurance policies or transaction fees for derivative instruments.

By understanding the various types of risk hedging methods available, individuals and businesses can tailor their approach to managing financial risks effectively. It’s essential to assess the risks involved, analyze the potential impact, and determine the most appropriate hedging strategy to achieve the desired risk-return balance.

Benefits of Risk Hedging

Risk hedging offers several significant benefits for individuals, businesses, and financial institutions. Let’s explore some of the key advantages:

- Protection against Adverse Market Movements: One of the primary benefits of risk hedging is its ability to protect against adverse market movements. By employing hedging strategies, individuals and organizations can mitigate potential losses resulting from market volatility or unexpected events. This can help preserve their investments and financial stability, even during times of market turbulence.

- Stabilization of Cash Flows: Risk hedging can provide a certain level of predictability and stability to cash flows. By hedging against currency fluctuations, interest rate changes, or other external factors, businesses can better forecast their cash inflows and outflows. This allows for more accurate financial planning and reduces the uncertainty associated with financial performance.

- Minimization of Risk Exposure: Through risk hedging, individuals and organizations can actively manage and minimize their exposure to various types of risks, such as market risks, currency risks, or credit risks. This can help protect the value of investments, maintain profitability, and enhance financial resilience. By diversifying portfolios or using hedging instruments, risks can be spread across different assets and effectively managed.

- Flexibility in Decision-Making: Risk hedging provides individuals and organizations with more flexibility in making financial decisions. By hedging against potential risks, they can focus on long-term objectives and make strategic investments without being overly influenced by short-term market fluctuations. This allows for more rational decision-making and reduces the impact of emotional biases on financial outcomes.

- Increased Confidence and Peace of Mind: Implementing risk hedging strategies can instill a sense of confidence and peace of mind. Knowing that appropriate measures are in place to manage potential risks provides individuals and businesses with a level of financial security. This can lead to improved overall well-being and a better ability to navigate uncertain times.

It is important to note that while risk hedging offers significant benefits, it is not without its potential drawbacks and limitations. Costs associated with implementing hedging strategies, such as transaction fees or insurance premiums, should be carefully considered. Additionally, there is no guarantee that hedging strategies will always be successful in mitigating risks or producing desired outcomes. Proper risk assessment, analysis, and a thorough understanding of the chosen hedging strategies are essential for maximizing the benefits.

Overall, risk hedging provides a range of advantages, allowing individuals, businesses, and financial institutions to protect their financial interests, minimize potential losses, and navigate the ever-changing landscape of the financial markets with greater confidence.

Strategies for Risk Hedging

There are several strategies that individuals and organizations can employ to effectively hedge against various types of financial risks. These strategies aim to mitigate the impact of adverse events or market movements. Here are some commonly used risk hedging strategies:

- Diversification: Diversification is a strategy that involves spreading investments across different asset classes, sectors, or geographical regions. By diversifying their portfolios, individuals and businesses can reduce the impact of a single investment or market downturn on their overall wealth. This strategy aims to minimize risk by not putting all eggs in one basket.

- Derivatives: Derivative instruments, such as options, futures, and swaps, can be used to hedge against specific risks. For example, options can protect against price fluctuations, while futures contracts can hedge against commodity price changes. These instruments allow individuals and businesses to establish predetermined terms and conditions to protect their investments or liabilities against adverse market movements.

- Forward Contracts: Forward contracts are agreements between two parties to buy or sell an asset or currency at a predetermined price and future date. They are commonly used to hedge against currency fluctuations or commodity price risks. By locking in the price in advance, individuals and businesses can protect themselves from potential losses resulting from unfavorable price movements.

- Insurance: Insurance is a common risk hedging strategy used to protect against various types of risks, such as property damage, liability claims, or business interruption. By paying a premium, individuals and businesses transfer the risk to the insurance company, which provides financial compensation in the event of a covered loss.

- Swaps: Swaps involve exchanging cash flows or payments based on predetermined terms. Interest rate swaps, for example, allow individuals or businesses to hedge against interest rate fluctuations by exchanging fixed-rate and variable-rate payments. Currency swaps can also help hedge against currency fluctuations by exchanging one currency for another at an agreed-upon rate.

These strategies serve as tools to manage and mitigate specific risks. The specific strategy chosen will depend on the type of risk being hedged, the financial goals, and the risk appetite of the individual or organization.

It’s important to note that implementing risk hedging strategies requires careful consideration of costs, potential benefits, and the specific circumstances of the individual or organization. Professional advice from financial advisors or experts may be beneficial to evaluate different strategies and determine the most suitable approach for effective risk management.

Examples of Risk Hedging

Risk hedging strategies are commonly employed in various industries and financial activities. Let’s explore some real-world examples of how risk hedging is utilized:

- Agriculture and Commodity Trading: Farmers often use futures contracts to hedge against price fluctuations of agricultural commodities, such as wheat or corn. By locking in the sale price in advance, farmers can protect themselves from potential losses if commodity prices drop before harvest.

- Foreign Exchange Trading: Companies conducting business internationally may use currency forward contracts to hedge against exchange rate risks. For example, if a company expects to receive payment in a foreign currency in the future, they can enter into a forward contract to guarantee the exchange rate and protect against potential losses resulting from currency fluctuations.

- Investment Portfolio Diversification: Individual investors often diversify their investment portfolios across various asset classes, such as stocks, bonds, and real estate. By spreading their investments, they reduce the impact of a single investment’s poor performance or market downturn. Diversification helps ensure a balanced risk-return profile for long-term wealth creation.

- Interest Rate Risk Management: Banks and financial institutions use interest rate swaps to manage interest rate risks. For example, a bank with a large amount of floating-rate loans may enter into interest rate swap agreements to convert those loans into fixed-rate assets, thereby hedging against the risk of rising interest rates.

- Insurance Policies: Individuals and businesses purchase various insurance policies, such as property insurance, liability insurance, or business interruption insurance, to hedge against potential losses. These policies transfer the financial risk to the insurance company, providing compensation to cover losses in the event of specified incidents.

These examples illustrate how risk hedging strategies are implemented in different industries and financial contexts. By employing these strategies, individuals and organizations can mitigate potential losses, protect their assets, and achieve greater financial stability and resilience.

It’s worth noting that risk hedging approaches will vary depending on specific circumstances, risk tolerance, and financial goals. It is essential to understand the risks involved, evaluate available hedging options, and consult with experts when necessary to effectively implement risk hedging strategies.

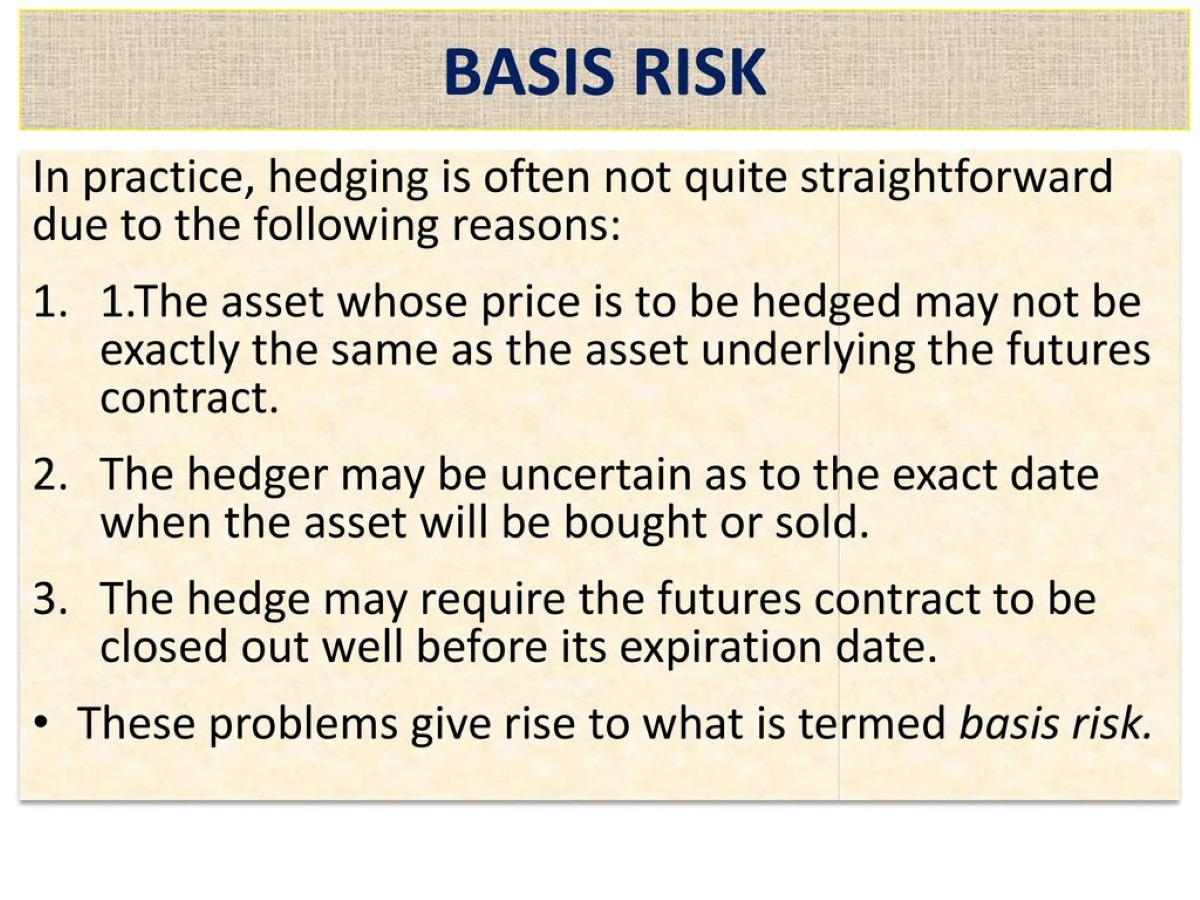

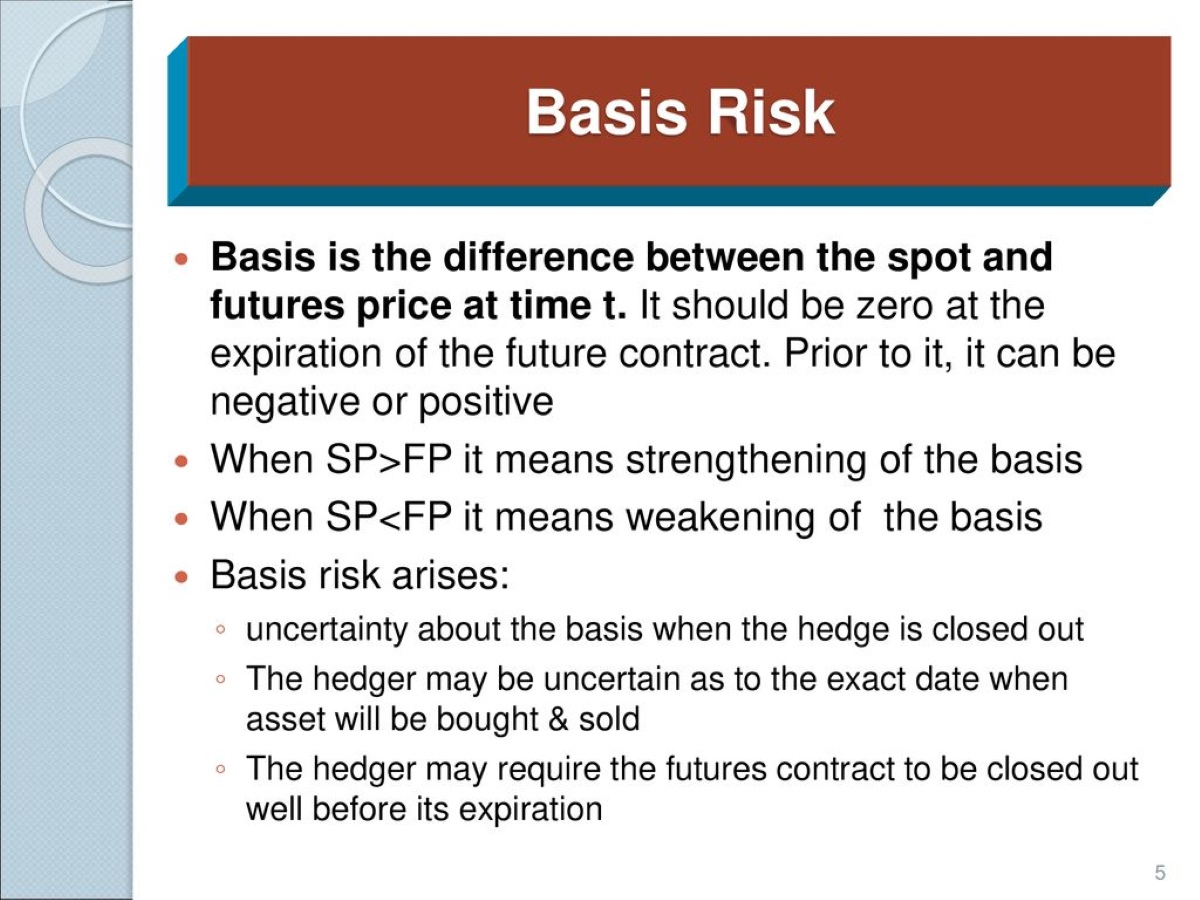

Criticisms and Limitations of Risk Hedging

While risk hedging strategies offer numerous benefits, they are not without criticisms and limitations. It is important to be aware of these factors when considering the implementation of risk hedging techniques. Let’s explore some of the criticisms and limitations of risk hedging:

- Costs and Fees: Implementing risk hedging strategies can involve costs, such as premiums for insurance policies, transaction fees for derivatives, or the opportunity cost of diversification. These costs can erode potential gains or reduce overall returns, impacting the effectiveness of risk hedging strategies.

- Market Timing: Successfully timing the market is challenging and often relies on accurately predicting future market movements. Risk hedging strategies typically involve making decisions based on assumptions about future events, which may not always unfold as anticipated. Incorrect timing or faulty predictions can lead to missed opportunities or unnecessary costs.

- Complexity and Expertise: Implementing effective risk hedging strategies requires a deep understanding of financial instruments, markets, and risk management techniques. It can be complex and may require the involvement of specialized professionals or advisors. Lack of expertise or inadequate understanding may lead to inefficient hedging or the wrong choice of strategies.

- No Guarantees: Risk hedging strategies, although designed to mitigate potential losses, do not provide absolute guarantees. They may reduce the impact of adverse events but cannot eliminate risks entirely. Unforeseen circumstances, market shocks, or systemic failures can still result in unanticipated losses, even with risk hedging measures in place.

- Opportunity Cost: Risk hedging often involves sacrificing potential gains or opportunities in exchange for protection against potential losses. While this can provide a sense of security, it may also limit the upside potential and hinder the ability to fully benefit from favorable market conditions or investment opportunities.

Additionally, it’s important to note that risk hedging strategies are not suitable for everyone. The decision to implement risk hedging techniques should consider an individual’s risk tolerance, financial goals, and specific circumstances. Some individuals may be comfortable taking on higher levels of risk and prefer not to hedge, while others may opt for more conservative approaches.

Despite these criticisms and limitations, risk hedging remains an important tool for managing financial risks. By understanding and carefully evaluating these factors, individuals and organizations can make informed decisions regarding the implementation of risk hedging strategies and strike a balance between risk mitigation and potential rewards.

Conclusion

Risk hedging is a vital aspect of financial management, allowing individuals, businesses, and financial institutions to navigate the uncertainties of the market and protect their financial interests. By employing various strategies and techniques, risk hedging aims to mitigate potential losses resulting from adverse events or market fluctuations.

We started by defining risk hedging as the practice of minimizing financial risks through proactive measures. It is not about avoiding risks altogether, but rather about managing and mitigating them in a controlled manner. Risk hedging involves protecting investments, assets, or liabilities from fluctuations in market conditions, currency values, interest rates, credit risks, and operational risks.

We explored different types of risk hedging, such as market risk hedging, currency risk hedging, interest rate risk hedging, credit risk hedging, and operational risk hedging. Each type targets specific risks and employs different strategies and tools to manage exposure and mitigate potential losses.

Additionally, we discussed the benefits of risk hedging, which include protection against adverse market movements, stabilization of cash flows, minimization of risk exposure, flexibility in decision-making, and increased confidence and peace of mind. Risk hedging allows individuals and organizations to proactively manage risks, make informed financial decisions, and achieve greater financial stability.

Furthermore, we outlined various strategies for risk hedging, such as diversification, derivatives, forward contracts, insurance, and swaps. These strategies provide individuals and organizations with a toolkit to manage risks effectively and tailor their approach based on their specific needs and risk appetite.

While risk hedging offers many advantages, we also addressed the criticisms and limitations associated with it. Costs, market timing challenges, complexity, lack of guarantees, and opportunity costs are factors that need to be considered when implementing risk hedging strategies. It is crucial to weigh the potential benefits against these limitations and assess their relevance to individual circumstances.

In conclusion, risk hedging is an integral part of financial management that plays a vital role in protecting investments, managing risks, and achieving financial stability. By understanding the concept, types, benefits, strategies, and limitations of risk hedging, individuals and organizations can make informed decisions and effectively navigate the dynamic and uncertain landscape of the financial markets.