Finance

What Is Internet Credit Optimum

Published: January 10, 2024

Learn about Internet Credit Optimum and how it can help you with your finance needs. Improve your financial situation with Internet Credit Optimum.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Internet Credit Optimum

- Benefits of Internet Credit Optimum

- How Does Internet Credit Optimum Work

- Application and Approval Process

- Tips for Using Internet Credit Optimum Efficiently

- Managing and Paying off Internet Credit Optimum

- Potential Drawbacks of Internet Credit Optimum

- Conclusion

Introduction

In today’s fast-paced digital age, consumers are often looking for convenient and efficient ways to manage their finances. Internet Credit Optimum is a unique financial tool that has gained popularity in recent years. But what exactly is Internet Credit Optimum, and how can it benefit you?

Internet Credit Optimum, also known as ICO, is an online credit service that allows individuals to obtain credit-based products and services through the internet. It offers a flexible and convenient way to access funds and make purchases without the need for traditional brick-and-mortar financial institutions.

Unlike traditional credit options, Internet Credit Optimum provides a streamlined and user-friendly experience. With just a few clicks, users can apply for credit, receive approval, and start using their funds almost immediately. This convenience has made it a popular choice among consumers looking for quick access to funds.

Moreover, Internet Credit Optimum offers a range of benefits that make it an attractive option for many individuals. From its flexibility to its accessibility and unique features, it has revolutionized the way people manage their finances and make purchases online.

In this article, we will explore the concept of Internet Credit Optimum in more detail, discussing its benefits, how it works, the application and approval process, tips for using it efficiently, managing and paying off the credit, and potential drawbacks. By the end of this article, you will have a comprehensive understanding of Internet Credit Optimum and whether it is the right financial tool for you.

Definition of Internet Credit Optimum

Internet Credit Optimum is an innovative financial service that enables individuals to access credit-based products and services online. It operates on an online platform, eliminating the need for in-person interactions and paperwork traditionally associated with obtaining credit from physical financial institutions.

This digital credit option allows individuals to borrow funds for various purposes, such as making online purchases, paying bills, or covering unexpected expenses. The credit is usually provided in the form of a virtual credit line or a credit card linked to an individual’s account.

One of the defining features of Internet Credit Optimum is its flexibility. Unlike traditional credit options, which often have fixed terms and payment schedules, Internet Credit Optimum allows users to manage their credit line according to their needs. They can choose how much credit they want to use and pay back, as long as they stay within the approved credit limit.

Another fundamental aspect of Internet Credit Optimum is its accessibility. Most platforms offering Internet Credit Optimum are available online, 24/7, allowing individuals to apply for credit and manage their accounts from the comfort of their own homes. This convenience appeals to individuals who prefer the flexibility of managing their finances online and those who may have limited access to traditional financial institutions.

It is important to note that Internet Credit Optimum is not a substitute for traditional banking services or long-term financial planning. While it can provide quick access to funds and flexibility in managing credit, it is still essential for individuals to maintain responsible financial habits and use Internet Credit Optimum as a tool to support their financial goals.

Overall, Internet Credit Optimum offers a convenient and accessible way for individuals to access credit-based products and services online. By leveraging the digital landscape, it has simplified the process of obtaining credit and provides users with greater control over their financial decisions.

Benefits of Internet Credit Optimum

Internet Credit Optimum offers a range of benefits that make it an attractive option for many individuals. Here are some key advantages:

- Convenience: One of the primary benefits of Internet Credit Optimum is the convenience it offers. With just a few clicks, users can apply for credit, receive approval, and start using their funds almost immediately. There is no need for in-person visits to financial institutions or lengthy paperwork, saving users valuable time and effort.

- Flexibility: Internet Credit Optimum provides users with flexibility in managing their credit. Users can choose how much credit they want to use and pay back within their approved credit limit. This allows individuals to tailor their credit usage according to their financial needs and repayment capabilities.

- Accessibility: Internet Credit Optimum is accessible to individuals who may have limited access to traditional financial institutions. Online platforms offering Internet Credit Optimum are available 24/7, allowing users to apply for credit and manage their accounts from the comfort of their own homes. This accessibility opens up financial opportunities for a wider range of individuals.

- Quick access to funds: With Internet Credit Optimum, users can have quick access to funds when they need them. Whether it’s for emergency expenses or making time-sensitive purchases, Internet Credit Optimum allows users to obtain credit swiftly, eliminating the need to wait for traditional loan processing times.

- Rewards and perks: Many Internet Credit Optimum providers offer rewards and perks to their users. These can include cashback on purchases, discounts, or loyalty programs. By utilizing Internet Credit Optimum for everyday expenses, users can earn rewards and maximize the benefits of their credit usage.

Overall, Internet Credit Optimum offers a convenient and flexible way for individuals to access credit-based products and services online. It simplifies the process of obtaining credit, provides quick access to funds, and offers a range of benefits and rewards for users. However, it is important to use Internet Credit Optimum responsibly and ensure that credit is managed effectively to avoid accumulating excessive debt.

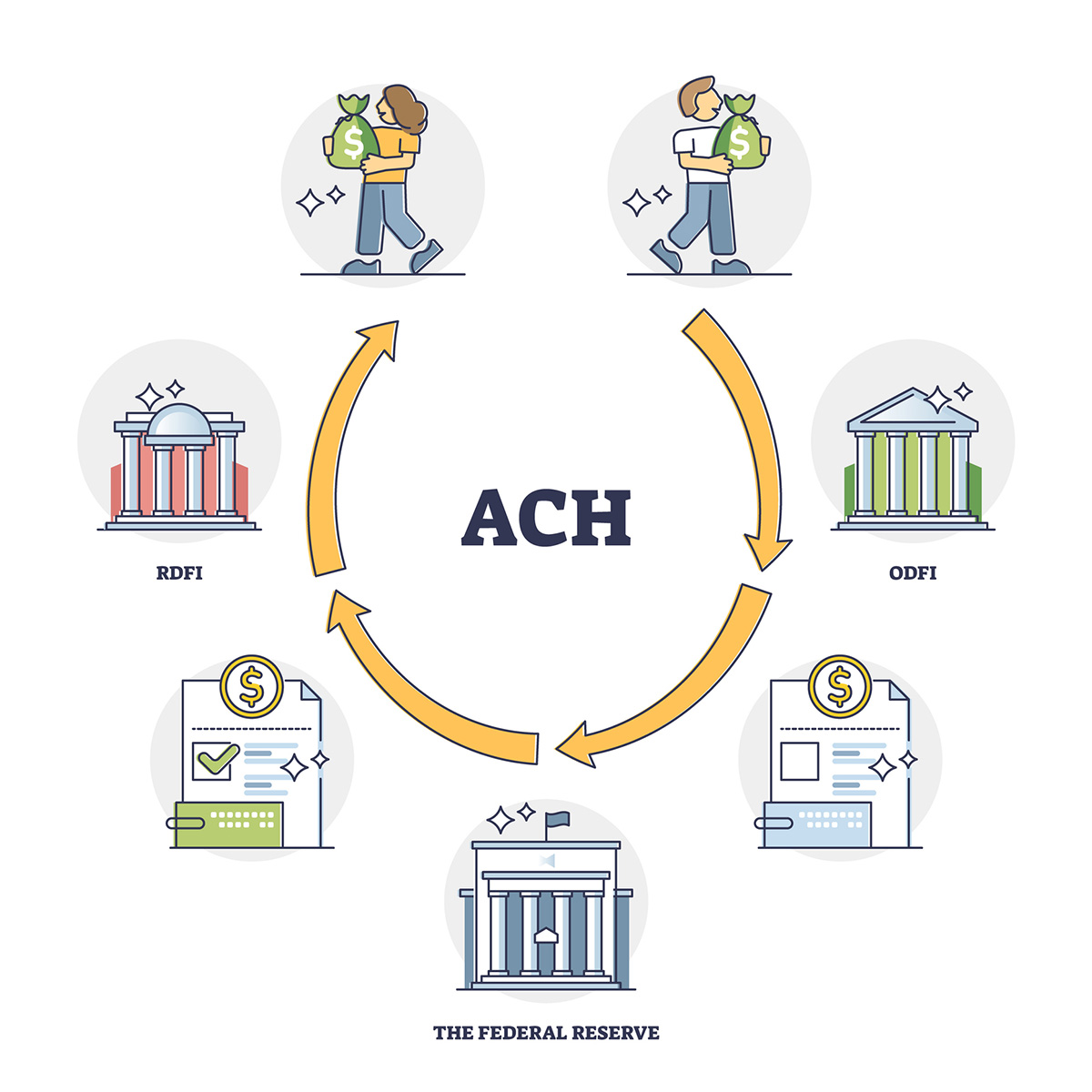

How Does Internet Credit Optimum Work

Internet Credit Optimum operates through online platforms that facilitate the application, approval, and management of credit-based products and services. The process typically involves the following steps:

- Application: To apply for Internet Credit Optimum, individuals need to visit the preferred online platform and provide the required information, such as personal details, income information, and identification documents. Some platforms may also require a credit check to assess the applicant’s creditworthiness.

- Approval: Once the application is submitted, the platform evaluates the provided information and determines whether to approve or decline the applicant’s request. The approval process may vary depending on the platform, but it is typically faster compared to traditional credit applications.

- Credit Limit: If the application is approved, the individual is assigned a credit limit. This limit represents the maximum amount of credit the individual can use. The assigned credit limit is based on various factors, such as income, credit history, and the platform’s evaluation criteria.

- Accessing Credit: Once the credit limit is established, users can start accessing credit through the online platform. This can be done through virtual credit lines or credit cards linked to the individual’s account. Users can use the credit to make purchases, pay bills, or withdraw cash if applicable.

- Repayment: Individuals are responsible for repaying the borrowed funds within the specified terms and conditions. This includes making regular payments, which can be done through online transfers, automatic payments, or other methods accepted by the platform.

- Managing Credit: Internet Credit Optimum provides users with online account management tools where they can monitor their credit usage, view transaction history, and track their repayment progress. This allows individuals to have better control and visibility over their credit activities.

Internet Credit Optimum platforms may also offer additional features, such as setting automatic payment reminders, personalizing spending limits, or providing financial insights and tips to help users manage their credit more effectively.

It is important to note that the specific workings and features of Internet Credit Optimum can vary depending on the platform and the terms and conditions offered. Therefore, individuals must carefully review and understand the terms and conditions of the specific Internet Credit Optimum they choose to use.

By leveraging the advancements in technology and the digital landscape, Internet Credit Optimum offers users a convenient and efficient way to access and manage credit. It simplifies the application and approval process, provides quick access to funds, and gives users control over their credit usage.

Application and Approval Process

The application and approval process for Internet Credit Optimum can vary depending on the platform or provider. However, the general steps remain consistent. Here is an overview of the typical application and approval process:

- Online Application: To apply for Internet Credit Optimum, individuals need to visit the platform’s website or mobile app and complete an online application form. This typically involves providing personal information such as name, address, contact details, and employment information. Some platforms may also require additional details like income, expenses, and identification documents to assess creditworthiness.

- Credit Assessment: After the application is submitted, the platform assesses the provided information to determine the applicant’s creditworthiness. This assessment may involve checking credit reports, credit scores, and income verification, depending on the platform’s criteria. The platform uses this information to evaluate the applicant’s ability to repay the credit and make a decision on approval.

- Approval or Decline: Once the credit assessment is complete, the platform notifies the applicant about the approval or decline of their application. If approved, the notification usually includes details about the approved credit limit, terms, and conditions. If declined, the notification may outline the reasons for the decline and provide suggestions or alternatives.

- Verification: In some cases, the platform may require additional verification before final approval. This can include verifying the applicant’s identity, income, or employment details. The verification process may involve providing additional documentation or completing additional steps as requested by the platform.

- Acceptance: If the applicant is approved, they are typically required to confirm their acceptance of the approved credit terms and conditions. This can be done through electronic acceptance or by signing a digital agreement.

- Activation: Once the acceptance is confirmed, the platform activates the individual’s Internet Credit Optimum account. This allows the user to access their approved credit limit and start using the credit for purchases or withdrawals, depending on the platform’s services.

It’s important to note that the time it takes for the application and approval process can vary. Some platforms offer instant approvals, allowing users to access credit almost immediately. In contrast, others may require more time for verification or manual review, resulting in a longer processing period.

When applying for Internet Credit Optimum, it is crucial for individuals to provide accurate and up-to-date information. This ensures a smooth and efficient application process and increases the chances of approval. Additionally, it is essential to review and understand the terms and conditions of the approved credit before using it to make informed financial decisions.

Tips for Using Internet Credit Optimum Efficiently

Internet Credit Optimum can be a valuable financial tool when used responsibly and efficiently. Here are some tips to help you make the most of your Internet Credit Optimum:

- Create a Budget: Before using your Internet Credit Optimum, create a budget to help you manage your finances effectively. Determine how much you can afford to spend and repay each month to avoid accumulating excessive debt.

- Use Credit Wisely: Only use your Internet Credit Optimum for necessary expenses and emergencies. Avoid using it for frivolous purchases that could lead to unnecessary debt. Set clear priorities and use your credit line accordingly.

- Pay On Time: Make it a priority to pay your Internet Credit Optimum bills on time. Late payments can result in additional fees and damage your credit score. Set up automatic payments or reminders to ensure you never miss a payment.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum required payment. This allows you to reduce your outstanding balance faster and save on interest charges in the long run.

- Avoid Maxing Out Your Credit Limit: It’s recommended to keep your credit utilization ratio low. Avoid maxing out your Internet Credit Optimum as it can negatively impact your credit score and make it harder to manage your repayment.

- Monitor Your Credit: Regularly check your Internet Credit Optimum account and review your transaction history. This helps you stay on top of your credit usage, identify any unauthorized charges, and track your spending habits.

- Manage Multiple Credit Lines: If you have multiple Internet Credit Optimum accounts or other credit lines, be sure to manage them effectively. Keep track of the terms, payment due dates, and credit limits to avoid overspending or late payments.

- Review Terms and Conditions: Familiarize yourself with the terms and conditions of your Internet Credit Optimum. Understand the interest rates, fees, and any other charges associated with the credit. This knowledge will help you make informed decisions and avoid unexpected costs.

- Stay Mindful of Credit Score Impact: Using Internet Credit Optimum responsibly can positively impact your credit score. On the other hand, excessive debt, missed payments, or maxing out your credit limit can harm your creditworthiness. Be mindful of the implications and make responsible credit decisions.

- Seek Financial Advice if Needed: If you’re struggling with debt or need assistance managing your credit, consider seeking financial advice from professionals. They can provide guidance tailored to your specific situation and help you create a plan to improve your financial well-being.

By following these tips, you can use Internet Credit Optimum efficiently and responsibly. It will help you maintain control over your finances, avoid unnecessary debt, and make positive financial progress.

Managing and Paying off Internet Credit Optimum

Effectively managing and paying off your Internet Credit Optimum is essential to maintain financial stability and avoid excessive debt. Here are some strategies to help you manage and pay off your Internet Credit Optimum successfully:

- Track Your Spending: Keep a record of your Internet Credit Optimum transactions and monitor your spending habits. This will help you identify areas where you can cut back and make necessary adjustments to your budget.

- Create a Repayment Plan: Develop a clear repayment plan for your Internet Credit Optimum. Determine how much you can afford to pay each month and stick to it. Prioritize paying off outstanding balances to minimize interest charges.

- Pay More than the Minimum: Whenever possible, pay more than the minimum monthly payment. This will help you reduce your outstanding balance faster and save on interest charges over time.

- Consolidate and Refinance: Consider consolidating multiple Internet Credit Optimum accounts or other debts into a single loan to simplify your repayment. Additionally, refinancing your credit may provide an opportunity to obtain better terms or interest rates.

- Communicate with the Provider: If you’re facing financial difficulties and are unable to make timely payments, reach out to your Internet Credit Optimum provider. They may offer assistance programs or alternative repayment options to help you manage your credit effectively.

- Avoid Late Payments: Make it a priority to pay your Internet Credit Optimum bills on time. Late payments can result in additional fees and negatively impact your credit score. Set up automatic payments or reminders to ensure you never miss a payment.

- Stay Within Your Credit Limit: Avoid maxing out your Internet Credit Optimum as it can lead to higher interest charges and impact your credit utilization ratio. Use your credit responsibly and keep your balance well below the assigned credit limit.

- Review Your Statements: Regularly review your Internet Credit Optimum statements for accuracy and report any errors or unauthorized charges immediately. This ensures that you are aware of your credit activity and can take necessary action if needed.

- Keep a Good Credit History: Maintaining a positive credit history is crucial for your financial well-being. Use your Internet Credit Optimum responsibly, make timely payments, and avoid excessive debt. This will help you build a strong credit profile and secure better credit opportunities in the future.

- Seek Professional Help if Needed: If you’re struggling to manage your Internet Credit Optimum or facing overwhelming debt, consider seeking guidance from a financial professional. They can provide personalized advice and assistance to help you regain control of your finances.

Remember, responsible management and timely repayment of your Internet Credit Optimum are keys to maintaining good financial health. By implementing these strategies and staying committed to your repayment plan, you can effectively manage your credit and work towards a debt-free future.

Potential Drawbacks of Internet Credit Optimum

While Internet Credit Optimum offers convenience and flexibility, it is important to consider the potential drawbacks before utilizing this financial tool. Here are some factors to be aware of:

- Higher Interest Rates: Internet Credit Optimum may have higher interest rates compared to traditional loans or credit options. It is essential to carefully review the terms and conditions, including the interest rate, to understand the cost of borrowing and avoid accumulating excessive interest charges.

- Additional Fees: Internet Credit Optimum providers may charge various fees, such as annual fees, late payment fees, or transaction fees. These fees can add up and affect the overall cost of credit. It is important to read and understand the fee structure and factor them into your financial planning.

- Risk of Overspending: The ease and convenience of using Internet Credit Optimum can lead to overspending. Without careful budgeting and self-discipline, it is easy to accumulate debt beyond your means to repay. It is crucial to use Internet Credit Optimum responsibly and avoid impulsive or unnecessary purchases.

- Potential Impact on Credit Score: Mismanaging your Internet Credit Optimum can negatively affect your credit score. Late payments, high credit utilization, or defaulting on payments can result in a lower credit score, making it challenging to obtain credit in the future.

- Privacy and Security Risks: When using Internet Credit Optimum, you are entrusting your personal and financial information to the online platform. It is essential to choose reputable and securely encrypted platforms to protect your data from unauthorized access or cyber threats.

- Limited Acceptance: Not all merchants or service providers may accept Internet Credit Optimum as a payment method. This can limit your usage and potentially require alternative payment methods, reducing the convenience factor.

- Potential for Debt Accumulation: Internet Credit Optimum, if not managed responsibly, can lead to excessive debt. Carelessly utilizing available credit and only making minimum payments can result in a long-term debt burden that may be challenging to resolve.

- Temptation of Impulsive Spending: The ease of accessing credit online can tempt individuals to make impulsive purchases and overspend. It is important to exercise self-control and carefully consider the necessity of a purchase before using Internet Credit Optimum.

- Dependence on Digital Infrastructure: Internet Credit Optimum relies on stable internet access and functioning digital infrastructure. Technical glitches, outages, or disruptions in connectivity can temporarily limit or hinder access to credit and account management.

- Lack of In-person Assistance: Unlike traditional banks, Internet Credit Optimum platforms may not offer in-person assistance or access to customer service representatives. This can be challenging for individuals who prefer face-to-face interactions or require personalized guidance for managing their credit.

Considering these potential drawbacks allows individuals to make informed decisions when it comes to utilizing Internet Credit Optimum. By understanding the risks involved, individuals can mitigate them and make the most of this financial tool while maintaining responsible financial practices.

Conclusion

Internet Credit Optimum offers a convenient and flexible solution for individuals seeking quick access to credit-based products and services online. With its streamlined application process, accessibility, and unique features, it has revolutionized the way people manage their finances and make purchases in the digital age.

Throughout this article, we have explored the definition of Internet Credit Optimum, its benefits, application and approval process, tips for efficient usage, managing and paying off the credit, and potential drawbacks to consider. By understanding these aspects, individuals can make informed financial decisions and maximize the benefits while avoiding common pitfalls.

Internet Credit Optimum provides convenience and flexibility, allowing individuals to access funds and make purchases without the need for traditional brick-and-mortar financial institutions. It offers quick approval and virtual access to credit lines or credit cards, empowering users to manage their credit within approved limits.

However, it is important to use Internet Credit Optimum responsibly. Creating a budget, paying attention to interest rates and fees, and making timely payments can help individuals maintain control over their credit usage and avoid excessive debt. Regularly monitoring credit statements and tracking spending habits also play a crucial role in effective management.

While Internet Credit Optimum has its advantages, it is not without its potential drawbacks. Individuals must be mindful of higher interest rates, additional fees, and the potential impact on their credit scores. Responsible usage and avoiding impulsive spending are vital to prevent excessive debt accumulation and maintain a healthy financial standing.

In conclusion, Internet Credit Optimum can be a valuable financial tool when utilized wisely. By understanding its features, benefits, and potential risks, individuals can confidently navigate the online credit landscape and make informed choices that align with their financial goals. It is important to manage Internet Credit Optimum responsibly, making it a useful and efficient tool to support your overall financial well-being.