Finance

What Is Kentucky State Income Tax Rate

Published: November 2, 2023

Learn about the Kentucky state income tax rate and how it impacts your finances. Find out everything you need to know about taxes in Kentucky.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Kentucky state income tax rates! Whether you’re a resident, a worker, or a business owner in the Bluegrass State, understanding how the state’s income tax system works is crucial for managing your finances effectively. Kentucky levies income tax on its residents and non-residents who earn income within the state. The tax revenue generated is used to fund state programs and services, such as education, infrastructure, healthcare, and public safety.

In this comprehensive guide, we’ll provide you with an overview of Kentucky state income tax, including its rates, deductions, credits, and filing requirements. We’ll break down the complexities and demystify the process, ensuring that you have all the information necessary to navigate the world of Kentucky state income tax with confidence.

Whether you’re a new resident, a seasoned taxpayer, or simply curious about how income tax works in the Bluegrass State, this article is your ultimate resource. So let’s dive in and explore the intricacies of Kentucky state income tax rates!

Overview of Kentucky State Income Tax

Kentucky state income tax is a progressive tax system, meaning that higher income earners pay a higher tax rate compared to those with lower incomes. It is based on the taxpayer’s federal adjusted gross income and is calculated using a series of tax brackets. The Kentucky Department of Revenue is responsible for administering and enforcing the state’s income tax laws.

In Kentucky, residents are generally subject to state income tax on their worldwide income, while non-residents are only taxed on income earned within the state. The income tax rates in Kentucky range from 2% to 5%, with the highest tax rate applying to income over a certain threshold.

It’s important to note that Kentucky allows certain deductions and credits that can help reduce your overall tax liability. These deductions and credits include but are not limited to educational expenses, retirement contributions, child and dependent care expenses, and various business-related deductions.

Kentucky residents are required to file their state income tax returns by April 15th of each year, following the federal tax deadline. However, if you need more time to prepare your return, you can request a six-month extension.

Now that we have a general overview of Kentucky state income tax, let’s delve deeper into the tax rates and brackets to gain a better understanding of how they apply to different income levels.

Understanding Kentucky State Income Tax Rates

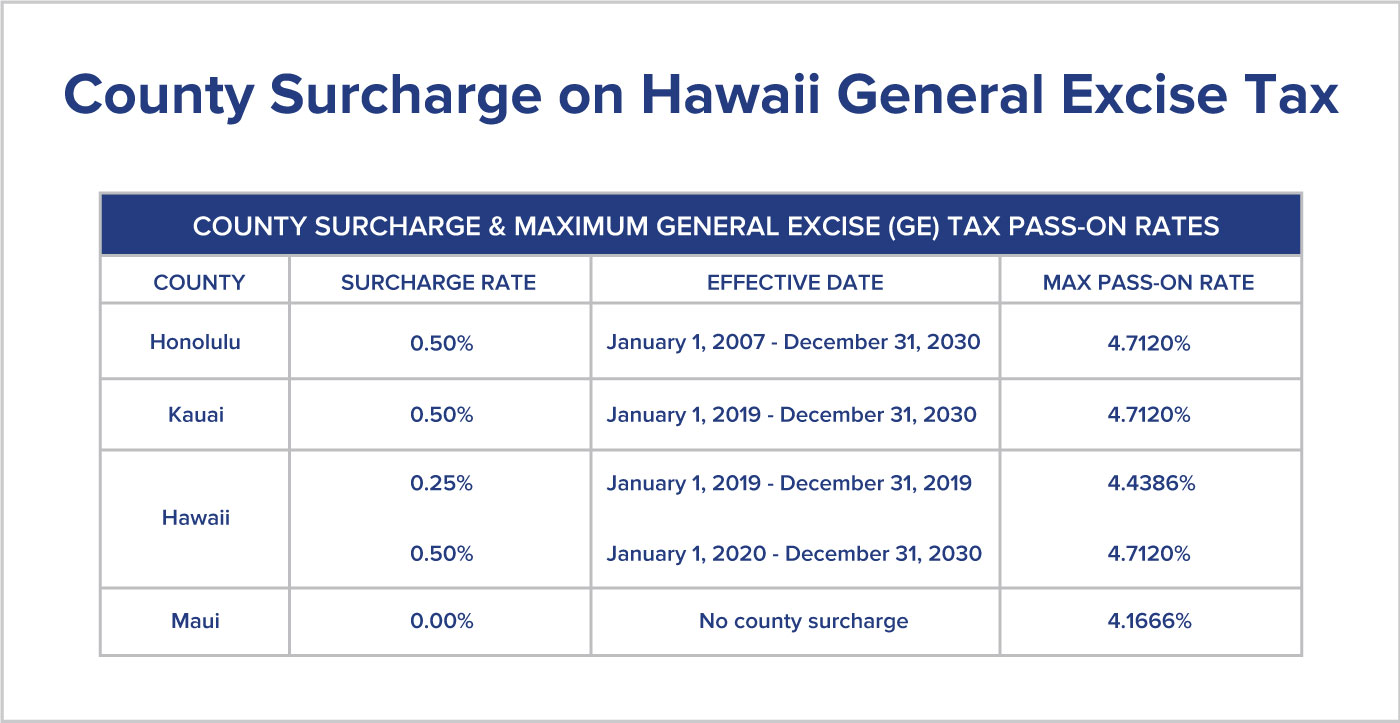

The Kentucky state income tax rates are structured in a progressive manner, meaning that the tax rate increases as your income level rises. Currently, Kentucky has a total of six income tax brackets, ranging from 2% to 5%.

Here is an overview of the current tax rates and brackets for Kentucky state income tax:

- 2%: For taxable income up to $3,000

- 3%: For taxable income between $3,001 and $4,000

- 4%: For taxable income between $4,001 and $5,000

- 5%: For taxable income exceeding $5,000

It’s worth noting that Kentucky also offers a refundable tax credit called the Kentucky Earned Income Credit (KEIC), which is designed to provide relief for low-income individuals and families. The KEIC is based on a percentage of the federal Earned Income Tax Credit (EITC) and can help reduce the tax burden for eligible taxpayers.

In addition to the income tax rates, Kentucky imposes a flat 5% tax on certain types of unearned income, such as interest, dividends, and capital gains. This is known as the Kentucky Retirement Systems Tax or the KRS Tax. It is important to include this tax liability in your overall tax planning if you receive income from these sources.

When calculating your Kentucky state income tax, it’s essential to note that you should start with your federal adjusted gross income (AGI) and make adjustments based on Kentucky-specific deductions, credits, and exemptions. These modifications will help arrive at your taxable income, which is then used to determine the applicable tax bracket and the corresponding tax rate.

Understanding the tax rates and brackets is essential in estimating your tax liability accurately. It allows you to plan for potential tax obligations and identify opportunities for tax-saving strategies, such as optimizing deductions and credits.

Now that we have a better understanding of the tax rates and brackets in Kentucky, let’s explore how to calculate your Kentucky state income tax and the deductions and credits available to further reduce your tax liability.

Calculating Kentucky State Income Tax

Calculating your Kentucky state income tax is a relatively straightforward process once you have determined your federal adjusted gross income (AGI) and made any necessary adjustments specific to Kentucky. Here’s a step-by-step guide to help you navigate through the calculation:

- Start with your federal AGI: Begin by determining your federal AGI, which is the starting point for calculating your Kentucky state income tax.

- Make Kentucky-specific adjustments: Kentucky allows certain deductions and adjustments to be made to your federal AGI. Examples of these adjustments include the Kentucky pension exclusion, the Social Security income exclusion, and any other Kentucky-specific deductions.

- Calculate your taxable income: After making the necessary adjustments, you arrive at your taxable income for Kentucky state income tax purposes.

- Determine your tax bracket: Based on your taxable income, you can determine the appropriate tax bracket and the corresponding tax rate using the Kentucky income tax brackets mentioned earlier.

- Apply applicable tax rate: Multiply your taxable income by the tax rate corresponding to your tax bracket to calculate the initial tax liability.

- Consider applicable credits and deductions: Kentucky offers various tax credits and deductions that can help reduce your overall tax liability. Examples include the Kentucky Earned Income Credit (KEIC) and other available credits for education, retirement contributions, and child and dependent care expenses.

- Calculate the final tax liability: After offsetting your initial tax liability with any applicable credits and deductions, you arrive at your final Kentucky state income tax liability.

It’s important to note that the Kentucky Department of Revenue provides resources and guidance to assist taxpayers in accurately calculating their state income tax. This includes tax publications, online calculators, and software options that can facilitate the process and ensure compliance with the state’s tax laws.

By understanding the process of calculating your Kentucky state income tax, you can better plan for your tax obligations and explore strategies to optimize your deductions and credits, ultimately minimizing your tax liability.

Now that we’ve covered the calculation process, let’s explore the deductions and credits available to Kentucky taxpayers, which can further reduce their state income tax liability.

Deductions and Credits for Kentucky State Income Tax

Kentucky offers a variety of deductions and credits that can help reduce your state income tax liability. These deductions and credits are designed to provide relief for specific expenses, encourage certain behaviors or investments, and support various individuals and businesses. Let’s explore some of the deductions and credits available to Kentucky taxpayers:

- Kentucky Pension Exclusion: This deduction allows taxpayers who are 59 ½ or older to exclude up to $41,110 ($82,220 for joint filers) of their retirement income from Kentucky state income tax.

- Social Security Income Exclusion: Kentucky offers an exclusion of up to $31,110 ($62,220 for joint filers) of Social Security income for taxpayers who are 65 or older.

- Kentucky Education Tuition Deduction: Taxpayers can deduct eligible education expenses paid during the tax year for themselves, their spouse, or dependents. This includes tuition, fees, books, and supplies for post-secondary education.

- Kentucky Earned Income Credit (KEIC): The KEIC is a refundable credit based on a percentage of the federal Earned Income Tax Credit (EITC). It provides support to low-income individuals and families, helping to alleviate their tax burden.

- Kentucky Child and Dependent Care Credit: This credit is available for taxpayers who incur expenses for the care of qualified dependents while they work or attend school. The amount of the credit varies based on the taxpayer’s income and the number of eligible dependents.

- Kentucky Historic Preservation Tax Credit: This credit is aimed at promoting the preservation and rehabilitation of historic properties in Kentucky. It provides a tax credit of up to 30% of qualified expenses incurred for eligible projects.

These are just a few examples of the deductions and credits available in Kentucky. It’s important to note that some deductions and credits may have specific eligibility requirements or limitations. It is recommended to consult the Kentucky Department of Revenue or a tax professional to ensure that you qualify for the deductions and credits you wish to claim.

By taking advantage of these deductions and credits, you can significantly reduce your Kentucky state income tax liability and keep more of your hard-earned money in your pocket. Now that we understand the deductions and credits available, let’s move on to explore the necessary forms and filing requirements for Kentucky state income tax.

Kentucky State Income Tax Forms and Filing

When it comes to filing your Kentucky state income tax return, it’s essential to use the appropriate forms and follow the required filing procedures. Here’s an overview of the forms commonly used for filing Kentucky state income tax:

- Form 740: This is the general income tax form for Kentucky residents. It is used to report your income, deductions, credits, and calculate your final tax liability.

- Form 740-NP: Non-resident individuals who earn income in Kentucky but are not residents of the state are required to file Form 740-NP. This form helps determine the portion of your income that is subject to Kentucky income tax.

- Form 740-EZ: This is a simplified version of Form 740, designed for taxpayers with less complex tax situations. It may be used if you meet certain criteria such as having only one employer, no dependents, and no itemized deductions.

- Form 740-X: If you need to make changes or corrections to a previously filed Kentucky state income tax return, you can use Form 740-X to amend your return.

When it comes to filing your Kentucky state income tax, you have several options:

- Electronic Filing: The Kentucky Department of Revenue offers an online filing system, known as “Kentucky Online Gateway,” where you can file your state income tax return electronically.

- Paper Filing: If you prefer to file a paper return, you can print the necessary forms and mail them to the Kentucky Department of Revenue. Be sure to use the correct mailing address specified on the form instructions.

- Professional Assistance: If you find the process overwhelming or have complex tax situations, it may be beneficial to seek the assistance of a tax professional who can guide you through the filing process and ensure accuracy.

It’s important to note that Kentucky follows the same deadline as the federal government for filing your state income tax return. Typically, the deadline is April 15th of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Additionally, if you need more time to file your Kentucky state income tax return, you can request an automatic extension of up to six months. However, it’s important to remember that this extension only applies to the filing of the return and not to the payment of any tax owed. Interest and penalties may apply if you do not pay any due taxes by the original filing deadline.

By understanding the required forms and filing procedures, you can ensure that you meet all the necessary obligations and accurately report your income to the Kentucky Department of Revenue. With that being said, it’s essential to stay informed about any changes or updates to Kentucky state income tax laws and requirements.

Now that we’ve covered the forms and filing process, let’s take a look at any recent changes to Kentucky state income tax rates and regulations.

Changes to Kentucky State Income Tax Rates

Over the years, there have been several changes to Kentucky state income tax rates and regulations. These changes have been implemented to address budgetary needs, align with federal tax reforms, or provide relief to taxpayers. Let’s explore some notable recent changes:

- 2021 Tax Year: In 2021, Kentucky increased the standard deduction for single filers, married individuals filing separately, and head of household filers from $2,590 to $2,650. For married individuals filing jointly, the standard deduction increased from $5,180 to $5,300.

- Conformity with Federal Tax Laws: Kentucky often aligns its tax laws with federal tax laws. As a result, changes at the federal level can impact Kentucky state income tax rates and regulations. For example, changes to federal tax brackets or deductions may also affect the corresponding Kentucky tax rates and deductions.

- COVID-19 Relief Measures: In response to the COVID-19 pandemic, Kentucky implemented several relief measures for taxpayers. These measures included extending the filing and payment deadlines for the 2019 tax year, waiving penalties for late payments, and offering installment payment plans for taxpayers facing financial hardships.

- Tax Reform Discussions: Kentucky has been considering various tax reform proposals in recent years. These proposals aim to simplify the tax code, lower tax rates, and attract businesses to the state. While no major changes have been implemented yet, it’s worth staying informed about potential future changes that may impact Kentucky state income tax rates.

It’s important to note that tax laws and regulations can change frequently, so it’s crucial to stay updated and seek professional advice or consult the Kentucky Department of Revenue for the most current information.

By staying informed about changes to Kentucky state income tax rates and regulations, you can ensure that you accurately calculate your tax liability and take advantage of any available deductions, credits, or incentives.

Now that we have explored the recent changes to Kentucky state income tax rates, let’s conclude our guide and recap the key points we’ve covered so far.

Conclusion

Understanding Kentucky state income tax rates is essential for individuals and businesses operating within the Bluegrass State. By grasping the intricacies of the tax system, taxpayers can accurately calculate their tax liability, optimize deductions and credits, and fulfill their obligations to the Kentucky Department of Revenue.

In this comprehensive guide, we’ve covered key aspects of Kentucky state income tax, including an overview of the tax system, the progressive tax rates, and the deductions and credits available to taxpayers. We’ve also explored the process of calculating Kentucky state income tax and the necessary forms and filing requirements.

As you navigate the world of Kentucky state income tax, it’s important to stay informed about any changes or updates to tax rates, regulations, and tax reform discussions. Staying up to date will enable you to make informed decisions and take advantage of available opportunities to minimize your tax liability.

Remember, if you have any questions or require assistance with your Kentucky state income tax, consider consulting a tax professional or utilizing resources provided by the Kentucky Department of Revenue. They can provide personalized guidance and ensure compliance with the state’s tax laws.

With a solid understanding of Kentucky state income tax rates and a proactive approach to managing your tax obligations, you can navigate the tax landscape with confidence and take control of your financial future in the Bluegrass State.