Finance

What Is Oklahoma State Income Tax Rate

Published: November 2, 2023

Learn about the current Oklahoma State income tax rate and how it may impact your finances. Plan your finances wisely with this helpful information.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on understanding and navigating the complexities of Oklahoma State Income Tax. Taxes are an integral part of our everyday lives, and understanding how they work is crucial for financial planning and compliance. In this article, we will dive into the various aspects of Oklahoma State Income Tax, including rates, calculations, deductions, and credits. Whether you’re a resident of Oklahoma or considering moving to the state, this guide will provide you with the necessary information to make informed decisions regarding your finances.

State income tax is a tax imposed by individual states on the income earned by its residents. Unlike federal income tax, state income tax rates and regulations vary from state to state. Oklahoma, like many other states, levies an income tax on its residents based on their income brackets. This means that the amount of tax you owe is determined by your taxable income and the corresponding tax rate for that income level.

Oklahoma’s progressive income tax system means that as your income increases, so does the tax rate you’ll pay on that additional income. It’s important to have a clear understanding of these rates to accurately calculate how much state income tax you owe.

Calculating your state income tax in Oklahoma involves determining your taxable income, applying the appropriate tax rates, and considering any deductions or credits you may be eligible for. Understanding the tax brackets and tax rates is crucial in accurately calculating your state income tax liability.

In addition to the tax rates, Oklahoma offers various deductions and credits that can help reduce your state income tax burden. These deductions and credits can vary based on factors such as your filing status, income level, and specific circumstances. Taking advantage of these deductions and credits can have a significant impact on the amount of state income tax you owe.

When it comes to filing state income tax in Oklahoma, individuals must follow the guidelines and deadlines set by the Oklahoma Tax Commission (OTC). It is important to understand the filing requirements, forms, and any associated documentation needed to complete the filing process accurately. Failure to comply with the filing requirements can result in penalties or interest on any tax owed.

As we delve deeper into the intricacies of Oklahoma State Income Tax, we will answer common questions and provide guidance on navigating through this process. By the end of this guide, you will have a comprehensive understanding of how Oklahoma State Income Tax works and be better equipped to manage your personal finances.

Understanding State Income Tax

State income tax is a form of taxation imposed by individual states on the income earned by its residents. While the federal government collects income tax from all U.S. citizens and residents, each state has the power to set its own income tax rates and regulations. Understanding state income tax is crucial for individuals to accurately calculate their tax liability and comply with their state’s tax laws.

State income tax is typically calculated on a progressive tax system, meaning that individuals pay different tax rates based on their income level. Higher incomes are subject to higher tax rates, while lower incomes are taxed at lower rates. It’s important to note that not all states have a state income tax. States like Texas, Nevada, Washington, and Florida, for example, do not impose a state income tax on their residents.

In states that do have an income tax, the tax rates and brackets vary. Some states, like California and New York, have high-income tax rates that can significantly impact high earners. Others, like Pennsylvania and Illinois, have a flat tax rate, meaning that all income levels are taxed at the same rate.

State income tax is usually calculated based on the taxpayer’s federal adjusted gross income (AGI), with adjustments and additions specific to each state. These adjustments can include deductions, exemptions, and credits that are unique to the state’s tax laws.

It’s important to note that state income tax is separate from federal income tax. While they are both based on the individual’s income, they have different tax rates, deductions, and regulations. Taxpayers must file separate tax returns for federal and state income tax.

In addition to state income tax, some states may also impose other types of taxes, such as sales tax, property tax, and estate tax. These additional taxes vary by state and can affect an individual’s overall tax liability.

Understanding state income tax is essential for taxpayers to accurately calculate and budget for their tax obligations. By familiarizing yourself with your state’s tax laws, rates, and deductions, you can better manage your finances and maximize any potential tax savings.

Overview of Oklahoma State Income Tax

Oklahoma is one of the many states in the United States that imposes a state income tax on its residents. The Oklahoma State Income Tax is collected by the Oklahoma Tax Commission (OTC) and is based on a progressive tax system, meaning that individuals with higher incomes are subject to higher tax rates. Understanding the key aspects of Oklahoma State Income Tax is essential for residents to accurately calculate their tax liability and fulfill their tax obligations.

The tax year for Oklahoma State Income Tax follows the same calendar year as the federal tax year, starting on January 1st and ending on December 31st. The tax return for Oklahoma State Income Tax must be filed by April 15th, unless an extension is granted. It’s important to note that even if you are not required to file a federal tax return, you may still need to file an Oklahoma state tax return if you meet certain income thresholds.

When determining the amount of tax owed to the state of Oklahoma, taxpayers must consider their taxable income. This includes income from various sources such as wages, salaries, self-employment income, rental income, and investment income. Certain types of income, such as Social Security benefits, are exempt from Oklahoma State Income Tax.

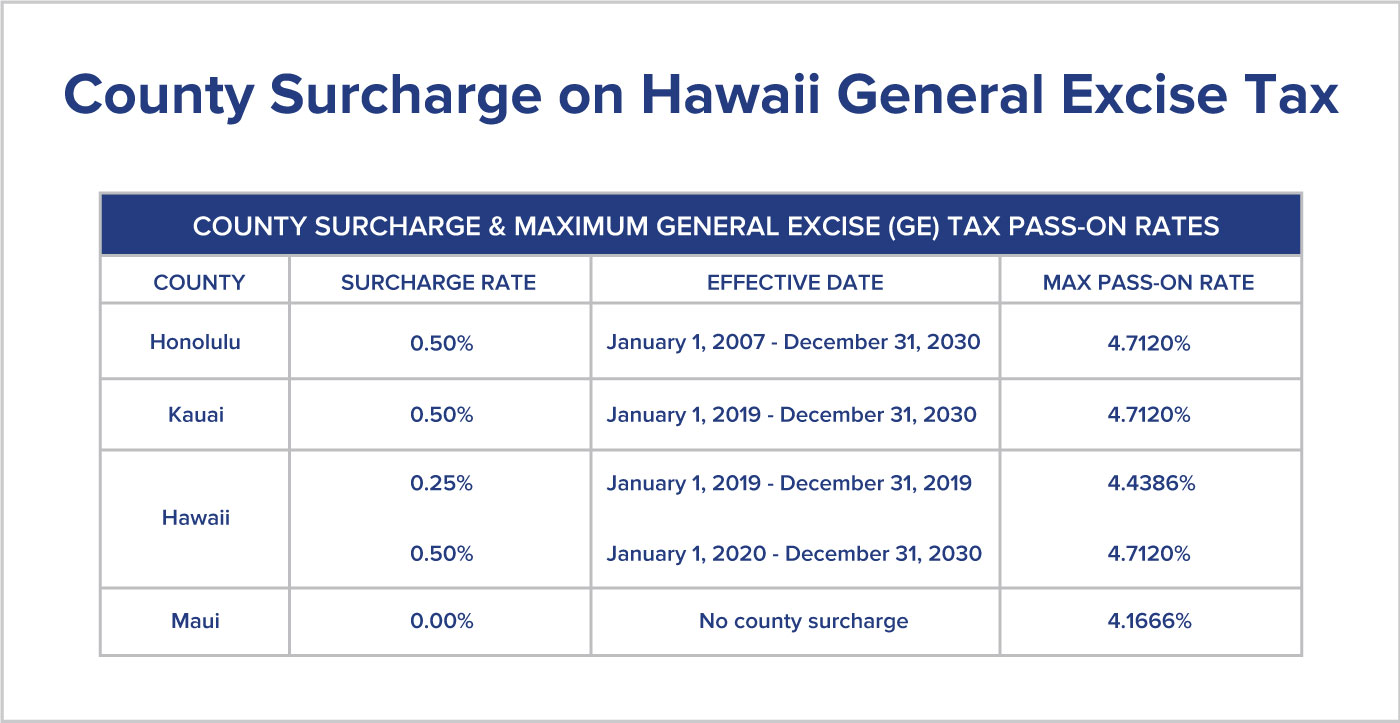

Oklahoma has multiple tax brackets, each with its own corresponding tax rate. As of the current tax year, there are seven tax brackets ranging from 0.5% to 5%, with higher-income earners subject to the higher rates. These rates are subject to change, so it’s important to check with the OTC or refer to the official Oklahoma tax laws for the most up-to-date information.

In addition to the tax rates, Oklahoma offers various tax credits and deductions that can help reduce an individual’s taxable income and overall tax liability. Some common Oklahoma tax credits include the Child Tax Credit, Earned Income Credit, and Senior Citizen/Retiree Credit. Deductions are also available for specific expenses such as education costs, retirement contributions, and certain charitable donations.

Filing the Oklahoma State Income Tax return can be done electronically or by paper mail. The OTC provides online tools and resources to assist taxpayers in completing their returns accurately. When filing, it’s important to gather all necessary documentation, including W-2 forms, 1099 forms, and any other supporting documents for deductions or credits claimed.

Failure to comply with Oklahoma State Income Tax requirements, such as filing late or underpaying your tax liability, can result in penalties and interest. It’s important to stay up-to-date with the latest tax laws, filing deadlines, and payment requirements to avoid any potential issues with the Oklahoma Tax Commission.

By understanding the key aspects of Oklahoma State Income Tax, residents can navigate the tax system more effectively, ensure compliance with state tax laws, and potentially maximize their tax savings. Consulting a tax professional or utilizing the resources provided by the OTC can provide further guidance and assistance in managing your Oklahoma State Income Tax obligations.

Current Oklahoma State Income Tax Rates

Understanding the current Oklahoma State Income Tax rates is crucial for residents to accurately calculate their tax liability. Oklahoma uses a progressive tax system, meaning that individuals with higher incomes are subject to higher tax rates. Let’s take a look at the current tax rates for Oklahoma State Income Tax.

As of [current tax year], Oklahoma has seven tax brackets that determine the applicable tax rate based on each taxpayer’s income. Here are the current tax rates for Oklahoma State Income Tax:

- Income up to $1,000: 0.5%

- Income between $1,001 and $2,500: 1.0%

- Income between $2,501 and $3,750: 2.0%

- Income between $3,751 and $4,900: 3.0%

- Income between $4,901 and $7,200: 4.0%

- Income between $7,201 and $8,700: 5.0%

- Income over $8,700: 5.5%

It’s important to note that these tax rates are subject to change, so it’s crucial to consult the Oklahoma Tax Commission (OTC) or refer to the official Oklahoma tax laws for the most up-to-date information. Additionally, married couples who file separate returns in Oklahoma must use the same filing status as used on their federal tax return.

Calculating your Oklahoma State Income Tax is a relatively straightforward process. You’ll take your taxable income, which is your total income minus any deductions or exemptions, and apply the corresponding tax rate based on the tax brackets. For example, if your taxable income falls into the $4,901 to $7,200 bracket, your tax liability would be calculated at the 4.0% rate.

It’s important to remember that these tax rates only apply to Oklahoma State Income Tax. Federal income tax is calculated separately, and you’ll need to file a separate federal tax return. Additionally, there may be other taxes and fees, such as local income tax or municipal taxes, depending on your specific location within the state.

Understanding the current Oklahoma State Income Tax rates and properly calculating your tax liability is essential for accurate financial planning. By staying informed about the tax rates and utilizing available deductions and credits, you can ensure that you fulfill your tax obligations while potentially maximizing your tax savings. If you have any questions or need further assistance, it’s recommended to consult a tax professional or refer to the resources provided by the Oklahoma Tax Commission.

Calculating Oklahoma State Income Tax

Calculating Oklahoma State Income Tax requires understanding the tax rates, tax brackets, and applicable deductions and credits. By following the proper steps, you can accurately determine your tax liability and ensure compliance with Oklahoma tax laws. Let’s explore how to calculate Oklahoma State Income Tax.

The first step in calculating your Oklahoma State Income Tax is to determine your taxable income. This includes all income earned from various sources such as wages, salaries, self-employment income, rental income, and investment income. Certain types of income, such as Social Security benefits, are exempt from Oklahoma State Income Tax.

Once you have calculated your gross income, you are eligible to claim certain deductions and exemptions. Deductions reduce your taxable income, which in turn reduces your overall tax liability. Common deductions in Oklahoma include expenses for education, retirement contributions, and certain charitable donations. It’s important to consult the official Oklahoma tax laws or seek advice from a tax professional to ensure you are claiming all applicable deductions.

After determining your taxable income and applying any deductions, you need to identify the tax bracket that corresponds to your income level. Oklahoma has seven tax brackets, each with its own tax rate. The tax rates range from 0.5% to 5.5% depending on your income level. Multiply your taxable income by the corresponding tax rate for your bracket to calculate the initial tax liability.

Next, consider any applicable tax credits. Tax credits directly reduce the amount of tax owed rather than reducing taxable income. Oklahoma offers various tax credits, such as the Child Tax Credit, Earned Income Credit, and Senior Citizen/Retiree Credit. These credits can greatly reduce your tax liability, so it’s important to see if you are eligible and claim them properly.

Once you have accounted for any applicable tax credits, subtract the credits from the initial tax liability to determine your final Oklahoma State Income Tax liability. It’s essential to double-check all calculations and consult the current tax laws or a tax professional, as the rates and regulations may change over time.

When it comes to filing your Oklahoma State Income Tax, you have the option to file electronically or by mail. The Oklahoma Tax Commission (OTC) provides resources and online tools to assist you with the filing process. Be sure to gather all necessary documents, such as W-2 forms, 1099 forms, and any additional supporting documentation for deductions or credits claimed.

It’s important to note that failure to accurately calculate and pay your Oklahoma State Income Tax can result in penalties and interest. To ensure compliance and avoid any issues, it’s recommended to stay informed about the most current tax laws, file on time, and pay the correct amount of tax owed.

By understanding the steps involved in calculating Oklahoma State Income Tax and taking advantage of applicable deductions and credits, you can accurately determine your tax liability and potentially save money. If you have specific questions or need personalized advice, consider consulting a tax professional or utilizing the resources provided by the Oklahoma Tax Commission.

Credits and Deductions

When it comes to reducing your overall tax liability, taking advantage of credits and deductions can be highly beneficial. Oklahoma offers various tax credits and deductions that can help decrease the amount of Oklahoma State Income Tax you owe. Let’s explore some common credits and deductions that you may be eligible for in Oklahoma.

Tax credits directly reduce the amount of tax you owe, providing a dollar-for-dollar reduction. In Oklahoma, there are several tax credits available to individuals. One example is the Child Tax Credit, which allows you to claim a certain amount for each qualifying child under the age of 17. Another credit is the Earned Income Credit, a refundable credit for individuals with low to moderate incomes. This credit is designed to provide additional financial assistance to working individuals and families.

Oklahoma also provides tax credits for specific groups or circumstances. For instance, there is a Senior Citizen/Retiree Credit available to individuals who are 65 years or older or are retired from military service. Additionally, individuals who adopt a child may be eligible for the Adoption Credit, which helps offset some of the costs associated with the adoption process. These are just a few examples of the tax credits that Oklahoma offers.

In addition to tax credits, Oklahoma allows for various deductions that reduce your taxable income. Deductions can include expenses related to education, retirement contributions, medical costs, and charitable donations, among others. For example, you may be able to deduct a portion of your qualifying education expenses, such as tuition and fees paid to an eligible educational institution.

It’s important to note that deductions are not a direct reduction in tax liability. Rather, they reduce your taxable income, which in turn can lower your overall tax liability. By carefully considering and claiming applicable deductions, you can effectively reduce your Oklahoma State Income Tax obligation.

When claiming credits and deductions, it’s essential to gather all necessary documentation and follow the specific guidelines provided by the Oklahoma Tax Commission (OTC). Be sure to maintain accurate records of your expenses and consult the official Oklahoma tax laws or seek advice from a tax professional to ensure you are eligible and claiming the credits and deductions correctly.

It’s worth mentioning that tax laws and regulations may change over time, so it’s crucial to stay updated on any new credits or deductions that become available in Oklahoma each tax year. By being proactive in identifying and utilizing applicable credits and deductions, you can reduce your tax liability and potentially increase your tax savings.

Remember, claiming credits and deductions requires careful consideration and adherence to the rules set by the OTC. Consulting a tax professional can provide valuable guidance in navigating the complexities of credits and deductions and ensuring you take full advantage of the tax benefits offered by the state of Oklahoma.

Filing Oklahoma State Income Tax

Filing your Oklahoma State Income Tax return is a fundamental part of meeting your tax obligations and ensuring compliance with the state’s tax laws. Understanding the process and requirements for filing your Oklahoma State Income Tax can help you navigate the process smoothly and accurately report your income and deductions. Let’s explore the key aspects of filing your Oklahoma State Income Tax return.

The filing deadline for Oklahoma State Income Tax aligns with the federal tax deadline, which is typically April 15th. However, if the 15th falls on a weekend or holiday, the deadline may be extended to the following business day. It’s essential to file your return and pay any tax owed by the deadline to avoid penalties and interest.

The Oklahoma Tax Commission (OTC) provides options for filing your state income tax return. You can choose to file electronically through the OTC’s online portal, which offers convenience and faster processing. Alternatively, you can file a paper return by mail. Make sure to use the appropriate forms and check the OTC website for any updates related to the filing process.

Before filing, gather all the necessary documentation, including your W-2 forms, 1099 forms, and any other income and deduction-related documents. Organizing these documents in advance will help ensure accurate reporting and reduce the risk of errors on your tax return.

When filling out your tax return, pay close attention to details such as your personal information, filing status, and any applicable exemptions or deductions. Double-check all entries to avoid mistakes that could potentially delay processing or trigger an audit. Consider seeking assistance from a tax professional if you have complex tax situations or any questions regarding the filling process.

It’s also important to be aware of any specific requirements imposed by the OTC. For example, if you electronically file your return, you may need to enter a Personal Identification Number (PIN) for added security. Follow the instructions provided by the OTC and ensure that you have included all required information and attachments.

If you are unable to file your Oklahoma State Income Tax return by the deadline, you can request an extension of time to file. However, keep in mind that an extension only gives you additional time to submit your return, not to pay any tax owed. Paying at least 90% of the tax owed by the original filing deadline will help avoid penalties and interest.

Once you have submitted your tax return, the OTC will process it and determine whether you are entitled to a refund, have a balance due, or need to provide additional information. If you receive a refund, you can choose to have it directly deposited into your bank account or receive a paper check through the mail.

It’s important to retain a copy of your filed tax return and any supporting documents for your records. This can be helpful in the event of an audit or if you ever need to reference your tax information in the future.

Overall, understanding the process of filing your Oklahoma State Income Tax return is essential for meeting your tax obligations. By carefully following the guidelines provided by the OTC, organizing your documents, and accurately reporting your income and deductions, you can ensure a smooth filing process and minimize the risk of errors or penalties.

Common Questions about Oklahoma State Income Tax

When it comes to filing taxes, it’s natural to have questions and concerns. Understanding key aspects of Oklahoma State Income Tax can help address any uncertainties and ensure compliance with tax laws. Here are some common questions about Oklahoma State Income Tax and their answers:

1. Who is required to file an Oklahoma State Income Tax return?

Individuals who are residents of Oklahoma and meet certain income thresholds are generally required to file an Oklahoma State Income Tax return. Non-residents who earn income from Oklahoma sources may also have a filing requirement.

2. How do I determine my residency status for tax purposes?

Your residency status for tax purposes is typically determined by factors such as the length of time you spend in Oklahoma, your permanent residence, and where you earn income. The Oklahoma Tax Commission provides guidelines to help individuals determine their residency status.

3. Can I file my Oklahoma State Income Tax return jointly with my spouse?

Yes, Oklahoma allows married couples to file a joint tax return. However, if you choose to file jointly for your federal tax return, you must use the same filing status on your Oklahoma State Income Tax return.

4. Can I e-file my Oklahoma State Income Tax return?

Yes, the Oklahoma Tax Commission provides an electronic filing option for individuals to file their state tax return. E-filing offers a faster and more convenient way to submit your return and receive any refunds.

5. Are there any deductions or credits specific to Oklahoma State Income Tax?

Yes, Oklahoma offers various deductions and credits that can help reduce your tax liability. Some common deductions include expenses for education, retirement contributions, and certain charitable donations. There are also specific tax credits available, such as the Child Tax Credit, Earned Income Credit, and Senior Citizen/Retiree Credit.

6. What if I can’t file my Oklahoma State Income Tax return by the deadline?

If you can’t file your state tax return by the deadline, you can request an extension of time to file. However, keep in mind that an extension only gives you additional time to submit your return, not to pay any tax owed. Paying at least 90% of the tax owed by the original filing deadline will help avoid penalties and interest.

7. How do I contact the Oklahoma Tax Commission for assistance?

The Oklahoma Tax Commission provides various resources and assistance to taxpayers. You can contact them through their website (tax.ok.gov) or by phone at the designated taxpayer assistance line. They also offer in-person assistance at their local offices.

Remember, these are general answers to common questions, and individual circumstances may vary. It’s always recommended to consult the official resources provided by the Oklahoma Tax Commission or seek advice from a tax professional for personalized guidance and accurate information regarding your specific situation.

Conclusion

In conclusion, understanding Oklahoma State Income Tax is vital for residents to navigate the tax system, accurately calculate their tax liability, and fulfill their tax obligations. By familiarizing yourself with the tax rates, deductions, and credits offered in Oklahoma, you can potentially optimize your financial planning and maximize your tax savings.

Knowing the key aspects of Oklahoma State Income Tax, such as the progressive tax system, tax brackets, and filing deadlines, can help you stay compliant with tax laws and avoid penalties or interest. It’s crucial to stay updated on any changes to tax rates or regulations by consulting the official resources provided by the Oklahoma Tax Commission.

Utilizing available deductions and credits can significantly impact your tax liability. Take advantage of deductions related to education expenses, retirement contributions, and charitable donations to reduce your taxable income. Additionally, explore the various tax credits offered in Oklahoma, such as the Child Tax Credit, Earned Income Credit, and Senior Citizen/Retiree Credit, which can directly lower the amount of tax you owe.

When it comes to filing your Oklahoma State Income Tax return, familiarize yourself with the available filing methods, such as e-filing or paper filing. Gather all necessary documentation, accurately report your income and deductions, and meet the filing deadline to ensure a smooth process and avoid penalties.

Remember, if you have specific questions or complex tax situations, it is always advisable to consult a tax professional who can provide personalized advice based on your individual circumstances. They can guide you through the intricacies of Oklahoma State Income Tax and help you make informed decisions regarding your tax planning.

By understanding and effectively managing your Oklahoma State Income Tax obligations, you can ensure compliance with tax laws, minimize your tax liability, and make the most of your financial resources. Stay informed, keep accurate records, and seek guidance as needed to navigate the complexities of Oklahoma State Income Tax efficiently and confidently.