Finance

What Is Lockbox In Banking

Published: October 12, 2023

Learn about lockboxes in banking and how they play a crucial role in finance operations. Discover the benefits and processes involved in this secure financial solution.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on lockbox services in banking. In today’s fast-paced and digital world, businesses face numerous challenges when it comes to managing their financial transactions efficiently. One solution that can help streamline payment processing and improve cash flow is a lockbox system.

A lockbox is a service provided by banks and financial institutions to help businesses handle incoming payments. It involves diverting customer payments to a designated post office box controlled by the bank. The bank then collects, processes, and deposits those payments into the business’s account. This system offers numerous benefits, such as efficient payment processing, improved cash flow, and enhanced security.

In this article, we will explore the concept of lockbox services in banking and examine their purpose, benefits, implementation considerations, and common challenges. Whether you are a business owner looking to optimize your payment processing or an individual curious about the mechanisms behind lockbox systems, this guide will provide you with the necessary insights.

So, let’s dive in and gain a deeper understanding of how lockbox services can revolutionize the way businesses manage their incoming payments.

Definition of Lockbox

Before diving into the intricacies of lockbox services, let’s start by understanding what a lockbox actually is in the context of banking. A lockbox, also known as a remittance processing service, is a method that businesses use to centralize the collection and processing of payments.

With a lockbox system, businesses designate a specific post office box operated by a bank to which their customers can send their payments. Instead of the payments being sent directly to the business’s physical address, they are directed to the lockbox. Once received, the bank collects the payments, processes them, and deposits the funds into the business’s bank account.

This process offers a secure and convenient way for businesses to receive payments from their customers. By utilizing a lockbox, businesses can simplify payment processing, reduce administrative burdens, and ensure faster availability of funds for their operations. Additionally, the bank can provide businesses with detailed reports and electronic records of the payment transactions, aiding in reconciliation and financial management.

A lockbox system is particularly beneficial for businesses that receive a large volume of payments through checks and other remittance documents. It streamlines the payment collection process, accelerates cash flow, and minimizes the risk of payment mishandling or loss. Furthermore, lockbox services can integrate with a business’s existing accounting systems, providing seamless integration and real-time data updates.

In summary, a lockbox is a banking service that enables businesses to consolidate and expedite the collection and processing of customer payments. By utilizing a dedicated post office box operated by the bank, businesses can simplify the payment handling process, improve cash flow, and enhance financial management.

Purpose of Lockbox Services

Lockbox services serve several important purposes for businesses, helping them streamline their payment processing and financial operations. Let’s explore the key objectives of using lockbox services:

- Efficient Payment Processing: One of the primary goals of lockbox services is to enable businesses to process customer payments quickly and accurately. Instead of businesses having to physically collect and process payments themselves, the bank takes on this responsibility. They collect payments from the lockbox, deposit funds into the business’s account, and provide timely notifications and reports of the transactions.

- Improved Cash Flow: By minimizing the time between payment receipt and the availability of funds, lockbox services can significantly enhance cash flow for businesses. Payments are processed promptly and deposited directly into the business’s account, ensuring faster access to funds. This enables businesses to meet their financial obligations, pursue growth opportunities, and better manage their day-to-day operations.

- Enhanced Security: Lockbox services offer a higher level of security compared to traditional payment processing methods. By diverting payments to a secure post office box operated by the bank, businesses reduce the risk of payment mishandling or loss. Banks employ rigorous security measures to protect the contents of the lockbox, ensuring the confidentiality of customer payment information.

- Reduced Administrative Burden: Managing payment collection, processing, and reconciliation can be time-consuming and resource-intensive for businesses. Lockbox services help alleviate this burden by outsourcing these tasks to the bank. Businesses are freed from the responsibilities of physically collecting payments, depositing them, and reconciling transactions. This allows them to focus on core business activities and improve operational efficiency.

- Better Financial Management: Lockbox services provide businesses with detailed reporting and electronic records of payment transactions. This valuable data helps in reconciling accounts, preparing financial statements, and conducting cash flow analysis. Additionally, banks may offer integration capabilities with existing accounting systems, facilitating seamless data transfer and real-time updates.

In summary, the purpose of lockbox services is to streamline payment processing, improve cash flow, enhance security, reduce administrative burdens, and provide businesses with the tools and information necessary for effective financial management. By leveraging lockbox services, businesses can optimize their payment operations and focus on their core competencies.

How Lockbox Systems Work

Lockbox systems are designed to simplify and expedite the payment processing and depositing process for businesses. Here’s a breakdown of how lockbox systems work:

- Designated PO Box: The business sets up a designated post office (PO) box with the bank or financial institution providing the lockbox service. This PO box is unique to the business and acts as the destination for customer payments.

- Customer Payments: Customers make payments by sending checks or remittance documents to the designated PO box. Alternatively, businesses may provide customers with electronic payment options, allowing direct transfer of funds into the lockbox account.

- Bank Collection: The bank regularly collects the contents of the lockbox. This can be done through an agreement with the postal service or by physically visiting the post office to retrieve the payments. Banks may use secure transport methods to ensure the safe transfer of the payments.

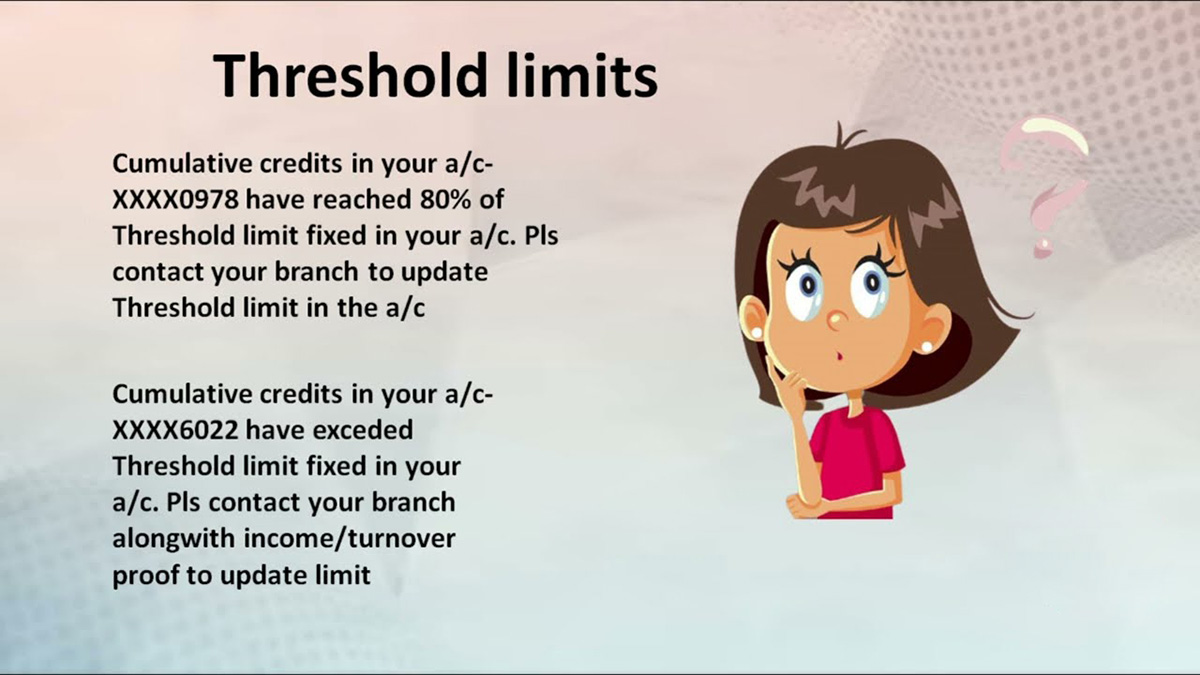

- Payment Processing: Once the bank receives the payments, they initiate the process of opening, sorting, and documenting the payments. This typically involves advanced technology, such as high-speed scanners and Optical Character Recognition (OCR) software, to capture payment details and remittance information accurately.

- Deposit and Notification: After processing the payments, the bank deposits the funds into the business’s designated bank account. Simultaneously, they generate detailed reports or electronic notifications to inform the business of the payments received, including relevant information like customer names, payment amounts, and invoice numbers.

- Reconciliation: The business reconciles the payment information received from the lockbox service with their own records. This ensures accurate tracking of payment receipts, identification of any discrepancies, and proper allocation of funds within the business’s accounting system.

- Additional Services: Depending on the specific lockbox service, banks may offer value-added services, such as check image archiving, online access to payment details, and customized reporting options. These services further support businesses’ financial management and payment processing needs.

By leveraging lockbox systems, businesses benefit from the efficient collection and processing of customer payments. The automated nature of the system, combined with advanced technology and secure processes, ensures timely depositing of funds and accurate reporting. It simplifies the payment handling process and allows businesses to focus on their core operations without the administrative burden of manual payment processing.

Benefits of Lockbox Services

Lockbox services offer a range of benefits for businesses, helping them streamline payment processing, improve cash flow, and enhance financial operations. Let’s explore the key advantages of using lockbox services:

- Efficient Payment Processing: By utilizing lockbox services, businesses can streamline their payment processing. The bank collects payments on behalf of the business, reducing the time and effort required for payment handling. This results in faster transaction processing, ensuring that funds are available in the business’s account promptly.

- Improved Cash Flow: Lockbox services play a critical role in accelerating cash flow for businesses. Payments are processed quickly and deposited directly into the business’s bank account, minimizing the time between payment receipt and fund availability. This enables businesses to meet financial obligations, make timely payments, and seize growth opportunities.

- Enhanced Security: Using a lockbox significantly reduces the risk of payment mishandling or loss. Payments are directed to a designated post office box operated by the bank, ensuring a secure collection process. Banks employ stringent security measures to safeguard the payment documents and sensitive customer information.

- Reduced Administrative Burden: Managing the collection, processing, and reconciling of payments can be time-consuming and resource-intensive. Lockbox services alleviate this burden by outsourcing these tasks to the bank. Businesses are freed from the responsibilities of physically collecting payments, preparing deposits, and reconciling transactions, allowing them to focus on core activities.

- Enhanced Financial Management: Lockbox services provide businesses with detailed reports and electronic records of payment transactions. This enables businesses to reconcile accounts easily, track payment receipts, and gain insights into cash inflows. The integration capabilities of lockbox services with accounting systems ensure seamless data transfer and real-time updates, facilitating efficient financial management.

- Convenience for Customers: Lockbox services offer convenience to customers by providing a centralized payment location. Customers can easily send payments to the designated PO box, eliminating the need for businesses to collect payments from multiple sources. This streamlined payment process enhances customer satisfaction and builds trust.

Overall, lockbox services provide businesses with significant advantages, including efficient payment processing, improved cash flow, enhanced security, reduced administrative burden, streamlined financial management, and convenience for customers. By leveraging lockbox services, businesses can optimize their payment operations, boost financial efficiency, and focus on their core competencies.

Types of Lockbox Systems

Lockbox systems come in various forms, catering to the unique needs and preferences of different businesses. Let’s explore some of the common types of lockbox systems available:

- Retail Lockbox: This type of lockbox system is commonly used by businesses that receive a large volume of payments in person or at a physical retail location. Retail lockboxes are typically located at the business’s storefront or office, allowing customers to deposit payments directly into the secure box. The business then retrieves the payments and forwards them to the bank for processing.

- Wholesale Lockbox: Wholesale lockbox systems, also known as corporate lockbox systems, are designed for businesses that receive a high volume of payments through the mail or from other businesses. The payments are mailed directly to a designated lockbox address provided by the bank. The bank collects the payments, processes them, and deposits the funds into the business’s account.

- Virtual Lockbox: Virtual lockbox systems are digital alternatives to traditional lockbox services. In this type of system, businesses redirect their customers to a secure online portal where payments can be made electronically. The payments are processed and deposited into the business’s account by the bank. Virtual lockbox systems offer convenience, speed, and enhanced security for businesses and their customers.

- Hybrid Lockbox: Hybrid lockbox systems combine the benefits of both physical and digital payment collection methods. Businesses can utilize a combination of retail, mail, and online payment collection methods based on their specific needs. Hybrid lockbox systems offer flexibility and customization, allowing businesses to optimize their payment processing based on customer preferences and operational considerations.

- Remote Lockbox: Remote lockbox systems are designed for businesses that operate in multiple locations or have a distributed customer base. In this system, businesses set up multiple lockbox locations in different geographic areas. Payments are directed to the nearest lockbox location, ensuring efficient collection and processing. The bank then consolidates the payments and deposits them into the business’s central account.

Each type of lockbox system has its own advantages and is suited for specific business requirements. Businesses can choose the most appropriate type based on factors such as the nature of their operations, customer payment behaviors, geographic reach, and technological capabilities.

It’s worth noting that the specific features and offerings of lockbox systems may vary among banks and financial institutions. Therefore, businesses should thoroughly evaluate and compare the services provided by different providers to choose the lockbox system that best aligns with their needs.

Considerations for Implementing Lockbox Services

Implementing lockbox services can bring significant benefits to businesses. However, there are several important considerations to keep in mind before diving into the implementation process. Let’s explore some key factors businesses should consider:

- Business Volume and Payment Types: Evaluate the volume and types of payments your business receives. This will help determine the appropriate lockbox system, as different systems excel in handling specific payment types or volumes.

- Integration with Existing Systems: Consider whether the lockbox service can integrate seamlessly with your existing accounting or payment processing systems. This ensures smooth data transfer, reduces manual entry, and streamlines reconciliation processes.

- Security Measures: Ensure that the lockbox service provider has robust security measures in place to safeguard customer payment information. This includes encryption protocols, access controls, and compliance with industry regulations such as PCI DSS.

- Customization and Reporting: Evaluate the flexibility of the lockbox service in terms of customizing reports, generating notifications, and providing real-time access to payment information. This allows businesses to tailor the service to their specific needs and gain valuable insights into cash flow and financial management.

- Service Level Agreements (SLAs): Review the SLAs offered by the lockbox service provider. Ensure that they align with your business’s requirements, particularly in terms of payment processing time, reporting frequency, and customer support availability.

- Cost and Pricing Structure: Understand the cost and pricing structure of the lockbox service. Consider factors such as setup fees, transaction fees, processing fees, and any additional charges for value-added services. Compare offerings from different providers to ensure affordability and value for money.

- Scalability and Growth: Consider whether the lockbox service can accommodate your business’s growth and scale. As your business expands, it is crucial to have a lockbox system that can handle increasing payment volumes and adapt to changing needs.

- Provider Reputation and Support: Research the reputation and reliability of the lockbox service provider. Read customer reviews, seek recommendations, and evaluate their customer support capabilities. A reputable provider with excellent support ensures a smooth implementation process and ongoing assistance.

By carefully considering these factors, businesses can choose the right lockbox service and provider that best fits their specific needs. Implementing lockbox services requires careful planning, but the benefits of streamlined payment processing, improved cash flow, and enhanced financial management make it a worthwhile investment for many businesses.

Common Challenges with Lockbox Services

While lockbox services offer considerable benefits, businesses may encounter certain challenges during the implementation and utilization of these services. It’s essential to be aware of these challenges and be prepared to address them effectively. Let’s explore some common challenges businesses may face with lockbox services:

- Implementation Complexity: Integrating a lockbox system with existing payment and accounting systems can be complex. It may require extensive coordination and configuration to ensure seamless data transfer and process synchronization.

- Change Management: Implementing a lockbox system may necessitate a change in payment collection processes and customer communication. Ensuring smooth transitions and educating customers about the new payment procedures can be challenging but is crucial for successful adoption.

- Data Accuracy and Reconciliation: Despite automated processing, issues related to data accuracy can arise. Document and payment mismatches, incorrect remittance information, or errors in recording transactions may require manual intervention and meticulous reconciliation procedures.

- Technical Issues: Like any technical system, lockbox services may encounter occasional downtime, software glitches, or communication failures. Businesses need to have contingency plans in place and maintain open lines of communication with their lockbox service provider to address such issues promptly.

- Security Risks: Despite the security measures implemented by lockbox service providers, there is always a risk of data breaches or unauthorized access to customer payment information. Businesses must work closely with the lockbox provider to ensure adequate security protocols and protocols to mitigate these risks.

- Limited Payment Options: Depending on the lockbox service provider, businesses may face limitations in terms of the payment types accepted. Some lockbox systems may only handle paper checks, while others may not support certain electronic payment methods. It is important to evaluate the compatibility of the lockbox system with the preferred payment options of your customers.

- Cost Considerations: While lockbox services can enhance efficiency, businesses must evaluate the costs associated with implementation, payment processing fees, and any additional charges for value-added services. Conduct a thorough cost analysis to ensure that the benefits gained outweigh the expenses.

- User Training and Support: Providing adequate training to employees who will be using the lockbox system and ensuring ongoing support can pose challenges. It is essential to have comprehensive training materials, access to user support, and clear communication channels to address any questions or issues.

By proactively identifying and addressing these challenges, businesses can maximize the effectiveness of their lockbox services. Communicating with the lockbox service provider, investing in training and support for employees, and continuously monitoring and improving processes will help overcome these challenges and optimize the benefits of lockbox services.

Conclusion

Lockbox services offer businesses a powerful tool to streamline payment processing, improve cash flow, and enhance financial management. By utilizing a designated post office box operated by a bank, businesses can offload the burden of payment collection, processing, and reconciliation. This enables them to focus on core activities while ensuring faster access to funds and reducing administrative demands.

Throughout this guide, we have explored the definition of lockbox services, their purpose, and the benefits they provide. We also delved into various types of lockbox systems, considerations for implementation, and common challenges that businesses may encounter.

In summary, lockbox services offer businesses advantages such as efficient payment processing, improved cash flow, enhanced security, reduced administrative burden, and better financial management. By carefully evaluating the specific needs of your business, selecting the appropriate lockbox system, and working closely with a reputable service provider, you can successfully implement lockbox services and reap the rewards.

Remember, implementation may come with challenges, such as technical issues, data accuracy concerns, or change management. However, by addressing these challenges proactively, businesses can overcome them and fully leverage the benefits of lockbox services.

In conclusion, lockbox services revolutionize payment processing for businesses, providing them with a secure, efficient, and convenient way to manage incoming payments. Exploring the possibilities and benefits of lockbox services can pave the way for improved financial operations, enhanced customer satisfaction, and a more agile business environment.