Finance

What Is My Auto Insurance Score?

Published: November 6, 2023

Wondering about your auto insurance score? Find out what it is and how it affects your finances. Learn more and make informed decisions now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Auto Insurance Scores

- Factors That Affect Auto Insurance Scores

- Importance of Auto Insurance Scores

- How Auto Insurance Scores are Calculated

- Ways to Improve Your Auto Insurance Score

- The Impact of Auto Insurance Scores on Your Premiums

- Auto Insurance Score vs. Credit Score: What’s the Difference?

- Frequently Asked Questions about Auto Insurance Scores

- Conclusion

Introduction

When it comes to auto insurance, scoring systems are often used by insurance companies to evaluate the risk associated with insuring a particular individual. One of the factors that can significantly impact your auto insurance premiums is your auto insurance score. But what exactly does this score entail?

Put simply, your auto insurance score is a numerical representation of your risk profile as a driver. It is calculated based on various factors such as your driving history, age, credit history, and other relevant data. Insurance companies use this score to determine the likelihood of you filing a claim and evaluate the level of risk they are taking by insuring you.

Understanding your auto insurance score is important because it can directly impact the amount you pay for your premiums. While insurance companies use different scoring models, the general idea is the same: the lower your auto insurance score, the higher your premiums may be.

It’s important to note that auto insurance scores are different from credit scores, although they do share some similarities. While credit scores assess your creditworthiness, auto insurance scores specifically focus on your driving-related risk factors.

In this article, we will delve deeper into auto insurance scores, explore the factors that affect them, discuss how they are calculated, and provide insights on how you can improve your score to potentially lower your auto insurance premiums. We will also discuss the differences between auto insurance scores and credit scores.

By the end of this article, you will have a comprehensive understanding of what your auto insurance score means and how it can impact your car insurance rates. So, let’s dive in and demystify your auto insurance score!

Understanding Auto Insurance Scores

Your auto insurance score is a numerical representation of the risk you pose as a driver to an insurance company. It is calculated by analyzing various factors related to your driving history and personal information. The purpose of auto insurance scores is to help insurance companies determine the likelihood of you filing a claim and assess the level of risk they are taking by insuring you.

Auto insurance scores are different from credit scores, although they do share some similarities. While credit scores evaluate your creditworthiness, auto insurance scores specifically focus on factors related to your driving habits and history. Therefore, even if you have a good credit score, your auto insurance score could still be adversely affected if you have a history of accidents or traffic violations.

Insurance companies use proprietary models to calculate auto insurance scores, and these models may vary between different insurers. However, common factors that are typically considered include:

- Driving record: This includes your history of accidents, traffic violations, and claims.

- Age: Young drivers, especially those under 25, often have higher auto insurance scores due to their lack of experience on the road.

- Years of driving experience: The more experience you have as a driver, the lower your auto insurance score may be.

- Credit history: While not directly related to your driving, studies have shown a correlation between credit history and the likelihood of filing an insurance claim.

- Vehicle type: Certain vehicles, such as sports cars or luxury cars, may be assigned higher auto insurance scores due to their higher risk of theft or expensive repairs.

It’s important to note that auto insurance scores do not take into account factors such as gender, ethnicity, marital status, or income. These factors are considered discriminatory and are not permitted in the calculation of auto insurance scores.

By understanding how auto insurance scores are calculated and the factors that affect them, you can gain insight into why your premiums may be higher or lower. Additionally, this knowledge can help you make informed decisions when comparing insurance quotes and finding the best coverage that fits your needs.

Factors That Affect Auto Insurance Scores

Auto insurance scores are influenced by several factors that insurance companies use to assess the risk profile of drivers. These factors are important because they help determine the likelihood of a driver filing a claim and the potential cost of that claim. By understanding the factors that affect auto insurance scores, you can gain insight into why your premiums may be higher or lower.

1. Driving record: One of the most significant factors that affect auto insurance scores is your driving record. Insurance companies look at your history of accidents, traffic violations, and claims to assess how risky of a driver you are. Drivers with a clean driving record and no recent accidents or violations generally have lower auto insurance scores.

2. Age: Age is another crucial factor that influences auto insurance scores. Young and inexperienced drivers, especially those under the age of 25, often have higher scores. This is because they are statistically more likely to be involved in accidents due to their lack of experience behind the wheel.

3. Credit history: Although not directly related to driving, credit history is considered an important factor in determining auto insurance scores. Studies have shown that individuals with poor credit scores are more likely to file insurance claims. Insurers consider this information to assess the risk of insuring someone with a less favorable credit history.

4. Years of driving experience: The number of years you have been licensed as a driver can impact your auto insurance score. Generally, the more experience you have on the road, the lower your score will be. This is because experienced drivers are presumed to be more responsible and less prone to accidents.

5. Vehicle type: The type of vehicle you drive can also affect your auto insurance score. Certain types of cars, such as sports cars or luxury vehicles, are considered higher risk due to their higher potential for accidents or theft. Therefore, drivers of these vehicles may have higher auto insurance scores.

It’s important to note that factors like gender, ethnicity, marital status, and income are not included in the calculation of auto insurance scores. These factors are considered discriminatory and are prohibited by law from influencing insurance premiums.

By understanding the factors that affect your auto insurance score, you can take steps to potentially improve it. By maintaining a clean driving record, being mindful of your credit, and choosing a vehicle that is considered less risky, you can work towards achieving a lower auto insurance score and potentially lower premiums.

Importance of Auto Insurance Scores

Auto insurance scores play a significant role in determining the cost of your auto insurance premiums. Insurance companies use these scores to assess the level of risk associated with insuring you as a driver. Understanding the importance of auto insurance scores can help you comprehend why maintaining a good score is essential.

1. Pricing Accuracy: Auto insurance scores help determine the accurate pricing of insurance policies. Insurance companies analyze various factors to calculate your score and use that information to assess the likelihood of you filing a claim. This helps them set appropriate premiums based on the potential risk you pose as a driver. By accurately pricing policies, insurance companies can ensure that responsible drivers pay lower premiums while high-risk drivers are charged accordingly.

2. Risk Assessment: Auto insurance scores provide insurers with a standardized way to assess the risk associated with insuring an individual. By evaluating factors such as driving record, age, and credit history, insurers can better understand the likelihood of a policyholder filing a claim. This risk assessment allows insurance companies to allocate their resources effectively and provide coverage to drivers who are less likely to have accidents or incur losses.

3. Personalization of Insurance Rates: Auto insurance scores enable insurers to personalize insurance rates based on individual risk profiles. Rather than using a one-size-fits-all approach, insurance companies can tailor premiums to reflect the specific risk level of each driver. This personalized approach ensures that drivers with a better insurance score are rewarded with lower premiums, while drivers with a higher score are charged higher rates that reflect their increased risk.

4. Effective Claims Management: Auto insurance scores help insurers manage claims more effectively. By analyzing a driver’s score, insurance companies can predict the likelihood of that driver filing a claim. This allows insurers to allocate resources appropriately, improve claims processing efficiency, and ensure that policyholders are adequately compensated for their losses.

5. Incentive for Safe Driving: Auto insurance scores incentivize safe driving behavior. Drivers who maintain a clean driving record and have a good score are likely to benefit from lower insurance premiums. This encourages responsible driving habits and motivates drivers to prioritize safety on the road.

Understanding the importance of auto insurance scores can help you make informed decisions when it comes to managing your insurance coverage and improving your driving habits. By maintaining a good score, you not only lower your insurance premiums but also contribute to safer roads for everyone.

How Auto Insurance Scores are Calculated

Auto insurance scores are calculated using various factors and algorithms that are specific to each insurance company. While the exact calculation method differs between insurers, there are common elements that are typically considered when determining auto insurance scores.

1. Driving record: Your driving record is a crucial factor in calculating your auto insurance score. Insurance companies will look at your history of accidents, traffic violations, and claims to assess the level of risk you pose as a driver. A clean driving record with no recent incidents typically results in a better auto insurance score.

2. Credit history: Credit history plays a role in determining auto insurance scores, despite not being directly related to driving. Insurance companies have found a correlation between credit history and the likelihood of filing an insurance claim. To calculate your auto insurance score, insurers may take into account factors such as your credit score, payment history, and length of credit history.

3. Age and driving experience: Age and driving experience are important factors that insurance companies consider when calculating auto insurance scores. Young and inexperienced drivers are often assigned higher scores due to the higher likelihood of accidents. As you gain more driving experience and age, your score may improve.

4. Vehicle type: The type of vehicle you drive can impact your auto insurance score. Insurance companies assess the risk associated with the make, model, and age of the vehicle. Certain types of cars, such as sports cars or luxury vehicles, may have higher scores due to their increased potential for accidents or theft.

5. Location: Your geographical location can also affect your auto insurance score. Insurers look at factors such as the crime rate, traffic congestion, and accident statistics in your area to assess the level of risk. Areas with higher rates of accidents or theft may result in higher auto insurance scores.

Insurance companies use proprietary algorithms to weigh these factors and calculate an individual’s auto insurance score. The specific weight given to each factor may vary between insurers, which is why it’s essential to compare quotes from multiple providers to find the best coverage and rates for your specific circumstances.

It’s important to note that auto insurance scores do not take into account factors such as gender, ethnicity, marital status, or income. These factors are considered discriminatory and are not used to calculate auto insurance scores. The focus is solely on factors directly related to driving habits and risk.

By understanding how auto insurance scores are calculated, you can be better equipped to manage and potentially improve your score. By maintaining a clean driving record, demonstrating responsible credit behavior, and choosing a safe vehicle, you can work towards achieving a favorable auto insurance score and potentially lower premiums.

Ways to Improve Your Auto Insurance Score

Your auto insurance score is a crucial factor that influences the cost of your auto insurance premiums. The higher your score, the more favorable your rates are likely to be. Fortunately, there are several steps you can take to improve your auto insurance score and potentially lower your insurance costs.

1. Maintain a clean driving record: One of the most effective ways to improve your auto insurance score is to maintain a clean driving record. Avoid accidents, traffic violations, and claims whenever possible. Safe driving demonstrates your responsibility behind the wheel and reduces your risk as a policyholder.

2. Pay your bills on time: Since credit history is also a factor in calculating auto insurance scores, it’s crucial to maintain a good credit record. Pay your bills on time, manage your credit utilization ratio, and regularly check your credit report for any errors or discrepancies. A strong credit history can positively impact your auto insurance score.

3. Take driver safety courses: Completing driver safety courses can demonstrate your commitment to safe driving and potentially lead to a lower auto insurance score. Many insurance companies offer discounts to drivers who have successfully completed approved defensive driving courses.

4. Choose a safe vehicle: The type of vehicle you drive can impact your auto insurance score. Opting for a vehicle with safety features and a lower likelihood of being involved in accidents or theft can help improve your score. Insurance companies often provide lower rates for cars equipped with advanced safety technologies.

5. Bundle your insurance policies: If you have multiple insurance policies, such as auto and home insurance, consider bundling them with the same provider. Insurance companies often offer discounts for policyholders who choose to bundle their coverage, which can help reduce your overall insurance costs.

6. Review your coverage limits: Regularly review your coverage limits and consider adjusting them to better align with your needs. While increasing your coverage may result in slightly higher premiums, it can provide you with added protection in the event of an accident or unexpected circumstances. This responsible approach to insurance can positively impact your auto insurance score.

7. Shop around for insurance quotes: Don’t hesitate to shop around and compare quotes from different insurance providers. Each insurer has its own scoring model, and rates can vary significantly. By exploring multiple options, you can find the best coverage at the most competitive rates.

Improving your auto insurance score takes time and effort, but the benefits are worth it. By incorporating these tips into your driving habits and insurance management, you can work towards achieving a higher score, potentially leading to lower premiums and greater peace of mind on the road.

The Impact of Auto Insurance Scores on Your Premiums

Your auto insurance score plays a significant role in determining the cost of your auto insurance premiums. Insurance companies analyze your score to assess the level of risk you present as a driver. The impact of your auto insurance score on your premiums varies depending on the insurer and their specific scoring model, but there are a few common trends to keep in mind.

1. Lower score, higher premiums: In general, a lower auto insurance score will result in higher premiums. Insurance companies consider individuals with lower scores to be higher-risk drivers, which means they are more likely to file claims and incur costs. To offset this increased risk, insurance companies charge higher premiums to individuals with lower scores.

2. Affordability for high-scoring drivers: On the other hand, drivers with higher auto insurance scores often enjoy more affordable premiums. Insurance companies view these individuals as lower-risk and more responsible drivers, which reduces the likelihood of costly claims. As a result, they may reward high-scoring drivers with lower premiums compared to those with lower scores.

3. Potential for significant rate differences: The impact of auto insurance scores on premiums can be substantial. For example, drivers with poor scores may pay significantly higher premiums compared to drivers with excellent scores, even for the same coverage and driving history. The difference in premiums between a poor score and an excellent score can sometimes be hundreds or even thousands of dollars per year.

4. Balancing other factors: It’s important to note that insurance companies use auto insurance scores in conjunction with other relevant factors to determine premiums. While your score plays a significant role, insurers also consider your driving record, credit history, age, and other demographic factors. These additional factors help paint a comprehensive picture of your risk profile and influence the final premium amount.

5. Opportunities for improvement: The impact of your auto insurance score on premiums underscores the importance of actively working to improve your score. By practicing safe driving habits, maintaining good credit, and taking other steps to enhance your score, you can potentially qualify for lower premiums over time. Regularly reviewing your coverage, comparing quotes from different insurers, and leveraging discounts and bundling options can also help mitigate the impact of your auto insurance score on premiums.

Understanding the impact of your auto insurance score on your premiums can empower you to take control of your insurance costs. By striving to maintain a good score and exploring opportunities for improvement, you can work towards securing more favorable premiums that align with your budget and coverage needs.

Auto Insurance Score vs. Credit Score: What’s the Difference?

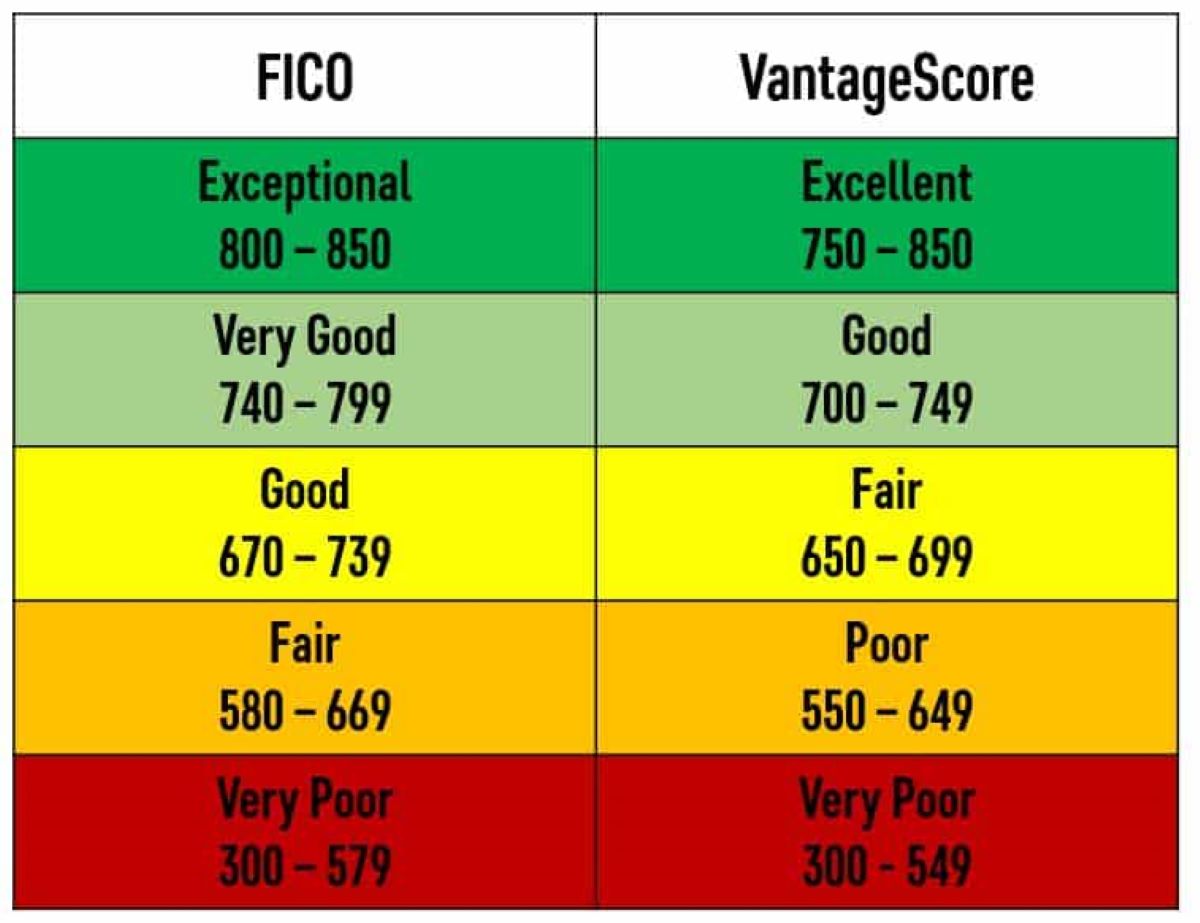

While both auto insurance scores and credit scores play a role in determining your insurance premiums, they are distinct and serve different purposes. Understanding the differences between these two scores can help you grasp how they impact your insurance rates and overall financial standing.

Auto Insurance Score:

Your auto insurance score is a numerical representation of your risk as a driver. It is specifically calculated by insurance companies to assess the likelihood of you filing a claim and evaluate the level of risk they are taking by insuring you. Factors such as your driving record, age, credit history, and vehicle type are considered when calculating your auto insurance score.

The primary purpose of an auto insurance score is to determine the appropriate cost of your insurance premiums. A high score indicates that you are a lower-risk driver, leading to potentially lower premiums. Conversely, a lower score suggests a higher risk and may result in higher premiums.

Credit Score:

A credit score, on the other hand, is a measure of your creditworthiness. It is used mainly by lenders to assess the risk of lending to you and to determine the terms of credit offers, such as interest rates. Credit scores evaluate your credit history, including factors such as payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries.

While credit scores are not directly related to driving, some insurance companies use credit information as a component of the auto insurance scoring process. Studies have shown a correlation between credit history and the likelihood of filing an insurance claim. However, it is important to note that not all insurance companies consider credit information and that the use of credit scores in determining auto insurance premiums varies by state and insurer.

Differences and Similarities:

– Purpose: Auto insurance scores are specifically designed to assess driving-related risk and determine appropriate insurance premiums. Credit scores focus on evaluating creditworthiness for financial transactions and loan eligibility.

– Factors Considered: Auto insurance scores take into account factors such as driving record, age, credit history, and vehicle type. Credit scores focus on credit-related factors such as payment history, credit utilization, and length of credit history.

– Impact on Insurance Premiums: Auto insurance scores directly impact the cost of your insurance premiums. A higher score typically leads to lower premiums, while a lower score can result in higher premiums. Credit scores do not directly impact insurance premiums, although credit information may influence auto insurance scores for some insurers.

It’s important to note that both auto insurance scores and credit scores have their respective importance in assessing risk and evaluating financial credibility. While you may not have control over some factors that affect these scores, such as age or credit history, maintaining a clean driving record and responsible credit behavior can positively impact both scores and potentially lead to more favorable insurance rates and financial opportunities.

Frequently Asked Questions about Auto Insurance Scores

1. What is an auto insurance score?

An auto insurance score is a numerical representation of your risk profile as a driver. It is calculated using various factors such as your driving record, age, credit history, and vehicle type. Insurance companies use this score to assess the likelihood of you filing a claim and determine the appropriate cost of your insurance premiums.

2. How does my auto insurance score affect my premiums?

Your auto insurance score can have a significant impact on your premiums. A higher score typically results in lower premiums, as it indicates that you are a lower-risk driver. On the other hand, a lower score may lead to higher premiums because it suggests a higher likelihood of filing claims and incurring costs.

3. What factors are considered when calculating my auto insurance score?

Insurance companies consider several factors when calculating auto insurance scores, including your driving record, age, credit history, and vehicle type. These factors help insurers assess your risk as a driver and determine the appropriate level of coverage and premiums for you.

4. How can I improve my auto insurance score?

To improve your auto insurance score, focus on maintaining a clean driving record, practicing safe driving habits, and avoiding incidents and claims. Pay your bills on time, manage your credit responsibly, and regularly review your credit report to ensure accuracy. Additionally, consider taking driver safety courses and selecting a safe vehicle to potentially improve your score.

5. Can I change my auto insurance score?

While you cannot directly change your auto insurance score, you can take steps to improve it over time. By practicing safe driving habits, maintaining a good credit record, and making responsible financial decisions, you can positively impact the factors that contribute to your score. This may result in a higher score and potentially lower insurance premiums.

6. Do all insurance companies use auto insurance scores?

While many insurance companies utilize auto insurance scores in their underwriting process, not all companies use them. The use of auto insurance scores can vary by state and insurer. It’s important to check with insurance providers to understand their specific underwriting practices and how auto insurance scores may be considered in determining premiums.

7. What if I have a low credit score but a clean driving record?

In cases where you have a low credit score but a clean driving record, it’s important to remember that not all insurers use credit information or assign significant weight to credit scores. While a low credit score may affect your auto insurance score, other factors such as your driving history and age are also considered. As such, it’s possible to still secure affordable insurance coverage with a low credit score if you have a favorable driving record.

These are general answers to frequently asked questions about auto insurance scores. Remember that insurance practices and regulations can vary, so it’s always best to consult with your insurance provider for specific details regarding your coverage and premiums.

Conclusion

Understanding your auto insurance score is crucial when it comes to managing your insurance premiums and ensuring that you are adequately protected on the road. Auto insurance scores are unique to each individual and take into account factors such as driving history, age, credit history, and vehicle type. These scores play a significant role in determining the cost of your insurance premiums, with higher scores typically resulting in lower premiums.

By actively working to improve your auto insurance score, such as maintaining a clean driving record, managing your credit responsibly, and selecting safe vehicles, you can potentially lower your insurance premiums over time. Taking advantage of driver safety courses and bundling your insurance policies can also help reduce costs.

It’s important to note that auto insurance scores and credit scores are different, although they may share some similarities. Auto insurance scores focus on driving-related risk factors, while credit scores evaluate creditworthiness for financial transactions. While credit information may be considered in the calculation of auto insurance scores by some insurers, it is not the sole determining factor.

Remember to shop around and compare quotes from multiple insurance providers to find coverage that suits your needs and offers competitive rates. Each insurance company has its own scoring model, so exploring different options can help you find the most favorable premiums.

Ultimately, maintaining a good auto insurance score not only helps you secure affordable coverage but also encourages safe driving habits and responsible financial behavior. By understanding the factors that affect your auto insurance score and taking proactive steps to improve it, you can enjoy the benefits of lower premiums and greater peace of mind on the road.

Always consult with your insurance provider to fully understand their scoring methods, as specific practice and regulations may vary. With the necessary knowledge and effort, you can navigate the world of auto insurance scores and make informed decisions to protect yourself and your vehicles.