Finance

How Do I Find My Auto Insurance Score

Modified: December 30, 2023

Looking to find your auto insurance score? Learn how to access and understand your finance-related auto insurance score with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Auto insurance is a necessity for every vehicle owner, providing financial protection and peace of mind in the event of accidents, theft, or damage. When it comes to determining insurance premiums, insurance companies rely on various factors to assess the risk associated with each individual policyholder. One crucial aspect that plays a significant role in this assessment is the auto insurance score.

An auto insurance score is a numerical representation of an individual’s risk level as a driver, based on various factors such as driving history, credit history, vehicle type, and more. Just like a credit score, the higher the insurance score, the better the chances of securing affordable insurance rates. Understanding how your auto insurance score is calculated and knowing how to find it can help you make informed decisions when shopping for car insurance.

In this article, we will dive deeper into auto insurance scores, exploring the factors that impact them and providing tips on how to improve your score. Whether you are a new driver looking to establish a good insurance score or a seasoned driver aiming to lower your premiums, this article will guide you through the process of understanding and optimizing your auto insurance score.

What is an Auto Insurance Score?

An auto insurance score is a numerical representation of a person’s likelihood of filing an insurance claim based on various risk factors. It is used by insurance companies to assess the potential financial risk associated with an individual and determine the insurance premiums they will be charged. Similar to a credit score, an auto insurance score helps insurers evaluate the level of risk they are taking on when insuring a person.

The auto insurance score is derived from a combination of factors, including but not limited to:

- Driving record: The number of accidents, traffic violations, and claims on record can significantly impact the insurance score. Safe drivers with a clean driving record tend to have higher insurance scores.

- Credit history: Insurance companies often consider an individual’s credit history when calculating their auto insurance score. Studies have shown a correlation between creditworthiness and the likelihood of filing claims.

- Age and experience: Younger and inexperienced drivers often have higher insurance scores due to their limited driving history and higher probability of being involved in accidents.

- Vehicle type and usage: The make, model, and age of the vehicle, as well as its primary usage (such as personal or business), can all influence the insurance score. High-performance sports cars or those frequently used for commuting may be associated with higher risk.

- Location: The area where the vehicle is primarily driven and parked can affect the insurance score. Areas with higher rates of accidents or theft may result in higher insurance premiums.

It’s important to note that the weightage given to each factor may vary among insurance companies, as they have their own proprietary algorithms and scoring models. Some insurers may also consider additional factors such as marital status, education level, or occupation when determining the insurance score.

By analyzing these factors, insurance companies can assess the likelihood of a policyholder filing a claim in the future. A higher insurance score indicates a lower risk of filing a claim, making the policyholder a more desirable customer for the insurer.

Now that we understand the concept of an auto insurance score, let’s explore how you can find out what your personal score is and why it is important.

Factors that Affect Your Auto Insurance Score

Your auto insurance score is determined by a variety of factors that collectively reflect your level of risk as a driver. These factors are used by insurance companies to assess the likelihood of you needing to file a claim and play a significant role in determining your insurance premiums. Understanding these factors can help you make informed decisions and potentially take steps to improve your score. Here are some key factors that can affect your auto insurance score:

- Driving record: Your driving history is one of the primary factors considered by insurance companies. Traffic violations, accidents, and claims can negatively impact your score, as they suggest a higher likelihood of future claims.

- Credit history: Your credit score can also influence your auto insurance score. Studies have shown a correlation between creditworthiness and the likelihood of filing insurance claims. Maintaining good credit can help improve your insurance score.

- Age and experience: Younger and inexperienced drivers typically have lower insurance scores due to their higher risk profile. As you gain more driving experience and maintain a clean record, your insurance score is likely to improve.

- Vehicle type: The type of vehicle you own can impact your score. High-performance or luxury vehicles may be associated with higher insurance risks and could result in a lower score.

- Vehicle usage: How you use your vehicle can also affect your insurance score. If you primarily use your vehicle for personal purposes, your score may be different compared to someone who uses their vehicle for business or commercial purposes.

- Location: Your geographical location can impact your insurance score. Areas with higher rates of accidents, theft, or vandalism may result in a lower score.

It’s important to note that the weightage given to each factor may vary among insurance companies. They may have their own proprietary algorithms and scoring models that prioritize certain factors over others. Additionally, other factors such as marital status, education level, or occupation may also be considered by some insurers.

While you may not have control over certain factors such as your age or location, there are steps you can take to help improve your auto insurance score. In the next section, we will explore how you can find out your auto insurance score and why it is important.

How to Find Your Auto Insurance Score

Finding out your auto insurance score is essential to understanding how insurance companies evaluate your risk profile and determine your premiums. While insurance companies may not disclose the exact formula used to calculate your score, there are ways to gain insight into your score. Here are some methods to help you find your auto insurance score:

Check with your insurance provider: Start by reaching out to your insurance provider directly. They may be able to provide you with information on your auto insurance score or offer access to online tools that allow you to view your score and track its changes over time.

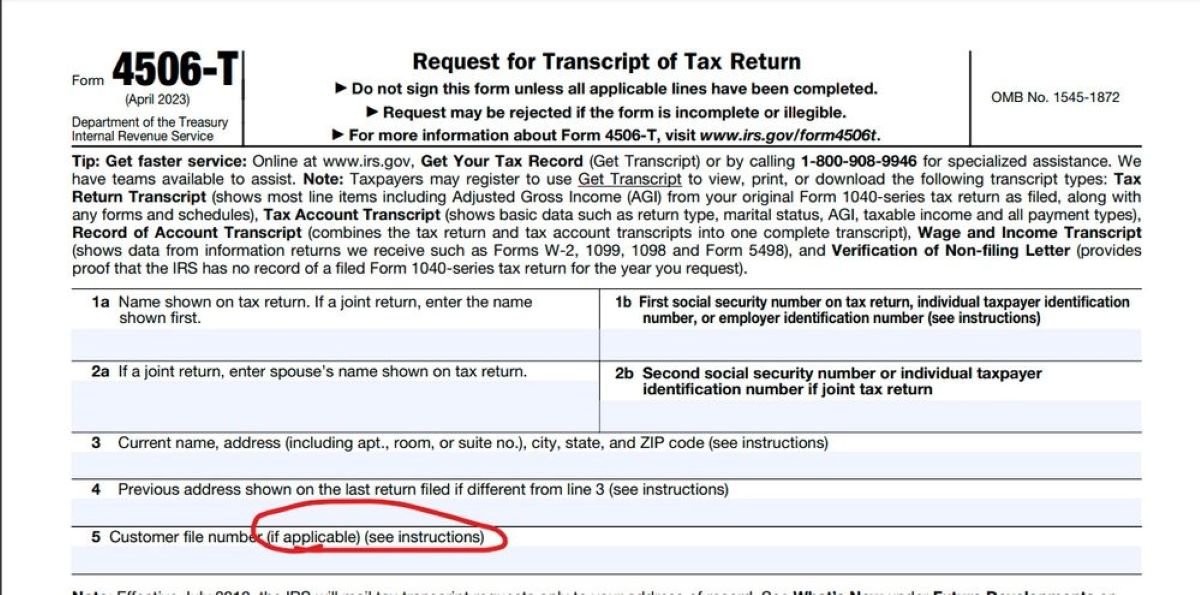

Use third-party services: There are several reputable third-party services available that can help you obtain your auto insurance score. These services typically require you to provide some personal information, such as your driver’s license number and Social Security number, to generate your score. Keep in mind that while these services may give you an estimate of your score, it may not be the exact score used by your insurance company.

Monitor your credit report: Your credit history plays a significant role in determining your auto insurance score. By regularly monitoring your credit report, you can stay informed about your creditworthiness and identify any potential issues that could impact your insurance score. You are entitled to one free credit report from each of the major credit bureaus annually, which you can access through AnnualCreditReport.com.

Consult with an insurance agent: If you have an insurance agent or broker, they can provide valuable insights into your auto insurance score. They can review your policy and discuss factors that may be influencing your score. They may also be able to offer advice on how to improve your score and potentially lower your insurance premiums.

Keep in mind that your auto insurance score may vary between insurance companies. Each insurer has its own criteria and weighting system when calculating your score. That’s why it’s essential to compare quotes from multiple insurance providers to ensure you are getting the best coverage at the most competitive rates.

Now that you know how to find your auto insurance score, let’s explore why it is crucial to understand and improve your score.

Importance of Your Auto Insurance Score

Your auto insurance score plays a crucial role in determining the premiums you will pay for your car insurance. Understanding the importance of your auto insurance score can help you make informed decisions when it comes to your coverage and potentially save you money. Here are some key reasons why your auto insurance score is important:

Premiums and affordability: Insurance companies use your auto insurance score to assess the level of risk you pose as a driver. A higher insurance score generally translates to lower premiums since it indicates that you are less likely to file a claim. On the other hand, a lower score may result in higher premiums due to the perceived higher risk. By maintaining a good insurance score, you have a better chance of securing affordable and competitive insurance rates.

Access to insurance coverage: Some insurance companies may be more selective in providing coverage to individuals with lower insurance scores. If your score is low, you may be deemed high-risk and face difficulties in finding insurance coverage. Improving your insurance score can expand your options and ensure that you have access to the coverage you need.

Financial savings: A good insurance score can translate into significant financial savings over time. When you pay lower premiums, you save money in the long run. These savings can be utilized for other financial goals or be allocated towards maintaining your vehicle or addressing unexpected expenses.

Ability to qualify for discounts: Insurance companies often offer various discounts and incentives to policyholders with higher insurance scores. These discounts can range from safe driver discounts to bundling discounts for insuring multiple vehicles or policies with the same company. By having a good insurance score, you increase your chances of qualifying for these discounts and further reducing your premium costs.

Long-term benefits: Maintaining a good insurance score is not just beneficial in the present; it can also have long-term advantages. As you continue to build a positive driving and credit history, your insurance score is likely to improve. A higher score opens doors to better insurance options and lower premiums, providing you with peace of mind and financial stability for years to come.

Understanding the importance of your auto insurance score empowers you to take steps to improve it. By focusing on maintaining a clean driving record, managing your credit responsibly, and shopping around for the best insurance rates, you can enhance your insurance score and enjoy the associated benefits.

Next, let’s explore some strategies to help you improve your auto insurance score.

How to Improve Your Auto Insurance Score

Your auto insurance score is a reflection of your risk level as a driver. Improving your score can not only help you secure better insurance rates but also demonstrate responsible driving behavior. Here are some strategies to help you improve your auto insurance score:

Maintain a clean driving record: One of the most effective ways to improve your auto insurance score is by maintaining a clean driving record. Avoid traffic violations, accidents, and claims whenever possible. Safe driving habits not only improve your score but also contribute to your overall safety on the road.

Manage your credit responsibly: Since your credit history factors into your insurance score, it’s important to manage your credit responsibly. Pay bills on time, keep credit card balances low, and avoid unnecessary debt. Regularly monitor your credit report to ensure its accuracy and address any issues promptly.

Take advantage of defensive driving courses: Some insurance companies offer discounts or benefits to drivers who complete defensive driving courses. Not only will these courses improve your skills and knowledge on the road, but they may also contribute positively to your insurance score.

Choose your vehicle wisely: When selecting a vehicle, consider its impact on your insurance score. High-performance sports cars, luxury vehicles, or models with a higher risk of theft may result in lower scores. Opt for vehicles with good safety ratings and security features to improve your score.

Bundle your insurance policies: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in discounts and benefits. Not only does this potentially lower your premiums, but it also demonstrates responsibility and loyalty to your insurance provider, positively impacting your score.

Shop around for insurance quotes: Insurance rates can vary significantly among different providers. Take the time to shop around and compare quotes from multiple companies to ensure you are getting the best coverage at the most competitive rates. Consider factors such as customer service, claims handling, and the overall reputation of the insurance company along with the price.

Pay your premiums on time: Timely payment of your insurance premiums demonstrates responsibility and reliability. Late payments or missed payments can negatively impact your score, so make it a priority to pay your premiums on time.

Improving your auto insurance score may take time and effort, but the benefits are worth it. By maintaining a clean driving record, managing your credit responsibly, and taking advantage of available discounts and benefits, you can steadily improve your score and enjoy lower insurance premiums.

Let’s wrap up and summarize the key points covered in this article.

Conclusion

Your auto insurance score is a vital factor that insurance companies use to assess your risk level as a driver and determine your insurance premiums. Understanding the factors that impact your score and knowing how to improve it can help you secure better insurance rates and potentially save you money.

In this article, we explored what an auto insurance score is and the various factors that can affect it, including your driving record, credit history, age, vehicle type, and location. We also discussed how to find your auto insurance score through your insurance provider, third-party services, credit monitoring, and consultation with an insurance agent.

We emphasized the importance of your auto insurance score, including its impact on your premiums, access to coverage, potential savings, and eligibility for discounts. Maintaining a good insurance score not only benefits you financially but also provides you with peace of mind and long-term advantages.

To improve your auto insurance score, we provided strategies such as maintaining a clean driving record, managing your credit responsibly, taking defensive driving courses, selecting the right vehicle, bundling insurance policies, comparing quotes, and ensuring timely premium payments.

Remember, improving your auto insurance score may take time and effort, but the rewards are significant. By implementing these strategies and being proactive, you can enhance your insurance score and enjoy lower insurance premiums while demonstrating responsible driving habits.

Now that you’re equipped with knowledge about auto insurance scores, take control of your insurance premiums by understanding your score and exploring opportunities for improvement. Shop around, compare quotes, and choose the insurance coverage that meets your needs while fitting within your budget. Safe driving and responsible credit management will not only benefit your insurance score but also contribute to your overall financial well-being.