Finance

What Is NAIC On Insurance Card

Modified: February 21, 2024

Learn what NAIC on an insurance card means and its importance in the world of finance. Discover how this code is used to identify insurance companies and policies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of insurance! If you’ve ever had an insurance policy, you might have come across a code called NAIC on your insurance card. The NAIC, which stands for the National Association of Insurance Commissioners, is an important aspect of insurance policies that is worth understanding.

Insurance can be a complex subject, and it’s important to have a clear understanding of the different elements associated with it. The NAIC code plays a crucial role in identifying various aspects of an insurance policy, and it provides valuable information for insurance companies, regulators, and consumers alike.

In this article, we will delve deeper into what the NAIC code is, why it is important, and how to identify it on your insurance card. Whether you’re a seasoned insurance professional or just starting your insurance journey, this article will provide you with the knowledge you need to navigate the world of insurance with confidence.

Understanding the NAIC code on your insurance card can help you decipher important details about your policy, such as the type of policy, the insurance company, and even the state in which the policy was issued. So, let’s begin our exploration of the NAIC code and unravel its significance in the insurance industry.

Understanding NAIC on Insurance Card

The NAIC code, also known as the National Association of Insurance Commissioners code, is a unique identifier assigned to insurance companies by the NAIC. This code helps in identifying and categorizing insurance companies across the United States. It serves as a standardized system that ensures consistency and accuracy in the insurance industry.

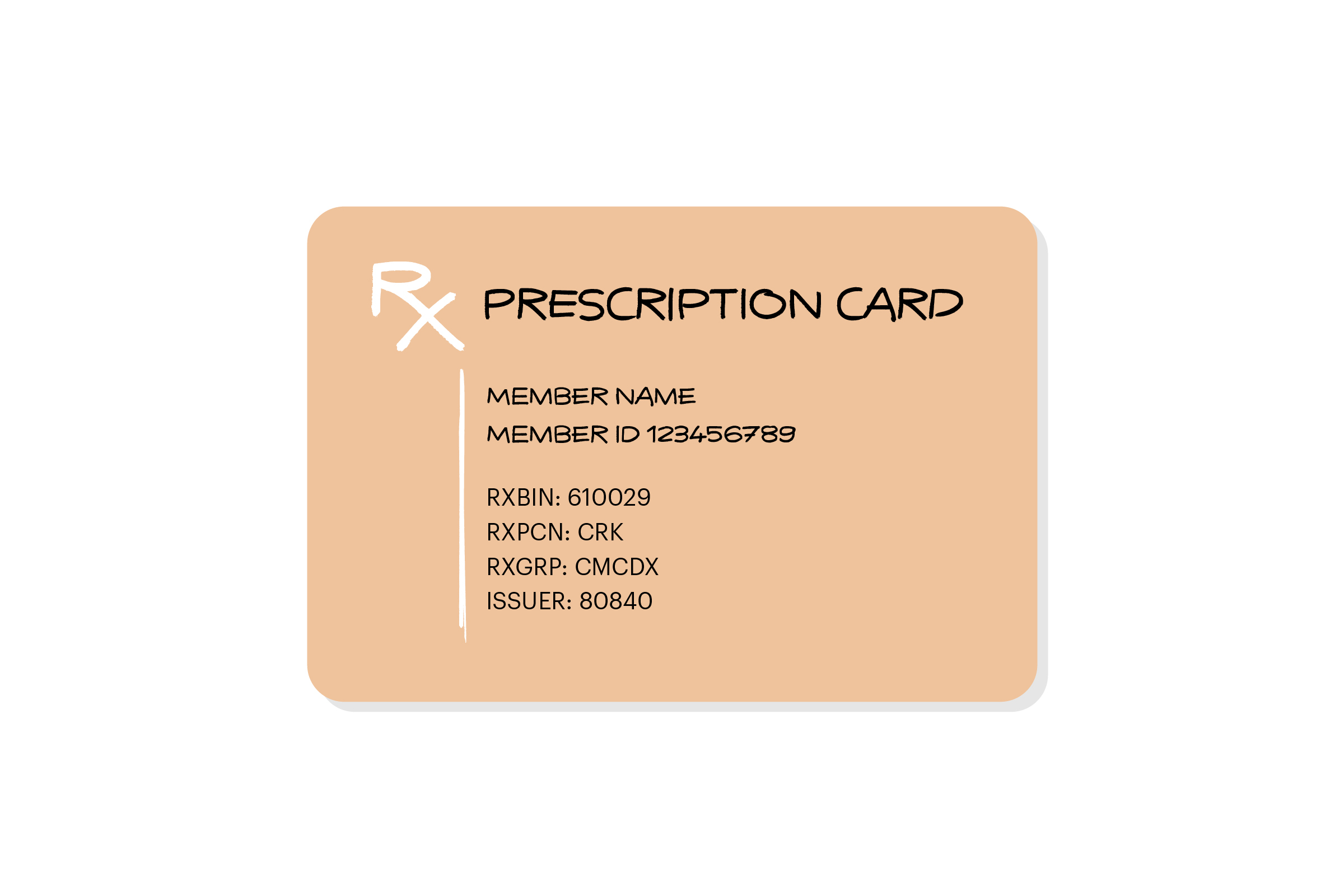

The NAIC code is typically displayed on an insurance card, along with other important information such as the policyholder’s name, policy number, and coverage details. It plays a vital role in facilitating communication between insurance companies, regulatory bodies, and consumers. By having a standardized code for each insurance company, it becomes easier to track and reference specific insurers.

Each insurance company is assigned a unique code by the NAIC, which helps in maintaining uniformity across the industry. This code is not only important for insurance companies themselves, but also for various stakeholders, including regulators, agents, and policyholders.

For insurance companies, the NAIC code is used for internal purposes, such as identifying policies, handling claims, and tracking business activities. It helps in streamlining processes and ensuring efficiency within the company.

Regulators also rely on the NAIC code to monitor and regulate insurance companies effectively. It allows them to track the financial stability of insurers, ensure compliance with state regulations, and provide consumer protection. The NAIC code serves as an important tool in conducting audits, investigations, and market analysis.

Policyholders can also benefit from understanding the NAIC code on their insurance card. It provides them with a means of verifying the authenticity of their insurance company and ensuring they are dealing with a reputable insurer. Additionally, the NAIC code can be useful when comparing insurance policies and researching insurers.

Overall, the NAIC code serves as a fundamental component in the insurance industry, providing a standardized system for identifying and categorizing insurance companies. Its usage spans across various aspects of the insurance process, ensuring transparency, efficiency, and reliability for all parties involved.

Importance of NAIC on Insurance Card

The NAIC code, displayed on your insurance card, holds significant importance in the insurance industry for several reasons. Let’s explore why the NAIC code is valuable and how it impacts both insurance companies and policyholders.

One of the key roles of the NAIC code is to provide a standardized identification system for insurance companies operating across the United States. This ensures uniformity and consistency in the insurance industry, making it easier to track, reference, and communicate with specific insurers.

For insurance companies, the NAIC code simplifies administrative tasks and streamlines internal processes. It helps them accurately identify policies, track claims, and manage business transactions more efficiently. The code also assists in data collection and analysis, enabling insurers to make informed decisions based on industry trends and market insights.

Regulators rely on the NAIC code to effectively monitor and regulate insurance companies. It acts as a tracking mechanism, allowing regulators to assess the financial stability and compliance of insurers with state regulations. This ensures consumer protection and helps maintain a fair and competitive insurance market.

Policyholders benefit from the NAIC code as well. It provides them with a means to verify the legitimacy of the insurance company listed on their card. By cross-referencing the NAIC code with the NAIC database, policyholders can ensure that their insurer is licensed, authorized, and in good standing. This adds a layer of trust and assurance that their insurance coverage is valid and backed by a reputable company.

The NAIC code also aids policyholders when they need to make changes to their policy or file a claim. It acts as a reference point when communicating with their insurance company or agent, ensuring that the correct information is accessed and processed promptly.

Furthermore, understanding the NAIC code allows policyholders to conduct research and make more informed decisions when shopping for insurance. They can compare different insurers based on NAIC codes, assess their financial strength and stability, and choose a company that meets their specific needs and expectations.

In summary, the presence of the NAIC code on your insurance card is of great importance. It serves as a standardized identification system that benefits insurance companies, regulators, and policyholders alike. By understanding the significance of the NAIC code, policyholders can ensure they are dealing with a reputable insurer and make informed decisions about their insurance coverage.

How to Identify NAIC on Insurance Card

Identifying the NAIC code on your insurance card is relatively straightforward. The code is typically located on the card itself, along with other important information. Here’s a step-by-step guide on how to identify the NAIC code:

- Take out your insurance card.

- Look for a section or field that contains information about the insurance company.

- Scan through the information provided and locate a code that is labeled as the “NAIC code” or “Company Code.”

- The NAIC code is usually a series of numbers or alphanumeric characters.

- Make a note of the code for reference.

In some cases, the NAIC code may be listed as a separate line item on the insurance card. In other instances, it may be incorporated within a larger string of information that includes the insurance company’s name, address, and other details. Regardless of how it is presented, the NAIC code is typically clearly labeled to ensure easy identification.

If you are having trouble finding the NAIC code on your insurance card, you can contact your insurance company directly. They will be able to provide you with the code or guide you on where to locate it on your card.

It is important to note that the NAIC code may vary from one insurance company to another. Each insurer has its own unique code assigned by the NAIC, allowing for easy identification and differentiation.

Once you have identified the NAIC code on your insurance card, you can use it as a reference point for various purposes. You can verify the legitimacy and standing of your insurance company by cross-referencing the code with the NAIC database. You can also use the NAIC code when conducting research or comparing insurance policies from different companies.

By understanding how to identify the NAIC code on your insurance card, you can ensure that you have the necessary information to navigate the insurance landscape effectively and confidently.

Common Questions about NAIC on Insurance Card

When it comes to the NAIC code on your insurance card, you may have some questions. Let’s address some of the common questions that arise regarding this code:

- What does the NAIC code represent?

- Why is the NAIC code important?

- Is the NAIC code the same for all insurance companies?

- How can I find the NAIC code on my insurance card?

- Can I use the NAIC code to research insurance companies?

The NAIC code represents the National Association of Insurance Commissioners code. It is a unique identifier that is assigned to insurance companies to facilitate accurate identification and categorization within the insurance industry.

The NAIC code holds importance for insurance companies, regulators, and policyholders. It allows for streamlined processes within insurance companies, helps regulators monitor and regulate insurers, and provides policyholders with a means to verify the authenticity and legitimacy of their insurance company.

No, the NAIC code is unique to each insurance company. It is assigned by the NAIC to ensure that every insurer has a distinct code for identification purposes.

The NAIC code is typically listed on your insurance card along with other key information about your policy and insurance company. Look for a section labeled “NAIC code” or “Company Code” on your card, and you should be able to locate it.

Yes, the NAIC code can be a useful tool for researching insurance companies. It allows you to verify the legitimacy and standing of an insurer by cross-referencing the code with the NAIC database. You can also use the code to compare different insurance policies and companies.

These are just a few of the common questions that arise regarding the NAIC code on insurance cards. If you have further inquiries or need more specific information, it is recommended to reach out to your insurance company or refer to the resources provided by the NAIC.

Understanding the NAIC code and its significance can help you navigate the insurance landscape more confidently, ensuring that you have a clear understanding of your insurance coverage and the company providing it.

Conclusion

The NAIC code on your insurance card may seem like a small detail, but it plays a significant role in the world of insurance. Understanding the importance of the NAIC code can help you navigate the insurance industry with confidence and make informed decisions about your insurance coverage.

The NAIC code is a standardized identifier assigned to insurance companies by the National Association of Insurance Commissioners. It allows for accurate identification and categorization of insurers, ensuring consistency and reliability across the industry.

The NAIC code holds value for insurance companies, regulators, and policyholders. It facilitates streamlined processes within insurance companies, aids regulators in monitoring and regulating insurers effectively, and provides policyholders with a means to verify the authenticity of their insurance company.

To identify the NAIC code on your insurance card, look for a section labeled “NAIC code” or “Company Code.” It is usually listed alongside other important information about your policy and insurance company. If you have trouble locating it, contacting your insurance company directly can provide you with the necessary information.

By understanding the NAIC code, you can use it as a valuable tool when researching insurance companies, comparing policies, and ensuring the legitimacy of your insurance coverage. It empowers you to make informed decisions and have a clear understanding of your insurance provider.

In conclusion, the NAIC code is a crucial aspect of the insurance industry. Its presence on your insurance card serves as a standardized identifier for your insurance company, allowing for easy tracking, verification, and communication. By familiarizing yourself with the NAIC code, you can navigate the complex world of insurance with confidence and ensure that you have the necessary information to make informed decisions about your coverage.