Finance

How To Value An Insurance Company

Published: November 14, 2023

Learn how to value an insurance company in the finance industry. Discover tips and strategies for evaluating the worth of insurance companies in this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Insurance Companies

- Key Factors in Valuing an Insurance Company

- Valuation Methods for Insurance Companies

- Discounted Cash Flow (DCF) Analysis

- Price-to-Earnings (P/E) Ratio

- Price-to-Book (P/B) Ratio

- Dividend Discount Model (DDM)

- Comparative Market Analysis

- Limitations and Challenges in Valuing Insurance Companies

- Conclusion

Introduction

Insurance companies play a vital role in our modern society, providing financial protection and security to individuals, businesses, and institutions. However, when it comes to assessing the value of an insurance company, things can get complex. The unique nature of the insurance industry requires a specific set of considerations and methodologies.

Valuing an insurance company involves determining its worth based on various factors such as its assets, liabilities, cash flow, profitability, and growth potential. This valuation process is crucial for investors, analysts, and policymakers to make informed decisions.

In this article, we will delve into the key factors involved in valuing an insurance company and explore the different methods used to assess its worth. We will also discuss the limitations and challenges associated with valuing insurance companies to provide a comprehensive understanding of this intricate process.

By the end of this article, you will have a solid foundation to navigate the world of insurance company valuation, empowering you to make informed investment choices and understand the financial health and potential risks of these entities.

Understanding Insurance Companies

Before diving into the valuation of insurance companies, it is essential to grasp the fundamental aspects that shape these entities. Insurance companies operate on the principle of risk transfer and pooling. They provide coverage to policyholders in exchange for regular premium payments, effectively transferring the financial risk associated with unexpected events.

Insurance companies offer a wide range of policies, including life insurance, property and casualty insurance, health insurance, and more. Each type of insurance comes with its own set of risks, coverage terms, and regulations.

To effectively evaluate the value of an insurance company, it is crucial to understand its key components. These include:

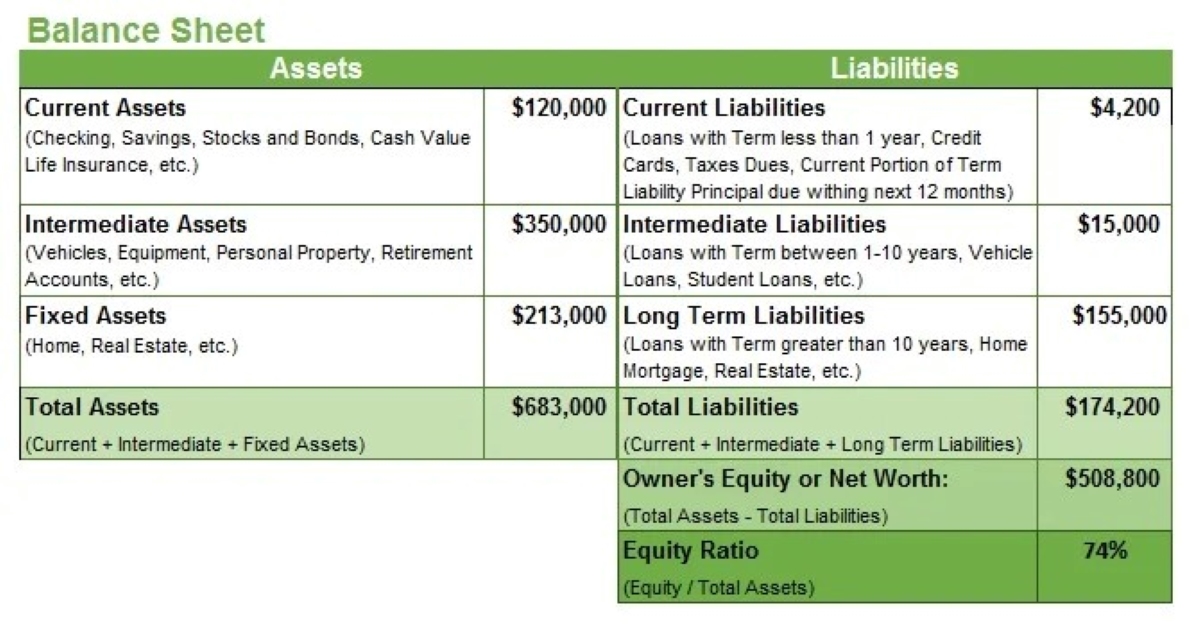

- Assets: Insurance companies hold assets to cover potential claims and ensure their ability to fulfill policyholder obligations. These assets may include investments, cash reserves, and physical properties.

- Liabilities: Liabilities represent the potential claims that the company is obligated to pay to policyholders. These can include outstanding claims, policyholder benefits, and other liabilities that may arise from operational activities.

- Underwriting: Underwriting is the process through which an insurance company assesses risks, determines coverage terms, and sets premium rates. Effective underwriting is crucial for an insurance company’s profitability and long-term sustainability.

- Reserves: Insurance companies must set aside reserves to cover future claims and ensure their ability to meet policyholder obligations. Adequate reserves are a key indicator of an insurance company’s financial stability.

- Regulation: Insurance companies are subject to regulatory oversight to ensure fair practices, adequate capitalization, and protection of policyholders’ interests.

By understanding these components, one can start to grasp the intricate workings of an insurance company. This knowledge forms the foundation for the valuation methods we will explore in the following sections.

Key Factors in Valuing an Insurance Company

Valuing an insurance company requires a comprehensive analysis of various factors that contribute to its overall worth. While each company is unique, there are several key considerations that play a significant role in determining its value. Let’s explore these factors:

- Financial Performance: The financial performance of an insurance company is a crucial factor in its valuation. Key metrics to evaluate include revenue growth, profitability, return on investment, and underwriting results. A consistently profitable company with a strong track record indicates a higher value.

- Market Position: The market position and competitive advantage of an insurance company have a significant impact on its value. Factors such as market share, brand reputation, distribution channels, and customer loyalty contribute to its market position. A company with a strong market presence has a higher valuation.

- Asset Quality: The quality and composition of an insurance company’s assets are important indicators of its value. Investments in low-risk securities, well-diversified portfolios, and high-quality assets contribute to a higher valuation. On the other hand, risky or volatile assets may lower the company’s value.

- Liability Profile: The liabilities of an insurance company, including outstanding claims and policyholder obligations, must be evaluated. A company with manageable liabilities and effective risk management practices is considered more valuable.

- Capitalization: The capitalization of an insurance company, including its equity and debt structure, is a crucial factor in valuation. A well-capitalized company with a strong solvency position is more likely to withstand adverse events and is valued higher.

- Regulatory Environment: The regulatory environment in which an insurance company operates has an impact on its value. Compliance with regulations and licensing requirements ensures operational stability and enhances the company’s worth.

- Future Growth Potential: Assessing the growth potential of an insurance company is crucial for its valuation. Factors such as expansion opportunities, product innovation, market trends, and demographic changes can influence future growth prospects and the company’s value.

These key factors, when analyzed in conjunction with each other, provide a holistic view of an insurance company’s value. It is important to note that the weightage placed on each factor may vary depending on the specific circumstances and the purpose of the valuation.

Now that we have explored the key factors involved in valuing an insurance company, let’s delve into the methods commonly used in the industry to assess their worth.

Valuation Methods for Insurance Companies

Valuing an insurance company requires the use of specific methodologies tailored to the unique characteristics of the industry. These valuation methods help investors, analysts, and policymakers determine the fair value of an insurance company. Let’s explore some of the most commonly used methods:

- Discounted Cash Flow (DCF) Analysis: DCF analysis is a widely used valuation method that estimates the present value of the future cash flows generated by an insurance company. This approach considers factors such as projected premium income, claims expenses, investment income, and operating costs. By discounting the projected cash flows at an appropriate rate, the present value of the insurance company can be determined.

- Price-to-Earnings (P/E) Ratio: The P/E ratio is a straightforward valuation method that compares the market price of an insurance company’s shares to its earnings per share. This method provides a quick snapshot of the company’s value relative to its earnings. However, it is important to consider other factors such as growth prospects, risk profile, and industry trends when using this method.

- Price-to-Book (P/B) Ratio: The P/B ratio compares an insurance company’s market price per share to its book value per share. The book value represents the net worth of the company, calculated as total assets minus liabilities. This method provides an indication of how the market values the company’s tangible assets.

- Dividend Discount Model (DDM): The DDM is used to value insurance companies that pay dividends to shareholders. It calculates the present value of expected future dividends based on assumptions such as dividend growth rate and required rate of return. The DDM provides insights into the company’s dividend-paying capacity and its attractiveness to income-seeking investors.

- Comparative Market Analysis: Comparative market analysis involves comparing a target insurance company to similar companies in the industry. Key financial metrics such as revenue, profitability, market share, and growth rates are compared to identify valuation multiples. These multiples are then applied to the target company’s financials to estimate its value relative to the market.

It is important to note that these valuation methods should be used in conjunction with one another to get a comprehensive view of an insurance company’s value. Each method has its own strengths and limitations, and the choice of method depends on the availability of data, the purpose of valuation, and the specific circumstances surrounding the company.

Now that we have covered the main valuation methods, let’s proceed to the next section to discuss the limitations and challenges in valuing insurance companies.

Discounted Cash Flow (DCF) Analysis

One of the most widely used valuation methods for insurance companies is the Discounted Cash Flow (DCF) analysis. DCF analysis estimates the present value of future cash flows generated by an insurance company, taking into account various financial factors and projections. This method provides a comprehensive understanding of the company’s intrinsic value and helps stakeholders make informed investment decisions.

The DCF analysis involves several steps:

- Cash Flow Projections: The first step is to estimate the future cash flows generated by the insurance company. This includes anticipated premium income, claims expenses, investment income, operating costs, and other relevant revenue and cost streams. Cash flow projections are typically forecasted over a specific time horizon, usually ranging from 5 to 10 years.

- Discount Rate Determination: A discount rate or the required rate of return is applied to the projected cash flows to determine their present value. The discount rate takes into account the time value of money and factors in the risk associated with the insurance industry. Various factors influence the choice of discount rate, such as the company’s risk profile, market conditions, and the opportunity cost of capital.

- Calculation of Present Value: The projected cash flows are discounted to their present value using the determined discount rate. A lower discount rate indicates higher present value, while a higher discount rate reduces the present value of future cash flows.

- Terminal Value Estimation: At the end of the projected time horizon, an insurance company is assumed to stabilize and generate cash flows in perpetuity. The terminal value represents the present value of these perpetual cash flows. Various methods, such as the Gordon Growth Model or the Exit Multiple Method, can be used to estimate the terminal value.

- Summation of Present Values: The present value of projected cash flows and the estimated terminal value are summed up to determine the total value of the insurance company. This sum represents its intrinsic value or fair market value.

DCF analysis provides a comprehensive valuation of an insurance company, accounting for its unique financial characteristics and future cash flow potential. However, it is important to note that DCF analysis is based on assumptions and projections, which may introduce some uncertainty into the valuation. Sensitivity analysis can be performed to assess the impact of different assumptions on the valuation outcome.

By employing the DCF analysis, stakeholders can assess the value of an insurance company, compare it to the market price, and make informed investment decisions based on the company’s future cash flow potential.

Now that we have explored the DCF analysis for valuing insurance companies, let’s move on to discuss other valuation methods.

Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio is a commonly used valuation method for insurance companies that provides a quick snapshot of the market’s perception of a company’s earnings potential. This simple ratio compares the market price of the insurance company’s shares to its earnings per share (EPS).

The formula for calculating the P/E ratio is as follows:

P/E Ratio = Market Price per Share / Earnings per Share

A higher P/E ratio indicates that investors are willing to pay more for each unit of earnings generated by the insurance company. This may be due to factors such as strong growth prospects, market leadership, or positive investor sentiment. Conversely, a lower P/E ratio suggests that the market has a less optimistic outlook on the company’s earnings potential.

When using the P/E ratio to value insurance companies, it is important to consider a few key factors:

- Growth Prospects: Companies with higher growth potential often command a higher P/E ratio. This is because investors are willing to pay a premium for companies that are expected to generate above-average earnings growth in the future.

- Risk Profile: Insurance companies operating in more volatile or risky segments of the market may have lower P/E ratios as investors may demand a higher return to compensate for the additional risk involved.

- Industry Comparisons: Comparing the P/E ratio of an insurance company to its industry peers can provide insights into its relative value. A company with a lower P/E ratio than its competitors may indicate that it is undervalued in comparison.

- Historical Trends: Analyzing the historical P/E ratio of an insurance company can help assess its valuation relative to its own historical performance. Significant deviations from the historical average may warrant further investigation.

- Earnings Quality: It is important to consider the quality and sustainability of the insurance company’s earnings when interpreting the P/E ratio. Factors such as non-recurring items or accounting adjustments may distort the earnings figure and result in an inaccurate valuation.

While the P/E ratio provides a quick and simple measure of valuation, it is not without limitations. It does not take into account factors such as the company’s assets, liabilities, or growth potential. Additionally, the P/E ratio may be influenced by market sentiment and investor expectations, which can sometimes lead to overvaluation or undervaluation.

Therefore, it is advisable to use the P/E ratio in conjunction with other valuation methods and consider the specific circumstances and industry dynamics when evaluating an insurance company’s worth.

Now, let’s move on to discuss another common valuation method for insurance companies – the Price-to-Book (P/B) ratio.

Price-to-Book (P/B) Ratio

The Price-to-Book (P/B) ratio is a valuation method commonly used in the insurance industry to assess the relative value of a company’s tangible assets. The P/B ratio compares the market price per share of the insurance company to its book value per share.

The formula for calculating the P/B ratio is as follows:

P/B Ratio = Market Price per Share / Book Value per Share

The book value represents the net worth of the insurance company and is calculated as total assets minus liabilities. It provides an indication of the value of the company’s tangible assets that can be used to support operations, pay claims, and generate future earnings.

When evaluating insurance companies using the P/B ratio, there are a few key considerations to keep in mind:

- Asset Composition: Analyzing the composition of an insurance company’s assets is crucial. High-quality assets, such as stable investments and a well-diversified portfolio, may result in a higher P/B ratio, indicating that the company’s assets are valued more by the market.

- Liability Assessment: The company’s liability profile should also be assessed to understand its financial obligations. An insurance company with manageable liabilities may command a higher P/B ratio, as it indicates a healthier financial position.

- Comparative Analysis: Comparing the P/B ratio of an insurance company to its industry peers can provide insights into its relative value. A company with a lower P/B ratio compared to its competitors may indicate that it is undervalued in comparison.

- Market Sentiment: It’s important to note that the P/B ratio can be influenced by market sentiment and investor perception. Market optimism or pessimism can impact the market price of the company’s shares and, consequently, the P/B ratio.

- Non-Tangible Assets: The P/B ratio focuses solely on tangible assets and does not consider non-tangible assets, such as intellectual property or brand value, which may hold significant value for an insurance company.

The P/B ratio provides insight into how the market values the insurance company’s tangible assets relative to its market price. A P/B ratio below 1 could indicate that the company’s tangible assets are valued less by the market than the current price, suggesting potential undervaluation. Conversely, a P/B ratio above 1 indicates that the company’s tangible assets are valued higher than the share price, suggesting potential overvaluation.

It’s important to note that the P/B ratio should not be used in isolation and should be considered alongside other valuation methods and factors specific to the insurance industry. By analyzing the P/B ratio together with other metrics, investors and analysts can gain a more comprehensive understanding of an insurance company’s valuation.

Now, let’s explore another valuation method for insurance companies – the Dividend Discount Model (DDM).

Dividend Discount Model (DDM)

The Dividend Discount Model (DDM) is a valuation method commonly used for insurance companies that pay dividends to their shareholders. The DDM estimates the present value of expected future dividends based on assumptions such as the dividend growth rate and the required rate of return.

The DDM takes into account the cash flows generated by an insurance company in the form of dividends and discounts them back to their present value. This approach provides insights into the company’s dividend-paying capacity and attractiveness to income-seeking investors.

The steps involved in implementing the Dividend Discount Model are as follows:

- Dividend Projections: The first step is to estimate the expected future dividends that the insurance company will distribute to its shareholders. These projections are typically based on historical dividend payments, growth trends, and management forecasts.

- Dividend Growth Rate: Next, a dividend growth rate is determined, reflecting the expected rate at which the company’s dividends will increase over time. This growth rate can be based on historical trends, industry projections, and the company’s growth prospects.

- Required Rate of Return: An appropriate required rate of return is chosen, considering factors such as the company’s risk profile, market conditions, and the opportunity cost of capital. The required rate of return reflects the return that investors expect to receive for investing in the insurance company.

- Calculation of Present Value: The projected future dividends are discounted back to their present value using the determined required rate of return. This calculates the intrinsic value of the insurance company based on its dividend stream.

- Summation of Present Values: The present values of the expected future dividends are summed up to determine the total value of the insurance company.

The Dividend Discount Model is particularly relevant for insurance companies that have a history of paying dividends and are expected to continue doing so in the future. It assesses the attractiveness of the company’s dividend payments and enables comparison with other investment alternatives.

It’s important to note that the Dividend Discount Model has some limitations. It assumes constant dividend growth rates, which may not hold true in practical scenarios. Additionally, changes in the company’s dividend policy, shifts in market conditions, or unforeseen events can impact the accuracy of the model’s projections.

When using the Dividend Discount Model, it is advisable to consider a range of scenarios and conduct sensitivity analysis to evaluate the impact of various assumptions on the valuation outcome.

Now that we have explored the Dividend Discount Model, let’s move on to discuss another valuation method – Comparative Market Analysis.

Comparative Market Analysis

Comparative Market Analysis is a valuation method that involves comparing an insurance company to its industry peers to determine its relative value in the market. This method provides insights into how the company’s financial metrics, growth prospects, and market position stack up against similar companies in the industry.

When conducting a Comparative Market Analysis for insurance companies, several key factors are considered:

- Financial Metrics: Key financial metrics such as revenue, profitability, and return on investment are analyzed and compared across similar insurance companies. This comparison helps determine if the company is outperforming or underperforming its peers.

- Market Share: The company’s market share within its specific insurance sector is assessed. A larger market share may indicate a more favorable market position and potentially greater value.

- Growth Rates: Comparing the company’s growth rates to industry averages provides insights into its ability to capture market opportunities and expand its business. Above-average growth rates may indicate a higher valuation.

- Operational Efficiency: Assessing the company’s operational efficiency, such as expense ratios and combined ratios, helps determine if it is running its operations cost-effectively compared to its competitors. A more efficient company may be valued higher.

- Market Trends: Evaluating industry trends and dynamics, such as regulatory changes or shifts in consumer behavior, provides context for understanding the company’s position and potential future value.

Comparative Market Analysis allows stakeholders to gain a sense of how the insurance company is performing relative to its peers and the overall industry. By identifying and analyzing the differences in financial metrics, market position, and growth prospects, investors can make informed decisions about the company’s value.

It’s important to note that Comparative Market Analysis has its limitations. Companies within the same industry can vary significantly in terms of their business models, markets served, and strategic directions. Therefore, it is crucial to consider the specific circumstances and characteristics of each company when conducting this analysis.

In addition, other qualitative factors, such as management quality, brand reputation, and competitive advantages, should also be considered alongside the quantitative metrics to gain a holistic understanding of the company’s value.

Now that we have explored the Comparative Market Analysis method, let’s move on to discuss the limitations and challenges in the valuation of insurance companies.

Limitations and Challenges in Valuing Insurance Companies

Valuing insurance companies can be a complex task due to the unique characteristics of the industry. It is important to recognize the limitations and challenges that arise when assessing the worth of these entities. Some key limitations and challenges include:

- Uncertain Cash Flows: Unlike other industries, insurance companies face uncertainty when projecting future cash flows. Factors such as claims fluctuations, changes in interest rates, and regulatory developments can have a significant impact on the company’s financial performance and cash flow projections.

- Intangible Value: Determining the value of intangible assets, such as brand reputation, customer loyalty, and intellectual property, can be challenging. These intangibles contribute to the company’s overall value but are difficult to quantify and incorporate into traditional valuation models.

- Complex Risk Assessment: Evaluating the risks faced by insurance companies is complex due to the unique nature of their business. The evaluation of underwriting risks, investment risks, and regulatory risks requires specialized knowledge and analysis to accurately gauge the potential impact on the company’s value.

- Regulatory Environment: Insurance companies are subject to strict regulations and oversight to ensure stability and protect policyholders. Changes in regulations can impact the company’s operations, profitability, and ultimately its value. It is crucial to stay updated with the evolving regulatory landscape when conducting valuations.

- Long-Term View: Insurance companies operate with a long-term outlook, which can make short-term market-based valuation methods less accurate. The value of an insurance company is often derived from the expected future cash flows over an extended period, making it essential to consider the sustainability and long-term viability of the business.

- Unique Asset-Liability Structures: The asset and liability structures of insurance companies are unique. Matching the duration and risk profiles of assets and liabilities is critical to their financial stability. A mismatch between these structures can have a substantial impact on the company’s value and risk assessment.

It is important to recognize these limitations and challenges when valuing insurance companies. Working with experienced professionals in insurance valuation and taking a comprehensive approach that considers both quantitative and qualitative factors can help mitigate these challenges and provide a more accurate assessment of the company’s value.

Now, let’s conclude our discussion on valuing insurance companies.

Conclusion

Valuing insurance companies requires a deep understanding of their unique characteristics, financial performance, and market dynamics. Through careful analysis and consideration of key factors, stakeholders can determine the fair value of an insurance company and make informed investment decisions.

In this article, we have explored important aspects of valuing insurance companies. We discussed the fundamental principles that underpin insurance companies, such as risk transfer and pooling. Understanding these principles is crucial for assessing the value of an insurance company.

We then identified the key factors involved in valuing insurance companies, including financial performance, market position, asset quality, liability profile, capitalization, regulatory environment, and future growth potential. These factors provide valuable insights into the company’s financial position and growth prospects.

We also examined several valuation methods commonly used for insurance companies, such as the Discounted Cash Flow (DCF) analysis, Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, Dividend Discount Model (DDM), and Comparative Market Analysis. Each method offers a unique perspective on valuation and helps paint a more complete picture of the company’s worth.

However, we must acknowledge the limitations and challenges associated with valuing insurance companies. Uncertain cash flows, intangible value, complex risk assessment, regulatory considerations, long-term view, and unique asset-liability structures all present challenges in accurately assessing value.

In conclusion, valuing insurance companies is a multifaceted process that involves analyzing various factors, utilizing appropriate valuation methods, and considering the specific challenges of the insurance industry. By taking a comprehensive approach and seeking expert guidance, stakeholders can gain a deeper understanding of the financial health and potential risks of insurance companies, aiding them in making well-informed investment decisions.

Remember, valuation is not an exact science, but by leveraging financial acumen, industry knowledge, and robust analysis, we can arrive at a reasonable estimation of an insurance company’s value.