Finance

What Is Open P&L?

Published: February 29, 2024

Open P&L, or open profit and loss, is a key financial metric used to measure the unrealized profits or losses of open positions in trading and investing. Learn how open P&L impacts your finance strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding Open P&L in Finance

- Unveiling the Essence of Open P&L

- Unveiling the Significance of Open P&L in Finance

- Influential Elements Shaping Open P&L Dynamics

- Unraveling the Methodology of Open P&L Computation

- Strategies for Effective Open P&L Management

- Navigating Financial Success Through Open P&L Mastery

Introduction

Understanding Open P&L in Finance

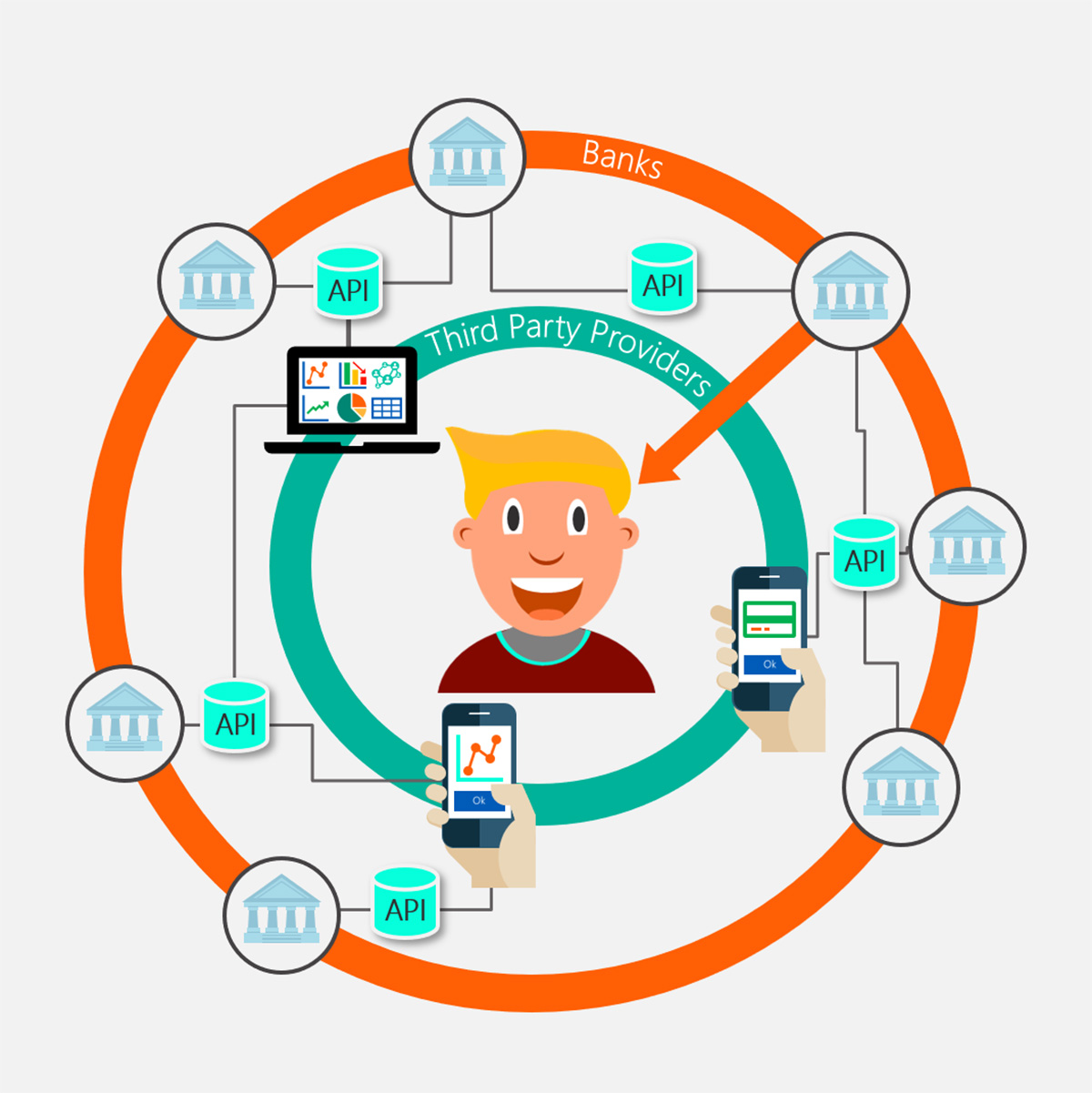

In the realm of finance, the concept of Open P&L holds significant weight, influencing investment decisions and risk management strategies. Open P&L, short for Open Profit and Loss, serves as a crucial indicator of the potential profit or loss on an investment that has not yet been realized. This metric plays a pivotal role in assessing the performance of investment portfolios and trading positions, providing valuable insights into the financial health of these assets.

Open P&L is a dynamic and fluid metric, susceptible to fluctuations in the market, making it a key concern for investors and traders. The ability to comprehend and effectively manage Open P&L is essential for navigating the complexities of financial markets and optimizing investment outcomes.

This article delves into the intricacies of Open P&L, elucidating its definition, significance, calculation methods, and the factors that influence it. Furthermore, it explores the strategies for managing Open P&L to mitigate risks and capitalize on opportunities. By unraveling the nuances of Open P&L, investors and traders can gain a deeper understanding of their financial positions and make informed decisions to achieve their investment objectives.

Definition of Open P&L

Unveiling the Essence of Open P&L

Open P&L, an abbreviation for Open Profit and Loss, encapsulates the unrealized profits or losses on an investment or trading position at any given point in time. It represents the difference between the current market value of an open position and its initial cost basis, reflecting the potential financial gain or loss if the position were to be closed at that moment.

When an asset is held in a portfolio or as part of a trading position without being sold, the profit or loss remains unrealized and is classified as Open P&L. This metric is instrumental in gauging the performance of investments and trading activities, offering insights into the potential returns or risks associated with these positions.

Open P&L is inherently dynamic, fluctuating in response to market movements and price volatility. As the market value of assets changes, so does the Open P&L, reflecting the evolving profitability or loss potential of the positions. This dynamic nature underscores the importance of monitoring Open P&L regularly to adapt to changing market conditions and make informed decisions.

Understanding Open P&L is paramount for investors and traders, as it provides a real-time assessment of the financial implications of their open positions. By comprehending the Open P&L of their investments, individuals can make informed decisions regarding portfolio rebalancing, profit-taking, or implementing risk management strategies to optimize their overall financial performance.

Importance of Open P&L

Unveiling the Significance of Open P&L in Finance

The Open Profit and Loss (P&L) metric holds immense significance in the realm of finance, serving as a pivotal indicator of the potential profitability or loss associated with open investment positions. Its importance resonates across various aspects of investment management and trading activities, profoundly influencing decision-making processes and risk assessment strategies.

Real-Time Performance Evaluation: Open P&L provides real-time insights into the financial performance of open positions, enabling investors and traders to assess the unrealized profits or losses associated with their investments. This real-time evaluation empowers individuals to make informed decisions regarding portfolio adjustments and risk management strategies based on the current financial implications of their open positions.

Risk Assessment and Mitigation: By comprehending the Open P&L of their investment portfolios and trading positions, individuals can effectively assess the potential risks and exposures. This understanding allows for the implementation of proactive risk mitigation measures, such as setting stop-loss orders or adjusting position sizes to manage potential losses and protect capital in volatile market conditions.

Performance Benchmarking: Open P&L serves as a benchmark for evaluating the performance of investment portfolios and trading strategies. It enables individuals to compare the unrealized profits or losses of their open positions against predefined targets or performance benchmarks, facilitating a comprehensive assessment of their investment objectives and the effectiveness of their trading activities.

Decision-Making Insights: The insights derived from Open P&L play a pivotal role in guiding investment and trading decisions. By understanding the potential profitability or loss associated with open positions, individuals can make informed choices regarding profit-taking, portfolio rebalancing, or the execution of trading strategies to capitalize on favorable market conditions or mitigate potential losses.

Market Sentiment and Position Management: Open P&L reflects the market sentiment and the financial implications of open positions, empowering individuals to adapt their investment and trading strategies in response to changing market conditions. This adaptive approach to position management is essential for optimizing investment outcomes and navigating the dynamic landscape of financial markets.

By recognizing the importance of Open P&L and leveraging its insights, investors and traders can enhance their decision-making processes, manage risks effectively, and strive for optimal financial performance in their investment endeavors.

Factors Affecting Open P&L

Influential Elements Shaping Open P&L Dynamics

The Open Profit and Loss (P&L) of investment portfolios and trading positions is influenced by a myriad of factors that contribute to its dynamic and fluctuating nature. Understanding the key elements that affect Open P&L is essential for investors and traders, as it empowers them to anticipate potential changes in profitability and manage the associated risks effectively.

Market Volatility: Fluctuations in market volatility can significantly impact Open P&L, especially for assets and positions sensitive to price movements. High volatility can amplify the potential profits or losses of open positions, leading to rapid changes in Open P&L and necessitating proactive risk management measures to mitigate the impact of market fluctuations.

Price Movements: The directional movements of asset prices directly influence Open P&L, as the market value of open positions fluctuates in response to price changes. Favorable price movements can result in increased Open P&L, while adverse price movements may lead to potential losses. Monitoring price trends and their impact on Open P&L is crucial for making informed investment and trading decisions.

Position Size and Leverage: The size of investment positions and the utilization of leverage can significantly affect Open P&L. Larger position sizes and higher leverage amplify the potential profits or losses associated with open positions, increasing the sensitivity of Open P&L to market movements. Managing position sizes and leverage is essential for controlling the impact of these factors on Open P&L.

Market Conditions and Sentiment: The prevailing market conditions and sentiment can influence Open P&L, as investor behavior and market dynamics impact the profitability of open positions. Bullish market sentiment may bolster Open P&L, while bearish sentiment can exert downward pressure on potential profits. Adapting to changing market conditions is crucial for managing the impact of market sentiment on Open P&L.

Dividends and Corporate Actions: Dividend payments, stock splits, and other corporate actions can affect Open P&L for equity investments. Positive corporate actions, such as dividend distributions, can enhance Open P&L, while events like stock splits may alter the composition and valuation of open positions, influencing their potential profitability.

Interest Rates and Forex Fluctuations: For foreign exchange (Forex) trading and interest rate-sensitive instruments, fluctuations in interest rates and currency exchange rates can impact Open P&L. Changes in interest differentials and currency valuations can alter the potential profits or losses of open positions, necessitating a comprehensive understanding of these factors for effective risk management.

By recognizing the influential factors shaping Open P&L dynamics, investors and traders can adapt their strategies, implement risk management measures, and make informed decisions to navigate the evolving financial landscape and optimize their investment outcomes.

Calculating Open P&L

Unraveling the Methodology of Open P&L Computation

The calculation of Open Profit and Loss (P&L) involves a straightforward yet pivotal methodology that provides insights into the potential profitability or losses associated with open investment positions. By comprehending the calculation process, investors and traders can gauge the financial implications of their open positions and make informed decisions to optimize their investment strategies.

Basic Calculation Formula: The fundamental formula for calculating Open P&L is the difference between the current market value of an open position and its initial cost basis. This calculation is expressed as:

Open P&L = Current Market Value – Initial Cost Basis

Where:

- Current Market Value: This represents the real-time market valuation of the open position, reflecting the current price at which the asset could be sold.

- Initial Cost Basis: The initial cost basis denotes the price at which the asset was acquired, encompassing transaction costs and fees associated with the purchase.

Example Scenario: Consider an investor who purchases 100 shares of a stock at $50 per share, incurring $100 in transaction costs. If the current market price of the stock is $60 per share, the calculation of Open P&L would be as follows:

Open P&L = (100 shares * $60) – ($50 * 100 shares + $100) = $6,000 – $5,100 = $900

This calculation reveals an Open P&L of $900, indicating the unrealized profit associated with the open position based on the current market value.

Considerations and Adjustments: When calculating Open P&L, it is imperative to account for additional factors such as accrued dividends, interest expenses, and adjustments for corporate actions that may impact the cost basis and market value of the open positions. These considerations ensure a comprehensive and accurate assessment of the potential profits or losses associated with the investments.

By mastering the calculation of Open P&L and incorporating relevant considerations, investors and traders can gain valuable insights into the financial implications of their open positions, enabling them to make informed decisions and optimize their investment strategies.

Managing Open P&L

Strategies for Effective Open P&L Management

Effectively managing Open Profit and Loss (P&L) is integral to the success of investment portfolios and trading activities, enabling investors and traders to navigate market fluctuations and optimize their financial performance. By implementing strategic approaches to Open P&L management, individuals can mitigate risks, capitalize on opportunities, and maintain a balanced approach to their investment endeavors.

Proactive Risk Management: Implementing proactive risk management measures is essential for mitigating the impact of market volatility and price fluctuations on Open P&L. This includes setting stop-loss orders, diversifying portfolios, and adjusting position sizes to limit potential losses and protect capital in adverse market conditions.

Regular Performance Reviews: Conducting regular reviews of Open P&L and investment portfolios allows for the assessment of performance trends and the identification of areas for optimization. By monitoring Open P&L over time, individuals can gain insights into the effectiveness of their investment strategies and make informed adjustments to enhance overall performance.

Adaptive Position Management: Adapting to changing market conditions and sentiment is crucial for managing Open P&L effectively. This involves adjusting investment and trading strategies in response to market dynamics, leveraging insights derived from Open P&L to capitalize on favorable opportunities and mitigate potential risks associated with open positions.

Utilization of Hedging Strategies: Employing hedging strategies can help mitigate the impact of adverse market movements on Open P&L. Utilizing financial instruments such as options, futures, and derivatives allows investors and traders to hedge against potential losses and volatility, safeguarding their open positions from unfavorable market conditions.

Disciplined Profit-Taking: Implementing disciplined profit-taking strategies based on Open P&L insights enables individuals to capitalize on favorable market conditions and realize profits from their open positions. By setting predefined profit targets and adhering to disciplined profit-taking practices, investors and traders can optimize their returns and manage the impact of market fluctuations on Open P&L.

Continuous Education and Analysis: Maintaining a commitment to continuous education and market analysis is essential for effective Open P&L management. Staying informed about market trends, economic indicators, and industry developments empowers individuals to make informed decisions and adapt their strategies to optimize Open P&L in evolving market environments.

By embracing these strategies for managing Open P&L, investors and traders can navigate the complexities of financial markets, mitigate risks, and strive for optimal performance in their investment endeavors.

Conclusion

Navigating Financial Success Through Open P&L Mastery

Open Profit and Loss (P&L) stands as a cornerstone of financial management, offering invaluable insights into the unrealized profits or losses associated with investment portfolios and trading positions. Its dynamic nature, influenced by market fluctuations and various factors, underscores the importance of comprehending and effectively managing Open P&L to optimize investment outcomes.

By unraveling the essence of Open P&L, investors and traders can gain a deeper understanding of the financial implications of their open positions, empowering them to make informed decisions, mitigate risks, and capitalize on opportunities. The calculation of Open P&L, incorporating considerations and adjustments, provides a comprehensive assessment of potential profits or losses, guiding strategic decision-making processes.

Managing Open P&L entails proactive risk management, adaptive position management, and disciplined profit-taking, fostering a balanced and informed approach to investment strategies. By embracing these strategies, individuals can navigate market dynamics, mitigate risks, and strive for optimal financial performance.

Ultimately, the mastery of Open P&L is not merely a technical endeavor but a strategic art, requiring continuous education, market analysis, and a disciplined approach to decision-making. By leveraging the insights derived from Open P&L, investors and traders can navigate the complexities of financial markets, adapt to changing conditions, and pursue their investment objectives with confidence.

As Open P&L remains a pivotal metric in the realm of finance, its mastery equips individuals with the tools to navigate the dynamic landscape of investment and trading, fostering resilience, adaptability, and informed decision-making to achieve enduring financial success.