Finance

What Is Savings And Loans?

Published: February 18, 2024

Learn about savings and loans in the world of finance. Understand the benefits and how they can help you achieve your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Role of Savings and Loans in Personal Finance

Savings and loans institutions play a crucial role in the financial landscape, serving as pillars of stability and opportunity for individuals and communities. These institutions are deeply intertwined with the concept of saving and borrowing, providing a range of financial services that empower individuals to achieve their goals, whether it's purchasing a home, funding education, or building a nest egg for the future.

At its core, the concept of savings and loans revolves around the fundamental principles of thrift and prudent financial management. It encompasses the act of saving money, typically in interest-bearing accounts, and obtaining loans for various purposes, such as buying a home or funding a business venture. This symbiotic relationship between saving and borrowing forms the cornerstone of personal finance, enabling individuals to accumulate wealth and access capital when needed.

Savings and loans institutions have a rich history, deeply rooted in the fabric of American society. Dating back to the 19th century, these institutions have played a pivotal role in democratizing access to financial resources, particularly for homeownership. Understanding the historical evolution, operational dynamics, regulatory framework, and the benefits and drawbacks of savings and loans is essential for comprehending their significance in today's financial landscape. In this article, we will delve into the multifaceted world of savings and loans, exploring their historical underpinnings, operational intricacies, regulatory oversight, and the impact they have on individuals and communities.

History of Savings and Loans

The history of savings and loans in the United States can be traced back to the 19th century when the concept of thrift and homeownership gained prominence. The roots of these institutions can be found in the building and loan associations that emerged to provide financial support to individuals aspiring to own homes. These associations were formed by communities pooling their resources to extend mortgage loans to members, fostering a culture of collective savings and homeownership.

One of the defining moments in the history of savings and loans was the passage of the Federal Home Loan Bank Act in 1932, which aimed to bolster the housing market by establishing a network of Federal Home Loan Banks. These banks provided a stable source of funding for savings and loans associations, enabling them to offer long-term, fixed-rate mortgages to a broader segment of the population. This legislative initiative laid the groundwork for the expansion of homeownership across the country, contributing to the economic stability and prosperity of countless families.

During the mid-20th century, savings and loans institutions experienced significant growth, driven by increased demand for mortgage financing. The post-World War II era witnessed a surge in homeownership aspirations, leading to a proliferation of savings and loans associations catering to the housing needs of returning veterans and their families. This period marked the heyday of savings and loans, characterized by their pivotal role in fueling the American Dream of homeownership.

However, the landscape of savings and loans underwent a tumultuous transformation in the late 20th century. The industry faced a series of challenges, including a changing regulatory environment, economic fluctuations, and structural issues within some institutions. These factors culminated in the savings and loan crisis of the 1980s, a period marred by widespread insolvencies and regulatory interventions that reshaped the industry’s landscape.

Despite the challenges and reforms that followed, savings and loans institutions have continued to adapt and evolve, remaining integral to the financial ecosystem. Their historical journey reflects the enduring significance of fostering thrift, homeownership, and community-oriented financial services, underscoring their enduring impact on the fabric of American society.

Operations of Savings and Loans

Savings and loans institutions operate on a unique business model that revolves around the dual functions of gathering deposits and providing mortgage loans. These institutions primarily attract funds from depositors, offering them a variety of savings products such as savings accounts, certificates of deposit, and individual retirement accounts. By accumulating these deposits, savings and loans institutions amass the capital necessary to extend mortgage loans to individuals and families seeking to purchase homes or refinance existing mortgages.

One of the distinguishing features of savings and loans is their emphasis on long-term, fixed-rate mortgage lending. Unlike commercial banks that often focus on a broader array of financial services, savings and loans institutions specialize in residential mortgage lending, with a particular focus on promoting homeownership. This specialization allows them to tailor their products and services to meet the specific needs of homebuyers, offering competitive mortgage rates and personalized customer service.

Furthermore, savings and loans institutions often maintain close ties to the communities they serve, fostering a deep sense of local engagement and personalized relationships with their customers. This community-oriented approach sets them apart from larger financial institutions, as they strive to cultivate a supportive and accessible environment for individuals navigating the homeownership journey.

In addition to mortgage lending, savings and loans institutions may also offer other financial products and services, such as home equity loans, personal loans, and basic banking services. While their primary focus remains on residential mortgage lending, these supplementary offerings enable them to cater to a broader range of financial needs within their communities, further solidifying their role as integral financial partners.

Overall, the operations of savings and loans institutions revolve around the core principles of prudent financial management, community engagement, and specialized mortgage lending. Their dedication to fostering homeownership, coupled with a commitment to personalized service, underscores their enduring relevance in the financial landscape.

Regulations and Oversight of Savings and Loans

The operations of savings and loans institutions are subject to rigorous regulatory oversight aimed at safeguarding the stability of the financial system and protecting the interests of depositors and borrowers. Historically, the regulation of savings and loans has evolved in response to various legislative initiatives and industry developments, shaping the regulatory framework that governs their activities.

One of the pivotal moments in the regulatory history of savings and loans was the enactment of the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) in 1989. This legislation was a direct response to the savings and loan crisis of the 1980s, which exposed vulnerabilities in the industry and led to widespread insolvencies. FIRREA introduced comprehensive reforms, including the creation of the Office of Thrift Supervision (OTS) and the establishment of stringent capital requirements and regulatory standards for savings and loans institutions.

Following the passage of FIRREA, savings and loans became subject to heightened regulatory scrutiny, with a focus on risk management, capital adequacy, and compliance with consumer protection laws. The regulatory framework encompasses oversight by federal agencies such as the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC), ensuring that savings and loans institutions adhere to prudent financial practices and maintain the necessary safeguards to protect depositors and borrowers.

Moreover, savings and loans institutions are also subject to regulatory examinations and periodic assessments of their financial condition, conducted by regulatory authorities to evaluate their compliance with regulatory requirements and the overall soundness of their operations. These examinations play a critical role in identifying potential risks and ensuring that savings and loans institutions operate in a safe and sound manner, thereby contributing to the stability of the financial system.

Furthermore, the regulatory landscape for savings and loans continues to evolve, reflecting ongoing efforts to adapt to changing market dynamics and emerging risks. Regulatory authorities remain vigilant in monitoring the activities of savings and loans institutions, emphasizing the importance of prudent risk management, corporate governance, and adherence to regulatory compliance standards.

Ultimately, the regulatory and oversight framework for savings and loans institutions underscores the commitment to maintaining a resilient and secure financial sector, reinforcing the trust and confidence of depositors and borrowers in these vital financial institutions.

Benefits and Drawbacks of Savings and Loans

Savings and loans institutions offer a range of benefits that contribute to their enduring appeal as financial partners for individuals and communities. At the same time, they also face certain drawbacks and challenges that shape their operational landscape and influence their role in the financial ecosystem.

Benefits

- Promotion of Homeownership: Savings and loans institutions have historically played a pivotal role in promoting homeownership by providing accessible mortgage financing to individuals and families. This commitment to facilitating homeownership opportunities contributes to the stability and vitality of communities.

- Community Engagement: These institutions often maintain close ties to the communities they serve, fostering a sense of local engagement and personalized customer relationships. Their community-oriented approach creates a supportive environment for individuals navigating the homeownership journey and seeking financial guidance.

- Specialized Mortgage Lending: Savings and loans institutions specialize in long-term, fixed-rate mortgage lending, offering tailored products and competitive rates that cater to the specific needs of homebuyers. This specialization sets them apart from larger financial institutions and positions them as experts in residential mortgage financing.

- Prudent Financial Management: The emphasis on thrift and prudent financial management underscores the commitment of savings and loans institutions to fostering a culture of responsible saving and borrowing. This focus on sound financial practices benefits both depositors and borrowers, contributing to the overall financial well-being of their clientele.

Drawbacks

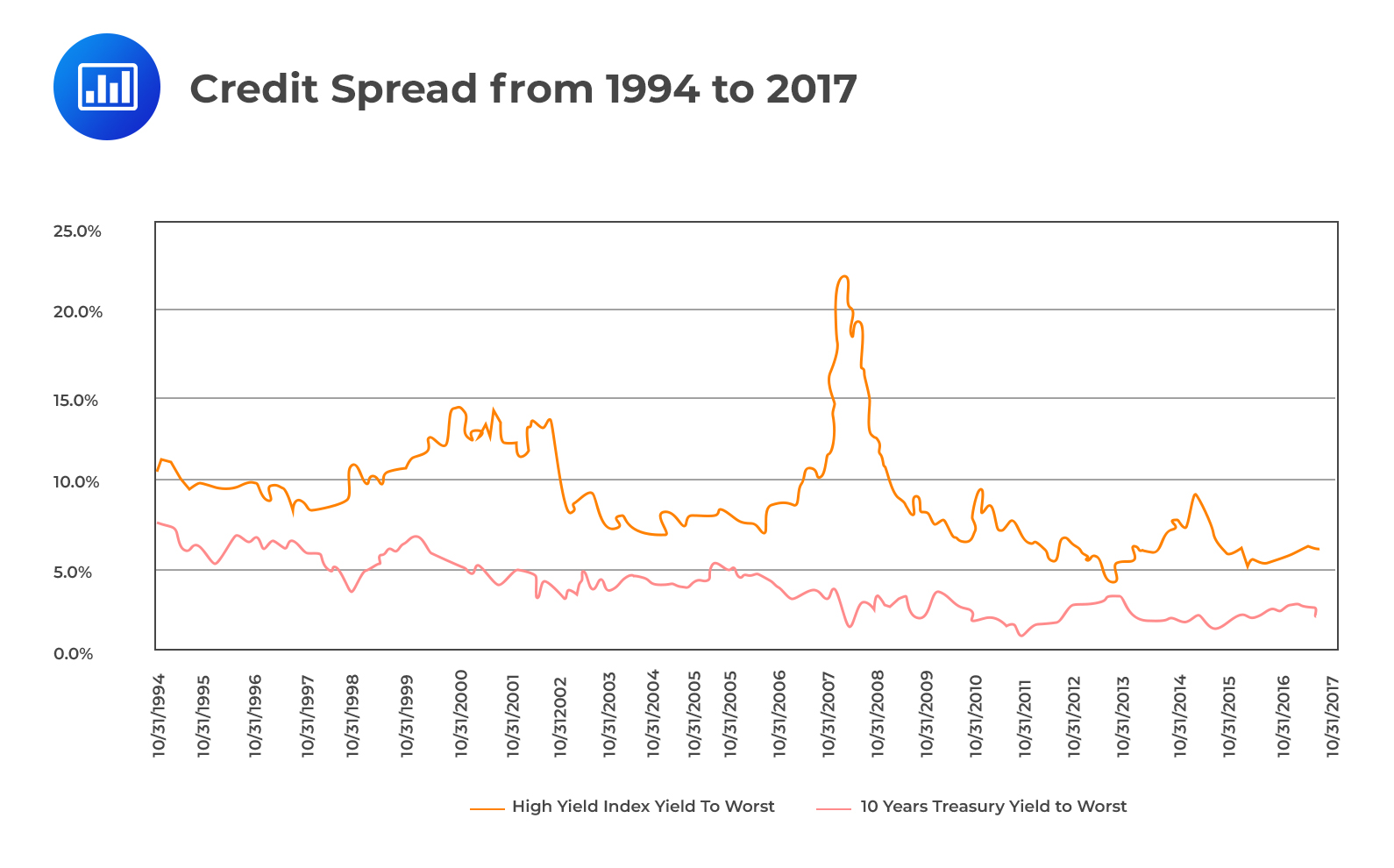

- Interest Rate Risk: Savings and loans institutions are exposed to interest rate risk, given their reliance on long-term, fixed-rate mortgage lending. Fluctuations in interest rates can impact their profitability and financial stability, necessitating effective risk management strategies to mitigate potential adverse effects.

- Regulatory Compliance Burden: The regulatory framework governing savings and loans institutions imposes compliance requirements and reporting obligations, which can create administrative burdens and operational complexities. Adhering to regulatory standards and maintaining capital adequacy necessitates ongoing diligence and resources.

- Market Competition: These institutions operate in a competitive financial services landscape, contending with larger banks, credit unions, and non-traditional mortgage lenders. Navigating market competition requires strategic positioning and differentiation to maintain a strong market presence.

- Economic and Market Volatility: Savings and loans institutions are susceptible to economic fluctuations and housing market dynamics, which can impact the demand for mortgage loans and the overall performance of their loan portfolios. Adapting to market volatility and managing credit risk is essential for sustained resilience.

Despite these challenges, savings and loans institutions continue to play a vital role in providing accessible mortgage financing and fostering a culture of thrift and homeownership, contributing to the financial well-being of individuals and the prosperity of communities.

Conclusion

In conclusion, savings and loans institutions stand as pillars of stability and opportunity in the financial landscape, embodying the enduring principles of thrift, homeownership, and community-oriented financial services. Their historical evolution, operational dynamics, regulatory oversight, and the benefits and drawbacks collectively underscore their significance as vital financial partners for individuals and communities.

The rich history of savings and loans institutions reflects their integral role in democratizing access to homeownership and fostering financial stability. From the early building and loan associations to the modern-day specialized mortgage lenders, these institutions have been instrumental in shaping the landscape of residential mortgage financing, contributing to the realization of the American Dream for countless families.

Furthermore, the operations of savings and loans institutions exemplify their commitment to prudent financial management, specialized mortgage lending, and community engagement. By offering a range of savings products and personalized mortgage financing, these institutions empower individuals to achieve their homeownership aspirations and build financial security.

Amidst the regulatory framework and oversight, savings and loans institutions navigate the complexities of compliance, risk management, and market dynamics, striving to maintain resilience and uphold the trust and confidence of their depositors and borrowers. The regulatory landscape continues to evolve, reflecting the ongoing efforts to ensure the stability and soundness of these vital financial institutions.

While savings and loans institutions face challenges such as interest rate risk, regulatory burdens, market competition, and economic volatility, their enduring benefits, including the promotion of homeownership, community engagement, specialized mortgage lending, and prudent financial management, solidify their role as indispensable financial partners.

In essence, savings and loans institutions embody the ethos of responsible saving and borrowing, enabling individuals to realize their homeownership dreams and fostering the economic prosperity of communities. Their enduring legacy and commitment to financial empowerment underscore their continued relevance and significance in the ever-evolving landscape of personal finance.