Finance

What Is Smurfing In Banking

Published: November 2, 2023

Learn what smurfing is in the banking industry and how it relates to finance. Discover the strategies and consequences involved in this financial practice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Smurfing

- History of Smurfing in Banking

- Motivations behind Smurfing

- Techniques and Strategies of Smurfing

- Legal and Regulatory Measures to Combat Smurfing

- Consequences of Smurfing for Banks

- Case Studies of Smurfing in the Banking Industry

- Preventive Measures for Banks against Smurfing

- Conclusion

Introduction

Smurfing in banking is a term used to describe a money laundering technique that involves the structuring of illicit funds in smaller, less conspicuous transactions to avoid detection by regulatory authorities. This deceptive practice has been a longstanding challenge in the financial industry, with serious consequences for both banks and society at large.

In simple terms, smurfing involves breaking down large amounts of money into smaller, seemingly legitimate transactions that do not raise suspicion. The term “smurfing” is derived from the animated characters known as ‘smurfs’, who were known for their small size and ability to work collectively to achieve a task. Similarly, in the realm of banking, individuals or groups participating in smurfing engage in multiple separate transactions to obscure the origin and purpose of the funds.

The intention behind smurfing is to make illicit funds appear to be legitimate income or business transactions. By conducting multiple smaller transactions, criminals can bypass financial institutions’ reporting thresholds, which require the reporting of large transactions to the appropriate authorities. This technique allows them to stay beneath the radar and evade detection.

Smurfing poses significant challenges for banks and regulatory bodies in their efforts to combat money laundering. As a result, understanding the techniques, motivations, and preventive measures associated with smurfing is essential for the financial sector and law enforcement agencies.

In this article, we will delve deeper into the definition and history of smurfing, explore the motivations behind this illicit activity, discuss the techniques and strategies employed, examine the legal and regulatory measures in place to combat smurfing, analyze the consequences for banks, present case studies illustrating real-world examples, and provide proactive measures banks can take to prevent and detect smurfing.

Definition of Smurfing

Smurfing, also known as structuring or structuring transactions, is a money laundering technique that involves breaking down large sums of money into smaller, less conspicuous transactions to avoid detection by authorities. It is based on the assumption that smaller transactions are less likely to draw suspicion and scrutiny compared to larger transactions that could be flagged as potentially illicit.

The concept of smurfing revolves around making illicit funds appear legitimate by disguising the true source and purpose of the funds. Criminals engage in multiple separate transactions, each below the reporting threshold of financial institutions, to prevent the triggering of mandatory reporting to regulatory authorities.

Financial institutions are required by law to report any transactions over a certain threshold as a precautionary measure against money laundering. These thresholds vary from country to country but typically range from a few thousand to tens of thousands of dollars. By fragmenting large amounts of money into smaller transactions, smurfers aim to fly under the radar of transaction monitoring systems.

The term “smurfing” is often used to describe the practice of conducting these multiple smaller transactions, likening it to the activity of the fictional characters known as smurfs. Like the smurfs working together to achieve a goal, smurfers coordinate and distribute the illicit funds across various transactions and accounts to complicate the tracing of the money’s origin and purpose.

It’s important to note that smurfing is not limited to cash transactions alone. It can also involve electronic transfers, deposits, and withdrawals of funds, often across different accounts or financial institutions. Moreover, smurfing techniques can vary, ranging from using multiple individuals to conduct the transactions to employing sophisticated methods such as shell companies or nominee accounts to further obfuscate the paper trail.

Overall, the primary objective of smurfing is to avoid arousing suspicion and circumvent the legal obligations of financial institutions to report suspicious or potentially illicit activities. By conducting multiple smaller transactions, smurfers aim to make the illegal funds appear legitimate and launder them through the traditional banking system, making detection and investigation challenging for authorities.

History of Smurfing in Banking

The practice of smurfing in banking has a long and notorious history, dating back several decades. Its origins can be traced to the evolution of anti-money laundering (AML) regulations and the continuous adaptability of criminals seeking to exploit loopholes in the system.

In the early days, smurfing was primarily associated with the structuring of cash transactions. Criminals would break down large sums of cash into smaller amounts to evade the reporting thresholds established by financial institutions and regulatory authorities. This allowed them to launder money obtained from illegal activities, such as drug trafficking, racketeering, or corruption.

However, with the advancements in technology and the increasing digitalization of financial transactions, smurfing techniques have expanded beyond cash transactions. Criminals now leverage electronic transfers, online banking, and other financial instruments to conduct smaller, less noticeable transactions that can be easily dispersed across multiple accounts or financial institutions.

One of the earliest high-profile cases involving smurfing took place in the 1980s with the Bank of Credit and Commerce International (BCCI). BCCI was a global bank involved in numerous money laundering activities, including smurfing, to conceal the illegal proceeds of organized crime, terrorism, and drug trafficking. The case shed light on the vulnerabilities of the banking sector to such illicit practices and led to increased scrutiny and regulatory measures.

Over the years, regulatory authorities and law enforcement agencies have intensified their efforts to combat smurfing and money laundering. This has resulted in more stringent AML regulations and the implementation of sophisticated detection and reporting systems by financial institutions.

Despite these efforts, smurfing remains a persistent problem due to the constantly evolving techniques employed by criminals. Advanced technologies and the globalization of financial markets have made it easier for individuals and criminal organizations to exploit loopholes and evade detection.

Moreover, the rise of virtual currencies and online platforms has further complicated the fight against smurfing. Cryptocurrencies, in particular, have been used to facilitate anonymous transactions, making it even more challenging for authorities to trace the flow of illicit funds.

As a result, international cooperation among financial institutions, regulatory bodies, and law enforcement agencies has become crucial in combating smurfing. Information sharing, data analytics, and the implementation of robust AML processes are essential measures to detect and prevent the fragmentation of illicit funds through multiple transactions.

In the next section, we will explore the motivations that drive individuals and criminal organizations to engage in smurfing, shedding light on the underlying factors that perpetuate this illicit practice.

Motivations behind Smurfing

Smurfing, as a money laundering technique, is driven by various motivations that prompt individuals and criminal organizations to engage in this illicit practice. Understanding these motivations is crucial in developing effective strategies to combat smurfing and disrupt the flow of illicit funds.

1. Evasion of Regulatory Scrutiny: The primary motivation behind smurfing is to avoid detection and circumvent the reporting requirements imposed by regulatory authorities. By breaking down large sums of money into smaller transactions, smurfers aim to stay under the threshold that triggers mandatory reporting to financial institutions and law enforcement agencies. This evasion allows criminals to launder money obtained through illegal activities without attracting attention.

2. Concealment of Illegal Proceeds: Smurfing provides a means to obscure the origin and purpose of illicit funds. By fragmenting large amounts of money into multiple transactions, criminals can make the money trail more challenging to follow for investigators. This not only helps to conceal the proceeds of various criminal activities but also hinders efforts to seize and recover these funds.

3. Integration of Illicit Funds: Smurfing enables criminals to integrate their illegally obtained funds into the legitimate financial system. It allows them to make the illicit funds appear as legitimate income or business transactions, making it easier to use those funds for legal purposes such as investments, purchasing assets, or funding other criminal activities or organizations.

4. Capital Flight and Tax Evasion: Smurfing can also be driven by individuals or entities seeking to evade taxes or transfer capital out of a country illegally. By breaking down large amounts of money into smaller transactions, individuals or entities can move funds covertly across borders or within jurisdictions with less suspicion raised. This allows them to avoid taxation and maintain control over their assets without scrutiny from financial authorities.

5. Money Laundering for Criminal Enterprises: Smurfing plays a significant role in facilitating money laundering for various criminal enterprises, such as drug trafficking, human trafficking, fraud, racketeering, corruption, and terrorist financing. The fragmented nature of smurfing transactions makes it difficult to trace the flow of funds and identify the individuals or groups involved in illegal activities.

6. Exploitation of Flaws in the Financial System: Criminals engaged in smurfing often capitalize on weaknesses or vulnerabilities in the financial system. They exploit gaps in regulations, reporting thresholds, or transaction monitoring processes to carry out their illicit activities. The constantly evolving nature of financial transactions and advancements in technology provide new avenues for criminals to exploit and stay ahead of detection efforts.

By understanding the motivations behind smurfing, financial institutions, regulatory bodies, and law enforcement agencies can develop targeted strategies to detect and prevent these activities. In the next section, we will explore the techniques and strategies employed in smurfing to evade detection and launder illicit funds.

Techniques and Strategies of Smurfing

Smurfing, as a money laundering technique, involves various techniques and strategies that criminals employ to evade detection and launder illicit funds. These methods are designed to break down large sums of money into smaller, less conspicuous transactions, making it difficult for authorities to trace the source and purpose of the funds. Understanding these techniques is vital for financial institutions and law enforcement agencies in detecting and combating smurfing activities.

1. Transaction Fragmentation: The most common strategy in smurfing is to break down a large sum of money into smaller transactions, each below the reporting threshold of financial institutions. By conducting multiple transactions, often involving different accounts and financial institutions, smurfers aim to fly under the radar and avoid attracting suspicion. This fragmentation tactic makes it challenging for authorities to identify the complete picture of the money trail.

2. Use of Multiple Individuals: Smurfers may enlist the help of multiple individuals, known as smurfer agents or mules, to conduct the smaller transactions on their behalf. These individuals are often unaware of the illicit nature of the funds and may falsely believe they are partaking in legitimate activities. The use of multiple individuals helps to distribute the risk and prevent any single person from being linked to the entire money laundering operation.

3. Structuring Electronic Transfers: Smurfing techniques have evolved to encompass electronic transfers, allowing criminals to conduct smaller transactions without the need for physical cash. They may utilize online banking platforms or electronic payment systems to move funds across different accounts or financial institutions. This method offers convenience and anonymity, making it easier to execute smurfing operations undetected.

4. Utilizing Shell Companies: Criminals may set up shell companies, which are essentially entities with no significant operations or assets, to facilitate smurfing activities. These companies can be used to receive and disburse funds, making it difficult to trace the true beneficiaries or owners of the illicit funds. Shell companies provide an additional layer of anonymity and complexity, further obscuring the money trail.

5. Nominee Accounts: Smurfers may use nominee accounts, where a third party holds an account on behalf of the actual owner, to conduct transactions. By using nominee accounts, criminals can distance themselves from the illicit funds and create confusion in the ownership and control of the assets. This tactic makes it harder for authorities to connect the funds to the individuals involved in money laundering activities.

6. Layering: Layering is a technique used to further obfuscate the source of funds and create a complex web of transactions. Criminals conduct multiple layers of transactions, moving funds through various accounts, entities, and jurisdictions. Each layer serves to distance the illicit funds from their original source, making it extremely difficult for authorities to untangle the money trail.

As financial institutions become more adept at detecting smurfing activities, criminals continue to develop new techniques and strategies to evade detection. It is crucial for banks, regulators, and law enforcement agencies to stay vigilant, keep pace with emerging tactics, and implement robust risk-based AML systems to proactively detect and prevent smurfing in the financial system.

Legal and Regulatory Measures to Combat Smurfing

The fight against smurfing has led to the implementation of various legal and regulatory measures aimed at combating this money laundering technique. Governments and regulatory bodies worldwide have recognized the need to enhance anti-money laundering (AML) frameworks to prevent the fragmentation of illicit funds. These measures aim to strengthen reporting requirements, increase transparency, and improve collaboration between financial institutions and law enforcement agencies.

1. Reporting Thresholds: One of the key measures in combatting smurfing is establishing reporting thresholds for financial institutions. These thresholds require institutions to report transactions that exceed a certain amount, providing authorities with valuable data to identify suspicious activity. By setting appropriate reporting thresholds and periodically reviewing them, regulators can ensure suspicious transactions are adequately captured, reducing the opportunities for smurfers to evade detection.

2. Transaction Monitoring Systems: Financial institutions are required to implement robust transaction monitoring systems that can detect patterns and anomalies indicative of smurfing activities. These systems employ sophisticated algorithms and analytics to analyze customer transactions, identify unusual behavior, and generate alerts for further investigation. Regular reviews and updates to these systems are crucial to ensure their effectiveness in detecting and preventing smurfing.

3. Know Your Customer (KYC) and Customer Due Diligence (CDD): KYC and CDD procedures require financial institutions to verify the identities of their customers, assess their risk profile, and monitor their transactions for any suspicious activity. By implementing comprehensive KYC and CDD processes, banks can establish a clear understanding of their customers’ financial activities, making it easier to detect and report any potentially illicit transactions associated with smurfing.

4. Enhanced Due Diligence (EDD): In cases where there is a higher risk of smurfing or money laundering, financial institutions may be required to conduct enhanced due diligence on customers or transactions. This involves gathering additional information and conducting more thorough analysis to ensure a higher level of scrutiny. EDD measures can help detect smurfing activities that may otherwise go unnoticed in regular transaction monitoring procedures.

5. International Cooperation: Combatting smurfing requires international cooperation and information-sharing among regulatory bodies and law enforcement agencies. Cooperation frameworks, such as mutual legal assistance agreements and international organizations like the Financial Action Task Force (FATF), facilitate the exchange of intelligence and coordination of efforts to combat smurfing on a global scale.

6. Regulatory Oversight and Compliance: Regulatory bodies play a crucial role in ensuring that financial institutions comply with AML regulations and implement effective measures to detect and prevent smurfing. Regular examinations and audits of banks’ AML programs, as well as enforcement actions for non-compliance, serve as deterrents and encourage institutions to maintain robust AML controls.

7. Training and Awareness: Financial institutions can strengthen their defense against smurfing by providing training and awareness programs to employees. These programs educate staff members on the detection and prevention of smurfing activities, raising overall awareness and vigilance throughout the organization.

While these legal and regulatory measures enhance the fight against smurfing, the evolving nature of money laundering techniques necessitates continuous adaptation and improvement of AML frameworks. Effective collaboration between regulators, financial institutions, and law enforcement agencies is crucial to stay one step ahead of smurfers and disrupt their illicit activities.

Consequences of Smurfing for Banks

Smurfing poses significant consequences for banks, both in terms of reputation and legal implications. The involvement of banks in facilitating money laundering through smurfing activities can result in severe financial, operational, and regulatory consequences for these institutions.

1. Regulatory Penalties and Fines: Banks that fail to implement adequate anti-money laundering (AML) controls and systems to detect and prevent smurfing can face substantial regulatory penalties and fines. Regulatory bodies have the authority to impose significant monetary sanctions, which can severely impact a bank’s financial stability and significantly damage its reputation.

2. Reputational Damage: Banks implicated in smurfing scandals often face immense reputational damage. The public’s trust in the institution can erode, leading to a loss of customers, investors, and business partners. Rebuilding a tarnished reputation can be a long and costly process, requiring extensive PR efforts and implementing stronger compliance measures.

3. Legal Liabilities: Banks can face legal liabilities if they are found to have knowingly or negligently facilitated smurfing activities. This can lead to civil lawsuits and potential criminal charges, further exacerbating financial and reputational consequences. In some cases, banks may be required to pay restitution to victims of smurfing-related crimes.

4. Increased Regulatory Scrutiny: Banks involved in smurfing scandals often face increased regulatory scrutiny and more rigorous examination of their AML frameworks. Regulators may impose stricter oversight or require additional compliance measures to ensure that the bank is effectively addressing the vulnerabilities associated with smurfing and money laundering.

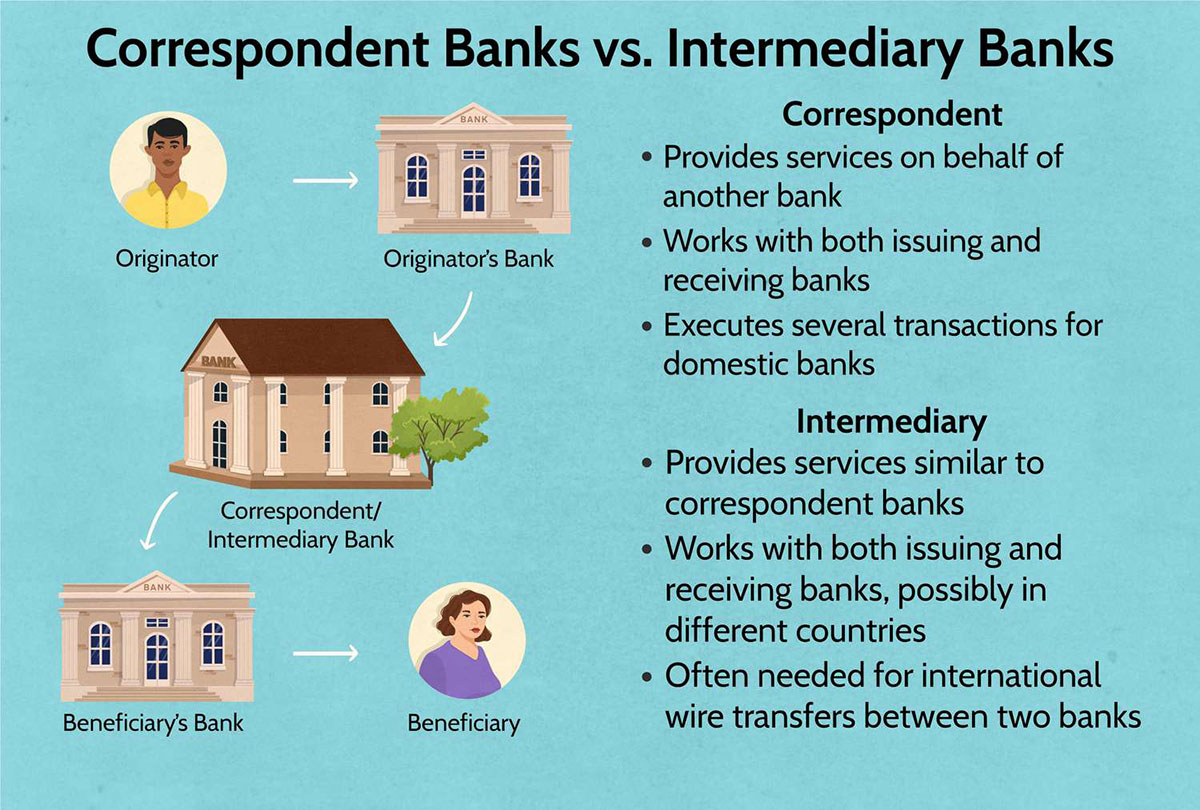

5. Loss of Correspondent Banking Relationships: Smurfing activities can lead to the loss of correspondent banking relationships for financial institutions. Correspondent banks, which provide services to other banks, are cautious about working with institutions that have been involved in money laundering activities. The loss of correspondent banking relationships can restrict a bank’s access to international transactions, impacting its ability to conduct business globally.

6. Economic and Operational Consequences: Smurfing can result in economic and operational consequences for banks. The costs of investigating, mitigating, and rectifying smurfing-related activities can be substantial. Banks may also need to allocate significant resources to enhance their AML controls, systems, and employee training to prevent future occurrences of smurfing.

7. Damage to Financial System Integrity: Smurfing undermines the integrity and stability of the financial system. When banks unknowingly facilitate money laundering activities, it can impact public confidence in the system. The overall soundness of the banking industry may be compromised, requiring increased regulatory measures and surveillance to rebuild trust.

To mitigate these consequences, banks need to prioritize robust AML frameworks, invest in advanced transaction monitoring systems, strengthen their compliance programs, and ensure thorough due diligence in customer onboarding. Proactive measures and ongoing monitoring can help banks detect and prevent smurfing activities, safeguard their reputation, and maintain regulatory compliance.

Case Studies of Smurfing in the Banking Industry

Real-world case studies serve as a stark reminder of the impact of smurfing in the banking industry and highlight the need for robust anti-money laundering (AML) measures. These cases demonstrate how criminals have exploited vulnerabilities in the financial system to carry out smurfing activities, resulting in significant consequences for both banks and society at large.

1. Bank of Credit and Commerce International (BCCI): The BCCI case, one of the most notorious instances of money laundering and smurfing, unfolded in the late 1980s. BCCI was involved in a complex web of illegal activities, including drug trafficking, arms smuggling, and terrorist financing. The bank employed smurfing techniques to conceal the proceeds of these activities, using a network of fictitious accounts, shell companies, and nominee accounts. The extensive use of smurfing allowed BCCI to operate undetected for years until its eventual exposure, resulting in the closure of the bank and massive financial losses for depositors.

2. Zhenli Ye Gon and HSBC: In another high-profile case, businessman Zhenli Ye Gon was accused of orchestrating a vast global money laundering operation involving billions of dollars. HSBC, one of the world’s largest banks, was implicated in facilitating the smurfing activities of Zhenli Ye Gon’s criminal organization. The scheme involved the use of shell companies and multiple individuals making small transactions to move and launder large sums of money. The case led to substantial regulatory penalties and fines for HSBC and underscored the importance of rigorous AML controls and compliance programs for banks.

3. Operation Green Soul: Operation Green Soul was a multinational investigation that targeted a syndicate engaged in the smuggling of wildlife, drugs, and counterfeit goods. The operation revealed a sophisticated smurfing operation where individuals were recruited to make multiple small transactions to move funds across borders and disguise the illicit proceeds. Financial institutions were unwittingly involved in facilitating the smurfing activities, highlighting the need for enhanced diligence in detecting and reporting suspicious transactions related to criminal networks involved in illicit activities.

These case studies demonstrate the complex nature of smurfing and its devastating effects on both the banking industry and society. They highlight the importance of effective AML measures, including robust transaction monitoring systems, due diligence processes, and information sharing among financial institutions and regulatory bodies. By learning from these cases, banks can strengthen their defenses against smurfing and mitigate the risks associated with money laundering.

Preventive Measures for Banks against Smurfing

Preventing smurfing, a significant money laundering technique, requires banks to implement comprehensive preventive measures to detect and deter such activities. By employing a multi-faceted approach that encompasses technology, risk assessment, employee training, and collaboration, banks can enhance their defenses against smurfing. Here are some preventive measures that banks can adopt:

1. Robust Transaction Monitoring Systems: Banks should invest in sophisticated transaction monitoring systems that employ advanced analytics and algorithms. These systems can detect patterns and anomalies suggestive of smurfing activities, such as multiple small transactions or frequent structuring of funds. Regular reviews and updates to the systems will ensure their effectiveness in identifying suspicious transactions.

2. Enhanced Customer Due Diligence (CDD): Implementing a robust CDD process is critical in preventing smurfing. Banks should conduct thorough customer risk assessments, verify the identities of customers, and scrutinize their transaction patterns. This includes monitoring for any sudden increase in transaction volumes or repeated small transactions that may indicate smurfing attempts.

3. Collaboration and Information Sharing: Establishing strong collaboration and information-sharing mechanisms with other financial institutions, regulatory bodies, and law enforcement agencies is crucial. Sharing relevant intelligence on emerging smurfing techniques or suspicious activities can help create a collective defense against money laundering. Participation in public-private partnerships and sharing best practices can also enhance industry-wide efforts to combat smurfing.

4. Employee Training and Awareness: Banks should provide comprehensive training to employees to raise awareness about smurfing and related money laundering risks. Training should focus on recognizing potential red flags, understanding reporting obligations, and promoting a culture of compliance throughout the organization. Regular updates and refreshers on emerging smurfing techniques will keep employees vigilant and equipped to detect and report suspicious activities.

5. Ongoing Risk Assessment: Banks should regularly assess and reassess their risk profiles, including the vulnerabilities to smurfing. This involves considering factors such as customer types, geographical risks, and evolving regulatory requirements. Conducting frequent assessments allows banks to adapt their AML frameworks, transaction monitoring systems, and customer due diligence processes to address emerging smurfing risks.

6. Compliance with Regulatory Requirements: Banks must comply with AML regulations and guidelines mandated by their respective jurisdictions. This includes adherence to reporting thresholds, suspicious activity reporting, and record-keeping requirements. Regular audits and self-assessments can help identify any compliance gaps and enable timely remediation.

7. Continuous Technological Advancements: Banks should stay abreast of technological advancements and leverage innovative solutions to enhance their AML capabilities. This includes utilizing artificial intelligence, machine learning, and data analytics to improve transaction monitoring, detect patterns, and identify potential smurfing activities.

By implementing these preventive measures, banks can significantly mitigate the risks associated with smurfing in the financial system. Proactive efforts, regular assessments, and ongoing collaboration will help ensure that banks stay one step ahead of smurfing activities and contribute to the overall fight against money laundering.

Conclusion

Smurfing, as a money laundering technique, continues to be a significant challenge for banks and the financial industry. It involves the fragmentation of large sums of money into smaller transactions to evade detection and obscure the origin and purpose of illicit funds. This deceptive practice not only undermines the integrity of the financial system but also enables criminals to operate with impunity, funding various illegal activities.

To combat smurfing, banks must implement robust preventive measures that encompass advanced transaction monitoring systems, enhanced customer due diligence, employee training, collaboration with regulatory bodies, and compliance with AML regulations. By adopting a multi-layered approach, banks can detect and deter smurfing activities, minimize the risk of regulatory penalties, and protect their reputation.

Furthermore, international cooperation and information-sharing among financial institutions, regulatory bodies, and law enforcement agencies play a crucial role in the fight against smurfing. Only by working together can we create a unified front to detect and disrupt these illicit activities.

While banks bear the primary responsibility for preventing smurfing, it is also essential for governments to enact and enforce robust AML regulations. Regulators must continuously assess the effectiveness of existing frameworks, adapt to emerging risks and technological advancements, and impose appropriate penalties for non-compliance.

In conclusion, smurfing remains a persistent threat, requiring constant vigilance and proactive measures from banks, regulators, and law enforcement agencies. By strengthening AML controls, fostering a culture of compliance, and embracing technological advancements, the financial industry can strike a significant blow against smurfing and protect the integrity of the global financial system.