Finance

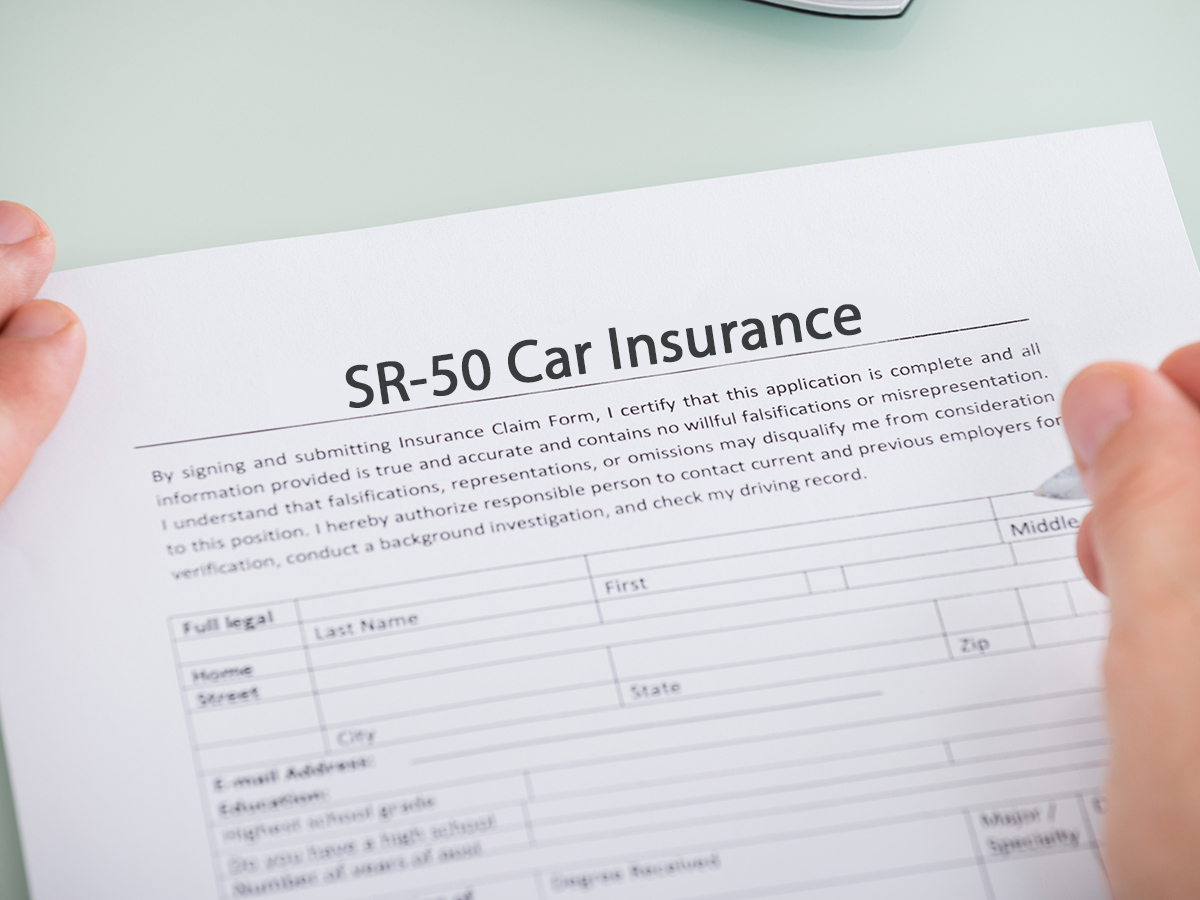

What Is SR-22 Insurance In Illinois?

Published: November 26, 2023

Learn all about SR-22 insurance in Illinois, a finance-related topic. Understand its requirements and how it affects your auto insurance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where understanding the intricacies of insurance is crucial. In particular, one type of insurance that has gained attention is SR-22 insurance. If you’re unfamiliar with SR-22 insurance and its significance, this article will serve as your comprehensive guide.

SR-22 insurance is not a typical insurance policy; rather, it is a form that some drivers are required to file with their state’s Department of Motor Vehicles (DMV). It serves as proof of financial responsibility and is often mandated for individuals who have been convicted of certain driving offenses.

In the state of Illinois, SR-22 insurance is a critical requirement that individuals must fulfill to maintain their driving privileges. Whether you have recently been convicted of driving under the influence (DUI) or have accumulated excessive traffic violations, understanding SR-22 insurance is essential to getting back on the road.

This article will provide an overview of SR-22 insurance in Illinois, including its purpose, requirements, and how to obtain it. Whether you are a first-time offender or a seasoned driver, this information will empower you with the knowledge you need to navigate the SR-22 insurance process.

So, let’s dive in and explore what SR-22 insurance entails and when it is necessary in the state of Illinois.

What is SR-22 Insurance?

SR-22 insurance is a specific type of insurance certificate that is required for individuals who have been involved in serious driving offenses or have been deemed a high-risk driver by their state’s DMV. It is not an actual insurance policy but rather a document that demonstrates to the DMV that a driver has the necessary liability coverage.

The SR-22 certificate is typically filed by an insurance company on behalf of the driver, and it serves as a guarantee that the driver has met the minimum insurance coverage requirements imposed by the state. This certificate is mandated in order for the driver to reinstate or maintain their driving privileges.

In Illinois, SR-22 insurance is often required for individuals who have been convicted of driving under the influence (DUI), driving without insurance, or accumulating excessive traffic violations. It acts as proof that the driver is financially responsible and has the necessary insurance coverage to protect themselves and others on the road.

It’s important to note that SR-22 insurance is not limited to car insurance alone. It can also apply to motorcycles, trucks, and other motor vehicles, depending on the circumstances. Additionally, SR-22 insurance is typically required for a specified period of time, usually three years, although this can vary depending on the offense and the state’s regulations.

Although SR-22 insurance may seem like a burden, it is a necessary step in regaining driving privileges and demonstrating responsible behavior on the road. It serves as a way for the state to monitor high-risk individuals and ensure that they comply with the necessary insurance requirements.

Understanding the purpose and requirements of SR-22 insurance is essential, as failure to comply with this mandate can lead to further penalties, suspension of driving privileges, and even legal repercussions.

Next, let’s explore when SR-22 insurance is required in Illinois and the circumstances that may lead to its imposition.

When is SR-22 Insurance Required in Illinois?

In the state of Illinois, SR-22 insurance is typically required under certain circumstances where individuals have committed serious driving offenses or demonstrated risky behavior on the road. The following are some situations that may result in the need for SR-22 insurance:

- DUI Conviction: If you have been convicted of driving under the influence (DUI) in Illinois, you will likely be required to obtain SR-22 insurance. This is an important step in the process of reinstating your driving privileges.

- Driving Without Insurance: If you have been caught driving without insurance, whether it was a result of an accident or a routine traffic stop, you may be required to file an SR-22 certificate. This serves as proof that you now have the necessary insurance coverage.

- Multiple Traffic Violations: If you have accumulated an excessive number of traffic violations within a specific time period, the Illinois DMV may view you as a high-risk driver and require you to obtain SR-22 insurance before you can continue driving.

- Driving with a Suspended License: If your license has been suspended due to various reasons, such as unpaid fines, failure to appear in court, or other violations, you may need to file an SR-22 certificate to reinstate your driving privileges.

It’s important to note that the specific requirements for SR-22 insurance can vary depending on the severity of the offense and the discretion of the Illinois DMV. In some cases, individuals may be required to maintain SR-22 insurance for a specific period of time, while others may need to have it for an extended duration.

If you find yourself in a situation where SR-22 insurance is required, it’s crucial to understand the process and fulfill the necessary obligations in order to regain your driving privileges. Non-compliance or failure to maintain the mandated SR-22 insurance can lead to further penalties and difficulties in the future.

Now that you have an understanding of when SR-22 insurance is required in Illinois, let’s delve into how SR-22 insurance works and the steps involved in obtaining it.

How Does SR-22 Insurance Work?

Understanding how SR-22 insurance works is essential for those who are required to obtain it in Illinois. Although it is not a traditional insurance policy, SR-22 insurance functions as a guarantee for the state that an individual has the necessary liability coverage.

Here’s how SR-22 insurance works:

- Request for SR-22 Filing: If you are required to have SR-22 insurance, you will need to contact an insurance company that is authorized to provide SR-22 filings in Illinois. They will guide you through the process and assist you in obtaining the necessary coverage.

- Purchase an Insurance Policy: To fulfill the SR-22 insurance requirement, you will need to purchase an insurance policy that meets the minimum liability coverage mandated by the state of Illinois. The insurance company will then file the SR-22 certificate on your behalf.

- Cost of SR-22 Insurance: It’s important to note that SR-22 insurance often comes with higher premiums compared to standard insurance policies. This is because individuals who require SR-22 insurance are considered high-risk drivers. The cost can vary depending on factors such as your driving record, age, and the type of vehicle you drive.

- Continuous Coverage: Once you have obtained SR-22 insurance, it is crucial to maintain continuous coverage for the required period of time. Any lapses or cancellations in coverage can result in the suspension of your driving privileges.

- SR-22 Filing Period: In Illinois, the duration of SR-22 filing can vary depending on the offense and the requirements set by the DMV. Typically, it ranges from three to five years. It’s important to adhere to this timeframe and fulfill all obligations to ensure a smooth driving experience.

It’s important to remember that SR-22 insurance only covers liability and not comprehensive or collision coverage. Additionally, it does not provide coverage for damages or injuries sustained by the insured driver. SR-22 insurance is solely meant to prove financial responsibility and satisfy the state’s requirements.

It’s also important to note that SR-22 insurance is not transferrable between states. If you move to a different state while on an SR-22 filing period, you will need to meet the SR-22 insurance requirements of the new state.

Now that you have an understanding of how SR-22 insurance works, let’s explore the process of obtaining SR-22 insurance in Illinois.

How to Obtain SR-22 Insurance in Illinois

If you find yourself in a situation where SR-22 insurance is required in Illinois, it’s important to understand the steps involved in obtaining it. Follow these guidelines to ensure a smooth process:

- Contact an Authorized Insurance Provider: Start by contacting an insurance company that is authorized to provide SR-22 filings in Illinois. They will be experienced in handling SR-22 insurance and will guide you through the process.

- Provide Necessary Information: When applying for SR-22 insurance, be prepared to provide personal and vehicle information, as well as details regarding the offense that led to the SR-22 requirement. This information will help the insurance company determine the appropriate coverage and file the SR-22 certificate with the state’s DMV.

- Purchase the Required Coverage: The insurance company will help you select the appropriate insurance policy that meets the minimum liability coverage requirements set by the state. Be prepared for higher premiums, as SR-22 insurance is often more expensive due to the high-risk nature of the situation.

- File the SR-22 Certificate: Once you have purchased the required coverage, the insurance company will file the SR-22 certificate with the Illinois DMV on your behalf. This is a crucial step in fulfilling the SR-22 insurance requirement and reinstating your driving privileges.

- Maintain Continuous Coverage: It’s important to maintain continuous coverage for the entire SR-22 filing period. Any lapses or cancellations in coverage can lead to the suspension of your driving privileges and further complications.

- Monitor SR-22 Expiration Date: Take note of the expiration date of your SR-22 filing. It’s your responsibility to renew the SR-22 certificate before it expires, as failure to do so can result in license suspension and additional penalties.

Remember, the process of obtaining SR-22 insurance may vary depending on the insurance company and the specific circumstances of your case. It’s crucial to work closely with the insurance provider and follow their guidance throughout the process.

Lastly, keep in mind that SR-22 insurance is not a permanent requirement. Once the mandated filing period expires and you have maintained a clean driving record, you can transition back to a standard insurance policy.

Now that you know how to obtain SR-22 insurance in Illinois, let’s recap some key points to remember about SR-22 insurance.

Key Points to Remember about SR-22 Insurance in Illinois

As you navigate the process of obtaining SR-22 insurance in Illinois, it’s important to keep the following key points in mind:

- SR-22 insurance is not an actual insurance policy: It is a certificate that serves as proof of financial responsibility and is required for individuals who have committed serious driving offenses.

- SR-22 insurance is mandated by the state: If you have been convicted of a DUI, driving without insurance, or accumulated excessive traffic violations, you will likely be required to obtain SR-22 insurance to reinstate or maintain your driving privileges.

- SR-22 insurance comes with higher premiums: Due to the high-risk nature of individuals who require SR-22 insurance, the premiums for this type of coverage are often higher than standard insurance policies.

- SR-22 insurance requires continuous coverage: It is crucial to maintain continuous coverage throughout the entire SR-22 filing period. Any lapses or cancellations in coverage can lead to the suspension of your driving privileges.

- SR-22 insurance is not transferrable between states: If you move to a different state while on an SR-22 filing period, you will need to meet the SR-22 insurance requirements of the new state.

- SR-22 insurance is not a permanent requirement: Once the mandated filing period expires and you have maintained a clean driving record, you can transition back to a standard insurance policy.

It’s important to familiarize yourself with these key points and comply with the requirements set by the Illinois DMV. Failure to do so can result in further penalties, suspension of driving privileges, and legal ramifications.

Remember, SR-22 insurance is a temporary hurdle in your journey to regain your driving privileges. By fulfilling the SR-22 insurance requirements and maintaining responsible driving behavior, you can eventually transition back to a standard insurance policy and enjoy the freedom of the open road.

Now that you have a comprehensive understanding of SR-22 insurance in Illinois, you are better equipped to navigate the process and fulfill the necessary obligations. Remember to seek guidance from authorized insurance providers and follow the guidelines set by the state’s DMV.

Safe travels!

Conclusion

Navigating the world of SR-22 insurance in Illinois can be overwhelming, but it’s a necessary step for individuals who have been convicted of serious driving offenses. By understanding the purpose, requirements, and process of obtaining SR-22 insurance, you can successfully reinstate or maintain your driving privileges.

SR-22 insurance is not a typical insurance policy, but rather a certificate that proves your financial responsibility and compliance with state regulations. It is required for individuals who have committed offenses such as DUI, driving without insurance, or accumulating excessive traffic violations.

When obtaining SR-22 insurance in Illinois, it’s important to work closely with authorized insurance providers who can guide you through the process. They will help you select the required coverage, file the SR-22 certificate with the DMV, and ensure continuous coverage throughout the mandated filing period.

While SR-22 insurance may come with higher premiums, it’s crucial to maintain responsible driving behavior and fulfill the obligations set by the state. Failure to comply with SR-22 requirements can lead to further penalties, suspension of driving privileges, and legal repercussions.

Remember, SR-22 insurance is not a permanent requirement. Once the mandated filing period expires and you have maintained a clean driving record, you can transition back to a standard insurance policy.

By familiarizing yourself with the key points of SR-22 insurance in Illinois and adhering to the necessary obligations, you can successfully navigate through this temporary hurdle and regain your freedom on the road.

Now that you have a comprehensive understanding of SR-22 insurance, you can approach the process with confidence and ensure compliance with the requirements set by the Illinois DMV. Stay informed, drive responsibly, and enjoy your journey towards reinstating your driving privileges.

Safe travels!