Finance

How Much Is Flood Insurance In Illinois?

Published: November 15, 2023

Get the details on flood insurance in Illinois and find out how much it will cost you. Protect your finances with the right coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to protecting your home and belongings, having the right insurance coverage is crucial. While most homeowners are familiar with standard home insurance policies, many may not be aware of the importance of flood insurance, especially in flood-prone areas like Illinois.

Floods can be devastating, causing extensive damage to properties and resulting in significant financial losses. It’s essential to understand the risks associated with floods and how flood insurance can provide a safety net in the event of such a disaster.

In this article, we will delve into the world of flood insurance in Illinois, exploring how it works, the factors influencing its costs, and how to obtain the necessary coverage to protect your property.

Whether you live near a river, in a floodplain, or in an area prone to heavy rainfall, having flood insurance can provide peace of mind and financial security. It’s crucial to be informed about the ins and outs of flood insurance to make well-informed decisions about protecting your home and investments.

So, let’s dive into the details of flood insurance and how it applies specifically to Illinois.

Understanding Flood Insurance

Flood insurance is a specialized type of insurance coverage that provides financial protection in the event of flooding. It is important to note that standard homeowner’s insurance typically does not cover flood damage, which is why obtaining a separate flood insurance policy is necessary.

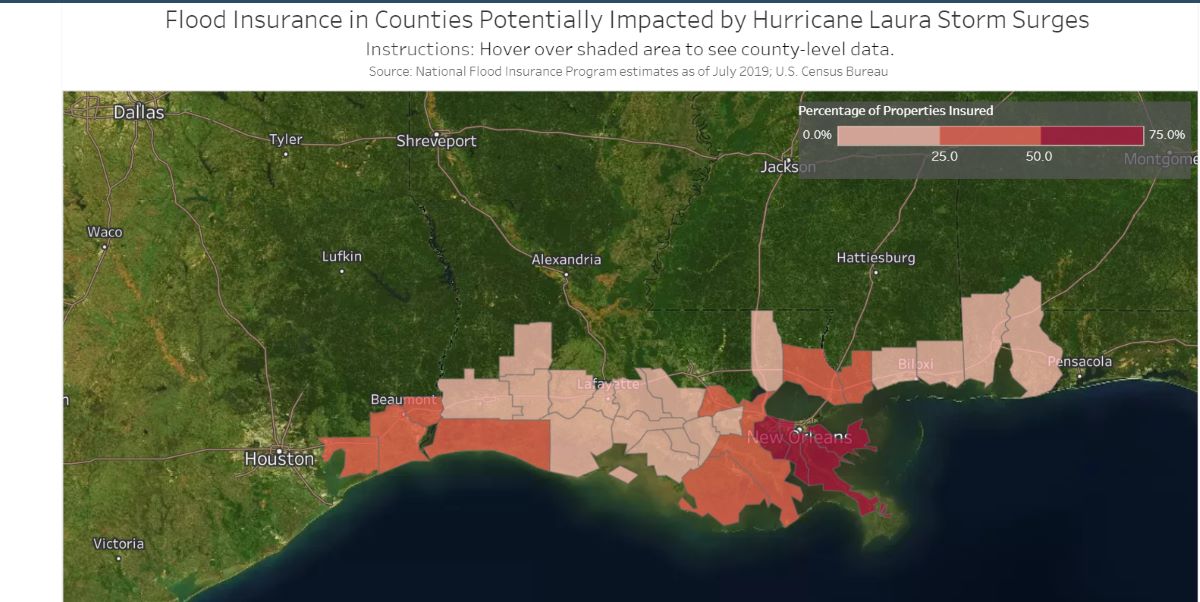

Flood insurance policies are typically offered by the National Flood Insurance Program (NFIP) in the United States. The NFIP works in collaboration with participating insurance companies to offer flood insurance policies to homeowners, renters, and business owners in flood-prone areas.

Now you might be wondering, what exactly is considered a flood? According to the NFIP, a flood is defined as a temporary overflow of water onto normally dry land. This can be due to heavy rainfall, hurricanes, melting snow, or other factors that cause water to accumulate and potentially damage properties.

It’s essential to understand that there are different types of coverage options available under flood insurance policies. The two main categories are building property coverage and personal property coverage.

Building property coverage helps protect the physical structure of your home, including its foundation, walls, electrical systems, plumbing, and appliances. Personal property coverage, on the other hand, covers your belongings, such as furniture, electronics, clothing, and other personal items.

It’s important to assess your specific needs and consider both building property and personal property coverage to ensure comprehensive protection against flood damage.

It’s also worth noting that there are limitations to flood insurance coverage. Certain items, such as currency, valuable papers, and precious metals, may have limited coverage under a flood insurance policy. Additionally, coverage for basements and areas below the lowest elevated floor may also be limited.

Understanding the scope of coverage and any exclusions or limitations is crucial when selecting a flood insurance policy. Consulting with an insurance professional can help clarify any questions or concerns you may have regarding your specific situation.

Factors Affecting Flood Insurance Costs

When determining the cost of flood insurance in Illinois, several factors come into play. Understanding these factors can help homeowners get a better idea of what to expect in terms of premiums.

1. Flood Zone: One of the main factors that influence the cost of flood insurance is the flood zone in which your property is located. Flood zones are classified based on the level of risk for flooding, with higher-risk zones generally having higher insurance premiums.

2. Elevation: The elevation of your property in relation to the base flood elevation is another important factor. Properties situated at higher elevations, away from flood-prone areas, tend to have lower insurance premiums.

3. Age and Construction: The age and construction of your home or building can also impact your flood insurance costs. Older structures or those with less flood-resistant building materials may be associated with higher premiums.

4. Deductible and Coverage Limits: The deductible and coverage limits you choose for your flood insurance policy can also affect the cost. Opting for higher deductibles or lower coverage limits may lead to lower premiums but also means you may have more out-of-pocket expenses in the event of a claim.

5. Previous Flood History: If your property has a history of flood damage or claims, it can impact the cost of flood insurance. Insurance providers may take into account the risk associated with previous flood events when calculating premiums.

6. Base Flood Elevation (BFE): The BFE for your area is the level at which floodwaters are expected to rise during a base flood. Properties located above the BFE may have lower premiums compared to those below it.

7. Availability of NFIP Coverage: The availability of flood insurance coverage through the National Flood Insurance Program may also play a role in the cost. Areas with limited coverage options may experience higher premiums due to the lack of competition.

It’s important to note that these factors can vary from one property to another, and insurance rates are determined on a case-by-case basis. Consulting with an insurance professional or using online tools provided by insurance companies can help you get a more accurate estimate of your flood insurance costs.

By understanding these factors, homeowners in Illinois can better assess their flood insurance needs and find the most suitable coverage options for their property.

Flood Insurance Rates in Illinois

When it comes to flood insurance rates in Illinois, several factors contribute to the overall cost of coverage. It’s important to note that these rates can vary depending on the specific location within the state. Here are some key points to consider:

- Flood Zones: The flood zone where your property is located plays a crucial role in determining the insurance rates. Properties in high-risk flood zones, such as A or V zones, generally have higher premiums compared to those in moderate or low-risk zones.

- Elevation: The elevation of your property in relation to the base flood elevation (BFE) is an important factor. Higher elevations are typically associated with lower premiums, as they are considered less susceptible to flooding.

- Construction and Age of the Property: The construction materials used in your home and its age can also affect insurance rates. Properties with flood-resistant materials or those built after certain floodplain management regulations may qualify for lower premiums.

- Previous Flood Claims: If your property has a history of flood damage or insurance claims, it can impact the cost of coverage. Insurance providers may consider previous claims as an indicator of future risk, resulting in higher premiums.

- Coverage Limits and Deductibles: The coverage limits you choose and the deductible amount can also affect the cost. Higher coverage limits and lower deductibles may lead to higher premiums, while lower coverage limits and higher deductibles may result in lower premiums.

It’s worth noting that flood insurance rates in Illinois are determined by the National Flood Insurance Program (NFIP) and are standardized across the state. Private flood insurance options are also available, and their rates may vary based on the provider.

To get an accurate estimate of flood insurance rates for your property in Illinois, it’s recommended to reach out to insurance providers or consult with an insurance agent. They can assess the specific characteristics of your property and provide you with personalized quotes.

Remember, investing in flood insurance is a proactive and essential step in protecting your property. It provides financial security in the event of a flood disaster and offers peace of mind knowing that you have coverage to help rebuild and recover.

How to Obtain Flood Insurance in Illinois

Obtaining flood insurance in Illinois is a relatively straightforward process. Here are the steps to follow:

- Evaluate your flood risk: Assess your property’s flood risk by checking the flood maps provided by the Federal Emergency Management Agency (FEMA) or consulting with a professional insurance agent.

- Contact insurance providers: Reach out to insurance companies that offer flood insurance in Illinois. You can search for providers online or ask for referrals from friends, family, or neighbors who have flood insurance coverage.

- Get quotes: Request quotes from multiple insurance providers to compare coverage options and rates. This will help you find the most suitable policy that meets your needs and budget.

- Work with an insurance agent: Consider working with an insurance agent who specializes in flood insurance. They can guide you through the process, help you understand policy terms and coverage limits, and assist in filling out the necessary paperwork.

- Complete the application: Fill out the application form provided by the insurance company of your choice. You will need to provide information about your property, its location, and other relevant details.

- Pay your premiums: Once your application is approved, you will be required to pay the premium amount to activate your flood insurance coverage. The premium can be paid annually or through installments, depending on the insurance provider’s policies.

- Review your policy: Take the time to carefully review your flood insurance policy. Understand the coverage limits, deductibles, exclusions, and any additional endorsements or options that may be available.

- Keep your policy up to date: It’s important to keep your flood insurance policy up to date by renewing it annually. Review your coverage regularly to ensure it aligns with any changes to your property or circumstances.

Remember, obtaining flood insurance is a proactive measure to protect your property from potential flood damage. It’s crucial to secure coverage that adequately meets your needs and provides financial security in the face of a flood disaster.

Consulting with an insurance professional can help navigate the process and provide valuable insights to ensure you obtain the right flood insurance policy for your property in Illinois.

Tips for Reducing Flood Insurance Costs

While flood insurance is essential for protecting your property, there are several steps you can take to potentially reduce the costs associated with coverage. Here are some helpful tips:

- Elevate your property: Elevating your property above the base flood elevation (BFE) can significantly lower your flood insurance premiums. By taking measures such as raising your home on stilts or installing flood vents, you can demonstrate to insurance providers that your property is less susceptible to flood damage.

- Invest in flood-resistant materials: Using flood-resistant materials for your property’s construction and renovations can lead to lower insurance premiums. These materials, such as impact-resistant windows, reinforced doors, and flood-resistant walls, can help mitigate potential damage from flooding.

- Install flood mitigation devices: Installing flood mitigation devices can help reduce the risk of damage from flooding and potentially lower insurance costs. Some examples include sump pumps, foundation vents, and backflow valves, which can prevent water from entering your property.

- Consider higher deductibles: Opting for a higher deductible on your flood insurance policy can lead to lower premium payments. However, it’s important to ensure that you can comfortably afford the deductible amount in the event of a flood-related claim.

- Check for available discounts: Inquire with your insurance provider about any available discounts for flood mitigation efforts or being part of a community that has implemented floodplain management measures. Some insurers may offer reduced rates for homeowners who take proactive steps to mitigate flood risks.

- Bundle insurance policies: In some cases, bundling your flood insurance policy with other insurance policies, such as homeowner’s insurance, can lead to potential discounts or cost savings. Check with your insurance provider to see if this option is available.

- Periodically review your coverage: Regularly assess your flood insurance coverage and evaluate whether any adjustments need to be made. Changes in property value, renovations, or improvements to your property may warrant a review of your coverage limits to ensure they align with your needs.

It’s important to remember that while these tips may help reduce flood insurance costs, it’s crucial not to compromise on the necessary coverage for your property. Balancing cost savings with sufficient protection is key when navigating flood insurance options.

Consulting with an insurance professional can provide further guidance on available cost-saving measures specific to your property and help you make informed decisions about your flood insurance coverage.

Conclusion

Flood insurance is a crucial component of protecting your property and financial well-being, particularly in flood-prone areas like Illinois. Understanding the ins and outs of flood insurance can empower homeowners to make informed decisions and secure appropriate coverage.

In this article, we explored the fundamentals of flood insurance, including how it works, the factors influencing its costs, and how to obtain coverage in Illinois. We also provided tips for potentially reducing flood insurance costs without compromising on essential protection.

By understanding flood zones, elevations, construction materials, and previous flood history, homeowners can get a better grasp of the factors that impact their insurance premiums. Furthermore, exploring flood mitigation strategies, bundled insurance options, and periodic coverage reviews can help homeowners make smart financial decisions while ensuring comprehensive protection.

It’s important to remember that flood insurance is a proactive approach to safeguarding your property against the potentially devastating effects of flooding. While flood damage can be costly and emotionally challenging, having the right insurance coverage can provide peace of mind and financial security.

If you live in an area prone to flooding or are concerned about the potential risks, it’s strongly recommended to reach out to insurance providers or insurance agents specializing in flood insurance to assess your specific needs. They can guide you through the process, answer your questions, and provide personalized quotes to help you obtain the most suitable flood insurance coverage for your property.

Ultimately, investing in flood insurance in Illinois is an essential step in protecting your home, possessions, and financial stability. By being proactive and well-informed, you can be better prepared for the unexpected and have peace of mind knowing that you have adequate coverage in the event of a flood.