Finance

Book Value Reduction Definition

Published: October 18, 2023

Discover the definition of book value reduction in the field of finance. Gain insights into how this concept affects the valuation of assets and overall financial performance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Book Value Reduction in Finance

Welcome to the “Finance” category on our blog! In this post, we will delve into the concept of book value reduction and its significance in financial management. Whether you are a business owner, investor, or simply interested in expanding your financial knowledge, this article will provide you with valuable insights into this important topic.

Key Takeaways:

- Book value reduction is a decrease in the recorded value of an asset or company.

- It can occur due to various factors, including depreciation, obsolescence, or a decline in market value.

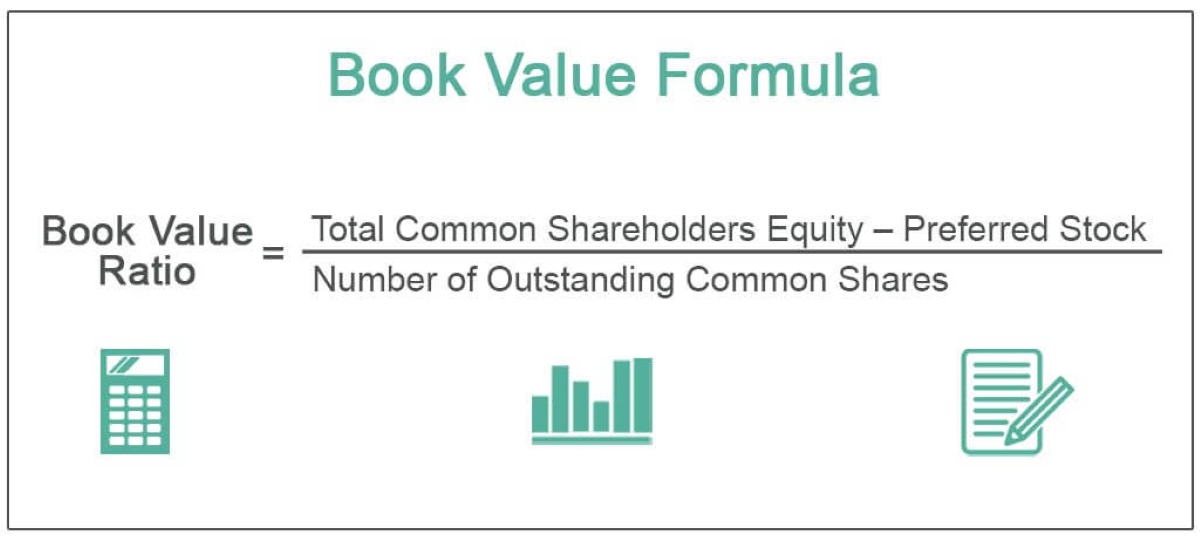

What is Book Value Reduction?

Book value reduction refers to the decrease in the recorded value of an asset or company. It is an important concept in finance that helps determine the true value of a business or an asset at a given point in time. Book value reduction can occur due to various factors, such as depreciation, obsolescence, or a decline in market value.

When an asset is initially acquired, it is recorded on the balance sheet at its cost or purchase price. As time passes, the asset may lose value due to wear and tear, technological advancements, changes in market demand, or other external factors. This decrease in value is reflected in the book value of the asset, leading to book value reduction.

Similarly, book value reduction can also occur for a company as a whole. If a company’s assets decrease in value or its liabilities increase, the book value of the company will be reduced. This reduction can impact financial ratios, such as return on assets and return on equity, which are used by investors and analysts to assess the financial health and performance of a company.

It is important to note that book value reduction does not necessarily reflect the true market value of an asset or company. The book value represents the historical cost of the asset or the company’s net worth based on accounting principles, while the market value is the price that the asset or the company would fetch in the open market.

Why is Book Value Reduction Significant?

Understanding book value reduction is crucial for several reasons:

- Asset Valuation: It helps stakeholders estimate the current value of an asset, taking into account its historical cost and any accrued depreciation or obsolescence.

- Financial Analysis: Book value reduction affects financial ratios and indicators, providing insights into the financial health and performance of a company.

- Investment Decision-making: Investors consider book value reduction when evaluating investment opportunities and making informed decisions based on the true value of an asset or company.

In conclusion, book value reduction is a crucial concept in finance that helps determine the true value of an asset or company. It provides valuable insights into asset valuation, financial analysis, and investment decision-making. By understanding book value reduction, individuals can make informed financial choices and navigate the dynamic world of finance more effectively.